Key Insights

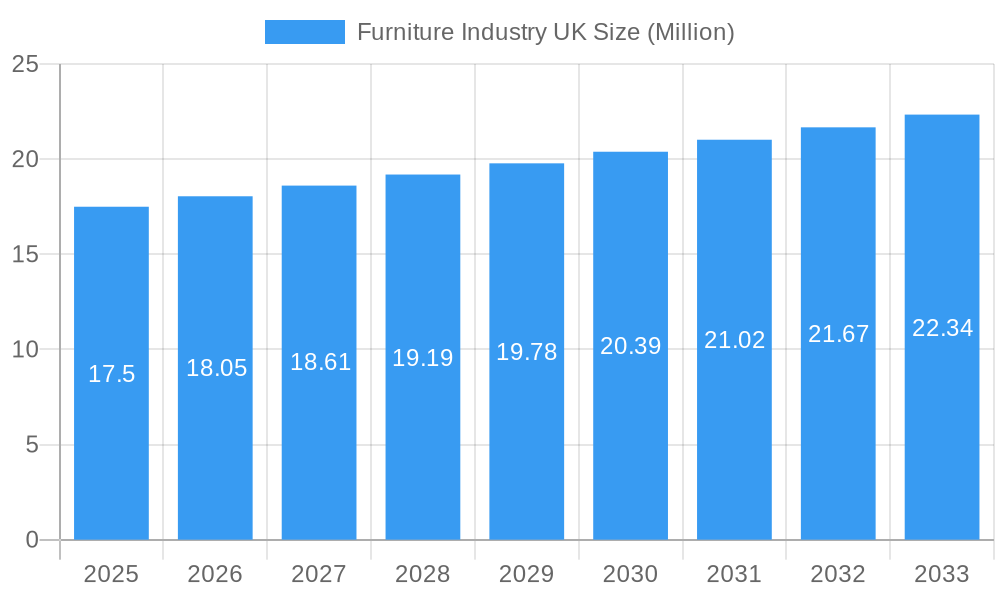

The UK furniture industry is poised for steady growth, with a projected market size of £18.78 billion and a Compound Annual Growth Rate (CAGR) of 3.20% expected over the forecast period of 2025-2033. This expansion is fueled by several key drivers. A significant factor is the increasing consumer spending power and a growing demand for home improvements, particularly following recent shifts in lifestyle that prioritize comfortable and functional living spaces. Furthermore, the rising trend of urbanization and smaller living spaces necessitates adaptable and multi-functional furniture solutions, contributing to market dynamism. The “work-from-home” culture has also elevated the importance of well-equipped and aesthetically pleasing home offices, boosting demand for relevant furniture segments. Technological advancements in manufacturing, leading to more sustainable and customized furniture options, are also acting as powerful catalysts for market expansion. The industry is witnessing a continuous evolution in consumer preferences, with a growing emphasis on eco-friendly materials, artisanal craftsmanship, and personalized designs.

Furniture Industry UK Market Size (In Million)

The market is strategically segmented to cater to diverse consumer needs. Key product categories, including Living Room Furniture, Dining Room Furniture, and Bedroom Furniture, are expected to see consistent demand. Kitchen Furniture and "Other Types" of furniture, encompassing outdoor and office furniture, are also anticipated to contribute significantly to the overall market value. Distribution channels are evolving, with a notable surge in online sales, driven by convenience and wider product availability. Home Centers and Flagship Stores remain crucial for a tactile customer experience, while Specialty Stores cater to niche markets. Key players like IKEA, Wayfair Inc., and Dunelm Group PLC are instrumental in shaping market trends through their innovative product offerings and extensive reach. Restraints such as rising raw material costs and global supply chain disruptions could pose challenges, but the industry's resilience, coupled with ongoing innovation and adaptation to evolving consumer behaviors, suggests a robust future for the UK furniture market.

Furniture Industry UK Company Market Share

This in-depth report offers a definitive analysis of the UK furniture market, exploring its current composition, historical trajectory, and future outlook. Designed for furniture manufacturers, retailers, investors, and industry stakeholders, this report provides critical insights into market trends, segmentation, key players, and strategic opportunities within the UK furniture industry. Our rigorous research covers the study period 2019–2033, with the base year and estimated year being 2025, and a comprehensive forecast period from 2025–2033, building upon historical data from 2019–2024. Discover how innovations in living room furniture, dining room furniture, bedroom furniture, and kitchen furniture, coupled with evolving distribution channels including online sales and home centers, are shaping the future of this dynamic sector. We delve into the impact of sustainability initiatives, e-commerce growth, and changing consumer preferences on the UK furniture market size and market share.

Furniture Industry UK Market Composition & Trends

The UK furniture industry exhibits a moderately concentrated market structure, with a few dominant players alongside a robust network of independent manufacturers and retailers. Key innovation catalysts include the ongoing demand for sustainable and ethically sourced products, alongside technological advancements driving efficiency in manufacturing and design. The regulatory landscape is influenced by environmental policies and consumer protection laws, impacting product standards and material sourcing. Substitute products, primarily from overseas and emerging markets, present a continuous competitive pressure. End-user profiles are increasingly diverse, ranging from budget-conscious consumers seeking value for money to affluent buyers prioritizing luxury, craftsmanship, and bespoke solutions. Merger and acquisition (M&A) activities are strategic, often aimed at expanding market reach, consolidating supply chains, or acquiring innovative technologies. The UK furniture market share distribution is influenced by these factors, with significant value in M&A deals observed in recent years as larger entities seek to scale operations and enhance their competitive edge. For example, the Dunelm Group PLC and DFS Furniture PLC often engage in strategic expansions. The market value is estimated to reach £25 Million by 2025.

- Market Share Distribution: Fragmented, with key players holding substantial shares in specific niches.

- M&A Deal Values: Expected to witness significant transactions as companies consolidate to capture market dominance and achieve economies of scale.

- Innovation Catalysts: Sustainability, customization, and smart furniture technologies.

- Regulatory Landscape: Focus on eco-friendly materials, product safety, and fair trade practices.

Furniture Industry UK Industry Evolution

The evolution of the UK furniture market has been a dynamic interplay of economic shifts, technological breakthroughs, and evolving consumer behaviors. Over the historical period 2019–2024, the industry experienced fluctuations influenced by global economic trends and domestic policy changes. However, a consistent upward trajectory in demand for home furnishings has been observed, driven by an increasing focus on home improvement and interior design. Technological advancements have played a pivotal role, with the adoption of digital design tools, advanced manufacturing techniques like CNC machining, and the rise of online furniture sales significantly transforming production and distribution models. The furniture industry UK has seen a substantial growth in e-commerce, with platforms like Wayfair Inc. and IKEA's online presence becoming dominant forces. Consumer demand has shifted towards more personalized, sustainable, and space-saving furniture solutions. The COVID-19 pandemic accelerated the adoption of home office furniture and prompted a greater investment in creating comfortable and functional living spaces. This has led to increased market penetration for specialized furniture segments. For instance, the demand for living room furniture and bedroom furniture has surged as consumers spend more time at home. The market growth rate for the online furniture segment has been exceptionally high, often exceeding 20% annually. Furthermore, investments in specialty stores focusing on unique designs and eco-friendly materials are gaining traction. The estimated market size is projected to reach £22 Million in 2025, with a projected compound annual growth rate (CAGR) of 5% during the forecast period 2025–2033. The industry is also witnessing a rise in direct-to-consumer (DTC) models, bypassing traditional retail channels and offering greater transparency and customization. This evolution reflects a mature market segment adapting to new consumer paradigms and technological capabilities, ensuring continued relevance and expansion.

Leading Regions, Countries, or Segments in Furniture Industry UK

The UK furniture industry is characterized by distinct leading segments and distribution channels. Within Product Type, Living Room Furniture consistently emerges as the dominant segment, driven by its central role in the home and the continuous demand for comfortable and aesthetically pleasing pieces. This is followed closely by Bedroom Furniture, reflecting ongoing investments in personal sanctuaries. Dining Room Furniture and Kitchen Furniture also represent significant segments, albeit with varying growth rates depending on housing market trends and lifestyle shifts. Other Types, encompassing outdoor furniture, office furniture, and accent pieces, are experiencing considerable growth due to evolving work-from-home trends and a desire for versatile living spaces.

In terms of Distribution Channel, the Online segment has witnessed exponential growth, becoming a primary driver for market expansion. Its convenience, wide product selection, and competitive pricing appeal to a broad consumer base. Home Centers and Specialty Stores also retain significant market share, offering consumers tangible experiences and expert advice. Flagship Stores, particularly for premium brands, cater to a discerning clientele seeking curated collections and brand immersion.

Leading Product Type: Living Room Furniture

- Dominance Factors: High replacement rates, strong influence of interior design trends, and the central role of the living area in modern homes.

- Investment Trends: Increased investment in modular designs, smart furniture, and sustainable materials.

- Consumer Demand: Driven by comfort, style, functionality, and the need for versatile furniture that adapts to different uses.

Leading Distribution Channel: Online

- Dominance Factors: Accessibility, vast product variety, competitive pricing, and ease of comparison.

- Regulatory Support: E-commerce regulations ensuring consumer protection and fair trading practices.

- Growth Drivers: Increasing internet penetration, mobile commerce adoption, and the expanding reach of online retailers like IKEA and Wayfair Inc.

The dominance of Living Room Furniture is further amplified by its association with evolving lifestyle needs, such as home entertainment and social gatherings. Similarly, the surge in Online sales is supported by robust logistical networks and innovative digital marketing strategies employed by companies like Dunelm Group PLC and DFS Furniture PLC. The estimated market value for these leading segments in 2025 is approximately £12 Million for Living Room Furniture and £8 Million for Online sales.

Furniture Industry UK Product Innovations

Product innovations in the UK furniture sector are increasingly focused on sustainability, smart technology, and modular design. Manufacturers are actively developing furniture made from recycled and biodegradable materials, such as FSC-certified wood and recycled plastics, to meet growing environmental consciousness. The integration of smart technology, including charging ports, adjustable lighting, and integrated sound systems, is transforming traditional pieces into multi-functional hubs. Modular and adaptable designs are also gaining prominence, allowing consumers to customize and reconfigure their furniture to suit changing spatial needs and personal preferences, exemplified by the offerings from IKEA. Performance metrics such as durability, ease of assembly, and long-term material integrity are paramount. The unique selling proposition often lies in the combination of these features, offering consumers not just furniture, but enhanced living experiences. The UK furniture market is witnessing a strong trend towards bespoke and handcrafted items, alongside mass-produced but ethically sourced goods, reflecting a diverse consumer demand.

Propelling Factors for Furniture Industry UK Growth

Several key factors are propelling the growth of the UK furniture industry. Economically, rising disposable incomes and a strong housing market, particularly in urban centers, drive demand for new and updated furnishings. Technologically, advancements in e-commerce platforms and digital marketing are expanding market reach and facilitating direct-to-consumer sales, leading to increased market accessibility. The growing consumer consciousness towards sustainability and ethical sourcing is a significant driver, encouraging manufacturers to invest in eco-friendly materials and production processes. Furthermore, the government's support for domestic manufacturing through various initiatives and the ongoing trend of home renovation and interior design contribute to sustained market expansion. The estimated market value growth is projected to be around 4-6% annually.

- Economic Growth: Increased consumer spending and investment in home improvement.

- Technological Advancements: Dominance of online sales channels and innovative design software.

- Sustainability Focus: Demand for eco-friendly materials and ethical production.

- Housing Market Dynamics: Steady demand driven by new builds and home renovations.

Obstacles in the Furniture Industry UK Market

Despite robust growth, the UK furniture market faces several obstacles. Intense competition from international manufacturers, particularly those offering lower price points, exerts significant pressure on domestic producers. Supply chain disruptions, exacerbated by global events and logistical challenges, can lead to increased costs and production delays. Regulatory challenges, including evolving environmental standards and import regulations, require continuous adaptation and investment from businesses. Fluctuations in raw material prices, such as timber and metals, can impact profit margins. Furthermore, shifting consumer preferences and the fast-paced nature of interior design trends necessitate constant innovation and product development, which can be resource-intensive. The estimated impact of these obstacles on market growth could be a reduction of 1-2% in potential expansion.

- Global Competition: Pressure from lower-cost international suppliers.

- Supply Chain Volatility: Disruptions leading to increased costs and lead times.

- Raw Material Price Fluctuations: Impacting production costs and profitability.

- Rapidly Changing Consumer Tastes: Requiring continuous product updates.

Future Opportunities in Furniture Industry UK

The UK furniture industry is poised for significant future opportunities, particularly in emerging trends and niche markets. The growing demand for sustainable furniture presents a substantial opportunity for manufacturers to innovate and market eco-friendly product lines. The expansion of the online furniture market continues to offer vast potential for direct-to-consumer brands and innovative e-commerce strategies. Furthermore, the increasing interest in smart home technology integrated with furniture provides a fertile ground for technological advancements and new product development. The customization and personalization trend allows for the creation of bespoke furniture experiences catering to individual consumer needs. Finally, the growing awareness and demand for ethically produced and locally sourced furniture will continue to open avenues for smaller, specialized manufacturers and brands. The market value is projected to reach £30 Million by 2030.

- Sustainable Furniture Market: Growth driven by environmental consciousness.

- Smart Furniture Integration: Opportunities in technology-enabled home furnishings.

- Personalization & Customization: Catering to individual consumer preferences.

- Ethical & Local Sourcing: Increasing demand for transparency and traceability.

Major Players in the Furniture Industry UK Ecosystem

The UK furniture industry is populated by a diverse range of influential companies, each contributing to the market's vibrancy. These include established manufacturers, prominent retailers, and innovative e-commerce platforms. The landscape is dynamic, with companies consistently adapting to market demands and technological advancements.

- Cotteswood Furniture

- ercol

- Alpha Designs Upholstery Limited

- Steve Bristow Furniture

- Delcor Limited

- DFS Furniture PLC

- Steinhoff UK Retail Limited

- Andrena Furniture Ltd

- Dunelm Group PLC

- Wayfair Inc

- IKEA

- Bed Bath & Beyond Inc

Key Developments in Furniture Industry UK Industry

The UK furniture industry has witnessed several impactful developments in recent months, reshaping market dynamics and consumer engagement. These advancements highlight a growing emphasis on sustainability, innovative marketing, and evolving consumer service.

- November 2023: IKEA launched a new mattress removal and recycling scheme in partnership with The Furniture Recycling (TFR) Group. This initiative aims to offer a sustainable solution for recycling old mattresses that would otherwise end up as waste. The mattresses are recycled, and the materials they contain are reused, underscoring a commitment to circular economy principles and environmental responsibility.

- September 2023: Dunelm launched its new 'Home of Homes' ad campaign, providing shoppers with a preview of this season's essential homeware. This campaign focuses on showcasing diverse product ranges and inspiring consumers, effectively driving brand visibility and encouraging seasonal purchasing.

Strategic Furniture Industry UK Market Forecast

The strategic forecast for the UK furniture market indicates a period of sustained growth and transformation. Driven by robust demand for living room furniture, bedroom furniture, and the ever-expanding online furniture sector, the market is expected to continue its upward trajectory. Key growth catalysts include ongoing investments in home renovation, the increasing adoption of sustainable and smart furniture solutions, and the evolving preferences of younger demographics towards personalized and ethically sourced products. The online distribution channel is projected to solidify its dominance, necessitating enhanced digital strategies and efficient logistics from all players. The estimated market value is set to reach £28 Million by 2033, with a projected CAGR of 4.5% from 2025 to 2033, demonstrating significant untapped potential and a promising future for strategic players within the UK furniture market.

Furniture Industry UK Segmentation

-

1. Product Type

- 1.1. Living Room Furniture

- 1.2. Dining Room Furniture

- 1.3. Bedroom Furniture

- 1.4. Kitchen Furniture

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Home Centers

- 2.2. Flagship Stores

- 2.3. Specialty Stores

- 2.4. Online

- 2.5. Other Distribution Channels

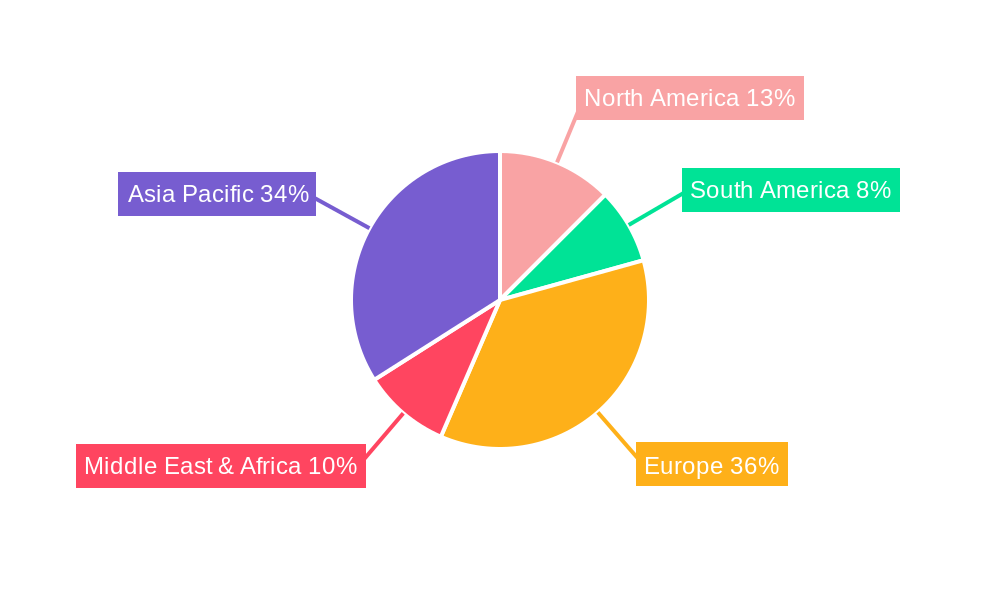

Furniture Industry UK Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Furniture Industry UK Regional Market Share

Geographic Coverage of Furniture Industry UK

Furniture Industry UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Creative Office Furniture; Growing Working Population is Boosting the Market

- 3.3. Market Restrains

- 3.3.1. High Competitive with a Large Number of Domestic and International Players; Changing Work Habits

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Furniture and Furnishings in the United Kingdom is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Furniture Industry UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Living Room Furniture

- 5.1.2. Dining Room Furniture

- 5.1.3. Bedroom Furniture

- 5.1.4. Kitchen Furniture

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Home Centers

- 5.2.2. Flagship Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Furniture Industry UK Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Living Room Furniture

- 6.1.2. Dining Room Furniture

- 6.1.3. Bedroom Furniture

- 6.1.4. Kitchen Furniture

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Home Centers

- 6.2.2. Flagship Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Furniture Industry UK Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Living Room Furniture

- 7.1.2. Dining Room Furniture

- 7.1.3. Bedroom Furniture

- 7.1.4. Kitchen Furniture

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Home Centers

- 7.2.2. Flagship Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Furniture Industry UK Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Living Room Furniture

- 8.1.2. Dining Room Furniture

- 8.1.3. Bedroom Furniture

- 8.1.4. Kitchen Furniture

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Home Centers

- 8.2.2. Flagship Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Furniture Industry UK Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Living Room Furniture

- 9.1.2. Dining Room Furniture

- 9.1.3. Bedroom Furniture

- 9.1.4. Kitchen Furniture

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Home Centers

- 9.2.2. Flagship Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Furniture Industry UK Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Living Room Furniture

- 10.1.2. Dining Room Furniture

- 10.1.3. Bedroom Furniture

- 10.1.4. Kitchen Furniture

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Home Centers

- 10.2.2. Flagship Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cotteswood Furniture

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ercol

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alpha Designs Upholstery Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Steve Bristow Furniture

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Delcor Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DFS Furniture PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Steinhoff UK Retail Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Andrena Furniture Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dunelm Group PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wayfair Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IKEA**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bed Bath & Beyond Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Cotteswood Furniture

List of Figures

- Figure 1: Global Furniture Industry UK Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Furniture Industry UK Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Furniture Industry UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Furniture Industry UK Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Furniture Industry UK Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Furniture Industry UK Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Furniture Industry UK Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Furniture Industry UK Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America Furniture Industry UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Furniture Industry UK Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America Furniture Industry UK Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Furniture Industry UK Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Furniture Industry UK Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Furniture Industry UK Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Furniture Industry UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Furniture Industry UK Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Furniture Industry UK Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Furniture Industry UK Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Furniture Industry UK Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Furniture Industry UK Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Furniture Industry UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Furniture Industry UK Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Furniture Industry UK Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Furniture Industry UK Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Furniture Industry UK Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Furniture Industry UK Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Furniture Industry UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Furniture Industry UK Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Furniture Industry UK Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Furniture Industry UK Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Furniture Industry UK Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Furniture Industry UK Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Furniture Industry UK Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Furniture Industry UK Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Furniture Industry UK Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Furniture Industry UK Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Furniture Industry UK Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Furniture Industry UK Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Industry UK?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Furniture Industry UK?

Key companies in the market include Cotteswood Furniture, ercol, Alpha Designs Upholstery Limited, Steve Bristow Furniture, Delcor Limited, DFS Furniture PLC, Steinhoff UK Retail Limited, Andrena Furniture Ltd, Dunelm Group PLC, Wayfair Inc, IKEA**List Not Exhaustive, Bed Bath & Beyond Inc.

3. What are the main segments of the Furniture Industry UK?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Creative Office Furniture; Growing Working Population is Boosting the Market.

6. What are the notable trends driving market growth?

Increasing Expenditure on Furniture and Furnishings in the United Kingdom is Driving the Market.

7. Are there any restraints impacting market growth?

High Competitive with a Large Number of Domestic and International Players; Changing Work Habits.

8. Can you provide examples of recent developments in the market?

In November 2023, IKEA launched a new mattress removal and recycling scheme in partnership with The Furniture Recycling (TFR) Group. This initiative aims to offer a sustainable solution for recycling old mattresses that would otherwise end up as waste. The mattresses are recycled, and the materials they contain are reused.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Furniture Industry UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Furniture Industry UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Furniture Industry UK?

To stay informed about further developments, trends, and reports in the Furniture Industry UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence