Key Insights

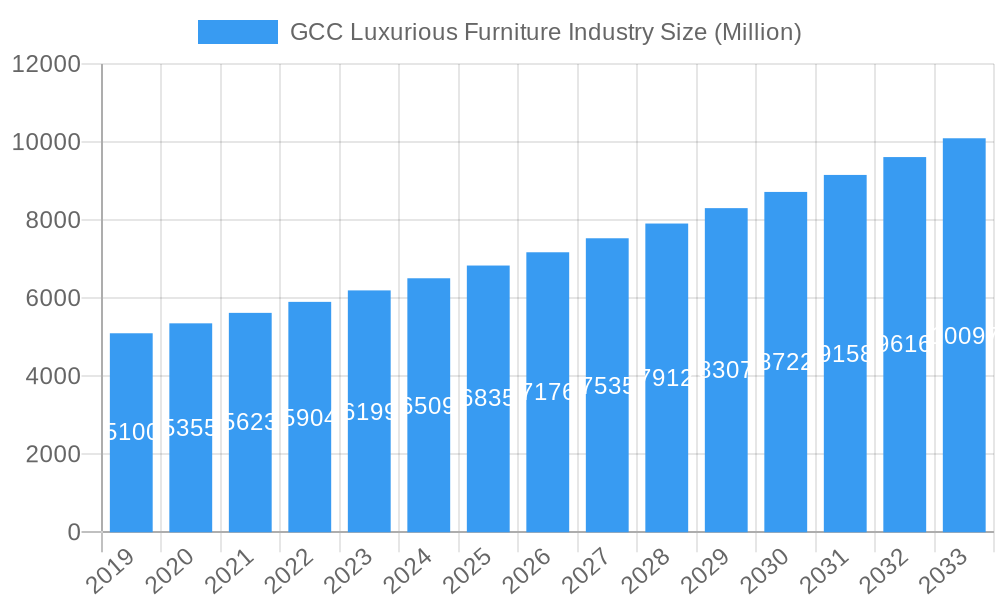

The GCC luxurious furniture market is poised for significant expansion, projected to reach an estimated market size of over $7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 6.00% throughout the forecast period. This growth is fueled by a confluence of escalating disposable incomes, a burgeoning expatriate population with a penchant for high-end living, and substantial government investments in infrastructure and tourism development, particularly in countries like Saudi Arabia and the UAE. The demand for premium home furnishings is further amplified by evolving lifestyle aspirations and the increasing trend of luxury residential and commercial projects, including opulent hotels, high-end retail spaces, and exclusive private residences. Key drivers such as the "Vision" programs across GCC nations, which aim to diversify economies and boost non-oil sectors like tourism and real estate, are creating fertile ground for the luxury furniture industry to flourish. The market is witnessing a strong demand for sophisticated lighting solutions, ergonomic and stylish chairs and sofas, and custom-designed cabinets, reflecting a consumer desire for both aesthetic appeal and functional excellence.

GCC Luxurious Furniture Industry Market Size (In Billion)

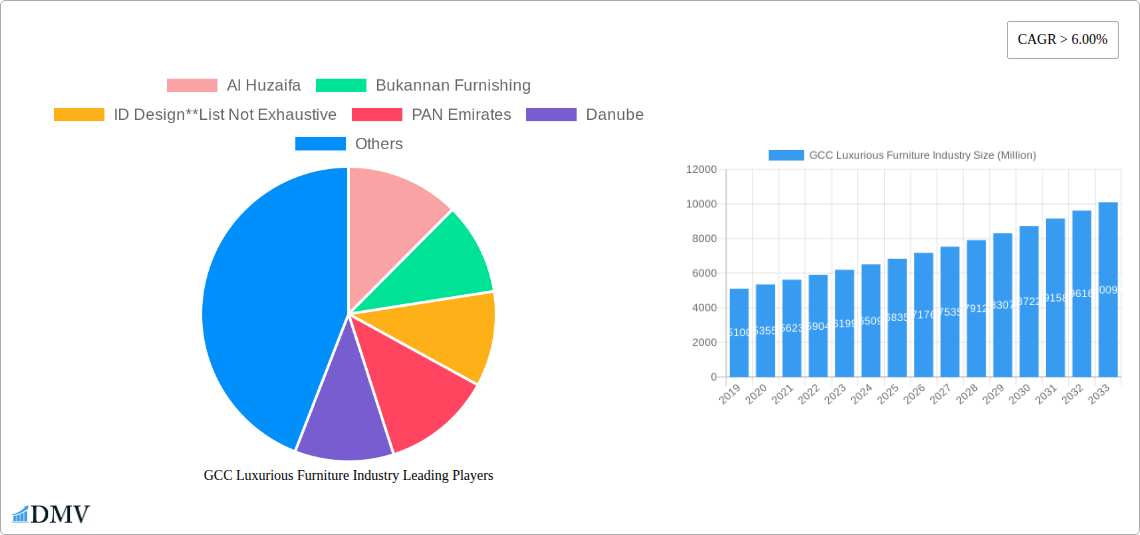

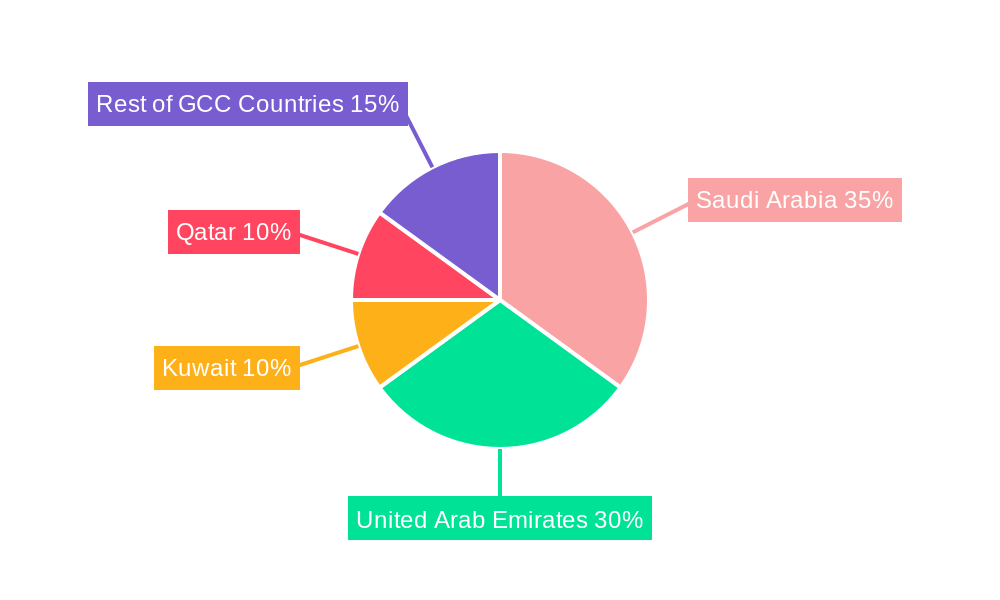

The GCC luxurious furniture landscape is characterized by a dynamic interplay of market segments and distribution channels. The "Residential" end-user segment continues to dominate, driven by new property developments and renovations, while the "Commercial" segment, encompassing hospitality and corporate spaces, is showing rapid acceleration due to significant investment in tourism and entertainment infrastructure. Geographically, Saudi Arabia and the United Arab Emirates are anticipated to remain the largest markets, accounting for a substantial share, owing to their advanced economies and a high concentration of affluent consumers. Kuwait and Qatar also present promising growth opportunities. The distribution strategy is increasingly omnichannel, with "Online" channels gaining traction alongside traditional "Home Centers," "Flagship Stores," and "Specialty Stores," offering consumers greater accessibility and choice. Companies such as IKEA, Home Center, Danube, and PAN Emirates are actively competing with established luxury brands like Al Huzaifa and Bukannan Furnishing, as well as international players like ID Design and B&B Italia, intensifying market competition and fostering innovation. The market is ripe for strategic expansion and product diversification to cater to the discerning tastes of the GCC's affluent clientele.

GCC Luxurious Furniture Industry Company Market Share

This comprehensive report offers an in-depth analysis of the GCC Luxurious Furniture Industry, providing critical insights for stakeholders looking to navigate this dynamic and rapidly evolving market. Spanning the historical period of 2019–2024 and projecting through a robust forecast period of 2025–2033, with a base year of 2025, this study leverages detailed market research to uncover key trends, growth drivers, competitive strategies, and future opportunities within the opulent furniture sector of the Gulf Cooperation Council.

GCC Luxurious Furniture Industry Market Composition & Trends

The GCC Luxurious Furniture Industry exhibits a moderately concentrated market, driven by a strong demand for bespoke and high-end home furnishings. Innovation is a key catalyst, with leading brands continuously introducing sophisticated designs and premium materials to cater to affluent consumers. The regulatory landscape, while generally supportive of luxury goods, is evolving to encourage local manufacturing and sustainable practices. Substitute products, primarily imported mass-market furniture, pose a limited threat to the luxury segment due to distinct consumer preferences for exclusivity and craftsmanship.

- Market Share Distribution (Illustrative - XX Million):

- Premium Brands: XX%

- Bespoke Designers: XX%

- International Luxury Houses: XX%

- Innovation Catalysts:

- Adoption of smart furniture technology.

- Integration of sustainable and ethically sourced materials.

- Personalization and customization services.

- M&A Activities (Illustrative Deal Values - XX Million):

- Strategic acquisitions by established players for market expansion.

- Consolidations to enhance supply chain efficiencies.

- Investments in niche design studios.

The end-user profile is predominantly affluent residential clients seeking to enhance their living spaces with statement pieces. However, a growing segment of high-end commercial projects, including luxury hotels, premium offices, and exclusive retail spaces, are also significant contributors to market growth. Mergers and acquisitions are on the rise as companies aim to consolidate market presence and expand their product portfolios within the ultra-luxury segment. The market is characterized by a continuous pursuit of aesthetic excellence and functional superiority, ensuring its continued appeal to discerning clientele.

GCC Luxurious Furniture Industry Industry Evolution

The GCC Luxurious Furniture Industry has witnessed remarkable growth trajectories, largely propelled by robust economic development, increasing disposable incomes, and a rising penchant for opulent home décor among the region's affluent population. Over the historical period of 2019–2024, the market has demonstrated consistent expansion, with an estimated Compound Annual Growth Rate (CAGR) of XX% during this phase. This growth has been fueled by substantial investments in real estate development, particularly in luxury residential and hospitality sectors across key economies like the UAE and Saudi Arabia.

Technological advancements have played a pivotal role in shaping the industry's evolution. The adoption of advanced manufacturing techniques, including precision CNC machinery and 3D printing for intricate designs, has enabled manufacturers to produce more complex and customized furniture pieces. Furthermore, the integration of smart home technology into furniture, offering features like integrated lighting, charging ports, and adjustable settings, has become a significant trend. Consumer demand has shifted towards furniture that not only signifies status but also offers superior comfort, functionality, and personalized aesthetics. The preference for sustainable materials and eco-friendly production processes is also gaining traction, influencing design choices and material sourcing.

The market's evolution is also characterized by a growing demand for experiential retail, leading to the establishment of more flagship stores and immersive showrooms that offer personalized design consultations. Online channels are becoming increasingly important, providing consumers with greater access to a wider range of luxury furniture options, albeit with a strong emphasis on high-quality visuals and detailed product descriptions. Industry growth rates have been consistently positive, with specific segments like custom-made furniture and designer lighting experiencing double-digit expansion. The adoption of digital design tools and augmented reality (AR) for visualization is also on the rise, enhancing the customer journey and reducing purchase uncertainties.

Leading Regions, Countries, or Segments in GCC Luxurious Furniture Industry

The GCC Luxurious Furniture Industry is spearheaded by a few dominant players and regions that consistently set benchmarks for quality, design, and market penetration. Within the Product Type segment, Bedroom furniture and Chairs and Sofas command significant market share, driven by their central role in residential comfort and aesthetic appeal. These categories often feature bespoke designs and premium materials, catering directly to the discerning tastes of the GCC clientele. Lighting also represents a high-growth area, with luxury lighting fixtures often serving as statement pieces that elevate interior design.

Geographically, the United Arab Emirates and Saudi Arabia are the undisputed leaders in the GCC Luxurious Furniture Industry. Their status is underpinned by several key drivers.

- Investment Trends: Both nations have witnessed massive investments in luxury real estate, including high-end residential towers, opulent villas, and world-class hospitality projects. This directly translates into substantial demand for premium furniture and interior fit-outs.

- Regulatory Support: Governments in these regions actively encourage foreign investment and luxury retail development, creating a conducive environment for high-end furniture brands to establish a strong presence.

- Affluent Consumer Base: The concentration of high-net-worth individuals (HNWIs) and expatriates with significant disposable income in these countries fuels the demand for luxury goods, including furniture.

- Economic Diversification: Initiatives focused on economic diversification, moving away from oil dependency, have led to significant growth in sectors like tourism, retail, and real estate, all of which are strong consumers of luxurious furnishings.

Within End User segments, Residential remains the largest market, with homeowners investing heavily in creating luxurious and personalized living spaces. However, the Commercial sector is rapidly gaining momentum, particularly driven by the expansion of luxury hotels, high-end corporate offices, and premium retail outlets. These projects often require bespoke furniture solutions that align with sophisticated branding and guest experiences.

The Distribution Channel landscape is evolving. While Home Centers continue to play a role, often housing premium sub-brands, Flagship Stores and Specialty Stores dedicated to luxury brands are becoming increasingly prevalent. These provide an immersive brand experience and personalized customer service. The Online channel is also experiencing significant growth, with e-commerce platforms increasingly offering curated selections of luxury furniture, emphasizing high-quality imagery, virtual consultations, and seamless delivery services.

The dominance of the UAE and Saudi Arabia can be attributed to their visionary urban development projects, a strong culture that values opulence and craftsmanship, and their strategic positioning as regional hubs for luxury commerce. The continuous influx of international luxury brands further solidifies their leadership in the GCC Luxurious Furniture Industry.

GCC Luxurious Furniture Industry Product Innovations

The GCC Luxurious Furniture Industry is characterized by a relentless pursuit of innovation, with manufacturers and designers pushing the boundaries of aesthetics and functionality. Innovations in materials science have led to the incorporation of exotic woods, precious metals, and sustainable luxury fabrics, enhancing both visual appeal and tactile experience. Smart furniture, integrating seamlessly with home automation systems, is a significant advancement, offering features like adjustable comfort settings, ambient lighting, and discreet charging solutions. Product innovations also extend to modular designs that offer unparalleled customization for diverse spatial needs, alongside advanced ergonomic principles to ensure supreme comfort. These advancements are critical for maintaining a competitive edge and capturing the evolving preferences of the affluent GCC consumer.

Propelling Factors for GCC Luxurious Furniture Industry Growth

Several key factors are propelling the growth of the GCC Luxurious Furniture Industry. Robust economic development and sustained wealth creation within the region are leading to increased disposable incomes, enabling higher consumer spending on premium home furnishings. A growing trend of urbanization and a burgeoning expatriate population further fuel demand for sophisticated and aesthetically pleasing furniture.

- Rising Disposable Incomes: Increased wealth amongst GCC residents and expatriates directly translates to higher spending on luxury goods.

- Real Estate Boom: Significant investments in luxury residential and hospitality projects create substantial demand for high-end furniture.

- Cultural Affinity for Luxury: A deep-rooted appreciation for opulence and craftsmanship drives the preference for premium furniture.

- Government Initiatives: Visionary economic diversification plans and support for retail sector development foster market expansion.

Obstacles in the GCC Luxurious Furniture Industry Market

Despite the strong growth, the GCC Luxurious Furniture Industry faces several obstacles. Regulatory hurdles, particularly concerning import duties and local content requirements, can impact pricing and supply chain agility. Intense competition from both established international brands and emerging local designers also presents a challenge, necessitating continuous innovation and differentiation.

- Supply Chain Vulnerabilities: Global disruptions and logistical complexities can affect the timely delivery of high-value furniture.

- Intensified Competition: A crowded market demands unique value propositions and superior customer experiences.

- Economic Volatility: Fluctuations in global economic conditions can indirectly influence consumer confidence and discretionary spending on luxury items.

Future Opportunities in GCC Luxurious Furniture Industry

The GCC Luxurious Furniture Industry is ripe with future opportunities. The growing emphasis on sustainability presents a chance for brands to innovate with eco-friendly materials and production processes, appealing to a more environmentally conscious consumer base. The expansion of e-commerce offers a direct channel to reach a wider audience, while the increasing demand for smart home integration opens doors for technologically advanced furniture solutions.

- Sustainable Luxury: Development and marketing of furniture using recycled, upcycled, and ethically sourced materials.

- Digital Transformation: Enhancing online customer experience with AR/VR for visualization and personalized online consultations.

- Niche Market Penetration: Targeting specific segments like outdoor luxury furniture or custom office fit-outs.

Major Players in the GCC Luxurious Furniture Industry Ecosystem

- Al Huzaifa

- Bukannan Furnishing

- ID Design

- PAN Emirates

- Danube

- IKEA

- Home Center

- Luxe Living

- B&B Italia

- Royal Furniture

Key Developments in GCC Luxurious Furniture Industry Industry

- June 2023: Daze Furniture, the leading furniture brand known for its bespoke collection of furniture, lighting, and home accessories, is poised to revolutionise the luxury furniture segment in the UAE.

- May 2023: PAN Emirates, a premier home furnishings and online furniture shopping store in UAE, has rebranded itself as PAN Home. The rebranding effort includes a complete makeover, signaling a more modernised perspective for PAN Home.

Strategic GCC Luxurious Furniture Industry Market Forecast

The GCC Luxurious Furniture Industry is strategically poised for sustained growth, driven by ongoing economic prosperity and a pervasive consumer desire for premium home environments. Future opportunities lie in embracing technological integration, such as smart furniture and enhanced online shopping experiences, alongside a growing demand for sustainable and ethically sourced products. The expansion of hospitality and commercial real estate sectors will continue to be significant demand catalysts, further solidifying the market's upward trajectory.

GCC Luxurious Furniture Industry Segmentation

-

1. Product Type

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Accessories

- 1.5. Bedroom

- 1.6. Cabinets

- 1.7. Other Products

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Kuwait

- 4.4. Qatar

- 4.5. Rest of GCC Countries

GCC Luxurious Furniture Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Kuwait

- 4. Qatar

- 5. Rest of GCC Countries

GCC Luxurious Furniture Industry Regional Market Share

Geographic Coverage of GCC Luxurious Furniture Industry

GCC Luxurious Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend for Luxury Furniture; Real Estate Development

- 3.3. Market Restrains

- 3.3.1. High Import Taxes and Duties; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Changing Consumer Preferences Toward Luxury Goods Like Luxury Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Accessories

- 5.1.5. Bedroom

- 5.1.6. Cabinets

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Kuwait

- 5.4.4. Qatar

- 5.4.5. Rest of GCC Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Kuwait

- 5.5.4. Qatar

- 5.5.5. Rest of GCC Countries

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lighting

- 6.1.2. Tables

- 6.1.3. Chairs and Sofas

- 6.1.4. Accessories

- 6.1.5. Bedroom

- 6.1.6. Cabinets

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Flagship Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online

- 6.3.5. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Kuwait

- 6.4.4. Qatar

- 6.4.5. Rest of GCC Countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lighting

- 7.1.2. Tables

- 7.1.3. Chairs and Sofas

- 7.1.4. Accessories

- 7.1.5. Bedroom

- 7.1.6. Cabinets

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Flagship Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online

- 7.3.5. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Kuwait

- 7.4.4. Qatar

- 7.4.5. Rest of GCC Countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Kuwait GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lighting

- 8.1.2. Tables

- 8.1.3. Chairs and Sofas

- 8.1.4. Accessories

- 8.1.5. Bedroom

- 8.1.6. Cabinets

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Flagship Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online

- 8.3.5. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Kuwait

- 8.4.4. Qatar

- 8.4.5. Rest of GCC Countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Qatar GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lighting

- 9.1.2. Tables

- 9.1.3. Chairs and Sofas

- 9.1.4. Accessories

- 9.1.5. Bedroom

- 9.1.6. Cabinets

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Flagship Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online

- 9.3.5. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Kuwait

- 9.4.4. Qatar

- 9.4.5. Rest of GCC Countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of GCC Countries GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lighting

- 10.1.2. Tables

- 10.1.3. Chairs and Sofas

- 10.1.4. Accessories

- 10.1.5. Bedroom

- 10.1.6. Cabinets

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Flagship Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online

- 10.3.5. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Kuwait

- 10.4.4. Qatar

- 10.4.5. Rest of GCC Countries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Al Huzaifa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bukannan Furnishing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ID Design**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PAN Emirates

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danube

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IKEA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Home Center

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Luxe Living

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B&B Italia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Al Huzaifa

List of Figures

- Figure 1: Global GCC Luxurious Furniture Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 19: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 25: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 27: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 29: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 37: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 43: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 45: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 47: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 49: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 13: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 23: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Luxurious Furniture Industry?

The projected CAGR is approximately 7.13%.

2. Which companies are prominent players in the GCC Luxurious Furniture Industry?

Key companies in the market include Al Huzaifa, Bukannan Furnishing, ID Design**List Not Exhaustive, PAN Emirates, Danube, IKEA, Home Center, Luxe Living, B&B Italia, Royal Furniture.

3. What are the main segments of the GCC Luxurious Furniture Industry?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend for Luxury Furniture; Real Estate Development.

6. What are the notable trends driving market growth?

Changing Consumer Preferences Toward Luxury Goods Like Luxury Furniture.

7. Are there any restraints impacting market growth?

High Import Taxes and Duties; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2023: Daze Furniture, the leading furniture brand known for its bespoke collection of furniture, lighting, and home accessories, is poised to revolutionise the luxury furniture segment in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Luxurious Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Luxurious Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Luxurious Furniture Industry?

To stay informed about further developments, trends, and reports in the GCC Luxurious Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence