Key Insights

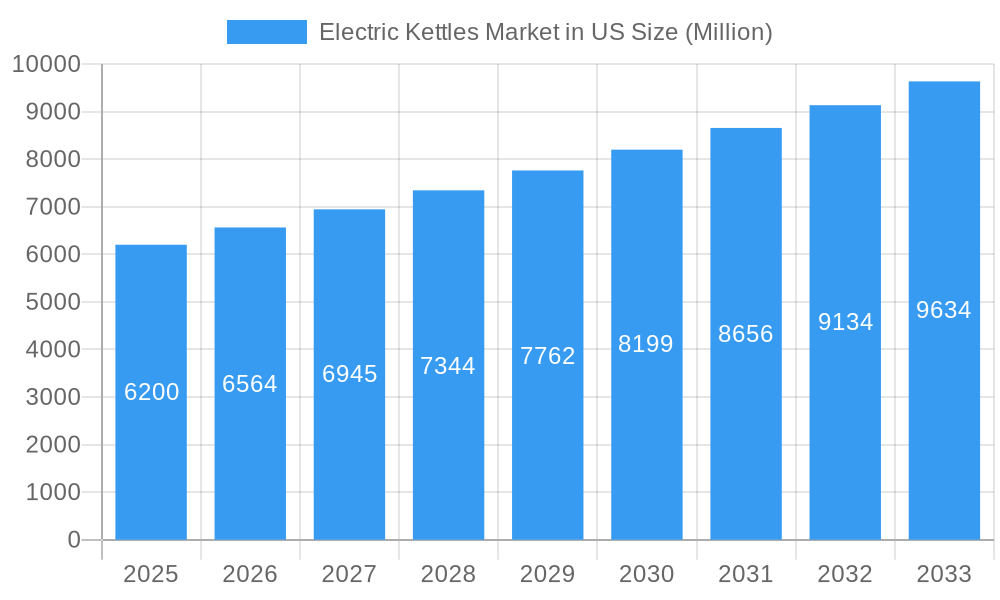

The electric kettles market in the United States is poised for substantial growth, projected to reach approximately USD 6.2 billion in 2025, driven by a healthy CAGR of 5.8% over the forecast period. This expansion is fueled by an increasing consumer preference for convenience and speed in food preparation, particularly among busy households and working professionals. The rising adoption of smart home devices and the integration of innovative features like temperature control and rapid boiling capabilities are also significant growth catalysts. Furthermore, a growing awareness of energy efficiency in appliances is pushing consumers towards electric kettles over traditional stovetop methods, especially in regions with higher energy costs. The market's robust performance is also supported by a dynamic product landscape featuring diverse materials such as stainless steel and glass, catering to varied aesthetic and functional demands.

Electric Kettles Market in US Market Size (In Billion)

The market's trajectory is further bolstered by expanding distribution channels, with online retail platforms playing an increasingly crucial role in reaching a wider consumer base. Supermarkets and hypermarkets continue to be significant contributors, while specialty stores offer premium and niche product segments. While the market is dominated by established players like Smeg, Cuisinart, and Philips, there is ample room for innovation and market penetration by emerging brands. Potential restraints might include intense price competition and the availability of lower-cost alternatives, but the overall demand for efficient and modern kitchen appliances suggests a strong and sustained growth outlook for the U.S. electric kettles market. The forecast period, extending to 2033, indicates a continuous upward trend, reflecting enduring consumer interest and technological advancements in the sector.

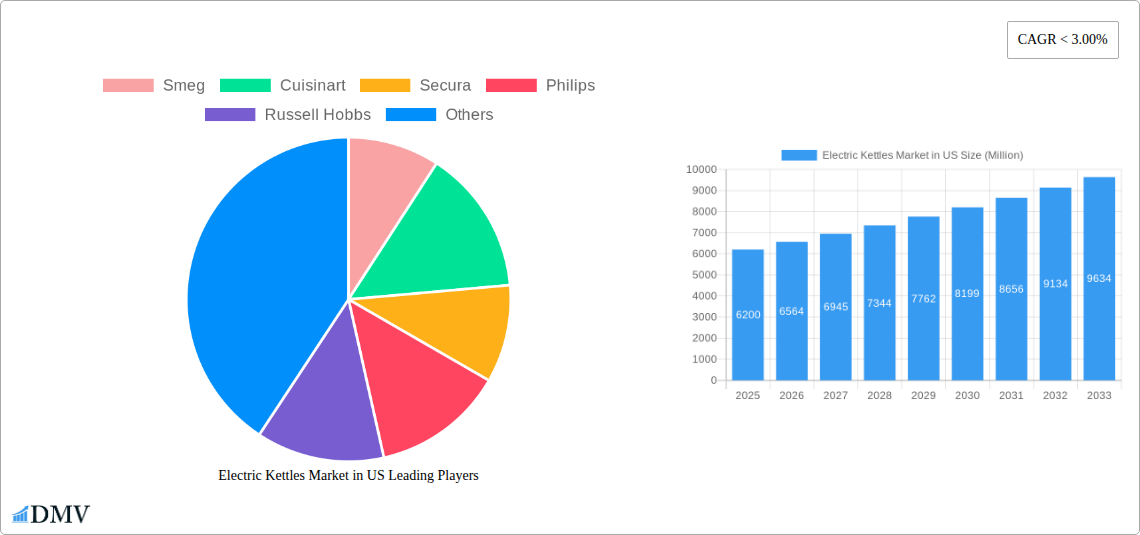

Electric Kettles Market in US Company Market Share

Electric Kettles Market in US Market Composition & Trends

The US electric kettles market is characterized by a dynamic interplay of established brands and emerging innovators, creating a moderately concentrated landscape. Key companies like Smeg, Cuisinart, Philips, Russell Hobbs, and Breville command significant market share, leveraging brand recognition and extensive distribution networks. Innovation is a primary catalyst for growth, with manufacturers continuously introducing smart features, enhanced safety mechanisms, and sophisticated designs to cater to evolving consumer preferences. The US electric kettles market size is projected to witness steady expansion. Regulatory landscapes primarily focus on safety standards and energy efficiency, ensuring product reliability and sustainability. Substitute products, such as stovetop kettles and microwave heating, present a mild competitive pressure, but the convenience and speed of electric kettles maintain their dominance. End-user profiles range from busy households seeking rapid beverage preparation to commercial establishments like cafes and offices requiring high-volume boiling solutions. Mergers and acquisitions (M&A) activity, while not pervasive, has played a role in consolidating market presence and expanding product portfolios. For instance, strategic acquisitions by larger players have aimed to integrate innovative technologies and tap into new consumer segments. The US electric kettles market growth is influenced by these strategic moves and the ongoing pursuit of market leadership.

- Market Share Distribution: Leading brands are estimated to hold collectively over 60% of the market share, with niche players focusing on specific product segments like premium designs or smart functionalities.

- M&A Deal Values: While specific deal values fluctuate, acquisitions in the appliance sector often range from tens of millions to several hundred million dollars, signaling significant investment in market consolidation and technological advancement.

- Innovation Focus: Features like variable temperature control, rapid boil technology, and smart connectivity are becoming increasingly standard, driving product differentiation and consumer interest.

Electric Kettles Market in US Industry Evolution

The US electric kettles industry has undergone a significant evolution, driven by technological advancements, shifting consumer lifestyles, and an increasing emphasis on convenience and energy efficiency. The historical period, from 2019 to 2024, witnessed steady growth in the US electric kettles market, fueled by increasing disposable incomes and the growing popularity of home beverage consumption. The base year, 2025, marks a pivotal point with an estimated market value of approximately $3.2 billion, reflecting the sustained demand for these essential kitchen appliances. Technological advancements have been at the forefront of this evolution. Early electric kettles were primarily designed for basic water boiling, but innovation has introduced features like precise temperature control for different types of beverages (e.g., green tea, coffee), rapid boil technology that significantly reduces heating time, and enhanced safety features such as auto-shutoff and boil-dry protection. The integration of smart technology, allowing users to control kettles remotely via smartphone apps, has also become a notable trend, catering to the tech-savvy consumer.

Consumer demand has also played a crucial role in shaping the industry. The increasing pace of modern life has amplified the need for quick and efficient kitchen solutions. Electric kettles offer a significant time-saving advantage over traditional stovetop methods. Furthermore, a growing awareness of health and wellness has led to a demand for appliances that can precisely prepare beverages at optimal temperatures, thereby enhancing the flavor and beneficial properties of teas and other hot drinks. The US electric kettles market forecast from 2025 to 2033 anticipates continued robust growth, projected to reach an estimated $4.9 billion by 2033. This expansion is underpinned by the ongoing adoption of advanced features, a growing middle class with higher disposable incomes, and a sustained preference for convenient home appliances. The industry's trajectory is marked by a consistent upward trend in adoption rates, with smart electric kettles experiencing particularly rapid growth in recent years. This evolution showcases the industry's ability to adapt to changing market dynamics and consumer expectations.

Leading Regions, Countries, or Segments in Electric Kettles Market in US

While the entire United States represents a significant market for electric kettles, the dominance can be further dissected by looking at regional consumption patterns, specific product types, applications, and distribution channels.

Product Type Dominance: Stainless Steel

The stainless steel electric kettles segment is poised to maintain its leading position within the US market. Its inherent durability, resistance to staining and odor, and sleek aesthetic appeal resonate strongly with American consumers. The perceived premium quality and longevity of stainless steel products often justify a higher price point, aligning with consumer willingness to invest in durable kitchenware.

- Key Drivers for Stainless Steel Dominance:

- Durability and Longevity: Consumers prioritize appliances that last, and stainless steel is renowned for its robust construction.

- Aesthetic Appeal: The modern and sophisticated look of stainless steel complements a wide range of kitchen designs.

- Hygiene and Ease of Cleaning: Stainless steel surfaces are non-porous, making them easy to clean and resistant to bacteria.

- Material Safety: It's perceived as a safe material for food preparation and consumption.

Application Dominance: Household

The household application segment overwhelmingly drives the demand for electric kettles in the US. The majority of sales are attributed to individual consumers and families incorporating these appliances into their daily routines for breakfast beverages, afternoon teas, and quick hot water needs.

- Key Drivers for Household Dominance:

- Convenience and Speed: Essential for busy households to prepare hot drinks and water rapidly.

- Growing Single-Person Households: An increasing number of smaller households contribute to a higher per-capita ownership rate.

- Beverage Culture: The strong culture of coffee and tea consumption in the US fuels consistent demand.

- Affordability of Basic Models: Entry-level electric kettles are widely accessible to most households.

Distribution Channel Dominance: Online

The online distribution channel is the most influential and fastest-growing segment for electric kettles in the US. E-commerce platforms offer unparalleled convenience, a vast selection, competitive pricing, and detailed product information, attracting a broad spectrum of consumers.

- Key Drivers for Online Dominance:

- Wide Product Selection: Consumers can easily compare models from various brands and price points.

- Competitive Pricing and Promotions: Online retailers often offer attractive discounts and deals.

- Convenience of Home Delivery: Eliminates the need for physical store visits.

- Customer Reviews and Ratings: Provide valuable insights to aid purchasing decisions.

- Rise of Direct-to-Consumer (DTC) Brands: Many innovative brands leverage online channels for direct sales, further boosting this segment.

The interplay of these dominant segments – stainless steel products, household applications, and online distribution – forms the backbone of the current US electric kettles market, dictating product development, marketing strategies, and overall market trajectory.

Electric Kettles Market in US Product Innovations

Product innovation in the US electric kettles market is largely centered around enhancing user experience, safety, and functionality. Manufacturers are increasingly integrating smart features, such as Wi-Fi connectivity for app-controlled operation, allowing users to schedule boiling times or adjust temperatures remotely. Rapid boil technology, which can heat water to boiling point in under a minute for select models, is a key performance metric. Variable temperature control has also become a significant selling proposition, catering to discerning consumers who require precise temperatures for different types of teas and coffee brewing methods. Furthermore, design aesthetics are evolving, with premium finishes, brushed metal exteriors, and glass designs gaining traction. Safety features, including boil-dry protection, automatic shut-off, and cool-touch exteriors, remain paramount, ensuring user peace of mind.

Propelling Factors for Electric Kettles Market in US Growth

Several key factors are propelling the US electric kettles market growth. Technologically, the introduction of smart features like app control and precise temperature settings is attracting a younger, tech-savvy demographic and catering to specialized beverage preparation needs. Economically, rising disposable incomes and a growing demand for convenience in busy households continue to fuel sales. The strong American coffee and tea culture, with an increasing emphasis on specialty beverages, also creates sustained demand for efficient and accurate water heating solutions. Furthermore, the widespread availability and competitive pricing of a diverse range of electric kettles across various distribution channels, especially online, make them easily accessible to a vast consumer base. Regulatory support for energy-efficient appliances indirectly benefits the market by promoting models with better performance.

Obstacles in the Electric Kettles Market in US Market

Despite robust growth, the US electric kettles market faces several obstacles. Intense competition among numerous brands, including established giants and emerging players, can lead to price wars and thin profit margins. Regulatory hurdles related to evolving safety and energy efficiency standards can necessitate costly product redesigns and certifications. Supply chain disruptions, as witnessed in recent years, can impact manufacturing timelines and increase raw material costs, affecting product availability and pricing. Furthermore, the presence of effective substitute products, such as stovetop kettles and microwave ovens, continues to pose a competitive challenge, particularly for price-sensitive consumers. Lastly, economic downturns or recessions can curb consumer spending on non-essential kitchen appliances, slowing market expansion.

Future Opportunities in Electric Kettles Market in US

The US electric kettles market presents several promising future opportunities. The burgeoning smart home ecosystem offers a significant avenue for growth, with opportunities to integrate electric kettles more seamlessly into connected kitchens. Innovations in sustainable materials and energy-efficient designs will appeal to the growing segment of environmentally conscious consumers. The rising popularity of artisanal coffee and specialty teas continues to drive demand for kettles with advanced temperature control and brewing features. Expansion into niche markets, such as compact and portable kettles for travelers or dorm rooms, can unlock new consumer segments. Moreover, the increasing demand for aesthetically pleasing and functional kitchen appliances presents opportunities for brands focusing on premium design and unique color palettes.

Major Players in the Electric Kettles Market in US Ecosystem

- Smeg

- Cuisinart

- Secura

- Philips

- Russell Hobbs

- Ovente

- Newell Brands

- Electrolux

- BrentWood Appliances

- Galanz

- Breville

- Dash

- KitchenAid

- Hamilton Beach Brands

Key Developments in Electric Kettles Market in US Industry

- January 2024: Philips launches a new line of smart electric kettles with advanced temperature control and app integration, targeting tech-savvy consumers.

- November 2023: Cuisinart introduces an innovative rapid boil feature across its premium electric kettle range, significantly reducing boiling times.

- August 2023: Smeg expands its retro-inspired appliance line with new designer electric kettles, focusing on aesthetic appeal and premium finishes.

- March 2023: Russell Hobbs enhances its existing models with improved energy efficiency certifications, aligning with growing consumer demand for sustainable appliances.

- December 2022: Breville focuses on enhancing user interface design for its connected kettles, aiming for a more intuitive smart home experience.

- June 2022: Newell Brands strengthens its market position by acquiring a smaller appliance manufacturer specializing in innovative heating solutions.

- February 2022: Ovente introduces a range of more affordable, yet feature-rich, electric kettles to cater to a wider consumer base.

Strategic Electric Kettles Market in US Market Forecast

The US electric kettles market is set for continued robust expansion, driven by an increasing consumer appetite for convenience and technological integration. The forecast period (2025-2033) anticipates the market to grow steadily as manufacturers continue to innovate with smart features, variable temperature control, and enhanced safety mechanisms. The sustained popularity of hot beverages and the growing trend towards sophisticated home kitchens will further fuel demand. Key growth catalysts include the increasing adoption of smart home technology, a focus on energy-efficient designs, and the expanding online retail landscape. This strategic outlook suggests a dynamic market ripe with opportunities for companies that can adapt to evolving consumer preferences and technological advancements. The projected market value by 2033 is estimated to be around $4.9 billion, underscoring the significant potential within this sector.

Electric Kettles Market in US Segmentation

-

1. Product Type

- 1.1. Stainless Steel

- 1.2. Plastic

- 1.3. Glass

- 1.4. Others

-

2. Application

- 2.1. Household

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Electric Kettles Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

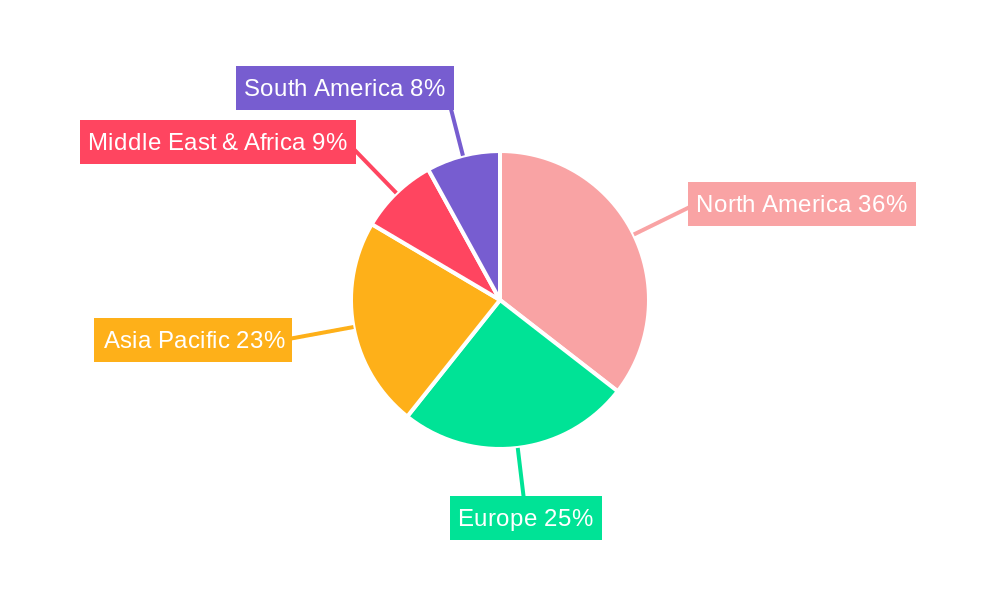

Electric Kettles Market in US Regional Market Share

Geographic Coverage of Electric Kettles Market in US

Electric Kettles Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Hygiene and Cleanliness Awareness is Driving the Market; Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Downturns are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increase in Retailing of Electric Kettles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Kettles Market in US Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Stainless Steel

- 5.1.2. Plastic

- 5.1.3. Glass

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Household

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Electric Kettles Market in US Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Stainless Steel

- 6.1.2. Plastic

- 6.1.3. Glass

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Household

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Electric Kettles Market in US Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Stainless Steel

- 7.1.2. Plastic

- 7.1.3. Glass

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Household

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Electric Kettles Market in US Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Stainless Steel

- 8.1.2. Plastic

- 8.1.3. Glass

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Household

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Electric Kettles Market in US Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Stainless Steel

- 9.1.2. Plastic

- 9.1.3. Glass

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Household

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Electric Kettles Market in US Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Stainless Steel

- 10.1.2. Plastic

- 10.1.3. Glass

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Household

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Smeg

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cuisinart

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Secura

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Philips

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Russell Hobbs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ovente

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Newell Brands

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Electrolux

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BrentWood Appliances*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Galanz

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Breville

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dash

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KitchenAid

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hamilton Beach Brands

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Smeg

List of Figures

- Figure 1: Global Electric Kettles Market in US Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electric Kettles Market in US Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Electric Kettles Market in US Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Electric Kettles Market in US Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Electric Kettles Market in US Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Electric Kettles Market in US Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Electric Kettles Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Electric Kettles Market in US Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Electric Kettles Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Electric Kettles Market in US Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: South America Electric Kettles Market in US Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Electric Kettles Market in US Revenue (undefined), by Application 2025 & 2033

- Figure 13: South America Electric Kettles Market in US Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Electric Kettles Market in US Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America Electric Kettles Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Electric Kettles Market in US Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Electric Kettles Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Electric Kettles Market in US Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Europe Electric Kettles Market in US Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Electric Kettles Market in US Revenue (undefined), by Application 2025 & 2033

- Figure 21: Europe Electric Kettles Market in US Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Electric Kettles Market in US Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Europe Electric Kettles Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Electric Kettles Market in US Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Electric Kettles Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Electric Kettles Market in US Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Electric Kettles Market in US Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Electric Kettles Market in US Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East & Africa Electric Kettles Market in US Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa Electric Kettles Market in US Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Electric Kettles Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Electric Kettles Market in US Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Electric Kettles Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Electric Kettles Market in US Revenue (undefined), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Electric Kettles Market in US Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Electric Kettles Market in US Revenue (undefined), by Application 2025 & 2033

- Figure 37: Asia Pacific Electric Kettles Market in US Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Electric Kettles Market in US Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Electric Kettles Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Electric Kettles Market in US Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Electric Kettles Market in US Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Kettles Market in US Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Electric Kettles Market in US Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Electric Kettles Market in US Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Electric Kettles Market in US Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Electric Kettles Market in US Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global Electric Kettles Market in US Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Electric Kettles Market in US Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Electric Kettles Market in US Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Kettles Market in US Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Electric Kettles Market in US Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Electric Kettles Market in US Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Electric Kettles Market in US Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Electric Kettles Market in US Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Electric Kettles Market in US Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Electric Kettles Market in US Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Electric Kettles Market in US Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Electric Kettles Market in US Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Electric Kettles Market in US Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Electric Kettles Market in US Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Electric Kettles Market in US Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Electric Kettles Market in US Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 43: Global Electric Kettles Market in US Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Global Electric Kettles Market in US Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Electric Kettles Market in US Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Electric Kettles Market in US Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Kettles Market in US?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Electric Kettles Market in US?

Key companies in the market include Smeg, Cuisinart, Secura, Philips, Russell Hobbs, Ovente, Newell Brands, Electrolux, BrentWood Appliances*List Not Exhaustive, Galanz, Breville, Dash, KitchenAid, Hamilton Beach Brands.

3. What are the main segments of the Electric Kettles Market in US?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Hygiene and Cleanliness Awareness is Driving the Market; Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Retailing of Electric Kettles.

7. Are there any restraints impacting market growth?

Economic Downturns are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Kettles Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Kettles Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Kettles Market in US?

To stay informed about further developments, trends, and reports in the Electric Kettles Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence