Key Insights

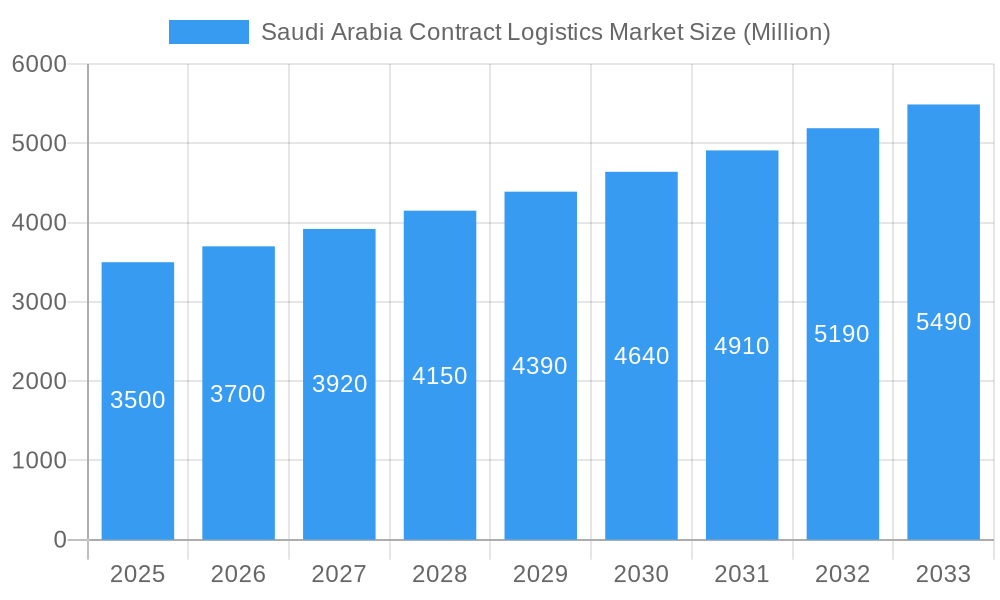

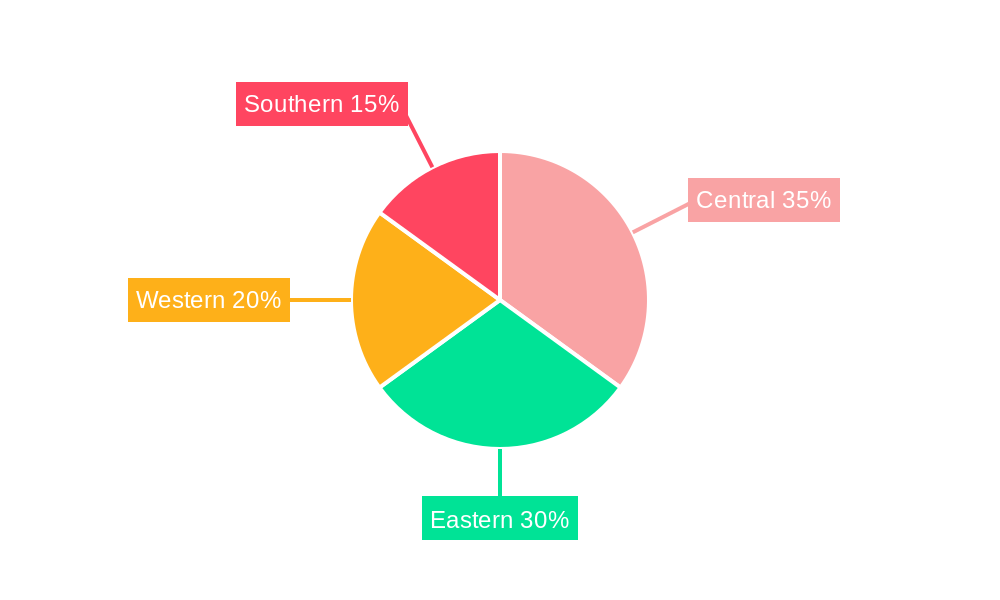

The Saudi Arabian contract logistics market is poised for significant expansion, propelled by the nation's ambitious Vision 2030 economic diversification agenda and the rapid growth of the e-commerce sector. Key growth drivers include substantial infrastructure investments, increasing manufacturing output, and thriving sectors such as healthcare, pharmaceuticals, and consumer goods. Businesses are increasingly outsourcing logistics functions to optimize efficiency, reduce operational costs, and concentrate on core business activities. The market is segmented by logistics model (insourced and outsourced) and diverse end-user industries, including manufacturing, automotive, consumer goods, high-tech, healthcare, pharmaceuticals, chemicals, petrochemicals, and others. With a projected Compound Annual Growth Rate (CAGR) of 6.04%, the market size was estimated at $3.2 billion in the base year 2025, with expectations to surpass $5 billion by 2033. Regional growth disparities exist, with the central and eastern regions anticipated to lead due to their strategic proximity to industrial centers and major ports, although overall market expansion benefits all regions.

Saudi Arabia Contract Logistics Market Market Size (In Billion)

Potential constraints to market growth include oil price volatility and geopolitical influences that can impact economic activity and logistics demand. However, the long-term outlook remains robust, supported by ongoing government initiatives focused on infrastructure enhancement, regulatory streamlining, and the promotion of foreign investment. This supportive environment fosters the growth of both international and domestic logistics providers, cultivating a competitive yet collaborative market landscape. Leading companies are prioritizing technological advancements, including digitalization and automation, to enhance operational efficiency and secure a competitive advantage, thereby shaping future market trajectories. The successful realization of Vision 2030 will solidify the Saudi Arabian contract logistics market's position as a regional leader and a critical enabler of the Kingdom's economic diversification.

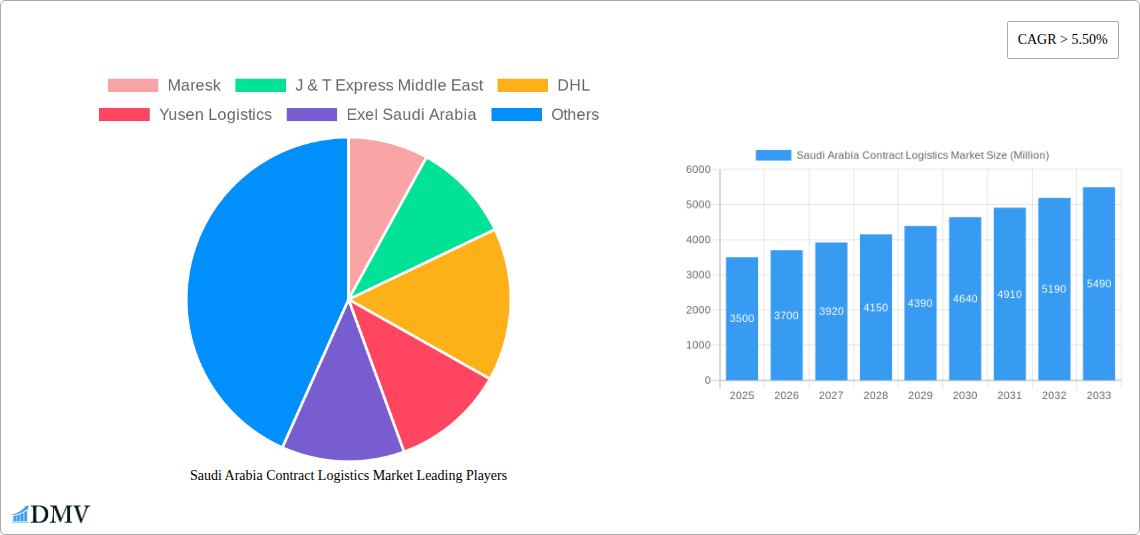

Saudi Arabia Contract Logistics Market Company Market Share

Saudi Arabia Contract Logistics Market Analysis: 2025-2033 Forecast

This comprehensive market analysis delivers in-depth insights into the Saudi Arabia contract logistics market, providing essential intelligence for stakeholders assessing its current standing and future potential. The market is experiencing robust growth, driven by Vision 2030 objectives and significant government investment in logistics infrastructure. This report covers the forecast period from 2025 to 2033, offering a detailed overview of market size, key industry participants, emerging trends, and future projections. The market is projected to reach a value of $3.2 billion by 2025, with an anticipated CAGR of 6.04%.

Saudi Arabia Contract Logistics Market Composition & Trends

The Saudi Arabia contract logistics market exhibits a moderately concentrated landscape, with key players such as DHL, Agility, and Aramex holding significant market share. However, the emergence of smaller, specialized providers is increasing competition. Innovation is driven by technological advancements like AI-powered route optimization and blockchain for enhanced transparency. The regulatory landscape is evolving with a focus on streamlining logistics processes and improving infrastructure. Substitute products, primarily in-house logistics operations, face increasing pressure from the cost-effectiveness and efficiency of outsourced solutions. Mergers and acquisitions (M&A) activity is anticipated to increase, driven by the need for expansion and diversification.

- Market Share Distribution (2024): DHL (20%), Agility (15%), Aramex (10%), Other Players (55%). These figures are estimates based on publicly available information and market analysis.

- Recent M&A Deal Values (2022-2024): xx Million (estimated). Precise figures are unavailable due to the private nature of many transactions.

- End-User Profiles: The manufacturing and automotive, consumer goods and retail, and petrochemical sectors are major drivers of market growth.

Saudi Arabia Contract Logistics Market Industry Evolution

The Saudi Arabia contract logistics market is witnessing robust growth, driven by several factors. The Kingdom's Vision 2030 initiative aims to diversify the economy and reduce reliance on oil, thereby fostering growth in various sectors and increasing demand for efficient logistics solutions. Technological advancements, such as the adoption of advanced warehouse management systems (WMS) and transportation management systems (TMS), are improving operational efficiency and reducing costs. This trend is further supported by the government's push to digitize logistics operations. The increasing e-commerce penetration in the Kingdom has also contributed to the demand for contract logistics services. The market is estimated to have grown at a CAGR of xx% during the historical period (2019-2024), and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The adoption of automation technologies is expected to increase significantly in the coming years.

Leading Regions, Countries, or Segments in Saudi Arabia Contract Logistics Market

The Eastern Province and Riyadh are the leading regions for contract logistics in Saudi Arabia, driven by their concentration of industrial activity and major ports. The outsourced segment dominates the market due to its cost-effectiveness and flexibility, exceeding the insourced segment by approximately xx%.

By Type:

- Outsourced: Dominates due to cost-effectiveness and scalability. Strong growth driven by increasing demand for specialized expertise.

- Insourced: Retains a presence, primarily among large enterprises with significant internal resources.

By End User:

Manufacturing and Automotive: Highest demand due to the complex supply chains involved. Government initiatives promoting manufacturing contribute to growth.

Petrochemicals: Significant demand driven by large-scale operations and stringent regulations.

Consumer Goods and Retail: Growing rapidly due to e-commerce expansion.

Key Drivers: Government investments in infrastructure, economic diversification initiatives (Vision 2030), and the growth of e-commerce are leading factors. Regulatory support for logistics sector growth also plays a vital role.

Saudi Arabia Contract Logistics Market Product Innovations

Recent innovations include the adoption of advanced technologies like AI-powered route optimization, blockchain for enhanced transparency and traceability, and automated warehousing systems, leading to improved efficiency and reduced costs. These technological advancements significantly enhance supply chain visibility and provide greater control over logistics operations. Unique selling propositions (USPs) for providers include specialized expertise in specific sectors, such as healthcare or petrochemicals, and tailored supply chain solutions.

Propelling Factors for Saudi Arabia Contract Logistics Market Growth

Several factors propel the growth of the Saudi Arabia contract logistics market. These include the Kingdom's Vision 2030 initiative that is driving economic diversification and industrial growth, leading to increased demand for efficient logistics solutions. Government investments in infrastructure development, such as new ports and logistics hubs, improve connectivity and reduce transportation costs. Additionally, the rise of e-commerce and a growing consumer base are creating a surge in demand for last-mile delivery services.

Obstacles in the Saudi Arabia Contract Logistics Market

The market faces challenges like the high cost of land and labor, and potential supply chain disruptions from global events. Bureaucracy and regulatory hurdles can increase operational complexity, while intense competition among existing and emerging players poses a pressure on profit margins. A fluctuation in oil prices can affect the overall economic outlook and demand in certain segments.

Future Opportunities in Saudi Arabia Contract Logistics Market

Future opportunities lie in leveraging technology like AI and IoT to optimize logistics operations, catering to the growing e-commerce sector, and expanding into specialized segments like cold chain logistics for pharmaceuticals and healthcare. The development of new logistics zones and industrial cities presents significant growth potential. Focus on sustainability initiatives within logistics operations is another key future trend.

Key Developments in Saudi Arabia Contract Logistics Market Industry

- March 2023: Aramco and DHL Supply Chain announced a joint venture for a new procurement and logistics hub in Saudi Arabia, focusing on the industrial, energy, chemical, and petrochemical sectors. This represents a significant investment in sustainable and efficient supply chain solutions.

- October 2022: The Saudi government announced plans to launch 59 logistics zones to strengthen supply chains and enhance the Kingdom's global logistics role. This development will significantly improve infrastructure and boost the industry.

Strategic Saudi Arabia Contract Logistics Market Forecast

The Saudi Arabia contract logistics market is poised for continued strong growth driven by Vision 2030, infrastructural investments, and technological advancements. The expanding e-commerce sector and the government's focus on enhancing logistics efficiency will further fuel market expansion. The anticipated growth in various sectors will create a robust pipeline of opportunities for contract logistics providers to cater to heightened demands. The market's future trajectory indicates promising potential for both established and emerging players.

Saudi Arabia Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare

- 2.5. Pharmaceuticals

- 2.6. Chemicals

- 2.7. Petrochemicals

- 2.8. Other End Users

Saudi Arabia Contract Logistics Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Contract Logistics Market Regional Market Share

Geographic Coverage of Saudi Arabia Contract Logistics Market

Saudi Arabia Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 SAG'S Increased Focus Toward Transportation Infrastructure

- 3.2.2 Including Railways

- 3.2.3 Airports

- 3.2.4 And Seaports; Establishment Of Special Economic Zones

- 3.3. Market Restrains

- 3.3.1. Limited Visible of Shipments; Increasing Transportation

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare

- 5.2.5. Pharmaceuticals

- 5.2.6. Chemicals

- 5.2.7. Petrochemicals

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maresk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 J & T Express Middle East

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Exel Saudi Arabia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Move One

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GAC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Careem

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hala Supply Chain Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aramex

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DSV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Almajdouie Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mosanada Logistics Services

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Maresk

List of Figures

- Figure 1: Saudi Arabia Contract Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Contract Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia Contract Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Contract Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Saudi Arabia Contract Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Contract Logistics Market?

The projected CAGR is approximately 6.04%.

2. Which companies are prominent players in the Saudi Arabia Contract Logistics Market?

Key companies in the market include Maresk, J & T Express Middle East, DHL, Yusen Logistics, Exel Saudi Arabia, Move One, GAC, Agility, Careem, Hala Supply Chain Services, Aramex, DSV, Almajdouie Group, Mosanada Logistics Services.

3. What are the main segments of the Saudi Arabia Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.2 billion as of 2022.

5. What are some drivers contributing to market growth?

SAG'S Increased Focus Toward Transportation Infrastructure. Including Railways. Airports. And Seaports; Establishment Of Special Economic Zones.

6. What are the notable trends driving market growth?

Growth in E-commerce Driving the Market.

7. Are there any restraints impacting market growth?

Limited Visible of Shipments; Increasing Transportation.

8. Can you provide examples of recent developments in the market?

March 2023: To improve the sustainability and efficiency of the supply chain, Aramco and DHL Supply Chain have announced the signing of a shareholders' agreement for a new procurement and logistics hub in Saudi Arabia. It would be the first such center in the area, serving clients in the industrial, energy, chemical, and petrochemical industries. To serve businesses in the industrial, energy, chemical, and petrochemical industries, the joint venture plans to start operating in 2025. It will offer dependable end-to-end integrated procurement and supply chain services. The combined business would concentrate initially on Saudi Arabia, with plans to grow throughout the MENA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence