Key Insights

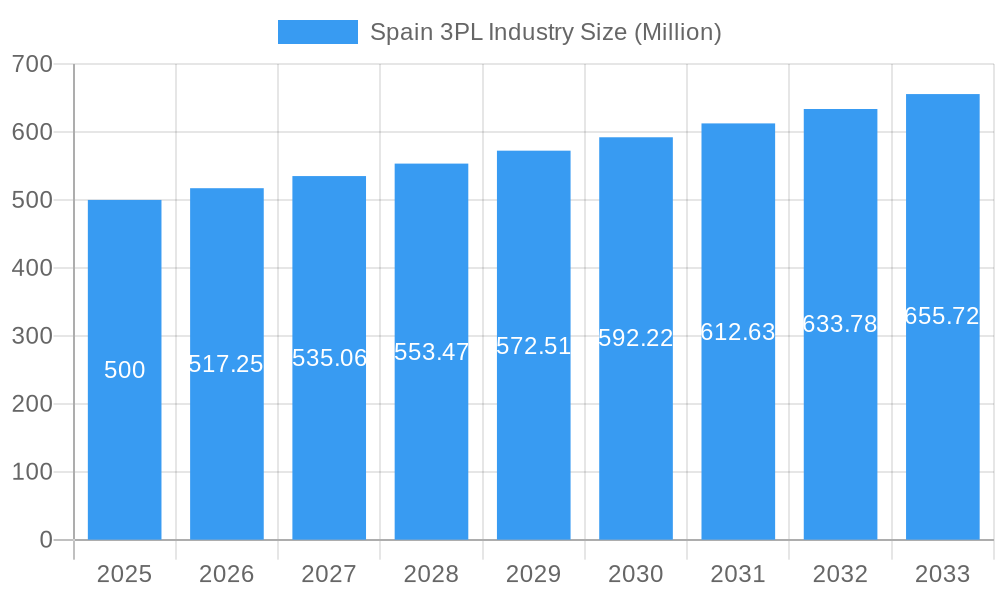

The Spanish Third-Party Logistics (3PL) market, estimated at €14.46 billion in the base year 2025, is projected for robust expansion. The industry is expected to witness a Compound Annual Growth Rate (CAGR) of 4.03% between 2025 and 2033. Key growth drivers include the accelerating adoption of e-commerce, which amplifies the need for sophisticated warehousing, distribution, and last-mile delivery. Additionally, expanding sectors such as manufacturing & automotive, oil & gas and chemicals, and pharma & healthcare in Spain are increasing their reliance on dependable supply chain management, prompting greater outsourcing to specialized 3PL partners. Companies are increasingly prioritizing core business functions, leading to the delegation of non-core logistics operations, including domestic and international transportation management. While challenges like volatile fuel costs and potential labor scarcity exist, sustained e-commerce growth and ongoing supply chain optimization efforts are poised to counterbalance these concerns.

Spain 3PL Industry Market Size (In Billion)

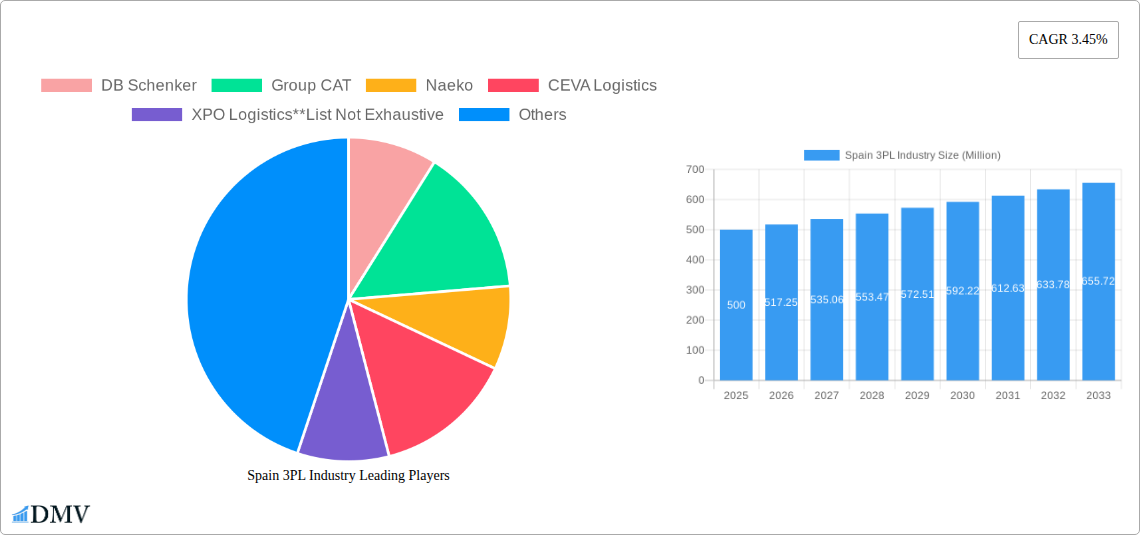

The competitive Spanish 3PL market features a blend of global leaders including DB Schenker, XPO Logistics, and DSV, alongside established regional and niche providers such as Naeko, Carcaba, and TIBA. These entities deliver a comprehensive suite of services, ranging from fundamental transportation management to advanced warehousing and distribution solutions, often customized for specific industry verticals. This diverse competitive landscape ensures that a wide spectrum of client needs is addressed, fostering innovation and market dynamism. Future expansion will be significantly shaped by technological advancements, including warehouse automation, enhanced supply chain visibility through data analytics, and the growing implementation of sustainable logistics. Providers who can offer integrated end-to-end solutions and demonstrate specialized industry expertise will be best positioned to secure market share in Spain's evolving logistics sector.

Spain 3PL Industry Company Market Share

Spain 3PL Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Spain 3PL (Third-Party Logistics) industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report analyzes market size, trends, key players, and future growth potential. The Spanish 3PL market, valued at xx Million in 2024, is projected to reach xx Million by 2033, presenting significant opportunities for investment and expansion.

Spain 3PL Industry Market Composition & Trends

The Spanish 3PL market exhibits a moderately concentrated structure, with key players like DB Schenker, CEVA Logistics, and XPO Logistics holding significant market share. However, numerous smaller, specialized 3PL providers contribute significantly to the overall market volume. Market share distribution in 2025 is estimated as follows: DB Schenker (xx%), CEVA Logistics (xx%), XPO Logistics (xx%), with the remaining share distributed amongst other players like Group CAT, Naeko, OIA Global, Carcaba, TIBA, Rhenus Logistics, DSV, and Decal FM Logistics. The market is driven by increasing e-commerce adoption, the need for efficient supply chain management, and the growing complexity of global trade. Mergers and acquisitions (M&A) activity is prevalent, with deal values exceeding xx Million in the past five years, largely driven by consolidation amongst smaller players and expansion by larger multinational logistics companies. Regulatory changes impacting logistics and transportation are ongoing and influence operational costs. Substitute products, such as in-house logistics solutions, are limited due to the cost and complexity involved, reinforcing the demand for 3PL services.

- Market Concentration: Moderately concentrated, with a mix of large multinational and smaller regional players.

- Innovation Catalysts: E-commerce growth, technological advancements in automation and data analytics.

- Regulatory Landscape: Evolving regulations impacting transportation and logistics, creating both opportunities and challenges.

- Substitute Products: Limited viable substitutes due to cost and complexity, reinforcing 3PL reliance.

- End-User Profiles: Diverse, spanning Manufacturing & Automotive, Oil & Gas and Chemicals, Distributive Trade (including e-commerce), Pharma & Healthcare, and Construction.

- M&A Activity: Significant activity observed in recent years, particularly involving smaller to medium-sized firms, with total deal values exceeding xx Million.

Spain 3PL Industry Industry Evolution

The Spanish 3PL industry has experienced robust growth over the past five years, fueled by several key factors. The increasing penetration of e-commerce has significantly boosted demand for warehousing, distribution, and last-mile delivery solutions. Technological advancements, particularly in areas like automation, data analytics, and IoT, have improved efficiency, transparency, and traceability across supply chains. Furthermore, the evolving needs of end-user industries, such as the rise of omnichannel strategies and the emphasis on speed and reliability in delivery, have further driven the growth of 3PL services. The Compound Annual Growth Rate (CAGR) for the Spanish 3PL market during the historical period (2019-2024) was xx%, exceeding the global average. This upward trend is expected to continue into the forecast period (2025-2033), driven by continued technological innovation and expanding e-commerce activities. Adoption of warehouse automation technologies such as AutoStore systems, as seen with Factor 5’s recent investment, shows the industry's commitment to efficiency improvements.

Leading Regions, Countries, or Segments in Spain 3PL Industry

The Distributive Trade (Wholesale and Retail, including e-commerce) segment currently represents the largest share of the Spanish 3PL market, followed closely by Manufacturing & Automotive. Growth in these segments is primarily driven by the expanding e-commerce sector and increased outsourcing of logistics functions by manufacturers seeking to optimize their supply chains.

- Key Drivers for Distributive Trade Dominance:

- Rapid growth of online retail and e-commerce.

- Need for efficient last-mile delivery solutions.

- Increased demand for warehousing and fulfillment services.

- Key Drivers for Manufacturing & Automotive Dominance:

- Growing demand for complex supply chain management services.

- Focus on cost optimization and efficiency improvements.

- Increased reliance on outsourcing logistics functions.

The Madrid and Barcelona regions are the leading geographical hubs for 3PL activities, benefiting from their well-established infrastructure, proximity to major ports, and access to a large consumer base. However, other regions are experiencing growth as e-commerce expands nationwide.

Spain 3PL Industry Product Innovations

Recent innovations in the Spanish 3PL sector encompass advanced warehouse management systems (WMS), automated guided vehicles (AGVs), and the integration of AI-powered solutions for route optimization and demand forecasting. These technological advancements enhance operational efficiency, improve order accuracy, and reduce costs. The implementation of goods-to-person systems, as exemplified by Factor 5's recent investment in an AutoStore system, represents a significant step towards enhanced productivity and competitiveness in the market. These innovations are creating unique selling propositions for 3PL providers, enabling them to offer tailored solutions and improved service levels to their clients.

Propelling Factors for Spain 3PL Industry Growth

Several factors are fueling the expansion of the Spanish 3PL market. Technological advancements, such as AI-powered logistics optimization and the adoption of automated warehousing solutions, are driving efficiency gains and cost reductions. The robust growth of e-commerce continues to propel demand for fulfillment and last-mile delivery services. Favorable government policies and infrastructure investments further support industry expansion.

Obstacles in the Spain 3PL Industry Market

Challenges facing the Spanish 3PL industry include increasing labor costs, fluctuating fuel prices, and the potential for supply chain disruptions. The ongoing scarcity of skilled labor and the competition for talent pose significant constraints on growth. Furthermore, the industry needs to consistently adapt to evolving regulatory requirements and remain competitive in a rapidly changing global landscape.

Future Opportunities in Spain 3PL Industry

Future opportunities lie in expanding into new market segments, such as the growing cold chain logistics sector and the increasing demand for sustainable and environmentally friendly logistics solutions. Technological innovation, particularly in areas like autonomous vehicles and drone delivery, holds significant potential for enhancing efficiency and disrupting existing market dynamics.

Major Players in the Spain 3PL Industry Ecosystem

- DB Schenker

- Group CAT

- Naeko

- CEVA Logistics

- XPO Logistics

- OIA Global

- Carcaba

- TIBA

- Rhenus Logistics

- DSV

- Decal FM Logistics

Key Developments in Spain 3PL Industry Industry

- June 2023: Factor 5 implements an AutoStore automated storage and picking system, boosting efficiency in perfume and cosmetics order fulfillment.

- April 2023: CEVA Logistics acquires full control of BERGÉ GEFCO, expanding its finished vehicle logistics (FVL) services.

Strategic Spain 3PL Industry Market Forecast

The Spanish 3PL market is poised for continued growth, driven by technological advancements, e-commerce expansion, and increased outsourcing of logistics functions. The market's diverse end-user segments and strategic geographic location provide significant opportunities for both established players and new entrants. The forecast period (2025-2033) is expected to witness substantial market expansion, with significant potential for value creation through innovation and strategic partnerships.

Spain 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Spain 3PL Industry Segmentation By Geography

- 1. Spain

Spain 3PL Industry Regional Market Share

Geographic Coverage of Spain 3PL Industry

Spain 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. Growth in Refrigerated Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Group CAT

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Naeko

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEVA Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XPO Logistics**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OIA Global

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carcaba

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TIBA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DSV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Decal FM Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Spain 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Spain 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Spain 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Spain 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain 3PL Industry?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the Spain 3PL Industry?

Key companies in the market include DB Schenker, Group CAT, Naeko, CEVA Logistics, XPO Logistics**List Not Exhaustive, OIA Global, Carcaba, TIBA, Rhenus Logistics, DSV, Decal FM Logistics.

3. What are the main segments of the Spain 3PL Industry?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.46 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Growth in Refrigerated Logistics.

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

June 2023: Third-party logistics operator Factor 5 recently commissioned a goods-to-person solution featuring an AutoStore™ automated storage and picking system provided by intelligent automation solution provider Dematic. The solution enhances its order process for perfumes and cosmetics products with the aim of boosting sales and strengthening its ability to compete in the long term. The solution went live in March at Factor 5’s Alovera site northeast of Madrid.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain 3PL Industry?

To stay informed about further developments, trends, and reports in the Spain 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence