Key Insights

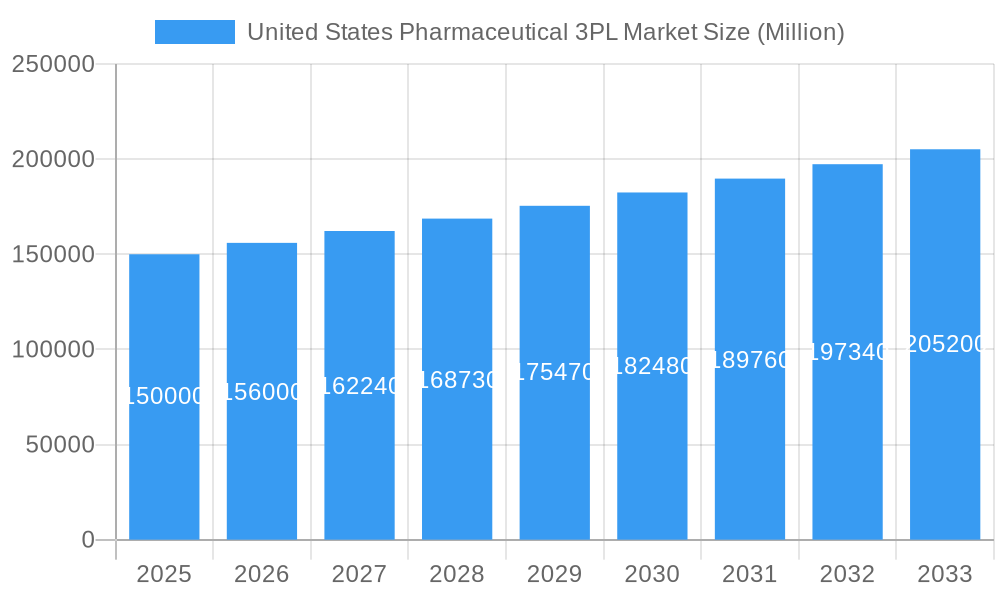

The United States pharmaceutical 3PL market is experiencing robust growth, driven by increasing demand for specialized logistics solutions within the pharmaceutical industry. The rising complexity of pharmaceutical supply chains, stringent regulatory requirements, and the need for temperature-controlled transportation (cold chain) are key factors fueling this expansion. The market's CAGR exceeding 4% suggests a consistent upward trajectory, projected to continue through 2033. Major players like DHL, FedEx, UPS, and others are fiercely competing to capture market share, investing heavily in advanced technologies like track-and-trace systems, real-time monitoring, and sophisticated warehousing capabilities to meet the demanding needs of pharmaceutical manufacturers and distributors. The market is segmented by function (domestic and international transportation management, value-added warehousing and distribution) and supply chain type (cold chain and non-cold chain), with cold chain logistics commanding a significant portion due to the temperature-sensitive nature of many pharmaceutical products. Specific market size figures for the US pharmaceutical 3PL market are unavailable in the provided data; however, based on the global market size and regional trends, a reasonable estimate would place the US market value in the billions of dollars, with growth mirroring the global CAGR. This substantial market value reflects the critical role 3PL providers play in ensuring the safe, efficient, and compliant transportation and storage of pharmaceuticals throughout the supply chain. The competitive landscape is expected to remain dynamic, with ongoing consolidation and innovation characterizing the industry's evolution.

United States Pharmaceutical 3PL Market Market Size (In Billion)

This growth is further propelled by the increasing adoption of advanced technologies, such as blockchain for enhanced traceability and AI for predictive analytics and route optimization. However, challenges remain, including maintaining regulatory compliance across diverse jurisdictions and managing the risks associated with temperature-sensitive products during transportation and storage. The market's future growth will hinge on the ability of 3PL providers to adapt to evolving regulatory landscapes, invest in cutting-edge technology, and efficiently manage complex, global supply chains for their pharmaceutical clients. Further segmentation within the US market could reveal crucial insights into regional variations in growth and the specific needs of different pharmaceutical segments. A deeper analysis of these factors would provide a more precise understanding of market dynamics and opportunities.

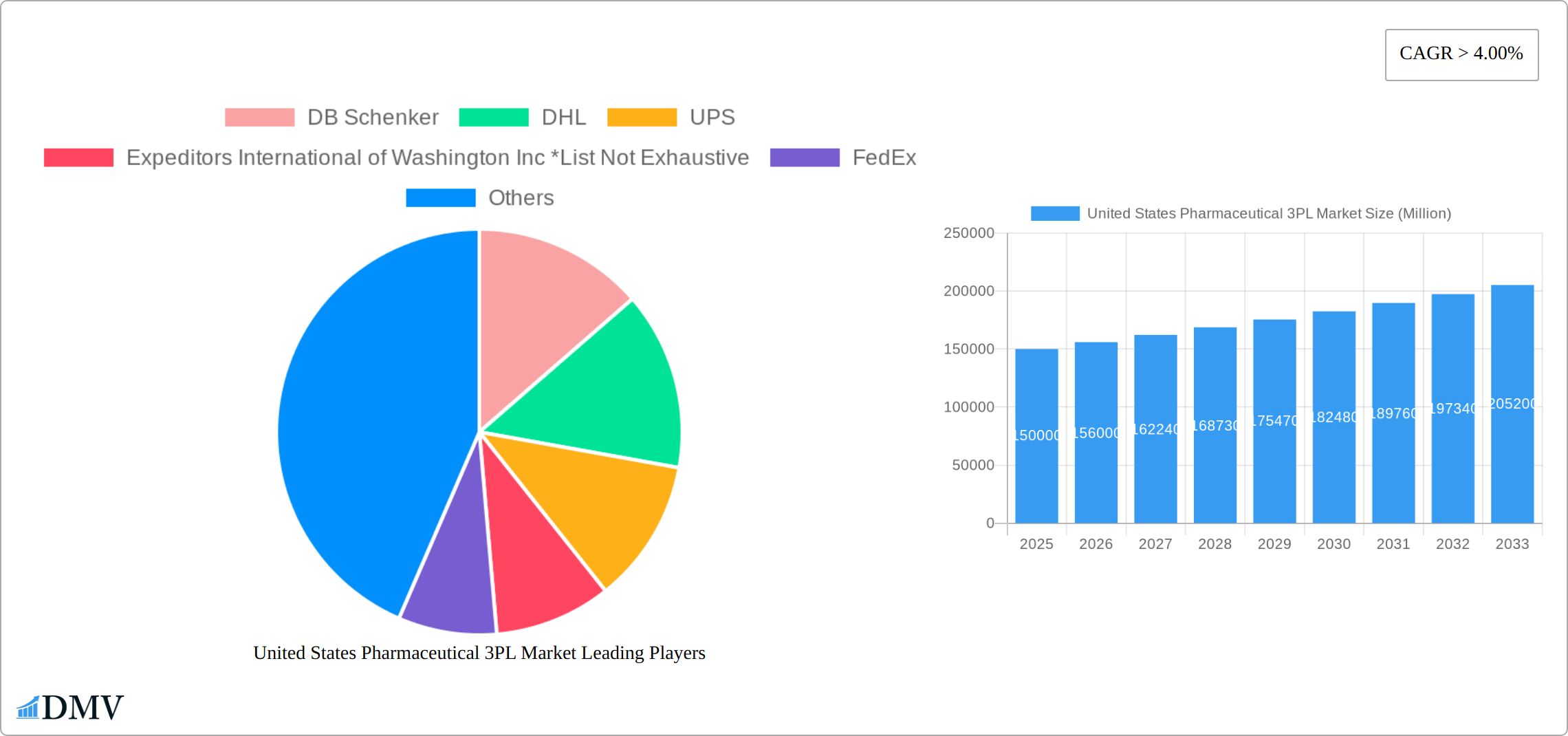

United States Pharmaceutical 3PL Market Company Market Share

United States Pharmaceutical 3PL Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States Pharmaceutical 3PL market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this study is an invaluable resource for stakeholders seeking to understand and navigate this dynamic market. The report projects a market value exceeding xx Million by 2033, showcasing significant growth potential.

United States Pharmaceutical 3PL Market Market Composition & Trends

The US Pharmaceutical 3PL market is characterized by a moderately concentrated landscape, with key players like DB Schenker, DHL, UPS, FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, and C.H. Robinson vying for market share. While precise market share distribution remains dynamic and proprietary, analysis reveals a trend towards consolidation through mergers and acquisitions (M&A). Significant M&A activity, with deal values exceeding xx Million in recent years, reflects the pursuit of scale, enhanced service offerings, and geographical expansion. Innovation, driven by technological advancements in cold chain logistics and data analytics, is a crucial catalyst for growth. The regulatory landscape, particularly concerning drug safety and data privacy, presents both challenges and opportunities. Substitute products are limited, given the stringent regulatory requirements and specialized nature of pharmaceutical logistics. End-users, primarily pharmaceutical manufacturers and distributors, prioritize reliability, compliance, and cost-effectiveness.

- Market Concentration: Moderately concentrated, with top players holding a significant, albeit not dominant, share.

- M&A Activity: Significant activity observed, with deal values exceeding xx Million annually in recent years.

- Innovation Catalysts: Technological advancements in cold chain, data analytics, and automation.

- Regulatory Landscape: Stringent regulations regarding drug safety and data privacy.

- End-User Profile: Pharmaceutical manufacturers and distributors prioritizing reliability, compliance, and cost.

United States Pharmaceutical 3PL Market Industry Evolution

The US Pharmaceutical 3PL market has witnessed robust growth over the historical period (2019-2024), driven by factors such as the increasing outsourcing of logistics functions by pharmaceutical companies, the growing demand for temperature-sensitive drug delivery (cold chain logistics), and the expanding e-commerce sector for pharmaceuticals. Technological advancements, particularly in real-time tracking, predictive analytics, and automation, are further accelerating market growth. Consumer demands for faster, more reliable, and transparent delivery are influencing the market's evolution. The market is projected to maintain a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), fueled by continuous technological innovation and increasing regulatory scrutiny. The adoption rate of advanced technologies such as blockchain for traceability and AI for predictive maintenance is steadily increasing, exceeding xx% in 2025.

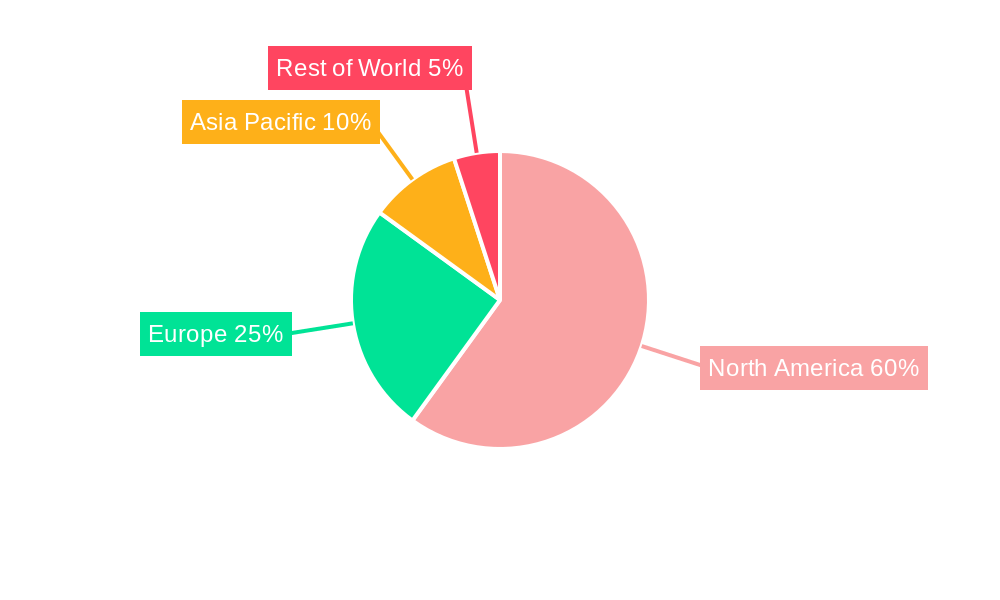

Leading Regions, Countries, or Segments in United States Pharmaceutical 3PL Market

The US Pharmaceutical 3PL market demonstrates significant regional disparity, with certain segments exhibiting robust growth. Market dominance is not uniform geographically, reflecting the concentration of pharmaceutical manufacturers and distribution hubs.

Functional Specialization: Value-added services, such as specialized warehousing and distribution tailored to the unique needs of pharmaceutical products (including temperature-sensitive medications and hazardous materials), represent a substantial market share. This is driven by the growing demand for secure, compliant storage and handling. International transportation management is experiencing particularly rapid growth fueled by the global nature of the pharmaceutical industry.

Supply Chain Focus: The cold chain logistics segment remains dominant, reflecting the paramount importance of maintaining precise temperature control throughout the entire supply chain. This segment's expansion is propelled by substantial investments in cutting-edge cold chain infrastructure, advanced technologies, and stringent regulatory compliance requirements.

Geographic Concentration: The Northeast and West Coast regions currently exhibit higher market concentration due to the established presence of major pharmaceutical manufacturers and key distribution centers. However, growth is anticipated in other regions as the industry expands and diversifies.

Key Growth Catalysts:

- High Investment in Advanced Cold Chain Infrastructure: Continued significant capital expenditure in specialized facilities and innovative temperature-control technologies.

- Stringent Regulatory Compliance: The ever-increasing demand for fully compliant and highly reliable logistics providers capable of navigating complex regulatory landscapes.

- Technological Advancements: Widespread implementation of real-time tracking systems, automation solutions, and sophisticated data analytics for enhanced supply chain visibility and efficiency.

- E-commerce Expansion: The rising popularity of online pharmaceutical sales creates new opportunities for 3PL providers to manage the complexities of direct-to-consumer fulfillment.

United States Pharmaceutical 3PL Market Product Innovations

Recent innovations focus on enhancing temperature control precision, real-time tracking capabilities, and data analytics to optimize supply chain efficiency and ensure product integrity. Solutions such as active temperature-controlled containers, advanced sensors, and cloud-based platforms are gaining traction, offering unique selling propositions through improved visibility, reduced risks, and enhanced compliance.

Propelling Factors for United States Pharmaceutical 3PL Market Growth

Technological advancements, particularly in cold chain logistics and data analytics, are key growth drivers. The increasing complexity of pharmaceutical supply chains and the growing demand for specialized services are also propelling market growth. Government regulations aimed at improving drug safety and supply chain security are creating opportunities for specialized 3PL providers. The expansion of e-commerce for pharmaceuticals is further boosting market growth.

Obstacles in the United States Pharmaceutical 3PL Market Market

Stringent regulations, increasing transportation costs, and the potential for supply chain disruptions pose significant challenges. Maintaining regulatory compliance, managing fluctuating fuel prices, and mitigating risks associated with temperature excursions are major hurdles. Intense competition among established players and the entry of new entrants also impact market dynamics. These factors, in aggregate, could negatively impact projected growth by an estimated xx%.

Future Opportunities in United States Pharmaceutical 3PL Market

The growing demand for personalized medicine, the expansion of the biologics market, and the increasing adoption of advanced technologies present significant growth opportunities. The development of novel cold chain solutions, the integration of AI and machine learning for predictive maintenance, and the exploration of blockchain technology for enhanced traceability are key avenues for future growth.

Major Players in the United States Pharmaceutical 3PL Market Ecosystem

- DB Schenker

- DHL

- UPS

- Expeditors International of Washington Inc

- FedEx

- CEVA Logistics

- Kuehne + Nagel

- Agility

- Kerry Logistics

- C.H. Robinson

Key Developments in United States Pharmaceutical 3PL Market Industry

- May 2021: UPS expanded its specialty pharmaceutical offerings by establishing UPS Cold Chain Solutions.

- December 2021: FedEx Corp. opened a substantially larger air cargo hub at Miami International Airport, including a significantly expanded cold storage facility.

Strategic United States Pharmaceutical 3PL Market Market Forecast

The US Pharmaceutical 3PL market is poised for sustained growth, driven by technological innovations, regulatory changes, and evolving consumer demands. The increasing demand for specialized services, particularly in the cold chain logistics segment, will continue to fuel market expansion. Strategic partnerships, technological advancements, and geographical expansion will remain key strategies for success in this dynamic market. The market is projected to reach xx Million by 2033, demonstrating considerable potential for investors and industry participants.

United States Pharmaceutical 3PL Market Segmentation

-

1. Function

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Supply Chain

- 2.1. Cold Chain

- 2.2. Non-cold Chain

United States Pharmaceutical 3PL Market Segmentation By Geography

- 1. United States

United States Pharmaceutical 3PL Market Regional Market Share

Geographic Coverage of United States Pharmaceutical 3PL Market

United States Pharmaceutical 3PL Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. The United States is Leading in the Pharmaceutical Market Across the World

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical 3PL Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Supply Chain

- 5.2.1. Cold Chain

- 5.2.2. Non-cold Chain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expeditors International of Washington Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 C H Robinson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: United States Pharmaceutical 3PL Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical 3PL Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 3: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 6: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical 3PL Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United States Pharmaceutical 3PL Market?

Key companies in the market include DB Schenker, DHL, UPS, Expeditors International of Washington Inc *List Not Exhaustive, FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, C H Robinson.

3. What are the main segments of the United States Pharmaceutical 3PL Market?

The market segments include Function, Supply Chain.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

The United States is Leading in the Pharmaceutical Market Across the World.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

December 2021: FedEx Corp. began operations at its substantially bigger air cargo hub at Miami International Airport. The USD 72 million addition, two years under development and roughly the size of two football fields, doubles the hub's size to 282,000 square feet. The hub includes FedEx's largest cold storage section, covering 70,000 square feet - the equivalent of 33 tennis courts - of refrigerated and frozen storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical 3PL Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical 3PL Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical 3PL Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical 3PL Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence