Key Insights

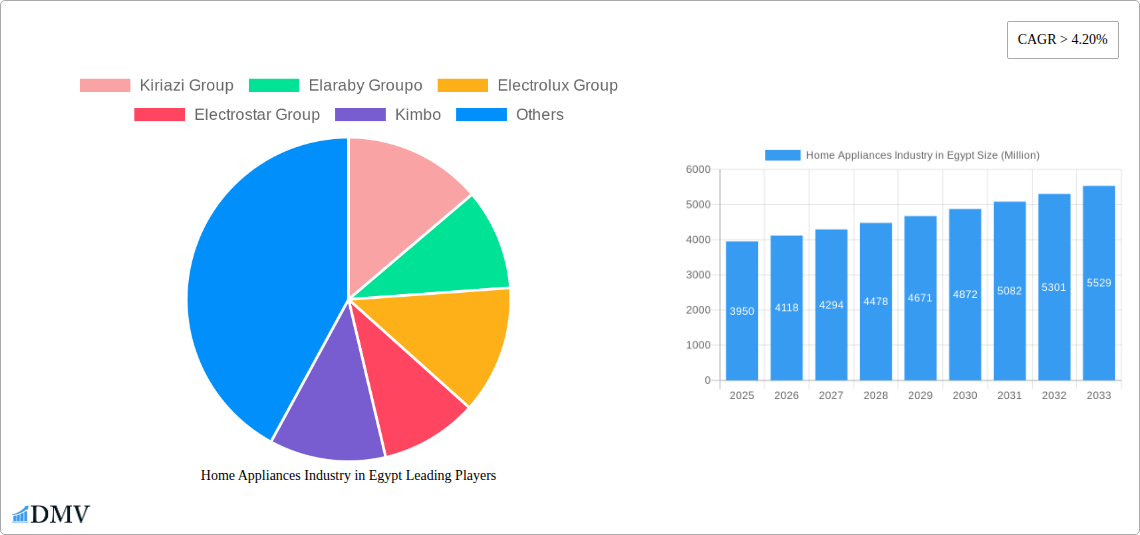

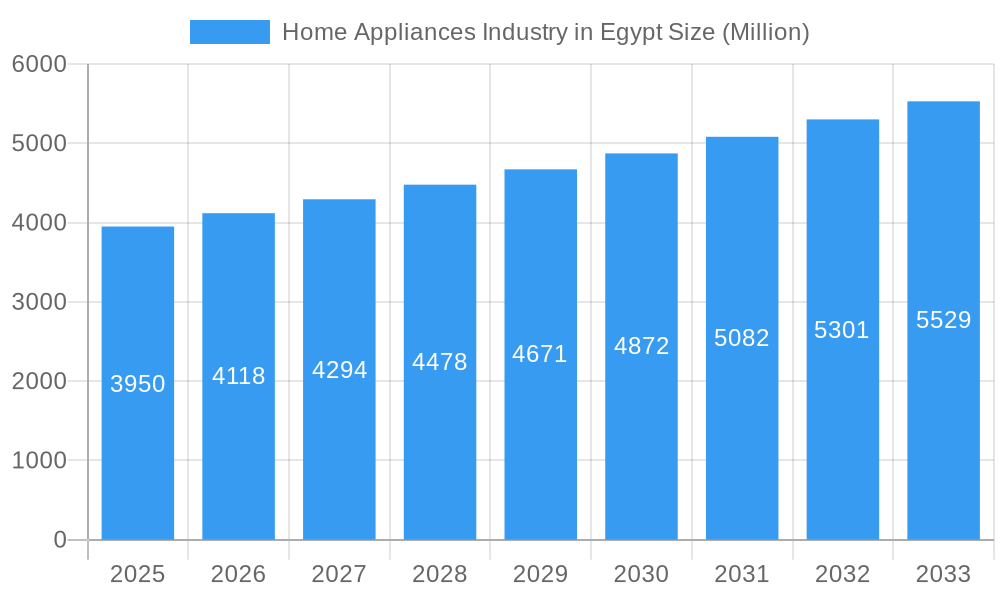

The Egyptian home appliances market is poised for robust expansion, driven by a burgeoning population, increasing disposable incomes, and a growing middle class eager to upgrade their living standards. With a projected market size of approximately $4,500 million and a Compound Annual Growth Rate (CAGR) exceeding 4.20% between 2019 and 2033, the sector presents significant opportunities. Key growth drivers include the increasing adoption of energy-efficient appliances, a rising demand for smart home technology, and government initiatives aimed at boosting domestic manufacturing and consumer spending. The trend towards premiumization, with consumers seeking more sophisticated and feature-rich products, is also a significant factor. Furthermore, the ongoing urbanization and development of new residential projects are creating a sustained demand for a wide range of home appliances.

Home Appliances Industry in Egypt Market Size (In Billion)

The market's growth trajectory is further supported by a diverse distribution network, encompassing traditional channels like supermarkets and specialty stores, alongside the rapidly expanding online retail segment. This accessibility ensures that a broad spectrum of consumers can engage with and purchase home appliances. While the market is largely driven by domestic demand, favorable economic conditions and strategic investments by leading players like Kiriazi Group, Elaraby Group, and Samsung Electronics are expected to further stimulate growth. However, potential restraints such as fluctuating currency exchange rates, supply chain disruptions, and the price sensitivity of a segment of the consumer base will need to be navigated by market participants. The product segmentation reveals a strong demand for core appliances like vacuum cleaners, hair clippers, irons, toasters, and hair dryers, alongside a growing interest in coffee machines and grills/roasters, indicating evolving consumer lifestyles.

Home Appliances Industry in Egypt Company Market Share

This in-depth report delves into the dynamic Home Appliances Industry in Egypt, providing a strategic outlook for stakeholders. Covering a Study Period from 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, this analysis draws upon Historical Period data from 2019–2024. We meticulously examine market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities within Egypt's burgeoning home appliance market.

Home Appliances Industry in Egypt Market Composition & Trends

The Egyptian home appliance market exhibits a dynamic composition, characterized by a moderate to high level of concentration with key players like Kiriazi Group, Elaraby Group, and Electrolux Group commanding significant market share. Innovation catalysts are primarily driven by technological advancements in energy efficiency, smart home integration, and user convenience. The regulatory landscape, while evolving, aims to foster local manufacturing and promote quality standards. Substitute products, though present in some categories, are increasingly differentiated by brand reputation, features, and after-sales service. End-user profiles are diverse, ranging from budget-conscious households to affluent segments seeking premium and smart appliances. Merger and acquisition (M&A) activities, though not at peak levels historically, are anticipated to gain momentum as larger international players seek to capitalize on Egypt's growing consumer base and strategic location. For instance, a projected XXX Million in M&A deals is expected over the forecast period. Market share distribution among leading brands is approximately: Kiriazi Group (XX%), Elaraby Group (XX%), Electrolux Group (XX%), Electrostar Group (XX%), Samsung Electronics (XX%), and others (XX%).

Home Appliances Industry in Egypt Industry Evolution

The Egyptian home appliance sector has witnessed remarkable evolution over the Historical Period and is poised for significant expansion in the coming years. Market growth trajectories have been shaped by increasing disposable incomes, a burgeoning young population, and a growing demand for modern household solutions. Technological advancements have been pivotal, with a noticeable shift towards energy-efficient appliances, smart home connectivity, and enhanced user-friendly interfaces. Adoption metrics for these advanced appliances are on an upward trend, driven by both consumer awareness and manufacturer promotions. For example, the adoption rate of smart refrigerators has grown by an estimated XX% annually since 2021. Consumer demand is increasingly influenced by global trends, with a growing appreciation for durability, aesthetic appeal, and integrated functionalities. This sustained demand, coupled with strategic government initiatives promoting industrial development, paints a robust picture for the industry's future. The overall market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033.

Leading Regions, Countries, or Segments in Home Appliances Industry in Egypt

Within the Egyptian home appliance market, while specific regional breakdowns are not detailed in this summary, key product segments and distribution channels exhibit varying degrees of dominance. In terms of product type, kitchen appliances such as refrigerators, ovens, and cookers consistently lead in sales volume due to their essential nature. However, the vacuum cleaner market and the hair dryer market are experiencing rapid growth, fueled by rising consumer interest in household cleanliness and personal grooming. The online stores distribution channel is rapidly gaining traction, challenging traditional supermarkets/hypermarkets and specialty stores. This shift is attributed to the convenience, wider product selection, and competitive pricing offered by e-commerce platforms. Investment trends are leaning towards expanding manufacturing capabilities for these high-demand product categories. Regulatory support for local production and import substitution further bolsters the dominance of segments that can leverage these policies.

- Product Type Dominance: Kitchen appliances maintain leadership, but growth in Vacuum Cleaners and Hair Dryers is notable.

- Distribution Channel Shift: Online stores are emerging as a significant channel, impacting traditional retail.

- Investment Focus: Manufacturing of high-demand kitchen and personal care appliances is attracting significant investment.

- Regulatory Impact: Policies favoring local manufacturing are influencing segment growth and competitiveness.

Home Appliances Industry in Egypt Product Innovations

Product innovations in the Egyptian home appliance industry are increasingly focused on enhancing user experience and sustainability. Smart appliances featuring AI-powered functionalities, energy-saving modes, and remote control capabilities are becoming more prevalent. For instance, the introduction of self-cleaning ovens and refrigerators with advanced cooling systems are key selling points. Applications extend to improved convenience in daily chores and enhanced personal care. Performance metrics are continually being refined, with manufacturers striving for higher energy efficiency ratings and longer product lifespans. Unique selling propositions often revolve around intuitive interfaces, integrated smart home ecosystems, and sleek, modern designs that appeal to the evolving Egyptian consumer. Technological advancements in areas like induction heating for cooktops and advanced filtration for vacuum cleaners are setting new industry benchmarks.

Propelling Factors for Home Appliances Industry in Egypt Growth

Several key factors are propelling the growth of the home appliances industry in Egypt.

- Economic Growth and Rising Disposable Income: An expanding middle class with increased purchasing power drives demand for both essential and aspirational home appliances.

- Young and Growing Population: Egypt's demographic profile, with a large proportion of young consumers, fuels demand for modern, technologically advanced home solutions.

- Government Initiatives and FDI: Policies encouraging local manufacturing and foreign direct investment (FDI) are stimulating production and innovation within the sector.

- Urbanization and Changing Lifestyles: Increasing urbanization leads to smaller living spaces and a greater need for efficient and multi-functional appliances.

- Technological Advancements: The integration of smart technology and energy-efficient features in appliances is creating new market opportunities and consumer interest.

Obstacles in the Home Appliances Industry in Egypt Market

Despite its promising growth, the Egyptian home appliances market faces certain obstacles.

- Supply Chain Disruptions: Global supply chain vulnerabilities, including those related to component sourcing and logistics, can impact production timelines and costs.

- Import Tariffs and Regulations: Fluctuations in import tariffs and evolving trade regulations can affect the cost of imported components and finished goods, influencing pricing strategies.

- Counterfeit Products: The presence of counterfeit or substandard products can erode consumer trust and create an uneven playing field for legitimate manufacturers.

- Consumer Price Sensitivity: While incomes are rising, a significant portion of the population remains price-sensitive, posing a challenge for premium product adoption.

- Infrastructure Development: In some regions, inadequate infrastructure can hinder the efficient distribution and after-sales service of appliances.

Future Opportunities in Home Appliances Industry in Egypt

The Egyptian home appliance sector is ripe with future opportunities. The increasing adoption of smart home technology presents a significant avenue for growth, with potential for integrated solutions and personalized user experiences. The burgeoning demand for sustainable and energy-efficient appliances aligns with global environmental consciousness and offers opportunities for eco-friendly product lines. Expanding into underserved rural markets with affordable yet functional appliances represents another untapped potential. Furthermore, the government's focus on promoting local manufacturing creates prospects for joint ventures and technology transfer partnerships, further strengthening the domestic industry. The rise of e-commerce also provides a vast platform for reaching a wider consumer base, especially for niche and specialized appliance categories.

Major Players in the Home Appliances Industry in Egypt Ecosystem

- Kiriazi Group

- Elaraby Group

- Electrolux Group

- Electrostar Group

- Kimbo

- Lord International

- Fresh Electric

- Universal Group

- Samsung electronics

Key Developments in Home Appliances Industry in Egypt Industry

- August 2022: Egypt's Investment Authority and China's Haier signed an MoU to establish an industrial complex for household appliance manufacturing, aiming to increase local component reliance by 60%.

- December 2022: Beko Egypt, a subsidiary of Arçelik, laid the foundation stone for its first factory in Egypt, scheduled for operation by Q4 2023 with a projected annual capacity of 1.5 million household appliances.

Strategic Home Appliances Industry in Egypt Market Forecast

The Egyptian home appliance market is projected for substantial growth, driven by a confluence of favorable economic indicators, a young demographic, and increasing consumer adoption of modern technologies. Strategic investments in local manufacturing, as evidenced by recent MoUs and factory expansions, will enhance production capabilities and reduce reliance on imports, further bolstering the market's resilience. The continuous evolution of product offerings, with a focus on smart functionalities and energy efficiency, will cater to the sophisticated demands of the Egyptian consumer. Emerging distribution channels, particularly online retail, will broaden market reach and accessibility. The market forecast indicates a sustained upward trend, positioning Egypt as a significant hub for home appliance production and consumption in the MENA region.

Home Appliances Industry in Egypt Segmentation

-

1. Product Type

- 1.1. Vacuum Cleaners

- 1.2. Hair Clippers

- 1.3. Irons

- 1.4. Toasters

- 1.5. Hair Dryers

- 1.6. Coffee Machines

- 1.7. Grills and Roasters

- 1.8. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Home Appliances Industry in Egypt Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

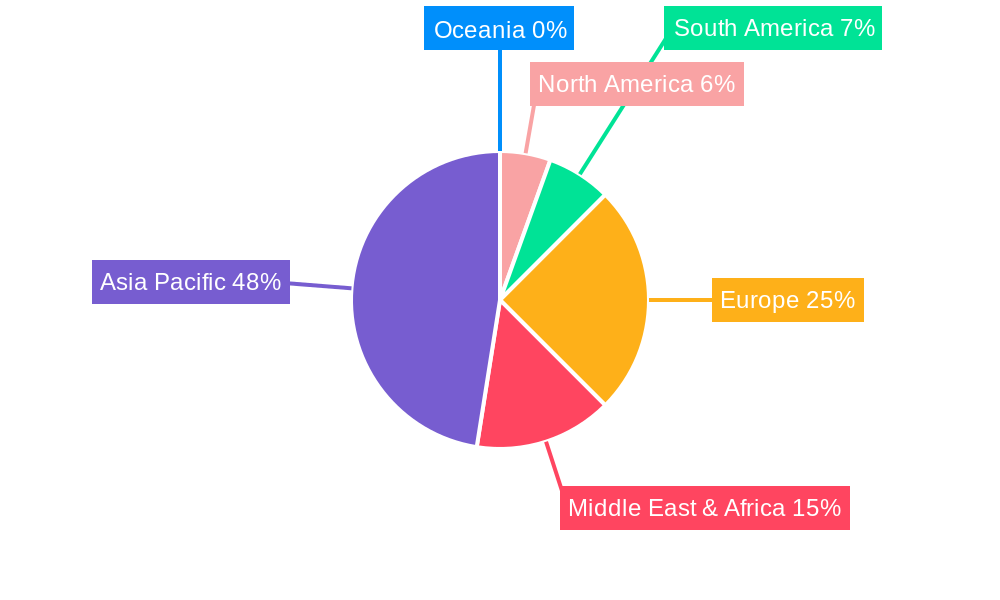

Home Appliances Industry in Egypt Regional Market Share

Geographic Coverage of Home Appliances Industry in Egypt

Home Appliances Industry in Egypt REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological innovation in appliance market raising their demand.; Increase in Purchasing power of the consumers.

- 3.3. Market Restrains

- 3.3.1. Rising global competition having a negative impact on domestic producers.; Rising Inflation rate having a negative impact on consumer purchase

- 3.4. Market Trends

- 3.4.1. PRODUCT INNOVATION DRIVING THE MARKET

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Appliances Industry in Egypt Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vacuum Cleaners

- 5.1.2. Hair Clippers

- 5.1.3. Irons

- 5.1.4. Toasters

- 5.1.5. Hair Dryers

- 5.1.6. Coffee Machines

- 5.1.7. Grills and Roasters

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Home Appliances Industry in Egypt Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vacuum Cleaners

- 6.1.2. Hair Clippers

- 6.1.3. Irons

- 6.1.4. Toasters

- 6.1.5. Hair Dryers

- 6.1.6. Coffee Machines

- 6.1.7. Grills and Roasters

- 6.1.8. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Home Appliances Industry in Egypt Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vacuum Cleaners

- 7.1.2. Hair Clippers

- 7.1.3. Irons

- 7.1.4. Toasters

- 7.1.5. Hair Dryers

- 7.1.6. Coffee Machines

- 7.1.7. Grills and Roasters

- 7.1.8. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Home Appliances Industry in Egypt Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vacuum Cleaners

- 8.1.2. Hair Clippers

- 8.1.3. Irons

- 8.1.4. Toasters

- 8.1.5. Hair Dryers

- 8.1.6. Coffee Machines

- 8.1.7. Grills and Roasters

- 8.1.8. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Home Appliances Industry in Egypt Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vacuum Cleaners

- 9.1.2. Hair Clippers

- 9.1.3. Irons

- 9.1.4. Toasters

- 9.1.5. Hair Dryers

- 9.1.6. Coffee Machines

- 9.1.7. Grills and Roasters

- 9.1.8. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Home Appliances Industry in Egypt Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Vacuum Cleaners

- 10.1.2. Hair Clippers

- 10.1.3. Irons

- 10.1.4. Toasters

- 10.1.5. Hair Dryers

- 10.1.6. Coffee Machines

- 10.1.7. Grills and Roasters

- 10.1.8. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kiriazi Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elaraby Groupo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Electrolux Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Electrostar Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kimbo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lord International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fresh Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Universal Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung electronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kiriazi Group

List of Figures

- Figure 1: Global Home Appliances Industry in Egypt Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Home Appliances Industry in Egypt Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Home Appliances Industry in Egypt Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Home Appliances Industry in Egypt Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Home Appliances Industry in Egypt Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Home Appliances Industry in Egypt Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Home Appliances Industry in Egypt Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 8: North America Home Appliances Industry in Egypt Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 9: North America Home Appliances Industry in Egypt Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Home Appliances Industry in Egypt Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Home Appliances Industry in Egypt Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Home Appliances Industry in Egypt Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Home Appliances Industry in Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Home Appliances Industry in Egypt Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Home Appliances Industry in Egypt Revenue (undefined), by Product Type 2025 & 2033

- Figure 16: South America Home Appliances Industry in Egypt Volume (K Unit), by Product Type 2025 & 2033

- Figure 17: South America Home Appliances Industry in Egypt Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: South America Home Appliances Industry in Egypt Volume Share (%), by Product Type 2025 & 2033

- Figure 19: South America Home Appliances Industry in Egypt Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 20: South America Home Appliances Industry in Egypt Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 21: South America Home Appliances Industry in Egypt Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Home Appliances Industry in Egypt Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Home Appliances Industry in Egypt Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Home Appliances Industry in Egypt Volume (K Unit), by Country 2025 & 2033

- Figure 25: South America Home Appliances Industry in Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Home Appliances Industry in Egypt Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Home Appliances Industry in Egypt Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Europe Home Appliances Industry in Egypt Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Europe Home Appliances Industry in Egypt Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe Home Appliances Industry in Egypt Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe Home Appliances Industry in Egypt Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 32: Europe Home Appliances Industry in Egypt Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 33: Europe Home Appliances Industry in Egypt Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Home Appliances Industry in Egypt Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Home Appliances Industry in Egypt Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Home Appliances Industry in Egypt Volume (K Unit), by Country 2025 & 2033

- Figure 37: Europe Home Appliances Industry in Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Home Appliances Industry in Egypt Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Home Appliances Industry in Egypt Revenue (undefined), by Product Type 2025 & 2033

- Figure 40: Middle East & Africa Home Appliances Industry in Egypt Volume (K Unit), by Product Type 2025 & 2033

- Figure 41: Middle East & Africa Home Appliances Industry in Egypt Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East & Africa Home Appliances Industry in Egypt Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East & Africa Home Appliances Industry in Egypt Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Home Appliances Industry in Egypt Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Home Appliances Industry in Egypt Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Home Appliances Industry in Egypt Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Home Appliances Industry in Egypt Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Home Appliances Industry in Egypt Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East & Africa Home Appliances Industry in Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Home Appliances Industry in Egypt Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Home Appliances Industry in Egypt Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Asia Pacific Home Appliances Industry in Egypt Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Asia Pacific Home Appliances Industry in Egypt Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Asia Pacific Home Appliances Industry in Egypt Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Asia Pacific Home Appliances Industry in Egypt Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Home Appliances Industry in Egypt Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Home Appliances Industry in Egypt Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Home Appliances Industry in Egypt Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Home Appliances Industry in Egypt Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Home Appliances Industry in Egypt Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Home Appliances Industry in Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Home Appliances Industry in Egypt Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Brazil Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Argentina Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Germany Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Russia Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Benelux Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Nordics Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 56: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Turkey Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Israel Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: GCC Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: North Africa Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: South Africa Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 74: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 75: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Home Appliances Industry in Egypt Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Home Appliances Industry in Egypt Volume K Unit Forecast, by Country 2020 & 2033

- Table 79: China Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: India Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Japan Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: South Korea Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Oceania Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Home Appliances Industry in Egypt Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Home Appliances Industry in Egypt Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Appliances Industry in Egypt?

The projected CAGR is approximately 4.57%.

2. Which companies are prominent players in the Home Appliances Industry in Egypt?

Key companies in the market include Kiriazi Group, Elaraby Groupo, Electrolux Group, Electrostar Group, Kimbo, Lord International, Fresh Electric, Universal Group, Samsung electronics.

3. What are the main segments of the Home Appliances Industry in Egypt?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Technological innovation in appliance market raising their demand.; Increase in Purchasing power of the consumers..

6. What are the notable trends driving market growth?

PRODUCT INNOVATION DRIVING THE MARKET.

7. Are there any restraints impacting market growth?

Rising global competition having a negative impact on domestic producers.; Rising Inflation rate having a negative impact on consumer purchase.

8. Can you provide examples of recent developments in the market?

On August 2022, Egypt's Investment Authority and the China's Haier, home appliances company, signed a memorandum of understanding (MoU) for establishing an industrial complex to manufacture of household appliance. This deal will be increasing Egypt's reliance on local component for home appliances by 60%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Appliances Industry in Egypt," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Appliances Industry in Egypt report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Appliances Industry in Egypt?

To stay informed about further developments, trends, and reports in the Home Appliances Industry in Egypt, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence