Key Insights

The Qatar Third-Party Logistics (3PL) market, projected to reach $2.33 billion by 2024, is set for significant expansion. Anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.8%, this robust growth is driven by several pivotal factors. The rapid ascent of e-commerce in Qatar is a primary catalyst, demanding sophisticated warehousing and distribution solutions. Concurrently, substantial government investments in infrastructure, including port enhancements and road network upgrades, are fostering an optimal environment for logistics providers. Furthermore, thriving sectors such as manufacturing, oil & gas, and healthcare are increasingly outsourcing their logistics needs. While global economic volatility and labor market dynamics present potential challenges, the Qatar 3PL market's trajectory remains highly positive, underpinned by sustained economic development and a national focus on logistics efficiency.

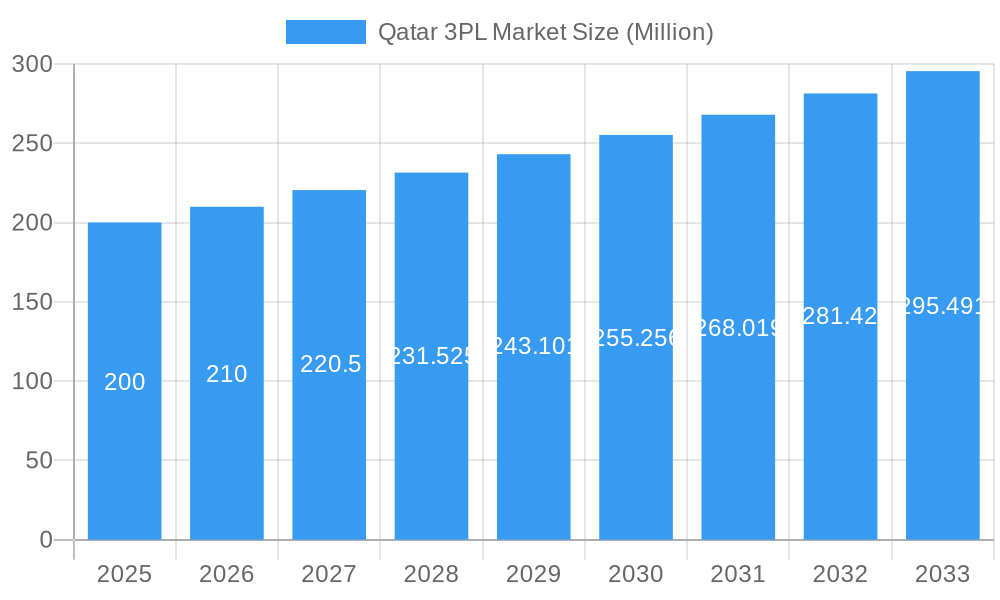

Qatar 3PL Market Market Size (In Billion)

The market is strategically segmented by service type, encompassing Domestic Transportation Management, International Transportation Management, and Value-added Warehousing and Distribution. Key end-user industries include Manufacturing & Automotive, Oil, Gas & Chemicals, Distributive Trade, Pharma & Healthcare, Construction, and Others. Prominent global players such as Maersk, DHL, FedEx, and Kuehne + Nagel are actively engaged in the competitive landscape, alongside established regional logistics providers. The international transportation management segment is poised for exceptional growth, leveraging Qatar's strategic geographic position as a vital trade nexus. Value-added warehousing and distribution services are also gaining prominence, addressing the growing demand for specialized inventory management and optimized supply chain solutions. This dynamic competitive environment, coupled with continuous infrastructural advancements, positions Qatar's 3PL market for sustained future growth.

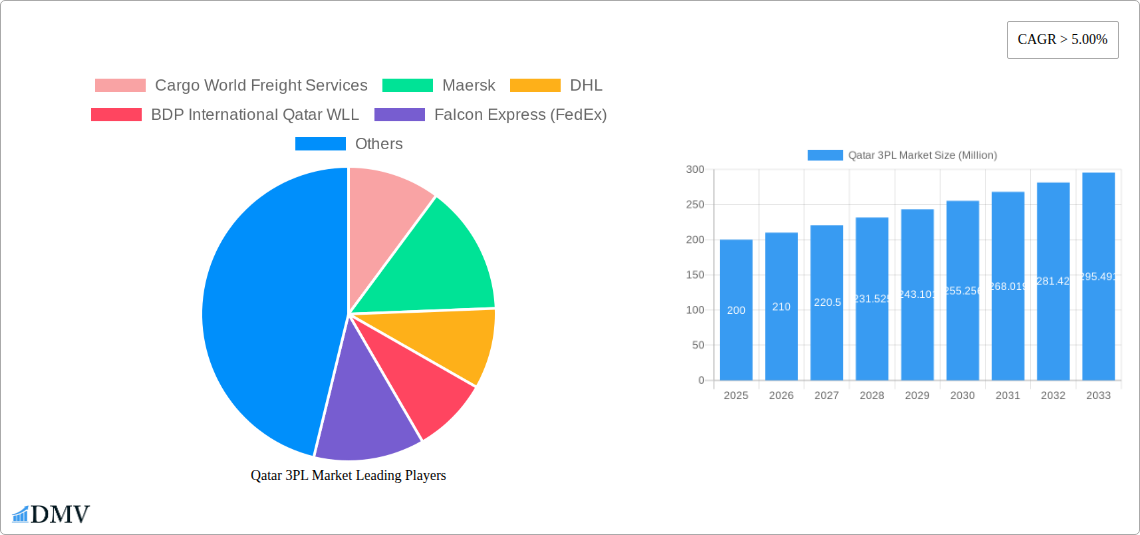

Qatar 3PL Market Company Market Share

Qatar 3PL Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Qatar 3PL market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033, driven by factors detailed within.

Qatar 3PL Market Composition & Trends

This section delves into the competitive landscape of Qatar's 3PL market, analyzing market concentration, innovation, regulations, and M&A activity. The market exhibits a moderately concentrated structure, with key players like Maersk, DHL, and GWC holding significant market share. However, numerous smaller players, including Cargo World Freight Services, BDP International Qatar WLL, Falcon Express (FedEx), Links Shipping, CEVA Logistics, Kuehne + Nagel, Doha Express, GAC, Panalpina, Geodis, AMCO Logistics Services, and Aramex, contribute significantly to the overall market dynamics.

- Market Share Distribution (2024 Estimate): Maersk (xx%), DHL (xx%), GWC (xx%), Others (xx%). Exact figures are unavailable pending detailed market research.

- Innovation Catalysts: Technological advancements such as AI-powered logistics solutions and blockchain technology are driving efficiency and transparency.

- Regulatory Landscape: Qatar's supportive regulatory framework and initiatives to improve infrastructure are fostering market growth.

- Substitute Products: Limited substitute products currently exist.

- End-User Profiles: Key end-users include Manufacturing & Automotive, Oil, Gas & Chemicals, Distributive Trade (including e-commerce), Pharma & Healthcare, and Construction. Oil and Gas currently dominates due to the significant energy sector in Qatar.

- M&A Activities: While specific deal values remain confidential for many transactions, several M&A activities indicate consolidation trends within the market. Over the period 2019-2024, an estimated xx Million USD was invested in M&A activity within the Qatar 3PL market.

Qatar 3PL Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the Qatar 3PL market, factoring in technological advancements and evolving consumer demands. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, driven by robust economic growth and increased investments in infrastructure. The forecast period (2025-2033) projects continued expansion, with a projected CAGR of xx%, fueled by rising e-commerce adoption and the government's focus on diversifying the economy. The adoption of advanced technologies such as warehouse management systems (WMS), transportation management systems (TMS), and automated guided vehicles (AGVs) is also anticipated to contribute to this growth. Increased demand for efficient and reliable supply chains, driven by consumers' expectations for faster and more cost-effective delivery, is a major market driver.

Leading Regions, Countries, or Segments in Qatar 3PL Market

The Qatar 3PL market is primarily concentrated within the country itself, with Doha emerging as the leading hub due to its central location and established infrastructure. However, the rapid growth of several industrial zones and the focus on free trade are gradually diversifying this concentration.

By Services:

- International Transportation Management: This segment is expected to dominate due to Qatar's strategic geopolitical position and its role in facilitating trade across regions. Key growth drivers include increased international trade, particularly in energy and consumer goods.

- Value-Added Warehousing and Distribution: This segment is experiencing strong growth, fueled by the rising demand for specialized warehousing solutions, particularly temperature-controlled facilities for the pharmaceutical and food & beverage sectors.

By End-User:

Oil, Gas & Chemicals: This sector remains the dominant end-user, due to Qatar's vast hydrocarbon reserves and ongoing investments in petrochemical projects. Government investment in infrastructure and continued energy export growth provide strong support for this segment.

Distributive Trade (including e-commerce): Rapidly expanding, driven by the increasing popularity of online shopping and a young, digitally-savvy population.

Key Drivers: Government initiatives focused on infrastructure development, particularly in transportation and logistics, combined with the FIFA World Cup 2022, greatly stimulated market growth across multiple segments.

Qatar 3PL Market Product Innovations

Recent product innovations focus on enhancing efficiency and visibility within the supply chain. The adoption of sophisticated software solutions, such as route optimization tools and real-time tracking systems, is streamlining operations and improving customer satisfaction. The rise of e-commerce is also driving the development of specialized last-mile delivery solutions and integrated fulfillment services.

Propelling Factors for Qatar 3PL Market Growth

Several factors contribute to the positive outlook for the Qatar 3PL market. Firstly, the government's significant investments in infrastructure, including ports and transportation networks, are enhancing the efficiency of logistics operations. Secondly, the burgeoning e-commerce sector is creating a strong demand for reliable and efficient 3PL services. Finally, the country's strategic geographical location makes it a vital transit point for regional and international trade.

Obstacles in the Qatar 3PL Market

Challenges include the relatively high cost of labor, potential supply chain disruptions due to global events (as evidenced in recent years), and the competitive landscape with both established international and local players. Strict regulatory compliance requirements can also present obstacles for some companies.

Future Opportunities in Qatar 3PL Market

Future opportunities lie in expanding e-commerce logistics, leveraging technological advancements like AI and automation, and capitalizing on the growth of specific sectors like healthcare and pharmaceuticals that require specialized handling and storage. The development of sustainable and eco-friendly logistics solutions is another emerging opportunity.

Key Developments in Qatar 3PL Market Industry

- June 2022: GWC secures a three-year agreement with Ponticelli Frères Group, expanding its presence in the Oil & Gas, energy, chemical, pharmaceutical, and steel sectors. This signifies the growing importance of specialized 3PL services for large industrial players.

- December 2022: GAC Qatar opens a new state-of-the-art facility, demonstrating significant investments in expanding capacity and enhancing service offerings within the rapidly growing food and beverage, FMCG, retail, and telecommunications sectors. This highlights the commitment of major players to cater to evolving market demands.

Strategic Qatar 3PL Market Forecast

The Qatar 3PL market is poised for sustained growth, driven by robust economic expansion, increasing e-commerce adoption, and government investments in infrastructure. The continued diversification of the Qatari economy, particularly beyond the oil and gas sector, will create further opportunities for 3PL providers. The adoption of advanced technologies will further enhance efficiency and competitiveness, leading to a more robust and dynamic market in the coming years.

Qatar 3PL Market Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil, Gas & Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Qatar 3PL Market Segmentation By Geography

- 1. Qatar

Qatar 3PL Market Regional Market Share

Geographic Coverage of Qatar 3PL Market

Qatar 3PL Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Operations

- 3.4. Market Trends

- 3.4.1. eCommerce Sector Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar 3PL Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil, Gas & Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargo World Freight Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BDP International Qatar WLL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Falcon Express (FedEx)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Links Shipping

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Doha Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GAC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panalpina

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Geodis

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 GWC**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AMCO Logistics Services

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Aramex

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Cargo World Freight Services

List of Figures

- Figure 1: Qatar 3PL Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Qatar 3PL Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar 3PL Market Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Qatar 3PL Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Qatar 3PL Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Qatar 3PL Market Revenue billion Forecast, by Services 2020 & 2033

- Table 5: Qatar 3PL Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Qatar 3PL Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar 3PL Market?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the Qatar 3PL Market?

Key companies in the market include Cargo World Freight Services, Maersk, DHL, BDP International Qatar WLL, Falcon Express (FedEx), Links Shipping, CEVA Logistics, Kuehne + Nagel, Doha Express, GAC, Panalpina, Geodis, GWC**List Not Exhaustive, AMCO Logistics Services, Aramex.

3. What are the main segments of the Qatar 3PL Market?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.33 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market.

6. What are the notable trends driving market growth?

eCommerce Sector Driving the Market Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Operations.

8. Can you provide examples of recent developments in the market?

June 2022: GWC (Q.P.S.C.), the leading logistics provider in the State of Qatar, has signed an agreement with Ponticelli Frères Group, by which GWC will handle the freight forwarding, customs brokerage, and transport for Ponticelli in the State of Qatar for a period of three years. The agreement is aimed at enhancing the speed of delivery and efficiency of operations for both Ponticelli and its customers in the State of Qatar. Ponticelli Frères is an independent and family-owned group providing industrial services mainly to companies in the oil and gas, energy, chemical, pharmaceutical, and steelworks sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar 3PL Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar 3PL Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar 3PL Market?

To stay informed about further developments, trends, and reports in the Qatar 3PL Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence