Key Insights

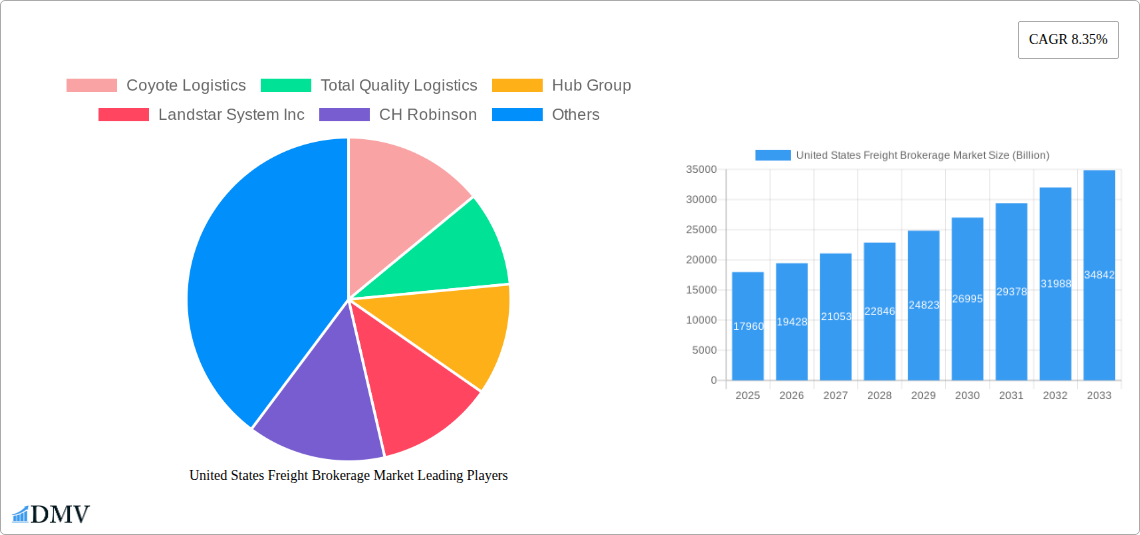

The United States freight brokerage market, valued at approximately $17.96 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.35% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector necessitates efficient and cost-effective logistics solutions, significantly boosting demand for freight brokerage services. Simultaneously, the increasing complexity of supply chains, coupled with fluctuating fuel prices and driver shortages, compels businesses to outsource their freight management to specialized brokers who can optimize routes, negotiate rates, and manage risk. Technological advancements, such as digital freight matching platforms and advanced analytics, are further enhancing efficiency and transparency within the industry, attracting more businesses to utilize freight brokerage services. Growth is particularly strong within the LTL (Less than Truckload) and FTL (Full Truckload) segments, driven by the need for flexible transportation options to accommodate varying shipment sizes and delivery requirements. Major end-user industries such as manufacturing, automotive, and e-commerce are significant contributors to this market growth.

United States Freight Brokerage Market Market Size (In Billion)

While the market demonstrates considerable potential, certain restraints exist. Regulatory changes and compliance requirements related to trucking regulations can increase operational costs for brokers. Economic downturns can also impact freight volumes, leading to reduced demand for brokerage services. Furthermore, intense competition among established players and the emergence of new entrants in the market necessitates continuous innovation and strategic adaptation to maintain market share. Despite these challenges, the long-term outlook for the US freight brokerage market remains positive, driven by the underlying growth of e-commerce, the increasing complexity of supply chains, and technological advancements that improve efficiency and reduce costs. The market's segmentation by service type (LTL, FTL, etc.) and end-user industry allows for targeted strategies, with significant opportunities identified in sectors experiencing rapid growth, such as e-commerce and renewable energy.

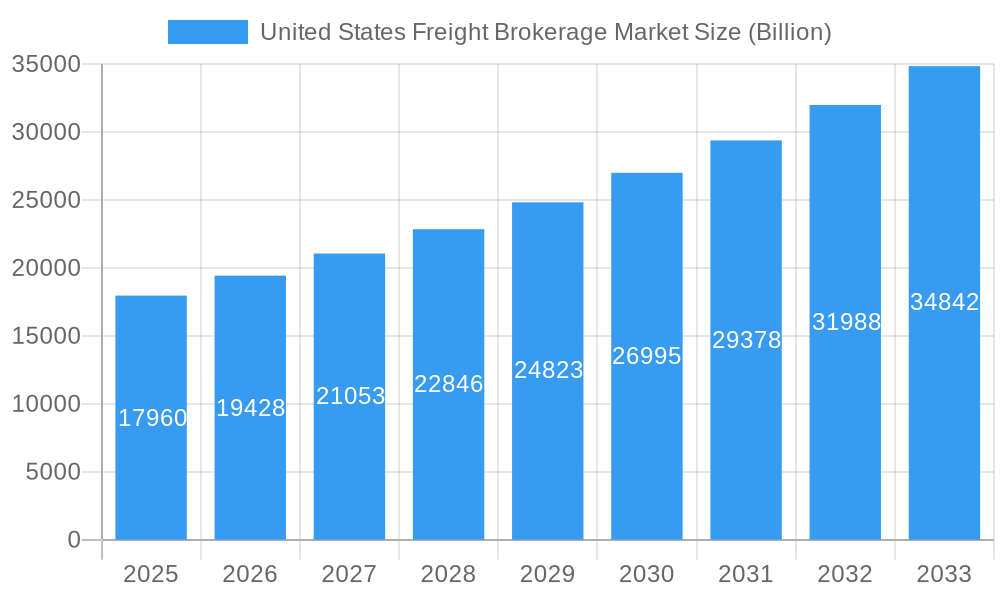

United States Freight Brokerage Market Company Market Share

United States Freight Brokerage Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States Freight Brokerage Market, offering a comprehensive overview of its current state, future trajectory, and key players. Valued at $XX Billion in 2025, the market is poised for significant growth, reaching an estimated $XX Billion by 2033. This in-depth study covers the period from 2019 to 2033, with 2025 serving as the base year. It delves into market segmentation, competitive landscapes, technological advancements, and emerging opportunities, providing stakeholders with crucial insights for strategic decision-making.

United States Freight Brokerage Market Market Composition & Trends

The US freight brokerage market is a dynamic landscape shaped by intense competition, rapid technological advancements, and evolving regulatory frameworks. Market concentration is moderate, with several large players such as Coyote Logistics, Total Quality Logistics, Hub Group, Landstar System Inc, CH Robinson, and others commanding significant market share. However, a large number of smaller and regional players also contribute to the overall market size. The market share distribution is currently estimated to be as follows: top 5 players account for XX%, the next 10 players for XX%, and the remaining market share is divided among numerous smaller players.

- Market Concentration: Moderately concentrated with a few dominant players and numerous smaller firms.

- Innovation Catalysts: Technological advancements in digital freight matching, AI-powered route optimization, and real-time tracking.

- Regulatory Landscape: Subject to evolving federal and state regulations concerning safety, insurance, and environmental compliance.

- Substitute Products: Limited direct substitutes, but alternative transportation modes (rail, maritime) offer indirect competition.

- End-User Profiles: Diverse, spanning Manufacturing & Automotive, Oil & Gas, Retail, and other sectors.

- M&A Activities: Significant M&A activity observed in recent years, with deal values ranging from $XX Billion to $XX Billion. These activities often involve the acquisition of smaller, specialized firms by larger players to enhance their service offerings and market reach.

United States Freight Brokerage Market Industry Evolution

The US freight brokerage market has witnessed remarkable growth over the past decade, driven by increasing e-commerce activity, rising freight volumes, and the ongoing expansion of the logistics and supply chain sector. The market has experienced a Compound Annual Growth Rate (CAGR) of approximately XX% during the historical period (2019-2024). This growth is projected to continue, with a forecast CAGR of XX% expected during the forecast period (2025-2033). This positive trajectory is fueled by several factors: the accelerating adoption of digital technologies, including advanced analytics, AI and machine learning; increasing demand for efficient and reliable transportation solutions across multiple industry sectors; and government initiatives promoting infrastructure development and logistics optimization. The ongoing shift towards just-in-time (JIT) inventory management models also creates new opportunities for freight brokerages to offer flexible and responsive solutions. Furthermore, the emergence of new business models, such as digital freight marketplaces and on-demand trucking platforms, is significantly changing the competitive landscape. These platforms are often disrupting traditional business models, streamlining operations, and enhancing transparency within the freight brokerage market. Finally, regulatory developments, including those focusing on driver safety, sustainability, and supply chain resilience, are continuously impacting market dynamics.

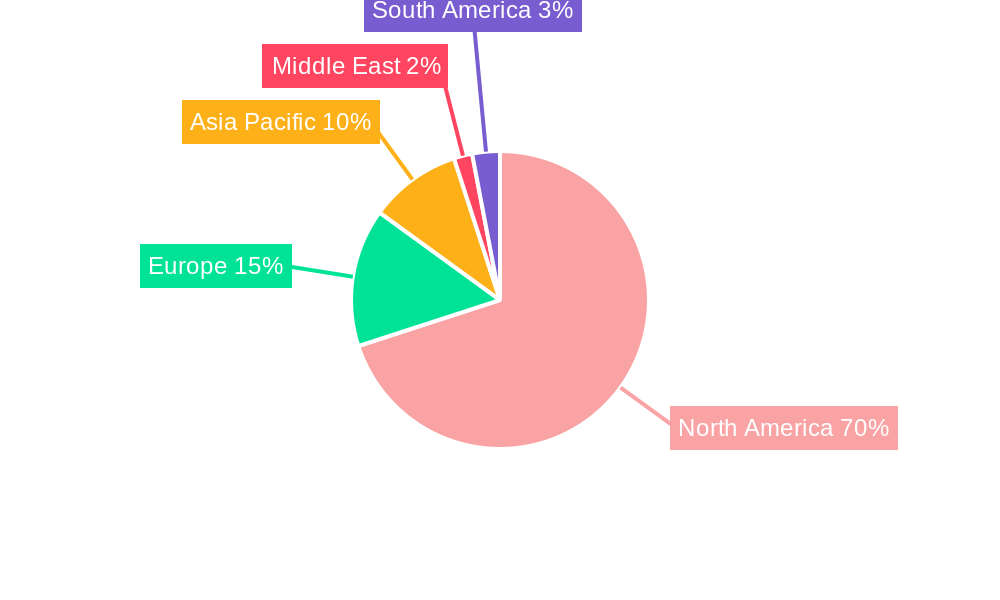

Leading Regions, Countries, or Segments in United States Freight Brokerage Market

The US freight brokerage market is geographically diverse, with strong presence across multiple states and regions. However, certain segments exhibit greater growth potential and dominance:

By Service:

- Full Truckload (FTL): This segment currently holds the largest market share, driven by the high demand for large-scale goods transportation.

- Less-Than-Truckload (LTL): A significant segment, characterized by the cost-effective movement of smaller shipments. Growth in this sector is expected to remain steady, aligning with various industries’ demands for efficient small-parcel shipping solutions.

- Other Services: This encompasses specialized services like intermodal transportation, temperature-controlled freight, and oversized cargo shipping, which are growing in line with the specialized needs of diverse industries.

By End User:

- Manufacturing and Automotive: This sector consistently represents a substantial portion of the market due to the high volume of goods movement required throughout the manufacturing, distribution, and supply chains.

- Distributive Trade (Wholesale and Retail, FMCG included): The expansion of e-commerce and the associated need for efficient last-mile delivery solutions fuels significant growth within this market segment.

Key Drivers:

- High volume of freight movement in these segments.

- Significant investments in logistics infrastructure and technology.

- Strong regulatory support for efficient transportation.

The dominance of these segments reflects the overall economic activity and the transportation needs of major industries in the US.

United States Freight Brokerage Market Product Innovations

Recent product innovations in the US freight brokerage market emphasize technology integration to enhance efficiency, transparency, and customer experience. This includes the development of sophisticated digital platforms for freight matching, route optimization, and real-time tracking, as well as the adoption of AI and machine learning algorithms for predictive analytics and risk management. Furthermore, the integration of telematics and IoT devices enables enhanced visibility into shipment status and asset tracking, while the introduction of innovative insurance products and cargo protection schemes offers added value to clients. Unique selling propositions center on improved efficiency, cost savings, and enhanced supply chain visibility.

Propelling Factors for United States Freight Brokerage Market Growth

Several factors fuel the growth of the US freight brokerage market: the booming e-commerce sector and the resulting increase in package deliveries, the continuous demand for efficient and reliable logistics solutions across various sectors (manufacturing, retail, etc.), technological advancements that enable optimization and automation of freight processes, and government regulations which strive to ensure safety and compliance within the industry. These combined factors stimulate strong demand for the services provided by freight brokerages.

Obstacles in the United States Freight Brokerage Market Market

The US freight brokerage market faces challenges including fluctuations in fuel prices, driver shortages, and ongoing supply chain disruptions. These disruptions may lead to increased freight costs and delays. Intense competition from both established players and emerging digital platforms also presents a significant hurdle. Stringent regulatory requirements, increasing insurance costs, and cybersecurity concerns further complicate the market environment. These obstacles can lead to decreased profitability and operational inefficiencies for freight brokerage firms.

Future Opportunities in United States Freight Brokerage Market

The US freight brokerage market holds significant growth potential, particularly within niche sectors such as cold chain logistics, specialized cargo transportation, and sustainable transportation options. The integration of advanced technologies, such as blockchain and AI, presents opportunities for enhanced security and efficiency. The development of innovative business models, such as integrated logistics platforms, and the expansion into new markets with high growth potential, create ample opportunities for growth.

Major Players in the United States Freight Brokerage Market Ecosystem

- Coyote Logistics

- Total Quality Logistics

- Hub Group

- Landstar System Inc

- CH Robinson

- KAG Logistics Inc

- SunteckTTS

- BNSF Logistics LLC

- XPO Logistics Inc

- Uber Freight

- 63 Other Companies

- Worldwide Express

- Schneider

- Echo Global Logistics

- GlobalTranz

- J B Hunt Transport Inc

Key Developments in United States Freight Brokerage Market Industry

August 2023: Convoy launches a just-in-time (JIT) trucking service, enhancing flexibility and responsiveness for shippers. This development reflects the market's growing demand for agile and customized logistics solutions.

February 2023: Echo Global Logistics introduces EchoInsure+, a comprehensive cargo insurance product, improving risk management for clients and potentially raising the bar for industry standards.

Strategic United States Freight Brokerage Market Market Forecast

The US freight brokerage market is poised for continued growth, driven by technological advancements, increasing e-commerce activity, and the ongoing demand for efficient and reliable transportation services. The market’s potential is substantial, with numerous opportunities for innovation, expansion into new segments, and the development of cutting-edge logistics solutions. The forecast period suggests robust growth potential, particularly for companies able to adapt to evolving market dynamics and leverage technological advancements.

United States Freight Brokerage Market Segmentation

-

1. Service

- 1.1. LTL

- 1.2. FTL

- 1.3. Other Services

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

United States Freight Brokerage Market Segmentation By Geography

- 1. United States

United States Freight Brokerage Market Regional Market Share

Geographic Coverage of United States Freight Brokerage Market

United States Freight Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Construction Across the Country4.; The Growing Number of Freight Brokers Across the Country

- 3.3. Market Restrains

- 3.3.1. 4.; Rerouting of Cargo and Other Factors4.; Reducing Freight Imports Across the Country

- 3.4. Market Trends

- 3.4.1. FTL Service Has Gained Momentum in the Country in Recent Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Freight Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. LTL

- 5.1.2. FTL

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coyote Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total Quality Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hub Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Landstar System Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CH Robinson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KAG Logistics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SunteckTTS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BNSF Logistics LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Uber Freight**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Worldwide Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Schneider

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Echo Global Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 GlobalTranz

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 J B Hunt Transport Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Coyote Logistics

List of Figures

- Figure 1: United States Freight Brokerage Market Revenue Breakdown (Billion, %) by Product 2025 & 2033

- Figure 2: United States Freight Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Freight Brokerage Market Revenue Billion Forecast, by Service 2020 & 2033

- Table 2: United States Freight Brokerage Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 3: United States Freight Brokerage Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 4: United States Freight Brokerage Market Revenue Billion Forecast, by Service 2020 & 2033

- Table 5: United States Freight Brokerage Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 6: United States Freight Brokerage Market Revenue Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Freight Brokerage Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the United States Freight Brokerage Market?

Key companies in the market include Coyote Logistics, Total Quality Logistics, Hub Group, Landstar System Inc, CH Robinson, KAG Logistics Inc, SunteckTTS, BNSF Logistics LLC, XPO Logistics Inc, Uber Freight**List Not Exhaustive 6 3 Other Companie, Worldwide Express, Schneider, Echo Global Logistics, GlobalTranz, J B Hunt Transport Inc.

3. What are the main segments of the United States Freight Brokerage Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 Billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Construction Across the Country4.; The Growing Number of Freight Brokers Across the Country.

6. What are the notable trends driving market growth?

FTL Service Has Gained Momentum in the Country in Recent Years.

7. Are there any restraints impacting market growth?

4.; Rerouting of Cargo and Other Factors4.; Reducing Freight Imports Across the Country.

8. Can you provide examples of recent developments in the market?

August 2023: Digital logistics provider and freight brokerage Convoy unveiled an offering for just-in-time (JIT) trucking, with a pledge of delivery within 15 minutes of the set arrival time. Convoy spotted an opening for a more flexible service that gives shippers the ability to scale up and down in response to fast-changing conditions. Its new JIT service leverages a network of over 400,000 trucks and the IT infrastructure to find matching carriers to meet specific shipper requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Freight Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Freight Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Freight Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Freight Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence