Key Insights

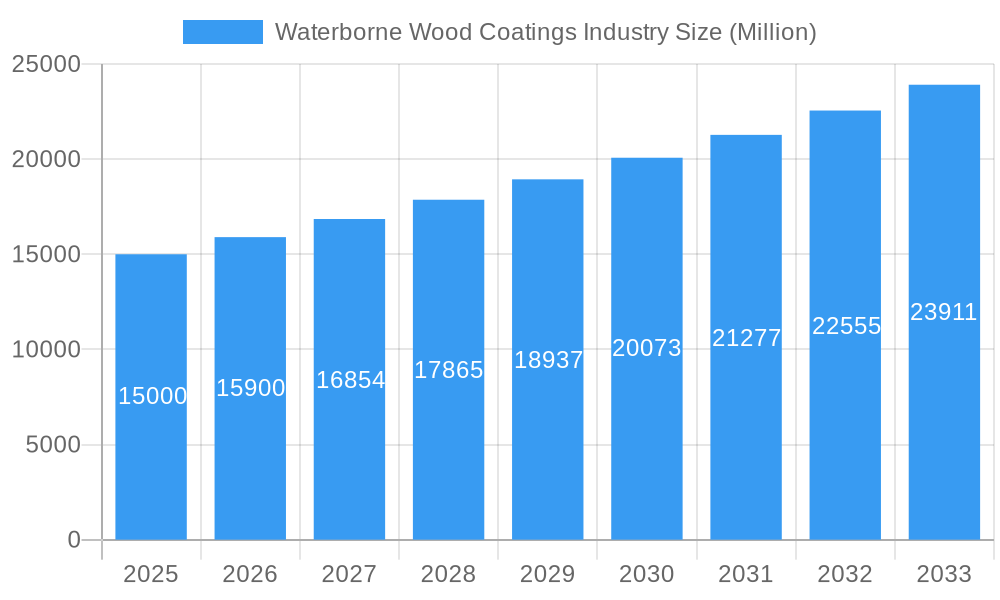

The Waterborne Wood Coatings market is poised for robust growth, projected to reach a significant market size of approximately USD 15,000 million by 2025. Driven by increasing environmental regulations and a growing consumer preference for sustainable and low-VOC (Volatile Organic Compound) products, the industry is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.00% over the forecast period of 2025-2033. This upward trajectory is further bolstered by advancements in coating technology, leading to improved performance, durability, and aesthetic appeal of waterborne formulations, making them increasingly competitive with traditional solvent-borne alternatives. The growing demand for eco-friendly solutions in both residential and commercial applications, including furniture, flooring, cabinetry, and architectural elements, is a primary catalyst for this expansion. Emerging economies, particularly in the Asia Pacific region, are expected to contribute significantly to this growth due to rapid industrialization and increasing disposable incomes.

Waterborne Wood Coatings Industry Market Size (In Billion)

Key trends shaping the Waterborne Wood Coatings market include the continuous innovation in resin technologies and additive formulations that enhance scratch resistance, chemical resistance, and drying times. The shift towards high-solids and ultra-low VOC waterborne coatings addresses stringent environmental mandates and consumer health concerns. Furthermore, the integration of smart technologies, such as self-healing properties and antimicrobial additives, is gaining traction. While the market exhibits strong growth potential, certain restraints, such as the perceived higher initial cost of some waterborne products compared to solvent-borne coatings and the need for specialized application equipment and training, could pose challenges. However, the long-term benefits of reduced environmental impact, improved air quality, and enhanced worker safety are increasingly outweighing these initial considerations, positioning waterborne wood coatings as the future standard in the industry.

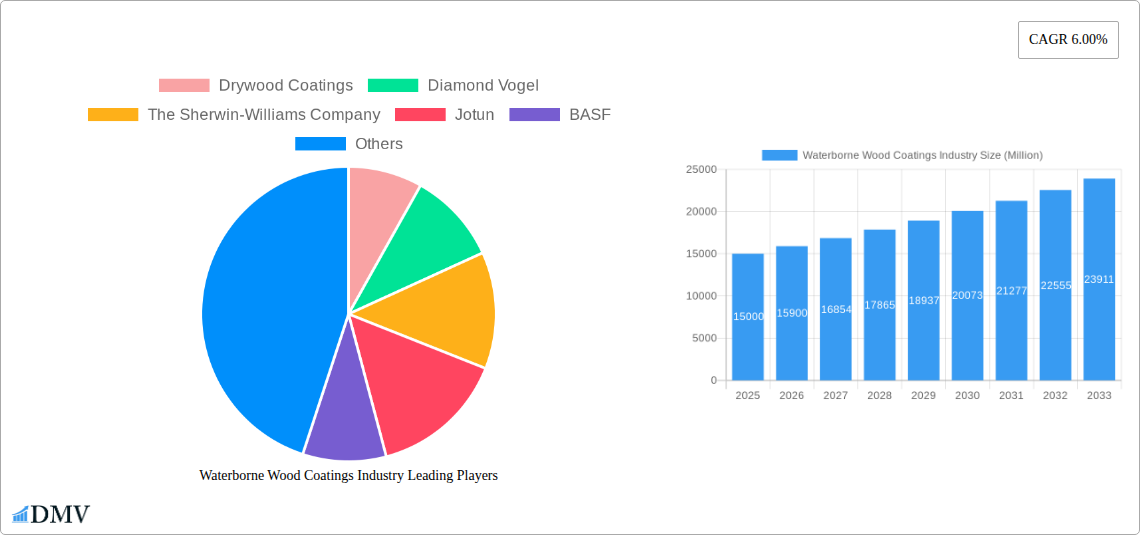

Waterborne Wood Coatings Industry Company Market Share

Waterborne Wood Coatings Industry Market Composition & Trends

The global waterborne wood coatings market is a dynamic and evolving sector, characterized by increasing environmental consciousness and stringent regulatory mandates pushing manufacturers towards sustainable solutions. The market exhibits a moderate to high concentration, with a few dominant players holding significant market share, while a substantial number of smaller and medium-sized enterprises cater to niche segments. Innovation serves as a primary catalyst, with continuous research and development focused on enhancing performance attributes such as durability, scratch resistance, and aesthetic appeal while reducing VOC emissions. The regulatory landscape is a crucial determinant, with governmental policies promoting eco-friendly products and penalizing high-VOC alternatives. The threat of substitute products, such as solvent-borne coatings, is diminishing as performance parity and cost-effectiveness of waterborne options improve. End-user profiles are diverse, spanning residential DIYers seeking safe and low-odor products, commercial entities demanding durable and aesthetically pleasing finishes for furniture and cabinetry, and industrial applications requiring robust protective coatings for high-traffic areas. Mergers and acquisitions (M&A) activities are a notable trend, with larger entities consolidating their market presence and expanding their product portfolios to capitalize on the growing demand for sustainable wood coatings. Recent M&A deals are estimated to be in the range of several hundred million USD, reflecting strategic investments in this high-growth sector. The market share distribution is estimated to see water-borne coatings capture approximately 55% of the total wood coatings market by 2025.

- Market Concentration: Moderate to High, with key players like Akzo Nobel, PPG Industries, and The Sherwin-Williams Company leading.

- Innovation Catalysts: Focus on low-VOC formulations, enhanced durability, and faster drying times.

- Regulatory Landscape: Stringent environmental regulations (e.g., REACH, EPA) driving adoption of water-based technologies.

- Substitute Products: Solvent-borne coatings are facing increasing pressure due to environmental concerns.

- End-User Profiles: Residential (DIY, new construction), Commercial (furniture, cabinetry, architectural millwork), Industrial (flooring, musical instruments).

- M&A Activities: Strategic acquisitions to expand market reach and technological capabilities, with estimated deal values in the range of $200 Million - $700 Million.

Waterborne Wood Coatings Industry Industry Evolution

The waterborne wood coatings industry has undergone a significant transformation over the historical period of 2019–2024, driven by a confluence of technological advancements, escalating environmental awareness, and evolving consumer preferences. Initially, waterborne wood coatings faced challenges in terms of performance and application compared to their solvent-borne counterparts. However, continuous research and development have led to substantial improvements in resin technologies, additive formulations, and manufacturing processes, bridging this performance gap. The market growth trajectory has been consistently upward, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% during the historical period. This growth is largely attributed to the increasing stringency of environmental regulations across major economies, mandating lower Volatile Organic Compound (VOC) emissions. Many regions have implemented bans or restrictions on solvent-based coatings, compelling manufacturers and end-users to shift towards more sustainable alternatives. Technological advancements have been instrumental in this evolution. Innovations in waterborne acrylics, polyurethanes, and epoxies have resulted in coatings that offer comparable or even superior durability, scratch resistance, and aesthetic finishes to traditional solvent-borne systems. Furthermore, the development of faster-drying formulations and improved application techniques has addressed historical concerns regarding application time and efficiency.

Consumer demand has also played a pivotal role. As awareness of the health and environmental impacts of VOCs grows, consumers, both residential and commercial, are increasingly seeking low-odor, non-toxic, and eco-friendly finishing solutions for their wood products. This shift in demand has created a strong pull for waterborne wood coatings, particularly in interior applications like furniture, cabinetry, and flooring. The base year of 2025 is projected to see waterborne wood coatings command a significant share of the overall wood coatings market, estimated to be around 55% of the total market volume. This market share is expected to continue its ascent throughout the forecast period of 2025–2033. The industry's evolution is characterized by a continuous cycle of innovation, driven by the need to meet and exceed regulatory standards while simultaneously satisfying the performance and aesthetic expectations of an increasingly discerning customer base. The successful adoption of waterborne technologies is a testament to the industry's ability to adapt and thrive in a rapidly changing global landscape, moving from a niche product to a mainstream solution for wood finishing.

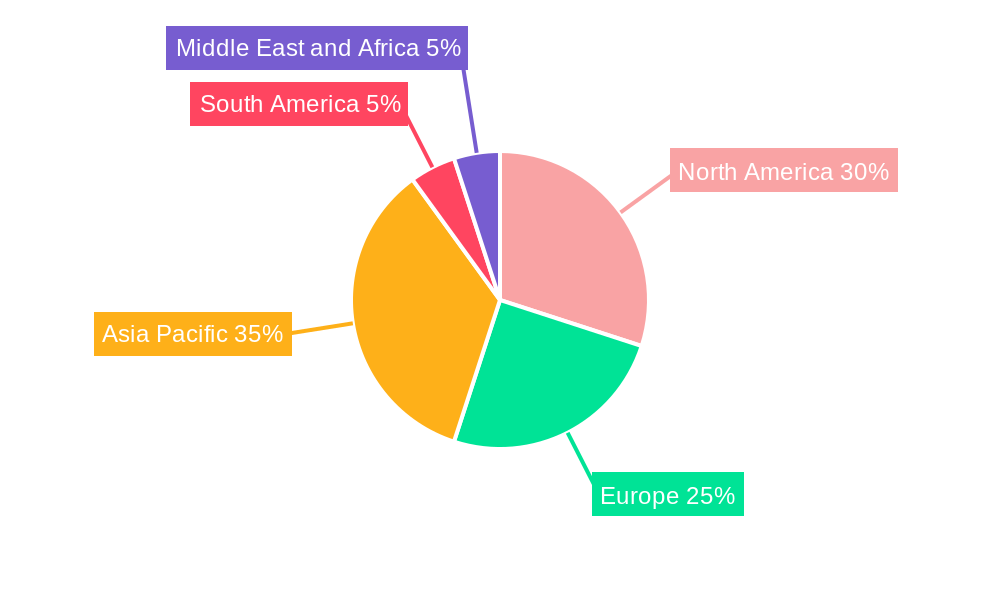

Leading Regions, Countries, or Segments in Waterborne Wood Coatings Industry

The global waterborne wood coatings industry is experiencing dominant growth and adoption in specific regions and segments, driven by a powerful synergy of regulatory support, robust industrial infrastructure, and burgeoning consumer demand for sustainable solutions. Among the product segments, Water-borne Coatings themselves are clearly emerging as the undisputed leader, not just within the broader wood coatings market but also as the primary focus of innovation and investment within the waterborne wood coatings industry itself. This segment is projected to capture a market share exceeding 70% of the total wood coatings market by the forecast period's end, driven by its inherent environmental advantages and continually improving performance characteristics.

Geographically, North America and Europe stand out as the leading regions for waterborne wood coatings. This dominance is underpinned by decades of proactive environmental legislation, such as the Clean Air Act in the United States and various EU directives on VOC emissions. These regulations have created a fertile ground for waterborne technologies to flourish, incentivizing manufacturers and consumers to move away from harmful solvent-based alternatives. The presence of major woodworking industries, a high disposable income among consumers, and a strong preference for sustainable and healthy living environments further solidify the leadership of these regions.

Within the end-user segments, the Commercial sector is a significant driver of demand for waterborne wood coatings. This includes applications in furniture manufacturing, cabinetry for both kitchens and bathrooms, architectural millwork, and flooring in commercial spaces like offices, hotels, and retail establishments. The stringent fire safety and indoor air quality standards in commercial settings, coupled with the need for durable and aesthetically pleasing finishes, make waterborne coatings an ideal choice. The Residential segment is also a substantial contributor, fueled by a growing trend towards DIY projects, home renovations, and a heightened awareness among homeowners about the health implications of VOCs, especially in living spaces. The ease of use, low odor, and quick drying times of modern waterborne coatings make them highly attractive for residential applications.

- Leading Product Segment: Water-borne Coatings (projected to exceed 70% market share by 2033).

- Key Drivers: Environmental compliance, performance advancements, versatility across applications.

- Dominance Factors: Strong regulatory push, R&D investment, and consumer preference for eco-friendly options.

- Leading Regions: North America and Europe.

- Key Drivers: Strict VOC regulations, established woodworking industries, high consumer environmental awareness, advanced R&D capabilities.

- Dominance Factors: Proactive governmental policies, significant investments in sustainable manufacturing, and a well-developed distribution network.

- Leading End User Segments: Commercial and Residential.

- Commercial: Furniture, cabinetry, architectural millwork, flooring in offices, hospitality, and retail.

- Key Drivers: Indoor air quality standards, durability requirements, aesthetic appeal, regulatory compliance.

- Residential: DIY projects, renovations, furniture finishing, interior and exterior woodwork.

- Key Drivers: Health consciousness, low-odor requirements, ease of application, desire for sustainable home products.

- Commercial: Furniture, cabinetry, architectural millwork, flooring in offices, hospitality, and retail.

Waterborne Wood Coatings Industry Product Innovations

Product innovations in the waterborne wood coatings industry are intensely focused on enhancing performance and sustainability. Manufacturers are developing advanced waterborne formulations that rival or surpass traditional solvent-borne coatings in terms of durability, scratch resistance, and chemical resistance. Key advancements include the incorporation of novel cross-linking technologies for improved hardness and flexibility, as well as the development of specialized additives for enhanced UV protection and moisture resistance. Furthermore, there's a significant push towards one-component systems that offer the performance of two-component systems without the need for mixing, simplifying application for both professionals and DIYers. This includes high-solids waterborne coatings that reduce application cycles and improve productivity. The industry is also witnessing innovations in aesthetic finishes, with the development of waterborne coatings that achieve metallic, matte, and high-gloss effects with superior clarity and color retention. The unique selling proposition lies in achieving these high-performance and aesthetic qualities while maintaining extremely low VOC content, often below 50 g/L, and meeting stringent environmental certifications.

Propelling Factors for Waterborne Wood Coatings Industry Growth

The growth of the waterborne wood coatings industry is propelled by several key factors, chief among them being increasingly stringent environmental regulations across the globe that mandate reductions in Volatile Organic Compound (VOC) emissions. This regulatory push is compelling manufacturers and end-users to transition from solvent-borne to more sustainable waterborne alternatives. Technological advancements play a crucial role, with ongoing innovation leading to improved performance characteristics of waterborne coatings, such as enhanced durability, faster drying times, and superior aesthetic finishes, effectively closing the performance gap with traditional coatings. Economic factors, including the rising cost of raw materials for solvent-borne coatings and the long-term cost savings associated with reduced waste and lower compliance costs, also contribute to the industry's expansion. Finally, a growing consumer awareness and demand for eco-friendly, low-odor, and healthy living environments further fuel the adoption of waterborne wood coatings.

Obstacles in the Waterborne Wood Coatings Industry Market

Despite the robust growth, the waterborne wood coatings industry faces several obstacles. One significant barrier is the perception of inferior performance compared to traditional solvent-borne coatings, particularly in terms of drying time and durability, though this is rapidly diminishing with technological advancements. Regulatory complexity and varying standards across different regions can also pose challenges for global manufacturers. The initial cost of switching to waterborne technologies for some industrial applications, including the potential need for new application equipment and retraining of staff, can also be a restraint. Supply chain disruptions for key raw materials, coupled with fluctuations in their pricing, can impact production costs and availability. Furthermore, while the market is expanding, intense competition from established players and new entrants can exert downward pressure on prices and profit margins.

Future Opportunities in Waterborne Wood Coatings Industry

The future holds significant opportunities for the waterborne wood coatings industry. The increasing global focus on sustainability and green building practices will continue to drive demand for eco-friendly coatings. Emerging markets in Asia-Pacific and Latin America, with their rapidly developing construction and furniture industries, present substantial untapped potential. Technological advancements are expected to yield even higher-performing, faster-drying, and more cost-effective waterborne formulations. Innovations in bio-based and renewable raw materials for coatings offer another avenue for growth and differentiation. Furthermore, the expansion of the DIY market and the growing consumer preference for aesthetically pleasing and healthy home environments will continue to create opportunities for specialized residential waterborne wood coatings.

Major Players in the Waterborne Wood Coatings Industry Ecosystem

- Drywood Coatings

- Diamond Vogel

- The Sherwin-Williams Company

- Jotun

- BASF

- The Dow Chemical Company

- Benjamin Moore & Co

- Helios Group

- Rust-Oleum

- IVM Chemicals

- PPG Industries

- Royal DSM

- Akzo Nobel

- KAPCI Coatings

Key Developments in Waterborne Wood Coatings Industry Industry

- 2023 October: PPG Industries launches a new range of ultra-low VOC waterborne wood coatings designed for furniture and cabinetry, enhancing durability and application ease.

- 2023 August: Akzo Nobel acquires a specialized waterborne coatings manufacturer to expand its sustainable product portfolio in emerging markets.

- 2023 May: BASF introduces a novel waterborne resin technology offering superior scratch and abrasion resistance for industrial wood applications.

- 2023 March: The Sherwin-Williams Company announces significant investments in R&D to accelerate the development of next-generation waterborne wood finishes.

- 2023 January: Jotun expands its waterborne wood coatings production capacity in Southeast Asia to meet growing regional demand.

- 2022 November: Royal DSM unveils a new range of waterborne polyurethane dispersions (PUDs) with improved flexibility and weatherability for outdoor wood applications.

- 2022 September: Helios Group develops a new series of one-component waterborne coatings that offer the performance of two-component systems without mixing.

- 2022 July: Benjamin Moore & Co. introduces enhanced formulations of its waterborne wood stains, offering improved color retention and ease of application.

- 2022 April: Rust-Oleum expands its line of waterborne wood finishes to include specialized products for marine and outdoor furniture.

- 2022 February: IVM Chemicals launches a bio-based waterborne coating line, catering to the growing demand for sustainable wood finishing solutions.

- 2021 December: The Dow Chemical Company announces a breakthrough in waterborne acrylic technology, enabling faster curing times for industrial wood coatings.

- 2021 October: KAPCI Coatings introduces a high-performance waterborne wood coating series for the automotive refinish market.

- 2021 June: Diamond Vogel invests in advanced manufacturing processes to increase the output of its eco-friendly waterborne wood coatings.

- 2021 March: Drywood Coatings expands its distribution network to better serve the growing residential market for waterborne wood finishes.

Strategic Waterborne Wood Coatings Industry Market Forecast

The strategic forecast for the waterborne wood coatings industry is exceptionally promising, driven by an unyielding global shift towards environmental sustainability and stricter regulatory frameworks. Anticipated growth will be fueled by continuous technological innovation, leading to coatings that not only meet but exceed the performance benchmarks set by traditional solvent-borne alternatives in terms of durability, aesthetics, and application efficiency. Emerging economies present significant expansion opportunities as their construction and furniture sectors mature and increasingly adopt eco-friendly standards. The increasing consumer awareness regarding health and well-being will further solidify demand for low-VOC, low-odor finishes, particularly in residential and commercial interior applications. Strategic investments in R&D and market penetration will be crucial for players aiming to capture a larger share of this expanding market, ensuring the waterborne wood coatings industry remains a dominant force in sustainable wood finishing solutions.

Waterborne Wood Coatings Industry Segmentation

-

1. Product

- 1.1. Solvent-borne Coatings

- 1.2. Water-borne Coatings

- 1.3. Radiation-cured Coatings

- 1.4. Powder coating Coatings

-

2. End User

- 2.1. Residential

- 2.2. Commercial

Waterborne Wood Coatings Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Waterborne Wood Coatings Industry Regional Market Share

Geographic Coverage of Waterborne Wood Coatings Industry

Waterborne Wood Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urabanization is Impacting the Market; Modular Kitchens are Booming the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Costs

- 3.4. Market Trends

- 3.4.1. Solvent-borne Coatings Segment is the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Solvent-borne Coatings

- 5.1.2. Water-borne Coatings

- 5.1.3. Radiation-cured Coatings

- 5.1.4. Powder coating Coatings

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Solvent-borne Coatings

- 6.1.2. Water-borne Coatings

- 6.1.3. Radiation-cured Coatings

- 6.1.4. Powder coating Coatings

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Solvent-borne Coatings

- 7.1.2. Water-borne Coatings

- 7.1.3. Radiation-cured Coatings

- 7.1.4. Powder coating Coatings

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Solvent-borne Coatings

- 8.1.2. Water-borne Coatings

- 8.1.3. Radiation-cured Coatings

- 8.1.4. Powder coating Coatings

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Solvent-borne Coatings

- 9.1.2. Water-borne Coatings

- 9.1.3. Radiation-cured Coatings

- 9.1.4. Powder coating Coatings

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Solvent-borne Coatings

- 10.1.2. Water-borne Coatings

- 10.1.3. Radiation-cured Coatings

- 10.1.4. Powder coating Coatings

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Drywood Coatings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Diamond Vogel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Sherwin-Williams Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jotun

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Dow Chemical Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Benjamin Moore & Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Helios Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rust-Oleum**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IVM Chemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PPG Industries

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Royal DSM

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Akzo Nobel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KAPCI Coatings

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Drywood Coatings

List of Figures

- Figure 1: Global Waterborne Wood Coatings Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Pacific Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 21: South America Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: South America Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: South America Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waterborne Wood Coatings Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Waterborne Wood Coatings Industry?

Key companies in the market include Drywood Coatings, Diamond Vogel, The Sherwin-Williams Company, Jotun, BASF, The Dow Chemical Company, Benjamin Moore & Co, Helios Group, Rust-Oleum**List Not Exhaustive, IVM Chemicals, PPG Industries, Royal DSM, Akzo Nobel, KAPCI Coatings.

3. What are the main segments of the Waterborne Wood Coatings Industry?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urabanization is Impacting the Market; Modular Kitchens are Booming the Market.

6. What are the notable trends driving market growth?

Solvent-borne Coatings Segment is the Largest Segment.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waterborne Wood Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waterborne Wood Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waterborne Wood Coatings Industry?

To stay informed about further developments, trends, and reports in the Waterborne Wood Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence