Key Insights

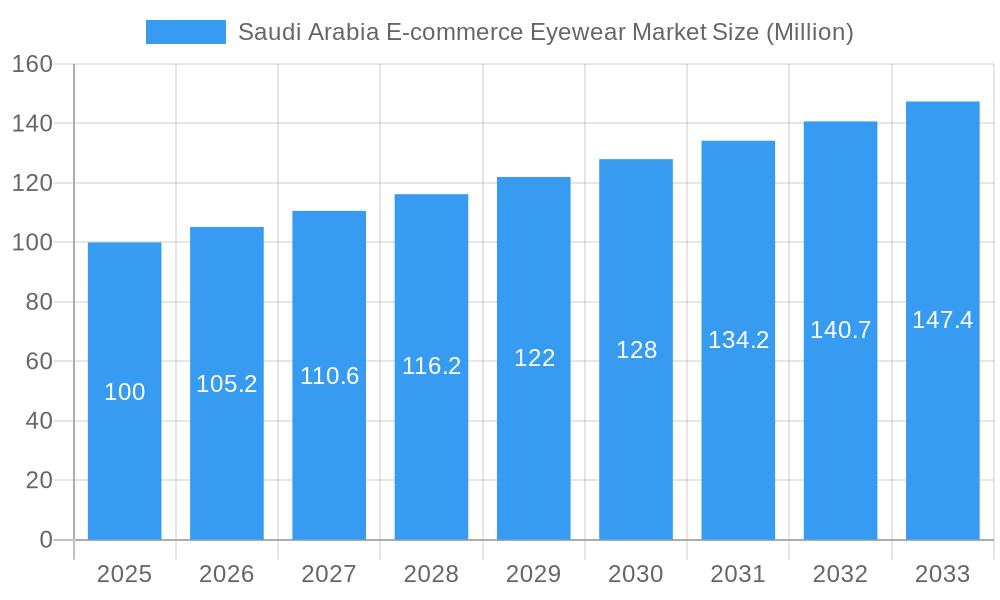

The Saudi Arabian e-commerce eyewear market is poised for substantial growth, driven by increasing internet penetration, rising disposable incomes, and a young, fashion-conscious demographic. While the broader Middle East and Africa (MEA) eyewear market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.20% from 2019 to 2033, Saudi Arabia's online segment is expected to surpass this due to the convenience, wider selection, and competitive pricing of e-commerce. Key growth drivers include the preference for online shopping, particularly among the growing middle class and due to increased smartphone adoption. However, challenges such as ensuring product authenticity, managing delivery logistics, and the absence of in-person fitting require strategic attention. The market is segmented by end-user (men, women, unisex) and product category (spectacles, sunglasses, contact lenses, other), with sunglasses anticipated to lead due to fashion and climatic influences. Major players, including EssilorLuxottica, Safilo Group, and Johnson & Johnson, alongside various online retailers, are actively competing. The government's role in enhancing e-commerce infrastructure and logistics will be critical for market expansion.

Saudi Arabia E-commerce Eyewear Market Market Size (In Million)

The forecast period, from 2025 to 2033, anticipates significant market expansion, with an estimated market size of 632.6 million in 2025. This growth will be further propelled by a growing middle class, increased smartphone penetration, and a preference for digitally native brands. To capitalize on this market, companies must prioritize robust e-commerce platforms, secure payment gateways, and reliable delivery systems. Implementing personalized customer experiences, leveraging augmented reality (AR) for virtual try-ons, and establishing trust through transparent return policies will be essential for success. Competition is expected to intensify as both global and regional players tailor their strategies to the specific needs of Saudi Arabian consumers. The overall market valuation for Saudi Arabia's e-commerce eyewear sector in 2025 is estimated to be a significant contributor to the MEA market size, reflecting its substantial economic influence. The projected CAGR for this sector is 7.89.

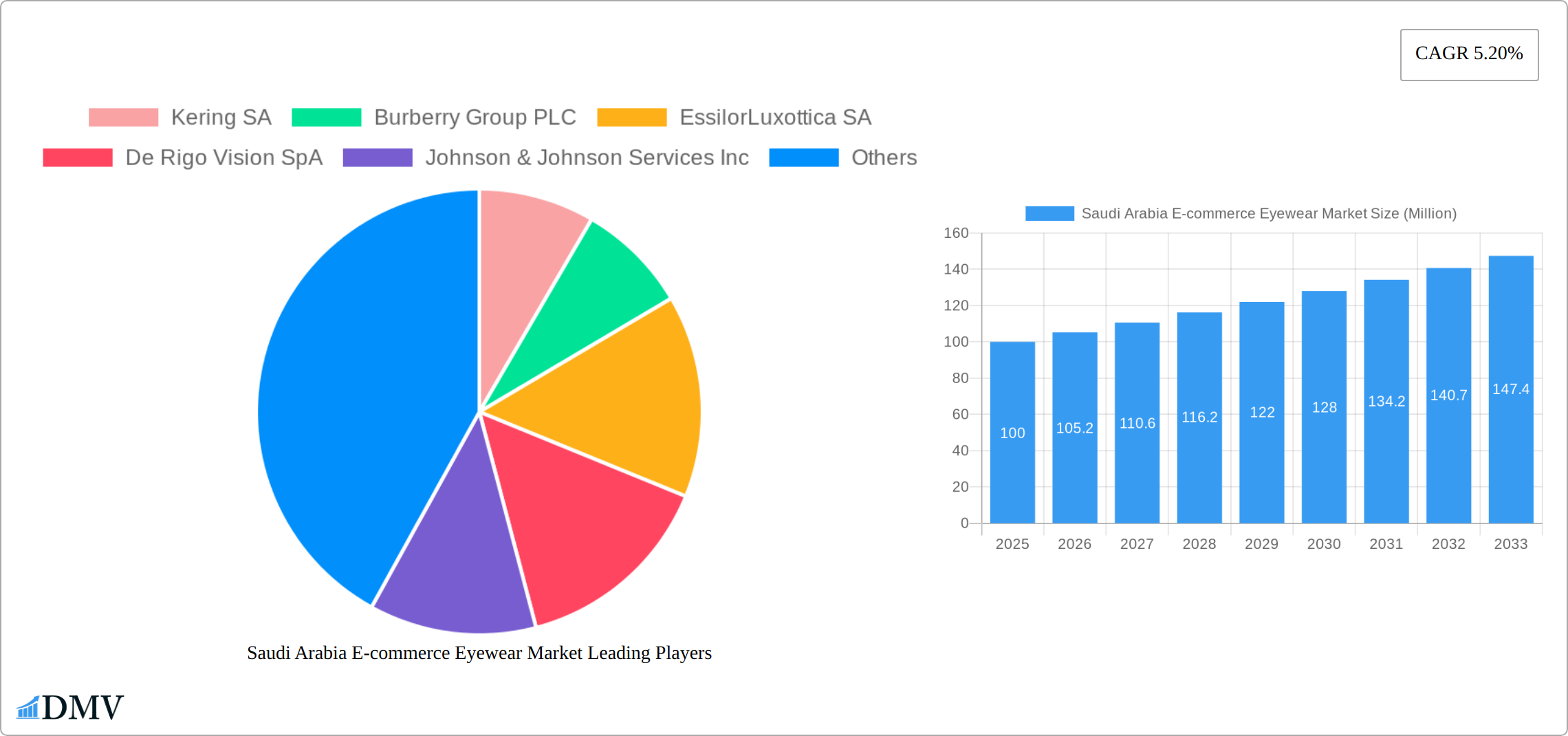

Saudi Arabia E-commerce Eyewear Market Company Market Share

Saudi Arabia E-commerce Eyewear Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Saudi Arabia e-commerce eyewear market, offering a comprehensive overview of market trends, key players, and future growth prospects. From market sizing and segmentation to competitive landscapes and emerging opportunities, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024.

Saudi Arabia E-commerce Eyewear Market Market Composition & Trends

This section delves into the intricate composition of the Saudi Arabia e-commerce eyewear market, examining its concentration, innovation drivers, regulatory environment, substitute products, and end-user preferences. We analyze market share distribution amongst key players, revealing the competitive dynamics at play. Furthermore, a detailed assessment of mergers and acquisitions (M&A) activities, including deal values (in Millions), provides valuable insights into market consolidation and strategic investments. The market is projected to reach xx Million by 2033.

- Market Concentration: The Saudi Arabian e-commerce eyewear market exhibits a moderately concentrated structure, with a few major players holding significant market share. Smaller, niche players also contribute to the overall market diversity.

- Innovation Catalysts: Technological advancements in eyewear design, manufacturing, and online retail experiences are driving market innovation. Personalized lens technologies and augmented reality (AR) virtual try-on features are gaining traction.

- Regulatory Landscape: The regulatory environment in Saudi Arabia plays a key role in shaping the e-commerce eyewear market, influencing aspects such as product safety standards and data privacy regulations.

- Substitute Products: Competition from substitute products, such as corrective laser surgeries, impacts the market growth of traditional eyewear.

- End-User Profiles: The market caters to diverse end-user segments, including men, women, and unisex demographics, with varying preferences and purchasing behaviors.

- M&A Activities: Recent M&A activities within the Saudi Arabian e-commerce eyewear market have involved strategic partnerships and acquisitions, aiming to enhance market presence and expand product portfolios. Deal values are estimated to be in the range of xx Million annually.

Saudi Arabia E-commerce Eyewear Market Industry Evolution

This section traces the evolution of the Saudi Arabia e-commerce eyewear market, analyzing market growth trajectories, technological advancements, and evolving consumer preferences. The report provides specific data points on growth rates, adoption metrics, and key market trends, painting a clear picture of the market's dynamic journey. This market has shown a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024 and is projected to continue its growth momentum with a CAGR of xx% during the forecast period.

- Technological Advancements: The integration of AR/VR technologies for virtual try-ons, the use of AI-powered lens prescription services, and the rise of personalized eyewear design have significantly impacted the market.

- Shifting Consumer Demands: Growing health consciousness, increasing disposable incomes, and a preference for convenient online shopping are driving market expansion. The demand for specific product types, such as sunglasses, spectacles, and contact lenses, is examined in detail.

- Market Growth Trajectories: The market is experiencing significant growth, fuelled by rising internet penetration, increasing smartphone usage, and growing adoption of online shopping platforms.

Leading Regions, Countries, or Segments in Saudi Arabia E-commerce Eyewear Market

This section identifies the dominant regions, countries, or segments within the Saudi Arabia e-commerce eyewear market, including end-user demographics (men, women, unisex) and product categories (spectacles, sunglasses, contact lenses, other). Key drivers such as investment trends and regulatory support are highlighted using bullet points, while paragraphs provide in-depth analysis of the factors contributing to segment dominance.

- Dominant Segment: The sunglasses segment is currently the most dominant, driven by fashion trends and increasing awareness of UV protection.

- Key Drivers for Dominant Segment:

- Growing Fashion Consciousness: Increased spending on fashion and accessories, including sunglasses, is a significant driver.

- Government Support: Government initiatives promoting tourism and lifestyle sectors indirectly benefit the eyewear market.

- E-commerce Infrastructure: Robust e-commerce infrastructure supports online sales of sunglasses.

- In-Depth Analysis: The dominance of the sunglasses segment stems from its appeal to a broader demographic, its association with fashion trends, and the relatively higher price points compared to other eyewear categories.

Saudi Arabia E-commerce Eyewear Market Product Innovations

The Saudi Arabia e-commerce eyewear market is witnessing a surge in groundbreaking product innovations designed to enhance both functionality and style. These advancements are not only catering to a growing demand for aesthetically pleasing eyewear but also addressing evolving consumer needs for advanced eye protection and digital well-being. Key innovations include the integration of blue light filtering lenses, which are increasingly crucial in an era dominated by digital screens, significantly reducing eye strain and protecting users from potential long-term damage. Furthermore, the market is seeing a rise in the adoption of advanced lens technologies offering superior UV protection, anti-scratch coatings, and enhanced clarity. Beyond traditional eyewear, smart eyewear with integrated technology is emerging as a significant differentiator. These devices offer features such as integrated cameras, audio capabilities, and even augmented reality overlays, signaling a shift towards eyewear as a multi-functional tech accessory. New and sustainable materials are also playing a vital role, with brands exploring eco-friendly and lightweight options that appeal to the environmentally conscious Saudi consumer. These innovations, coupled with unique selling propositions like personalized virtual try-on experiences and tailored prescription lens solutions, are collectively driving product differentiation and capturing consumer interest.

Propelling Factors for Saudi Arabia E-commerce Eyewear Market Growth

This section pinpoints the key factors driving the growth of the Saudi Arabia e-commerce eyewear market. Technological advancements, economic factors, and supportive regulatory frameworks all play crucial roles. Specific examples illustrating the impact of these drivers are provided.

- Technological Advancements: The development of advanced lens technologies and virtual try-on features boosts customer engagement and sales.

- Economic Factors: Rising disposable incomes and increased spending power within the target demographics fuel demand.

- Regulatory Support: Government initiatives promoting e-commerce and digital transformation benefit online eyewear retailers.

Obstacles in the Saudi Arabia E-commerce Eyewear Market Market

The burgeoning Saudi Arabia e-commerce eyewear market, while promising, faces several significant obstacles that temper its growth trajectory. These challenges require strategic mitigation and careful navigation by market participants. The analysis below outlines key constraints and their estimated quantifiable impacts in Millions of Saudi Riyals (SAR), highlighting the financial implications of these hurdles:

- Regulatory Challenges: Adherence to the Kingdom's stringent product safety standards, quality control mandates, and precise labeling requirements for medical devices and fashion accessories can lead to increased operational expenditures. Navigating these complex regulations and ensuring full compliance can add an estimated 5-10% to product development and launch costs.

- Supply Chain Disruptions: The reliance on global supply chains for raw materials, components, and finished eyewear products makes the market susceptible to international trade fluctuations, shipping delays, and geopolitical events. These disruptions can lead to stockouts, increased inventory holding costs, and a potential loss of sales, with an estimated financial impact of 3-7% on market revenue annually.

- Competitive Pressures: The market is characterized by intense competition from a diverse range of players, including established global luxury brands, specialized optical retailers, and agile local e-commerce startups. This fierce rivalry can lead to price wars and necessitate substantial investment in marketing and customer acquisition, potentially compressing profit margins by an estimated 10-15% for many players.

Future Opportunities in Saudi Arabia E-commerce Eyewear Market

The Saudi Arabia e-commerce eyewear market is ripe with untapped potential, presenting lucrative opportunities for growth and expansion. By strategically leveraging evolving consumer behaviors and technological advancements, businesses can unlock new revenue streams and solidify their market position. The key areas poised for significant development include:

- New Market Segments: There is a substantial opportunity to reach underserved populations in rural and remote areas through targeted e-commerce strategies and localized marketing efforts. Additionally, focusing on specific age demographics, such as the rapidly growing youth population seeking fashionable and protective eyewear, or the aging demographic requiring specialized vision correction, can open up new and profitable niches.

- Technological Advancements: The integration of advanced technologies promises to revolutionize the customer journey. Artificial Intelligence (AI) and machine learning can power sophisticated virtual try-on experiences, offering personalized frame recommendations based on facial features, style preferences, and prescription needs, thereby enhancing customer engagement and reducing return rates. The development of augmented reality (AR) applications further enriches the online shopping experience.

- Consumer Trends: A growing emphasis on eye health and preventative care is driving demand for specialized lenses and protective eyewear. Concurrently, the burgeoning adoption of smart eyewear, offering integrated functionalities beyond vision correction, is creating a new category of demand. The increasing comfort and familiarity with online shopping, particularly among younger generations, coupled with a rising disposable income, will continue to fuel market expansion.

Major Players in the Saudi Arabia E-commerce Eyewear Market Ecosystem

- Kering SA (including brands like Gucci, Saint Laurent)

- Burberry Group PLC

- EssilorLuxottica SA (including brands like Ray-Ban, Oakley, and extensive lens manufacturing)

- De Rigo Vision SpA (including brands like Police, Fila)

- Johnson & Johnson Vision (focusing on contact lenses and eye health solutions)

- Alcon Laboratories Inc (a global leader in eye care)

- LVMH Moët Hennessy Louis Vuitton (including brands like Dior, Fendi)

- Safilo Group S p A (with brands like Carrera, Polaroid)

- Charmant Group (known for its titanium eyewear technology)

- Bausch Health Companies Inc (offering a range of eye care products)

Key Developments in Saudi Arabia E-commerce Eyewear Market Industry

- November 2022: Ray-Ban launched its first-ever Middle East-exclusive product, significantly impacting the market's luxury segment.

- July 2022: Lenskart's partnership with noon.com broadened its market reach and strengthened its omnichannel presence.

- February 2021: Safilo Group's Jimmy Choo sunglass launch expanded the luxury eyewear segment's offerings.

Strategic Saudi Arabia E-commerce Eyewear Market Market Forecast

The Saudi Arabia e-commerce eyewear market is on a trajectory for robust and sustained growth in the coming years. This expansion will be primarily fueled by a confluence of favorable factors including rapid technological advancements in product development and online customer experience, a consistent rise in disposable incomes across the population, and an ever-increasing consumer preference for the convenience and accessibility of online shopping platforms. The market's future trajectory paints a picture of significant potential, offering compelling opportunities for both established global brands and agile new market entrants to gain market share and build strong customer bases. The e-commerce infrastructure within the Kingdom is continually evolving, with enhanced logistics, secure payment gateways, and improved last-mile delivery services further solidifying the foundation for e-commerce growth. This overall positive outlook is expected to drive significant market expansion, likely to be further accelerated by strategic mergers and acquisitions as companies seek to consolidate their positions and expand their product portfolios within this dynamic and growing market.

Saudi Arabia E-commerce Eyewear Market Segmentation

-

1. Product Category

- 1.1. Spectacles

- 1.2. Sunglasses

- 1.3. Contact Lenses

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

Saudi Arabia E-commerce Eyewear Market Segmentation By Geography

- 1. Saudi Arabia

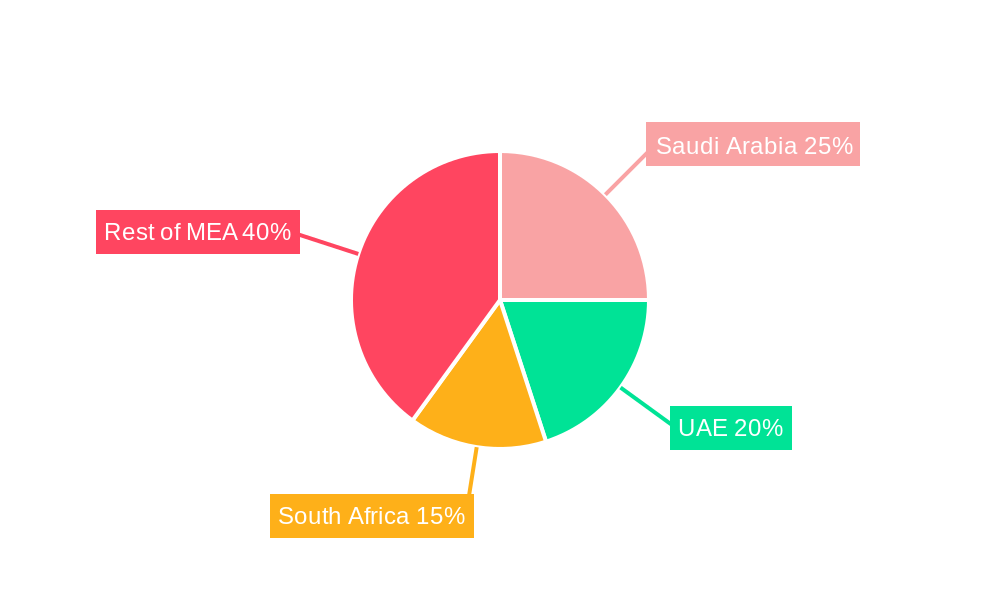

Saudi Arabia E-commerce Eyewear Market Regional Market Share

Geographic Coverage of Saudi Arabia E-commerce Eyewear Market

Saudi Arabia E-commerce Eyewear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Booming Online Retail Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-commerce Eyewear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 5.1.1. Spectacles

- 5.1.2. Sunglasses

- 5.1.3. Contact Lenses

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kering SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Burberry Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EssilorLuxottica SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 De Rigo Vision SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Laboratories Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moët Hennessy Louis Vuitton

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safilo Group S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charmant Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bausch Health Companies Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kering SA

List of Figures

- Figure 1: Saudi Arabia E-commerce Eyewear Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-commerce Eyewear Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Product Category 2020 & 2033

- Table 2: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Product Category 2020 & 2033

- Table 5: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-commerce Eyewear Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the Saudi Arabia E-commerce Eyewear Market?

Key companies in the market include Kering SA, Burberry Group PLC, EssilorLuxottica SA, De Rigo Vision SpA, Johnson & Johnson Services Inc, Alcon Laboratories Inc *List Not Exhaustive, LVMH Moët Hennessy Louis Vuitton, Safilo Group S p A, Charmant Group, Bausch Health Companies Inc.

3. What are the main segments of the Saudi Arabia E-commerce Eyewear Market?

The market segments include Product Category, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 632.6 million as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Booming Online Retail Industry.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Ray-Ban launched its first-ever Middle East-exclusive product, the Ray-Ban Legacy. The sunglasses came in a classic black, featuring gold detailing on the temples and a gold Ray-Ban logo. The sunglasses are a mix of modernity and ancestry, and their pair came in a custom-designed box showcasing the symbolic "shemagh" print, with the intricate packaging highlighting the brand's first Middle East exclusive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-commerce Eyewear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-commerce Eyewear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-commerce Eyewear Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-commerce Eyewear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence