Key Insights

The global toys and games market is poised for significant expansion, projected to reach $1.7 billion by 2025, with a compound annual growth rate (CAGR) of 0.7%. This growth is propelled by increasing disposable incomes in developing economies, rising consumer spending on entertainment, and technological integration. Interactive and smart toys are enhancing engagement and learning. The market is segmented by distribution channels (online and offline) and product types, including games and puzzles, video games, construction toys, dolls, outdoor and sports toys. E-commerce is driving rapid growth in online channels, while offline retail remains crucial for experiential purchases. Established players like Mattel, Hasbro, and LEGO dominate, alongside innovative startups. North America and Europe lead market share, with Asia-Pacific demonstrating high growth potential. Potential restraints include raw material costs, safety regulations, and economic downturns. The long-term outlook is positive, driven by innovation and the universal appeal of play.

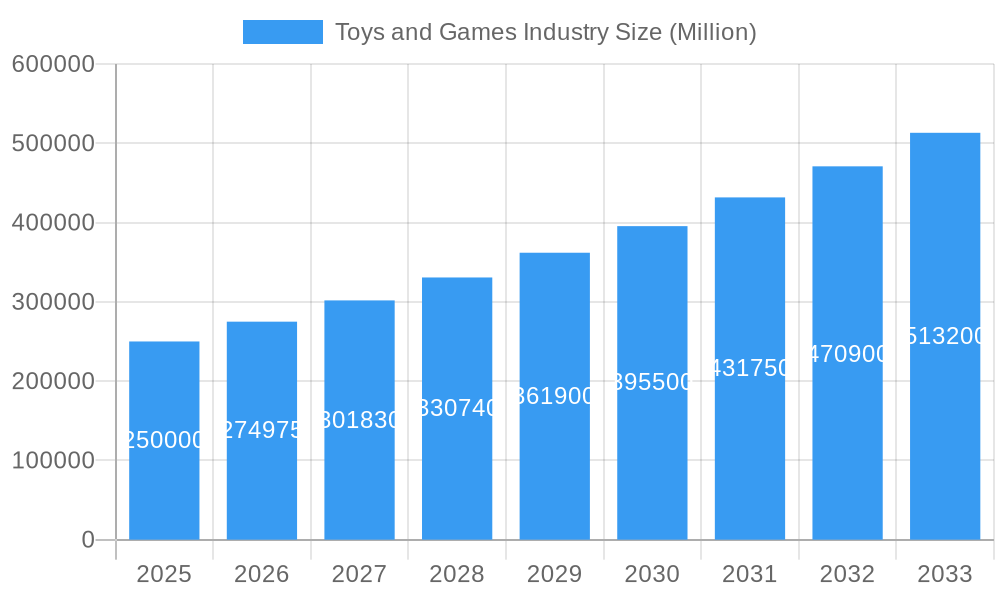

Toys and Games Industry Market Size (In Billion)

The forecast period (2025-2033) offers substantial opportunities. Industry leaders will likely invest in R&D, exploring augmented reality (AR) and virtual reality (VR) in toys and games. The influence of licensed characters and intellectual property (IP) will continue to drive product innovation. Expansion into emerging markets, particularly Asia-Pacific, presents significant growth potential. Effective marketing strategies emphasizing engagement, educational value, and sustainability will attract environmentally conscious consumers. Tailoring product offerings to specific age groups and demographics is crucial for market share growth. Navigating evolving consumer preferences and technological advancements will be key to sustained success in this competitive market.

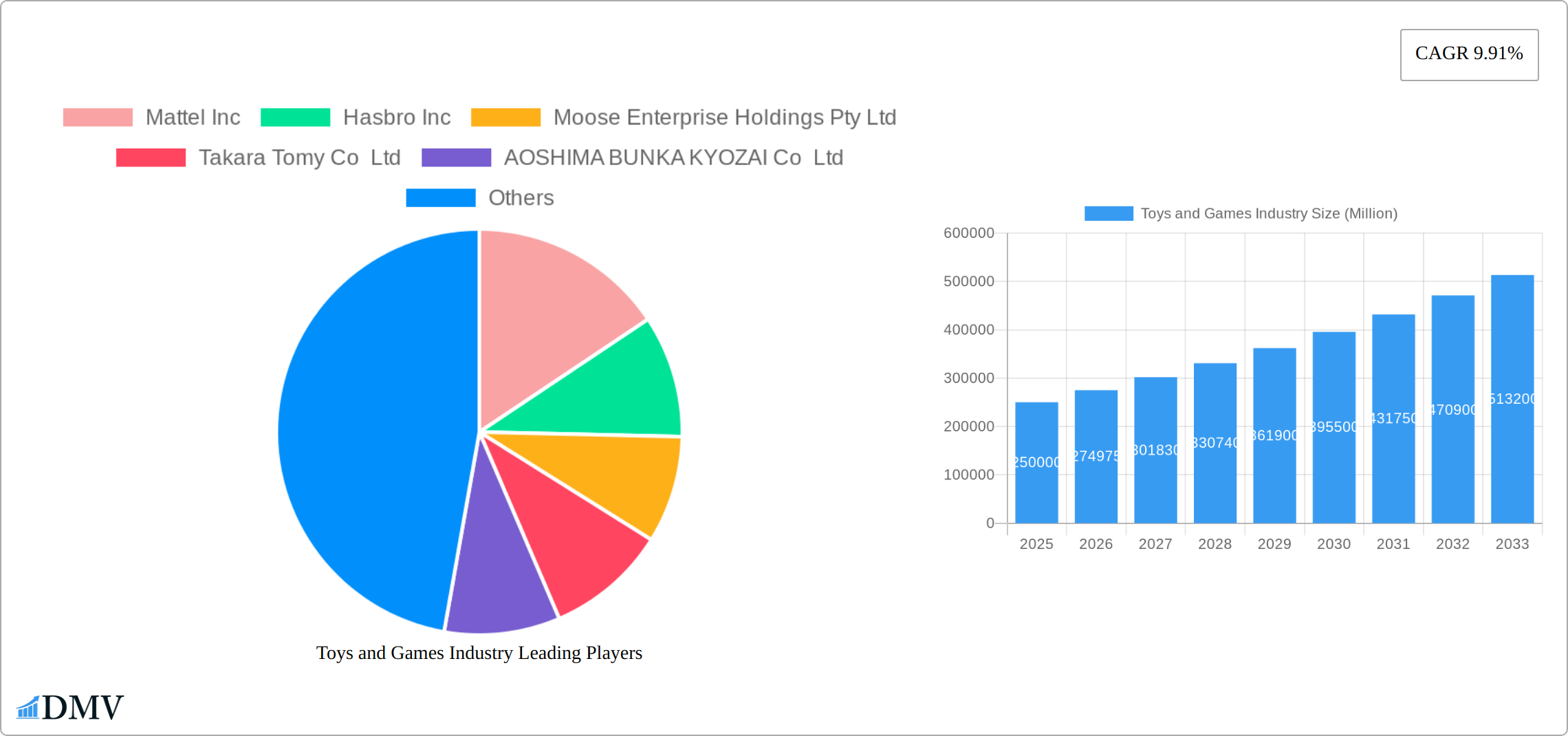

Toys and Games Industry Company Market Share

Toys and Games Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Toys and Games industry, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report offers invaluable insights into market trends, leading players, and future growth opportunities. The analysis incorporates data from the historical period (2019-2024) and examines key segments, including Games and Puzzles, Video Games, Construction Toys, Dolls and Accessories, Outdoor and Sports Toys, and Other Product Types, across both online and offline distribution channels. The market is expected to reach xx Million by 2033.

Toys and Games Industry Market Composition & Trends

This section provides a comprehensive analysis of the competitive landscape within the toys and games market. We delve into market concentration, the driving forces of innovation, prevailing regulatory frameworks, the impact of substitute products, evolving end-user behaviors, and significant mergers and acquisitions (M&A) activities. The industry is characterized by a moderately concentrated market, with key players such as Mattel Inc., Hasbro Inc., and the Lego Group commanding substantial market share. Despite this, a vibrant ecosystem of smaller players and specialized regional brands contributes to a dynamic and competitive environment.

- Market Share Distribution (2024): Mattel Inc. (estimated xx%), Hasbro Inc. (estimated xx%), Lego Group (estimated xx%), Others (estimated xx%). *[Note: Actual market share data will be updated with the latest available figures.]*

- Innovation Catalysts: The sector is witnessing a surge in demand for interactive and educational toys that foster cognitive development. Technological advancements, particularly in augmented reality (AR) and virtual reality (VR) integration, are revolutionizing play experiences. Furthermore, the enduring popularity of collectible toys and the emergence of subscription box models are significant innovation drivers.

- Regulatory Landscape: Stringent toy safety regulations, such as the Consumer Product Safety Improvement Act (CPSIA) in the US, remain paramount. Manufacturers must navigate varying regulations across different international markets. Additionally, the industry is increasingly mindful of evolving environmental standards, with a growing emphasis on sustainable materials and responsible manufacturing practices.

- Substitute Products: The traditional toy market faces competition from a broad spectrum of entertainment options. Digital entertainment platforms, mobile gaming, educational apps, and other forms of leisure activities are increasingly vying for consumers' attention and discretionary spending.

- End-User Profiles: The primary consumer base consists of children across various age demographics, each with distinct play preferences. Beyond this, the market also caters to dedicated collectors seeking rare and limited-edition items, as well as adults who are drawn to nostalgic products from their childhood.

- M&A Activity: Over the past five years, the toys and games industry has seen a notable increase in M&A activities, with a cumulative deal value exceeding xx Million. Consolidation remains a significant trend, particularly as smaller companies seek strategic partnerships or acquisitions to enhance their market position, expand their product portfolios, or gain access to new distribution channels.

Toys and Games Industry Industry Evolution

This section analyzes the evolution of the toys and games industry from 2019 to 2033, focusing on market growth trajectories, technological advancements, and shifting consumer preferences. The market experienced consistent growth throughout the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing urbanization, and the expanding popularity of online retail channels. Technological advancements, such as the integration of augmented reality (AR) and virtual reality (VR) features, have significantly influenced product innovation. This has fostered new possibilities for interactive gaming experiences and enhanced engagement for children. Consumer demand has transitioned towards educational and experiential toys, a trend that is expected to continue throughout the forecast period, while environmental awareness has driven demand for sustainable and ethically-sourced toys. The market is forecast to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), propelled by these ongoing trends.

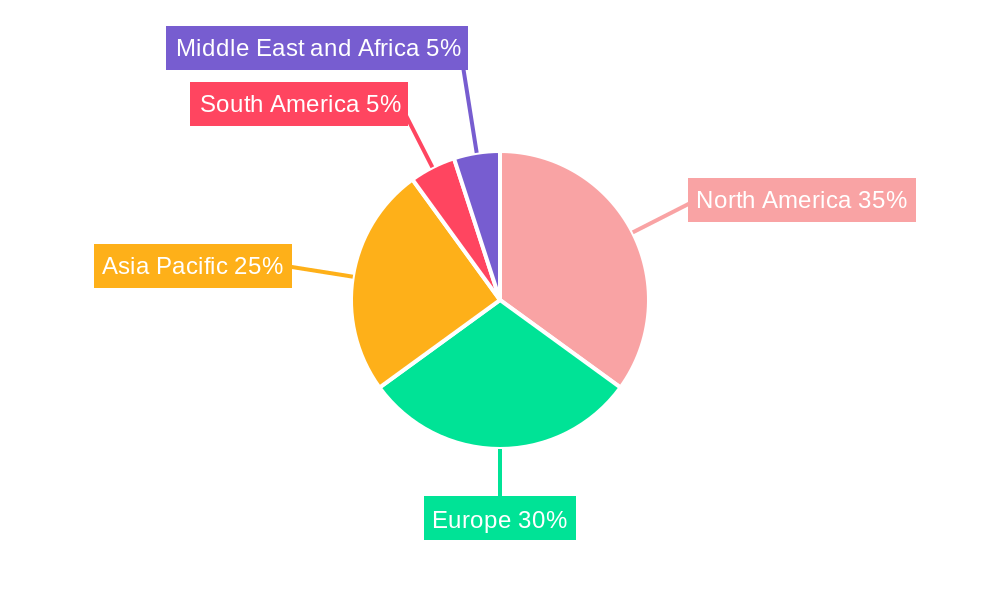

Leading Regions, Countries, or Segments in Toys and Games Industry

This section identifies the dominant regions, countries, and segments within the toys and games industry. The global nature of the market is significant.

- Dominant Region: North America, driven by strong consumer spending and the presence of major players.

- Dominant Country: The United States, owing to its large consumer base and established toy manufacturing industry.

- Dominant Distribution Channel: Online channels (xx% market share), demonstrating the growing importance of e-commerce platforms.

- Dominant Product Type: Construction Toys (xx% market share), favored due to their versatility and educational benefits.

Key Drivers:

- North America: High disposable incomes, a strong retail infrastructure, and established brand recognition.

- Online Channel: Growing internet penetration, convenience, and wider product selection.

- Construction Toys: Creative potential, educational value, and growing demand for STEM-related toys.

Toys and Games Industry Product Innovations

Recent innovations in the toys and games industry include the incorporation of smart technology into toys, fostering interactive and personalized play experiences. Augmented and virtual reality (AR/VR) applications are increasingly integrated into games, enriching the user's engagement. Sustainable materials are also gaining prominence, aligning with environmental concerns. These innovations significantly enhance user engagement and broaden the appeal of toys across various age groups.

Propelling Factors for Toys and Games Industry Growth

Several powerful forces are driving sustained growth within the toys and games industry. Technological advancements are at the forefront, with innovations in areas like AR/VR, robotics, and artificial intelligence (AI) continuously expanding the horizons of interactive and immersive play. Simultaneously, rising disposable incomes, particularly in emerging economies, are broadening the consumer base and increasing the affordability of toys and games. Favorable government regulations that support toy production, import, and distribution also play a crucial role in fostering a conducive environment for industry expansion.

Obstacles in the Toys and Games Industry Market

Despite considerable growth potential, challenges remain in the industry. Supply chain disruptions, which were acutely felt post-pandemic, cause significant production delays and increase manufacturing costs. Intense competition among established players as well as emerging brands places significant pressure on pricing and profitability. Stringent safety and regulatory requirements across various markets add complexity to product development and distribution. These factors can negatively impact profitability and market entry.

Future Opportunities in Toys and Games Industry

The toys and games industry is poised for continued growth. Expansion into emerging markets, especially in Asia and Africa, presents significant opportunities. The adoption of innovative technologies such as AI, metaverse integration, and personalization will reshape the product landscape, while the increasing focus on sustainable practices will drive demand for eco-friendly products.

Major Players in the Toys and Games Industry Ecosystem

- Mattel Inc.

- Hasbro Inc.

- Moose Enterprise Holdings Pty Ltd

- Takara Tomy Co Ltd

- AOSHIMA BUNKA KYOZAI Co Ltd

- Lego Group

- Simba-Dickie Group

- Tru Kids Inc.

- Spin Master Ltd.

- Bandai Namco Holdings Inc.

Key Developments in Toys and Games Industry Industry

- September 2022: Mattel Inc. made a significant stride in inclusivity with the introduction of Bruno the Brake Car, the first autistic character in the beloved Thomas & Friends franchise, championing representation and understanding in children's media.

- September 2022: The Lego Group continued to capitalize on pop culture trends by unveiling a new Lego Marvel Black Panther Set, further solidifying its position in the lucrative superhero merchandise market and expanding its diverse product line.

- October 2022: Building on the success of its Marvel collaborations, The Lego Group announced the Lego Marvel Studios Release, The Iron Man Hulkbuster set, strategically leveraging the immense popularity of the Marvel Cinematic Universe films to drive sales and engage fans.

Strategic Toys and Games Industry Market Forecast

The toys and games market is poised for robust and sustained growth in the coming years. This positive trajectory is largely attributed to continuous innovation across product categories, increasing consumer spending power fueled by a growing global middle class, and the ever-expanding influence of digital technologies. Emerging product categories, such as interactive educational toys designed for early childhood development and AR/VR-integrated games that offer immersive experiences, are expected to be significant growth drivers. The market's optimistic outlook is further reinforced by the rapid expansion of e-commerce and the increasing penetration of online retail channels worldwide, making toys and games more accessible to a broader consumer base.

Toys and Games Industry Segmentation

-

1. Product Type

- 1.1. Games and Puzzles

- 1.2. Video Games

- 1.3. Construction Toys

- 1.4. Dolls and Accessories

- 1.5. Outdoor and Sports Toys

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Online Channel

- 2.2. Offline Channel

Toys and Games Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Toys and Games Industry Regional Market Share

Geographic Coverage of Toys and Games Industry

Toys and Games Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Influence of Technology is Promoting Video Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Games and Puzzles

- 5.1.2. Video Games

- 5.1.3. Construction Toys

- 5.1.4. Dolls and Accessories

- 5.1.5. Outdoor and Sports Toys

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Channel

- 5.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Games and Puzzles

- 6.1.2. Video Games

- 6.1.3. Construction Toys

- 6.1.4. Dolls and Accessories

- 6.1.5. Outdoor and Sports Toys

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Channel

- 6.2.2. Offline Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Games and Puzzles

- 7.1.2. Video Games

- 7.1.3. Construction Toys

- 7.1.4. Dolls and Accessories

- 7.1.5. Outdoor and Sports Toys

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Channel

- 7.2.2. Offline Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Games and Puzzles

- 8.1.2. Video Games

- 8.1.3. Construction Toys

- 8.1.4. Dolls and Accessories

- 8.1.5. Outdoor and Sports Toys

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Channel

- 8.2.2. Offline Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Games and Puzzles

- 9.1.2. Video Games

- 9.1.3. Construction Toys

- 9.1.4. Dolls and Accessories

- 9.1.5. Outdoor and Sports Toys

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Channel

- 9.2.2. Offline Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Games and Puzzles

- 10.1.2. Video Games

- 10.1.3. Construction Toys

- 10.1.4. Dolls and Accessories

- 10.1.5. Outdoor and Sports Toys

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Channel

- 10.2.2. Offline Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mattel Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hasbro Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Moose Enterprise Holdings Pty Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Takara Tomy Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AOSHIMA BUNKA KYOZAI Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lego Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Simba-Dickie Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tru Kids Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spin Master Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bandai Namco Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mattel Inc

List of Figures

- Figure 1: Global Toys and Games Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Toys and Games Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 17: Europe Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: Europe Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 40: South America Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 41: South America Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: South America Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: South America Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East and Africa Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Toys and Games Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Toys and Games Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Toys and Games Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Spain Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Spain Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Germany Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Russia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Russia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 47: China Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: China Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Japan Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Japan Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: India Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: India Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Australia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Australia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 58: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 59: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 60: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 61: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 63: Brazil Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Brazil Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Argentina Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Argentina Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 70: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 71: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 72: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 73: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 74: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 75: South Africa Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: South Africa Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Saudi Arabia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Saudi Arabia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 79: Rest of Middle East and Africa Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Middle East and Africa Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Toys and Games Industry?

The projected CAGR is approximately 0.7%.

2. Which companies are prominent players in the Toys and Games Industry?

Key companies in the market include Mattel Inc, Hasbro Inc, Moose Enterprise Holdings Pty Ltd, Takara Tomy Co Ltd, AOSHIMA BUNKA KYOZAI Co Ltd, Lego Group, Simba-Dickie Group, Tru Kids Inc *List Not Exhaustive, Spin Master Ltd, Bandai Namco Holdings Inc.

3. What are the main segments of the Toys and Games Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Influence of Technology is Promoting Video Games.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

October 2022: The Lego Group announced the Lego Marvel Studios Release, The Iron Man Hulkbuster set, featuring Iron Man as he appeared in Infinity Saga - Age of Ultron, a mega-hit film.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Toys and Games Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Toys and Games Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Toys and Games Industry?

To stay informed about further developments, trends, and reports in the Toys and Games Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence