Key Insights

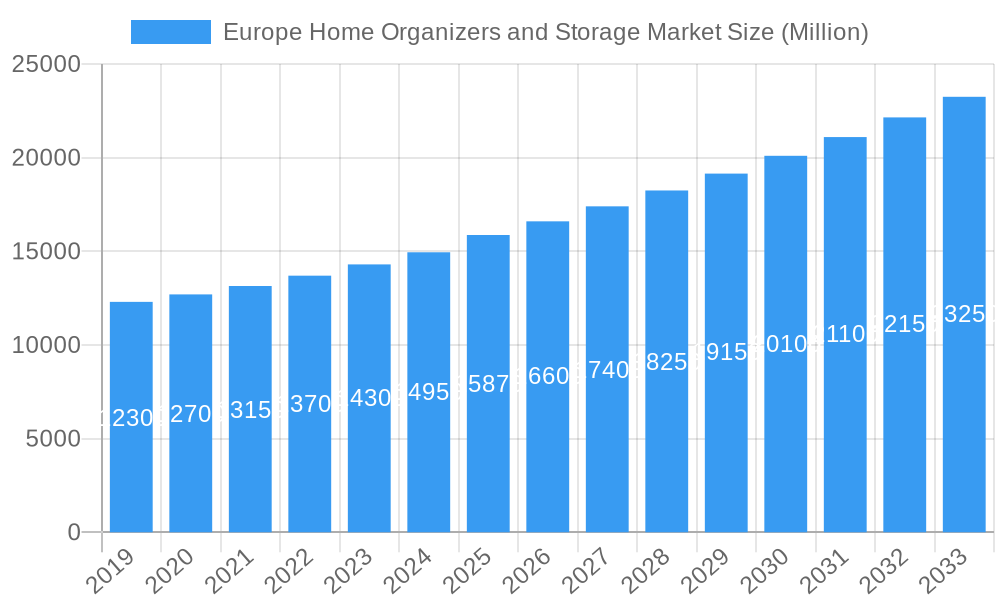

The European Home Organizers and Storage Market is projected to reach $8.95 billion by 2025, driven by a robust CAGR of 3%. This expansion is fueled by evolving lifestyles, urbanization, and a growing emphasis on decluttering and efficient space utilization, particularly in compact urban dwellings. Key growth catalysts include the rising popularity of minimalist living, social media's influence on home organization trends, and a preference for aesthetically appealing storage solutions. The growth of e-commerce platforms further enhances product accessibility and facilitates impulse purchases, stimulating demand for diverse and specialized storage options.

Europe Home Organizers and Storage Market Market Size (In Billion)

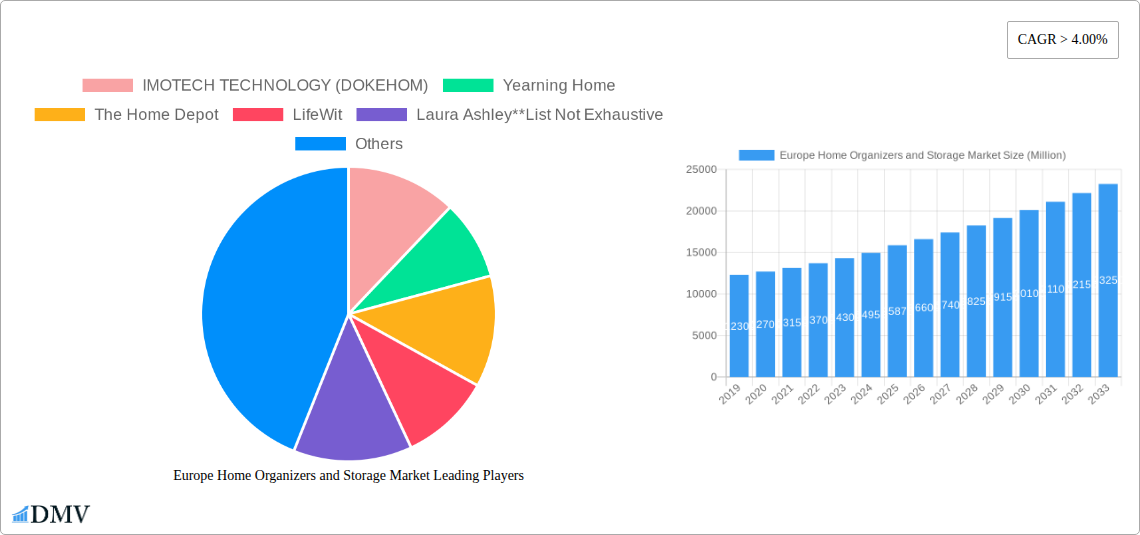

The competitive environment features both established global players and emerging companies competing through product innovation, strategic pricing, and targeted marketing. Key market participants include IMOTECH TECHNOLOGY (DOKEHOM), Yearning Home, The Home Depot, LifeWit, and Ikea. Market segmentation covers production, consumption, import, export, and pricing dynamics across major European nations like the United Kingdom, Germany, France, and Spain. While positive trends dominate, potential challenges such as fluctuating raw material costs, supply chain disruptions, and intense price competition require strategic navigation. Nevertheless, the sustained demand for functional, stylish, and space-saving solutions ensures a dynamic and growth-oriented future for the European Home Organizers and Storage Market.

Europe Home Organizers and Storage Market Company Market Share

This report provides an in-depth analysis of the Europe Home Organizers and Storage Market, offering critical insights into market composition, trends, industry evolution, and future projections. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report examines the intricate dynamics shaping this rapidly expanding consumer goods sector across Europe. Discover the strategic landscape, identify key growth drivers, and understand the challenges and opportunities defining the future of home organization and storage solutions on the continent.

Europe Home Organizers and Storage Market Market Composition & Trends

The Europe Home Organizers and Storage Market is characterized by a moderately concentrated landscape, with leading players vying for dominance through product innovation and strategic market penetration. Innovation catalysts are diverse, ranging from evolving aesthetic preferences to the increasing demand for smart and modular storage solutions. The regulatory environment, while generally supportive of consumer goods, presents nuances in product safety and material sourcing. Substitute products, such as general shelving or repurposed containers, exist but often fall short of the specialized functionality and design appeal offered by dedicated home organization products. End-user profiles are increasingly segmented, encompassing busy professionals seeking space-saving solutions, families prioritizing decluttered living environments, and individuals embracing minimalist lifestyles. Merger and acquisition (M&A) activities, while not exhaustive, are indicative of consolidation trends and the pursuit of market share. The value of recent M&A deals, though variable, underscores the strategic importance of acquiring established brands and innovative technologies within the European storage market. Market share distribution is dynamic, influenced by product portfolio breadth, pricing strategies, and distribution network reach.

- Market Concentration: Moderate, with a blend of large multinational corporations and agile niche players.

- Innovation Catalysts: Growing demand for aesthetically pleasing, functional, and sustainable storage systems; influence of interior design trends; rise of e-commerce for home goods.

- Regulatory Landscape: Focus on product safety standards, material recyclability, and fair trade practices.

- Substitute Products: DIY solutions, multi-purpose furniture, and general shelving units.

- End-User Profiles: Young professionals, families with children, retirees, eco-conscious consumers.

- M&A Activities: Strategic acquisitions to expand product lines, geographic reach, and technological capabilities.

Europe Home Organizers and Storage Market Industry Evolution

The Europe Home Organizers and Storage Market has undergone a significant transformation, driven by shifting consumer lifestyles, increasing urbanization, and a heightened awareness of the benefits of organized living. The historical period of 2019–2024 witnessed a steady growth trajectory, significantly accelerated by the COVID-19 pandemic, which spurred a global demand for more functional and decluttered living spaces. This era saw a surge in the adoption of smart home organization solutions, integrating technology to enhance convenience and efficiency. Technological advancements have been pivotal, with manufacturers investing heavily in developing durable, aesthetically pleasing, and often modular storage products made from sustainable materials. The integration of e-commerce platforms has revolutionized distribution, enabling wider market access and direct-to-consumer sales strategies. Consumer demands have evolved beyond mere functionality to encompass design aesthetics, environmental sustainability, and customization options. The market’s growth rate during the initial phases of the study period was robust, with an estimated CAGR of approximately 6%. Adoption metrics for new product categories, such as vertical storage systems and customizable drawer organizers, have consistently risen, indicating a receptive consumer base. The ongoing forecast period of 2025–2033 is projected to maintain this positive momentum, albeit with potentially nuanced growth patterns influenced by economic factors and evolving consumer preferences. The industry's evolution reflects a broader societal shift towards valuing efficient living spaces and a mindful approach to consumption, making home organization and storage a crucial segment within the broader European home goods market.

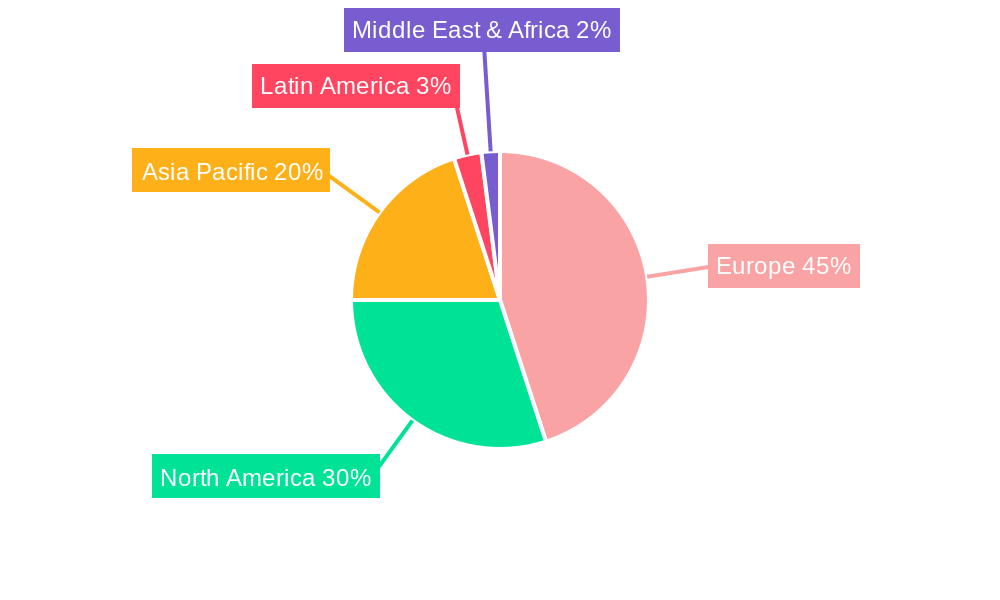

Leading Regions, Countries, or Segments in Europe Home Organizers and Storage Market

The Europe Home Organizers and Storage Market demonstrates distinct regional dominance, heavily influenced by economic prosperity, consumer spending habits, and established retail infrastructures. In terms of Production Analysis, countries with strong manufacturing bases and access to raw materials, such as Germany and Italy, tend to lead. These regions benefit from advanced manufacturing technologies and a skilled workforce, contributing to a significant volume of home storage solutions produced domestically.

For Consumption Analysis, Western European nations, particularly the United Kingdom, France, and Germany, represent the largest markets. High disposable incomes, a strong cultural emphasis on interior design and home improvement, and densely populated urban centers drive substantial demand for a wide array of organizer products.

The Import Market Analysis (Value & Volume) reveals significant trade flows into countries with high consumer demand but potentially less localized production capacity. The UK and France often exhibit substantial import values, sourcing diverse storage solutions to cater to their vast consumer bases. The volume of imports is also considerable, reflecting the scale of consumer purchasing power.

Conversely, the Export Market Analysis (Value & Volume) highlights countries that are not only production hubs but also successful exporters. Germany, with its reputation for quality and engineering, consistently ranks high in both export value and volume, supplying premium organizers and storage systems to other European nations and beyond.

Price Trend Analysis indicates that premium markets like Switzerland and Scandinavia often command higher prices due to perceived quality and brand value, while Eastern European markets may offer more competitive price points. Factors such as material costs, manufacturing efficiency, and import duties significantly influence these trends.

- Dominant Region: Western Europe, driven by high consumer spending and established retail networks.

- Key Drivers for Production: Strong manufacturing capabilities, access to raw materials, technological innovation.

- Drivers for Consumption: High disposable income, urbanization, interior design trends, growing awareness of decluttering benefits.

- Import Dynamics: Driven by demand in large consumer markets and specialized product sourcing.

- Export Strengths: Countries with robust manufacturing and a reputation for quality.

- Price Variations: Influenced by economic conditions, product segmentation, and brand positioning.

Europe Home Organizers and Storage Market Product Innovations

Product innovation in the Europe Home Organizers and Storage Market is increasingly focused on sustainability, modularity, and smart integration. Manufacturers are leveraging advanced materials, such as recycled plastics and sustainably sourced wood, to create eco-friendly storage solutions. Modular designs are gaining prominence, allowing consumers to customize their organizer systems to fit specific spaces and needs. The integration of smart technology, such as integrated lighting or app-controlled inventory management for pantry organizers, is also a growing trend. These innovations enhance functionality, offer unique selling propositions, and cater to the evolving demands of consumers seeking both aesthetic appeal and practical efficiency in their home organization products.

Propelling Factors for Europe Home Organizers and Storage Market Growth

Several key factors are propelling the growth of the Europe Home Organizers and Storage Market. The persistent trend of urbanization, leading to smaller living spaces, fuels the demand for efficient space-saving storage solutions. A growing consumer consciousness around decluttering and minimalist living, influenced by popular culture and expert advice, directly translates into increased sales of home organizers. Furthermore, rising disposable incomes across various European demographics enable greater investment in home improvement and lifestyle products, including high-quality storage systems. E-commerce expansion has also been a significant driver, providing wider accessibility to a diverse range of organizing products and facilitating easier comparison and purchasing.

Obstacles in the Europe Home Organizers and Storage Market Market

Despite robust growth, the Europe Home Organizers and Storage Market faces several obstacles. Supply chain disruptions, as highlighted by IKEA's price hikes in January 2022 due to transportation challenges, continue to pose a significant threat, impacting manufacturing costs and product availability. Intense competitive pressures from both established giants and agile online retailers can lead to price wars and squeezed profit margins. Regulatory hurdles, though generally manageable, can add complexity and cost to product development and compliance, especially concerning new materials and sustainable manufacturing practices. Furthermore, economic downturns or reduced consumer confidence can lead to a slowdown in discretionary spending on home goods, impacting the demand for premium organizer and storage solutions.

Future Opportunities in Europe Home Organizers and Storage Market

The Europe Home Organizers and Storage Market presents significant future opportunities. The burgeoning demand for sustainable and eco-friendly storage products offers a strong avenue for growth, with consumers increasingly prioritizing brands committed to environmental responsibility. The continued rise of e-commerce presents opportunities for direct-to-consumer models and innovative online retail experiences for home organization solutions. The expansion into emerging markets within Eastern Europe, where disposable incomes are rising, represents a largely untapped consumer base for storage products. Furthermore, the integration of smart home technology into organizer systems is a nascent but promising area, with potential for growth as consumers embrace connected living.

Major Players in the Europe Home Organizers and Storage Market Ecosystem

- IMOTECH TECHNOLOGY (DOKEHOM)

- Yearning Home

- The Home Depot

- LifeWit

- Laura Ashley

- Childhome

- Awekris

- Amazon Basics

- Mamas & Papas

- Ikea

Key Developments in Europe Home Organizers and Storage Market Industry

- Jan 2022: IKEA hiked its prices by an average of 9% due to ongoing supply and transportation disruptions. The announcement came as pandemic-fuelled shortages and shipping challenges ramp up inflation and pinch economies globally, with consumers increasingly feeling the pinch. This development underscored the vulnerability of the storage market to global logistics challenges and their impact on consumer pricing.

- Dec 2021: Inside an expansive and noisy distribution centre just east of Atlanta, Home Depot Inc. is trying to solve a problem that's plaguing its stores: large orders from pro shoppers. The new facility in Stonecrest, Georgia, which is called a flatbed distribution centre, is designed with contractors in mind. The hub is the centrepiece of Home Depot's plan to ease the complexity of direct-to-consumer sales and win market share from both its main rival, Lowe's Cos., and independent distributors. With growth from the do-it-yourself crowd being outpaced by sales to contractors, the stakes are high to get it right. This initiative highlights the evolving distribution strategies and the focus on catering to diverse customer segments within the broader home goods sector.

Strategic Europe Home Organizers and Storage Market Market Forecast

The strategic outlook for the Europe Home Organizers and Storage Market is overwhelmingly positive, fueled by sustained consumer demand for organized living spaces and an increasing appreciation for functional home design. Key growth catalysts include the ongoing trend towards urbanization and smaller living environments, which inherently necessitates efficient storage solutions. Furthermore, a growing environmental consciousness is driving demand for sustainable and eco-friendly organizer products, creating opportunities for brands prioritizing responsible manufacturing. The continued expansion of e-commerce will facilitate wider market reach and new sales channels for a diverse range of home storage items. As disposable incomes rise in emerging European economies, there is substantial potential for market penetration and growth. The integration of smart technologies into organizer systems is poised to unlock new avenues for innovation and consumer engagement, further solidifying the market's robust future potential.

Europe Home Organizers and Storage Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Home Organizers and Storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Organizers and Storage Market Regional Market Share

Geographic Coverage of Europe Home Organizers and Storage Market

Europe Home Organizers and Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and Commercial Construction Activities

- 3.3. Market Restrains

- 3.3.1 Alternative Water Heating Technologies

- 3.3.2 Such as Solar Water Heaters and Heat Pump Systems

- 3.4. Market Trends

- 3.4.1. Rise in Home Ownership Rate is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IMOTECH TECHNOLOGY (DOKEHOM)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yearning Home

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Home Depot

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LifeWit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Laura Ashley**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Childhome

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Awekris

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon Basics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mamas & Papas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IMOTECH TECHNOLOGY (DOKEHOM)

List of Figures

- Figure 1: Europe Home Organizers and Storage Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Home Organizers and Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Home Organizers and Storage Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Home Organizers and Storage Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Home Organizers and Storage Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Home Organizers and Storage Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Home Organizers and Storage Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Home Organizers and Storage Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Home Organizers and Storage Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Home Organizers and Storage Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Home Organizers and Storage Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Home Organizers and Storage Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Home Organizers and Storage Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Organizers and Storage Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Europe Home Organizers and Storage Market?

Key companies in the market include IMOTECH TECHNOLOGY (DOKEHOM), Yearning Home, The Home Depot, LifeWit, Laura Ashley**List Not Exhaustive, Childhome, Awekris, Amazon Basics, Mamas & Papas, Ikea.

3. What are the main segments of the Europe Home Organizers and Storage Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and Commercial Construction Activities.

6. What are the notable trends driving market growth?

Rise in Home Ownership Rate is Driving the Market.

7. Are there any restraints impacting market growth?

Alternative Water Heating Technologies. Such as Solar Water Heaters and Heat Pump Systems.

8. Can you provide examples of recent developments in the market?

Jan 2022 - IKEA hiked its prices by an average of 9% due to ongoing supply and transportation disruptions. The announcement came as pandemic-fuelled shortages and shipping challenges ramp up inflation and pinch economies globally, with consumers increasingly feeling the pinch.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Organizers and Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Organizers and Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Organizers and Storage Market?

To stay informed about further developments, trends, and reports in the Europe Home Organizers and Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence