Key Insights

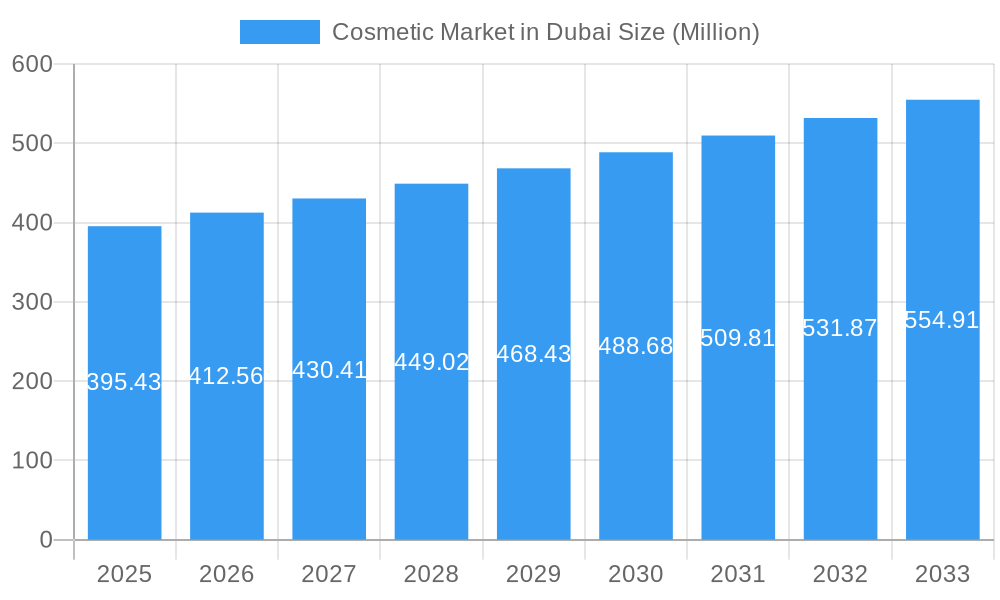

The cosmetic market in Dubai is poised for robust expansion, projected to reach an estimated $395.43 million by 2025, demonstrating a healthy CAGR of 4.27% throughout the forecast period of 2025-2033. This growth is underpinned by a dynamic interplay of consumer preferences, economic factors, and evolving retail landscapes. A significant driver for this surge is the increasing disposable income and a growing appetite for premium and luxury beauty products among Dubai's diverse and affluent population. The city's status as a global tourism hub further amplifies demand, attracting both international and local consumers keen on exploring the latest beauty innovations. Furthermore, the rising influence of social media and beauty influencers is playing a pivotal role in shaping consumer trends, encouraging experimentation with new products and brands, particularly in color cosmetics and hair styling segments. The market is also witnessing a strong inclination towards organic and natural beauty products, a trend that aligns with global wellness movements and a growing awareness of ingredient transparency.

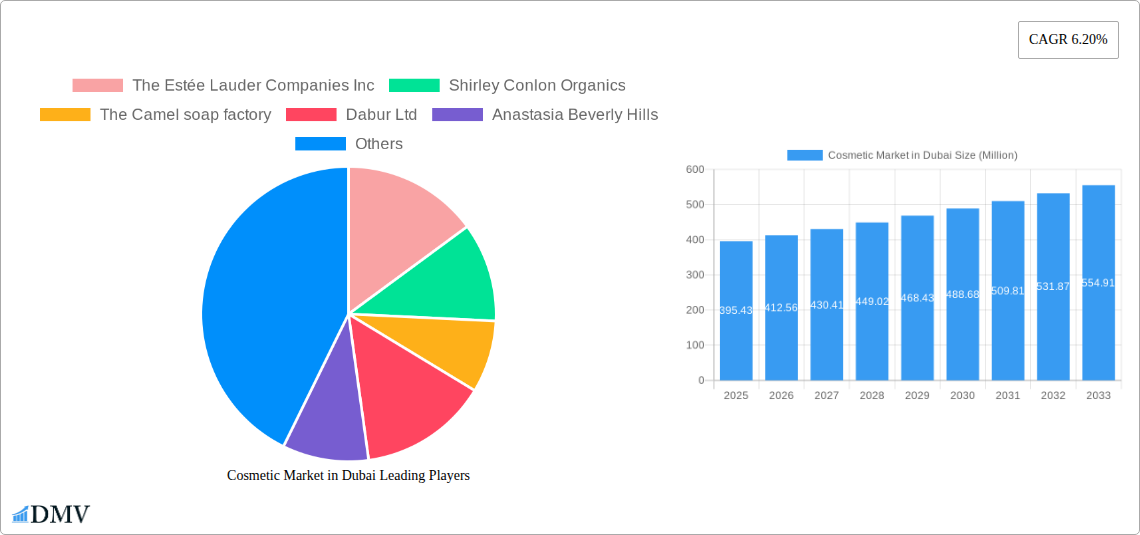

Cosmetic Market in Dubai Market Size (In Million)

The market is strategically segmented to cater to a wide array of consumer needs. Within product types, color cosmetics, encompassing facial, eye, lip, and nail makeup, are expected to dominate due to constant innovation and trend cycles. Hair styling and coloring products also present significant growth avenues, driven by the demand for both professional salon-quality products and accessible at-home solutions. Distribution channels are evolving, with online stores experiencing exponential growth, offering convenience and a wider selection, while hypermarkets/supermarkets and specialty stores continue to hold their ground, providing immediate accessibility and curated brand experiences. Key players like The Estée Lauder Companies Inc., Shiseido Company, and Unilever PLC, alongside prominent local and niche brands such as Huda Beauty and Shirley Conlon Organics, are actively shaping the competitive landscape through product innovation and strategic market penetration. This competitive environment, coupled with a consumer base that values both efficacy and aesthetics, is expected to fuel sustained growth in Dubai's vibrant cosmetic sector.

Cosmetic Market in Dubai Company Market Share

Cosmetic Market in Dubai: Comprehensive Market Analysis & Strategic Forecast (2019–2033)

This in-depth report provides a critical analysis of the cosmetic market in Dubai, offering strategic insights for stakeholders navigating this dynamic and high-growth sector. Spanning the historical period of 2019–2024 and projecting through 2033, with a base and estimated year of 2025, this study delves into market composition, industry evolution, product innovations, and future opportunities. Leveraging millions for all financial metrics and incorporating high-ranking keywords such as Dubai beauty market, UAE cosmetics industry, luxury beauty Dubai, and Halal cosmetics market, this report is an indispensable resource for investors, manufacturers, distributors, and policymakers.

Cosmetic Market in Dubai Market Composition & Trends

The cosmetic market in Dubai is characterized by a moderately concentrated landscape, with a strong presence of both global giants and agile local players. Innovation remains a primary catalyst, driven by evolving consumer preferences for efficacy, natural ingredients, and personalized solutions. The regulatory environment is increasingly focused on product safety and Halal certification, influencing formulation and marketing strategies. Substitute products, while present in adjacent categories, generally fail to replicate the specific performance and aspirational value offered by premium cosmetics. End-user profiles in Dubai are diverse, encompassing affluent residents, a significant expatriate population, and a growing segment of young, digitally-savvy consumers actively seeking the latest beauty trends. Merger and acquisition (M&A) activities, while not consistently dominating headlines, represent strategic moves for market consolidation and expansion into niche segments. Current M&A deal values are estimated to be in the range of tens of millions as established entities acquire innovative startups to enhance their product portfolios and market reach.

- Market Share Distribution: Global leaders hold significant sway, but local brands are rapidly gaining traction due to their understanding of regional preferences.

- Innovation Catalysts: Demand for sustainable, clean beauty, and advanced skincare technologies are key drivers.

- Regulatory Landscape: Stringent adherence to Halal standards and product safety regulations is paramount.

- Substitute Products: While general skincare exists, specialized cosmetic functions are less easily substituted.

- End-User Profiles: A mix of high-net-worth individuals, tourists, and a digitally native demographic.

- M&A Activities: Strategic acquisitions focused on niche markets and cutting-edge technologies.

Cosmetic Market in Dubai Industry Evolution

The cosmetic industry in Dubai has witnessed remarkable growth trajectories, propelled by robust economic development, a thriving tourism sector, and a cultural embrace of beauty and personal care. From 2019 to 2025, the market has seen an estimated Compound Annual Growth Rate (CAGR) of XX%, a testament to its resilience and adaptability. Technological advancements have played a pivotal role, with a surge in demand for AI-powered skincare diagnostics, personalized product recommendations through advanced analytics, and the integration of augmented reality (AR) for virtual try-ons, enhancing the online shopping experience. Shifting consumer demands are a constant force, moving from traditional product functionalities to a greater emphasis on wellness, ethical sourcing, and inclusivity. Consumers are increasingly seeking products that offer not just aesthetic benefits but also long-term skin health and well-being, leading to a rise in demand for scientifically formulated and ingredient-conscious cosmetics. The adoption of e-commerce platforms has accelerated, with online sales penetration estimated to reach XX% by 2025, demonstrating a significant shift in purchasing behavior. This evolution is further fueled by the influence of social media, where trends emerge and propagate rapidly, impacting product development cycles and marketing strategies. The market’s ability to adapt to these changing dynamics, incorporating new ingredients, sustainable practices, and innovative delivery systems, is crucial for sustained growth. The Dubai beauty market is thus a confluence of global trends and localized desires, creating a unique and dynamic ecosystem.

Leading Regions, Countries, or Segments in Cosmetic Market in Dubai

Within the cosmetic market in Dubai, the Color Cosmetics segment, particularly Facial Make-up Products, has historically been the dominant force, reflecting the region's passion for sophisticated beauty routines and trend-driven fashion. This dominance is supported by a strong foundation in Lip and Nail Make-up Products as well, catering to both everyday wear and special occasions. The Hair Styling and Coloring Products segment, while significant, follows closely, driven by the diverse hair types and styling needs of the population. In terms of distribution channels, Specialty Stores and Online Stores have emerged as the leading conduits for cosmetic products in Dubai. The allure of curated selections, expert advice, and the seamless convenience offered by e-commerce platforms have positioned these channels at the forefront of consumer engagement.

- Dominant Segment: Color Cosmetics (Facial Make-up Products):

- Key Drivers: High disposable incomes, influence of global beauty trends, strong demand for foundation, concealer, and contouring products.

- In-depth Analysis: Dubai's cosmopolitan nature and its status as a global fashion hub create a perpetual demand for high-performance facial makeup that caters to diverse skin tones and preferences, from subtle enhancements to bold, artistic expressions. The influence of beauty influencers and readily available tutorials further amplifies this demand.

- Emerging Segment: Hair Styling and Coloring Products:

- Key Drivers: Growing awareness of hair health, demand for innovative styling solutions, and a trend towards personalized hair color.

- In-depth Analysis: As consumers become more informed about hair care, there is an increasing demand for products that not only style but also nourish and protect hair. The desire for vibrant and personalized hair colors, coupled with the influence of global styling trends, is driving innovation in this segment.

- Leading Distribution Channel: Online Stores:

- Key Drivers: Convenience, wide product availability, competitive pricing, and the rise of e-commerce infrastructure.

- In-depth Analysis: The digital-savvy population of Dubai, coupled with the ease of online shopping and doorstep delivery, has propelled online stores to the forefront. This channel offers unparalleled access to a vast array of local and international brands, fostering price competition and consumer loyalty.

- Key Distribution Channel: Specialty Stores:

- Key Drivers: Personalized customer service, curated product assortments, and brand experience.

- In-depth Analysis: High-end beauty boutiques and brand-specific stores provide an exclusive shopping experience, offering expert consultations and a sense of luxury that appeals to a significant segment of Dubai's discerning consumers.

Cosmetic Market in Dubai Product Innovations

Product innovations in the cosmetic market in Dubai are increasingly focused on efficacy, natural ingredients, and advanced formulations. We are witnessing a surge in "clean beauty" products, free from parabens, sulfates, and synthetic fragrances, aligning with a growing consumer demand for healthier alternatives. Personalized beauty solutions, leveraging AI and data analytics, are also gaining traction, offering bespoke skincare and makeup recommendations. For instance, the launch of injection-free lip enhancers by Huda Beauty, utilizing a combination of warming and cooling agents, showcases the market's embrace of innovative, non-invasive cosmetic solutions.

Propelling Factors for Cosmetic Market in Dubai Growth

Several key factors are propelling the growth of the cosmetic market in Dubai. The strong economic performance of the UAE, coupled with high disposable incomes, fuels consumer spending on premium and luxury beauty products. The region's status as a global tourism hub attracts a diverse international clientele with varying beauty preferences, further stimulating demand. Furthermore, government initiatives promoting entrepreneurship and innovation in the beauty sector, alongside a rapidly expanding e-commerce infrastructure, create a conducive environment for market expansion. The increasing influence of social media and beauty influencers also plays a crucial role in driving consumer awareness and adoption of new products and trends.

Obstacles in the Cosmetic Market in Dubai Market

Despite robust growth, the cosmetic market in Dubai faces certain obstacles. Intense competition from both established global brands and nimble local players necessitates continuous innovation and strategic marketing. Navigating stringent regulatory requirements, particularly concerning Halal certification and product safety, can add complexity and cost to market entry. Supply chain disruptions, exacerbated by global events, can impact product availability and pricing. Additionally, economic fluctuations and changing consumer spending habits, although currently stable, can pose a challenge to sustained growth.

Future Opportunities in Cosmetic Market in Dubai

The cosmetic market in Dubai is ripe with future opportunities. The burgeoning demand for Halal-certified and ethically sourced beauty products presents a significant avenue for growth, catering to a large and influential consumer base. The increasing adoption of e-commerce and the growing popularity of direct-to-consumer (DTC) models offer new channels for market penetration. Furthermore, the rise of sustainable and eco-friendly packaging solutions aligns with global environmental consciousness and presents an opportunity for brands to differentiate themselves. Exploring niche segments like men's grooming and specialized skincare for diverse climate conditions also holds considerable potential.

Major Players in the Cosmetic Market in Dubai Ecosystem

- The Estée Lauder Companies Inc

- Shirley Conlon Organics

- The Camel soap factory

- Dabur Ltd

- Anastasia Beverly Hills

- Huda Beauty

- Shiseido Company

- Unilever PLC

- HRC

- Herbal Essentials

Key Developments in Cosmetic Market in Dubai Industry

- July 2022: Dubai-based beauty brand Huda Beauty announced the launch of two new lip products marketed as "injection-free lip enhancers." A combination of warming and cooling agents is used in Silk Balm's new lip balms: the Icy Cryo-Plumping Lip Balm and the Spicy Thermo Plumping Lip Balm.

- February 2022: In the United Arab Emirates, Vatika launched an Oil Shampoo for hair nourishment and care. This shampoo contains natural ingredients like avocado, hibiscus, and shea butter.

- October 2021: A Japanese company specializing in producing women's beauty and wellness products, HRC, chose the United Arab Emirates as its first country in the Gulf area and the Middle East to expand its business.

Strategic Cosmetic Market in Dubai Market Forecast

The cosmetic market in Dubai is poised for continued expansion, driven by a convergence of favorable economic conditions, evolving consumer preferences for premium and personalized beauty, and a robust digital ecosystem. Future growth will be significantly influenced by the sustained demand for Halal-compliant and natural ingredient-based products, coupled with the increasing penetration of online sales channels. Strategic investments in product innovation, sustainable practices, and localized marketing campaigns will be crucial for capitalizing on emerging opportunities. The market's inherent dynamism, fueled by its status as a global hub and its discerning consumer base, ensures a promising outlook for the UAE cosmetics industry over the forecast period of 2025–2033.

Cosmetic Market in Dubai Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Make-up Products

- 1.1.2. Eye Make-up Products

- 1.1.3. Lip and Nail Make-up Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Other Retail Stores

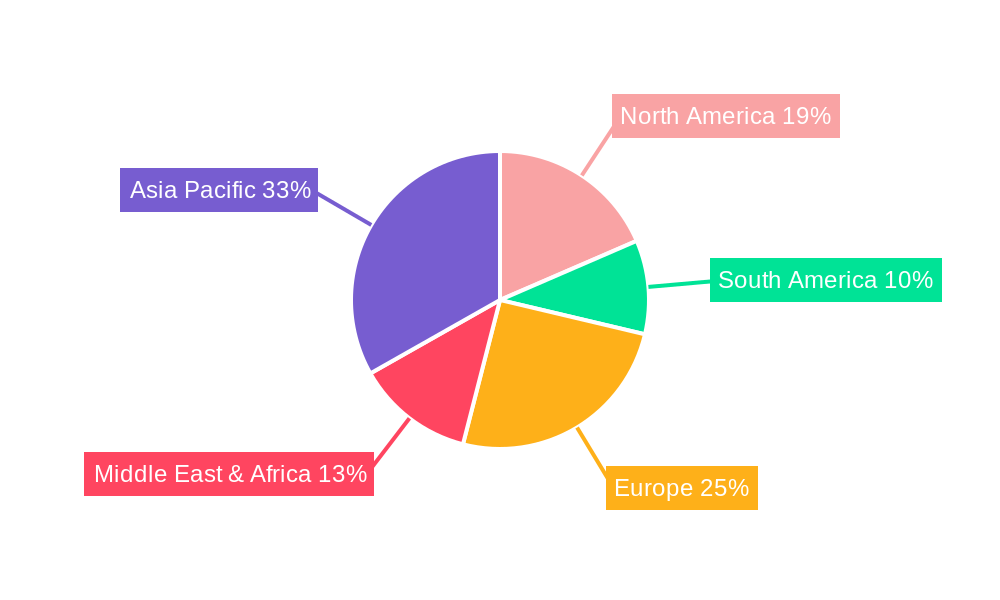

Cosmetic Market in Dubai Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cosmetic Market in Dubai Regional Market Share

Geographic Coverage of Cosmetic Market in Dubai

Cosmetic Market in Dubai REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations Regarding Worker's Safety; Importance Of Occupational Safety

- 3.3. Market Restrains

- 3.3.1. Impact of Counterfeit Products Coupled With Large Unorganized Labor Population Across Various Industries

- 3.4. Market Trends

- 3.4.1. Rising Awareness Towards Organic Products among Young Population in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Market in Dubai Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Make-up Products

- 5.1.1.2. Eye Make-up Products

- 5.1.1.3. Lip and Nail Make-up Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Other Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cosmetic Market in Dubai Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Color Cosmetics

- 6.1.1.1. Facial Make-up Products

- 6.1.1.2. Eye Make-up Products

- 6.1.1.3. Lip and Nail Make-up Products

- 6.1.2. Hair Styling and Coloring Products

- 6.1.2.1. Hair Colors

- 6.1.2.2. Hair Styling Products

- 6.1.1. Color Cosmetics

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Stores

- 6.2.4. Other Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cosmetic Market in Dubai Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Color Cosmetics

- 7.1.1.1. Facial Make-up Products

- 7.1.1.2. Eye Make-up Products

- 7.1.1.3. Lip and Nail Make-up Products

- 7.1.2. Hair Styling and Coloring Products

- 7.1.2.1. Hair Colors

- 7.1.2.2. Hair Styling Products

- 7.1.1. Color Cosmetics

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Stores

- 7.2.4. Other Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cosmetic Market in Dubai Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Color Cosmetics

- 8.1.1.1. Facial Make-up Products

- 8.1.1.2. Eye Make-up Products

- 8.1.1.3. Lip and Nail Make-up Products

- 8.1.2. Hair Styling and Coloring Products

- 8.1.2.1. Hair Colors

- 8.1.2.2. Hair Styling Products

- 8.1.1. Color Cosmetics

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Stores

- 8.2.4. Other Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cosmetic Market in Dubai Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Color Cosmetics

- 9.1.1.1. Facial Make-up Products

- 9.1.1.2. Eye Make-up Products

- 9.1.1.3. Lip and Nail Make-up Products

- 9.1.2. Hair Styling and Coloring Products

- 9.1.2.1. Hair Colors

- 9.1.2.2. Hair Styling Products

- 9.1.1. Color Cosmetics

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Stores

- 9.2.4. Other Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cosmetic Market in Dubai Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Color Cosmetics

- 10.1.1.1. Facial Make-up Products

- 10.1.1.2. Eye Make-up Products

- 10.1.1.3. Lip and Nail Make-up Products

- 10.1.2. Hair Styling and Coloring Products

- 10.1.2.1. Hair Colors

- 10.1.2.2. Hair Styling Products

- 10.1.1. Color Cosmetics

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online Stores

- 10.2.4. Other Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Estée Lauder Companies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shirley Conlon Organics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Camel soap factory

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dabur Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Anastasia Beverly Hills

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huda Beauty

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shiseido Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Unilever PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HRC *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Herbal Essentials

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Estée Lauder Companies Inc

List of Figures

- Figure 1: Global Cosmetic Market in Dubai Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Cosmetic Market in Dubai Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Cosmetic Market in Dubai Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cosmetic Market in Dubai Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Cosmetic Market in Dubai Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Cosmetic Market in Dubai Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Cosmetic Market in Dubai Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cosmetic Market in Dubai Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America Cosmetic Market in Dubai Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Cosmetic Market in Dubai Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America Cosmetic Market in Dubai Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Cosmetic Market in Dubai Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Cosmetic Market in Dubai Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cosmetic Market in Dubai Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Cosmetic Market in Dubai Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Cosmetic Market in Dubai Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe Cosmetic Market in Dubai Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Cosmetic Market in Dubai Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Cosmetic Market in Dubai Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cosmetic Market in Dubai Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Cosmetic Market in Dubai Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Cosmetic Market in Dubai Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Cosmetic Market in Dubai Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Cosmetic Market in Dubai Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cosmetic Market in Dubai Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cosmetic Market in Dubai Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Cosmetic Market in Dubai Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Cosmetic Market in Dubai Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Cosmetic Market in Dubai Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Cosmetic Market in Dubai Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Cosmetic Market in Dubai Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Cosmetic Market in Dubai Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cosmetic Market in Dubai Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Market in Dubai?

The projected CAGR is approximately 4.27%.

2. Which companies are prominent players in the Cosmetic Market in Dubai?

Key companies in the market include The Estée Lauder Companies Inc, Shirley Conlon Organics, The Camel soap factory, Dabur Ltd, Anastasia Beverly Hills, Huda Beauty, Shiseido Company, Unilever PLC, HRC *List Not Exhaustive, Herbal Essentials.

3. What are the main segments of the Cosmetic Market in Dubai?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations Regarding Worker's Safety; Importance Of Occupational Safety.

6. What are the notable trends driving market growth?

Rising Awareness Towards Organic Products among Young Population in the Country.

7. Are there any restraints impacting market growth?

Impact of Counterfeit Products Coupled With Large Unorganized Labor Population Across Various Industries.

8. Can you provide examples of recent developments in the market?

In July 2022, Dubai-based beauty brand Huda Beauty announced the launch of two new lip products marketed as "injection-free lip enhancers." A combination of warming and cooling agents is used in Silk Balm's new lip balms: the Icy Cryo-Plumping Lip Balm and the Spicy Thermo Plumping Lip Balm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Market in Dubai," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Market in Dubai report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Market in Dubai?

To stay informed about further developments, trends, and reports in the Cosmetic Market in Dubai, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence