Key Insights

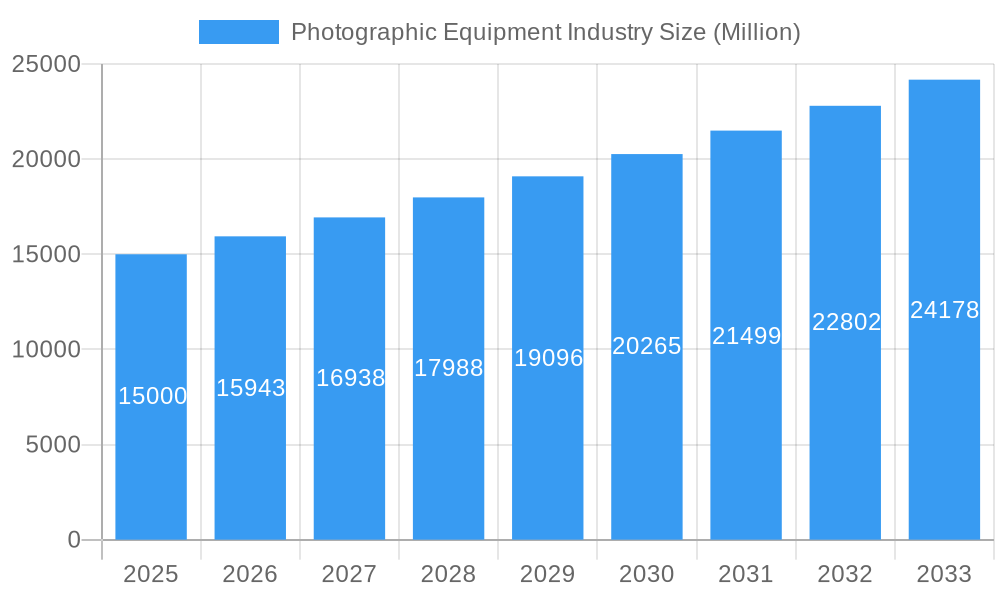

The global photographic equipment market, valued at approximately $6.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.1% from 2025 to 2033. This expansion is driven by increasing popularity of photography as a hobby and profession, fueled by social media and visual storytelling. Technological advancements, including improved sensor technology, enhanced image stabilization, and more compact, versatile cameras, are stimulating demand. Mirrorless camera adoption and the expansion of online retail channels present significant growth opportunities. While economic factors may pose temporary constraints, long-term prospects remain positive, particularly in emerging markets with rising photography adoption rates. Market segmentation highlights strong online and offline retail channels, with a diverse product portfolio including cameras, lenses, and accessories. Leading players such as Canon, Nikon, Sony, and Fujifilm, alongside specialized brands, dominate through innovation, brand reputation, and competitive pricing. North America and Asia Pacific are key revenue contributors, reflecting significant regional variations in geographical distribution. The continued evolution of camera technology and an expanding user base are anticipated to sustain market growth throughout the forecast period.

Photographic Equipment Industry Market Size (In Billion)

The market's dynamic nature demands a keen understanding of evolving consumer preferences and technological disruptions. While smartphone cameras initially seemed like a threat, they have paradoxically expanded the photography market by introducing a wider audience to visual creativity, increasing demand for higher-quality accessories and advanced equipment for superior image quality and functionality. Consequently, market participants are focusing on product innovation, strategic partnerships, and adapting to the evolving landscape to maintain a competitive edge. The growing demand for specialized equipment, such as high-quality lenses for specific applications like wildlife, sports, and portraits, creates further opportunities for niche players. Future market success will depend on a combination of product innovation, efficient distribution strategies, and effective marketing to target diverse consumer segments.

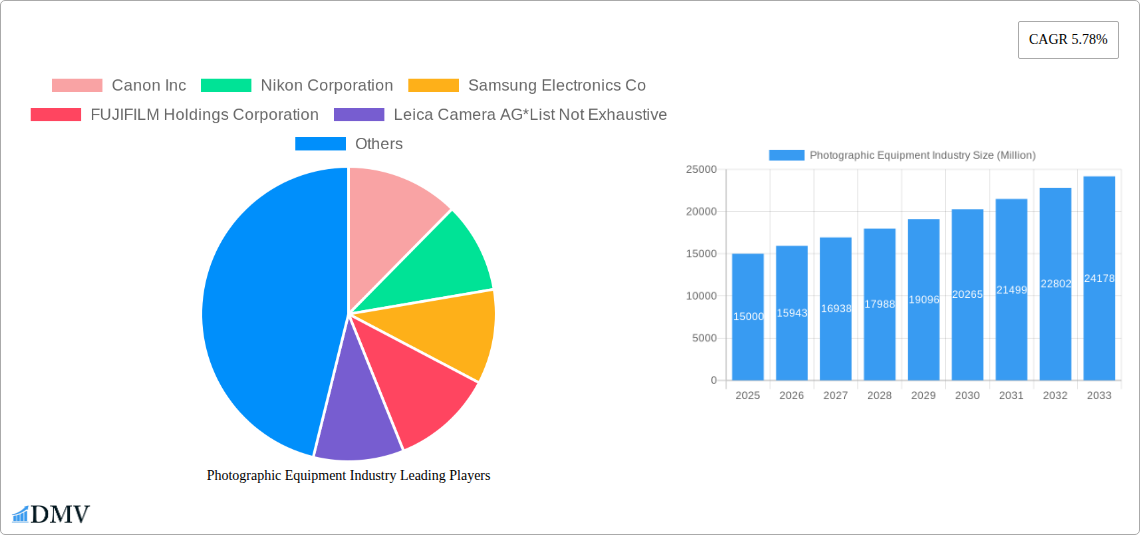

Photographic Equipment Industry Company Market Share

Photographic Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global photographic equipment industry, projecting a market value exceeding $XX Million by 2033. The study covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report meticulously examines market segmentation by distribution channel (online and offline retail) and product type (cameras, lenses, and others), providing a granular understanding of market dynamics and growth potential. Key players like Canon Inc, Nikon Corporation, and Sony Corporation are analyzed for their market share and strategic initiatives.

Photographic Equipment Industry Market Composition & Trends

This section evaluates the market concentration, identifying key players and their respective market shares. The analysis delves into the innovative technologies driving market growth, including advancements in sensor technology, image processing, and lens design. Regulatory landscapes impacting the industry, such as import/export regulations and safety standards, are also examined. The report assesses the impact of substitute products, such as smartphones with advanced camera capabilities, and profiles the evolving end-user segments. Finally, it details recent mergers and acquisitions (M&A) activities, including estimated deal values (e.g., a hypothetical $XX Million acquisition in 2023).

- Market Share Distribution (2025 Estimate): Canon Inc (XX%), Nikon Corporation (XX%), Sony Corporation (XX%), Others (XX%).

- M&A Activity (2019-2024): Three major acquisitions totaling an estimated $XX Million.

- Innovation Catalysts: Development of mirrorless cameras, AI-powered image processing, and advancements in lens technology.

- Regulatory Landscape: Compliance with international safety and environmental standards.

- Substitute Products: Impact of smartphone camera advancements.

Photographic Equipment Industry Evolution

This section analyzes the market's growth trajectory from 2019 to 2033, highlighting periods of expansion and contraction. Technological advancements like the rise of mirrorless cameras and the integration of artificial intelligence in photography are examined. The report explores shifting consumer demands, such as the increasing preference for compact and versatile cameras, and the growth in demand for high-resolution images and video capabilities. Specific data points, including compound annual growth rates (CAGR) and adoption rates for various camera technologies, are presented.

- Market Growth Trajectory (2019-2033): A projected CAGR of XX% driven by increased adoption of mirrorless cameras and growing consumer demand.

- Technological Advancements: Significant adoption of mirrorless technology, integration of AI and improved image stabilization systems.

- Shifting Consumer Demands: Increased demand for high-quality video recording in cameras and lightweight and portable devices.

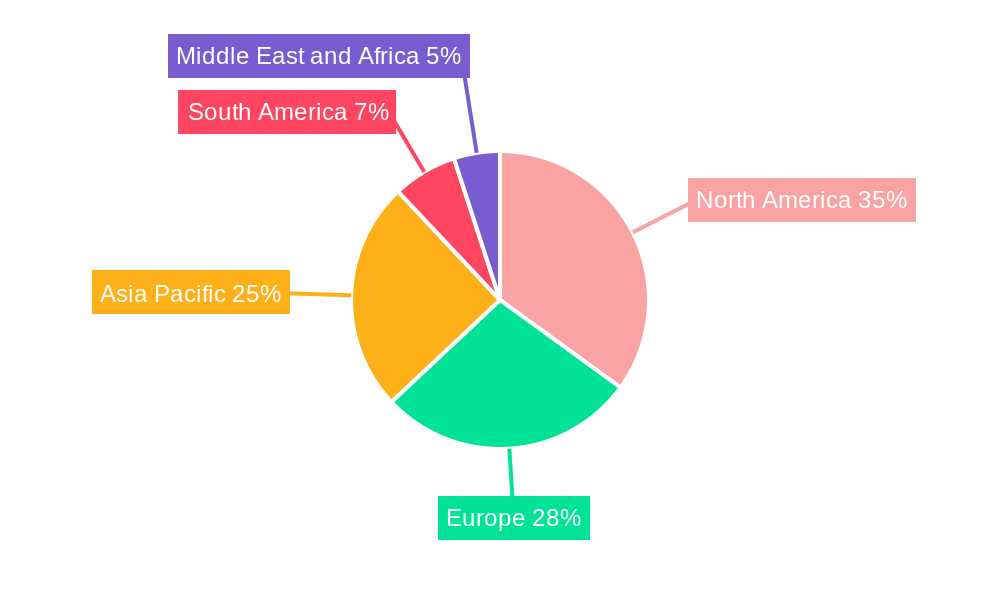

Leading Regions, Countries, or Segments in Photographic Equipment Industry

This section dissects the vanguard of the photographic equipment market, identifying the preeminent regions, nations, and market segments. It delves into the underlying dynamics that propel the ascendance of specific segments, encompassing the interplay between online and offline retail channels, and the evolving consumer preference for distinct product categories. Furthermore, it elucidates pivotal growth catalysts, such as investment patterns in specific geographical locales and the influence of supportive regulatory environments.

- Dominant Region: Asia Pacific and North America (Analysis based on current market data indicating significant growth in Asia and continued strength in North America). Reasons: Robust economic growth and a burgeoning middle class in Asia fuel demand, while North America maintains its position with high disposable incomes and a persistent consumer appetite for premium and professional-grade photographic gear.

- Dominant Segment (Distribution Channel): Online Retail continues its reign. Reasons: Unparalleled convenience, extensive product availability exceeding physical store limitations, and the fierce price competition inherent in e-commerce platforms solidify its dominance. The rise of social commerce also plays a significant role.

- Dominant Segment (Product Type): Mirrorless Cameras remain the frontrunner, with a strong and growing market share. Reasons: Their inherent superiority in image fidelity, remarkably compact and portable designs, and the integration of cutting-edge technological advancements, including sophisticated AI-driven functionalities, appeal to both professional and enthusiast photographers.

- Key Drivers for Online Retail Growth: Pervasive internet penetration worldwide, the exponential expansion of sophisticated e-commerce platforms offering seamless user experiences, and the widespread adoption of secure and diverse digital payment gateways.

- Key Drivers for Mirrorless Camera Popularity: Continuous breakthroughs in sensor technology leading to exceptional image quality and low-light performance, the widespread implementation of advanced in-body image stabilization (IBIS) systems, and the development of highly accurate and rapid autofocus (AF) capabilities.

Photographic Equipment Industry Product Innovations

The photographic equipment industry is in a state of perpetual evolution, driven by a relentless pursuit of enhanced imaging capabilities and user experience. Recent advancements have focused on revolutionary sensor technology, yielding a dramatic uplift in image quality, particularly in challenging low-light conditions. The integration of sophisticated in-body image stabilization (IBIS) systems and next-generation autofocus (AF) technologies is significantly improving user control and enabling sharper, more impactful shots. Furthermore, the pervasive influence of Artificial Intelligence (AI) is manifesting in intelligent features such as automatic scene recognition, advanced subject tracking, and predictive focusing, making professional-level photography more accessible and efficient for a broader audience. These innovations are not merely incremental improvements; they are creating novel selling propositions, enabling manufacturers to effectively differentiate their offerings and capture the attention of discerning consumer demographics.

Propelling Factors for Photographic Equipment Industry Growth

Several factors contribute to industry growth. Technological advancements continuously improve camera performance and functionality, fueling consumer demand. The rising disposable income in emerging economies is expanding the market base. Furthermore, supportive government policies and initiatives can stimulate investment and innovation within the sector.

Obstacles in the Photographic Equipment Industry Market

The photographic equipment industry navigates a landscape fraught with considerable challenges. The ubiquity and ever-improving capabilities of smartphone cameras present a significant competitive threat, diverting a portion of the consumer market away from dedicated camera sales, especially in the entry-level and casual photography segments. Global supply chain complexities and potential disruptions can lead to significant production delays and escalate manufacturing costs, impacting product availability and pricing. Additionally, increasingly stringent environmental regulations worldwide necessitate adaptations in manufacturing processes and product design, potentially adding to R&D and production overheads. These multifaceted pressures collectively pose a risk to sustained market growth and overall profitability.

Future Opportunities in Photographic Equipment Industry

Emerging opportunities exist in the development of specialized cameras for professional use (e.g., drones, underwater photography). The integration of virtual reality (VR) and augmented reality (AR) technologies into photography presents new avenues for innovation. Furthermore, the increasing demand for high-quality video content opens up possibilities for expanding product lines and targeting new customer groups.

Major Players in the Photographic Equipment Industry Ecosystem

- Canon Inc. - A long-standing leader known for its extensive range of cameras, lenses, and imaging solutions.

- Nikon Corporation - Another industry titan, renowned for its professional-grade DSLR and mirrorless camera systems, and optics.

- Sony Corporation - A dominant force, particularly in the mirrorless camera segment, pushing boundaries with sensor technology and advanced features.

- FUJIFILM Holdings Corporation - Famed for its innovative mirrorless cameras, distinctive film simulation modes, and strong presence in professional imaging.

- Leica Camera AG - A premium brand synonymous with exceptional build quality, timeless design, and unparalleled optical performance, catering to the high-end market.

- Panasonic Corporation - A significant player offering a diverse range of cameras, particularly strong in the mirrorless and compact camera segments, often with a focus on video capabilities.

- Samsung Electronics Co. - While its dedicated camera division has seen shifts, Samsung remains a major player in imaging technology, particularly through its smartphone camera innovations and contributions to sensor development.

Key Developments in Photographic Equipment Industry Industry

- 2022 Q4: Canon Inc launches new EOS R50 mirrorless camera.

- 2023 Q1: Nikon Corporation announces strategic partnership for lens production.

- 2023 Q3: Sony Corporation releases new flagship full-frame camera. (Further developments can be added here)

Strategic Photographic Equipment Industry Market Forecast

The photographic equipment market is poised for continued growth, driven by technological advancements and increasing consumer demand. The rising adoption of mirrorless cameras, the integration of AI-powered features, and the expansion into new application areas like VR and AR will fuel market expansion. The market is projected to reach significant value, presenting substantial opportunities for established players and new entrants.

Photographic Equipment Industry Segmentation

-

1. Product Type

- 1.1. Camera

- 1.2. Lens

- 1.3. Others

-

2. Distribution Channel

- 2.1. Online Retail

- 2.2. Offline Retail

Photographic Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Photographic Equipment Industry Regional Market Share

Geographic Coverage of Photographic Equipment Industry

Photographic Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing sale of Photography Equipment’s from Online Retailing Channels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Camera

- 5.1.2. Lens

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail

- 5.2.2. Offline Retail

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Camera

- 6.1.2. Lens

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail

- 6.2.2. Offline Retail

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Camera

- 7.1.2. Lens

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail

- 7.2.2. Offline Retail

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Camera

- 8.1.2. Lens

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail

- 8.2.2. Offline Retail

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Camera

- 9.1.2. Lens

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail

- 9.2.2. Offline Retail

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Photographic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Camera

- 10.1.2. Lens

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail

- 10.2.2. Offline Retail

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Canon Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nikon Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung Electronics Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FUJIFILM Holdings Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leica Camera AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sony Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Canon Inc

List of Figures

- Figure 1: Global Photographic Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Photographic Equipment Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 17: Europe Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: Europe Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 40: South America Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 41: South America Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: South America Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: South America Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Photographic Equipment Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Photographic Equipment Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Photographic Equipment Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Photographic Equipment Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Photographic Equipment Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Photographic Equipment Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Photographic Equipment Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Photographic Equipment Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Photographic Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Photographic Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East and Africa Photographic Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Photographic Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Photographic Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Photographic Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Germany Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Germany Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: France Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: France Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Italy Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Italy Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Russia Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Russia Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 40: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 41: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 45: China Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: China Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Japan Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: India Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: India Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Australia Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Australia Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 56: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 57: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Brazil Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Brazil Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Argentina Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Argentina Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Global Photographic Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 68: Global Photographic Equipment Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 69: Global Photographic Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Photographic Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Photographic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Photographic Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 73: South Africa Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Saudi Arabia Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Saudi Arabia Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Rest of Middle East and Africa Photographic Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of Middle East and Africa Photographic Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Photographic Equipment Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Photographic Equipment Industry?

Key companies in the market include Canon Inc, Nikon Corporation, Samsung Electronics Co, FUJIFILM Holdings Corporation, Leica Camera AG*List Not Exhaustive, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Photographic Equipment Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Increasing sale of Photography Equipment’s from Online Retailing Channels.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Photographic Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Photographic Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Photographic Equipment Industry?

To stay informed about further developments, trends, and reports in the Photographic Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence