Key Insights

The United States pharmaceutical transportation market is projected to reach $107.6 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6%. This expansion is driven by increasing pharmaceutical demand from an aging population and rising chronic disease prevalence, necessitating robust transportation networks. Stringent regulations for temperature-sensitive drug shipments are fueling the adoption of advanced cold chain logistics. The burgeoning e-commerce sector and direct-to-patient deliveries are further accelerating demand for specialized pharmaceutical logistics. Leading providers such as FedEx, UPS, and DHL are enhancing supply chain visibility and optimizing routes through technological advancements like real-time tracking and predictive analytics. Pharmaceutical companies are increasingly outsourcing logistics to focus on core competencies.

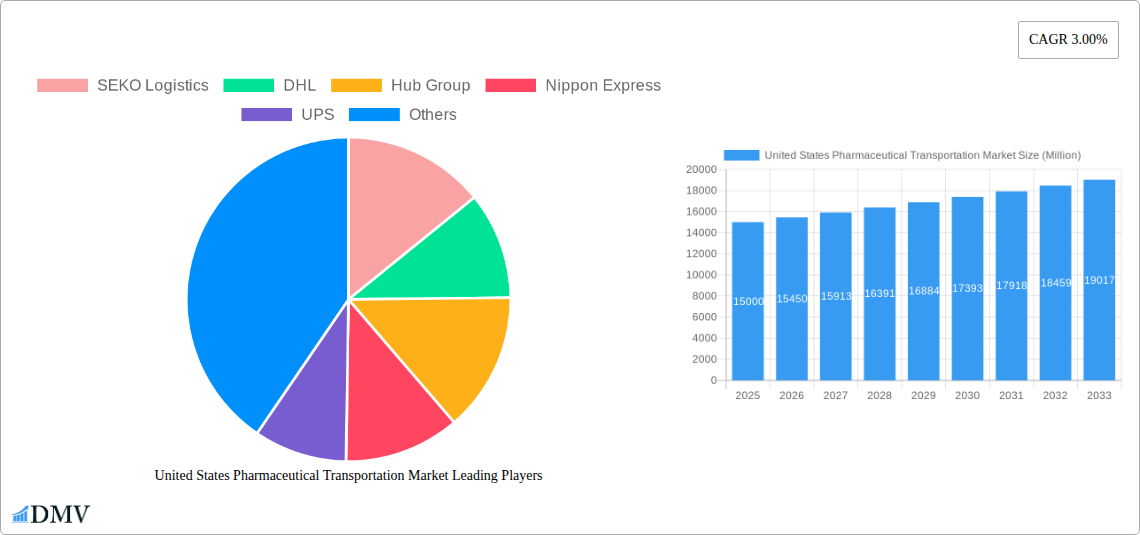

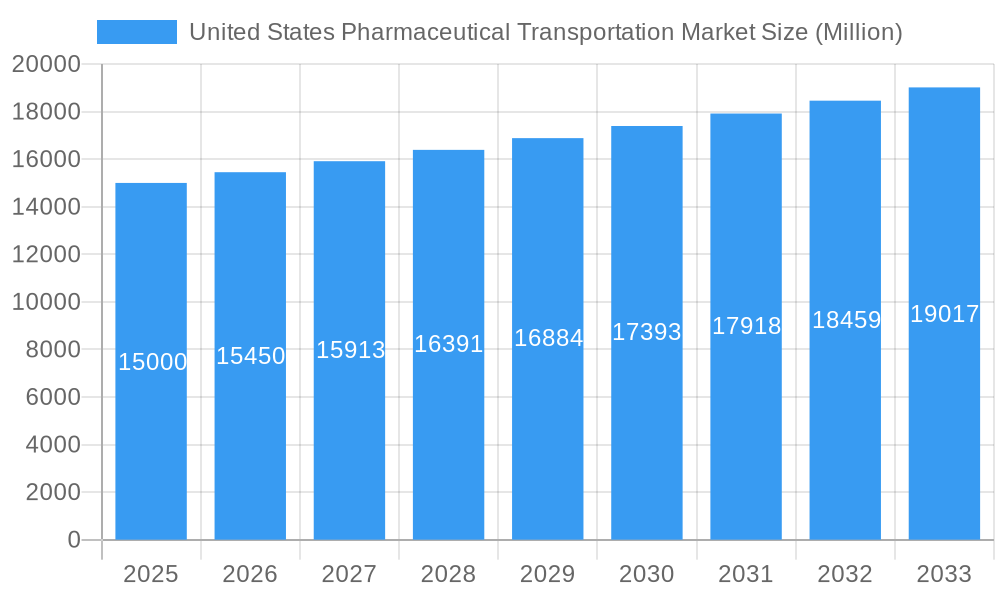

United States Pharmaceutical Transportation Market Market Size (In Billion)

Market segmentation includes product type (generic vs. branded drugs), operational mode (cold chain vs. non-cold chain), and services (transportation, warehousing, value-added services). Cold chain transport dominates due to the critical need for maintaining product integrity. The geographically diverse US market presents unique logistical challenges, driving innovation in last-mile delivery and specialized handling. The competitive landscape features both multinational providers and specialized firms, fostering continuous service improvement and efficiency. Future market trajectory will be shaped by technological evolution, regulatory shifts, and evolving consumer preferences.

United States Pharmaceutical Transportation Market Company Market Share

United States Pharmaceutical Transportation Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States pharmaceutical transportation market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this study is essential for stakeholders seeking to understand market dynamics, identify opportunities, and make informed strategic decisions. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Pharmaceutical Transportation Market Market Composition & Trends

This section delves into the competitive landscape of the U.S. pharmaceutical transportation market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market exhibits a moderately consolidated structure, with key players holding significant market share. For example, the top 5 players collectively account for approximately xx% of the market share in 2025. However, the presence of numerous smaller players ensures a dynamic competitive environment.

- Market Share Distribution (2025): Top 5 players: xx%; Next 10 players: xx%; Remaining players: xx%

- Innovation Catalysts: Technological advancements in cold chain logistics, automation, and data analytics are driving market innovation. The rising adoption of IoT sensors and AI-powered route optimization tools are key examples.

- Regulatory Landscape: Stringent regulations concerning drug safety and handling significantly influence market dynamics. Compliance with Good Distribution Practices (GDP) mandates is paramount for all market participants.

- Substitute Products: Limited viable substitutes exist for specialized pharmaceutical transportation services, particularly cold chain logistics for temperature-sensitive drugs.

- End-User Profile: Major end-users comprise pharmaceutical manufacturers, distributors, wholesalers, and healthcare providers.

- M&A Activity: The past five years have witnessed several notable M&A deals, with total deal values exceeding xx Million. These transactions reflect consolidation efforts and expansion strategies among key players. Examples include (but are not limited to) acquisitions focused on enhancing cold chain capabilities and expanding geographical reach.

United States Pharmaceutical Transportation Market Industry Evolution

This section analyzes the historical and projected growth trajectory of the U.S. pharmaceutical transportation market. The market has experienced robust growth over the historical period (2019-2024), driven by factors such as the increasing prevalence of chronic diseases, rising demand for specialized medications, and technological advancements improving logistics efficiency. The market is expected to maintain a steady growth rate during the forecast period (2025-2033). Technological advancements like the implementation of blockchain technology for improved traceability and the expansion of automated warehousing systems are key factors driving efficiency gains. The increasing demand for personalized medicine and the consequent rise in specialized drug shipments are also contributing to market expansion. The growth rate is expected to be influenced by macroeconomic factors, including economic growth and healthcare spending trends.

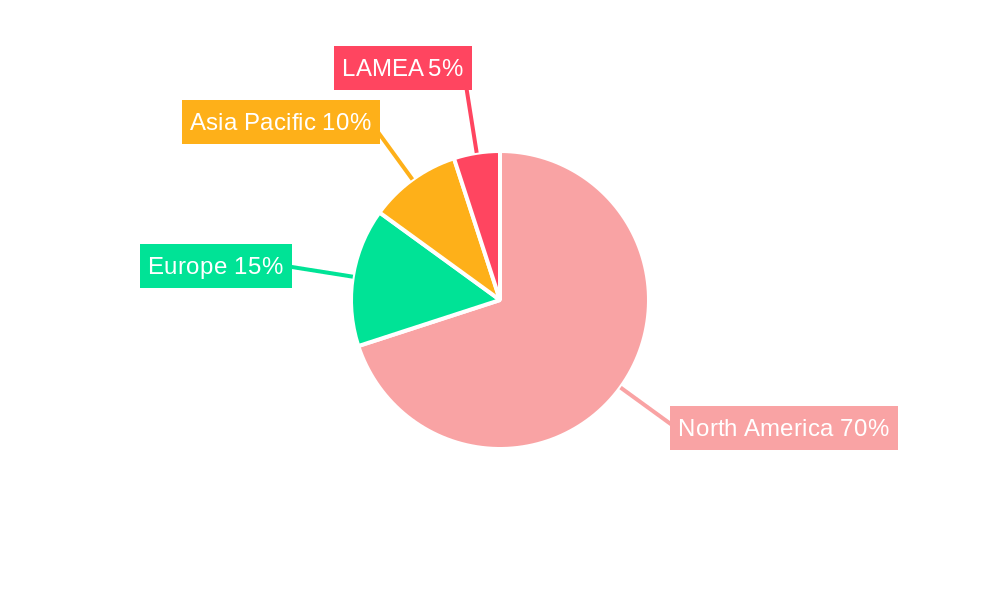

Leading Regions, Countries, or Segments in United States Pharmaceutical Transportation Market

The U.S. pharmaceutical transportation market displays regional variations in growth and segment dominance.

- By Product: Branded drugs currently hold a larger market share compared to generic drugs due to higher pricing and stricter handling requirements.

- By Mode of Operation: Cold chain transport dominates the market due to the temperature-sensitive nature of many pharmaceutical products. This segment is projected to grow significantly faster than non-cold chain transport.

- By Services: Transportation services constitute the largest segment. However, warehousing and value-added services (such as packaging and labeling) are witnessing strong growth, driven by increased demand for end-to-end logistical solutions.

Key Drivers:

- High Investment in Cold Chain Infrastructure: Significant investments in cold chain infrastructure, including specialized vehicles and warehousing facilities, are driving market expansion.

- Stringent Regulatory Requirements: Government regulations mandating strict adherence to temperature control and handling procedures are boosting demand for specialized pharmaceutical transportation services.

- Technological Advancements: The adoption of advanced technologies such as GPS tracking, RFID tagging, and real-time temperature monitoring systems enhances the efficiency and reliability of pharmaceutical transportation.

The Northeast and West Coast regions demonstrate the strongest growth due to a high concentration of pharmaceutical manufacturers and distribution centers.

United States Pharmaceutical Transportation Market Product Innovations

Recent innovations include the development of advanced temperature-controlled containers with enhanced insulation and monitoring capabilities, the implementation of real-time tracking and monitoring systems using IoT sensors, and the integration of AI-powered route optimization software. These improvements enhance the efficiency, safety, and security of pharmaceutical transportation, reducing spoilage and enhancing delivery timeliness. The unique selling propositions lie in improved temperature control, enhanced traceability, and reduced operational costs.

Propelling Factors for United States Pharmaceutical Transportation Market Growth

Several factors fuel the growth of the U.S. pharmaceutical transportation market. The rise in chronic diseases necessitates increased drug consumption, thus boosting demand for transportation services. Stringent regulatory requirements concerning drug safety and handling mandate specialized transportation solutions. Technological advancements in cold chain logistics, such as real-time monitoring systems and smart containers, improve efficiency and safety. Finally, increased e-commerce penetration in the pharmaceutical sector is further driving market expansion.

Obstacles in the United States Pharmaceutical Transportation Market Market

Challenges include the stringent regulatory environment, the high cost of compliance, and the risk of supply chain disruptions, particularly given the global nature of pharmaceutical sourcing and distribution. These disruptions can lead to significant financial losses for companies. Furthermore, intense competition among established players and the emergence of new entrants pose challenges to existing market participants. The fluctuating fuel prices also contribute to operational cost volatility.

Future Opportunities in United States Pharmaceutical Transportation Market

Future opportunities lie in expanding into niche segments, such as the transportation of specialized biologics and personalized medicines. The adoption of advanced technologies, such as drones and autonomous vehicles, could revolutionize the industry. Furthermore, the growing demand for temperature-sensitive pharmaceutical products presents significant potential for cold chain logistics providers. Expansion into underserved rural areas also presents an opportunity.

Major Players in the United States Pharmaceutical Transportation Market Ecosystem

- SEKO Logistics

- DHL (DHL)

- Hub Group (Hub Group)

- Nippon Express (Nippon Express)

- UPS (UPS)

- Penske Logistics (Penske Logistics)

- XPO Logistics (XPO Logistics)

- FedEx (FedEx)

- Expeditors International (Expeditors International)

- DB Schenker (DB Schenker)

- 6 Other Companies

- 3 Other Companies

Key Developments in United States Pharmaceutical Transportation Market Industry

- August 2022: Wabash expands its dealer network in the Northeast, enhancing its service reach for pharmaceutical transportation solutions. This strengthens its position in the market by improving parts and service accessibility for its customers.

- May 2022: Vertical Cold Storage's acquisition of three public refrigerated warehouses expands cold storage capacity, enhancing the overall capacity for pharmaceutical storage and distribution across key regions. This increases the availability of cold chain infrastructure for the pharmaceutical industry.

Strategic United States Pharmaceutical Transportation Market Market Forecast

The U.S. pharmaceutical transportation market is poised for continued growth, driven by technological advancements, increased demand for specialized pharmaceutical products, and the expansion of cold chain infrastructure. Future opportunities lie in leveraging emerging technologies to enhance efficiency, safety, and traceability throughout the supply chain. This includes investments in automation, AI, and blockchain solutions. The market's strong fundamentals suggest a promising outlook for investors and industry participants alike.

United States Pharmaceutical Transportation Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Transport

- 2.2. Non-cold Chain Transport

-

3. Services

-

3.1. Transport

- 3.1.1. Road

- 3.1.2. Air

- 3.1.3. Rail

- 3.1.4. Sea

- 3.2. Warehousing Services

- 3.3. Value-added Services and Other Services

-

3.1. Transport

United States Pharmaceutical Transportation Market Segmentation By Geography

- 1. United States

United States Pharmaceutical Transportation Market Regional Market Share

Geographic Coverage of United States Pharmaceutical Transportation Market

United States Pharmaceutical Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Growing Pharmaceutical Industry in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Transport

- 5.2.2. Non-cold Chain Transport

- 5.3. Market Analysis, Insights and Forecast - by Services

- 5.3.1. Transport

- 5.3.1.1. Road

- 5.3.1.2. Air

- 5.3.1.3. Rail

- 5.3.1.4. Sea

- 5.3.2. Warehousing Services

- 5.3.3. Value-added Services and Other Services

- 5.3.1. Transport

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SEKO Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hub Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Penske Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expeditors International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DB Schenker*List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SEKO Logistics

List of Figures

- Figure 1: United States Pharmaceutical Transportation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 3: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Services 2020 & 2033

- Table 4: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 7: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Services 2020 & 2033

- Table 8: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical Transportation Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the United States Pharmaceutical Transportation Market?

Key companies in the market include SEKO Logistics, DHL, Hub Group, Nippon Express, UPS, Penske Logistics, XPO Logistics, FedEx, Expeditors International, DB Schenker*List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the United States Pharmaceutical Transportation Market?

The market segments include Product, Mode of Operation, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.6 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

Growing Pharmaceutical Industry in the Country.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

August 2022: Wabash, a provider of transportation, logistics, and distribution solutions, announced the addition of two dealers to its industry-leading North American dealer network. Bergey's Truck Centers and Allegiance Trucks, two of the largest dealers in the Northeast, will be full-line dealers of Wabash parts, services, and equipment, including dry and refrigerated van trailers, dry and refrigerated truck bodies, and platform trailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical Transportation Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence