Key Insights

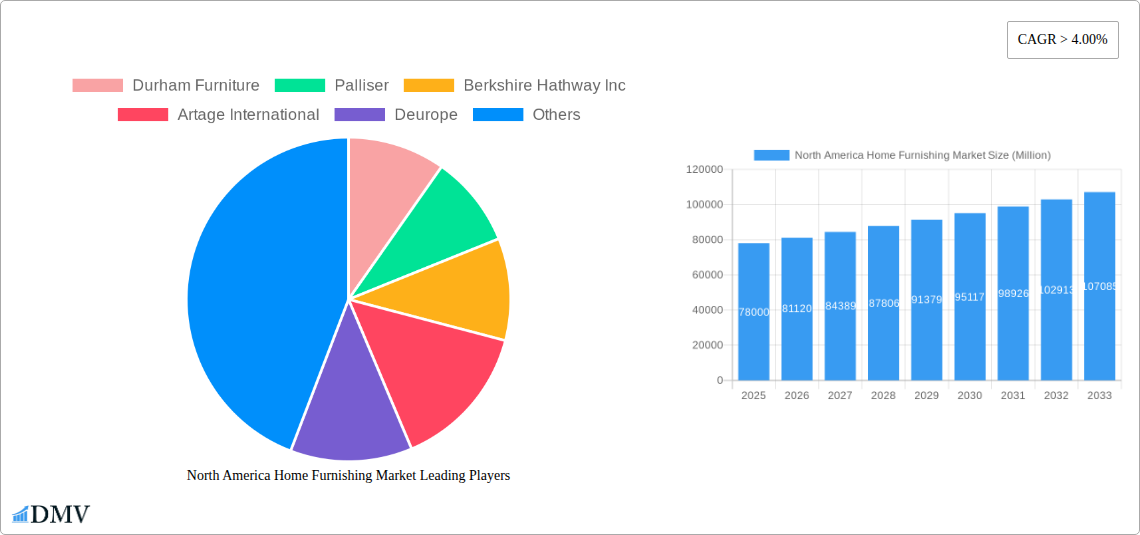

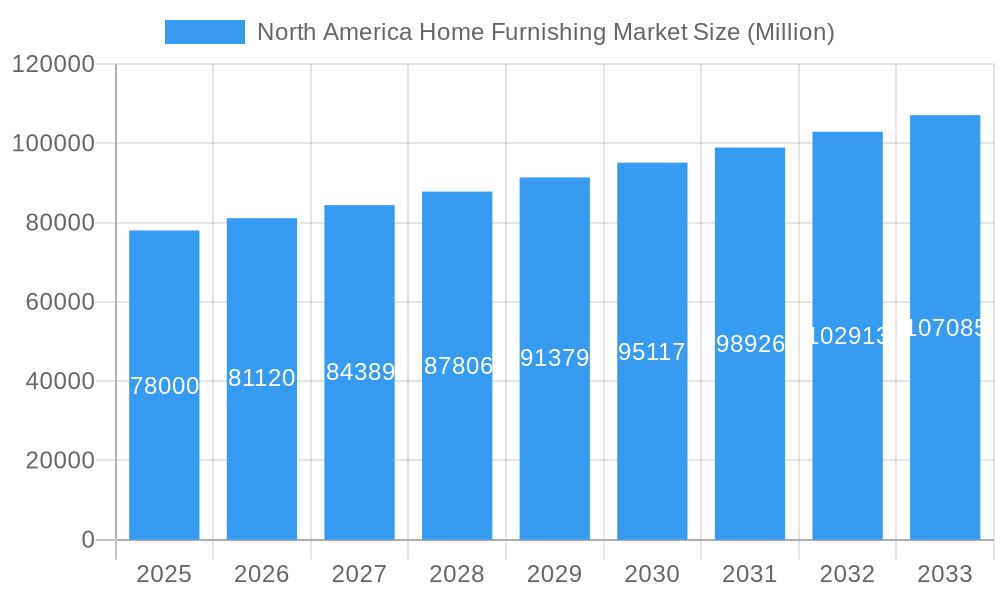

The North America Home Furnishing Market is poised for robust expansion, projected to achieve a market size exceeding \$XX million (estimating based on CAGR and typical market values) with a Compound Annual Growth Rate (CAGR) of over 4.00% throughout the forecast period of 2025-2033. This sustained growth is being propelled by a confluence of factors, including a rising disposable income among consumers, an increasing trend towards home renovation and interior design, and a growing demand for aesthetically pleasing and functional furniture. The post-pandemic era has seen a significant emphasis on creating comfortable and personalized living spaces, further fueling the demand for diverse home furnishing solutions. Furthermore, evolving consumer preferences towards sustainable and eco-friendly materials are shaping product development and market strategies, presenting opportunities for innovation and market penetration.

North America Home Furnishing Market Market Size (In Billion)

The market's dynamism is further illustrated by its segmentation across various categories. In terms of materials, wood and metal continue to dominate, but plastic and other innovative furniture materials are gaining traction due to their durability, affordability, and design versatility. The type segmentation highlights strong demand across living room, dining room, and bedroom furniture, reflecting the core areas of consumer spending on home interiors. Distribution channels are also evolving, with a notable shift towards online sales complementing the traditional presence of supermarkets, hypermarkets, and specialty stores. Geographically, the United States and Canada represent key markets, with the United States expected to hold a significant share due to its larger consumer base and higher spending power. Despite these positive indicators, challenges such as fluctuating raw material costs and intense market competition could present moderate restraints to rapid growth, necessitating strategic planning and adaptation by market players.

North America Home Furnishing Market Company Market Share

North America Home Furnishing Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a panoramic view of the North America Home Furnishing Market, a dynamic sector poised for significant expansion. Covering the study period of 2019–2033, with base year 2025 and forecast period 2025–2033, this analysis delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Leveraging high-ranking keywords like "home decor," "furniture market," "interior design trends," "US furniture sales," "Canadian home goods," and more, this report is meticulously crafted to boost search visibility and captivate stakeholders seeking actionable insights into the residential furniture market and home furnishings industry.

North America Home Furnishing Market Market Composition & Trends

The North America Home Furnishing Market exhibits a moderate concentration, with key players vying for market share across diverse product categories. Innovation is a significant catalyst, driven by evolving interior design trends and consumer preferences for sustainable and smart home solutions. The regulatory landscape primarily focuses on product safety standards and environmental impact, influencing material choices and manufacturing processes. Substitute products, such as DIY solutions and rental furniture services, present a competitive pressure, though the demand for durable and aesthetically pleasing furniture remains robust. End-user profiles are increasingly segmented, with millennials and Gen Z driving demand for personalized, eco-friendly, and tech-integrated furnishings. Mergers and acquisitions (M&A) activities are notable, reflecting strategic consolidations and expansions. For instance, in 2021, Berkshire Hathway Inc. made significant new stakes in Floor & Decor and Royalty Pharma, indicating an interest in the broader home improvement and related industries, potentially impacting supply chains for home furnishings. M&A deal values are expected to see continued growth as companies seek to expand their product portfolios and geographic reach within the North American furniture market. The market share distribution is dynamic, with specialized retailers and online platforms gaining traction.

- Market Concentration: Moderate, with a mix of large conglomerates and niche players.

- Innovation Catalysts: Smart home integration, sustainable materials, personalized designs, and evolving interior design trends.

- Regulatory Landscapes: Focus on product safety (e.g., flammability, VOC emissions) and environmental sustainability.

- Substitute Products: DIY furniture, rental services, and secondhand markets.

- End-User Profiles: Diverse, including millennials, Gen Z, and a growing segment of eco-conscious consumers.

- M&A Activities: Ongoing consolidation and strategic investments to enhance market position and product offerings. Expected M&A deal value in the US furniture market is projected to reach several hundred million USD over the forecast period.

North America Home Furnishing Market Industry Evolution

The North America Home Furnishing Market has undergone a remarkable evolution, marked by consistent growth trajectories, disruptive technological advancements, and a profound shift in consumer demands. Historically, the market was dominated by traditional brick-and-mortar retail, with a focus on mass-produced, functional furniture. However, the advent of e-commerce and digital platforms has fundamentally reshaped distribution channels and consumer purchasing habits. In the historical period of 2019–2024, the market witnessed a steady increase in sales, propelled by a strong housing market and rising disposable incomes. The base year 2025 sets the stage for continued expansion, with projected growth rates in the residential furniture market of approximately 4-6% annually during the forecast period.

Technological advancements have played a pivotal role in this evolution. The integration of smart technology into furniture, such as built-in charging stations and adjustable reclining mechanisms, has become increasingly popular. Furthermore, advancements in manufacturing processes, including 3D printing and sustainable material sourcing, are influencing product development and offering greater customization options. For example, Bassett Furniture Industries, Inc.'s strategic expansion with a new 123,000-square-foot manufacturing facility in Newton, North Carolina, highlights a commitment to enhancing production capabilities for diverse product lines, including custom upholstery and outdoor furniture, catering to evolving consumer needs for bespoke and specialized home furnishings.

Shifting consumer demands are a defining characteristic of the modern home furnishings industry. There is a growing preference for sustainable and eco-friendly materials, with consumers actively seeking out products made from recycled or ethically sourced resources. The rise of the "conscious consumer" has spurred manufacturers to invest in greener production methods and transparent supply chains. Furthermore, the emphasis on home as a sanctuary, amplified by recent global events, has led to increased spending on interior design and home improvement, driving demand for both aesthetically pleasing and functional furniture. The online furniture market, in particular, has experienced explosive growth, offering consumers unparalleled convenience and a wider selection. This digital shift necessitates robust online presence and efficient logistics from furniture companies. The Canadian home goods market mirrors these trends, with a growing appreciation for artisanal and custom-made pieces alongside mass-market offerings.

- Market Growth Trajectories: Consistent positive growth, with an average annual growth rate projected at 4-6% from 2025-2033.

- Technological Advancements: Smart furniture integration, advanced manufacturing (3D printing, automation), and digital design tools.

- Shifting Consumer Demands: Increased demand for sustainable materials, personalized designs, smart home features, and convenience in purchasing.

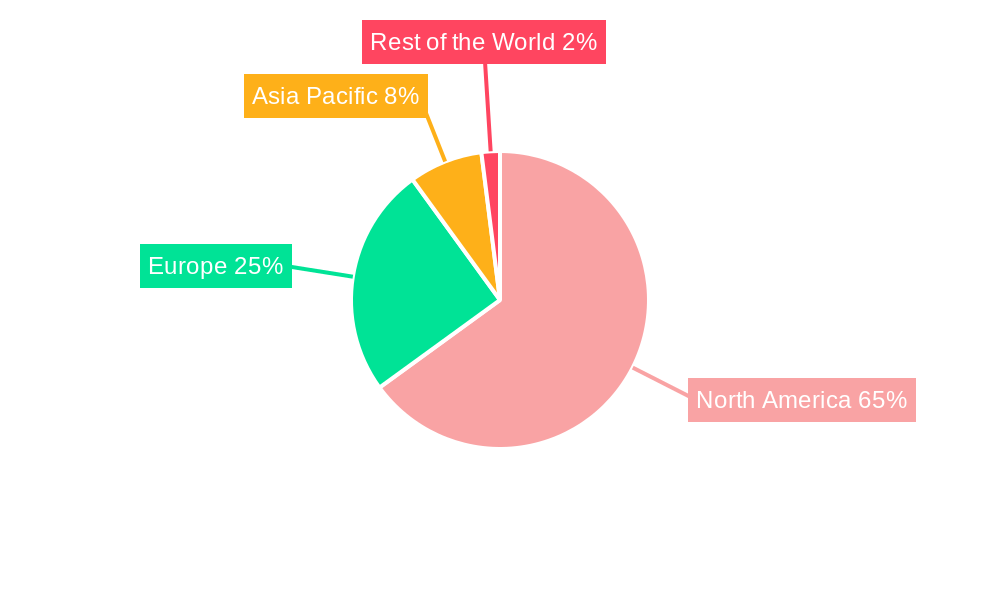

Leading Regions, Countries, or Segments in North America Home Furnishing Market

The North America Home Furnishing Market is characterized by distinct regional dominance and segment-specific growth. The United States stands as the undisputed leader, commanding the largest market share due to its vast consumer base, higher disposable incomes, and a mature housing market. Within the US, states with strong economic growth and high population density, such as California, Texas, and Florida, often lead in furniture sales. The Canadian home goods market, while smaller, exhibits robust growth driven by urbanization and a growing appreciation for quality and design.

Among the material segments, Wood furniture consistently holds the largest share, owing to its durability, aesthetic appeal, and widespread availability. However, the Metal and Plastic segments are experiencing significant growth, particularly in contemporary and outdoor furniture categories. The demand for Other Furniture, encompassing specialized items like accent pieces, storage solutions, and smart furniture, is also on an upward trajectory.

In terms of furniture type, Living Room Furniture typically leads, reflecting its central role in household activities and entertaining. Bedroom Furniture and Dining Room Furniture follow closely, with consistent demand. The Kitchen Furniture segment is gaining momentum with the increasing popularity of open-plan living spaces and the desire for functional and stylish kitchen designs.

The Distribution Channel landscape is rapidly evolving. While Specialty Stores and Wholesalers continue to play a significant role, Online & Others (including e-commerce platforms, direct-to-consumer brands, and marketplaces) are witnessing the most substantial growth. This shift is driven by consumer preference for convenience, wider selection, and competitive pricing. Supermarkets & Hypermarkets are also increasingly offering basic home furnishing items, catering to impulse purchases and budget-conscious consumers.

Key Drivers for Dominance:

- United States: Large population, high disposable income, robust housing market, strong retail infrastructure, and a culture of home improvement.

- Wood Furniture: Timeless appeal, durability, and versatility across design styles.

- Living Room Furniture: Centrality of the living space in modern homes and its role in social gatherings.

- Online & Others Distribution Channel: Unparalleled convenience, wider product selection, competitive pricing, and effective digital marketing strategies.

The continuous investment in product development and marketing by major players like Ashley Furniture Store and IKEA across these segments solidifies their market leadership.

North America Home Furnishing Market Product Innovations

Product innovations within the North America Home Furnishing Market are increasingly focused on enhancing functionality, sustainability, and user experience. Smart furniture, integrating technology like wireless charging, ambient lighting, and adjustable comfort settings, is a significant trend. For instance, advanced reclining mechanisms in La-Z-Boy chairs are pushing the boundaries of comfort and customization. The use of sustainable materials, such as recycled plastics, bamboo, and reclaimed wood, is also prominent, appealing to the environmentally conscious consumer. Furthermore, modular and adaptable furniture designs are gaining traction, allowing consumers to reconfigure their living spaces easily to suit evolving needs. Performance metrics highlight increased durability and ease of maintenance for many new products.

Propelling Factors for North America Home Furnishing Market Growth

The North America Home Furnishing Market is propelled by several key factors. Technologically, the integration of smart home features and the adoption of advanced manufacturing techniques are driving innovation and consumer interest. Economically, rising disposable incomes, a strong housing market with increasing homeownership rates, and a growing trend towards home renovation and upgrades are significant growth catalysts. Regulatory influences, such as government initiatives promoting sustainable manufacturing and energy-efficient products, also contribute to market expansion. The growing millennial and Gen Z population, who place a high value on personalized and aesthetically pleasing living spaces, are a crucial demographic driving demand for contemporary and stylish home decor.

Obstacles in the North America Home Furnishing Market Market

Despite robust growth, the North America Home Furnishing Market faces several obstacles. Supply chain disruptions, exacerbated by global events, can lead to increased lead times and higher material costs, impacting profitability for furniture companies. Intense competition from both established players and emerging online retailers exerts downward pressure on prices. Regulatory challenges, including evolving environmental standards and trade policies, can add complexity and cost to manufacturing and distribution. Furthermore, fluctuating raw material prices, particularly for wood and metals, pose a constant challenge to maintaining stable pricing strategies. The growing demand for fast furniture also raises concerns about product durability and environmental impact, potentially leading to future consumer backlash.

Future Opportunities in North America Home Furnishing Market

The North America Home Furnishing Market presents numerous future opportunities. The burgeoning demand for sustainable and ethically sourced furniture offers significant potential for eco-conscious brands and manufacturers. The continued growth of e-commerce and the direct-to-consumer (DTC) model provides avenues for new entrants and established players to reach a wider customer base. The increasing interest in smart home technology presents opportunities for furniture that seamlessly integrates with IoT ecosystems. Furthermore, the rising popularity of smaller living spaces and urban dwelling creates a demand for multi-functional, space-saving furniture solutions. Customization and personalization services are also expected to gain traction as consumers seek unique pieces that reflect their individual style.

Major Players in the North America Home Furnishing Market Ecosystem

- Durham Furniture

- Palliser

- Berkshire Hathway Inc

- Artage International

- Deurope

- Ashley Furniture Store

- American Eco Furniture LLC

- MiseWell

- Bermex

- IKEA

- La-Z-Boy

- Rooms To Go

- Bassett Furniture

Key Developments in North America Home Furnishing Market Industry

- 2021: Berkshire Hathway Inc. built new stakes in Floor & Decor and Royalty Pharma, disclosing a new, USD 99 million position in Floor & Decor, a flooring retailer, and a USD 475 million stake in Royalty Pharma, highlighting strategic diversification and potential synergy within the broader home improvement sector.

- 2021: Bassett Furniture Industries, Inc. signed a lease for a 123,000 square foot manufacturing facility in Newton, North Carolina, to create distinct production platforms for various product lines, enhancing manufacturing flexibility and capacity to meet diverse consumer demands in the residential furniture market.

Strategic North America Home Furnishing Market Market Forecast

The strategic forecast for the North America Home Furnishing Market anticipates sustained growth driven by innovation and evolving consumer preferences. Key growth catalysts include the increasing adoption of smart home technologies, a strong emphasis on sustainable and eco-friendly products, and the continued expansion of online retail channels. The market will benefit from a robust housing sector and a growing demand for personalized and adaptable furniture solutions. Emerging opportunities in niche segments like outdoor furniture and home office setups, coupled with strategic M&A activities, will further shape the market's trajectory, promising significant potential for stakeholders within the home decor and furniture market.

North America Home Furnishing Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Furniture

-

2. Type

- 2.1. Living Room Furniture

- 2.2. Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Kitchen Furniture

- 2.5. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online & Others

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Home Furnishing Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Home Furnishing Market Regional Market Share

Geographic Coverage of North America Home Furnishing Market

North America Home Furnishing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Furnishing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Living Room Furniture

- 5.2.2. Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Kitchen Furniture

- 5.2.5. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online & Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America Home Furnishing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Plastic

- 6.1.4. Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Living Room Furniture

- 6.2.2. Dining Room Furniture

- 6.2.3. Bedroom Furniture

- 6.2.4. Kitchen Furniture

- 6.2.5. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Wholesalers

- 6.3.4. Online & Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Canada North America Home Furnishing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Plastic

- 7.1.4. Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Living Room Furniture

- 7.2.2. Dining Room Furniture

- 7.2.3. Bedroom Furniture

- 7.2.4. Kitchen Furniture

- 7.2.5. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Wholesalers

- 7.3.4. Online & Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Durham Furniture

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Palliser

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Berkshire Hathway Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Artage International

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Deurope

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Ashely Furniture Store

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 American Eco Furniture LLC**List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 MiseWell

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Bermex

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 IKEA

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 La-Z-Boy

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Rooms To Go

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Bassett Furniture

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Durham Furniture

List of Figures

- Figure 1: North America Home Furnishing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Home Furnishing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Home Furnishing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: North America Home Furnishing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Home Furnishing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Home Furnishing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Home Furnishing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: North America Home Furnishing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Home Furnishing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Home Furnishing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Home Furnishing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: North America Home Furnishing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Home Furnishing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Home Furnishing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Furnishing Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Home Furnishing Market?

Key companies in the market include Durham Furniture, Palliser, Berkshire Hathway Inc, Artage International, Deurope, Ashely Furniture Store, American Eco Furniture LLC**List Not Exhaustive, MiseWell, Bermex, IKEA, La-Z-Boy, Rooms To Go, Bassett Furniture.

3. What are the main segments of the North America Home Furnishing Market?

The market segments include Material, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market.

6. What are the notable trends driving market growth?

United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Berkshire Hathway built new stakes in Floor & Decor and Royalty Pharma. It disclosed a new, USD 99 million position in Floor & Decor, a flooring retailer, and a USD 475 million stake in Royalty Pharma, which funds clinical trials in exchange for royalties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Furnishing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Furnishing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Furnishing Market?

To stay informed about further developments, trends, and reports in the North America Home Furnishing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence