Key Insights

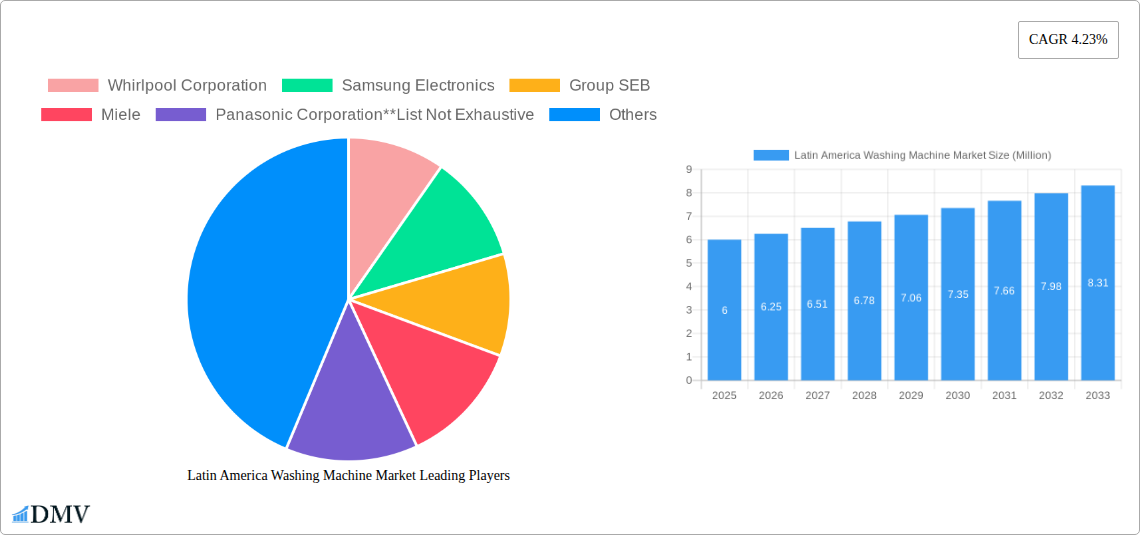

The Latin America Washing Machine Market is poised for robust growth, projected to reach a substantial market size of USD 6.00 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.23% extending through the forecast period of 2025-2033. This expansion is fueled by a confluence of favorable economic conditions and evolving consumer preferences across key nations like Brazil, Mexico, and Colombia. Increasing disposable incomes, coupled with a growing urbanization trend, are driving demand for modern home appliances, including advanced washing machines with energy-efficient features and larger capacities. Furthermore, a rising awareness about hygiene and convenience among households is creating a sustained appetite for automated laundry solutions. The market's trajectory is also being shaped by the strategic initiatives of leading manufacturers, who are introducing innovative products tailored to regional needs and price points, thereby broadening accessibility and market penetration.

Latin America Washing Machine Market Market Size (In Million)

Despite the promising outlook, certain factors could moderate the pace of growth. Economic volatility and currency fluctuations within some Latin American economies may impact consumer purchasing power for high-value durables. Additionally, the prevalence of informal markets and the availability of refurbished appliances present a competitive challenge to new product sales. However, the inherent demand for reliable and efficient washing machines, driven by a burgeoning middle class and a continuous need for domestic convenience, is expected to outweigh these restraints. The market segmentation, encompassing production, consumption, import/export dynamics, and price trends, will offer a comprehensive view of opportunities and challenges within countries like Brazil, Mexico, and Argentina, highlighting the strategic importance of understanding local market nuances.

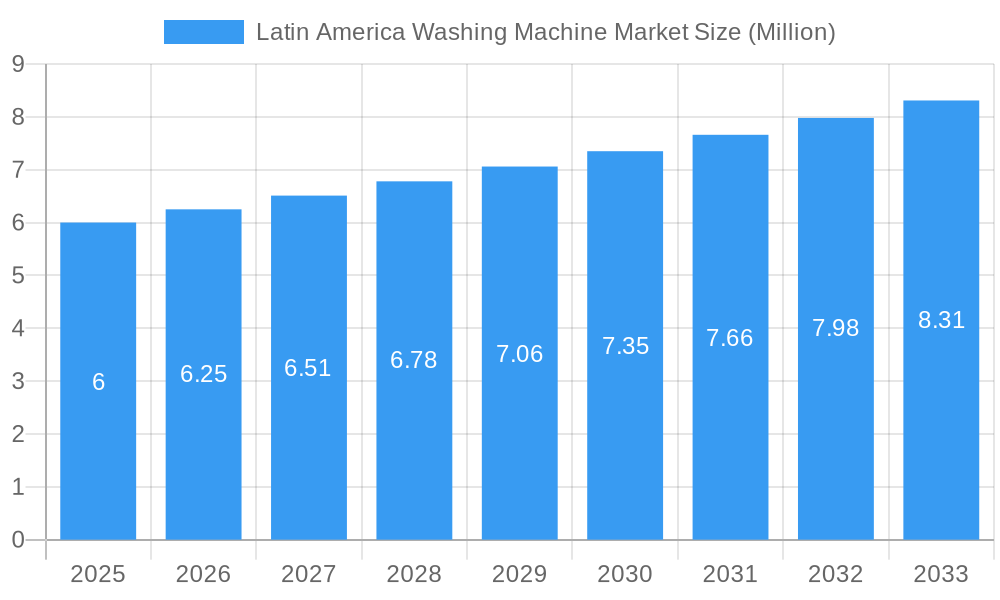

Latin America Washing Machine Market Company Market Share

This comprehensive report offers a definitive analysis of the Latin America Washing Machine Market, providing crucial insights for stakeholders navigating this dynamic sector. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report details historical trends, current market conditions, and future projections. We dissect market composition, industry evolution, leading regional and national segments, product innovations, growth drivers, obstacles, and emerging opportunities. For businesses aiming to capture market share in this burgeoning region, understanding the nuances of production, consumption, imports, exports, and pricing is paramount.

Latin America Washing Machine Market Market Composition & Trends

The Latin America Washing Machine Market is characterized by a dynamic interplay of established global manufacturers and emerging regional players, fostering both competition and innovation. Market concentration is moderate, with key global brands holding significant sway, yet local manufacturers are increasingly carving out niche markets. Innovation catalysts are primarily driven by the demand for energy-efficient appliances, smart home integration, and enhanced washing performance, directly influencing product development and marketing strategies. The regulatory landscape is evolving, with governments implementing stricter energy efficiency standards and environmental regulations, impacting manufacturing processes and product lifecycle management. Substitute products, such as manual washing or shared laundry facilities, still hold relevance in certain segments but are steadily being displaced by the convenience and efficacy of modern washing machines. End-user profiles vary significantly across the region, from budget-conscious households seeking affordable and durable solutions to affluent consumers demanding premium features and sophisticated designs. Mergers and acquisitions (M&A) activities, though not as frequent as in other mature markets, are strategic moves aimed at consolidating market presence, acquiring technological expertise, or expanding distribution networks. The value of recent M&A deals in the broader home appliance sector offers a benchmark for potential future consolidation within the washing machine segment.

- Market Share Distribution: Leading players hold approximately 70% of the market share, with the remaining distributed among smaller manufacturers and private labels.

- M&A Deal Values: Recent transactions in the Latin American home appliance sector indicate potential deal values ranging from $50 Million to $500 Million for significant market acquisitions.

- Innovation Focus: Energy efficiency (e.g., A+++ ratings), smart connectivity (Wi-Fi enabled models), and advanced fabric care technologies are key innovation drivers.

- Regulatory Impact: New energy efficiency mandates are expected to increase the average production cost by 5-10% but drive higher adoption of premium, efficient models.

Latin America Washing Machine Market Industry Evolution

The Latin America Washing Machine Market has witnessed a remarkable evolutionary trajectory over the historical period of 2019–2024, driven by a confluence of economic growth, increasing disposable incomes, and a growing consumer appreciation for convenience and technological advancements. Initially, the market was dominated by basic, top-loading machines, catering to the fundamental need for laundry solutions. However, as economic conditions improved and urbanization accelerated, consumer demand shifted towards more sophisticated and feature-rich appliances. The introduction of front-loading washing machines marked a significant turning point, offering superior washing performance, water efficiency, and energy savings, which resonated with a growing segment of environmentally conscious and cost-aware consumers.

Technological advancements have been a relentless force shaping the industry. The integration of inverter technology, for instance, has led to quieter operation and enhanced durability, while variable speed motors have allowed for more precise control over washing cycles, catering to a wider range of fabric types. The advent of smart washing machines, equipped with Wi-Fi connectivity, has further revolutionized the market. These appliances allow users to remotely control and monitor their laundry cycles via smartphone apps, receive notifications, and even diagnose potential issues, aligning with the broader trend of smart home adoption across Latin America. This digital integration not only enhances user convenience but also provides manufacturers with valuable data for product improvement and personalized marketing efforts.

Shifting consumer demands have been closely intertwined with these technological leaps. There is a discernible trend towards larger capacity machines to accommodate growing family sizes and the increasing popularity of larger household items. Furthermore, the emphasis on hygiene and health has spurred demand for washing machines with advanced sterilization features, such as steam functions and UV sanitization, a trend that was particularly amplified during recent global health concerns. The growing middle class across countries like Brazil, Mexico, and Colombia has fueled the demand for mid-range to premium washing machines, willing to invest in appliances that offer better performance, durability, and added convenience. This evolving consumer preference for higher value propositions has encouraged manufacturers to invest more in research and development, leading to a continuous stream of new models and features. The market's growth trajectory, estimated to reach a CAGR of approximately 7.5% during the forecast period, underscores the sustained consumer interest and the industry's capacity to adapt and innovate.

Leading Regions, Countries, or Segments in Latin America Washing Machine Market

The dominance within the Latin America Washing Machine Market is a multifaceted phenomenon, with certain regions and countries exhibiting exceptional growth and consumption patterns across key market segments. Brazil, as the largest economy in Latin America, consistently emerges as a leader in both Production Analysis and Consumption Analysis. Its vast population, growing middle class, and increasing urbanization contribute to a substantial demand for washing machines, making it a focal point for both domestic manufacturing and import activities. The country's robust industrial base also supports significant production capabilities for washing machine components and finished goods.

In terms of Import Market Analysis (Value & Volume), Mexico plays a pivotal role. Its strategic geographical location, strong manufacturing ties with North America, and a burgeoning consumer market make it a significant importer of washing machines and their components. The demand for feature-rich and energy-efficient models is particularly high in Mexico, driving substantial import volumes and values. Other notable importers include Colombia and Chile, where rising disposable incomes and a desire for modern home appliances are fueling growth.

Conversely, the Export Market Analysis (Value & Volume) is largely driven by countries with established manufacturing infrastructure and competitive production costs. While Brazil and Mexico are significant producers, they also serve as key export hubs, supplying to neighboring Latin American countries. Argentina, despite facing economic challenges, also contributes to the export landscape, particularly for specific product categories. The trend of regional trade agreements and the establishment of free trade zones further facilitate the flow of washing machines across the continent, influencing both import and export dynamics.

Analyzing the Price Trend Analysis reveals a segmentation based on product type and features. Basic, top-loading washing machines generally command lower price points, catering to budget-conscious consumers. Mid-range models, offering enhanced features like better energy efficiency and larger capacities, occupy a mid-tier price bracket. The premium segment, encompassing smart washing machines, advanced fabric care technologies, and superior build quality, commands the highest prices. Price sensitivity remains a crucial factor in many Latin American markets, but there is a clear upward trend as consumers increasingly prioritize long-term value, durability, and performance over initial cost.

Key drivers for this regional dominance include:

- Investment Trends: Significant foreign direct investment in manufacturing facilities, particularly in Brazil and Mexico, boosts local production and export capabilities.

- Regulatory Support: Government incentives for energy-efficient appliances and favorable trade policies encourage both production and consumption.

- Consumer Demographics: A young and growing population in many Latin American countries translates to sustained demand for household appliances.

- Urbanization: The migration to urban centers concentrates demand and facilitates access to retail and distribution networks.

Latin America Washing Machine Market Product Innovations

Product innovation in the Latin America Washing Machine Market is increasingly focused on delivering enhanced user convenience, superior washing performance, and greater sustainability. Manufacturers are introducing smart features, such as Wi-Fi connectivity for remote control and diagnostics, and AI-powered cycle optimization to cater to diverse fabric types and soil levels. Advanced drum designs and wash technologies, including steam functions and specialized cycles for delicates or heavily soiled items, are becoming standard in mid-range to premium models. Furthermore, a strong emphasis is placed on energy and water efficiency, with many new models achieving higher energy ratings, appealing to environmentally conscious consumers and those seeking to reduce utility bills. The integration of eco-friendly materials in appliance construction is also gaining traction, signaling a move towards more sustainable manufacturing practices.

Propelling Factors for Latin America Washing Machine Market Growth

The Latin America Washing Machine Market is propelled by several key factors driving its expansion. A significant growth catalyst is the increasing disposable income across the region, particularly within the burgeoning middle class, enabling consumers to upgrade from basic appliances to more advanced and feature-rich washing machines. Urbanization further fuels demand as more households move into apartments and homes where space-saving and efficient appliances are a priority. Technological advancements, including smart home integration and energy-efficient technologies, are creating new market segments and attracting consumers seeking modern conveniences and cost savings. Favorable government policies, such as incentives for energy-efficient products and initiatives promoting domestic manufacturing, also play a crucial role. Finally, the growing awareness of hygiene and health has boosted demand for washing machines with advanced sanitization features.

Obstacles in the Latin America Washing Machine Market Market

Despite robust growth prospects, the Latin America Washing Machine Market faces several obstacles. Economic volatility and currency fluctuations in several key countries can impact consumer purchasing power and increase the cost of imported components, affecting overall market affordability. Logistical challenges and underdeveloped infrastructure in certain remote areas can lead to higher distribution costs and delayed deliveries, hindering market penetration. Intense price competition, particularly from lower-cost imported brands and refurbished appliances, can pressure profit margins for manufacturers. Supply chain disruptions, stemming from global events or regional trade issues, can affect the availability of raw materials and finished goods. Lastly, limited consumer awareness of the benefits of advanced features, such as energy efficiency and smart technology, in some segments, can slow down the adoption of premium products.

Future Opportunities in Latin America Washing Machine Market

The Latin America Washing Machine Market presents numerous future opportunities for growth and innovation. The increasing adoption of smart home technology across the region opens avenues for connected washing machines with advanced digital functionalities and personalized user experiences. The rising demand for eco-friendly and sustainable appliances presents an opportunity for manufacturers to develop and market energy-efficient models and those made from recycled materials, aligning with growing environmental consciousness. Untapped rural and semi-urban markets offer significant potential for expansion, particularly for affordable and durable washing machine solutions. Furthermore, the development of specialized washing machines catering to the needs of specific demographics, such as smaller capacity machines for single-person households or enhanced hygiene features for families, can unlock new market segments. The growing trend of online appliance sales and direct-to-consumer models also provides opportunities for brands to reach a wider customer base and enhance customer engagement.

Major Players in the Latin America Washing Machine Market Ecosystem

- Whirlpool Corporation

- Samsung Electronics

- Group SEB

- Miele

- Panasonic Corporation

- Mabe

- AEG

- Bosch

- Electrolux AB

- LG Electronics

Key Developments in Latin America Washing Machine Market Industry

- February 2023: LG Electronics (LG) announced the new Multi V™ I launch in key global markets. It is a Variable Refrigerant Flow (VRF) solution with the company's highly evolved AI engine, indicating a broader push towards smart and efficient appliance technology adoption across the company's product lines.

- February 2023: The Electrolux Group developed a new line of built-in refrigerators. The recent launches include inner liners made from 70% recycled plastic, which equates to 13% of the total plastic used in the refrigerator. Electrolux is the first in the world to incorporate this much-recycled plastic into a refrigerator, making it an important industry breakthrough and highlighting a commitment to sustainability that will likely influence their entire appliance portfolio, including washing machines.

Strategic Latin America Washing Machine Market Market Forecast

The strategic forecast for the Latin America Washing Machine Market indicates a period of sustained growth, driven by a dynamic combination of increasing consumer purchasing power, rapid urbanization, and a growing embrace of technological innovation. The penetration of smart home appliances is expected to accelerate, with consumers increasingly valuing the convenience and efficiency offered by connected washing machines. Furthermore, the escalating demand for sustainable and energy-efficient products will continue to shape product development and marketing strategies, creating opportunities for brands that prioritize eco-friendly manufacturing and performance. The expanding middle class across key nations will fuel the demand for mid-range to premium washing machines, while untapped markets in developing regions offer significant potential for basic and affordable models. Strategic investments in localized production, robust distribution networks, and targeted marketing campaigns will be crucial for players aiming to capitalize on the evolving consumer preferences and capture significant market share in the coming years.

Latin America Washing Machine Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Washing Machine Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Washing Machine Market Regional Market Share

Geographic Coverage of Latin America Washing Machine Market

Latin America Washing Machine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising GDP Per Capita Income; Growing Demand for Smart Home Appliances

- 3.3. Market Restrains

- 3.3.1. High Costs and Electricity Consumption; Economic Recession May Affect Customers Purchasing Ability

- 3.4. Market Trends

- 3.4.1. Increasing Online sales for Washing Machines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Washing Machine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Group SEB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Miele

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mabe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AEG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrolux AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Latin America Washing Machine Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Washing Machine Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Washing Machine Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Latin America Washing Machine Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Latin America Washing Machine Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Latin America Washing Machine Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Latin America Washing Machine Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Latin America Washing Machine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Latin America Washing Machine Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Latin America Washing Machine Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Latin America Washing Machine Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Latin America Washing Machine Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Latin America Washing Machine Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Latin America Washing Machine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Peru Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Venezuela Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Ecuador Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Bolivia Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Paraguay Latin America Washing Machine Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Washing Machine Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Latin America Washing Machine Market?

Key companies in the market include Whirlpool Corporation, Samsung Electronics, Group SEB, Miele, Panasonic Corporation**List Not Exhaustive, Mabe, AEG, Bosch, Electrolux AB, LG Electronics.

3. What are the main segments of the Latin America Washing Machine Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising GDP Per Capita Income; Growing Demand for Smart Home Appliances.

6. What are the notable trends driving market growth?

Increasing Online sales for Washing Machines.

7. Are there any restraints impacting market growth?

High Costs and Electricity Consumption; Economic Recession May Affect Customers Purchasing Ability.

8. Can you provide examples of recent developments in the market?

February 2023: LG Electronics (LG) announced the new Multi V™ I launch in key global markets. It is a Variable Refrigerant Flow (VRF) solution with the company's highly evolved AI engine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Washing Machine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Washing Machine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Washing Machine Market?

To stay informed about further developments, trends, and reports in the Latin America Washing Machine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence