Key Insights

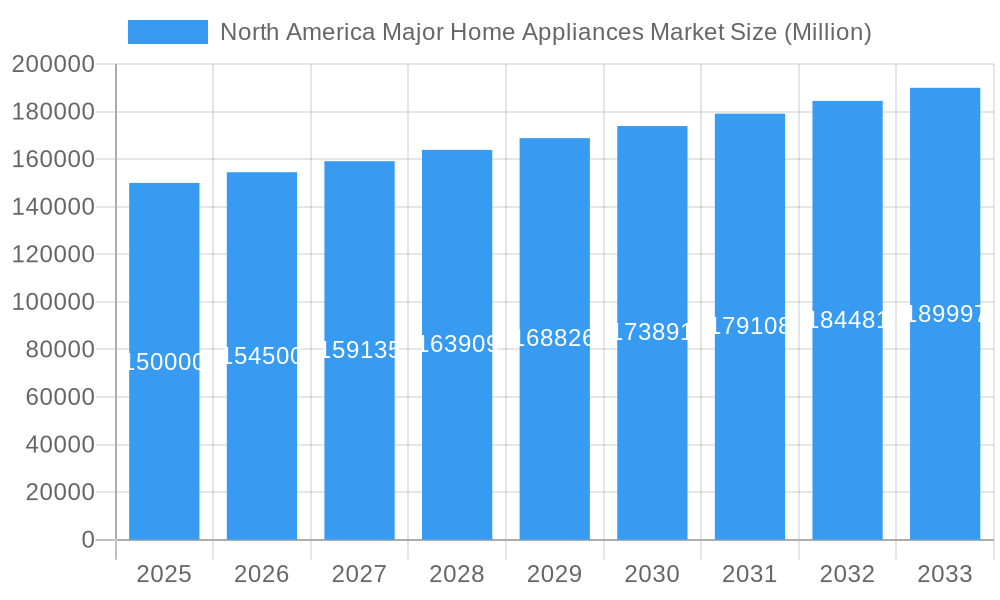

The North America Major Home Appliances Market is set for significant expansion, projected to reach $84.85 billion by 2025. Driven by a Compound Annual Growth Rate (CAGR) of 3.13%, sustained market growth is anticipated, reflecting robust demand for essential household equipment. Key growth drivers include rising disposable incomes, increasing adoption of smart and energy-efficient appliances, and consumer preference for advanced, feature-rich products. Demand for convenience, enhanced kitchen aesthetics, and improved laundry solutions also contribute significantly. Furthermore, home renovations and new constructions continue to fuel the need for these foundational household items.

North America Major Home Appliances Market Market Size (In Billion)

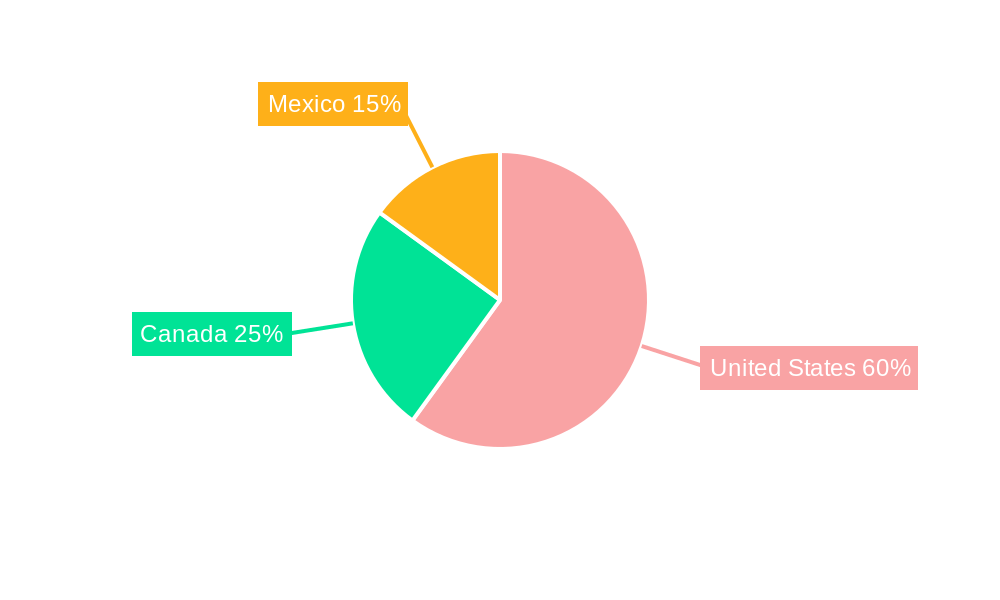

The market encompasses diverse product categories, with refrigerators and washing machines leading in demand due to their indispensable nature. Microwave ovens and dishwashers are also experiencing strong adoption, driven by consumer demand for convenience and time-saving solutions. The distribution network is evolving, with online sales experiencing substantial growth alongside traditional multi-brand and exclusive retail stores. Specialty stores are also gaining traction by offering premium and unique product lines. Geographically, the United States leads the market, followed by Canada and Mexico, each presenting unique market dynamics. Emerging trends such as IoT integration in home appliances, a strong focus on sustainability and eco-friendly designs, and the growth of compact appliances for smaller living spaces are shaping the future of the North America Major Home Appliances sector, requiring continuous innovation from key industry players.

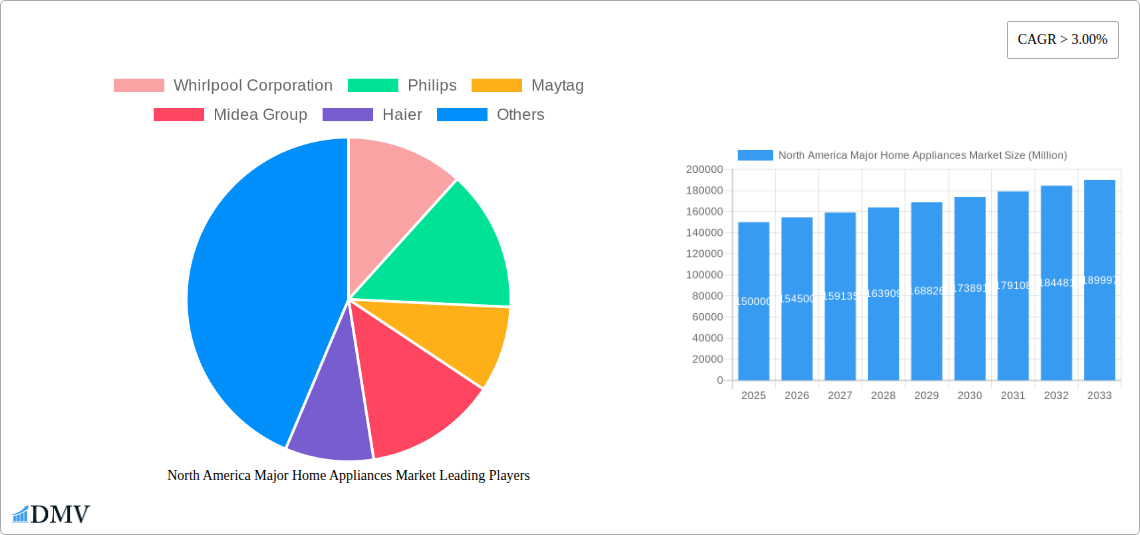

North America Major Home Appliances Market Company Market Share

North America Major Home Appliances Market Composition & Trends

The North America Major Home Appliances Market is characterized by a dynamic landscape, driven by innovation and evolving consumer preferences. Market concentration is moderately high, with key players like Whirlpool Corporation, Samsung Electronics, and LG Electronics holding significant market share. The report meticulously analyzes market share distribution across various product categories and distribution channels, offering stakeholders a clear view of competitive positioning. Innovation catalysts are numerous, ranging from the integration of smart home technology and energy efficiency mandates to the growing demand for aesthetically pleasing and multi-functional appliances. Regulatory landscapes, including evolving energy star certifications and safety standards, play a crucial role in shaping product development and market entry strategies. Substitute products, such as portable appliances and specialized kitchen gadgets, are also considered, though the core market remains dominated by built-in and freestanding major appliances. End-user profiles are segmented by household income, lifestyle, and technological adoption rates, providing granular insights into consumer behavior. Mergers and acquisitions (M&A) activities are a key trend, with deal values and strategic rationales extensively detailed, indicating consolidation efforts and the pursuit of expanded market reach and technological synergy. The market is projected to witness steady growth, fueled by replacement cycles and new housing construction.

North America Major Home Appliances Market Industry Evolution

The North America Major Home Appliances Market has undergone a significant transformation over the historical period of 2019–2024, driven by a confluence of technological advancements, shifting consumer demands, and economic influences. Market growth trajectories have been largely upward, albeit with fluctuations influenced by global economic conditions and the COVID-19 pandemic, which initially spurred demand for home-centric products. Technological advancements have been a primary catalyst for industry evolution. The integration of the Internet of Things (IoT) has moved beyond basic connectivity to enable sophisticated smart home ecosystems, allowing for remote control, diagnostics, and predictive maintenance of appliances like refrigerators, washing machines, and dishwashers. Energy efficiency has transitioned from a niche feature to a mainstream expectation, with consumers actively seeking appliances with higher Energy Star ratings, driven by both environmental consciousness and the desire to reduce utility bills. This has pushed manufacturers to invest heavily in R&D to develop more energy-efficient compressors, heating elements, and insulation technologies.

Shifting consumer demands are equally influential. There's a discernible trend towards premiumization, with consumers willing to invest in higher-end appliances that offer superior performance, advanced features, and enhanced aesthetics. This is evident in the growing popularity of sleek, integrated designs and advanced functionalities in refrigerators, such as customizable temperature zones and built-in water dispensers, and in washing machines with steam cycles and AI-powered fabric care. The rise of e-commerce has fundamentally altered the distribution landscape, making online purchasing of major appliances increasingly common. This necessitates robust online presence, efficient logistics, and compelling digital marketing strategies from manufacturers and retailers alike. Furthermore, sustainability is no longer a peripheral concern; consumers are increasingly factoring in the environmental impact of their purchases, from manufacturing processes to product lifespan and recyclability. This is driving demand for appliances made from recycled materials and those with extended warranty periods. The base year of 2025 marks a pivotal point, with the market poised for continued innovation and growth during the forecast period of 2025–2033, projected to reach significant market value, exceeding xx Billion USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx%. Specific data points indicate an average adoption rate of xx% for smart appliances in new home installations by 2024, with projections to reach over xx% by 2030.

Leading Regions, Countries, or Segments in North America Major Home Appliances Market

The North America Major Home Appliances Market is predominantly led by the United States, which commands the largest share due to its substantial consumer base, high disposable income, and robust housing market. Within the United States, key drivers of this dominance include continuous investment in home renovations and new construction projects, which directly fuel demand for major home appliances. Furthermore, the strong presence of leading appliance manufacturers and a highly developed retail infrastructure, encompassing both traditional brick-and-mortar outlets and a rapidly expanding online segment, solidify its leadership position. Regulatory support, such as government incentives for energy-efficient appliances and stringent safety standards, also contributes to market growth and innovation within the country.

Product Segment Dominance:

- Refrigerators: This segment consistently leads due to its essential nature and frequent replacement cycles. Technological innovations, such as French door configurations, smart features for inventory management, and advanced cooling systems, continue to drive consumer interest and expenditure. The market value for refrigerators alone is estimated to exceed xx Billion USD in 2025.

- Washing Machines: With a strong emphasis on energy efficiency, water conservation, and advanced fabric care technologies, washing machines represent another significant segment. The adoption of high-efficiency top-load and front-load models, coupled with smart functionalities, fuels consistent demand.

Distribution Channel Dominance:

- Online: The online distribution channel is experiencing exponential growth, driven by consumer convenience, competitive pricing, and a wider selection of products. E-commerce platforms, coupled with direct-to-consumer (DTC) strategies from manufacturers, are reshaping how consumers purchase major appliances. Projections indicate that online sales will account for over xx% of the total market by 2033.

- Multi-Branded Stores: Despite the rise of online channels, multi-branded appliance retailers continue to hold a significant market share, offering consumers the ability to see and compare products in person and benefit from in-store expertise.

Geographical Factors:

- United States: As previously mentioned, the United States' economic strength, consumer spending patterns, and proactive adoption of new technologies make it the undisputed leader. The sheer volume of housing units, both new and existing, requiring appliance upgrades or replacements ensures sustained demand. The market size for major home appliances in the United States is projected to reach xx Billion USD by 2033.

- Canada: Canada follows as a significant market, characterized by a strong demand for energy-efficient appliances and a growing interest in smart home technologies, mirroring trends in the U.S. The Canadian market is expected to grow at a CAGR of xx% during the forecast period.

- Mexico: While currently smaller in market size compared to the U.S. and Canada, Mexico presents substantial growth potential. Increasing urbanization, a rising middle class, and government initiatives aimed at improving housing infrastructure are expected to drive demand for major home appliances in the coming years. The Mexican market is anticipated to expand at a CAGR of xx%.

North America Major Home Appliances Market Product Innovations

The North America Major Home Appliances Market is witnessing a surge in product innovations, driven by the integration of smart technology and a focus on enhanced user experience. Refrigerators are now equipped with advanced inventory management systems, AI-powered recipe suggestions, and customizable temperature zones, optimizing food preservation. Washing machines and dryers are incorporating steam cycles, allergen removal features, and app-controlled operation for ultimate convenience and fabric care. Dishwashing machines are designed for greater water and energy efficiency, with quieter operation and specialized wash cycles. Microwave ovens are evolving beyond basic heating to include convection and air frying capabilities, offering greater versatility. These innovations are not just about functionality but also about aesthetics, with sleek designs and premium finishes becoming increasingly important selling propositions.

Propelling Factors for North America Major Home Appliances Market Growth

Several key factors are propelling the growth of the North America Major Home Appliances Market. Technological advancements, particularly the integration of smart home capabilities and AI, are driving consumer interest and enabling new functionalities. Increasing disposable incomes in key segments of the population allow for greater investment in premium and feature-rich appliances. The ongoing trend of home renovations and new housing construction directly translates into demand for major appliances. Furthermore, stringent energy efficiency regulations and growing consumer environmental awareness are pushing manufacturers to develop and market more sustainable and energy-saving products, creating a significant market opportunity.

Obstacles in the North America Major Home Appliances Market Market

Despite the positive growth trajectory, the North America Major Home Appliances Market faces several obstacles. Supply chain disruptions, stemming from global geopolitical events and raw material shortages, can impact production timelines and increase manufacturing costs, leading to higher retail prices. Intense competition among established players and the emergence of new entrants can lead to price wars and pressure on profit margins. Evolving regulatory landscapes, while often driving innovation, can also impose significant compliance costs and necessitate substantial retooling of manufacturing processes. Furthermore, the significant upfront cost of some advanced appliances can be a barrier for price-sensitive consumers, particularly in times of economic uncertainty.

Future Opportunities in North America Major Home Appliances Market

The North America Major Home Appliances Market presents numerous future opportunities. The continued expansion of the smart home ecosystem offers significant potential for interconnected appliances and integrated home management solutions. Growing consumer demand for sustainable and eco-friendly products presents an avenue for manufacturers to innovate with recyclable materials and energy-efficient designs. Emerging markets and underserved segments within North America offer untapped potential for market penetration. The increasing focus on health and wellness is also driving demand for appliances with features like advanced air purification and hygiene cycles. Furthermore, the development of subscription-based services for appliance maintenance and upgrades could unlock new revenue streams.

Major Players in the North America Major Home Appliances Market Ecosystem

- Whirlpool Corporation

- Samsung Electronics

- LG Electronics

- Haier Group Corporation

- Electrolux AB

- Bosch Home Appliances

- Midea Group

- GE Appliances

- Panasonic Corporation

- Maytag

- Philips

- Hitachi

- Fagor America

Key Developments in North America Major Home Appliances Market Industry

- May 2023: Whirlpool Corporation is proud to announce that 7 products among their Whirlpool, Hotpoint, and KitchenAid brands triumphed for exceptional product design by winning the internationally prestigious iF Design Award 2023.

- April 2023: Electrolux Group has been recognized for Its innovative and sustainable product design, with more than a dozen appliances winning world-renowned iF Design Awards including a coveted iF Gold Award for the Electrolux 600/AEG 6000 series of paint-free vacuum cleaners.

Strategic North America Major Home Appliances Market Market Forecast

The strategic North America Major Home Appliances Market forecast indicates robust growth, driven by ongoing technological integration, a persistent demand for energy-efficient solutions, and a strong replacement cycle. The increasing adoption of smart home technologies will continue to be a significant growth catalyst, fostering the development of interconnected appliance ecosystems and personalized user experiences. Furthermore, a growing consumer consciousness around sustainability will fuel demand for appliances with lower environmental footprints. The expansion of online retail channels and direct-to-consumer models will further democratize access to a wider range of products and competitive pricing, thereby driving market penetration. Emerging opportunities in urban renewal projects and a resilient housing market are expected to contribute positively to overall market expansion throughout the forecast period.

North America Major Home Appliances Market Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashing Machines

- 1.4. Washing Machines

- 1.5. Microwave Ovens

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Exclusive Stores

- 2.3. Specialty Stores

- 2.4. Online

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Major Home Appliances Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Major Home Appliances Market Regional Market Share

Geographic Coverage of North America Major Home Appliances Market

North America Major Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income; Changing Lifestyles and Time Constraints

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. Increase in the revenue of Major Home Appliances through Online sales channel over Offline

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Major Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashing Machines

- 5.1.4. Washing Machines

- 5.1.5. Microwave Ovens

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Exclusive Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Major Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Refrigerators

- 6.1.2. Freezers

- 6.1.3. Dishwashing Machines

- 6.1.4. Washing Machines

- 6.1.5. Microwave Ovens

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Multi-Branded Stores

- 6.2.2. Exclusive Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Major Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Refrigerators

- 7.1.2. Freezers

- 7.1.3. Dishwashing Machines

- 7.1.4. Washing Machines

- 7.1.5. Microwave Ovens

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Multi-Branded Stores

- 7.2.2. Exclusive Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Major Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Refrigerators

- 8.1.2. Freezers

- 8.1.3. Dishwashing Machines

- 8.1.4. Washing Machines

- 8.1.5. Microwave Ovens

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Multi-Branded Stores

- 8.2.2. Exclusive Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Whirlpool Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Philips

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Maytag

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Midea Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Haier

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Bosch

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Electrolux AB

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fagor America

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Panasonic Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Hitachi

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Whirlpool Corporation

List of Figures

- Figure 1: North America Major Home Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Major Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: North America Major Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Major Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: North America Major Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Major Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Major Home Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Major Home Appliances Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: North America Major Home Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Major Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Major Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: North America Major Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: North America Major Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Major Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Major Home Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Major Home Appliances Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: North America Major Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Major Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America Major Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: North America Major Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: North America Major Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Major Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Major Home Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Major Home Appliances Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Major Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Major Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: North America Major Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: North America Major Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: North America Major Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: North America Major Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: North America Major Home Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Major Home Appliances Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: North America Major Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Major Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Major Home Appliances Market?

The projected CAGR is approximately 3.13%.

2. Which companies are prominent players in the North America Major Home Appliances Market?

Key companies in the market include Whirlpool Corporation, Philips, Maytag, Midea Group, Haier, Bosch, Electrolux AB, Fagor America, Panasonic Corporation, Hitachi.

3. What are the main segments of the North America Major Home Appliances Market?

The market segments include Product, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income; Changing Lifestyles and Time Constraints.

6. What are the notable trends driving market growth?

Increase in the revenue of Major Home Appliances through Online sales channel over Offline.

7. Are there any restraints impacting market growth?

High Initial Costs; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

May 2023: Whirlpool Corporation is proud to announce that 7 products among their Whirlpool, Hotpoint, and KitchenAid brands triumphed for exceptional product design by winning the internationally prestigious iF Design Award 2023

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Major Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Major Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Major Home Appliances Market?

To stay informed about further developments, trends, and reports in the North America Major Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence