Key Insights

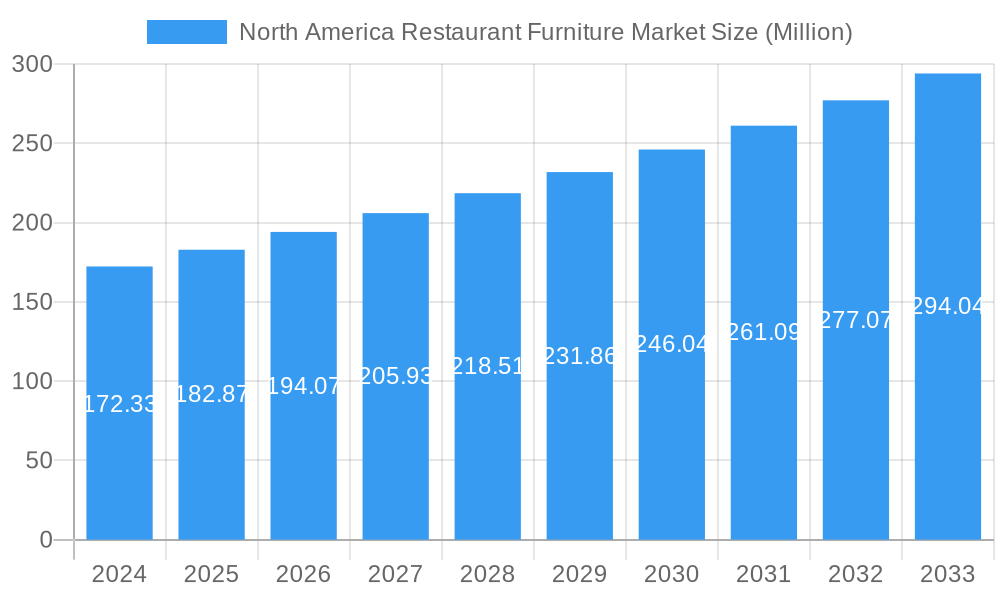

The North American restaurant furniture market is poised for significant expansion, projected to reach an estimated $172.33 billion by 2024, driven by a robust CAGR of 6.2%. This growth is underpinned by dynamic shifts in consumer dining habits and an increasing demand for aesthetically pleasing and functional restaurant interiors. Key growth drivers include the expansion of quick-service restaurants (QSRs) and fast-casual dining establishments, which require adaptable and durable furniture solutions. Furthermore, the rising trend of experiential dining, where ambiance plays a crucial role in customer satisfaction, is pushing restaurants to invest in more sophisticated and unique furniture designs. The integration of smart technology in furniture, offering features like charging ports and adjustable comfort settings, is also emerging as a key trend, catering to the modern diner's expectations. Geographically, North America, encompassing the United States, Canada, and Mexico, represents a substantial market due to its well-established food service industry and consistent consumer spending on dining out.

North America Restaurant Furniture Market Market Size (In Million)

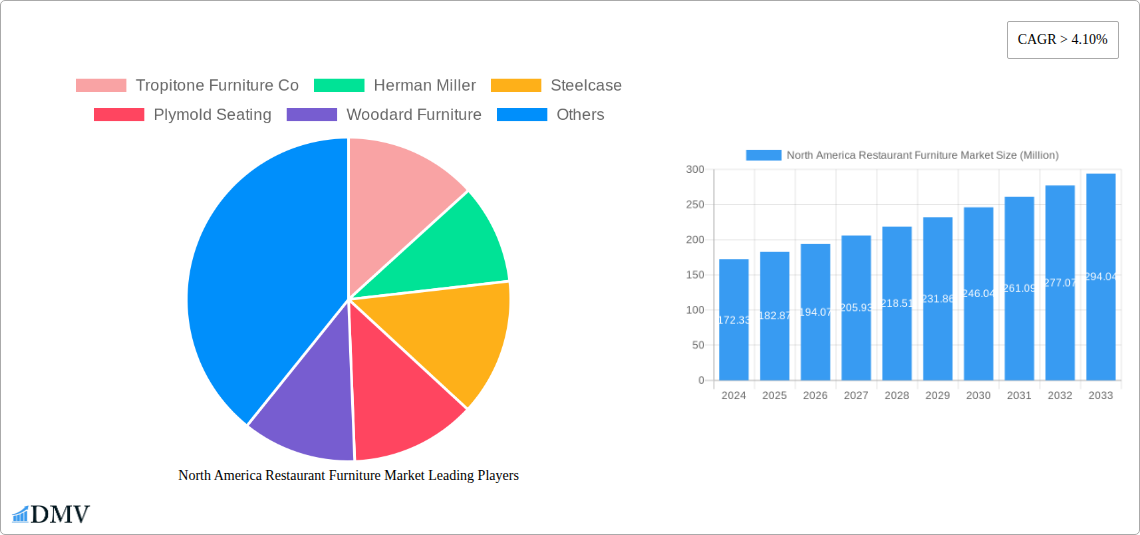

Despite the promising outlook, the market faces certain restraints. The fluctuating costs of raw materials, such as wood, metal, and upholstery fabrics, can impact profit margins for manufacturers and subsequently influence pricing for restaurant owners. Supply chain disruptions, amplified by global events, can also lead to delays and increased operational costs. However, these challenges are being addressed through innovations in material sourcing, sustainable furniture options, and the development of efficient manufacturing processes. The market segments of dining sets and seating furniture are experiencing steady demand, with restaurants, snack bars, hotels, and bars being the primary application areas. Leading companies in this space, including Tropitone Furniture Co., Herman Miller, and Steelcase, are continuously innovating to meet evolving market needs, focusing on durability, style, and ergonomic design to maintain a competitive edge in this dynamic industry.

North America Restaurant Furniture Market Company Market Share

This in-depth report provides a definitive analysis of the North America restaurant furniture market, offering critical insights into its composition, trends, and future trajectory. Covering the historical period from 2019 to 2024, the base year 2025, and a robust forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to capitalize on this dynamic sector. We delve into market segmentation by type (Dining Sets, Seating Furniture) and application (Restaurants, Snack Bars, Hotels and Bars), providing a granular view of consumer preferences and industry demands. With a projected market size expected to reach billions, this report equips you with the strategic intelligence needed to navigate competitive landscapes and identify lucrative opportunities.

North America Restaurant Furniture Market Market Composition & Trends

The North America restaurant furniture market is characterized by a moderate to high level of concentration, with key players dominating significant market share. Innovation is a primary catalyst for growth, driven by evolving design aesthetics, the demand for durable and sustainable materials, and the integration of smart technologies. Regulatory landscapes, primarily focused on safety standards, fire retardancy, and environmental certifications, play a crucial role in shaping product development and market entry. Substitute products, such as modular furniture systems and DIY solutions, present a competitive challenge, though they often fall short in terms of durability and aesthetic appeal for commercial establishments. End-user profiles range from independent restaurateurs and national hotel chains to fast-casual dining establishments and high-end fine dining venues, each with distinct furniture requirements and budget considerations. Mergers and acquisitions (M&A) activities are notable, with deal values in the hundreds of millions of dollars, indicating strategic consolidation and expansion efforts by established manufacturers. For instance, the acquisition of smaller, design-focused firms by larger corporations aims to broaden product portfolios and enhance market reach.

- Market Share Distribution: Dominated by a handful of leading manufacturers, with top 5-10 companies holding over 60% of the market share.

- M&A Deal Values: Significant transactions in the past few years have ranged from $50 million to $300 million, reflecting strategic consolidation.

- Innovation Focus: Emphasis on eco-friendly materials, customizable designs, and space-saving solutions.

- Key Regulatory Bodies: Compliance with ANSI/BIFMA standards and various state-specific fire codes.

North America Restaurant Furniture Market Industry Evolution

The North America restaurant furniture market has witnessed a remarkable evolution, driven by a confluence of economic growth, shifting consumer dining habits, and technological advancements. Over the historical period (2019-2024), the market experienced steady growth, punctuated by a temporary slowdown during global health crises, followed by a vigorous rebound. The base year (2025) marks a period of accelerated expansion, with the forecast period (2025-2033) projecting sustained, robust CAGR rates estimated between 5.5% and 7.0%. This growth trajectory is underpinned by an increasing number of restaurant openings, renovations and expansions of existing establishments, and the growing demand for unique and experiential dining environments. Technological advancements have significantly impacted product design and manufacturing. For example, the adoption of CAD/CAM software has streamlined custom design processes, allowing for greater personalization and faster production times. Furthermore, the use of advanced materials like high-performance laminates, durable metals, and sustainable composites has enhanced the longevity and aesthetic appeal of restaurant furniture.

Consumer demand has also undergone a significant transformation. There's a discernible shift towards comfortable, ergonomic seating, reflecting longer dining times and the desire for a more relaxed atmosphere. The rise of the "Instagrammable" restaurant aesthetic has fueled demand for visually appealing and design-forward furniture that contributes to the overall ambiance. Sustainability is no longer a niche concern but a mainstream expectation, with consumers and restaurateurs alike favoring furniture made from recycled, renewable, and ethically sourced materials. This has prompted manufacturers to invest in eco-friendly production processes and explore new material innovations. The integration of technology, such as built-in charging ports and smart lighting solutions within furniture, is also gaining traction, catering to the tech-savvy diner. The snack bar segment, in particular, is witnessing a surge in demand for compact, modular, and easily cleanable furniture solutions that optimize space utilization and operational efficiency. Similarly, hotels and bars are increasingly investing in versatile furniture that can adapt to various functional needs, from casual lounging to formal dining. The overall industry evolution points towards a market that is increasingly sophisticated, design-conscious, and responsive to both economic and societal shifts.

Leading Regions, Countries, or Segments in North America Restaurant Furniture Market

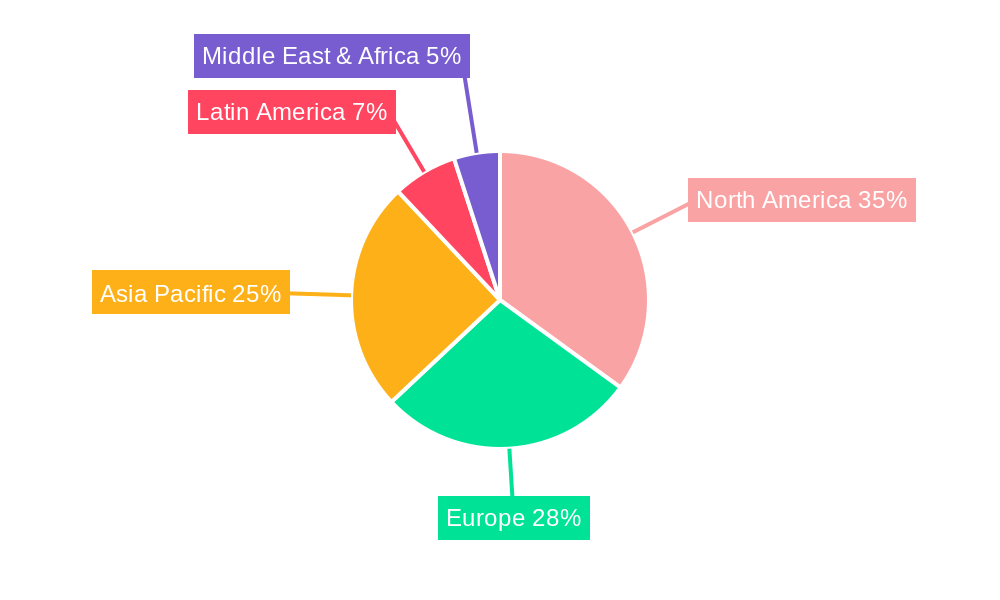

Within the North America restaurant furniture market, the United States stands as the undisputed leader, accounting for a substantial portion of the overall market value. This dominance is attributed to several key factors, including its vast and diverse culinary landscape, the sheer number of dining establishments, and a consistently high consumer spending on dining out. The presence of major hospitality chains and a robust independent restaurant sector across various cities fuels a continuous demand for diverse and high-quality furniture solutions.

- United States Dominance: The US market contributes over 70% to the total North American restaurant furniture market revenue, estimated to exceed $15 billion in 2025.

- Key Drivers in the US:

- High Density of Restaurants: Over 1 million restaurant locations nationwide, driving consistent demand.

- Consumer Spending Power: Robust disposable income and a culture of frequent dining out.

- Investment Trends: Significant investment in new restaurant openings and renovations, particularly post-pandemic.

- Design Innovation: A trend-driven market that embraces new aesthetics and functional designs.

- Regulatory Support: Generally supportive business environment with clear safety and building codes.

- Key Drivers in the US:

The Seating Furniture segment also emerges as the most significant within the North America restaurant furniture market. This is a natural consequence of the fundamental need for comfortable and functional seating in any dining or hospitality establishment. From plush banquettes and ergonomic chairs to bar stools and modular seating arrangements, the variety and volume of seating solutions required are immense. This segment directly impacts customer comfort, dining experience, and ultimately, the operational efficiency and profitability of establishments.

- Seating Furniture Segment Dominance: This segment is estimated to represent over 65% of the total market value, projected to reach approximately $10 billion in 2025.

- Key Drivers for Seating Furniture:

- Customer Comfort & Experience: Seating is a primary determinant of diner satisfaction and dwell time.

- Durability & Longevity: Commercial-grade seating requires high durability to withstand constant use.

- Aesthetic Versatility: A wide range of styles, materials, and colors to match diverse restaurant themes.

- Customization Options: Demand for tailored seating solutions to fit specific spatial and design needs.

- Health & Safety Regulations: Compliance with fire retardancy and ergonomic standards.

- Key Drivers for Seating Furniture:

While Canada and Mexico also represent significant markets within North America, their contributions are considerably smaller compared to the United States. Canada's market is driven by a strong food service industry, particularly in major urban centers, while Mexico's growing tourism sector and evolving domestic dining culture are fueling expansion. However, the scale and maturity of the US market solidify its leading position, influencing design trends and market dynamics across the entire continent.

North America Restaurant Furniture Market Product Innovations

Product innovations in the North America restaurant furniture market are primarily focused on enhancing durability, functionality, and aesthetic appeal. Manufacturers are increasingly utilizing advanced materials such as high-pressure laminates, powder-coated steel, and sustainable hardwoods to improve product lifespan and resistance to wear and tear. Ergonomic design principles are being integrated into chairs and banquettes to optimize customer comfort during extended dining periods. Furthermore, there's a growing trend towards modular and adaptable furniture systems that can be reconfigured to suit different seating capacities and event needs, offering greater flexibility for restaurant operators. The integration of subtle technological features, like built-in power outlets and USB ports, is also gaining traction in premium segments.

Propelling Factors for North America Restaurant Furniture Market Growth

Several key factors are propelling the growth of the North America restaurant furniture market. Economic recovery and increased consumer spending on dining out are primary drivers, leading to new restaurant openings and renovations. The growing demand for unique dining experiences is pushing establishments to invest in aesthetically appealing and comfortable furniture. Technological advancements in manufacturing, such as 3D printing and advanced material science, enable the creation of more durable, customizable, and innovative furniture designs. Furthermore, a heightened focus on sustainability and eco-friendly practices is creating opportunities for manufacturers offering products made from recycled or renewable materials, aligning with evolving consumer preferences and corporate social responsibility initiatives.

Obstacles in the North America Restaurant Furniture Market Market

Despite robust growth, the North America restaurant furniture market faces several obstacles. Supply chain disruptions, exacerbated by global geopolitical events and material shortages, can lead to increased lead times and costs for raw materials and finished products, impacting profitability and project timelines. Stringent regulatory requirements concerning fire safety, durability, and environmental impact necessitate significant investment in compliance and certification, which can be a barrier for smaller manufacturers. Intense competition among a large number of domestic and international players, coupled with price sensitivity from some market segments, can lead to price wars and reduced profit margins. Moreover, fluctuating raw material costs, particularly for wood and metals, present ongoing financial challenges.

Future Opportunities in North America Restaurant Furniture Market

Emerging opportunities in the North America restaurant furniture market are abundant. The growing demand for sustainable and eco-friendly furniture presents a significant avenue for growth, with a focus on recycled materials, renewable resources, and ethical manufacturing processes. The expansion of the fast-casual dining sector and the increasing popularity of food halls and ghost kitchens create demand for space-efficient, modular, and highly durable furniture solutions. Furthermore, technological integration, such as smart furniture with built-in charging capabilities and antimicrobial surfaces, caters to evolving consumer expectations for convenience and hygiene. The "experience economy" continues to fuel demand for unique and aesthetically striking furniture that enhances the overall dining ambiance, opening doors for designers and manufacturers focusing on bespoke and statement pieces.

Major Players in the North America Restaurant Furniture Market Ecosystem

- Tropitone Furniture Co

- Herman Miller

- Steelcase

- Plymold Seating

- Woodard Furniture

- Grosfillex Inc

- California House

- Grand Rapids Chair Co

- Knoll

- MTS Seating

Key Developments in North America Restaurant Furniture Market Industry

- January 2023: KOKUYO Co., Ltd. announced a partnership agreement with Allsteel Inc., a leading manufacturer of contract furnishings. This collaboration aims to enhance combined service and support for global clients, particularly in the Asia Pacific region for Kokuyo and in North America for Allsteel, potentially influencing their offerings in the contract furniture sector, including restaurant furnishings.

- September 2022: Herman Miller, in collaboration with Danish design brand HAY, unveiled the Herman Miller x HAY Collection. This collection reinterprets eight classic Eames mid-century designs with new color palettes and updated materials, showcasing a blend of timeless design and contemporary style, which can inspire new trends in restaurant and hospitality furniture.

Strategic North America Restaurant Furniture Market Market Forecast

The North America restaurant furniture market is poised for continued robust growth, driven by an expanding hospitality sector and evolving consumer preferences for dining experiences. Key growth catalysts include the persistent demand for durable and aesthetically pleasing furniture, particularly in the seating furniture segment, and the increasing adoption of sustainable and eco-friendly materials. The forecast period (2025-2033) is expected to witness significant market expansion, fueled by new restaurant constructions, renovations, and the growing popularity of diverse dining formats. Strategic investments in innovation, particularly in modular designs and integrated technology, will be crucial for manufacturers to capture market share. Opportunities lie in catering to niche markets, such as the growing demand for outdoor dining furniture and specialized solutions for snack bars and hotels, all contributing to a projected market value in the billions.

North America Restaurant Furniture Market Segmentation

-

1. Type

- 1.1. Dining Sets

- 1.2. Seating Furniture

-

2. Application

- 2.1. Restaurants

- 2.2. Snack Bar

- 2.3. Hotels and Bars

North America Restaurant Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Restaurant Furniture Market Regional Market Share

Geographic Coverage of North America Restaurant Furniture Market

North America Restaurant Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tech-Integrated Furniture are Helping to Grow the Market

- 3.3. Market Restrains

- 3.3.1. Raw Material Cost Barrier to Growth

- 3.4. Market Trends

- 3.4.1. Restaurants Drive Demand and Trends in the Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Restaurant Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dining Sets

- 5.1.2. Seating Furniture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Restaurants

- 5.2.2. Snack Bar

- 5.2.3. Hotels and Bars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tropitone Furniture Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Herman Miller

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Steelcase

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plymold Seating

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Woodard Furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grosfillex Inc **List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 California House

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grand Rapids Chair Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Knoll

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MTS Seating

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tropitone Furniture Co

List of Figures

- Figure 1: North America Restaurant Furniture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Restaurant Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: North America Restaurant Furniture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Restaurant Furniture Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Restaurant Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Restaurant Furniture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: North America Restaurant Furniture Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Restaurant Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Restaurant Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Restaurant Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Restaurant Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Restaurant Furniture Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the North America Restaurant Furniture Market?

Key companies in the market include Tropitone Furniture Co, Herman Miller, Steelcase, Plymold Seating, Woodard Furniture, Grosfillex Inc **List Not Exhaustive, California House, Grand Rapids Chair Co, Knoll, MTS Seating.

3. What are the main segments of the North America Restaurant Furniture Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Tech-Integrated Furniture are Helping to Grow the Market.

6. What are the notable trends driving market growth?

Restaurants Drive Demand and Trends in the Furniture Market.

7. Are there any restraints impacting market growth?

Raw Material Cost Barrier to Growth.

8. Can you provide examples of recent developments in the market?

In January 2023, KOKUYO Co., Ltd. announced the partnership agreement with Allsteel Inc., a leading manufacturer of contract furnishings. This partnership will allow Kokuyo to provide combined service and support of office furniture for global clients in the Asia Pacific region and Allsteel in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Restaurant Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Restaurant Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Restaurant Furniture Market?

To stay informed about further developments, trends, and reports in the North America Restaurant Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence