Key Insights

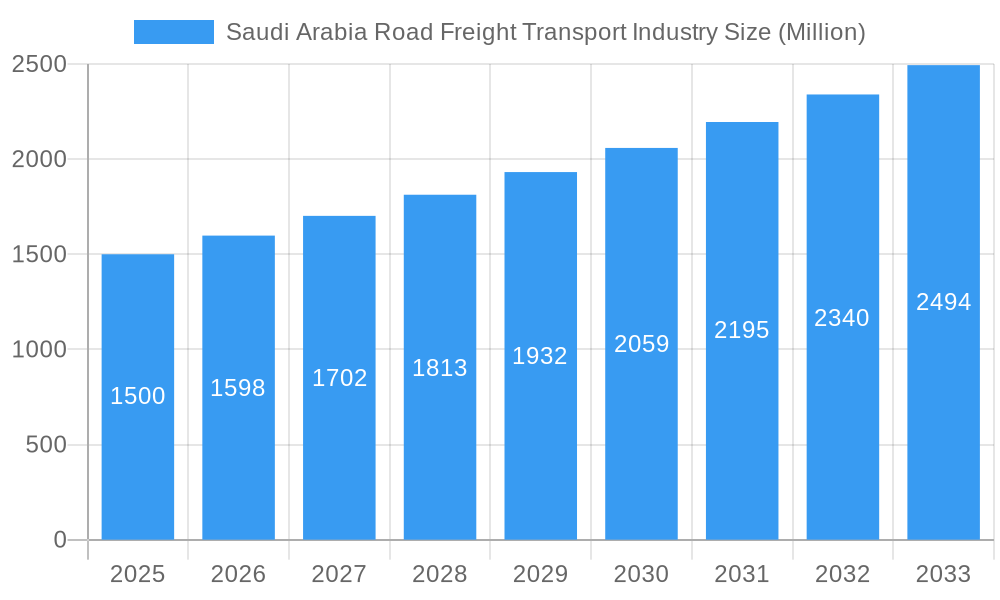

The Saudi Arabian road freight transport market, valued at approximately $8.61 billion in 2024, is projected to expand robustly with a Compound Annual Growth Rate (CAGR) of 6.2% from 2024 to 2033. This growth is propelled by Vision 2030’s extensive construction and infrastructure development, increasing e-commerce demands, and the nation's economic diversification into manufacturing and agriculture. The market is segmented by goods (fluid and solid), temperature control (controlled and non-controlled), end-user industry (agriculture, construction, manufacturing, oil & gas, mining, retail, and others), destination (domestic and international), truckload specification (FTL and LTL), containerization (containerized and non-containerized), and distance (long and short haul). Leading players like AMC Sea Transport Est, Almajdouie, and SMSA Express Transportation Company Ltd. are actively driving market evolution through strategic investments.

Saudi Arabia Road Freight Transport Industry Market Size (In Billion)

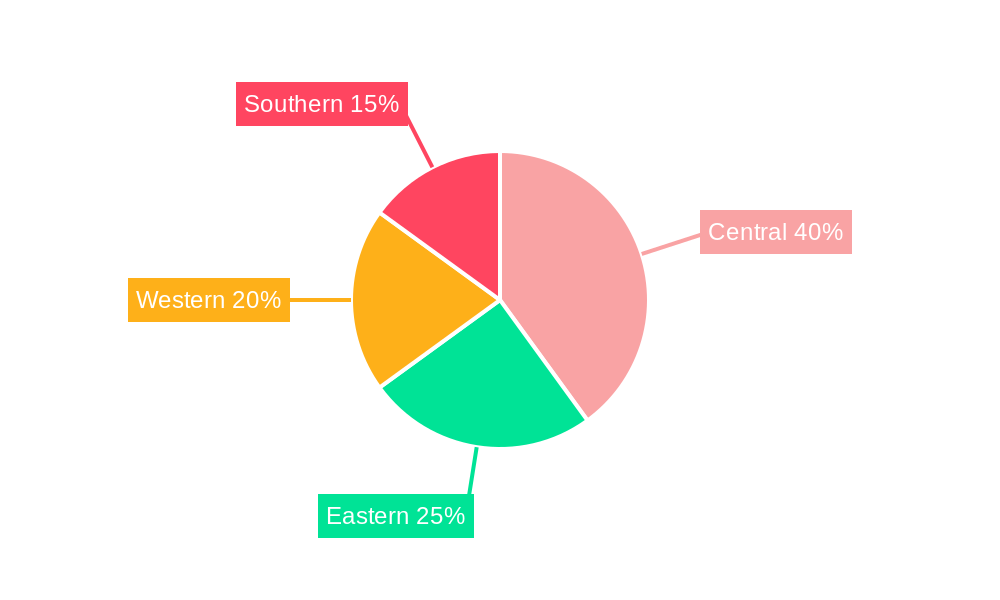

Market distribution across Saudi Arabia’s central, eastern, western, and southern regions is influenced by economic activity and infrastructure. While the central region currently leads, ongoing infrastructure enhancements are fostering more balanced growth. Challenges such as fuel price volatility, driver shortages, and the need for greater technological adoption (e.g., GPS tracking, route optimization) require strategic attention. Addressing these through policy, technological innovation, and driver training is vital for sustained industry expansion.

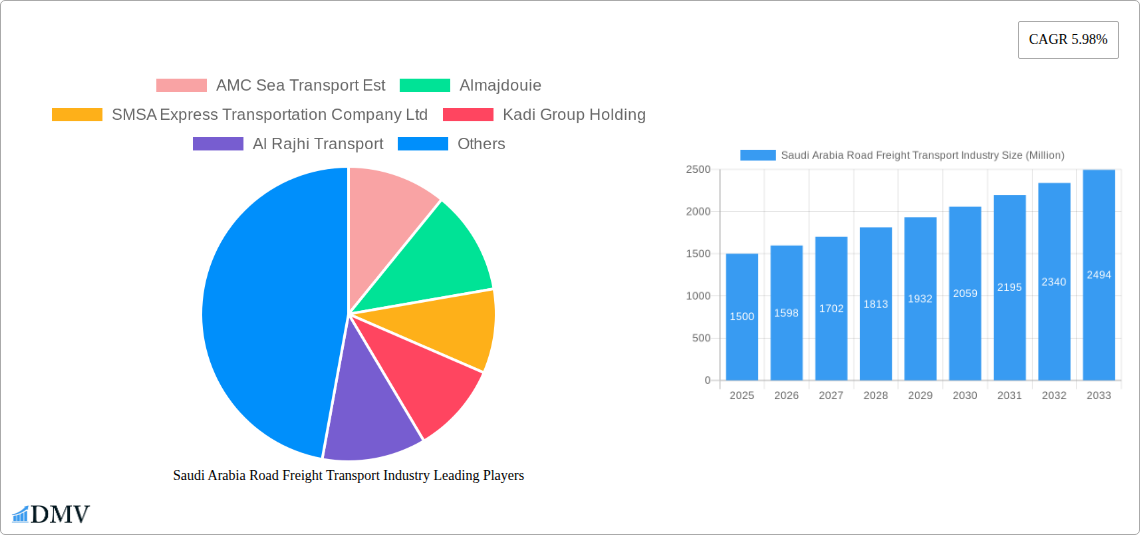

Saudi Arabia Road Freight Transport Industry Company Market Share

Saudi Arabia Road Freight Transport Market Analysis: Size, Growth & Forecast (2024-2033)

This comprehensive report offers an in-depth analysis of the Saudi Arabia road freight transport industry, detailing market size, segmentation, competitive dynamics, and future outlook. The study period spans 2024-2033, with 2024 serving as the base year. It provides critical insights for logistics providers, investors, and government agencies aiming to leverage opportunities in this dynamic market. The total market size is estimated at $8.61 billion in 2024, with significant growth anticipated by 2033.

Saudi Arabia Road Freight Transport Industry Market Composition & Trends

This section delves into the intricacies of the Saudi Arabian road freight transport market, examining its composition and prevailing trends. We analyze market concentration, highlighting the market share distribution among key players such as Almajdouie, SMSA Express, and Al Rajhi Transport. The report also explores innovation catalysts, including technological advancements in fleet management and logistics software. The regulatory landscape, including government initiatives to improve infrastructure and streamline logistics processes, is thoroughly assessed. Furthermore, the analysis encompasses substitute products (e.g., rail and air freight), end-user profiles across diverse sectors (Agriculture, Construction, Manufacturing, Oil & Gas, Mining, Wholesale & Retail), and recent M&A activities, providing insights into deal values and their impact on market dynamics. The total M&A deal value for the period 2019-2024 is estimated at xx Million.

- Market Concentration: High concentration with a few dominant players controlling a significant market share.

- Innovation Catalysts: Technological advancements in telematics, route optimization software, and autonomous vehicles.

- Regulatory Landscape: Government initiatives focused on infrastructure development and logistics efficiency.

- Substitute Products: Limited substitutes, with road transport remaining dominant for short-to-medium haul deliveries.

- End-User Profiles: Diverse end-user base spanning various sectors, with Oil & Gas and Construction being significant contributors.

- M&A Activities: Moderate M&A activity observed, with deal values ranging from xx Million to xx Million.

Saudi Arabia Road Freight Transport Industry Industry Evolution

This section traces the evolutionary path of the Saudi Arabia road freight transport industry, analyzing market growth trajectories from 2019 to 2024 and projecting future trends until 2033. We examine technological advancements impacting operational efficiency and explore shifting consumer demands, including increasing expectations for faster and more reliable delivery services. The historical period (2019-2024) shows a compound annual growth rate (CAGR) of xx%, driven by economic growth and infrastructure development. The forecast period (2025-2033) projects a CAGR of xx%, fueled by continued infrastructure investments and the growth of e-commerce. The adoption of advanced technologies like GPS tracking and telematics is expected to reach xx% by 2033. Increased adoption of temperature-controlled transport is also anticipated.

Leading Regions, Countries, or Segments in Saudi Arabia Road Freight Transport Industry

This section identifies leading segments within the Saudi Arabia road freight transport market. We analyze dominance factors for each category (Goods Configuration: Fluid Goods, Solid Goods; Temperature Control: Non-Temperature Controlled, Temperature Controlled; End User Industry: Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others; Destination: Domestic, International; Truckload Specification: Full-Truck-Load (FTL), Less than-Truck-Load (LTL); Containerization: Containerized, Non-Containerized; Distance: Long Haul, Short Haul). Dominant regions are also analyzed.

- Key Drivers (Examples):

- Investment Trends: Significant government investment in infrastructure projects.

- Regulatory Support: Favorable government policies promoting logistics sector development.

- Dominance Factors: The Oil & Gas sector is a significant driver due to its extensive logistics needs. FTL services are dominant due to larger shipment volumes. The domestic segment currently holds a larger market share than international freight.

Saudi Arabia Road Freight Transport Industry Product Innovations

This section highlights recent product innovations within the Saudi Arabia road freight transport industry, focusing on technological advancements in fleet management systems, telematics, and route optimization software. These innovations enhance efficiency, reduce operational costs, and improve delivery times. Unique selling propositions include improved tracking capabilities, real-time data analysis, and integration with other logistics platforms. The adoption of these technologies contributes to improved fuel efficiency and reduced carbon emissions.

Propelling Factors for Saudi Arabia Road Freight Transport Industry Growth

Key growth drivers include the ongoing expansion of Saudi Arabia's infrastructure, particularly road networks, supporting increased freight movement. Economic growth across various sectors, especially construction, manufacturing, and e-commerce, fuels demand for reliable and efficient transportation services. Government initiatives focused on streamlining logistics processes and reducing bureaucratic hurdles also contribute to industry growth. Technological advancements, such as the adoption of telematics and GPS tracking, further enhance efficiency and productivity.

Obstacles in the Saudi Arabia Road Freight Transport Industry Market

Challenges include maintaining a skilled workforce in a competitive labor market. Supply chain disruptions, particularly those stemming from global events, can significantly impact operations. Stringent regulatory compliance requirements can increase operational costs for companies. Intense competition among established players and new entrants exerts pressure on pricing and profitability.

Future Opportunities in Saudi Arabia Road Freight Transport Industry

Emerging opportunities exist in the growing e-commerce sector, demanding last-mile delivery solutions and specialized logistics services. The development of sustainable transportation practices presents opportunities for companies implementing eco-friendly technologies and strategies. Expanding into new markets within the region presents further opportunities for growth and diversification.

Major Players in the Saudi Arabia Road Freight Transport Industry Ecosystem

- AMC Sea Transport Est

- Almajdouie

- SMSA Express Transportation Company Ltd

- Kadi Group Holding

- Al Rajhi Transport

- Arabco Logistics

- Wared Logistic

- Rashed Abdul Rahman Al Rashed & Sons Group

- Munawla Cargo Co

Key Developments in Saudi Arabia Road Freight Transport Industry Industry

- October 2023: Almajdouie Logistics partners with IRU for driver training and development, enhancing workforce capabilities.

- April 2023: Almajdouie Logistics expands its fleet with 30 new Hyundai Xcient trucks, improving efficiency and sustainability.

- August 2022: Zajil Express launches ZajilApp V.2.0, improving user experience and operational efficiency.

Strategic Saudi Arabia Road Freight Transport Industry Market Forecast

The Saudi Arabia road freight transport industry is poised for robust growth, driven by infrastructure development, economic expansion, and technological advancements. Continued investments in logistics infrastructure and the adoption of innovative technologies will be key to maintaining a competitive edge. The market is expected to experience significant expansion across various segments, with considerable potential for new entrants and existing players to capitalize on emerging opportunities.

Saudi Arabia Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Saudi Arabia Road Freight Transport Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Road Freight Transport Industry Regional Market Share

Geographic Coverage of Saudi Arabia Road Freight Transport Industry

Saudi Arabia Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AMC Sea Transport Est

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Almajdouie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SMSA Express Transportation Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kadi Group Holding

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Rajhi Transport

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arabco Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wared Logistic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rashed Abdul Rahman Al Rashed & Sons Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Munawla Cargo Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 AMC Sea Transport Est

List of Figures

- Figure 1: Saudi Arabia Road Freight Transport Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Road Freight Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Saudi Arabia Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Road Freight Transport Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Saudi Arabia Road Freight Transport Industry?

Key companies in the market include AMC Sea Transport Est, Almajdouie, SMSA Express Transportation Company Ltd, Kadi Group Holding, Al Rajhi Transport, Arabco Logistics, Wared Logistic, Rashed Abdul Rahman Al Rashed & Sons Group, Munawla Cargo Co.

3. What are the main segments of the Saudi Arabia Road Freight Transport Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

October 2023: Almajdouie Logistics has entered into a strategic partnership with IRU. IRU RoadMasters helps mobility and logistics operators develop, strengthen and manage key workers, especially commercial drivers, with state-of-the-art training and assessment solutions.April 2023: Almajdouie Logistics recently enhanced its fleet with 30 new Hyundai Xcient trucks, which are equipped with advanced technology to improve efficiency and sustainability. Almajdouie Motors Company, the authorized distributor of Hyundai Commercial Vehicles in the eastern and northern regions of Saudi Arabia, delivered the trucks in line with an existing contract.August 2022: Zajil Express announced the launch of ZajilApp V.2.0 to provide a clearer, easier, and more interactive user experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence