Key Insights

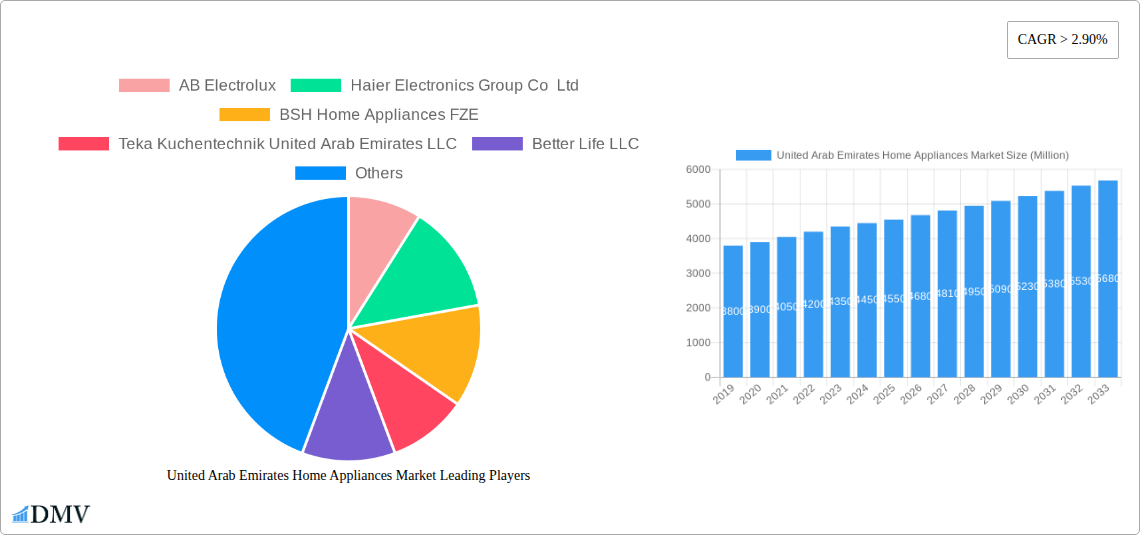

The United Arab Emirates (UAE) Home Appliances Market is projected to achieve significant growth, reaching an estimated market size of $3.48 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 4.13%. This expansion is propelled by demographic shifts, rising disposable incomes, and increasing demand for innovative, energy-efficient home solutions. The growing adoption of smart home technology and connected appliances further fuels market dynamism, aligning with consumer preferences for convenience and advanced features. Ongoing infrastructure development and real estate projects also contribute to sustained demand for both major and small appliances. A growing expatriate population and a high standard of living ensure a continuous need for modern and reliable home appliances.

United Arab Emirates Home Appliances Market Market Size (In Billion)

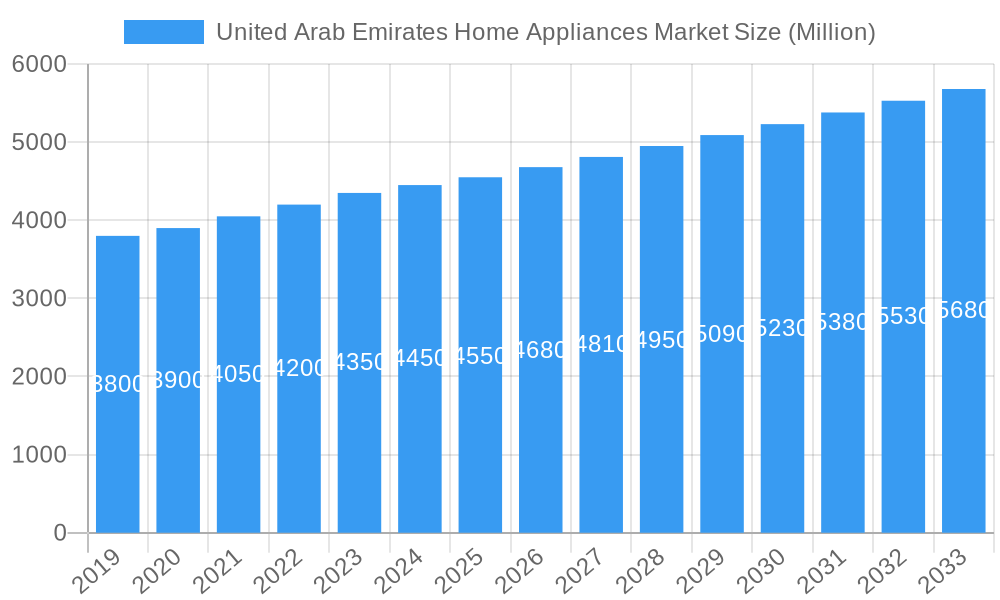

The UAE Home Appliances Market is segmented into Major Appliances (refrigerators, washing machines, air conditioners) which hold a substantial share, and Small Appliances (coffee makers, vacuum cleaners) experiencing notable growth. This growth in small appliances is attributed to consumer demand for convenience and an increased interest in culinary pursuits and smart home integration. Key distribution channels include Supermarkets, Hypermarkets, and Online platforms, which cater to a broad consumer base with accessibility and competitive pricing. Specialty Stores also contribute by offering premium and niche products. Leading market players, including Haier, Samsung, LG, and BSH Home Appliances, are actively engaged in product innovation and digital strategy to expand their market presence and enhance customer engagement across the UAE.

United Arab Emirates Home Appliances Market Company Market Share

United Arab Emirates Home Appliances Market: Comprehensive Analysis & Growth Forecast (2019-2033)

Unlock profound insights into the dynamic United Arab Emirates home appliances market with this exhaustive report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into market composition, trends, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and key players. Leverage high-ranking keywords such as UAE home appliances market, major appliances UAE, small appliances Dubai, kitchen appliances Abu Dhabi, smart home appliances UAE, refrigerator market UAE, washing machine market UAE, air conditioner market UAE, and home electronics UAE to inform strategic decisions. This report provides a detailed breakdown of market share distribution, M&A activities, technological advancements, and evolving consumer demands, offering a robust foundation for stakeholders seeking to capitalize on the burgeoning UAE electronics market.

United Arab Emirates Home Appliances Market Market Composition & Trends

The United Arab Emirates home appliances market exhibits a moderately concentrated structure, driven by the presence of established global brands and a growing number of local distributors. Innovation is significantly fueled by increasing consumer demand for smart and energy-efficient appliances, coupled with government initiatives promoting sustainable living. Regulatory landscapes are evolving to encourage the adoption of higher energy efficiency standards, impacting product development and market entry strategies. Substitute products primarily include refurbished appliances and DIY repair options, though their market share remains negligible compared to new product sales. End-user profiles are diverse, ranging from affluent expatriate households seeking premium, technologically advanced solutions to budget-conscious local families prioritizing durability and value. Mergers and acquisitions (M&A) activities, while not extensively documented publicly for every deal, are crucial for market consolidation and expansion. Estimated M&A deal values in related regional markets suggest significant investment potential, often in the multi-million dollar range, for companies looking to strengthen their foothold or acquire innovative technologies within the UAE home electronics market. Market share distribution is heavily influenced by brand reputation, product performance, and distribution network reach.

- Market Concentration: Moderately concentrated, with key global players holding significant shares.

- Innovation Catalysts: Demand for smart, energy-efficient, and aesthetically pleasing appliances.

- Regulatory Landscapes: Focus on energy efficiency standards and consumer protection.

- Substitute Products: Refurbished appliances and DIY repair solutions.

- End-User Profiles: Diverse, from premium-seeking expatriates to value-conscious locals.

- M&A Activities: Driven by market consolidation and expansion strategies, with estimated deal values in the millions of dollars in the broader region.

United Arab Emirates Home Appliances Market Industry Evolution

The United Arab Emirates home appliances market has witnessed remarkable evolution over the past decade, transforming from a basic utility sector to a sophisticated segment driven by technology, lifestyle aspirations, and economic prosperity. Historically, the market was characterized by the dominance of large, conventional appliances, with refrigerators, washing machines, and air conditioners forming the core of consumer purchases. However, the period between 2019 and 2024 saw a significant acceleration in the adoption of technologically advanced products. The estimated market size in the base year of 2025 is projected to be substantial, with continued robust growth anticipated through the forecast period of 2025–2033.

Technological advancements have been a primary driver of this evolution. The integration of smart technology, enabling remote control, AI-powered diagnostics, and enhanced energy management, has become a defining feature. For instance, the proliferation of Wi-Fi connectivity in appliances like refrigerators, ovens, and washing machines allows users to monitor and control their devices via smartphone applications, enhancing convenience and efficiency. This shift towards the smart home appliances UAE segment has been particularly pronounced.

Consumer demand has also undergone a significant transformation. Beyond functionality, UAE consumers now prioritize aesthetics, energy efficiency, and brand prestige. This has led to a surge in demand for premium, high-end appliances that complement modern interior design. The growing awareness of environmental sustainability has further fueled the demand for energy-star rated appliances, reducing electricity consumption and contributing to lower utility bills, a key consideration for households. The air conditioner market UAE is a prime example, with a growing preference for inverter technology and smart climate control systems.

Market growth trajectories have been consistently upward, supported by a growing population, a high disposable income, and a strong expatriate community with evolving lifestyle preferences. The robust construction sector in the UAE, with ongoing residential and commercial projects, directly stimulates demand for new home appliances. The kitchen appliances Abu Dhabi and kitchen appliances Dubai segments are particularly dynamic due to rapid urban development and a culture that values sophisticated home environments. The average growth rate within the UAE home appliances market has been estimated at approximately 6-8% annually in recent years, with projections indicating sustained growth driven by innovation and increasing consumer purchasing power. The major appliances UAE segment continues to form the largest share of the market, but the small appliances Dubai sector is experiencing rapid expansion due to convenience and gifting trends. The online distribution channel has also seen exponential growth, reflecting changing shopping habits.

Leading Regions, Countries, or Segments in United Arab Emirates Home Appliances Market

The United Arab Emirates home appliances market is characterized by the significant dominance of Dubai and Abu Dhabi as leading regions for consumption and sales. These Emirates, with their higher population density, substantial expatriate communities, and higher disposable incomes, drive a disproportionately large share of the market. Within the product segments, Major Appliances, particularly Refrigerators and Air Conditioners, consistently hold the largest market share. This is due to their essential nature in the UAE's climate and high household penetration rates. The air conditioner market UAE, in particular, is a cornerstone of the appliance sector due to the extreme climatic conditions, with demand remaining high throughout the year for both residential and commercial applications. The refrigerator market UAE also sees strong and consistent demand, driven by the need for efficient food preservation in a rapidly growing population.

However, the Small Appliances segment, encompassing products like Coffee/Tea Makers and Vacuum Cleaners, is exhibiting the fastest growth rate. This surge is attributable to evolving consumer lifestyles, an increased focus on convenience, and the growing popularity of these items as gifts. The demand for sophisticated kitchen gadgets and personal care appliances is also on the rise, reflecting a trend towards upgrading household amenities for enhanced comfort and efficiency.

In terms of distribution channels, Online sales have emerged as a powerful force, experiencing exponential growth over the historical period (2019-2024) and continuing to gain traction through the forecast period (2025-2033). E-commerce platforms offer convenience, competitive pricing, and a wider selection, attracting a significant portion of consumers, especially the younger demographic. While Supermarkets and Hypermarkets still command a substantial share due to their established presence and bulk purchasing capabilities, their dominance is being challenged by the convenience and reach of online retailers. Specialty Stores cater to the premium segment, offering a curated selection of high-end brands and personalized customer service, thus maintaining a vital role for specific consumer needs.

Key drivers for the dominance of these segments and regions include:

- Investment Trends: Significant foreign and local investments in real estate and retail infrastructure in Dubai and Abu Dhabi create a constant demand for home appliances.

- Regulatory Support: Government initiatives promoting energy efficiency and smart home adoption are indirectly boosting the demand for advanced appliances.

- Demographic Factors: A large expatriate population with diverse purchasing power and evolving lifestyle preferences fuels demand for a wide range of appliances.

- Economic Stability: The UAE's stable economy and high per capita income ensure consistent consumer spending on durable goods like home appliances.

- Climate Conditions: The extreme heat necessitates a strong market for air conditioners, making it a perpetually high-demand category.

- Urbanization: Continuous urban development and new residential projects in key Emirates drive the demand for new appliance installations.

The UAE home appliances market is thus a dynamic interplay of essential needs, aspirational purchases, technological integration, and evolving consumer behavior, with major appliances leading in volume and small appliances and online channels showcasing the highest growth potential.

United Arab Emirates Home Appliances Market Product Innovations

Product innovations in the United Arab Emirates home appliances market are rapidly transforming domestic life. Manufacturers are heavily investing in smart technology, integrating AI and IoT capabilities across product lines. This includes refrigerators with advanced food management systems and interactive displays, ovens with pre-programmed cooking modes and remote preheating, and washing machines offering app-controlled cycles and self-diagnosis features. Energy efficiency remains a paramount focus, with new models achieving higher star ratings and utilizing innovative materials and technologies to reduce power consumption, contributing to the smart home appliances UAE trend. Dyson Limited, for instance, continues to innovate in vacuum cleaners and air purifiers with advanced filtration and cordless designs. LG Electronics Gulf FZE and Samsung Electronics Ltd. are at the forefront of introducing connected appliances that offer enhanced user convenience and seamless integration into smart home ecosystems, revolutionizing the UAE home electronics market.

Propelling Factors for United Arab Emirates Home Appliances Market Growth

Several key factors are propelling the growth of the United Arab Emirates home appliances market.

- Economic Prosperity & Disposable Income: High per capita income and a thriving economy support consistent consumer spending on durable goods.

- Rapid Urbanization & Construction Boom: Ongoing development of residential and commercial properties creates a continuous demand for new appliance installations.

- Growing Expatriate Population: A diverse and affluent expatriate community with evolving lifestyle preferences drives demand for modern and technologically advanced appliances.

- Technological Advancements & Smart Home Integration: The increasing adoption of IoT and AI in appliances enhances functionality and convenience, aligning with the global smart home appliances UAE trend.

- Focus on Energy Efficiency & Sustainability: Growing environmental consciousness and government initiatives encourage the adoption of energy-saving appliances, reducing utility costs.

- E-commerce Growth: The expanding online retail sector provides convenient access to a wider range of products and competitive pricing, boosting sales.

Obstacles in the United Arab Emirates Home Appliances Market Market

Despite robust growth, the United Arab Emirates home appliances market faces certain obstacles.

- Intense Competition & Price Sensitivity: A highly competitive landscape can lead to price wars, impacting profit margins. While consumers appreciate premium products, price remains a significant factor for a large segment of the market.

- Supply Chain Disruptions & Logistics: Reliance on imports and global supply chains can lead to delays and increased costs, especially in the face of geopolitical events or global trade fluctuations.

- Evolving Regulatory Frameworks: While supportive of innovation, changes in import regulations, energy efficiency standards, and consumer protection laws require continuous adaptation by manufacturers and distributors.

- Counterfeit Products: The influx of counterfeit goods can erode market trust and pose safety risks, requiring vigilance from authorities and consumers.

- Skilled Labor Shortage: A shortage of trained technicians for installation and repair of complex, technologically advanced appliances can hinder customer satisfaction.

Future Opportunities in United Arab Emirates Home Appliances Market

The United Arab Emirates home appliances market presents numerous future opportunities.

- Expansion of Smart Home Ecosystems: Increasing consumer adoption of smart devices opens avenues for integrated home appliance solutions and advanced connectivity features.

- Growth in Sustainable & Energy-Efficient Appliances: Continued emphasis on environmental responsibility will drive demand for eco-friendly appliances, including those with advanced water-saving technologies.

- Emergence of Niche Markets: Growing demand for specialized appliances catering to specific culinary needs, health and wellness trends, and compact living solutions.

- Augmented Reality (AR) & Virtual Reality (VR) in Sales: Utilizing AR/VR for virtual product demonstrations and kitchen planning can enhance the online and in-store shopping experience.

- After-Sales Services & Maintenance Contracts: Offering comprehensive service packages and extended warranties can build customer loyalty and create recurring revenue streams.

Major Players in the United Arab Emirates Home Appliances Market Ecosystem

- AB Electrolux

- Haier Electronics Group Co Ltd

- BSH Home Appliances FZE

- Teka Kuchentechnik United Arab Emirates LLC

- Better Life LLC

- Samsung Electronics Ltd

- LG Electronics Gulf FZE

- Dyson Limited

- Hisense Middle East

- Karcher

Key Developments in United Arab Emirates Home Appliances Market Industry

- June 2023: LG Electronics (LG) announced the launch of its new line-up of built-in home appliances in the UAE. It includes premium ovens, hoods, electric and gas cooktops with versatile, elegant designs and easy controls, all built to revolutionize the way people cook and provide them with a seamless and modern cooking experience. The new appliances are designed to blend seamlessly into any kitchen interior, creating a sleek and modern look while delivering the latest technology and meeting the highest requirements for ergonomics and equipment in the modern kitchen.

- March 2023: BSH Home Appliances will invest in a state-of-the-art factory in Cairo. The German company will invest around €50 million (USD 53362500) in the stove factory.

Strategic United Arab Emirates Home Appliances Market Market Forecast

The United Arab Emirates home appliances market is strategically positioned for sustained growth, driven by an optimistic economic outlook, a young and tech-savvy population, and a strong commitment to innovation. The increasing disposable incomes and a preference for modern, connected living will continue to fuel demand for both major and small appliances. The smart home appliances UAE segment is expected to see particularly rapid expansion as consumers embrace integrated technologies for convenience and efficiency. Investments in sustainable and energy-efficient products will also be a significant growth catalyst, aligning with national and global environmental agendas. The expansion of online retail channels and innovative sales approaches like AR/VR will further enhance market accessibility and customer engagement, promising a dynamic and prosperous future for the UAE home electronics market.

United Arab Emirates Home Appliances Market Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee/Tea Makers

- 1.2.2. Food Processors

- 1.2.3. Grills & Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

United Arab Emirates Home Appliances Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Home Appliances Market Regional Market Share

Geographic Coverage of United Arab Emirates Home Appliances Market

United Arab Emirates Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income; Growing population and urbanization

- 3.3. Market Restrains

- 3.3.1. Price sensitivity; Seasonal demand fluctuations

- 3.4. Market Trends

- 3.4.1. Growing Expatriate Population is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee/Tea Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills & Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Electrolux

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSH Home Appliances FZE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Teka Kuchentechnik United Arab Emirates LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Better Life LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Gulf FZE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dyson Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hisense Middle East

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Karcher**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AB Electrolux

List of Figures

- Figure 1: United Arab Emirates Home Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Home Appliances Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the United Arab Emirates Home Appliances Market?

Key companies in the market include AB Electrolux, Haier Electronics Group Co Ltd, BSH Home Appliances FZE, Teka Kuchentechnik United Arab Emirates LLC, Better Life LLC, Samsung Electronics Ltd, LG Electronics Gulf FZE, Dyson Limited, Hisense Middle East, Karcher**List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income; Growing population and urbanization.

6. What are the notable trends driving market growth?

Growing Expatriate Population is Driving the Market.

7. Are there any restraints impacting market growth?

Price sensitivity; Seasonal demand fluctuations.

8. Can you provide examples of recent developments in the market?

June 2023: LG Electronics (LG) announced the launch of its new line-up of built-in home appliances in the UAE. It includes premium ovens, hoods, electric and gas cooktops with versatile, elegant designs and easy controls, all built to revolutionize the way people cook and provide them with a seamless and modern cooking experience. The new appliances are designed to blend seamlessly into any kitchen interior, creating a sleek and modern look while delivering the latest technology and meeting the highest requirements for ergonomics and equipment in the modern kitchen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Home Appliances Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence