Key Insights

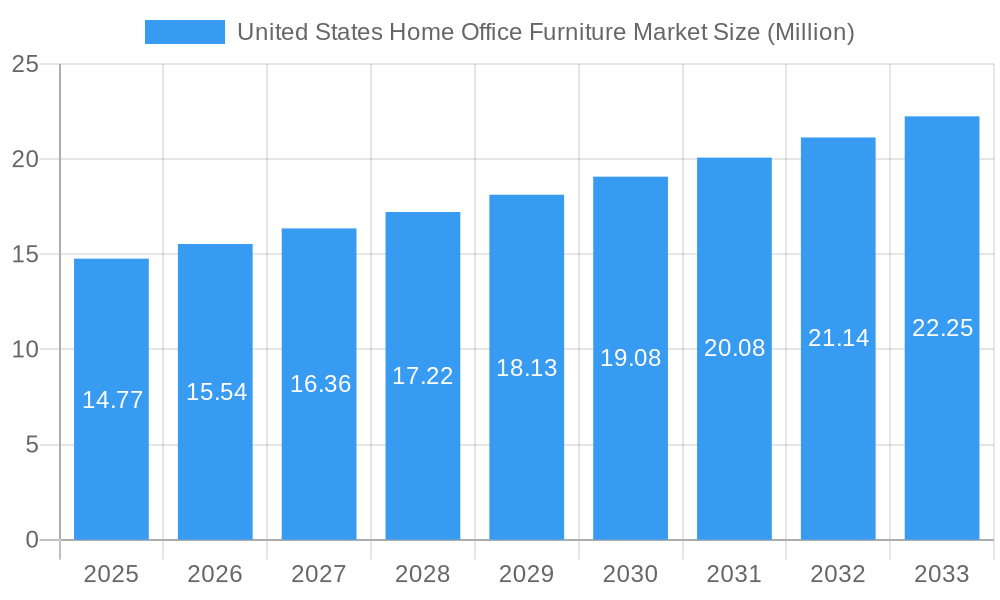

The United States Home Office Furniture Market is a robust and expanding sector, projected to reach an estimated market size of $14.77 million by 2025. This growth is fueled by a consistent Compound Annual Growth Rate (CAGR) of 5.34%, indicating sustained demand and market dynamism throughout the forecast period of 2025-2033. The increasing trend of remote work, hybrid work models, and a growing emphasis on creating functional and aesthetically pleasing home workspaces are primary drivers. This shift necessitates investments in ergonomic seating, efficient storage units, and versatile desks and tables, transforming home offices from mere functional spaces into extensions of professional environments. The market's expansion is also supported by evolving consumer preferences for quality, durability, and design, reflecting a growing appreciation for home office furniture that enhances productivity and well-being.

United States Home Office Furniture Market Market Size (In Million)

The market's segmentation reveals a diverse landscape. 'Product' segments, including Seating, Storage Units, Desks and Tables, and Other Home Office Furniture, all contribute to the overall market value. Distribution channels, such as Flagship Stores, Specialty Stores, and increasingly, Online platforms, are crucial for market reach. The growing prominence of online retail, offering convenience and a wider selection, is a significant trend. Key players like Steelcase Inc., Herman Miller Inc., Knoll Inc., and IKEA are actively shaping this market through product innovation, strategic partnerships, and expanding their online and offline retail footprints. While the market exhibits strong growth, potential restraints such as rising raw material costs and supply chain disruptions could pose challenges, necessitating strategic sourcing and operational efficiency from industry participants to maintain profitability and market share.

United States Home Office Furniture Market Company Market Share

This comprehensive report delves into the dynamic United States Home Office Furniture Market, offering in-depth insights and strategic forecasts from 2019 to 2033. With the base year set at 2025, this study meticulously analyzes historical trends, current market conditions, and future growth trajectories. It's an essential resource for stakeholders seeking to understand market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and emerging opportunities within this rapidly expanding sector.

United States Home Office Furniture Market Market Composition & Trends

The United States Home Office Furniture Market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Innovation is primarily driven by evolving work-from-home trends and the demand for ergonomic and space-saving solutions. Regulatory frameworks are largely stable, focusing on safety and environmental standards, with minimal direct impact on furniture sales but influencing manufacturing processes. Substitute products, such as adaptable modular shelving and multi-functional furniture, are emerging, challenging traditional product categories. End-user profiles range from remote professionals and freelancers seeking dedicated workspaces to students and hobbyists requiring functional areas. Mergers and acquisitions (M&A) activity has been observed, with deal values often undisclosed but indicative of strategic consolidation and expansion within the market. For instance, the acquisition of smaller, niche furniture brands by larger corporations aims to broaden product portfolios and market reach. The market share distribution is influenced by brand reputation, product quality, and competitive pricing strategies. The overall market size is projected to reach $XX Billion by 2033.

United States Home Office Furniture Market Industry Evolution

The United States Home Office Furniture Market has undergone a profound transformation, largely accelerated by the global shift towards remote and hybrid work models. The historical period (2019-2024) witnessed a steady, albeit moderate, growth as the concept of a dedicated home office gained traction. However, the pandemic acted as a significant inflection point, catapulting the demand for home office furniture to unprecedented levels. This surge in demand prompted manufacturers and retailers to rapidly adapt their product offerings and supply chains. Technological advancements have played a crucial role in shaping the industry. The integration of smart features in furniture, such as built-in charging stations and adjustable desk heights controlled via apps, has become increasingly prevalent. Furthermore, advancements in material science have led to the development of more sustainable, durable, and aesthetically pleasing furniture options. Consumer demands have evolved significantly; there's a growing emphasis on ergonomic design to promote well-being and prevent strain during long working hours. Aesthetics are no longer secondary to functionality, with consumers seeking furniture that complements their home décor and reflects their personal style. The rise of e-commerce and online furniture retailers has democratized access to a wider range of products, fostering greater competition and driving innovation. The market is projected to experience a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This sustained growth is underpinned by the increasing adoption of hybrid work policies across various industries, making a well-equipped home office a necessity rather than a luxury. The market's evolution is also marked by a greater focus on modularity and customization, allowing consumers to adapt their workspaces to changing needs and available space. The penetration of online sales channels has further fueled this evolution, offering consumers unparalleled convenience and choice.

Leading Regions, Countries, or Segments in United States Home Office Furniture Market

Within the United States Home Office Furniture Market, the Online distribution channel is emerging as a dominant force, exhibiting remarkable growth and influencing market dynamics significantly. This segment's ascendancy is driven by unparalleled convenience, a vast selection of products from various brands, competitive pricing, and efficient delivery services. Consumers appreciate the ability to browse, compare, and purchase furniture from the comfort of their homes, a trend that has been amplified by evolving consumer behaviors. The accessibility of online platforms removes geographical barriers, allowing individuals in all regions of the United States to access a wider array of home office furniture than ever before.

Key drivers contributing to the dominance of the online channel include:

- Investment Trends: Significant investments are being channeled into e-commerce infrastructure, including advanced warehousing, logistics, and digital marketing strategies, by both established furniture giants and new online entrants. This investment fuels greater reach and customer engagement.

- Technological Advancements in E-commerce: The adoption of augmented reality (AR) for virtual furniture placement, AI-powered recommendation engines, and seamless payment gateways enhances the online shopping experience, bridging the gap between online browsing and in-person purchasing.

- Consumer Behavior Shifts: The increasing comfort and familiarity with online shopping across all demographics, particularly post-pandemic, have solidified online channels as a primary purchasing avenue for furniture.

- Cost-Effectiveness: Online retailers often have lower overhead costs compared to brick-and-mortar stores, allowing them to offer more competitive pricing, which is a significant draw for cost-conscious consumers.

- Data Analytics and Personalization: Online platforms leverage data analytics to understand consumer preferences and offer personalized recommendations, further enhancing the shopping experience and driving sales.

While Flagship Stores and Specialty Stores retain their importance for consumers seeking a tactile experience and expert advice, the sheer scalability, reach, and evolving technological capabilities of the Online channel position it for sustained dominance in the United States Home Office Furniture Market. The Seating product segment, with its focus on ergonomics and comfort, also demonstrates robust growth within this channel.

United States Home Office Furniture Market Product Innovations

Product innovation in the United States Home Office Furniture Market is increasingly centered on creating adaptable, ergonomic, and aesthetically pleasing solutions. Manufacturers are developing multi-functional furniture that seamlessly transitions between work and leisure, such as desks with integrated storage and convertible seating. Advanced ergonomic designs, including adjustable height desks and chairs with advanced lumbar support, are gaining traction to promote user well-being. Material innovation, focusing on sustainable and durable options, is also a key trend, offering eco-conscious consumers appealing choices. The integration of smart technology, such as wireless charging pads and built-in power outlets, further enhances the functionality and appeal of home office furniture, meeting the evolving needs of the modern remote worker.

Propelling Factors for United States Home Office Furniture Market Growth

The United States Home Office Furniture Market is propelled by several key factors. The sustained adoption of hybrid and remote work policies across industries is a primary driver, creating a persistent demand for dedicated home workspaces. Economic factors, including rising disposable incomes and a growing appreciation for work-life balance, also contribute to increased spending on home office furnishings. Technological advancements, such as the development of ergonomic and smart furniture solutions, cater to evolving consumer needs for comfort and efficiency. Furthermore, government initiatives and corporate support for employee well-being in remote settings indirectly foster market growth.

Obstacles in the United States Home Office Furniture Market Market

Despite robust growth, the United States Home Office Furniture Market faces several obstacles. Supply chain disruptions, exacerbated by global logistics challenges and raw material shortages, can lead to increased production costs and extended delivery times, impacting profitability and customer satisfaction. Intense competition from a wide array of domestic and international manufacturers and retailers exerts downward pressure on pricing. Evolving consumer preferences and the rapid pace of technological change necessitate continuous product development and adaptation, requiring significant investment. Economic volatility and potential recessions could also dampen consumer spending on non-essential items like furniture.

Future Opportunities in United States Home Office Furniture Market

The United States Home Office Furniture Market is rife with future opportunities. The growing demand for sustainable and eco-friendly furniture presents a significant niche for manufacturers focused on ethical sourcing and production. The integration of smart home technology into furniture, creating connected and responsive workspaces, offers another avenue for innovation. The expansion of the "work-from-anywhere" trend, including co-working spaces and flexible office solutions, opens up new market segments. Furthermore, catering to the unique needs of diverse demographics, such as seniors and individuals with disabilities, through specialized ergonomic designs presents an underserved opportunity.

Major Players in the United States Home Office Furniture Market Ecosystem

- Knoll Inc

- Teknion Corporation

- HNI Corporation

- Haworth Inc

- Steelcase Inc

- Ashley Home Stores Ltd

- IKEA

- Krueger International Inc

- Herman Miller Inc

- Kimball International

Key Developments in United States Home Office Furniture Market Industry

- August 2023: Herman Miller introduced a Fuld Nesting Chair designed in collaboration with Stefan Diez's sleek, minimalist design that enables flexible configurations for workspaces.

- April 2023: IKEA United States announced the launch of its new Business Network. This loyalty program is designed to provide small businesses with access to resources that are designed to improve the quality of life at work, regardless of the size of the business.

Strategic United States Home Office Furniture Market Market Forecast

The United States Home Office Furniture Market is poised for continued growth, driven by the enduring shift towards flexible work arrangements and an increasing emphasis on employee well-being. Strategic investments in innovative, ergonomic, and sustainable furniture solutions will be crucial for market players to capitalize on emerging consumer trends. The expansion of e-commerce channels, coupled with advancements in digital customer engagement tools, will further fuel market penetration and sales. As the lines between home and office continue to blur, the demand for versatile, aesthetically pleasing, and functional home office furniture is expected to remain strong, presenting significant opportunities for companies that can adapt and innovate within this dynamic landscape.

United States Home Office Furniture Market Segmentation

-

1. Product

- 1.1. Seating

- 1.2. Storage Units

- 1.3. Desks and Tables

- 1.4. Other Home Office Furniture

-

2. Distribution Channel

- 2.1. Flagship Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

United States Home Office Furniture Market Segmentation By Geography

- 1. United States

United States Home Office Furniture Market Regional Market Share

Geographic Coverage of United States Home Office Furniture Market

United States Home Office Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tech-Integrated Furniture are Helping to Grow the Market

- 3.3. Market Restrains

- 3.3.1. Raw Material Cost Barrier to Growth

- 3.4. Market Trends

- 3.4.1. Desks and Chairs Furniture Industry Expanding Continuously

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Home Office Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Seating

- 5.1.2. Storage Units

- 5.1.3. Desks and Tables

- 5.1.4. Other Home Office Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Flagship Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Knoll Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teknion Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HNI Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haworth Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Steelcase Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashley Home Stores Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IKEA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Krueger International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Herman Miller Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kimball International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Knoll Inc

List of Figures

- Figure 1: United States Home Office Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Home Office Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: United States Home Office Furniture Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Home Office Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: United States Home Office Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Home Office Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Home Office Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Home Office Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: United States Home Office Furniture Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: United States Home Office Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: United States Home Office Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Home Office Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: United States Home Office Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Home Office Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Home Office Furniture Market?

The projected CAGR is approximately 5.34%.

2. Which companies are prominent players in the United States Home Office Furniture Market?

Key companies in the market include Knoll Inc, Teknion Corporation, HNI Corporation, Haworth Inc, Steelcase Inc, Ashley Home Stores Ltd, IKEA, Krueger International Inc, Herman Miller Inc, Kimball International.

3. What are the main segments of the United States Home Office Furniture Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Tech-Integrated Furniture are Helping to Grow the Market.

6. What are the notable trends driving market growth?

Desks and Chairs Furniture Industry Expanding Continuously.

7. Are there any restraints impacting market growth?

Raw Material Cost Barrier to Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Herman Miller introduced a Fuld Nesting Chair designed in collaboration with Stefan Diez's sleek, it is a minimalist design that enables flexible configurations for workspaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Home Office Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Home Office Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Home Office Furniture Market?

To stay informed about further developments, trends, and reports in the United States Home Office Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence