Key Insights

The global Luxury Furniture Market is set for significant expansion, projected to reach $27.19 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. This growth is driven by increasing demand for high-quality, design-forward, and durable furniture that expresses personal style and status. Key factors include rising disposable incomes of affluent consumers, a growing appreciation for artisanal craftsmanship and unique designs, and the influence of interior design trends popularized through digital media and design publications. The "home as a sanctuary" concept, amplified by recent global events, has also increased investment in premium home furnishings. Additionally, the expansion of the hospitality sector, particularly luxury hotels and resorts, significantly contributes to market demand.

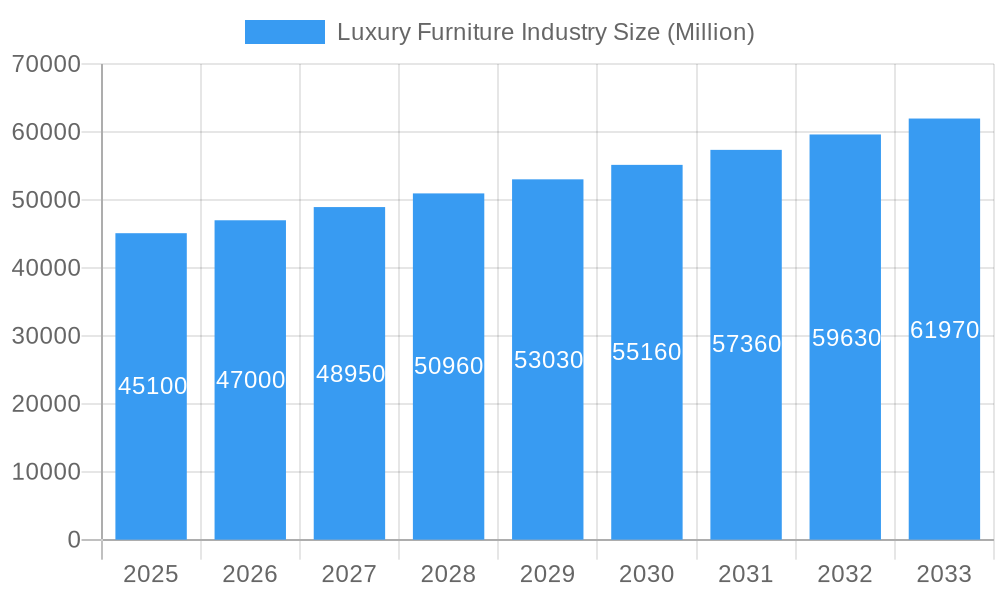

Luxury Furniture Industry Market Size (In Billion)

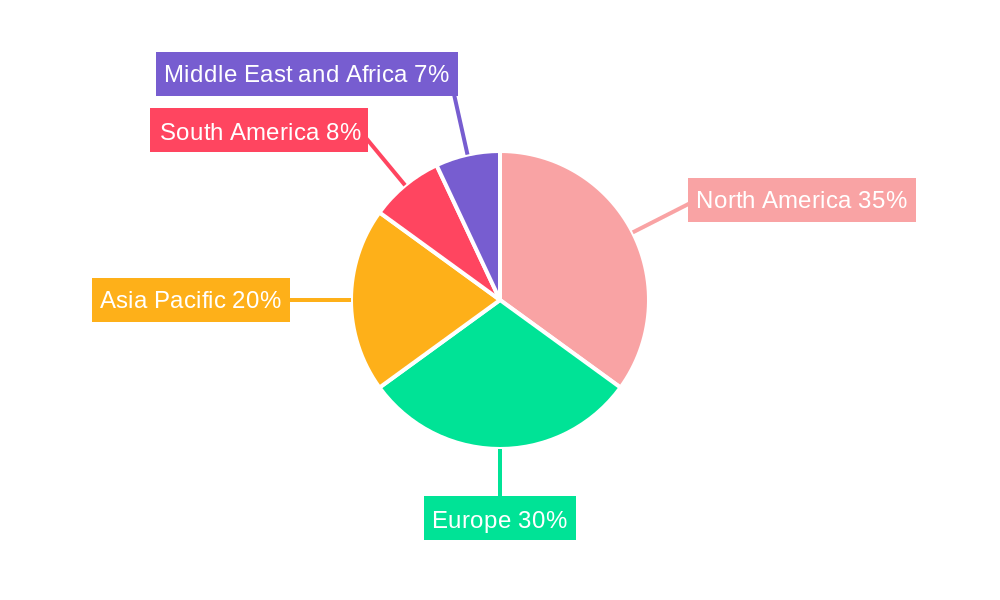

The market is segmented by product type, with Lighting, Tables, Chairs & Sofas, and Beds being the leading categories. Accessories and other specialized items also play a role in overall market value. Distribution channels are evolving, with a notable shift towards online sales alongside traditional channels like flagship stores and specialty boutiques, enhancing consumer accessibility and choice. The residential sector remains the primary end-user segment, fueled by affluent homeowners enhancing their living spaces. The commercial segment, including luxury offices, hotels, and retail spaces, presents a substantial growth opportunity. Geographically, North America and Europe currently dominate the market, but the Asia Pacific region exhibits remarkable growth potential due to its expanding affluent population and increasing adoption of Western interior design aesthetics. Leading players such as Knoll Inc., Ralph Lauren Corporation, and Boca Da Lobo are continuously innovating, launching new collections that blend timeless elegance with modern sensibilities, thereby shaping market dynamics.

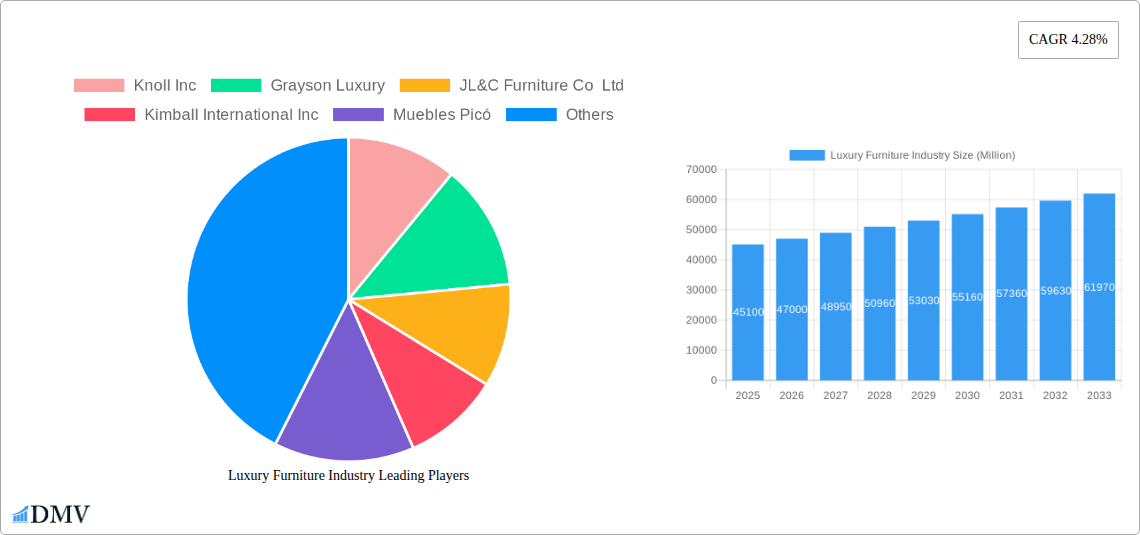

Luxury Furniture Industry Company Market Share

This comprehensive report provides an SEO-optimized, insightful analysis of the Luxury Furniture Market, designed to enhance visibility and engage stakeholders.

Luxury Furniture Industry Market Composition & Trends

This comprehensive report delves into the dynamic luxury furniture market, meticulously analyzing its composition and prevailing trends from 2019 to 2033, with a robust focus on the base year 2025 and a forecast period spanning 2025-2033. The market exhibits moderate concentration, with a significant portion driven by established brands and a growing influx of niche designers. Innovation catalysts are primarily fueled by a demand for sustainable materials, artisanal craftsmanship, and smart technology integration into home furnishings. The regulatory landscape, while generally supportive of high-end product development, is increasingly influenced by environmental compliance and ethical sourcing mandates. Substitute products, though present in the broader furniture market, face limited competition in the ultra-luxury segment where uniqueness and brand prestige are paramount. End-user profiles are increasingly sophisticated, with a strong emphasis on personalized aesthetics, unparalleled quality, and aspirational lifestyle branding. Mergers and acquisitions (M&A) activity is a key trend, with significant deal values observed as larger entities seek to acquire innovative smaller players or expand their global footprint. For instance, the acquisition of Marge Carson by Linly Designs in October 2022 highlights strategic consolidation within the high-end handcrafted furniture sector, valued at approximately xx Million. This report will detail market share distribution and the financial impact of such M&A activities throughout the study period.

Luxury Furniture Industry Industry Evolution

The luxury furniture industry is undergoing a profound evolution, characterized by consistent market growth trajectories, rapid technological advancements, and a significant shift in consumer demands. Over the historical period of 2019-2024, the industry has demonstrated resilience and an impressive growth rate, projected to average around 7.5% annually. This expansion is directly linked to rising disposable incomes in key emerging economies and a sustained desire for premium home environments among affluent demographics globally. Technological advancements are not merely confined to manufacturing processes; they are increasingly integrated into the very fabric of luxury furniture. We see the adoption of smart home functionalities, advanced material science leading to more durable and aesthetically versatile finishes, and the pervasive use of augmented reality (AR) and virtual reality (VR) in design and customer visualization tools, with an estimated adoption rate of 35% by 2025.

Consumer demands are rapidly evolving beyond mere aesthetics and comfort. Today's luxury consumer seeks unique narratives, ethical sourcing, and a strong sense of personal expression through their furniture choices. This has led to a surge in demand for bespoke pieces, sustainable luxury furniture, and collections that reflect a particular lifestyle or heritage. The industry is witnessing a transition from mass luxury to hyper-personalized luxury, where individual preferences dictate design and material choices. The influence of interior design trends, accelerated by social media platforms, also plays a crucial role, pushing brands to continually innovate and offer collections that are both timeless and trend-setting. For example, the growing interest in biophilic design and organic forms is influencing furniture aesthetics, and brands are responding with collections that incorporate natural elements and flowing lines. The market is projected to reach over $150 Billion by 2033, reflecting a CAGR of 8.2% from 2025 to 2033.

Leading Regions, Countries, or Segments in Luxury Furniture Industry

The luxury furniture market is dominated by specific regions, countries, and product segments, driven by a confluence of economic prosperity, cultural appreciation for design, and robust distribution networks.

Dominant Regions and Countries:

- North America: The United States remains a powerhouse in the luxury furniture sector, driven by a high concentration of affluent consumers, a well-established interior design industry, and a strong presence of global luxury brands. Key growth drivers include robust economic conditions, a thriving real estate market, and a culture that values home aesthetics and comfort. Investment trends are focused on sustainable and artisanal offerings, with regulatory support for eco-friendly manufacturing practices.

- Europe: Countries like Italy, France, and the United Kingdom are critical hubs for luxury furniture design and manufacturing. Italy, in particular, is renowned for its design heritage, craftsmanship, and innovative use of materials, contributing significantly to the global luxury furniture market. The resurgence of traditional craftsmanship and the adoption of modern design sensibilities are key factors.

- Asia-Pacific: This region is experiencing rapid growth, fueled by the rising middle and upper classes in countries such as China, India, and Southeast Asian nations. Increased urbanization and a growing appetite for Western luxury brands are propelling demand.

Dominant Product Segments:

- Chairs and Sofas: These remain the most significant product segments within the luxury furniture market, accounting for approximately 30% of the overall market share. Consumers invest heavily in statement pieces for their living spaces, prioritizing comfort, design, and premium upholstery.

- Tables: Dining tables, coffee tables, and console tables are crucial elements in luxury interior design, with demand driven by aesthetic appeal, material quality, and craftsmanship. This segment captures around 20% of the market.

- Beds: High-end beds and mattresses are a growing focus for luxury consumers seeking optimal sleep quality and bedroom aesthetics. This segment holds a substantial share, driven by a focus on wellness and personalized comfort.

- Lighting: Decorative and statement lighting fixtures are integral to luxury interiors, enhancing ambiance and showcasing architectural features. This segment contributes significantly to the overall market value.

- Accessories: While smaller individually, luxury accessories such as mirrors, decorative objects, and high-end rugs collectively form a vital part of the luxury furniture ecosystem, contributing to the overall market value and often acting as impulse or complementary purchases.

Dominant Distribution Channels:

- Flagship Stores and Specialty Stores: These channels offer an immersive brand experience and personalized service, crucial for the luxury segment. They represent a significant portion of luxury furniture sales, estimated at 40% of the market.

- Online: The e-commerce channel is rapidly gaining traction, offering convenience and a wider product selection. The luxury furniture market's online segment is projected to grow significantly, fueled by advancements in virtual try-on technologies and curated online marketplaces.

- Home Centers (Premium Segment): While not traditionally associated with high luxury, select premium home centers are expanding their high-end offerings, catering to a broader affluent demographic.

Luxury Furniture Industry Product Innovations

Product innovation in the luxury furniture industry is characterized by a fusion of exquisite craftsmanship, cutting-edge technology, and sustainable practices. We are witnessing the integration of smart features, such as embedded charging ports and adjustable lighting, into furniture pieces. The use of advanced materials, including sustainably sourced exotic woods, high-performance eco-friendly textiles, and innovative composite materials, is a significant trend. Performance metrics are evaluated not only on durability and comfort but also on the environmental impact and ethical sourcing of materials, with a growing emphasis on circular economy principles. Unique selling propositions often lie in bespoke customization options, limited edition collections, and collaborations with renowned artists and designers, offering unparalleled exclusivity and aesthetic appeal.

Propelling Factors for Luxury Furniture Industry Growth

The luxury furniture industry is propelled by a potent combination of technological advancements, robust economic influences, and evolving consumer behavior. A primary driver is the increasing global wealth and the subsequent rise in disposable income among high-net-worth individuals, fueling demand for premium home furnishings. Technological advancements, particularly in material science and digital design tools like AR/VR, enhance product appeal and customer engagement. The growing emphasis on sustainability and ethical sourcing resonates deeply with conscious luxury consumers, creating a market for eco-friendly and responsibly manufactured products. Furthermore, the aspirational nature of luxury living, amplified by social media and interior design trends, continuously drives consumers to invest in statement furniture pieces that reflect status and personal style. The market size is projected to reach $162,540 Million by 2033, indicating a substantial growth trajectory.

Obstacles in the Luxury Furniture Industry Market

Despite its robust growth, the luxury furniture market faces several obstacles. Regulatory challenges, particularly concerning stricter environmental compliance and import/export regulations, can add complexity and cost. Supply chain disruptions, exacerbated by geopolitical events and logistical bottlenecks, can impact lead times and the availability of bespoke materials. Intense competitive pressures, both from established luxury brands and emerging disruptors, necessitate continuous innovation and marketing investment. Furthermore, the perceived high cost of luxury furniture can be a barrier for some potential buyers, requiring brands to effectively communicate value beyond price. Economic downturns can also disproportionately affect the luxury sector, as discretionary spending often reduces during periods of uncertainty. The total cost associated with navigating these challenges can amount to millions of dollars annually for market participants.

Future Opportunities in Luxury Furniture Industry

The luxury furniture industry is ripe with future opportunities, particularly in emerging markets experiencing significant wealth creation and a growing demand for premium goods. Technological integration continues to offer fertile ground for innovation, with smart furniture and AI-driven design personalization poised for significant growth. The sustainability movement presents a substantial opportunity for brands that can authentically integrate eco-friendly practices and materials into their offerings, appealing to a growing segment of environmentally conscious affluent consumers. Furthermore, the expansion of direct-to-consumer (DTC) models and the increasing sophistication of e-commerce platforms provide avenues for brands to reach a wider global audience and enhance customer experience. The rise of experiential retail and personalized design services also opens doors for brands to offer unique value propositions.

Major Players in the Luxury Furniture Industry Ecosystem

- Knoll Inc

- Grayson Luxury

- JL&C Furniture Co Ltd

- Kimball International Inc

- Muebles Picó

- iola Furniture

- Duresta Upholstery Ltd

- Brown Jordan International

- Ralph Lauren Corporation

- Boca Da Lobo

- Nella Vetrina Giovanni Visentin S R L

- Valderamobili S R L

- Molteni Group

- Luxury Living Group

- PICO SA

- Crate & Barrel

- Century Furniture LLC

- Cassina SpA

Key Developments in Luxury Furniture Industry Industry

- October 2022: Marge Carson, a renowned manufacturer of handcrafted furniture, was acquired by Linly Designs, an interior design and retail business based in Chicago. The Marge Carson line, celebrated globally for its high quality, proportional forms, and exquisite textiles, saw its market presence potentially expand and its operational synergies explored. This strategic acquisition underscores the consolidation trend within the high-end furniture sector.

- September 2022: Muebles Picó introduced new outdoor collections at an exhibit in Valencia. The primary objective was to intentionally blur the lines between indoor and outdoor living, facilitating seamless transitions for outdoor living and dining areas. This development highlights a growing trend in furniture design towards creating cohesive and functional living spaces that extend beyond traditional indoor confines.

Strategic Luxury Furniture Industry Market Forecast

The strategic forecast for the luxury furniture industry is exceptionally promising, driven by a sustained increase in global wealth and a growing consumer appreciation for bespoke quality and design. Key growth catalysts include the pervasive integration of smart technologies and sustainable practices, catering to evolving consumer preferences for both convenience and ethical consumption. The expanding influence of digital platforms and innovative distribution channels, such as augmented reality visualization and curated online marketplaces, will further democratize access to luxury furnishings. Emerging markets represent a significant untapped potential, with rising disposable incomes creating new affluent customer bases. Continued M&A activity will likely reshape the competitive landscape, with strategic acquisitions of innovative smaller players by larger entities, bolstering market growth and expanding global reach, projecting a robust CAGR of 8.2% over the forecast period.

Luxury Furniture Industry Segmentation

-

1. Product

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Beds

- 1.5. Cabinets

- 1.6. Accessories

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Home Centers

- 2.2. Flagship Stores

- 2.3. Specialty Stores

- 2.4. Online

- 2.5. Other Distribution Channels

-

3. End User

- 3.1. Residential

- 3.2. Commercial

Luxury Furniture Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Luxury Furniture Industry Regional Market Share

Geographic Coverage of Luxury Furniture Industry

Luxury Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Wine Consumption Culture is Driving the Wine Cooler Market; Increasing Hospitality Industry's Wine Offering is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs of Wine Coolers Act as a Restraint

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Beds

- 5.1.5. Cabinets

- 5.1.6. Accessories

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Home Centers

- 5.2.2. Flagship Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Lighting

- 6.1.2. Tables

- 6.1.3. Chairs and Sofas

- 6.1.4. Beds

- 6.1.5. Cabinets

- 6.1.6. Accessories

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Home Centers

- 6.2.2. Flagship Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Lighting

- 7.1.2. Tables

- 7.1.3. Chairs and Sofas

- 7.1.4. Beds

- 7.1.5. Cabinets

- 7.1.6. Accessories

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Home Centers

- 7.2.2. Flagship Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Lighting

- 8.1.2. Tables

- 8.1.3. Chairs and Sofas

- 8.1.4. Beds

- 8.1.5. Cabinets

- 8.1.6. Accessories

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Home Centers

- 8.2.2. Flagship Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Lighting

- 9.1.2. Tables

- 9.1.3. Chairs and Sofas

- 9.1.4. Beds

- 9.1.5. Cabinets

- 9.1.6. Accessories

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Home Centers

- 9.2.2. Flagship Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Lighting

- 10.1.2. Tables

- 10.1.3. Chairs and Sofas

- 10.1.4. Beds

- 10.1.5. Cabinets

- 10.1.6. Accessories

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Home Centers

- 10.2.2. Flagship Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Knoll Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Grayson Luxury

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JL&C Furniture Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kimball International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Muebles Picó

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 iola Furniture

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Duresta Upholstery Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Brown Jordan International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ralph Lauren Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boca Da Lobo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Other Companies (Nella Vetrina Giovanni Visentin S R L Valderamobili S R L Molteni Group Luxury Living Group PICO SA Crate & Barrel and Century Furniture LLC)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cassina SpA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Knoll Inc

List of Figures

- Figure 1: Global Luxury Furniture Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Luxury Furniture Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 9: North America Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: North America Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 20: Europe Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 21: Europe Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 23: Europe Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 24: Europe Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 25: Europe Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Europe Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: Europe Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Europe Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 36: Asia Pacific Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 37: Asia Pacific Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 39: Asia Pacific Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 41: Asia Pacific Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Asia Pacific Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Asia Pacific Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Asia Pacific Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 52: South America Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 53: South America Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: South America Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: South America Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: South America Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: South America Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 60: South America Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: South America Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: South America Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: South America Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: South America Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 68: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 69: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 70: Middle East and Africa Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 71: Middle East and Africa Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 72: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 73: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Middle East and Africa Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Middle East and Africa Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 76: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Luxury Furniture Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Luxury Furniture Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 31: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 34: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 35: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 38: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 39: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 42: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 43: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 46: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Furniture Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Luxury Furniture Industry?

Key companies in the market include Knoll Inc, Grayson Luxury, JL&C Furniture Co Ltd, Kimball International Inc, Muebles Picó, iola Furniture, Duresta Upholstery Ltd, Brown Jordan International, Ralph Lauren Corporation, Boca Da Lobo, Other Companies (Nella Vetrina Giovanni Visentin S R L Valderamobili S R L Molteni Group Luxury Living Group PICO SA Crate & Barrel and Century Furniture LLC), Cassina SpA.

3. What are the main segments of the Luxury Furniture Industry?

The market segments include Product, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Wine Consumption Culture is Driving the Wine Cooler Market; Increasing Hospitality Industry's Wine Offering is Driving the Market.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

High Initial Costs of Wine Coolers Act as a Restraint.

8. Can you provide examples of recent developments in the market?

In October 2022, Marge Carson, a manufacturer of handcrafted furniture based in California, was purchased by Linly Designs, an interior design and retail business in Chicago. The Marge Carson furniture line is famous not just in the United States but also around the world for its high quality, proportional forms, and textiles in the industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Furniture Industry?

To stay informed about further developments, trends, and reports in the Luxury Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence