Key Insights

The Switzerland cosmetics market is poised for significant expansion, projected to reach $5.7 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.6% from the base year of 2024. This robust growth is propelled by several key drivers. Firstly, increasing disposable incomes and a heightened emphasis on personal grooming among the Swiss populace are stimulating demand for both premium and mass-market cosmetic products. Secondly, the considerable presence of international luxury brands, coupled with a growing consumer preference for natural and organic formulations, significantly contributes to market expansion. The burgeoning popularity of e-commerce platforms further bolsters sales by offering enhanced convenience and broader product accessibility. However, potential headwinds include economic fluctuations that may impact consumer discretionary spending and the increasing adoption of DIY skincare routines, which could present challenges to established market players. The market segmentation highlights a diverse landscape, with premium cosmetics capturing a substantial share due to Switzerland's high purchasing power. While specialist retail outlets remain a dominant distribution channel, online and supermarket sales are experiencing consistent growth. Key product segments include facial color cosmetics, such as foundations and concealers, alongside eye and lip cosmetics. The competitive arena is characterized by established multinational corporations including L'Oréal SA, Estée Lauder Inc., and Unilever plc, alongside agile niche brands adept at catering to specific consumer demands. The forecast indicates sustained growth, driven by these dynamic market forces.

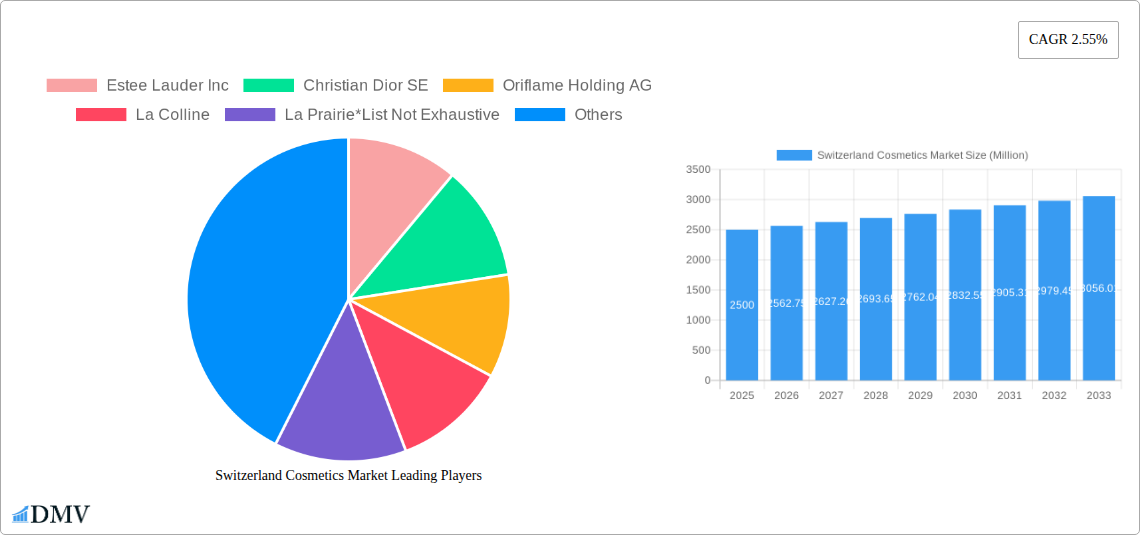

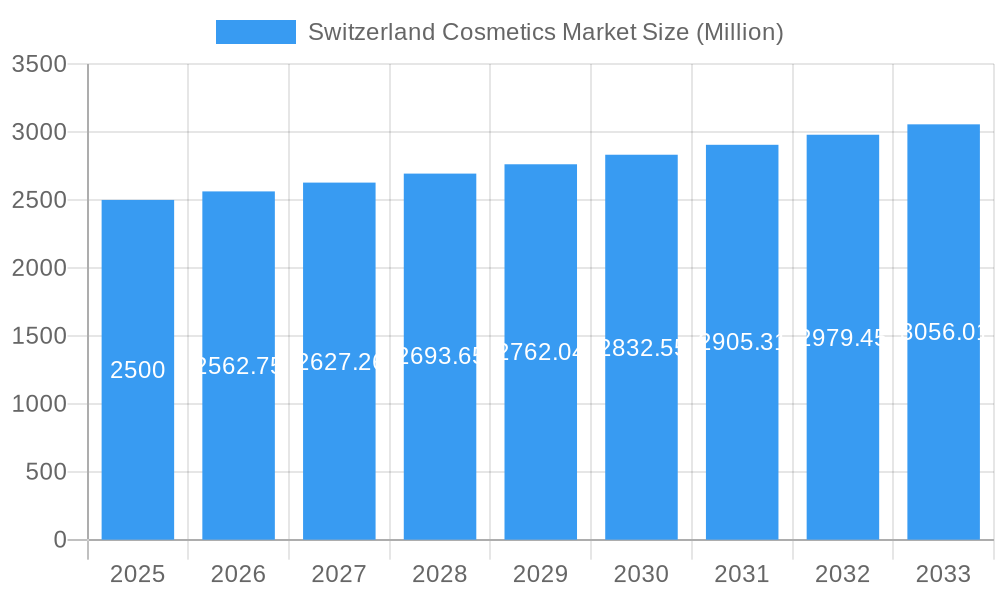

Switzerland Cosmetics Market Market Size (In Billion)

Future growth in the Swiss cosmetics sector will be significantly shaped by evolving consumer preferences. A growing imperative for ethically sourced and sustainable products is anticipated to fuel demand for eco-friendly and cruelty-free options. This trend presents opportunities for brands that prioritize supply chain transparency and responsible manufacturing practices. Furthermore, continuous innovation in product formulations and delivery systems will be crucial for brands seeking to maintain a competitive advantage. Strategic investments in personalized product recommendations and enhanced consumer experiences are expected to resonate with individual needs. The increasing integration of advanced technologies, such as AI and AR, in marketing and sales will play a pivotal role in optimizing the consumer journey and driving revenue. Intense competition will persist, necessitating refined brand positioning, impactful marketing strategies, and a profound understanding of emerging consumer demands.

Switzerland Cosmetics Market Company Market Share

Switzerland Cosmetics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Switzerland cosmetics market, offering a comprehensive overview of its current state, future trajectory, and key players. From market sizing and segmentation to growth drivers and challenges, this report equips stakeholders with the knowledge needed to navigate this dynamic industry. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025 to 2033, analyzing historical data from 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Switzerland Cosmetics Market Composition & Trends

The Switzerland cosmetics market is characterized by a blend of established international players and niche local brands. Market concentration is moderate, with several key players holding significant shares, but a substantial number of smaller companies contributing to the overall market dynamics. Innovation is a key driver, with companies continually introducing new products and formulations to cater to evolving consumer preferences. The stringent regulatory landscape in Switzerland influences product development and marketing strategies. Substitute products, such as natural remedies and homemade cosmetics, exert some competitive pressure, particularly within the mass market segment. The end-user profile is diverse, ranging from young adults focused on trends to older consumers prioritizing anti-aging solutions. M&A activity has been relatively moderate in recent years, with deal values averaging xx Million per transaction in the past five years.

- Market Share Distribution (2025): L'Oréal SA (xx%), Estée Lauder Inc. (xx%), Unilever plc (xx%), Others (xx%).

- M&A Deal Values (2020-2024): Average xx Million per transaction.

- Key Innovation Catalysts: Sustainability, personalization, and technological advancements in formulation and delivery systems.

- Regulatory Landscape: Strict regulations concerning ingredients and labeling, impacting product development and marketing claims.

Switzerland Cosmetics Market Industry Evolution

The Switzerland cosmetics market has experienced steady growth over the past five years, driven by factors such as rising disposable incomes, increasing awareness of personal care, and the expanding online retail channel. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological advancements, including the use of AI in personalized recommendations and the rise of e-commerce platforms, are reshaping the industry landscape. Shifting consumer demands towards natural, organic, and sustainable products are also significantly influencing product development and marketing strategies. Consumers increasingly seek transparency and ethical sourcing, placing pressure on companies to adopt sustainable practices across their supply chains. The adoption of digital marketing and social media has also increased significantly, with xx% of consumers reporting purchasing cosmetics online in 2024.

Leading Regions, Countries, or Segments in Switzerland Cosmetics Market

While Switzerland is a relatively small market, regional variations exist. Urban areas tend to exhibit higher consumption rates due to greater accessibility and higher disposable incomes. The Premium segment commands a higher average price point and contributes disproportionately to the market value compared to the Mass segment. Specialist Retail Stores remain the dominant distribution channel, benefiting from expert advice and brand image association, however, Online Retail Channels are experiencing rapid growth. Within product types, Facial Color Cosmetics consistently maintain a significant share due to diverse offerings and high demand.

- Key Drivers for Premium Segment Dominance: High disposable incomes, brand loyalty, and focus on high-quality ingredients.

- Key Drivers for Online Retail Channel Growth: Convenience, wider product selection, and competitive pricing.

- Key Drivers for Specialist Retail Store Dominance: Brand expertise, personalized advice, and product testing opportunities.

- Key Drivers for Facial Color Cosmetics: Wide range of options, versatility, and impact on overall appearance.

Switzerland Cosmetics Market Product Innovations

Recent innovations have focused on delivering products with enhanced performance, natural ingredients, and sustainable packaging. Personalized skincare regimens using AI-driven tools are gaining traction. Formulations emphasizing natural ingredients and sustainable sourcing are increasingly popular. Advanced delivery systems, such as microneedle patches and innovative applicators, provide consumers with a superior experience. Unique selling propositions often center around scientific backing, eco-friendly practices, and luxurious textures.

Propelling Factors for Switzerland Cosmetics Market Growth

Several factors contribute to the market's continued growth. Rising disposable incomes, especially amongst younger demographics, fuel the demand for premium and innovative cosmetic products. The increasing awareness of personal care and self-expression further drives market expansion. Technological advancements, including personalized beauty recommendations and digital marketing, improve consumer engagement and product accessibility. Favorable regulatory environments foster innovation and consumer confidence.

Obstacles in the Switzerland Cosmetics Market

Challenges include intense competition, especially from international brands. Stringent regulations can increase compliance costs. Supply chain disruptions resulting from global events can impact product availability and pricing. Economic fluctuations can affect consumer spending on non-essential items.

Future Opportunities in Switzerland Cosmetics Market

Future growth lies in expanding into niche segments, such as personalized cosmetics and sustainable products. Leveraging digital channels for targeted marketing and personalized recommendations represents a significant opportunity. Developing innovative products catering to specific skin types and concerns offers high potential. Exploring alternative distribution channels, such as pop-up stores and direct-to-consumer models, can expand reach.

Major Players in the Switzerland Cosmetics Market Ecosystem

- Estée Lauder Inc.

- Christian Dior SE

- Oriflame Holding AG

- La Colline

- La Prairie

- JACQUELINE PIOTAZ

- L'Oréal S.A.

- Unilever plc

- Shiseido Co Ltd

- Amway GmbH

Key Developments in Switzerland Cosmetics Market Industry

- July 2022: Estée Lauder Companies (ELC) expanded its distribution network by opening a new distribution center in Galgenen, Switzerland, boosting its global travel retail business.

- October 2021: La Prairie launched its "Skin Caviar Nighttime Oil," expanding its product portfolio and targeting a new consumer segment.

Strategic Switzerland Cosmetics Market Forecast

The Switzerland cosmetics market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and increasing disposable incomes. The premium segment is expected to continue its strong performance, while the mass segment will likely see moderate growth. Online retail channels will remain a key driver of market expansion. The focus on sustainable and personalized products will shape future innovation and market dynamics.

Switzerland Cosmetics Market Segmentation

-

1. Type

- 1.1. Facial Color Cosmetics

- 1.2. Eye Color Cosmetics

- 1.3. Lip Color Cosmetics

- 1.4. Nail Color Cosmetics

- 1.5. Hair Coloring and Styling Products

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience/Grocery Stores

- 3.4. Online Retail Channels

- 3.5. Other Distribution Channels

Switzerland Cosmetics Market Segmentation By Geography

- 1. Switzerland

Switzerland Cosmetics Market Regional Market Share

Geographic Coverage of Switzerland Cosmetics Market

Switzerland Cosmetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation

- 3.3. Market Restrains

- 3.3.1. Product Misrepresentation and Counterfeit Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Natural and Organic Beauty Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Cosmetics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facial Color Cosmetics

- 5.1.2. Eye Color Cosmetics

- 5.1.3. Lip Color Cosmetics

- 5.1.4. Nail Color Cosmetics

- 5.1.5. Hair Coloring and Styling Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience/Grocery Stores

- 5.3.4. Online Retail Channels

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Estee Lauder Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christian Dior SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oriflame Holding AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 La Colline

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 La Prairie*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JACQUELINE PIOTAZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LOreal S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Unilever plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiseido Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amway GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Estee Lauder Inc

List of Figures

- Figure 1: Switzerland Cosmetics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Switzerland Cosmetics Market Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Cosmetics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Switzerland Cosmetics Market Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Switzerland Cosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Switzerland Cosmetics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Switzerland Cosmetics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Switzerland Cosmetics Market Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Switzerland Cosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Switzerland Cosmetics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Cosmetics Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Switzerland Cosmetics Market?

Key companies in the market include Estee Lauder Inc, Christian Dior SE, Oriflame Holding AG, La Colline, La Prairie*List Not Exhaustive, JACQUELINE PIOTAZ, LOreal S A, Unilever plc, Shiseido Co Ltd, Amway GmbH.

3. What are the main segments of the Switzerland Cosmetics Market?

The market segments include Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand for Natural and Organic Beauty Products.

7. Are there any restraints impacting market growth?

Product Misrepresentation and Counterfeit Concerns.

8. Can you provide examples of recent developments in the market?

July 2022: Estee Lauder Companies (ELC) expanded its distribution network by opening a new distribution center in Galgenen, Switzerland. As per the company's claim, the expansion of the distribution network will help accommodate the growth of its global travel retail business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Cosmetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Cosmetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Cosmetics Market?

To stay informed about further developments, trends, and reports in the Switzerland Cosmetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence