Key Insights

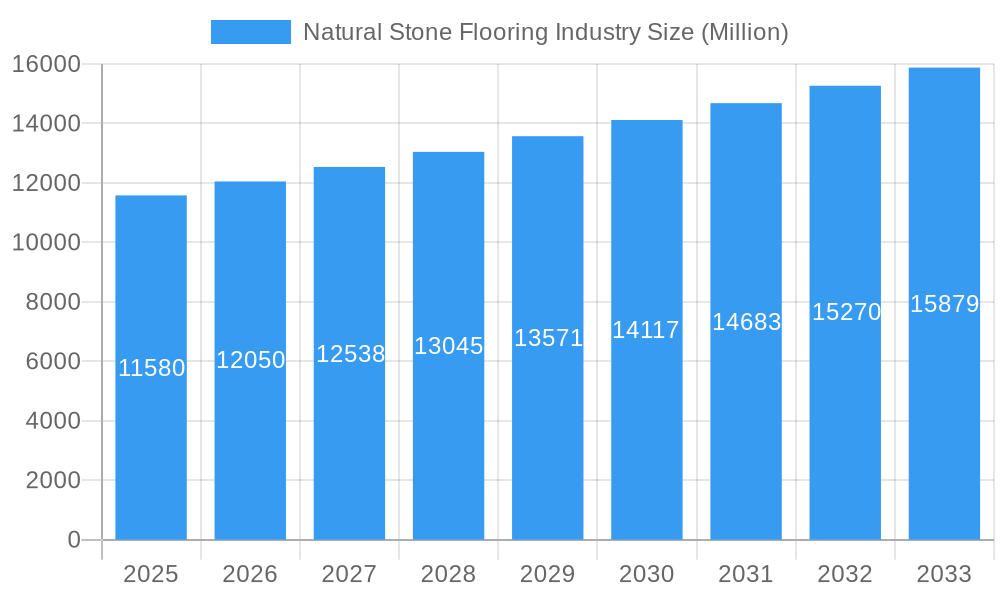

The global Natural Stone Flooring market is poised for robust expansion, projected to reach an estimated USD 11.58 billion by 2025, demonstrating a significant Compound Annual Growth Rate (CAGR) of 4.16% through 2033. This growth is underpinned by a confluence of powerful drivers, including the increasing consumer preference for durable, aesthetically pleasing, and eco-friendly flooring solutions. The inherent beauty and unique patterns of natural stone, such as marble, granite, limestone, and slate, continue to captivate homeowners and commercial developers alike, driving demand in both residential renovations and new construction projects. Furthermore, advancements in quarrying and processing technologies are making natural stone more accessible and cost-effective, further fueling its adoption. The market's trajectory is also influenced by rising disposable incomes in emerging economies, leading to greater investment in premium home improvements.

Natural Stone Flooring Industry Market Size (In Billion)

The market's expansion is further characterized by evolving trends that cater to diverse aesthetic preferences and functional requirements. Consumers are increasingly seeking natural stone with intricate veining, polished finishes, and custom-cut patterns, driving innovation in design and application. The growing awareness of sustainability is also playing a crucial role, as natural stone is inherently a long-lasting and recyclable material. However, the market faces certain restraints, primarily related to the higher initial cost compared to some synthetic alternatives and the logistical challenges associated with sourcing and installation. Fluctuations in raw material availability and potential price volatility can also impact market dynamics. Despite these challenges, the inherent value proposition of natural stone, coupled with ongoing innovation and a persistent demand for luxury and durability, ensures a promising outlook for the Natural Stone Flooring industry.

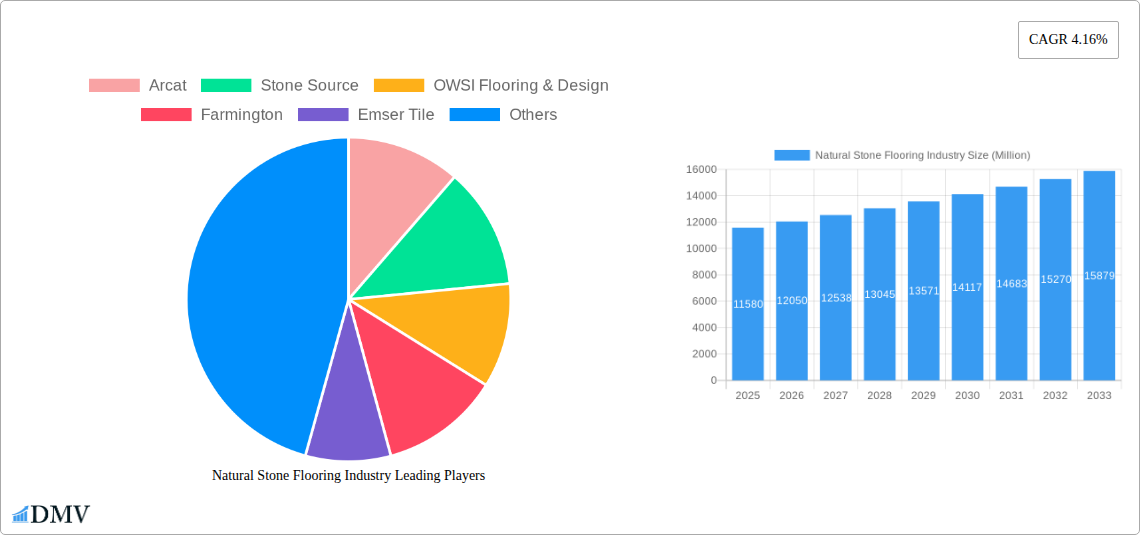

Natural Stone Flooring Industry Company Market Share

Here is an SEO-optimized, insightful report description for the Natural Stone Flooring Industry, designed to boost search visibility and captivate stakeholders.

Natural Stone Flooring Industry Market Composition & Trends

The global Natural Stone Flooring Industry is characterized by a moderate market concentration, with key players like Arcat, Stone Source, OWSI Flooring & Design, Farmington, Emser Tile, Templeton Floor Company, Universal Marble & Granite Group Ltd, BC Stone (List Not Exhaustive), and Island Stone carving out significant market shares. Innovation catalysts are primarily driven by advancements in quarrying techniques, processing technologies, and sustainable sourcing practices, appealing to an increasingly eco-conscious consumer base. The regulatory landscape varies by region, with stringent environmental regulations impacting extraction and processing, while building codes influence installation standards. Substitute products, such as luxury vinyl tile (LVT) and porcelain stoneware, present a competitive challenge, though natural stone retains its premium appeal for aesthetic durability. End-user profiles are diverse, encompassing residential homeowners seeking luxury and longevity, commercial establishments prioritizing durability and aesthetic appeal, and specialized sectors like healthcare and hospitality demanding hygienic and robust surfaces. Mergers and acquisitions (M&A) activity is a recurring theme, signaling consolidation and strategic expansion within the industry. For instance, the acquisition of Stone Source by Paramount Global Surfaces in April 2022 underscores the dynamic nature of market consolidation, with reported M&A deal values anticipated to reflect substantial strategic investments. Market share distribution is expected to see subtle shifts driven by regional demand and technological adoption.

- Market Concentration: Moderate, with a few dominant players and numerous smaller regional suppliers.

- Innovation Catalysts: Sustainable quarrying, advanced processing, enhanced durability coatings.

- Regulatory Landscapes: Growing emphasis on environmental impact, safety, and ethical sourcing.

- Substitute Products: Luxury Vinyl Tile (LVT), Porcelain Stoneware, Engineered Wood.

- End-User Profiles: Residential (Upscale), Commercial (Hospitality, Retail, Office), Healthcare.

- M&A Activities: Driven by market expansion, portfolio diversification, and vertical integration.

Natural Stone Flooring Industry Industry Evolution

The Natural Stone Flooring Industry has witnessed a remarkable evolution throughout the historical period of 2019–2024, driven by a confluence of technological advancements, shifting consumer preferences, and expanding global demand. The market growth trajectory has been consistently upward, fueled by the inherent aesthetic appeal, durability, and timeless elegance of natural stone materials like marble, granite, slate, and travertine. During this period, significant investments were made in improving quarrying efficiency and extraction techniques, leading to a more consistent supply of high-quality stone. Processing technologies have also seen substantial innovation, with advancements in cutting, polishing, and sealing methods enhancing the performance characteristics and reducing installation complexities. For example, the development of water-jet cutting and CNC machining has enabled intricate designs and precise fitting, elevating the perceived value and application range of natural stone.

Consumer demand has been a pivotal force in shaping the industry's evolution. There's a discernible shift towards prioritizing natural, sustainable, and eco-friendly building materials, a trend that strongly favors natural stone. Homeowners and commercial developers are increasingly willing to invest in materials that offer longevity, low maintenance (with proper sealing), and a unique, artisanal quality that synthetic alternatives struggle to replicate. This is particularly evident in the upscale residential and luxury commercial segments. Furthermore, the rise of online platforms and augmented reality visualization tools has empowered consumers to explore and select natural stone options more readily, bridging geographical barriers and democratizing access to premium materials.

The historical period also saw a growing awareness and demand for ethically sourced and environmentally responsible natural stone. This has prompted many industry players to adopt more sustainable quarrying practices and transparent supply chain management, further enhancing the desirability of natural stone. Despite occasional economic headwinds and supply chain disruptions, the industry has demonstrated resilience, adapting to market fluctuations and emerging trends. The base year of 2025 is anticipated to witness the continuation of these positive trends, with the forecast period of 2025–2033 poised for accelerated growth, driven by ongoing technological innovation, rising disposable incomes in developing economies, and a persistent consumer preference for high-value, natural products. The adoption of advanced digital technologies in design and installation is also expected to play a crucial role in future market expansion.

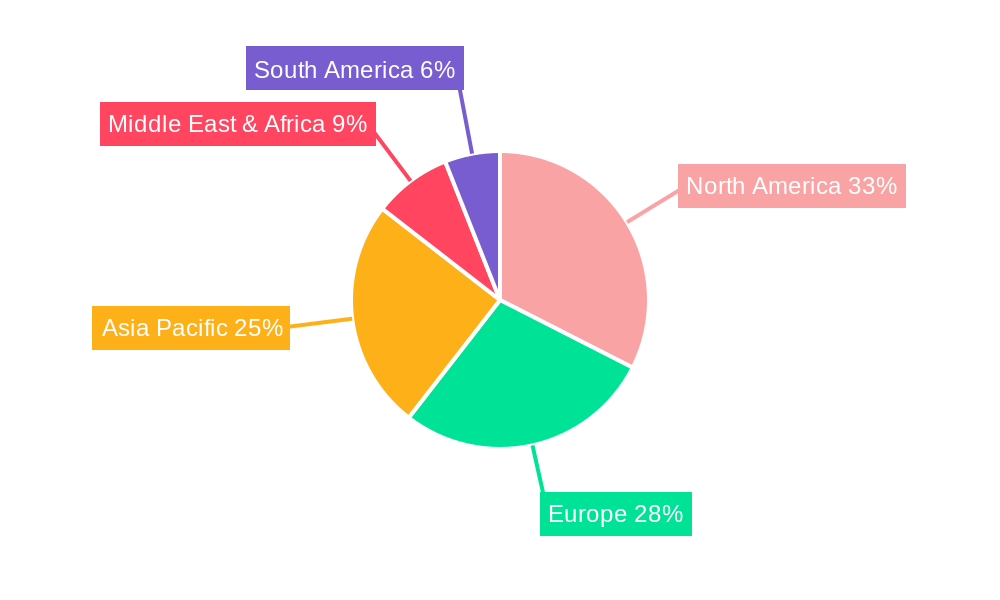

Leading Regions, Countries, or Segments in Natural Stone Flooring Industry

The global Natural Stone Flooring Industry's dominance is multifaceted, with key regions and segments exhibiting distinct growth drivers and market dynamics. From a Production Analysis: perspective, countries with rich geological reserves and established quarrying infrastructure, such as India, China, Brazil, Italy, and Turkey, are major global suppliers. These regions benefit from economies of scale and access to diverse natural stone types, ranging from granite and marble to limestone and slate. The sheer volume of extraction and processing capacity positions them as leaders in supplying raw materials to the global market.

In terms of Consumption Analysis:, North America (particularly the United States) and Europe stand out as leading markets. This dominance is driven by high disposable incomes, a strong preference for premium and durable building materials in both residential and commercial sectors, and a well-established construction and renovation industry. The architectural and design community in these regions plays a crucial role in specifying natural stone for a wide array of projects, from luxury homes and high-end retail spaces to corporate offices and hospitality venues.

The Import Market Analysis (Value & Volume): is heavily influenced by regions with significant demand but limited domestic production of certain stone types. The United States, for instance, imports vast quantities of natural stone from various global sources to meet its diverse project requirements. European nations also exhibit substantial import volumes, particularly for specialized marbles and granites not readily available domestically. Key drivers for import dominance include the demand for aesthetic variety, the need to supplement local supply, and the cost-effectiveness of sourcing from specialized producers.

The Export Market Analysis (Value & Volume): is led by countries with significant production capabilities and strong international trade relationships. Italy, renowned for its Carrara marble, and India, a major exporter of granite and sandstone, are prime examples. These countries have developed robust export logistics and marketing networks, catering to global demand. The value aspect of exports is often driven by the quality, rarity, and unique characteristics of the stone, as well as the brand reputation of the exporting country.

The Price Trend Analysis: reveals that natural stone prices are influenced by extraction costs, transportation, processing complexity, rarity, and market demand. High-end marbles and exotic granites command premium prices, while more common stones like granite and limestone are available at more competitive price points. Regional price variations are significant, influenced by local labor costs, energy prices, and import duties.

- Production Dominance Drivers:

- Abundant geological reserves.

- Advanced quarrying and processing technology.

- Economies of scale.

- Established export infrastructure.

- Consumption Dominance Drivers:

- High disposable incomes.

- Strong construction and renovation sectors.

- Preference for luxury and durable materials.

- Influence of architectural and design trends.

- Import Dominance Drivers:

- Demand for aesthetic diversity.

- Supplementation of domestic supply.

- Cost-effectiveness of sourcing.

- Export Dominance Drivers:

- High-quality and unique stone varieties.

- Strong brand reputation and established trade routes.

- Efficient logistics and marketing.

- Price Trend Influencers:

- Extraction and processing costs.

- Transportation and logistics.

- Rarity and uniqueness of the stone.

- Market demand and economic conditions.

Natural Stone Flooring Industry Product Innovations

Product innovations in the Natural Stone Flooring Industry are increasingly focused on enhancing performance, aesthetics, and sustainability. Advancements in sealing technologies are providing improved stain and water resistance, reducing maintenance requirements and extending the lifespan of natural stone installations. Innovative edge profiling and surface treatments offer new design possibilities, catering to diverse architectural styles and consumer preferences. The development of thinner, larger format natural stone tiles, achieved through advanced quarrying and cutting techniques, is simplifying installation and opening up new applications in both residential and commercial projects. Furthermore, the industry is witnessing a growing trend towards utilizing recycled natural stone materials and developing eco-friendly processing methods, aligning with the global demand for sustainable building solutions. These innovations address key performance metrics such as durability, ease of maintenance, aesthetic versatility, and environmental impact.

Propelling Factors for Natural Stone Flooring Industry Growth

Several key factors are propelling the growth of the Natural Stone Flooring Industry. A primary driver is the escalating consumer demand for premium, durable, and aesthetically pleasing interior finishes that offer a timeless appeal. This is supported by rising disposable incomes in emerging economies and a growing appreciation for natural, sustainable materials. Technological advancements in quarrying, processing, and installation techniques are making natural stone more accessible and versatile, reducing costs and enabling more intricate designs. The robust growth of the global construction and renovation sector, particularly in residential and luxury commercial segments, directly translates to increased demand for natural stone flooring. Furthermore, favorable government initiatives and building regulations that promote the use of sustainable and long-lasting materials indirectly contribute to market expansion.

Obstacles in the Natural Stone Flooring Industry Market

Despite its inherent advantages, the Natural Stone Flooring Industry faces several obstacles. The high initial cost of natural stone compared to some synthetic alternatives remains a significant barrier for price-sensitive consumers. Supply chain disruptions, including transportation challenges and fluctuating raw material availability due to geopolitical factors or extraction limitations, can impact lead times and project timelines. Stringent environmental regulations and the complexities of sustainable quarrying practices can increase operational costs for producers. Furthermore, the availability and effectiveness of skilled labor for installation can vary by region, potentially affecting project quality and customer satisfaction. Intense competition from engineered materials like porcelain and LVT, which often offer comparable aesthetics at lower price points and with simpler maintenance, also poses a challenge.

Future Opportunities in Natural Stone Flooring Industry

The Natural Stone Flooring Industry is poised for significant future opportunities driven by evolving consumer trends and technological advancements. The increasing global focus on sustainability and biophilic design presents a major avenue for growth, as natural stone is inherently a sustainable and aesthetically pleasing material that connects indoor spaces with nature. The development of innovative surface treatments and advanced sealing technologies will further enhance the durability and ease of maintenance of natural stone, broadening its appeal to a wider range of applications, including high-traffic commercial areas and moisture-prone spaces. The expansion of e-commerce platforms and digital visualization tools offers new channels to reach a global customer base and showcase the unique beauty of natural stone. Furthermore, the growing demand for personalized and luxury living spaces in developing economies will continue to fuel the demand for premium natural stone flooring.

Major Players in the Natural Stone Flooring Industry Ecosystem

- Arcat

- Stone Source

- OWSI Flooring & Design

- Farmington

- Emser Tile

- Templeton Floor Company

- Universal Marble & Granite Group Ltd

- BC Stone

- Island Stone

Key Developments in Natural Stone Flooring Industry Industry

- December 2022: Emser Tile, a prominent creator and manufacturer of high-quality tile and natural stone globally, introduced 4 fresh sets of glazed porcelain and ceramic tile: Tubage, Boxwood, Fragmento, and Estasi.

- April 2022: Paramount Global Surfaces, a company within the Platinum Equity portfolio, revealed the purchase of Stone Source from a consortium of investors led by Founders Equity. Based in New York, Stone Source specializes in supplying natural stone, ceramic tile, and other decorative surfaces to contractors and consumers through the architect and design channel, catering to both commercial and upscale residential applications.

Strategic Natural Stone Flooring Industry Market Forecast

The strategic Natural Stone Flooring Industry market forecast anticipates sustained growth, propelled by an increasing consumer preference for natural, durable, and aesthetically superior materials. Key growth catalysts include ongoing technological innovations in processing and installation, which are enhancing the accessibility and versatility of natural stone. The expanding global construction and renovation markets, particularly in the luxury residential and commercial sectors, will continue to drive demand. Emerging economies present significant untapped potential as disposable incomes rise and a greater appreciation for premium building materials takes hold. The industry's inherent sustainability and ability to contribute to biophilic design trends further position it for success in an environmentally conscious future, ensuring its long-term market relevance and expansion.

Natural Stone Flooring Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Natural Stone Flooring Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Natural Stone Flooring Industry Regional Market Share

Geographic Coverage of Natural Stone Flooring Industry

Natural Stone Flooring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Aesthetically Appealing Products to Fuel the Growth of the Stone Flooring Market; Demand for Stone Floors as a Decorative Tool in the Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Initial Cost; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization and Increasing Disposable Income Leads to Growth of the Construction Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Natural Stone Flooring Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Natural Stone Flooring Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Natural Stone Flooring Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Natural Stone Flooring Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Natural Stone Flooring Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Natural Stone Flooring Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arcat

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stone Source

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OWSI Flooring & Design

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Farmington

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emser Tile

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Templeton Floor Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Universal Marble & Granite Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BC Stone**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Island Stone

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Arcat

List of Figures

- Figure 1: Global Natural Stone Flooring Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Natural Stone Flooring Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Natural Stone Flooring Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Natural Stone Flooring Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Natural Stone Flooring Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Natural Stone Flooring Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Natural Stone Flooring Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Natural Stone Flooring Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Natural Stone Flooring Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Natural Stone Flooring Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Natural Stone Flooring Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Natural Stone Flooring Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Natural Stone Flooring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Natural Stone Flooring Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Natural Stone Flooring Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Natural Stone Flooring Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Natural Stone Flooring Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Natural Stone Flooring Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Natural Stone Flooring Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Natural Stone Flooring Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Natural Stone Flooring Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Natural Stone Flooring Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Natural Stone Flooring Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Natural Stone Flooring Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Natural Stone Flooring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Natural Stone Flooring Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Natural Stone Flooring Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Natural Stone Flooring Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Natural Stone Flooring Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Natural Stone Flooring Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Natural Stone Flooring Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Natural Stone Flooring Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Natural Stone Flooring Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Natural Stone Flooring Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Natural Stone Flooring Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Natural Stone Flooring Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Natural Stone Flooring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Natural Stone Flooring Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Natural Stone Flooring Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Natural Stone Flooring Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Natural Stone Flooring Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Natural Stone Flooring Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Natural Stone Flooring Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Natural Stone Flooring Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Natural Stone Flooring Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Natural Stone Flooring Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Natural Stone Flooring Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Natural Stone Flooring Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Natural Stone Flooring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Natural Stone Flooring Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Natural Stone Flooring Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Natural Stone Flooring Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Natural Stone Flooring Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Natural Stone Flooring Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Natural Stone Flooring Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Natural Stone Flooring Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Natural Stone Flooring Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Natural Stone Flooring Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Natural Stone Flooring Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Natural Stone Flooring Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Natural Stone Flooring Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Natural Stone Flooring Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Natural Stone Flooring Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Natural Stone Flooring Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Natural Stone Flooring Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Natural Stone Flooring Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Natural Stone Flooring Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Natural Stone Flooring Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Natural Stone Flooring Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Natural Stone Flooring Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Natural Stone Flooring Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Natural Stone Flooring Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Natural Stone Flooring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Natural Stone Flooring Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Natural Stone Flooring Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Natural Stone Flooring Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Natural Stone Flooring Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Natural Stone Flooring Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Natural Stone Flooring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Natural Stone Flooring Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Natural Stone Flooring Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Natural Stone Flooring Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Natural Stone Flooring Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Natural Stone Flooring Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Natural Stone Flooring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Natural Stone Flooring Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Natural Stone Flooring Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Natural Stone Flooring Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Natural Stone Flooring Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Natural Stone Flooring Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Natural Stone Flooring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Natural Stone Flooring Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Natural Stone Flooring Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Natural Stone Flooring Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Natural Stone Flooring Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Natural Stone Flooring Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Natural Stone Flooring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Natural Stone Flooring Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Stone Flooring Industry?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Natural Stone Flooring Industry?

Key companies in the market include Arcat, Stone Source, OWSI Flooring & Design, Farmington, Emser Tile, Templeton Floor Company, Universal Marble & Granite Group Ltd, BC Stone**List Not Exhaustive, Island Stone.

3. What are the main segments of the Natural Stone Flooring Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Aesthetically Appealing Products to Fuel the Growth of the Stone Flooring Market; Demand for Stone Floors as a Decorative Tool in the Construction Industry.

6. What are the notable trends driving market growth?

Rapid Urbanization and Increasing Disposable Income Leads to Growth of the Construction Activities.

7. Are there any restraints impacting market growth?

High Initial Cost; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

December 2022: Emser Tile, a prominent creator and manufacturer of high-quality tile and natural stone globally, introduced 4 fresh sets of glazed porcelain and ceramic tile: Tubage, Boxwood, Fragmento, and Estasi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Natural Stone Flooring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Natural Stone Flooring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Natural Stone Flooring Industry?

To stay informed about further developments, trends, and reports in the Natural Stone Flooring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence