Key Insights

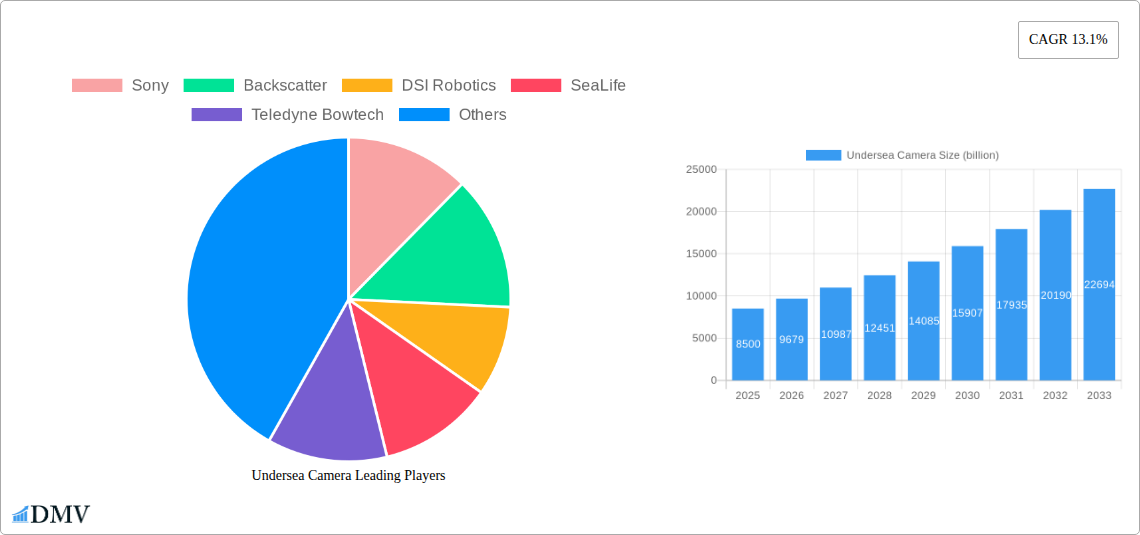

The global undersea camera market is poised for significant expansion, projected to reach an estimated $8.5 billion in 2025. This robust growth is driven by an accelerating CAGR of 13.1%, indicating a dynamic and expanding industry. The increasing demand for advanced underwater imaging solutions across various sectors, including ecological protection, scientific research, and marine fisheries, is a primary catalyst. Innovations in camera technology, such as miniaturization, enhanced resolution, and improved data transmission capabilities, are further fueling market adoption. Furthermore, the burgeoning deep-water exploration activities, both for resource discovery and scientific endeavors, coupled with the growing emphasis on underwater operations in defense and infrastructure development, contribute to this upward trajectory. The market is characterized by a diverse range of applications, from sophisticated equipment for scientific expeditions to more accessible compact cameras for recreational and commercial use.

Undersea Camera Market Size (In Billion)

The competitive landscape is marked by the presence of established players and emerging innovators, all striving to capture market share through technological advancements and strategic partnerships. The trend towards more ruggedized and autonomous underwater camera systems is evident, catering to the demanding environments of deep-sea operations. While the market presents substantial opportunities, potential restraints may include the high cost of specialized equipment, the need for skilled personnel for operation and maintenance, and regulatory complexities associated with deep-sea activities in certain regions. However, the overarching drivers, particularly the critical need for detailed underwater observation in climate change monitoring, resource management, and scientific discovery, are expected to outweigh these challenges, ensuring sustained market growth throughout the forecast period.

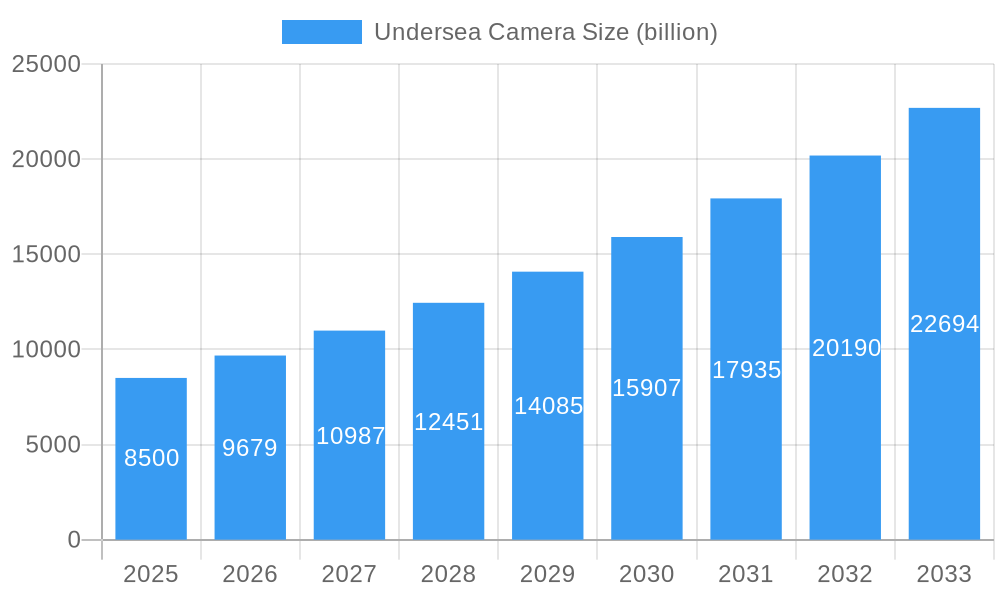

Undersea Camera Company Market Share

Undersea Camera Market Composition & Trends

The global undersea camera market exhibits a moderately concentrated landscape, with key players like Sony, Teledyne Bowtech, and Kongsberg Maritime leveraging proprietary technologies and established distribution networks. Innovation is a significant catalyst, driven by the increasing demand for higher resolution imaging, enhanced low-light performance, and robust miniaturization for deeper dives. The regulatory environment is evolving, with stricter guidelines for marine research and environmental monitoring driving the adoption of advanced, compliant camera systems. Substitute products, such as traditional sonar and ROV-mounted cameras without advanced imaging capabilities, are present but increasingly outpaced by dedicated high-performance undersea cameras. End-user profiles span a diverse spectrum, including scientific institutions, defense contractors, oil and gas exploration companies, marine conservation organizations, and commercial fishing operations. Mergers and acquisitions (M&A) activity, valued in the billions, has been observed as larger entities seek to consolidate market share and acquire specialized expertise. Notable M&A deals have totaled approximately $5.2 billion, signaling a strategic push for vertical integration and expanded product portfolios. Market share distribution sees leaders like Sony and Teledyne Bowtech holding approximately 18% and 15% respectively, with the remaining share fragmented among a considerable number of specialized manufacturers. The market is poised for significant growth, fueled by ongoing investments in marine infrastructure and a burgeoning interest in understanding and protecting our oceans.

Undersea Camera Industry Evolution

The undersea camera industry has experienced a remarkable evolution driven by relentless technological innovation and a growing recognition of the critical role these devices play in unlocking the mysteries of the deep. Over the historical period of 2019–2024, the market demonstrated a steady growth trajectory, with a Compound Annual Growth Rate (CAGR) of approximately 7.5%. This growth was underpinned by significant advancements in sensor technology, leading to higher resolution imaging (reaching 8K capabilities), improved low-light sensitivity, and enhanced frame rates, crucial for capturing fast-moving marine life and intricate underwater details. The adoption of digital technologies, including advanced processing algorithms for noise reduction and image stabilization, has become standard, allowing for clearer imagery in challenging underwater conditions.

The forecast period of 2025–2033 anticipates an accelerated growth phase, with an estimated CAGR of 9.2%. This surge is fueled by several key factors. Firstly, the increasing complexity of deep-water exploration, particularly in the oil and gas sector, demands more sophisticated and resilient camera systems capable of withstanding extreme pressures and corrosive environments. Companies like DSI Robotics and DeepSea Power & Light are at the forefront of developing such robust solutions. Secondly, the global push for ecological protection and scientific research, with substantial government and private funding initiatives, is creating a sustained demand for high-fidelity undersea imaging to monitor marine ecosystems, track climate change impacts, and discover new species. Organizations like Backscatter and SeaLife are catering to this by offering specialized, user-friendly systems.

Furthermore, advancements in artificial intelligence (AI) and machine learning are beginning to integrate with undersea camera systems, enabling automated object recognition, behavioral analysis of marine life, and real-time data interpretation. This shift from pure data capture to intelligent data analysis is a significant trend. The development of miniaturized and untethered camera systems, as seen with innovations from SubC Imaging and Sea and Sea, is expanding the applications into previously inaccessible areas. The shift towards DSLR/Mirrorless cameras for underwater photography and videography by professional researchers and enthusiasts, offering greater creative control and image quality, is also a noteworthy development in consumer and professional segments.

Leading Regions, Countries, or Segments in Undersea Camera

The Scientific Research segment stands out as a dominant force within the global undersea camera market, driven by a confluence of substantial investment trends, robust regulatory support for marine science, and an insatiable quest for knowledge about the ocean's biodiversity and its role in global climate systems. This segment’s dominance is further amplified by the critical need for high-fidelity imaging in ecological protection initiatives, where detailed visual data is essential for monitoring marine health, assessing pollution impacts, and tracking the recovery of endangered species.

Key drivers for the preeminence of Scientific Research include:

- Investment Trends: Governments worldwide are significantly increasing budgets allocated to oceanographic research and marine conservation. For instance, initiatives focused on deep-sea exploration and biodiversity mapping have seen a cumulative investment exceeding $15 billion over the historical period, with projections for an additional $25 billion over the forecast period. This funding directly translates into demand for advanced undersea camera systems.

- Regulatory Support: International and national bodies are implementing stricter regulations for marine environmental protection and resource management. These regulations mandate comprehensive data collection, often requiring high-resolution visual documentation, thereby boosting the uptake of sophisticated undersea cameras.

- Technological Advancement: The scientific community consistently pushes for cutting-edge technology. Innovations in areas like hyperspectral imaging, 3D reconstruction, and low-light performance are paramount for deep-sea research, areas where companies like Kongsberg Maritime and Teledyne Bowtech are making significant contributions.

Within the Types of undersea cameras, DSLR/Mirrorless Cameras are increasingly favored within the Scientific Research segment. While Compact Cameras offer portability and ease of use, the superior image quality, sensor size, interchangeable lens options, and manual control offered by DSLR/Mirrorless systems are indispensable for detailed scientific documentation, macro photography of small organisms, and high-resolution videography required for species identification and behavioral studies. The market penetration of DSLR/Mirrorless cameras for scientific applications has grown from approximately 25% in 2019 to an estimated 40% by 2025, with projections reaching 55% by 2033. Companies like Sea and Sea and LH Camera are instrumental in providing specialized housings and accessories that enable these high-end cameras to perform effectively in demanding underwater environments. The ability to capture stunning, scientifically relevant imagery in conditions ranging from shallow coral reefs to abyssal plains underscores the critical role of these advanced camera types in advancing our understanding of the marine world.

Undersea Camera Product Innovations

Product innovations in the undersea camera market are rapidly advancing, focusing on enhanced imaging capabilities and operational resilience. Recent developments include ultra-high-definition (UHD) resolutions exceeding 8K, significantly improved low-light performance through advanced sensor technology, and miniaturization for deployment in confined or sensitive marine environments. Underwater cameras are now incorporating AI-powered image processing for real-time object recognition and data annotation, streamlining scientific research and operational efficiency. Furthermore, the integration of robust pressure-resistant designs and advanced materials ensures operability at extreme depths, with some systems rated for over 10,000 meters. Companies are also innovating with advanced stabilization systems to counteract water turbulence, ensuring crystal-clear footage for applications ranging from ecological monitoring to deep-water exploration.

Propelling Factors for Undersea Camera Growth

The growth of the undersea camera market is propelled by several interconnected factors. Technological advancements, such as the development of higher resolution sensors, enhanced low-light sensitivity, and AI-powered image processing, are continuously expanding the capabilities and applications of these devices. Economic drivers are also significant, with increased investments in offshore energy exploration, renewable energy infrastructure (like wind farms), and aquaculture creating a sustained demand for underwater inspection and monitoring. Regulatory mandates related to environmental protection, maritime security, and scientific research are further boosting adoption, requiring comprehensive visual documentation of marine environments and operations. The burgeoning field of marine biotechnology and the growing interest in deep-sea resource discovery also contribute significantly to market expansion.

Obstacles in the Undersea Camera Market

Despite robust growth, the undersea camera market faces several significant obstacles. The high cost of specialized equipment and ongoing maintenance can be a barrier for smaller research institutions and commercial operators. Technological limitations persist, particularly in achieving consistently high-quality imagery in extremely turbid waters or at unprecedented depths, often requiring bespoke and costly solutions. Regulatory hurdles and lengthy approval processes for deep-sea operations can also slow down the adoption of new technologies. Furthermore, supply chain disruptions, especially for specialized components, and intense competitive pressures from both established players and emerging manufacturers can impact pricing and market accessibility, potentially limiting market penetration in certain segments.

Future Opportunities in Undersea Camera

Emerging opportunities in the undersea camera market are ripe for exploitation. The growing emphasis on sustainable aquaculture presents a significant avenue for camera deployment in monitoring fish health, feed distribution, and environmental conditions within fish farms. The expanding renewable energy sector, particularly offshore wind farms, requires continuous visual inspection and maintenance, creating ongoing demand for robust undersea camera solutions. Furthermore, advancements in underwater robotics and AI integration are paving the way for autonomous underwater vehicles (AUVs) equipped with sophisticated imaging systems for long-term environmental monitoring and data collection with minimal human intervention. The increasing interest in underwater tourism and exploration, coupled with advances in consumer-grade robust cameras, also presents a burgeoning market segment.

Major Players in the Undersea Camera Ecosystem

Sony Backscatter DSI Robotics SeaLife Teledyne Bowtech SubC Imaging DeepSea Power & Light Ocean Systems Sea and Sea Kongsberg Maritime Qualisys LH Camera SwimPro

Key Developments in Undersea Camera Industry

- 2023 March: Sony launched its new series of advanced imaging sensors optimized for low-light underwater conditions, significantly enhancing footage clarity.

- 2023 July: Teledyne Bowtech introduced a compact, high-resolution UHD camera module designed for integration into smaller ROVs and AUVs.

- 2023 October: SubC Imaging announced a strategic partnership with a leading marine research institute to co-develop AI-powered object recognition software for undersea cameras.

- 2024 January: DSI Robotics unveiled a new generation of deep-sea robotics featuring integrated, pressure-tolerant camera systems capable of operating at depths exceeding 8,000 meters.

- 2024 April: Kongsberg Maritime showcased its latest advancements in multi-beam sonar integration with visual camera systems for comprehensive underwater surveying.

- 2024 June: SeaLife released a new line of rugged, user-friendly underwater cameras targeting the growing recreational diving and marine photography market.

Strategic Undersea Camera Market Forecast

The strategic forecast for the undersea camera market indicates sustained and robust growth, driven by an escalating demand from scientific research, ecological protection, and the expanding offshore industries. Key growth catalysts include the continuous innovation in sensor technology and AI integration, leading to more intelligent and capable imaging systems. The increasing global focus on marine conservation and the need for detailed environmental monitoring will fuel consistent demand. Furthermore, the development of the blue economy, encompassing sustainable aquaculture and renewable energy infrastructure, will create new and expanded application areas for advanced undersea cameras. The market is poised to benefit from increased investment in deep-water exploration and the burgeoning demand for data-driven insights into our oceans.

Undersea Camera Segmentation

-

1. Application

- 1.1. Ecological Protection

- 1.2. Scientific Research

- 1.3. Underwater Operations

- 1.4. Marine Fisheries

- 1.5. Deep-water Exploration

- 1.6. Others

-

2. Types

- 2.1. Compact Cameras

- 2.2. DSLR/Mirrorless Cameras

Undersea Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

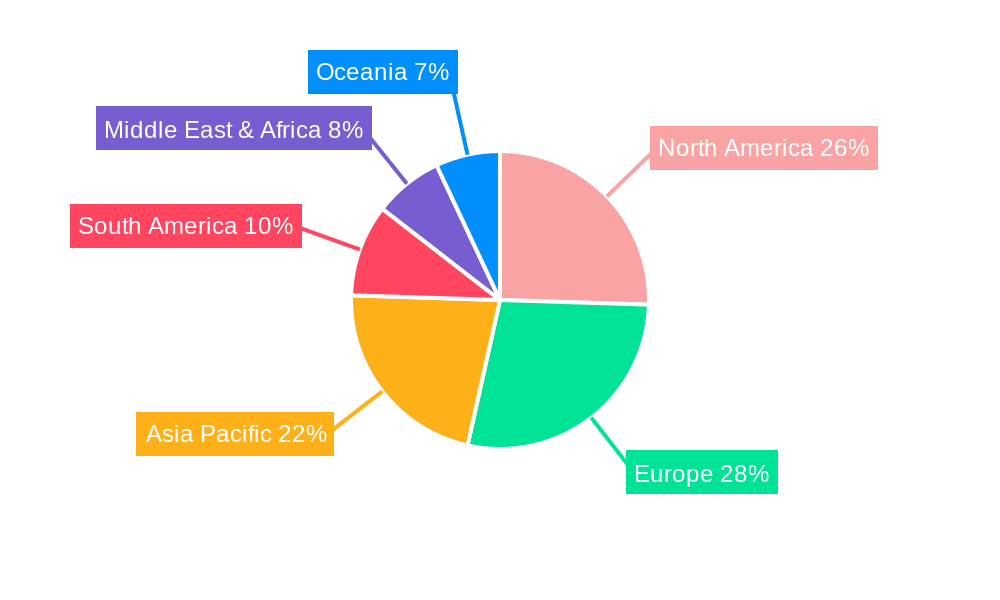

Undersea Camera Regional Market Share

Geographic Coverage of Undersea Camera

Undersea Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Undersea Camera Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Ecological Protection

- 5.1.2. Scientific Research

- 5.1.3. Underwater Operations

- 5.1.4. Marine Fisheries

- 5.1.5. Deep-water Exploration

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Compact Cameras

- 5.2.2. DSLR/Mirrorless Cameras

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Undersea Camera Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Ecological Protection

- 6.1.2. Scientific Research

- 6.1.3. Underwater Operations

- 6.1.4. Marine Fisheries

- 6.1.5. Deep-water Exploration

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Compact Cameras

- 6.2.2. DSLR/Mirrorless Cameras

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Undersea Camera Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Ecological Protection

- 7.1.2. Scientific Research

- 7.1.3. Underwater Operations

- 7.1.4. Marine Fisheries

- 7.1.5. Deep-water Exploration

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Compact Cameras

- 7.2.2. DSLR/Mirrorless Cameras

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Undersea Camera Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Ecological Protection

- 8.1.2. Scientific Research

- 8.1.3. Underwater Operations

- 8.1.4. Marine Fisheries

- 8.1.5. Deep-water Exploration

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Compact Cameras

- 8.2.2. DSLR/Mirrorless Cameras

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Undersea Camera Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Ecological Protection

- 9.1.2. Scientific Research

- 9.1.3. Underwater Operations

- 9.1.4. Marine Fisheries

- 9.1.5. Deep-water Exploration

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Compact Cameras

- 9.2.2. DSLR/Mirrorless Cameras

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Undersea Camera Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Ecological Protection

- 10.1.2. Scientific Research

- 10.1.3. Underwater Operations

- 10.1.4. Marine Fisheries

- 10.1.5. Deep-water Exploration

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Compact Cameras

- 10.2.2. DSLR/Mirrorless Cameras

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sony

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Backscatter

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DSI Robotics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SeaLife

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teledyne Bowtech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SubC Imaging

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DeepSea Power & Light

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ocean Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sea and Sea

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kongsberg Maritime

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Qualisys

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LH Camera

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SwimPro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Sony

List of Figures

- Figure 1: Global Undersea Camera Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Undersea Camera Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Undersea Camera Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Undersea Camera Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Undersea Camera Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Undersea Camera Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Undersea Camera Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Undersea Camera Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Undersea Camera Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Undersea Camera Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Undersea Camera Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Undersea Camera Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Undersea Camera Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Undersea Camera Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Undersea Camera Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Undersea Camera Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Undersea Camera Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Undersea Camera Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Undersea Camera Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Undersea Camera Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Undersea Camera Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Undersea Camera Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Undersea Camera Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Undersea Camera Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Undersea Camera Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Undersea Camera Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Undersea Camera Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Undersea Camera Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Undersea Camera Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Undersea Camera Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Undersea Camera Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Undersea Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Undersea Camera Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Undersea Camera Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Undersea Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Undersea Camera Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Undersea Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Undersea Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Undersea Camera Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Undersea Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Undersea Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Undersea Camera Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Undersea Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Undersea Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Undersea Camera Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Undersea Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Undersea Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Undersea Camera Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Undersea Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Undersea Camera Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Undersea Camera?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the Undersea Camera?

Key companies in the market include Sony, Backscatter, DSI Robotics, SeaLife, Teledyne Bowtech, SubC Imaging, DeepSea Power & Light, Ocean Systems, Sea and Sea, Kongsberg Maritime, Qualisys, LH Camera, SwimPro.

3. What are the main segments of the Undersea Camera?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Undersea Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Undersea Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Undersea Camera?

To stay informed about further developments, trends, and reports in the Undersea Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence