Key Insights

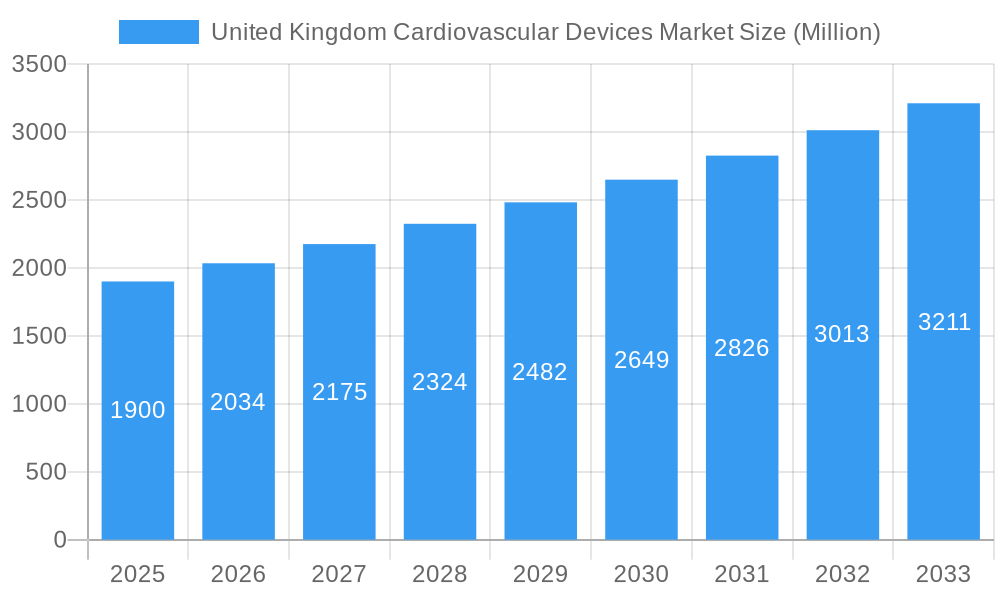

The United Kingdom cardiovascular devices market is poised for significant expansion, propelled by an aging demographic, escalating cardiovascular disease (CVD) incidence, and rapid technological innovation in minimally invasive procedures. Enhanced healthcare expenditure and widespread adoption of advanced diagnostic and therapeutic technologies further bolster this growth trajectory. The UK market is projected to reach approximately £19.07 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.6% from the base year 2025. This projection considers the nation's advanced healthcare infrastructure and substantial per capita healthcare spending. The market is bifurcated into diagnostic and monitoring devices, and therapeutic and surgical devices, with the latter segment anticipated to lead growth due to increasing demand for minimally invasive interventions and novel device solutions. Leading companies including Medtronic, Boston Scientific, and Abbott Laboratories are driving innovation through substantial R&D investments.

United Kingdom Cardiovascular Devices Market Market Size (In Billion)

The market demonstrates promising future prospects, with sustained growth anticipated through 2033. However, potential headwinds include stringent regulatory pathways, high device procurement costs, and the influence of Brexit on healthcare investment strategies. Despite these challenges, continuous advancements in implantable cardioverter-defibrillators (ICDs), cardiac rhythm management (CRM) devices, and minimally invasive surgical instruments are expected to propel market expansion. The emphasis on enhancing patient outcomes via early detection and effective treatment modalities will continue to drive demand for sophisticated cardiovascular devices within the UK. The rising prevalence of conditions such as coronary artery disease, heart failure, and arrhythmias are key contributors to this robust market dynamic.

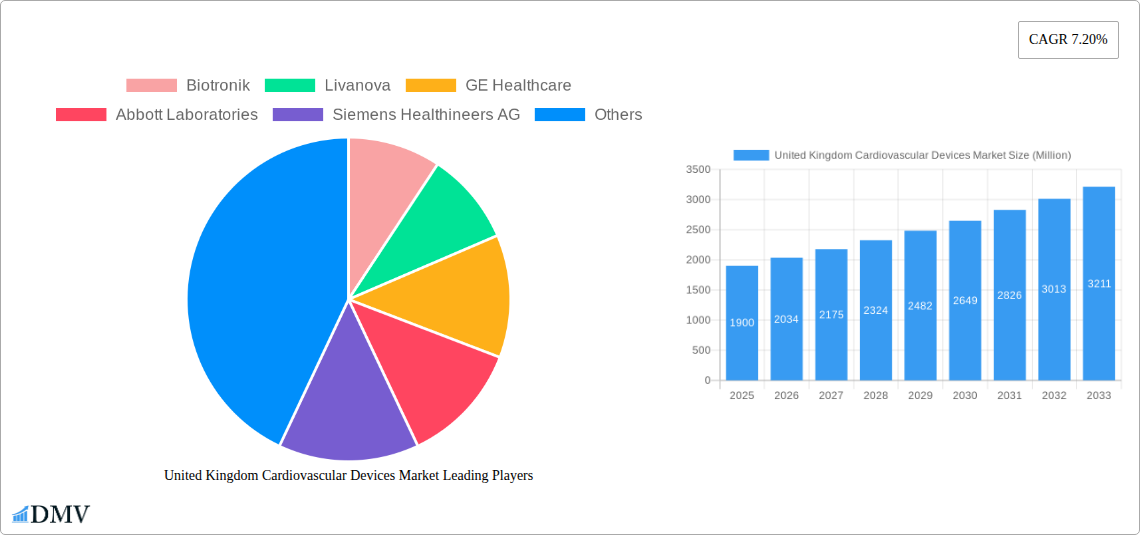

United Kingdom Cardiovascular Devices Market Company Market Share

United Kingdom Cardiovascular Devices Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United Kingdom Cardiovascular Devices Market, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United Kingdom Cardiovascular Devices Market Composition & Trends

The UK cardiovascular devices market is characterized by a moderately concentrated landscape, with key players like Medtronic Plc, Abbott Laboratories, and Boston Scientific Corporation holding significant market share. The market share distribution amongst these top players is estimated to be approximately xx% in 2025. Innovation is driven by advancements in minimally invasive procedures, digital health technologies, and personalized medicine. Stringent regulatory frameworks, primarily governed by the Medicines and Healthcare products Regulatory Agency (MHRA), play a crucial role in shaping market dynamics. Substitute products, such as lifestyle modifications and pharmaceutical interventions, exert competitive pressure. The end-user profile encompasses hospitals, clinics, and ambulatory surgical centers. M&A activities have been moderate in recent years, with deal values averaging approximately xx Million per transaction over the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Catalysts: Minimally invasive procedures, digital health, personalized medicine.

- Regulatory Landscape: Stringent, governed by the MHRA.

- Substitute Products: Lifestyle changes, pharmaceuticals.

- End-Users: Hospitals, clinics, ambulatory surgical centers.

- M&A Activity: Moderate, with average deal values of xx Million.

United Kingdom Cardiovascular Devices Market Industry Evolution

The UK cardiovascular devices market has experienced steady growth over the historical period (2019-2024), driven by an aging population, rising prevalence of cardiovascular diseases, and technological advancements. The market witnessed a growth rate of xx% between 2019 and 2024. Technological advancements, such as the introduction of novel drug-eluting stents and minimally invasive surgical techniques, have significantly improved patient outcomes and driven market expansion. Increasing demand for advanced diagnostic and monitoring devices, coupled with a shift towards remote patient monitoring, has further fueled market growth. Consumer demand is increasingly focused on minimally invasive procedures, shorter recovery times, and improved long-term outcomes. The adoption rate of advanced cardiovascular devices is expected to increase steadily during the forecast period, driven by factors such as increased healthcare expenditure and greater physician adoption of new technologies. The market is projected to witness a growth rate of xx% between 2025 and 2033.

Leading Regions, Countries, or Segments in United Kingdom Cardiovascular Devices Market

The Diagnostic and Monitoring Devices segment currently dominates the UK cardiovascular devices market, owing to the increasing demand for early diagnosis and continuous patient monitoring. The Therapeutic and Surgical Devices segment is expected to witness substantial growth during the forecast period, driven by advancements in minimally invasive procedures and the rising prevalence of complex cardiovascular conditions.

Diagnostic and Monitoring Market Key Drivers:

- High prevalence of cardiovascular diseases.

- Increased focus on early diagnosis and preventative care.

- Government initiatives promoting early detection programs.

- Technological advancements in diagnostic imaging and monitoring devices.

Therapeutic and Surgical Devices Market Key Drivers:

- Rising prevalence of complex cardiovascular diseases requiring advanced therapies.

- Technological advancements in minimally invasive procedures.

- Improved patient outcomes and reduced recovery times.

- Increasing healthcare expenditure.

The dominance of these segments is primarily driven by the increasing incidence of cardiovascular diseases in the UK and the subsequent demand for effective diagnostic and treatment solutions. London and other major urban centers are expected to remain key markets due to the concentration of specialized hospitals and healthcare professionals.

United Kingdom Cardiovascular Devices Market Product Innovations

Recent innovations include the development of bioabsorbable stents that dissolve over time, reducing the risk of long-term complications. Smart implantable devices with remote monitoring capabilities are also gaining traction, enabling continuous patient monitoring and early detection of potential issues. These innovations are characterized by enhanced precision, improved biocompatibility, and reduced invasiveness, leading to better patient outcomes and reduced healthcare costs. The unique selling propositions often include minimized invasiveness, improved efficacy, remote monitoring capabilities, and enhanced patient comfort.

Propelling Factors for United Kingdom Cardiovascular Devices Market Growth

The UK cardiovascular devices market is propelled by several factors: the aging population, increased prevalence of cardiovascular diseases, rising healthcare expenditure, and technological advancements leading to improved treatment options. Government initiatives promoting preventative healthcare and early diagnosis also contribute significantly to market growth. Furthermore, the increasing adoption of minimally invasive procedures reduces hospital stays and improves patient outcomes, further stimulating demand.

Obstacles in the United Kingdom Cardiovascular Devices Market

The market faces challenges including stringent regulatory approvals, potential supply chain disruptions, and intense competition from established players. High costs associated with advanced devices can also limit accessibility, while reimbursement policies can influence market uptake. These factors can collectively impact the market’s growth trajectory, though technological innovation and strategic partnerships may mitigate some of these risks.

Future Opportunities in United Kingdom Cardiovascular Devices Market

Emerging opportunities lie in the development and adoption of advanced digital health technologies, including remote patient monitoring and artificial intelligence-driven diagnostics. Furthermore, personalized medicine and the development of biocompatible and bioresorbable devices offer significant growth potential. The expansion of minimally invasive procedures and targeted drug delivery systems present further avenues for market expansion.

Major Players in the United Kingdom Cardiovascular Devices Market Ecosystem

- Biotronik

- Livanova

- GE Healthcare

- Abbott Laboratories

- Siemens Healthineers AG

- Cardinal Health

- Medtronic Plc

- Boston Scientific Corporation

- B Braun SE

- W L Gore & Associates Inc

Key Developments in United Kingdom Cardiovascular Devices Market Industry

July 2022: Novartis Pharmaceuticals United Kingdom launched the Novartis Biome UK Heart Health Catalyst 2022, a partnership aiming to improve patient heart health through home-based digital solutions. This initiative highlights the growing importance of digital health in cardiovascular care.

February 2022: Ceryx Medical Limited developed Cysoni, a bionic device pacing the heart with real-time respiratory modulation. This innovation represents a significant advancement in cardiac pacing technology.

Strategic United Kingdom Cardiovascular Devices Market Forecast

The UK cardiovascular devices market is poised for significant growth, driven by technological innovation, an aging population, and increasing awareness of cardiovascular diseases. Continued investment in research and development, coupled with the adoption of advanced digital health solutions, will further fuel market expansion. The focus on personalized medicine and minimally invasive procedures will create new opportunities for market players, leading to sustained growth throughout the forecast period.

United Kingdom Cardiovascular Devices Market Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Market

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Market

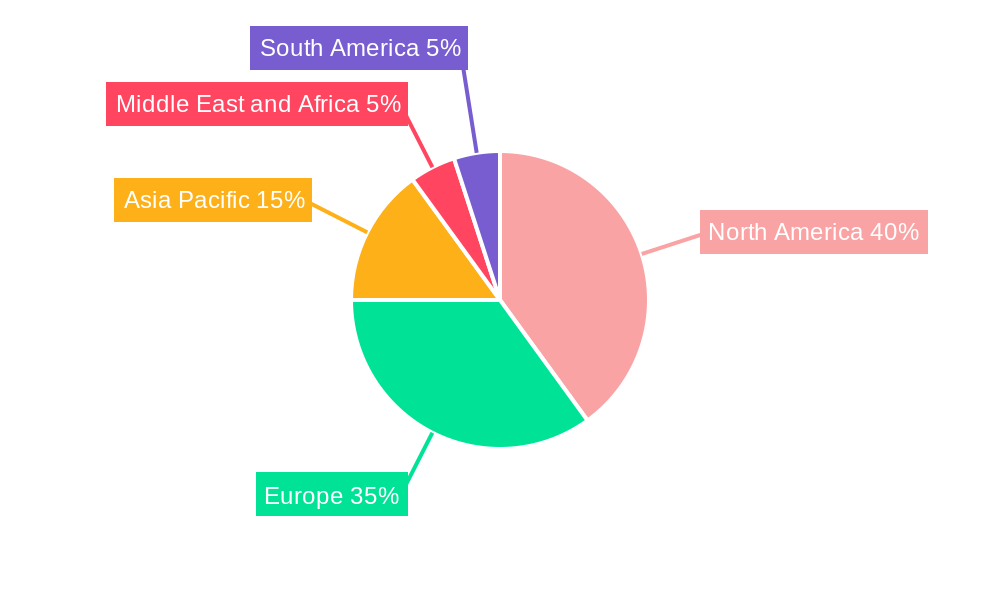

United Kingdom Cardiovascular Devices Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Cardiovascular Devices Market Regional Market Share

Geographic Coverage of United Kingdom Cardiovascular Devices Market

United Kingdom Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Cardiovascular Diseases; Technological Advancement in the Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Cardiac Rhythm Management Devices Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Market

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Market

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Biotronik

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Livanova

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cardinal Health

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Biotronik

List of Figures

- Figure 1: United Kingdom Cardiovascular Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Cardiovascular Devices Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 6: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Cardiovascular Devices Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the United Kingdom Cardiovascular Devices Market?

Key companies in the market include Biotronik, Livanova, GE Healthcare, Abbott Laboratories, Siemens Healthineers AG, Cardinal Health, Medtronic Plc, Boston Scientific Corporation, B Braun SE, W L Gore & Associates Inc.

3. What are the main segments of the United Kingdom Cardiovascular Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Cardiovascular Diseases; Technological Advancement in the Devices.

6. What are the notable trends driving market growth?

Cardiac Rhythm Management Devices Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

July 2022: Novartis Pharmaceuticals United Kingdom launched the Novartis Biome UK Heart Health Catalyst 2022 in a world-first investor partnership with Medtronic Ltd., RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust and its official charity, CW+. The initiative aims to identify and implement solutions that empower patients to improve their heart health and help prevent future heart attacks or strokes through home-based digital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the United Kingdom Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence