Key Insights

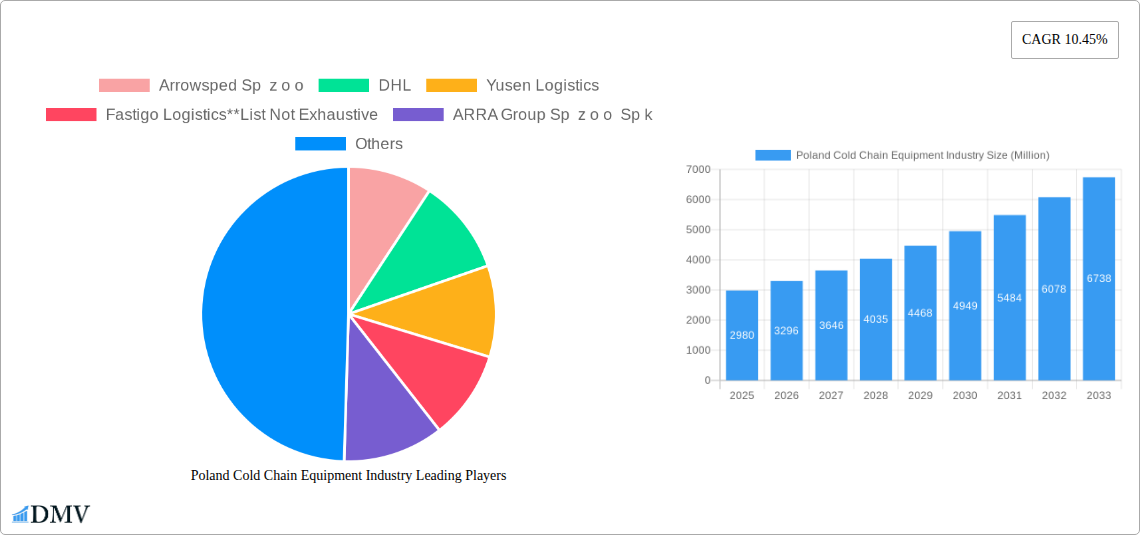

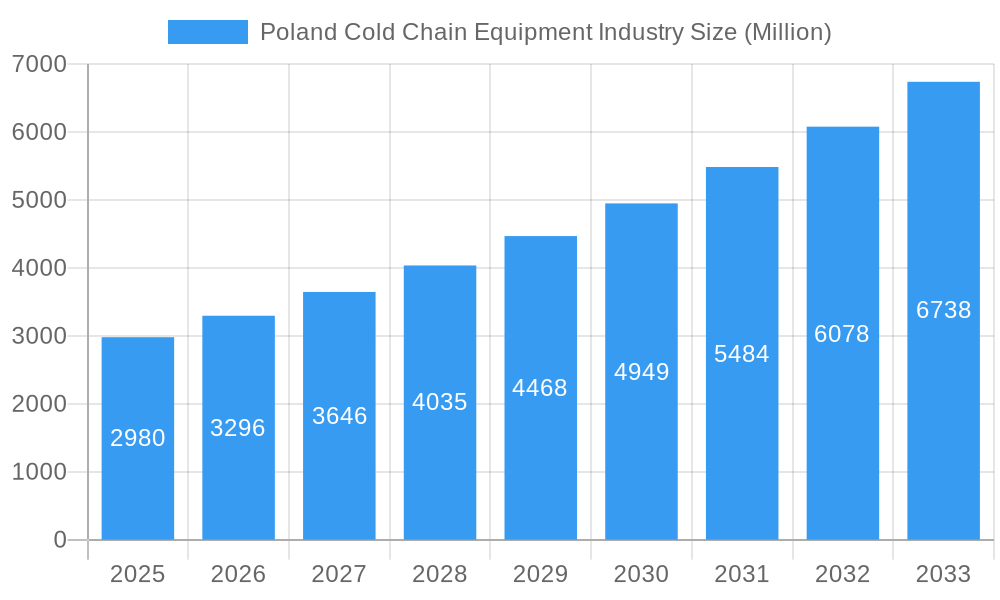

The Poland cold chain equipment market, valued at €2.98 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.45% from 2025 to 2033. This expansion is fueled by several key drivers. The rising demand for fresh produce, dairy, and processed foods, coupled with increasing consumer awareness of food safety and quality, is significantly boosting the need for efficient cold chain solutions. Furthermore, the growth of e-commerce and the burgeoning pharmaceutical and life sciences sectors in Poland are creating substantial opportunities for cold chain equipment providers. Expansion of modern retail infrastructure and government initiatives promoting food safety standards are also contributing to market growth. While challenges exist, such as high initial investment costs for advanced equipment and the need for skilled workforce, the overall market outlook remains positive. The market segmentation reveals a strong demand across various services, including storage, transportation, and value-added services like blast freezing and inventory management. Frozen products dominate the temperature type segment, driven by the long shelf life requirements of various goods. Horticulture, dairy, and meat products constitute the largest application segments, underscoring the importance of maintaining the quality and safety of perishable goods. Key players like Arrowsped, DHL, and Yusen Logistics are actively shaping the competitive landscape, highlighting the importance of robust logistics networks and efficient service provision.

Poland Cold Chain Equipment Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion driven by factors such as increasing disposable incomes, evolving consumer preferences toward convenience and quality food, and further advancements in cold chain technology. Technological innovations, such as smart sensors and IoT-enabled monitoring systems, are expected to increase efficiency and reduce spoilage, further fueling market growth. Companies are likely to invest in advanced equipment and services to meet the growing demand and maintain their competitive edge. The market's dynamic nature will be characterized by ongoing technological advancements, increasing competition, and a persistent focus on sustainability and environmental responsibility. The Polish government's support for the development of the cold chain infrastructure will play a pivotal role in shaping the market's trajectory over the forecast period.

Poland Cold Chain Equipment Industry Company Market Share

Poland Cold Chain Equipment Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Poland cold chain equipment industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market size, growth trajectories, leading players, and future opportunities. The report is essential for investors, industry professionals, and policymakers seeking to understand and capitalize on the evolving landscape of Poland's cold chain sector.

Poland Cold Chain Equipment Industry Market Composition & Trends

This section delves into the competitive dynamics of the Polish cold chain equipment market, analyzing market concentration, innovation drivers, and regulatory influences. We explore the roles of key players like Arrowsped Sp z o o, DHL, Yusen Logistics, Fastigo Logistics, ARRA Group Sp z o o Sp k, Raben Group, ZBYNEK - Transport Spedycja, United Parcel Service of America, Artrans Transport, and Fructus Transport (list not exhaustive), examining their market share distribution and the impact of mergers and acquisitions (M&A) activities. The report quantifies M&A deal values (where available) and assesses the influence of substitute products on market growth. End-user profiles are thoroughly analyzed across diverse sectors, revealing key trends in adoption and demand.

- Market Concentration: The Polish cold chain equipment market exhibits a [xx]% market concentration ratio in 2025, with the top 5 players holding a combined market share of [xx]%.

- Innovation Catalysts: Technological advancements in refrigeration, transportation, and logistics management are driving market innovation.

- Regulatory Landscape: Analysis of relevant Polish regulations impacting the cold chain industry, including safety and hygiene standards.

- Substitute Products: Examination of alternative solutions and their impact on market share.

- M&A Activity: Assessment of significant M&A transactions in the period 2019-2024, including deal values of approximately $xx Million. This section will also project future M&A activity based on market trends.

- End-User Profiles: Detailed analysis of end-user demand across various sectors, including horticulture, dairy, meat, pharmaceuticals, and chemicals.

Poland Cold Chain Equipment Industry Industry Evolution

This section traces the evolution of the Polish cold chain equipment industry from 2019 to 2033, analyzing market growth trajectories, technological advancements, and evolving consumer demands. We present a detailed analysis of market growth rates, highlighting periods of accelerated growth and identifying the factors driving these trends. The impact of technological innovations, such as improved refrigeration technologies and automated logistics solutions, is thoroughly examined. This analysis includes the adoption rates of various technologies within the industry and their impact on efficiency and cost reduction. The report also assesses changing consumer preferences regarding food safety and quality, and how these preferences influence market dynamics. The projected Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated at [xx]%.

Leading Regions, Countries, or Segments in Poland Cold Chain Equipment Industry

This section provides a detailed breakdown of the leading regions, countries, and segments that are shaping the Polish cold chain equipment market. Our analysis covers market performance across key segments, offering insights into their growth potential and competitive positioning:

By Services:

- Storage: An in-depth analysis of the market share, key infrastructure developments, and growth drivers within the cold storage facilities segment, including advancements in energy efficiency and automation.

- Transportation: A comprehensive assessment of the transportation segment, encompassing the latest trends in refrigerated trucking, specialized rail transport, and the growing role of multimodal logistics solutions.

- Value-added Services: An examination of the expanding market demand for services such as advanced blast freezing technologies, sophisticated inventory management systems, and customized packaging solutions designed to maintain product integrity throughout the supply chain.

By Temperature Type:

- Chilled: Detailed analysis of the chilled goods segment, focusing on its growth trajectory, the types of products included, and the specific equipment needs for maintaining optimal chilled temperatures.

- Frozen: An in-depth assessment of the frozen goods segment, identifying the key factors driving its expansion, including increased consumer demand for frozen convenience foods and the need for ultra-low temperature storage solutions.

By Application:

- Horticulture (Fresh Fruits & Vegetables): Analysis of the robust demand for specialized cold chain solutions in the horticulture sector, highlighting innovations in post-harvest handling and temperature-controlled logistics for produce.

- Dairy Products: A thorough assessment of the dairy products segment, including the specific requirements for milk, ice cream, cheese, and butter, and the equipment innovations supporting their distribution.

- Meats, Fish, Poultry: Examination of the critical role of the cold chain in the meat, fish, and poultry industries, focusing on maintaining safety, quality, and extending shelf life through advanced refrigeration and transport solutions.

- Processed Food Products: Analysis of the growing demand for cold chain solutions across the diverse range of processed food products, from ready-to-eat meals to frozen desserts.

- Pharma, Life Sciences, and Chemicals: A specialized assessment of the stringent market requirements for temperature-sensitive pharmaceuticals, vaccines, biologics, and chemicals, emphasizing the need for validated and highly reliable cold chain infrastructure.

Key drivers for each dominant segment are thoroughly identified, including emerging investment trends, supportive regulatory frameworks, and the adoption of cutting-edge technological advancements. A detailed analysis of the factors contributing to the sustained dominance of specific segments is provided. For instance, the significant growth of the [segment name] segment is primarily attributed to [specific reason, e.g., increasing export demand for Polish agricultural produce, government initiatives promoting pharmaceutical exports], leading to a projected market share of [xx]% by 2025.

Poland Cold Chain Equipment Industry Product Innovations

The Polish cold chain equipment industry is a hotbed of innovation, consistently introducing cutting-edge products to enhance efficiency, sustainability, and product integrity. This section highlights key advancements, including the development of next-generation refrigeration technologies that boast superior energy efficiency and precision temperature control, often utilizing eco-friendly refrigerants. Innovations in transportation and logistics are also prominent, with the widespread integration of sophisticated telematics systems, real-time tracking and monitoring solutions, and the burgeoning use of AI-powered route optimization to minimize transit times and reduce spoilage. We also delve into the unique selling propositions (USPs) of leading products and their demonstrable performance metrics, offering a clear view of the competitive landscape and the technological edge that defines market leaders.

Propelling Factors for Poland Cold Chain Equipment Industry Growth

Several key factors are driving the growth of the Poland cold chain equipment industry. Increased consumer demand for fresh and high-quality food products is a significant driver. Furthermore, advancements in refrigeration technologies and logistics management are leading to increased efficiency and reduced costs. Government regulations promoting food safety and quality standards also play a crucial role. The expanding e-commerce sector and rising disposable incomes are also contributing to market expansion. The growth of the pharmaceutical and life sciences sectors is another important driver.

Obstacles in the Poland Cold Chain Equipment Industry Market

Despite its considerable growth potential and the ongoing influx of innovation, the Poland cold chain equipment industry encounters several significant hurdles. Stringent and evolving regulatory compliance requirements, particularly concerning food safety and pharmaceutical handling, can substantially increase operational costs and necessitate continuous investment in updated equipment and processes. Global and regional supply chain disruptions, exacerbated by geopolitical uncertainties, can lead to material shortages, longer lead times for equipment procurement, and increased logistical complexities. Furthermore, the market is characterized by intense competition from both established domestic players and agile international providers. This competitive pressure can result in significant price wars, impacting profit margins and requiring companies to focus heavily on differentiation through quality, service, and technological superiority.

Future Opportunities in Poland Cold Chain Equipment Industry

The Polish cold chain equipment industry presents numerous future opportunities. Expanding into new market segments, such as specialized cold chain solutions for the pharmaceutical and life sciences industries, offers high growth potential. The adoption of innovative technologies, such as IoT-enabled monitoring systems and AI-driven optimization solutions, can lead to significant efficiency gains and improved service quality. Furthermore, tapping into emerging consumer trends, such as the growing demand for sustainable and environmentally friendly cold chain solutions, can create new market niches.

Major Players in the Poland Cold Chain Equipment Industry Ecosystem

- Arrowsped Sp z o o

- DHL

- Yusen Logistics

- Fastigo Logistics

- ARRA Group Sp z o o Sp k

- Raben Group

- ZBYNEK - Transport Spedycja

- United Parcel Service of America

- Artrans Transport

- Fructus Transport

Key Developments in Poland Cold Chain Equipment Industry Industry

- [Date]: [Development - e.g., Launch of new energy-efficient refrigeration system by Company X]

- [Date]: [Development - e.g., Acquisition of Company Y by Company Z]

- [Date]: [Development - e.g., Implementation of new cold chain regulations by the Polish government]

Strategic Poland Cold Chain Equipment Industry Market Forecast

The Poland cold chain equipment industry is poised for robust growth in the coming years, driven by a combination of factors, including rising consumer demand for fresh produce, technological advancements, and supportive government policies. The expansion of the e-commerce sector and increasing investments in logistics infrastructure will further stimulate market expansion. The market is expected to witness a significant increase in the adoption of innovative technologies, leading to enhanced efficiency and sustainability. The projected market size in 2033 is estimated at $xx Million, reflecting a healthy growth trajectory for the industry.

Poland Cold Chain Equipment Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

Poland Cold Chain Equipment Industry Segmentation By Geography

- 1. Poland

Poland Cold Chain Equipment Industry Regional Market Share

Geographic Coverage of Poland Cold Chain Equipment Industry

Poland Cold Chain Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Cold Chain Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arrowsped Sp z o o

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fastigo Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ARRA Group Sp z o o Sp k

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Raben Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZBYNEK - Transport Spedycja

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Artrans Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fructus Transport

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arrowsped Sp z o o

List of Figures

- Figure 1: Poland Cold Chain Equipment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Cold Chain Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Cold Chain Equipment Industry?

The projected CAGR is approximately 10.45%.

2. Which companies are prominent players in the Poland Cold Chain Equipment Industry?

Key companies in the market include Arrowsped Sp z o o, DHL, Yusen Logistics, Fastigo Logistics**List Not Exhaustive, ARRA Group Sp z o o Sp k, Raben Group, ZBYNEK - Transport Spedycja, United Parcel Service of America, Artrans Transport, Fructus Transport.

3. What are the main segments of the Poland Cold Chain Equipment Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Cold Chain Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Cold Chain Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Cold Chain Equipment Industry?

To stay informed about further developments, trends, and reports in the Poland Cold Chain Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence