Key Insights

The UK parcel delivery market, projected to reach 500.13 billion by 2025, is poised for substantial expansion. Driven by a robust Compound Annual Growth Rate (CAGR) of 12.2% from 2025 to 2033, this growth is significantly fueled by the booming e-commerce sector, a consequence of rising online shopping trends and consumer demand for convenient home delivery. Key industries such as financial services, healthcare, and manufacturing also contribute substantially, necessitating efficient and dependable parcel logistics. The market is segmented by transportation mode (air, road, others), end-user industry (e-commerce, BFSI, healthcare), destination (domestic, international), delivery speed (express, non-express), and business model (B2B, B2C, C2C). B2C deliveries are expected to remain dominant, though B2B growth is accelerating due to supply chain optimization. An increasing demand for expedited delivery and specialized handling of diverse shipment weights are key market drivers. The competitive landscape features established global players including DHL, FedEx, UPS, and Royal Mail, alongside agile regional and niche providers.

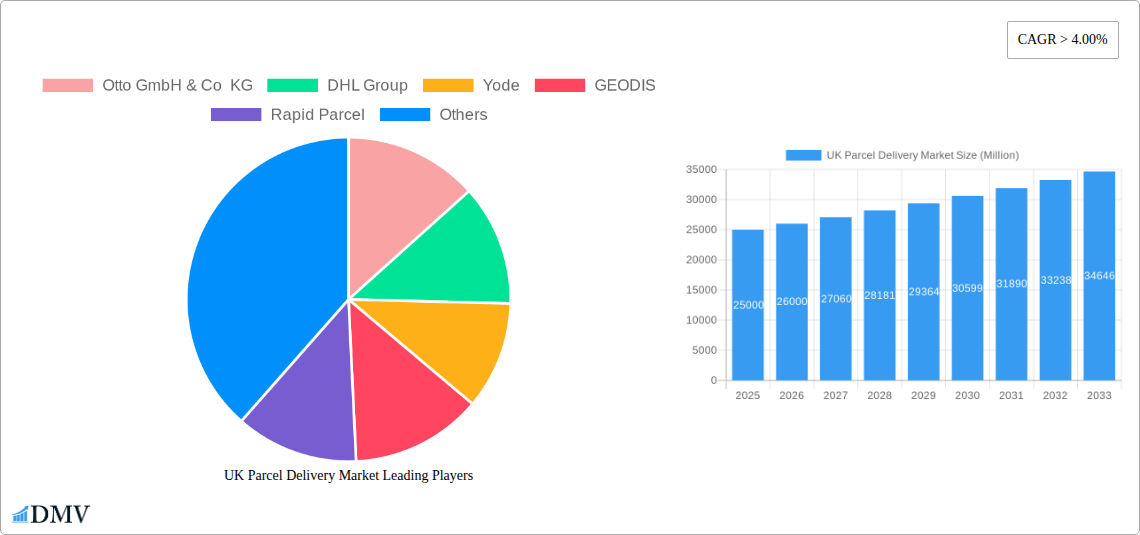

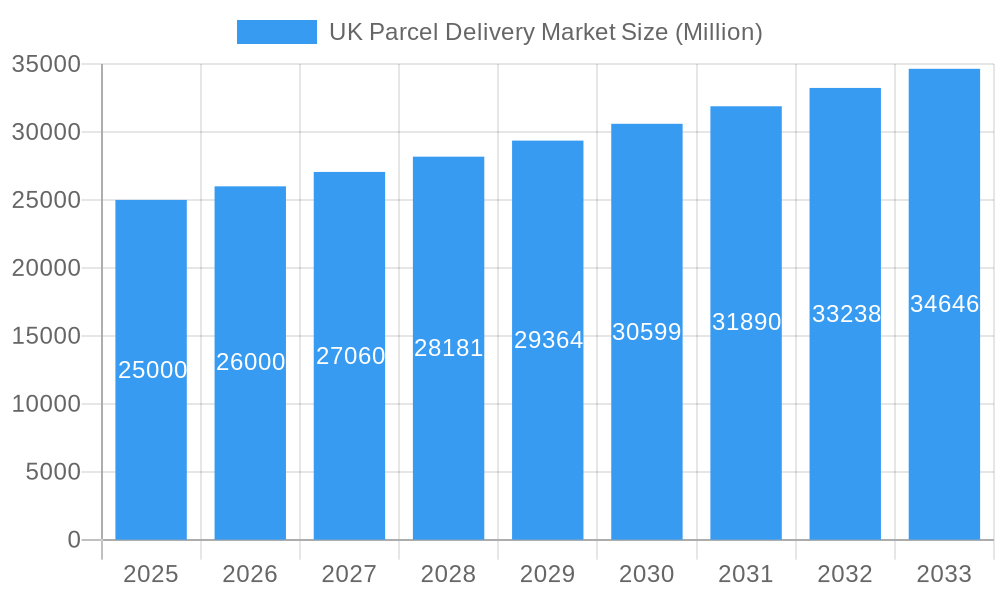

UK Parcel Delivery Market Market Size (In Billion)

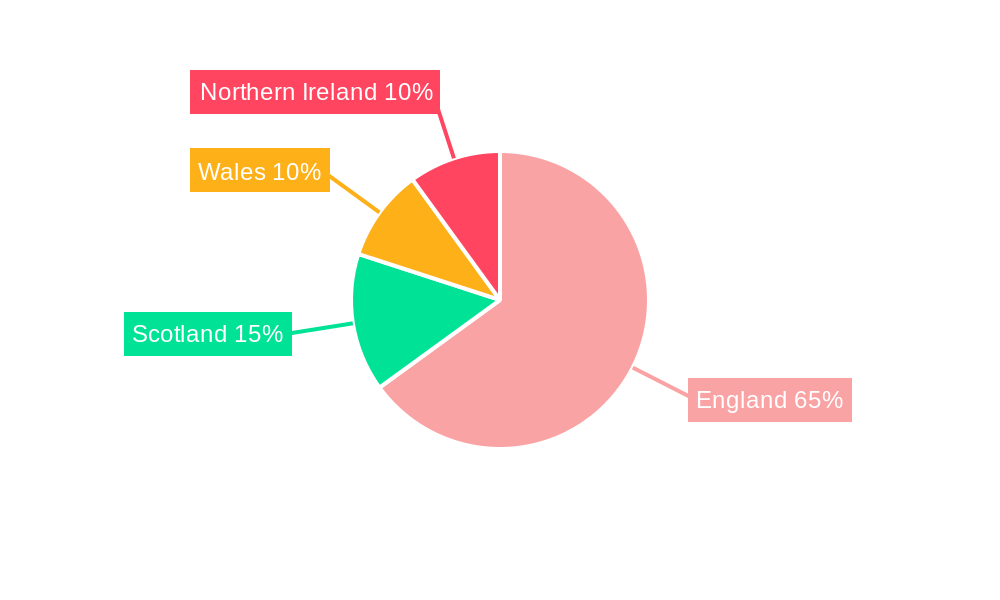

Regional market performance in the UK correlates with population density and economic activity, with England leading, followed by Scotland and Wales. While all regions are anticipated to grow, Northern Ireland may present distinct opportunities and challenges due to its geography and trade dynamics. Evolving environmental regulations and infrastructure developments, emphasizing efficient routing, reduced carbon footprints, and enhanced last-mile solutions, will shape future market trends. Continuous adaptation and innovation are crucial for market participants to maintain competitiveness and leverage growth prospects in this diverse and dynamic marketplace, characterized by both multinational corporations and specialized smaller enterprises.

UK Parcel Delivery Market Company Market Share

UK Parcel Delivery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the UK parcel delivery market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025, this study offers invaluable insights for stakeholders seeking to navigate this dynamic and rapidly evolving market. The market is projected to reach £XX Million by 2033, experiencing a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033).

UK Parcel Delivery Market Composition & Trends

The UK parcel delivery market is a highly competitive landscape characterized by a mix of established international giants and agile domestic players. Market concentration is moderate, with the top five players holding an estimated XX% market share in 2025. Innovation is a key driver, fueled by advancements in technology, automation, and sustainable logistics solutions. The regulatory landscape, encompassing environmental regulations and data privacy laws, significantly impacts market operations. Substitute products, such as local courier services and in-store pickup, exert competitive pressure.

The end-user profile is diverse, encompassing e-commerce, BFSI, healthcare, manufacturing, primary industry, wholesale & retail trade (offline), and others. Mergers and acquisitions (M&A) activity has been significant, with deal values totaling approximately £XX Million in the last five years. Key M&A trends include consolidation among smaller players and strategic acquisitions by larger corporations to expand service offerings and geographic reach.

- Market Share Distribution (2025): International Distributions Services (including Royal Mail): XX%; DHL Group: XX%; UPS: XX%; FedEx: XX%; Others: XX%.

- M&A Deal Values (2019-2024): Approximately £XX Million

- Key Innovation Catalysts: Automation, AI-powered route optimization, sustainable packaging.

- Regulatory Landscape: Environmental regulations (e.g., emissions targets), data privacy (GDPR).

- Substitute Products: Local courier services, in-store pickup.

UK Parcel Delivery Market Industry Evolution

The UK parcel delivery market has experienced substantial growth over the past five years, driven primarily by the boom in e-commerce. This trend is expected to continue, with the market projected to reach £XX Million by 2033. Technological advancements, such as automated sorting systems, real-time tracking, and drone delivery, are revolutionizing operations and improving efficiency. The shift in consumer demands towards faster, more reliable, and more sustainable delivery options is compelling market participants to innovate and adapt. The growth rate during the historical period (2019-2024) averaged XX%, with an anticipated increase to XX% during the forecast period (2025-2033). Adoption of technology like AI for route optimization has increased by XX% year-on-year, reflecting efficiency improvements.

Leading Regions, Countries, or Segments in UK Parcel Delivery Market

The most dominant segments within the UK parcel delivery market show strong growth across various parameters:

- Mode of Transport: Road transport remains the dominant mode, due to its cost-effectiveness and extensive infrastructure. Air freight is used for express deliveries and international shipments. Growth in other modes is expected but slower than the primary modes.

- End User Industry: E-commerce dominates, accounting for XX% of the market. This segment is fueled by the ongoing growth of online shopping and the increasing demand for fast and convenient delivery. BFSI is also contributing significantly as it requires efficient deliveries of sensitive documents, growing at XX%.

- Destination: Domestic deliveries comprise the largest share, reflecting the high volume of e-commerce transactions within the UK. International deliveries are also a significant segment, driven by globalization and cross-border e-commerce.

- Speed of Delivery: Express deliveries are growing rapidly, reflecting the consumer demand for faster delivery times.

- Model: B2C is the most dominant segment, due to the explosion in online shopping, followed by B2B.

- Shipment Weight: Medium weight shipments dominate the market, due to the nature of typical e-commerce orders.

- Key Drivers: Continued growth in e-commerce, investment in advanced logistics technologies, government support for infrastructure development.

The dominance of certain segments is driven by several factors, including the robust e-commerce sector, readily available infrastructure for road transport, and government initiatives to enhance logistical efficiency.

UK Parcel Delivery Market Product Innovations

Recent product innovations include the introduction of smart lockers for self-service parcel pickup and AI-powered route optimization software for improved delivery efficiency. These innovations aim to improve customer experience, enhance operational efficiency, and reduce environmental impact. Key selling propositions focus on speed, convenience, and sustainability. The adoption of autonomous delivery vehicles is anticipated within the next five to seven years.

Propelling Factors for UK Parcel Delivery Market Growth

The UK parcel delivery market is experiencing substantial growth propelled by several factors:

- E-commerce Boom: The relentless growth of online shopping fuels the demand for efficient and reliable delivery services.

- Technological Advancements: Automation, AI, and big data analytics are boosting efficiency and optimizing delivery routes.

- Government Initiatives: Investments in infrastructure and supportive regulations are enhancing the logistics sector.

Obstacles in the UK Parcel Delivery Market

Several factors hinder growth within the UK parcel delivery market:

- Supply Chain Disruptions: Global events and logistical bottlenecks can impact delivery times and costs.

- Competitive Pressure: The intense competition among existing players necessitates continuous innovation and cost optimization.

- Regulatory Challenges: Compliance with environmental regulations and data protection laws can add to operational complexity.

Future Opportunities in UK Parcel Delivery Market

Future opportunities include the expansion of last-mile delivery solutions, the adoption of drone technology, and the growth of sustainable delivery practices. Furthermore, tapping into emerging e-commerce niches and expanding into underserved regions will offer further expansion potentials.

Major Players in the UK Parcel Delivery Market Ecosystem

Key Developments in UK Parcel Delivery Market Industry

- November 2023: GEODIS opens a new 7,000 sq. m e-logistics platform, significantly enhancing its UK distribution capabilities. This expansion will enable faster delivery times and improved order processing to support their expanding client base.

- November 2023: Yodel initiates a six-month trial of parcel lockers in Northern Ireland, increasing customer convenience and contactless delivery options. This strategic partnership with PayPoint enhances their service range and explores new avenues of growth.

- September 2023: The Otto Group implements Covariant robots to optimize fulfillment center operations, increasing efficiency and building resilience against labor shortages. This automation drives productivity improvement and enhances their competitive advantage.

Strategic UK Parcel Delivery Market Forecast

The UK parcel delivery market is poised for continued growth, driven by the sustained expansion of e-commerce, technological advancements, and favorable regulatory environments. This growth will be further fueled by the increasing adoption of innovative technologies and sustainable logistics practices. The market is expected to witness significant consolidation and strategic partnerships in the coming years, potentially reshaping the competitive landscape. Further growth is expected within the express delivery segment and expansion of services into underserved areas.

UK Parcel Delivery Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

UK Parcel Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Parcel Delivery Market Regional Market Share

Geographic Coverage of UK Parcel Delivery Market

UK Parcel Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. North America UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6.2.1. Express

- 6.2.2. Non-Express

- 6.3. Market Analysis, Insights and Forecast - by Model

- 6.3.1. Business-to-Business (B2B)

- 6.3.2. Business-to-Consumer (B2C)

- 6.3.3. Consumer-to-Consumer (C2C)

- 6.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 6.4.1. Heavy Weight Shipments

- 6.4.2. Light Weight Shipments

- 6.4.3. Medium Weight Shipments

- 6.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.5.1. Air

- 6.5.2. Road

- 6.5.3. Others

- 6.6. Market Analysis, Insights and Forecast - by End User Industry

- 6.6.1. E-Commerce

- 6.6.2. Financial Services (BFSI)

- 6.6.3. Healthcare

- 6.6.4. Manufacturing

- 6.6.5. Primary Industry

- 6.6.6. Wholesale and Retail Trade (Offline)

- 6.6.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 7. South America UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7.2.1. Express

- 7.2.2. Non-Express

- 7.3. Market Analysis, Insights and Forecast - by Model

- 7.3.1. Business-to-Business (B2B)

- 7.3.2. Business-to-Consumer (B2C)

- 7.3.3. Consumer-to-Consumer (C2C)

- 7.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 7.4.1. Heavy Weight Shipments

- 7.4.2. Light Weight Shipments

- 7.4.3. Medium Weight Shipments

- 7.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.5.1. Air

- 7.5.2. Road

- 7.5.3. Others

- 7.6. Market Analysis, Insights and Forecast - by End User Industry

- 7.6.1. E-Commerce

- 7.6.2. Financial Services (BFSI)

- 7.6.3. Healthcare

- 7.6.4. Manufacturing

- 7.6.5. Primary Industry

- 7.6.6. Wholesale and Retail Trade (Offline)

- 7.6.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 8. Europe UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8.2.1. Express

- 8.2.2. Non-Express

- 8.3. Market Analysis, Insights and Forecast - by Model

- 8.3.1. Business-to-Business (B2B)

- 8.3.2. Business-to-Consumer (B2C)

- 8.3.3. Consumer-to-Consumer (C2C)

- 8.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 8.4.1. Heavy Weight Shipments

- 8.4.2. Light Weight Shipments

- 8.4.3. Medium Weight Shipments

- 8.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.5.1. Air

- 8.5.2. Road

- 8.5.3. Others

- 8.6. Market Analysis, Insights and Forecast - by End User Industry

- 8.6.1. E-Commerce

- 8.6.2. Financial Services (BFSI)

- 8.6.3. Healthcare

- 8.6.4. Manufacturing

- 8.6.5. Primary Industry

- 8.6.6. Wholesale and Retail Trade (Offline)

- 8.6.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 9. Middle East & Africa UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9.2.1. Express

- 9.2.2. Non-Express

- 9.3. Market Analysis, Insights and Forecast - by Model

- 9.3.1. Business-to-Business (B2B)

- 9.3.2. Business-to-Consumer (B2C)

- 9.3.3. Consumer-to-Consumer (C2C)

- 9.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 9.4.1. Heavy Weight Shipments

- 9.4.2. Light Weight Shipments

- 9.4.3. Medium Weight Shipments

- 9.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.5.1. Air

- 9.5.2. Road

- 9.5.3. Others

- 9.6. Market Analysis, Insights and Forecast - by End User Industry

- 9.6.1. E-Commerce

- 9.6.2. Financial Services (BFSI)

- 9.6.3. Healthcare

- 9.6.4. Manufacturing

- 9.6.5. Primary Industry

- 9.6.6. Wholesale and Retail Trade (Offline)

- 9.6.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 10. Asia Pacific UK Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10.2.1. Express

- 10.2.2. Non-Express

- 10.3. Market Analysis, Insights and Forecast - by Model

- 10.3.1. Business-to-Business (B2B)

- 10.3.2. Business-to-Consumer (B2C)

- 10.3.3. Consumer-to-Consumer (C2C)

- 10.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 10.4.1. Heavy Weight Shipments

- 10.4.2. Light Weight Shipments

- 10.4.3. Medium Weight Shipments

- 10.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.5.1. Air

- 10.5.2. Road

- 10.5.3. Others

- 10.6. Market Analysis, Insights and Forecast - by End User Industry

- 10.6.1. E-Commerce

- 10.6.2. Financial Services (BFSI)

- 10.6.3. Healthcare

- 10.6.4. Manufacturing

- 10.6.5. Primary Industry

- 10.6.6. Wholesale and Retail Trade (Offline)

- 10.6.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Otto GmbH & Co KG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yode

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEODIS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rapid Parcel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FedEx

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United Parcel Service of America Inc (UPS)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 La Poste Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 APC Overnight

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Distributions Services (including Royal Mail)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Otto GmbH & Co KG

List of Figures

- Figure 1: Global UK Parcel Delivery Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 3: North America UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 4: North America UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 5: North America UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 6: North America UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 7: North America UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 8: North America UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 9: North America UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 10: North America UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 11: North America UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 12: North America UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 13: North America UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: North America UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 15: North America UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 17: South America UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 19: South America UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 20: South America UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 21: South America UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 22: South America UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 23: South America UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 24: South America UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 25: South America UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 26: South America UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: South America UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: South America UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 29: South America UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 31: Europe UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 32: Europe UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 33: Europe UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 34: Europe UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 35: Europe UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 36: Europe UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 37: Europe UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 38: Europe UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 39: Europe UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 40: Europe UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 41: Europe UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 42: Europe UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Europe UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 45: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 46: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 47: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 48: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 49: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 50: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 51: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 52: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 53: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 54: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 55: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 56: Middle East & Africa UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 57: Middle East & Africa UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 58: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Destination 2025 & 2033

- Figure 59: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 60: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 61: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 62: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Model 2025 & 2033

- Figure 63: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Model 2025 & 2033

- Figure 64: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 65: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 66: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 67: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 68: Asia Pacific UK Parcel Delivery Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 69: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 70: Asia Pacific UK Parcel Delivery Market Revenue (billion), by Country 2025 & 2033

- Figure 71: Asia Pacific UK Parcel Delivery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Global UK Parcel Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 19: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 20: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 21: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 22: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 23: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 24: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Brazil UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Argentina UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 29: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 30: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 31: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 32: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 33: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 34: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: United Kingdom UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Germany UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: France UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Spain UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Nordics UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 45: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 46: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 47: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 48: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 49: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 50: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 51: Turkey UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Israel UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: GCC UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: North Africa UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Africa UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East & Africa UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Global UK Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 58: Global UK Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 59: Global UK Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 60: Global UK Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 61: Global UK Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 62: Global UK Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 63: Global UK Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 64: China UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 65: India UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Japan UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 67: South Korea UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: ASEAN UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 69: Oceania UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific UK Parcel Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Parcel Delivery Market?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the UK Parcel Delivery Market?

Key companies in the market include Otto GmbH & Co KG, DHL Group, Yode, GEODIS, Rapid Parcel, FedEx, United Parcel Service of America Inc (UPS), La Poste Group, APC Overnight, International Distributions Services (including Royal Mail).

3. What are the main segments of the UK Parcel Delivery Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 500.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

November 2023: GEODIS announced the opening of a new e-logistics platform in the United Kingdom. This 7,000-sq. m site is located strategically, allowing rapid distribution of products to good transport links. It can store more than 500,000 SKUs and process up to 5,000 orders per day.November 2023: Yodel has started a six-month trial of parcel lockers at sites in Northern Ireland in partnership with PayPoint via its Collect+ network. The trial intends to see the independent parcel carrier initially utilize self-service parcel lockers from OOHPod at nine locations, including Lidl stores in Castlereagh, Newtownards, Shore Road Belfast, and Lisburn. The parcel lockers, which provide contactless access for customers to pick up online deliveries at their convenience, will be available as a click & collect option to select via retailer’s store locators.September 2023: The Otto Group plans to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Parcel Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Parcel Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Parcel Delivery Market?

To stay informed about further developments, trends, and reports in the UK Parcel Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence