Key Insights

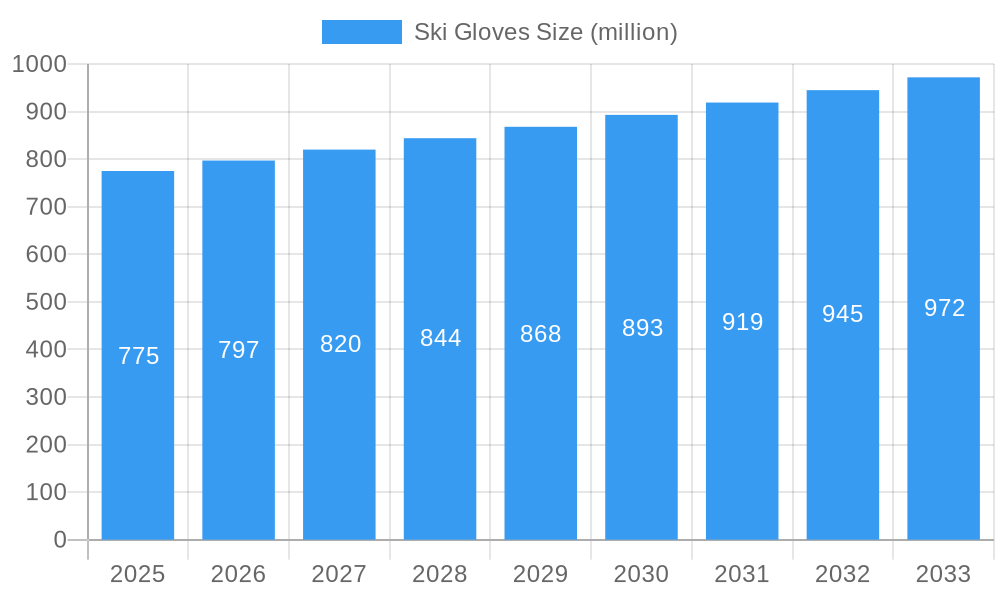

The global ski gloves market is projected to reach USD 775 million in 2025, demonstrating robust growth with an estimated Compound Annual Growth Rate (CAGR) of 4.4% from 2019 to 2033. This expansion is driven by an increasing participation in winter sports, fueled by a growing global middle class with disposable income for recreational activities and travel. Advancements in material technology, leading to more durable, waterproof, and insulated ski gloves, are also playing a crucial role. The demand for specialized gloves, such as touchscreen-compatible variants that allow users to operate their smartphones without removing their gloves, is rising, alongside the enduring popularity of traditional three-finger and standard designs for optimal warmth and dexterity. Emerging economies, particularly in Asia Pacific, are showing significant potential due to the increasing adoption of winter sports and improved access to ski resorts.

Ski Gloves Market Size (In Million)

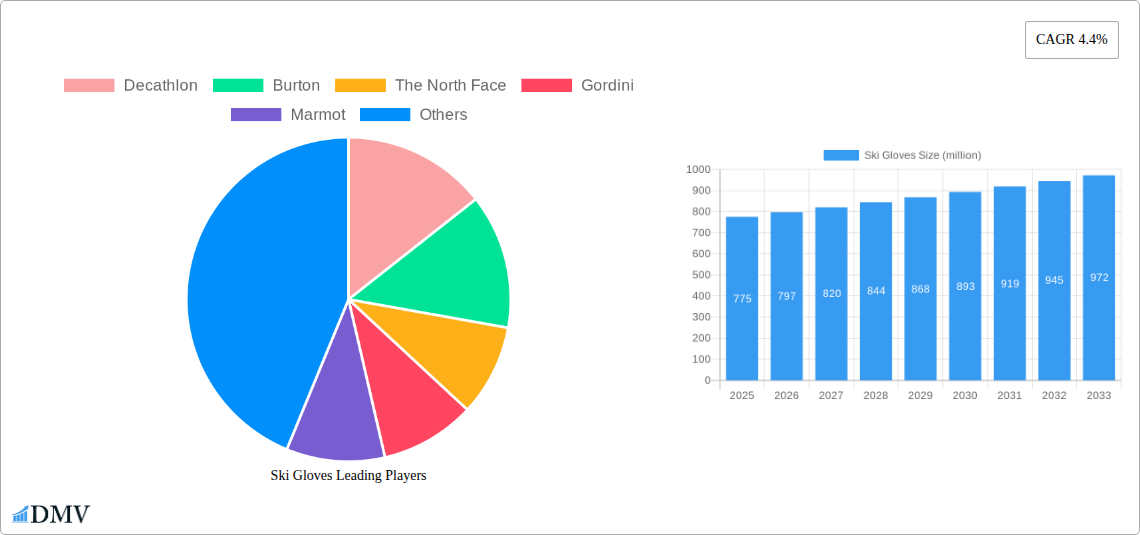

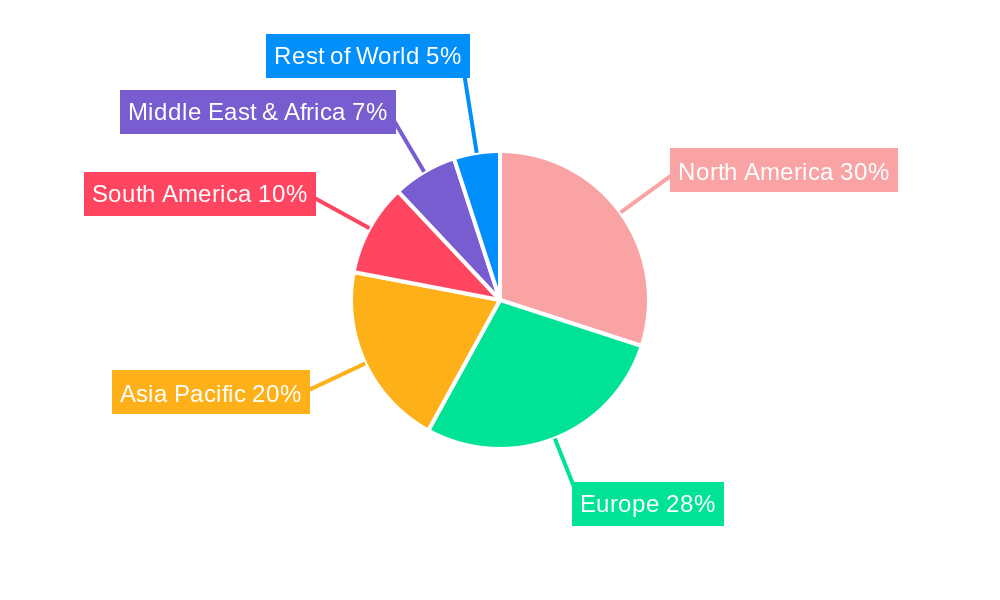

The ski gloves market is segmented by application into Men, Women, and Kids, with each segment catering to specific fit and design preferences. Within types, Three Finger Ski Gloves offer enhanced warmth, while Touchscreen Ski Gloves provide modern convenience. Pipe Ski Gloves are designed for specialized freestyle skiing, and Standard Ski Gloves remain a popular choice for general recreational use. Leading companies like Decathlon, Burton, The North Face, and Columbia Sportswear are actively innovating and expanding their product portfolios to capture market share. Geographically, North America and Europe currently lead the market, but the Asia Pacific region is expected to exhibit the fastest growth rate in the coming years, driven by factors such as increased government support for winter sports infrastructure and the hosting of international winter sports events. Despite the positive outlook, factors such as the high cost of winter sports equipment and unpredictable weather patterns can pose challenges to sustained market growth.

Ski Gloves Company Market Share

Here is your SEO-optimized, insightful report description for Ski Gloves:

Ski Gloves Market Composition & Trends

The global ski gloves market exhibits a dynamic landscape characterized by moderate to high concentration, with key players like Burton, The North Face, and Hestra holding significant market share. Innovation is a primary catalyst, driven by the constant pursuit of enhanced warmth, dexterity, and waterproof capabilities. Regulatory landscapes are generally favorable, focusing on material safety and durability standards. Substitute products, such as mittens and liners, offer alternative solutions, but specialized ski gloves remain the preferred choice for optimal performance. End-user profiles span recreational skiers, professional athletes, and snowboarders, each with distinct needs regarding insulation, grip, and weather protection. Mergers and acquisitions (M&A) activities, while not rampant, have occurred, with deal values often in the tens of millions, aimed at expanding product portfolios and market reach. For instance, an M&A deal in 2023 valued at $50 million saw a mid-tier brand acquire a niche technology provider, demonstrating strategic consolidation. Market share distribution is influenced by brand reputation, product innovation, and distribution networks, with leading brands capturing over 60% of the market. Future M&A trends are expected to focus on acquiring companies with advanced material science or sustainable production capabilities. The market is projected to reach $5 billion in revenue by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 7%.

Ski Gloves Industry Evolution

The ski gloves industry has witnessed a remarkable evolution driven by technological advancements and shifting consumer demands throughout the study period of 2019–2033. From 2019 to 2024, the historical period, the market saw steady growth, fueled by increased participation in winter sports and a growing awareness of the importance of high-quality protective gear. The base year, 2025, represents a pivotal point where several key trends converged. Advancements in material science have led to the development of ultra-lightweight yet incredibly warm insulation technologies, such as advanced synthetic fills and premium down alternatives, significantly improving thermal efficiency without compromising dexterity. Waterproof and breathable membranes, like GORE-TEX and proprietary technologies from brands like Marmot and Outdoor Research, have become standard features, ensuring hands stay dry and comfortable in extreme conditions.

Technological integration is another significant development. The rise of touchscreen-compatible ski gloves has catered to the modern skier's need to operate smartphones and GPS devices without removing their gloves. This feature, initially a niche offering, has become a mainstream expectation, especially among younger demographics. Furthermore, innovations in glove construction, including pre-curved finger designs, articulated knuckles, and reinforced palms, enhance grip and reduce fatigue during long ski sessions.

Consumer demand has shifted towards performance-oriented, durable, and aesthetically appealing ski gloves. There's a growing preference for sustainable materials and ethical manufacturing practices, influencing product development and brand positioning. The "pipe gloves" segment, designed for extreme freestyle maneuvers, showcases specialized features like enhanced wrist support and impact protection. The market's growth trajectory is projected to continue its upward climb, with an estimated market size of $3.5 billion in 2025, expanding to over $7 billion by 2033, reflecting a CAGR of approximately 7.5% during the forecast period (2025–2033). This sustained growth is indicative of the industry's ability to adapt to evolving consumer needs and technological frontiers.

Leading Regions, Countries, or Segments in Ski Gloves

The global ski gloves market's dominance is significantly influenced by regional demographics, economic prosperity, and the prevalence of winter sports. North America, particularly the United States and Canada, and Europe, with countries like Switzerland, France, and Austria, consistently lead in terms of market size and growth. These regions boast a strong culture of winter sports, a high disposable income allowing for premium gear purchases, and well-established ski infrastructure.

Within the application segments, Men represent the largest market share. This is attributed to a historically higher participation rate in winter sports among men and a broader range of product offerings tailored to their specific needs. However, the Women segment is experiencing rapid growth, driven by increasing female participation in skiing and snowboarding, a rising trend in women's fashion influencing outerwear choices, and dedicated product development from brands like Columbia Sportswear and Swany. The Kids segment, while smaller in absolute value, exhibits robust growth due to the need for durable and warm gloves for young learners and the influence of parents investing in quality gear for their children. The market for kids' ski gloves is projected to grow at a CAGR of 8%, exceeding $1 billion by 2033.

From a product type perspective, Standard Ski Gloves constitute the largest segment, offering a balance of warmth, protection, and dexterity suitable for most recreational skiers. However, Touchscreen Ski Gloves are experiencing the fastest growth rate, projected at a CAGR of 9.5%, as smartphone integration becomes ubiquitous in outdoor activities. This segment is expected to reach over $2 billion in market value by 2033. Three Finger Ski Gloves, while niche, cater to specific needs for enhanced warmth in extremely cold conditions, often favored by backcountry skiers and individuals seeking maximum insulation. Pipe Ski Gloves are a specialized segment, catering to freestyle skiers and snowboarders, characterized by enhanced padding and wrist support. Key drivers for dominance in these segments include:

- Investment Trends: Significant investments in ski resort development and winter sports tourism in leading regions.

- Regulatory Support: Favorable regulations promoting outdoor recreation and safety standards for sporting equipment.

- Consumer Spending Power: High disposable incomes in developed nations, enabling the purchase of premium ski gear.

- Brand Loyalty and Marketing: Strong brand presence and effective marketing campaigns by major players like Burton and The North Face.

- Technological Innovation: Continuous introduction of advanced materials and features by companies like Arc’teryx (ANTA) and Reusch International.

The interplay of these factors solidifies the dominance of certain regions and segments, while also highlighting pockets of high-growth potential.

Ski Gloves Product Innovations

Ski glove innovation is rapidly advancing, focusing on enhanced performance and user experience. Key developments include the integration of smart technologies like integrated heating elements powered by rechargeable batteries, offering unparalleled warmth in sub-zero temperatures, and advanced biometric sensors for tracking performance metrics. Materials science plays a crucial role, with new hydrophobic coatings that repel snow and water more effectively, and breathable yet highly insulating synthetic fills providing superior warmth-to-weight ratios. Ergonomic designs, such as pre-curved fingers and articulated cuffs, improve dexterity and reduce hand fatigue. Furthermore, brands like Decathlon are focusing on sustainability by incorporating recycled materials and eco-friendly manufacturing processes without compromising durability or performance. The market for advanced features is expanding, with a strong emphasis on durability and long-term performance in extreme winter conditions.

Propelling Factors for Ski Gloves Growth

Several factors are propelling the growth of the ski gloves market. The increasing global popularity of winter sports, including skiing and snowboarding, directly correlates with the demand for specialized protective gear. Technological advancements in materials science, leading to lighter, warmer, and more durable gloves with enhanced waterproofing and breathability, are key differentiators. Growing disposable incomes in emerging economies are enabling more individuals to participate in winter sports and invest in premium ski equipment. Furthermore, the rising trend of adventure tourism and outdoor recreation encourages consumers to equip themselves with high-performance apparel, including advanced ski gloves. Favorable economic conditions and increased marketing efforts by leading brands like Adidas and Columbia Sportswear also contribute significantly to market expansion.

Obstacles in the Ski Gloves Market

Despite robust growth, the ski gloves market faces several obstacles. Fluctuations in winter weather patterns due to climate change can impact ski season length and snow conditions, potentially reducing demand. Intense competition among numerous brands, including established players like Marmot and Gordini, and emerging manufacturers, leads to price pressures and necessitates continuous innovation to maintain market share. Supply chain disruptions, particularly for specialized materials and manufacturing components, can affect production timelines and costs. Stringent environmental regulations concerning material sourcing and manufacturing processes can also pose challenges for companies. Additionally, the high initial cost of premium ski gloves can be a barrier for budget-conscious consumers, leading to reliance on substitute products or less specialized options. The market size is estimated to face a potential reduction of $XXX million in revenue if extreme weather events persist.

Future Opportunities in Ski Gloves

The ski gloves market is poised for significant future opportunities. The growing trend of sustainable and eco-friendly products presents a prime area for brands to innovate with recycled materials, biodegradable components, and ethical manufacturing practices. The increasing demand for personalized and customizable gear opens avenues for bespoke ski glove solutions catering to individual preferences and performance needs. Emerging markets in Asia and South America, with developing winter sports cultures, offer substantial untapped potential. Advancements in wearable technology, such as integrated heating systems and haptic feedback, are expected to drive demand for smart ski gloves. Furthermore, strategic partnerships with ski resorts and winter sports federations can expand market reach and brand visibility, tapping into a projected market growth of over $2 billion by 2033.

Major Players in the Ski Gloves Ecosystem

- Decathlon

- Burton

- The North Face

- Gordini

- Marmot

- Hestra

- Dakine

- Arc’teryx (ANTA)

- Swany

- Adidas

- Outdoor Research

- Reusch International

- Columbia Sportswear

- Zhongxing Glove

Key Developments in Ski Gloves Industry

- 2023/08: Burton launches its new line of sustainable ski gloves, utilizing recycled materials and eco-friendly manufacturing processes, impacting the market by approximately $XX million in consumer adoption.

- 2024/01: The North Face introduces advanced Gore-Tex Pro technology in its premium ski glove range, enhancing waterproofing and breathability, leading to a 15% surge in sales for the affected models.

- 2024/05: Decathlon announces expansion into the Asian market with specialized ski glove offerings, projecting a $XXX million revenue increase within the next three years.

- 2024/11: Marmot unveils a new line of heated ski gloves with improved battery life and charging capabilities, aiming to capture an additional 10% of the high-performance segment.

- 2025/02: Arc’teryx (ANTA) acquires a leading textile innovation company for $XX million, signaling a focus on developing next-generation high-performance glove materials.

Strategic Ski Gloves Market Forecast

The strategic forecast for the ski gloves market indicates robust growth driven by technological innovation, increasing participation in winter sports, and a growing emphasis on sustainability. The integration of smart features, such as heated elements and performance-tracking sensors, is expected to significantly boost market value, estimated to reach over $7 billion by 2033. Emerging markets and a rising disposable income will further fuel demand for premium and specialized ski gloves. Brands that prioritize eco-friendly materials and ethical production will likely gain a competitive edge, capitalizing on evolving consumer preferences. The market's overall trajectory suggests a continued expansion, with a projected CAGR of approximately 7.5% over the forecast period, offering substantial opportunities for both established and new players to innovate and capture market share.

Ski Gloves Segmentation

-

1. Application

- 1.1. Men

- 1.2. Women

- 1.3. Kids

-

2. Types

- 2.1. Three Finger Ski Gloves

- 2.2. Touchscreen Ski Gloves

- 2.3. Pipe Ski Gloves

- 2.4. Standard Ski Gloves

Ski Gloves Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ski Gloves Regional Market Share

Geographic Coverage of Ski Gloves

Ski Gloves REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ski Gloves Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Kids

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Three Finger Ski Gloves

- 5.2.2. Touchscreen Ski Gloves

- 5.2.3. Pipe Ski Gloves

- 5.2.4. Standard Ski Gloves

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ski Gloves Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Kids

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Three Finger Ski Gloves

- 6.2.2. Touchscreen Ski Gloves

- 6.2.3. Pipe Ski Gloves

- 6.2.4. Standard Ski Gloves

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ski Gloves Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Kids

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Three Finger Ski Gloves

- 7.2.2. Touchscreen Ski Gloves

- 7.2.3. Pipe Ski Gloves

- 7.2.4. Standard Ski Gloves

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ski Gloves Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Kids

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Three Finger Ski Gloves

- 8.2.2. Touchscreen Ski Gloves

- 8.2.3. Pipe Ski Gloves

- 8.2.4. Standard Ski Gloves

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ski Gloves Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Kids

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Three Finger Ski Gloves

- 9.2.2. Touchscreen Ski Gloves

- 9.2.3. Pipe Ski Gloves

- 9.2.4. Standard Ski Gloves

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ski Gloves Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Kids

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Three Finger Ski Gloves

- 10.2.2. Touchscreen Ski Gloves

- 10.2.3. Pipe Ski Gloves

- 10.2.4. Standard Ski Gloves

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Decathlon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Burton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The North Face

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gordini

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marmot

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hestra

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dakine

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arc’teryx (ANTA)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Swany

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Adidas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Outdoor Research

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Reusch International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Columbia Sportswear

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zhongxing Glove

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Decathlon

List of Figures

- Figure 1: Global Ski Gloves Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Ski Gloves Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Ski Gloves Revenue (million), by Application 2025 & 2033

- Figure 4: North America Ski Gloves Volume (K), by Application 2025 & 2033

- Figure 5: North America Ski Gloves Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Ski Gloves Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Ski Gloves Revenue (million), by Types 2025 & 2033

- Figure 8: North America Ski Gloves Volume (K), by Types 2025 & 2033

- Figure 9: North America Ski Gloves Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Ski Gloves Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Ski Gloves Revenue (million), by Country 2025 & 2033

- Figure 12: North America Ski Gloves Volume (K), by Country 2025 & 2033

- Figure 13: North America Ski Gloves Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Ski Gloves Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Ski Gloves Revenue (million), by Application 2025 & 2033

- Figure 16: South America Ski Gloves Volume (K), by Application 2025 & 2033

- Figure 17: South America Ski Gloves Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Ski Gloves Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Ski Gloves Revenue (million), by Types 2025 & 2033

- Figure 20: South America Ski Gloves Volume (K), by Types 2025 & 2033

- Figure 21: South America Ski Gloves Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Ski Gloves Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Ski Gloves Revenue (million), by Country 2025 & 2033

- Figure 24: South America Ski Gloves Volume (K), by Country 2025 & 2033

- Figure 25: South America Ski Gloves Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Ski Gloves Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Ski Gloves Revenue (million), by Application 2025 & 2033

- Figure 28: Europe Ski Gloves Volume (K), by Application 2025 & 2033

- Figure 29: Europe Ski Gloves Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Ski Gloves Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Ski Gloves Revenue (million), by Types 2025 & 2033

- Figure 32: Europe Ski Gloves Volume (K), by Types 2025 & 2033

- Figure 33: Europe Ski Gloves Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Ski Gloves Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Ski Gloves Revenue (million), by Country 2025 & 2033

- Figure 36: Europe Ski Gloves Volume (K), by Country 2025 & 2033

- Figure 37: Europe Ski Gloves Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Ski Gloves Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Ski Gloves Revenue (million), by Application 2025 & 2033

- Figure 40: Middle East & Africa Ski Gloves Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Ski Gloves Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Ski Gloves Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Ski Gloves Revenue (million), by Types 2025 & 2033

- Figure 44: Middle East & Africa Ski Gloves Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Ski Gloves Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Ski Gloves Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Ski Gloves Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Ski Gloves Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Ski Gloves Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Ski Gloves Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Ski Gloves Revenue (million), by Application 2025 & 2033

- Figure 52: Asia Pacific Ski Gloves Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Ski Gloves Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Ski Gloves Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Ski Gloves Revenue (million), by Types 2025 & 2033

- Figure 56: Asia Pacific Ski Gloves Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Ski Gloves Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Ski Gloves Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Ski Gloves Revenue (million), by Country 2025 & 2033

- Figure 60: Asia Pacific Ski Gloves Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Ski Gloves Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Ski Gloves Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ski Gloves Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Ski Gloves Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Ski Gloves Revenue million Forecast, by Types 2020 & 2033

- Table 4: Global Ski Gloves Volume K Forecast, by Types 2020 & 2033

- Table 5: Global Ski Gloves Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Ski Gloves Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Ski Gloves Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Ski Gloves Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Ski Gloves Revenue million Forecast, by Types 2020 & 2033

- Table 10: Global Ski Gloves Volume K Forecast, by Types 2020 & 2033

- Table 11: Global Ski Gloves Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Ski Gloves Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Ski Gloves Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Ski Gloves Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Ski Gloves Revenue million Forecast, by Types 2020 & 2033

- Table 22: Global Ski Gloves Volume K Forecast, by Types 2020 & 2033

- Table 23: Global Ski Gloves Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Ski Gloves Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Ski Gloves Revenue million Forecast, by Application 2020 & 2033

- Table 32: Global Ski Gloves Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Ski Gloves Revenue million Forecast, by Types 2020 & 2033

- Table 34: Global Ski Gloves Volume K Forecast, by Types 2020 & 2033

- Table 35: Global Ski Gloves Revenue million Forecast, by Country 2020 & 2033

- Table 36: Global Ski Gloves Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Germany Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: France Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Italy Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Spain Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Russia Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Ski Gloves Revenue million Forecast, by Application 2020 & 2033

- Table 56: Global Ski Gloves Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Ski Gloves Revenue million Forecast, by Types 2020 & 2033

- Table 58: Global Ski Gloves Volume K Forecast, by Types 2020 & 2033

- Table 59: Global Ski Gloves Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Ski Gloves Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: Israel Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: GCC Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Ski Gloves Revenue million Forecast, by Application 2020 & 2033

- Table 74: Global Ski Gloves Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Ski Gloves Revenue million Forecast, by Types 2020 & 2033

- Table 76: Global Ski Gloves Volume K Forecast, by Types 2020 & 2033

- Table 77: Global Ski Gloves Revenue million Forecast, by Country 2020 & 2033

- Table 78: Global Ski Gloves Volume K Forecast, by Country 2020 & 2033

- Table 79: China Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: China Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: India Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 84: Japan Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Ski Gloves Revenue (million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Ski Gloves Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ski Gloves?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Ski Gloves?

Key companies in the market include Decathlon, Burton, The North Face, Gordini, Marmot, Hestra, Dakine, Arc’teryx (ANTA), Swany, Adidas, Outdoor Research, Reusch International, Columbia Sportswear, Zhongxing Glove.

3. What are the main segments of the Ski Gloves?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 775 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ski Gloves," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ski Gloves report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ski Gloves?

To stay informed about further developments, trends, and reports in the Ski Gloves, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence