Key Insights

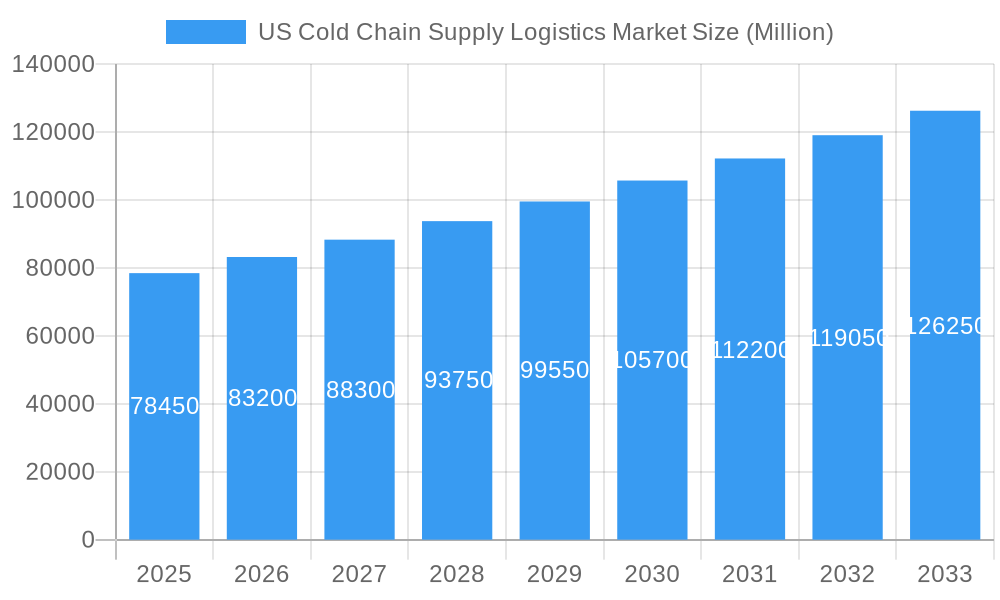

The US cold chain supply logistics market, valued at $78.45 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.83% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for perishable goods, particularly fresh produce, dairy, and seafood, coupled with rising consumer preference for high-quality, readily available food, significantly contributes to market growth. Furthermore, the growing healthcare and pharmaceutical sectors, necessitating stringent temperature-controlled transportation and storage for sensitive medications and vaccines, are bolstering market demand. E-commerce proliferation, with its emphasis on rapid delivery of temperature-sensitive products, is another major catalyst. Advancements in cold chain technologies, including improved refrigeration units, temperature monitoring systems, and automated warehousing solutions, are enhancing efficiency and reducing spoilage, further stimulating market expansion. However, challenges remain, including stringent regulatory compliance requirements and the inherent volatility of energy prices impacting operational costs.

US Cold Chain Supply Logistics Market Market Size (In Billion)

Market segmentation reveals a diverse landscape. Services encompass storage, transportation, and value-added services like blast freezing and inventory management. Temperature control ranges from chilled and frozen to ambient storage. Application-wise, fruits and vegetables, dairy, meat and seafood, and processed foods dominate, while healthcare and pharmaceuticals represent a rapidly expanding segment. Leading players like Lineage Logistics, Americold Logistics, and DHL Supply Chain are actively shaping the market through strategic investments in infrastructure, technology, and geographical expansion. Regional variations are expected, with densely populated areas like the Northeast and West potentially exhibiting higher growth rates due to high consumer demand and established logistics networks. The Midwest and South are also expected to see significant growth, driven by agricultural production and expanding distribution networks. The forecast period of 2025-2033 anticipates continued growth, with a projected market size exceeding $120 billion by 2033 based on a sustained CAGR of 5.83%.

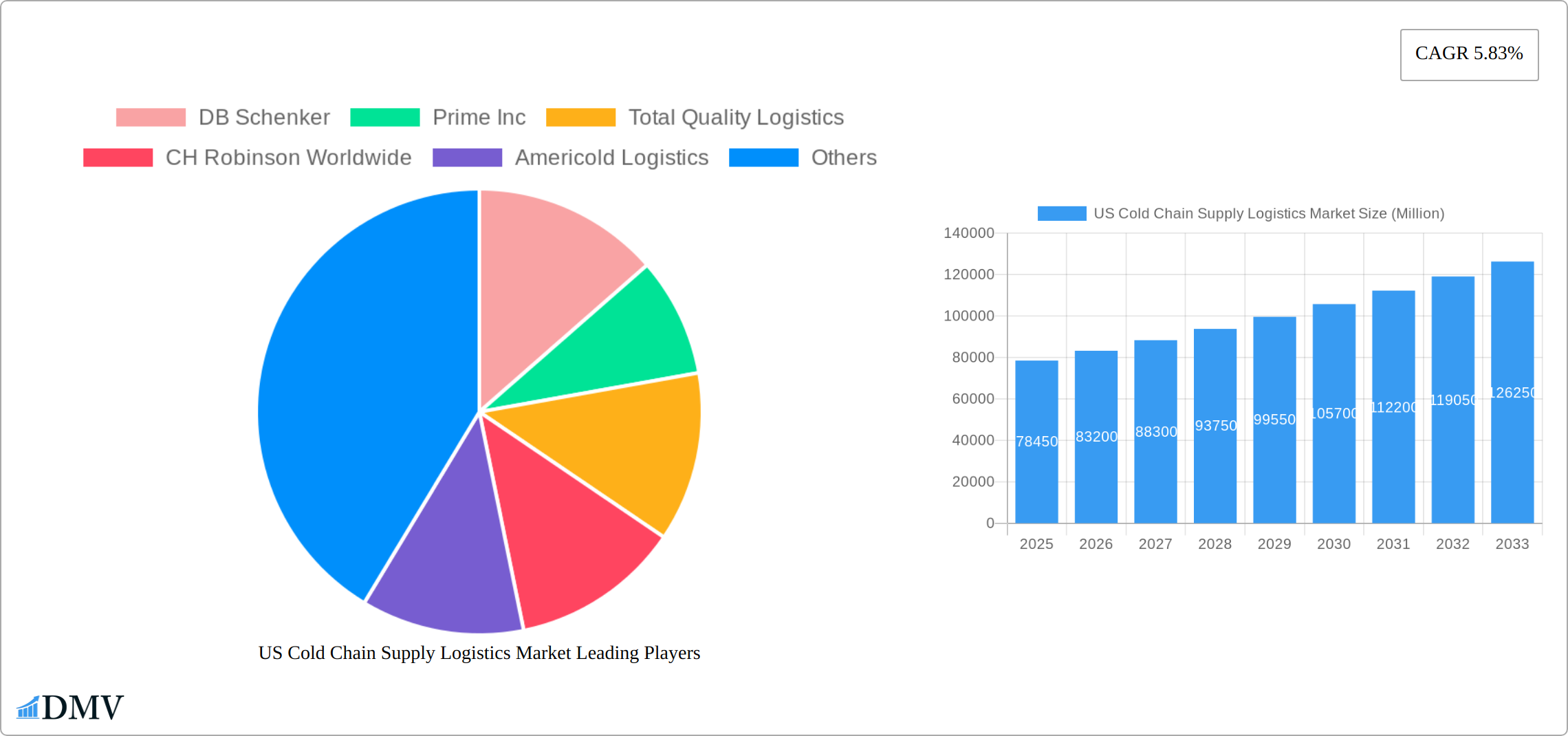

US Cold Chain Supply Logistics Market Company Market Share

US Cold Chain Supply Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the US cold chain supply logistics market, encompassing market size, growth drivers, competitive landscape, and future trends. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is invaluable for stakeholders seeking to understand the complexities and opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

US Cold Chain Supply Logistics Market Composition & Trends

The US cold chain supply logistics market is characterized by a moderately concentrated landscape with key players vying for market share. Market leaders like Americold Logistics, Lineage Logistics, and DB Schenker dominate the storage segment, while transportation is a more fragmented space involving players such as Prime Inc, Total Quality Logistics, and CH Robinson Worldwide. The value-added services segment is experiencing rapid growth due to increasing demand for specialized handling and inventory management.

Market share distribution is currently estimated as follows: Americold Logistics (xx%), Lineage Logistics (xx%), DB Schenker (xx%), with the remaining share distributed amongst other major and regional players. The regulatory landscape, focusing on food safety and transportation regulations, significantly impacts market operations. Substitute products are limited, with the primary focus being on improving efficiency and reducing waste within the existing cold chain. End-user profiles include diverse sectors such as food and beverage, pharmaceuticals, and healthcare, each with specific cold chain requirements. M&A activity has been robust, with significant deals involving USD xx Million in total value during the historical period (2019-2024), reflecting consolidation trends and expansion strategies. Key examples include recent acquisitions and investments by Americold Logistics detailed later in this report.

- Market Concentration: Moderately concentrated, with several major players dominating specific segments.

- Innovation Catalysts: Technological advancements in temperature monitoring, automation, and transportation.

- Regulatory Landscape: Stringent food safety and transportation regulations driving compliance investments.

- Substitute Products: Limited viable substitutes; focus on improving efficiency within the existing system.

- End-User Profiles: Diverse, including food & beverage, pharmaceuticals, and healthcare.

- M&A Activity: Significant activity observed, indicating market consolidation and expansion strategies.

US Cold Chain Supply Logistics Market Industry Evolution

The US cold chain logistics market has experienced substantial growth from 2019 to 2024, fueled by rising consumer demand for fresh and processed foods, the surge in e-commerce, and increasingly stringent food safety regulations. Technological advancements, such as the Internet of Things (IoT) sensors for real-time temperature monitoring and sophisticated Transportation Management Systems (TMS), have dramatically improved efficiency and minimized waste. Evolving consumer preferences, including a greater emphasis on convenience, healthier foods, and online grocery shopping, significantly contribute to this market's dynamic evolution. While precise growth figures for 2019-2024 and projected growth for 2024-2025 are omitted here, the market's trajectory demonstrates significant expansion. The integration of blockchain technology for enhanced traceability and the increasing automation of warehousing processes are further accelerating this growth. These trends are poised to fuel market expansion throughout the forecast period (2025-2033), presenting substantial opportunities for stakeholders.

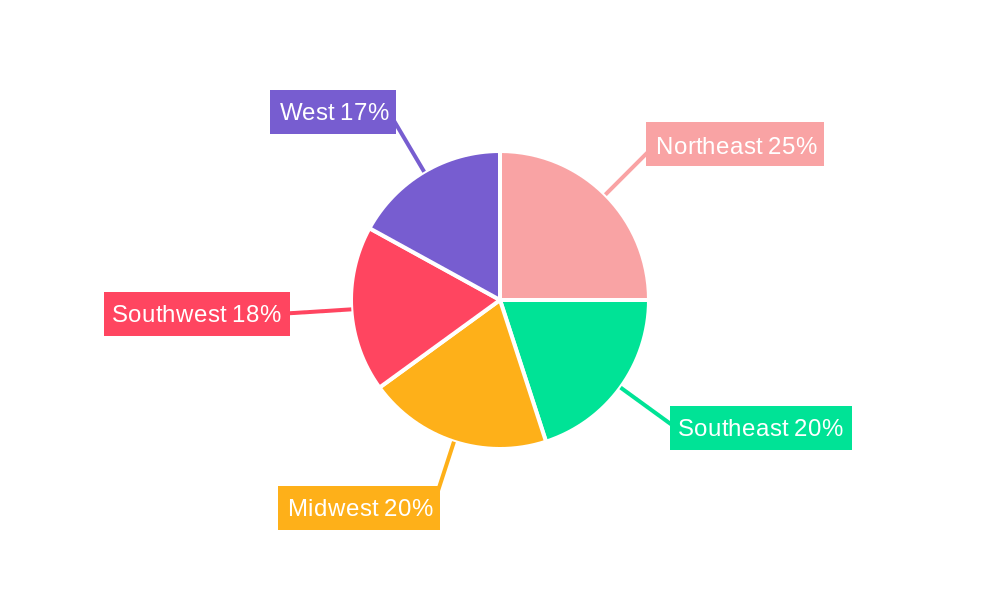

Leading Regions, Countries, or Segments in US Cold Chain Supply Logistics Market

The US cold chain market shows significant regional variations, with higher concentration in densely populated areas with robust food processing and distribution networks. The Northeast and West Coast regions demonstrate the highest market value due to factors such as large populations, and significant agricultural output.

By Services: The storage segment holds the largest market share due to the necessity of maintaining temperature-controlled environments for perishable goods. Transportation is a close second, reflecting the critical role of efficient distribution networks. Value-added services are rapidly gaining traction, driven by increasing demand for specialized handling and processing.

By Temperature Type: Frozen storage and transportation account for a significant portion of the market due to the high volume of frozen products. Chilled storage is also important, especially for fresh produce and dairy products. Ambient storage is comparatively smaller, but remains crucial for certain product types.

By Application: The food and beverage sector holds the dominant position, followed by healthcare and pharmaceuticals due to their rigorous temperature-sensitive requirements. Specific food applications like dairy and fruits/vegetables demonstrate high growth potential.

Key Drivers (by segment):

- Storage: High demand for temperature-controlled warehousing space, increasing investments in infrastructure and technology.

- Transportation: Expanding e-commerce, increased demand for faster and more reliable delivery of perishable goods.

- Value-Added Services: Growing consumer preference for convenience and specialization in handling, processing and packaging.

US Cold Chain Supply Logistics Market Product Innovations

Recent innovations are fundamentally reshaping cold chain logistics, focusing on enhanced temperature control, robust traceability, and increased automation. Smart sensors, seamlessly integrated with IoT platforms, provide real-time visibility into product temperature and location, minimizing spoilage and waste. Automated guided vehicles (AGVs) and robotic systems are streamlining warehousing operations, while advanced TMS solutions optimize delivery routes and reduce transportation costs. These advancements collectively deliver superior inventory management, unparalleled traceability, improved food safety, and significantly reduced operational expenses, making the cold chain more efficient and resilient.

Propelling Factors for US Cold Chain Supply Logistics Market Growth

The US cold chain market’s growth is fueled by several factors: The burgeoning e-commerce sector increases demand for efficient and reliable delivery of temperature-sensitive products. Stringent government regulations on food safety and product traceability necessitate investment in advanced cold chain technologies. Technological innovations such as IoT-enabled sensors, automation, and advanced data analytics provide improved supply chain visibility and efficiency, minimizing losses and enhancing overall performance. Increasing consumer demand for fresh and processed foods, along with growing concerns regarding food security and safety, further propels the market's expansion.

Obstacles in the US Cold Chain Supply Logistics Market

The US cold chain industry faces a complex web of challenges. Fluctuating fuel prices and persistent driver shortages significantly impact transportation costs and efficiency, driving up operational expenses. Supply chain disruptions, often triggered by extreme weather events or geopolitical instability, can severely disrupt the flow of goods, leading to significant financial losses. Intense competition among market players creates pricing pressures, squeezing profit margins. Strict regulatory compliance requirements and the substantial cost of implementing advanced technologies present considerable hurdles for many businesses. These constraints can impede profitability and hinder overall market growth, necessitating innovative strategies to overcome them.

Future Opportunities in US Cold Chain Supply Logistics Market

The future of the US cold chain logistics market is bright, brimming with significant opportunities. These include the expansion of cold chain infrastructure into underserved regions, the increasing adoption of sustainable and environmentally friendly cold chain solutions, and the development of specialized cold chain solutions tailored to niche markets such as pharmaceuticals and high-value food products. Groundbreaking technological advancements, such as AI-powered predictive analytics and advanced automation, offer immense potential for greater efficiency and optimization. The ever-growing demand for fresh and convenient food, especially via online channels, represents a significant catalyst for growth and innovation, promising a dynamic and evolving market landscape.

Major Players in the US Cold Chain Supply Logistics Market Ecosystem

- DB Schenker

- Prime Inc

- Total Quality Logistics

- CH Robinson Worldwide

- Americold Logistics

- Burris Logistics

- XPO Logistics

- FedEx

- Stevens Transport

- Expeditors

- Lineage Logistics

- United States Cold Storage

- Covenant Transportation Services

- DHL Supply Chain

- Arc Best

- JB Hunt

Key Developments in US Cold Chain Supply Logistics Market Industry

- May 2023: Americold Logistics announced a strategic investment of USD 3.9 Million (49% equity) in RSA Cold Chain, Dubai.

- May 2023: Americold Logistics announced the grand opening of its expanded facility in Santa Perpetua, Barcelona, adding 11 loading bays and 12,000 pallet positions.

- June 2023: Honor Foods (Burris Logistics) acquired Sunny Morning Foods, expanding its dairy expertise and market reach in the Southeast.

Strategic US Cold Chain Supply Logistics Market Forecast

The US cold chain supply logistics market is poised for robust growth, driven by a confluence of factors. Continued technological advancements, increasing e-commerce penetration, and strengthening regulations all contribute to a positive outlook. The focus on efficiency improvements, sustainability, and specialized services will shape future market dynamics. The market exhibits significant potential for expansion in various segments, promising lucrative opportunities for existing and new entrants alike. The projected market size in 2033 indicates significant growth opportunities, particularly within the value-added services and specialized segments.

US Cold Chain Supply Logistics Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Seafood

- 3.4. Processed Food

- 3.5. Healthcare & Pharmaceuticals

- 3.6. Bakery and Confectionary

- 3.7. Other Applications

US Cold Chain Supply Logistics Market Segmentation By Geography

- 1. United States

US Cold Chain Supply Logistics Market Regional Market Share

Geographic Coverage of US Cold Chain Supply Logistics Market

US Cold Chain Supply Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Rising fresh produce imports from Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Cold Chain Supply Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Seafood

- 5.3.4. Processed Food

- 5.3.5. Healthcare & Pharmaceuticals

- 5.3.6. Bakery and Confectionary

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prime Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Total Quality Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CH Robinson Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Americold Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Burris Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stevens Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Expeditors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lineage Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 United States Cold Storage

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Covenant Transportation Services**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DHL Supply Chain

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Arc Best

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 JB Hunt

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Global US Cold Chain Supply Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United States US Cold Chain Supply Logistics Market Revenue (Million), by Services 2025 & 2033

- Figure 3: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: United States US Cold Chain Supply Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 5: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: United States US Cold Chain Supply Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 7: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: United States US Cold Chain Supply Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 9: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Cold Chain Supply Logistics Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the US Cold Chain Supply Logistics Market?

Key companies in the market include DB Schenker, Prime Inc, Total Quality Logistics, CH Robinson Worldwide, Americold Logistics, Burris Logistics, XPO Logistics, FedEx, Stevens Transport, Expeditors, Lineage Logistics, United States Cold Storage, Covenant Transportation Services**List Not Exhaustive, DHL Supply Chain, Arc Best, JB Hunt.

3. What are the main segments of the US Cold Chain Supply Logistics Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.45 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Rising fresh produce imports from Mexico.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

June 2023: Honor Foods, the Burris Logistics food service redistribution company, purchased Sunny Morning Foods, a food service redistributor with dairy expertise located in Fort Lauderdale, FL. Sunny Morning Foods strengthens the company’s portfolio and broadens its position as a preferred food service redistributor in the Mid-Atlantic, New England, and now Southeast regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Cold Chain Supply Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Cold Chain Supply Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Cold Chain Supply Logistics Market?

To stay informed about further developments, trends, and reports in the US Cold Chain Supply Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence