Key Insights

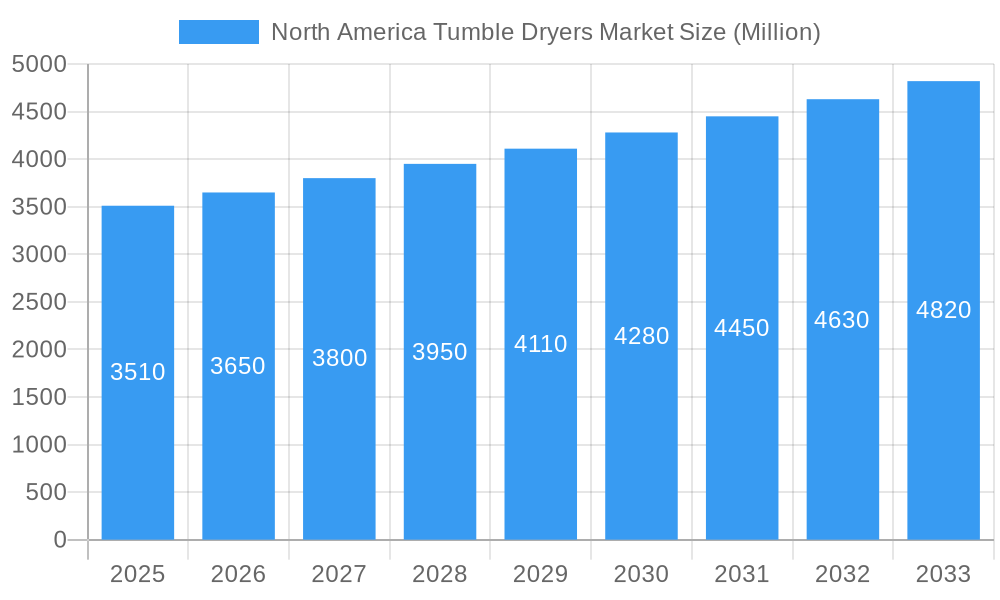

The North American tumble dryer market, valued at $3.51 billion in 2025, is projected to experience steady growth, driven by increasing disposable incomes, a preference for convenient laundry solutions, and the rising adoption of energy-efficient models like heat pump dryers. The market's 4.12% CAGR from 2019 to 2024 indicates a consistent demand, which is expected to continue through 2033. Key growth segments include heat pump dryers, which offer significant energy savings, and online distribution channels reflecting evolving consumer purchasing habits. The residential sector dominates market share, although the commercial segment is showing promising growth due to increasing demand in multi-unit dwellings, hotels, and laundromats. Leading brands like LG, Samsung, Whirlpool, and Miele compete intensely through product innovation, focusing on features such as smart connectivity, improved drying performance, and enhanced durability. While the market faces constraints such as fluctuating raw material prices and increasing competition, the overall outlook remains positive, driven by technological advancements and shifting consumer preferences towards premium and energy-efficient appliances.

North America Tumble Dryers Market Market Size (In Billion)

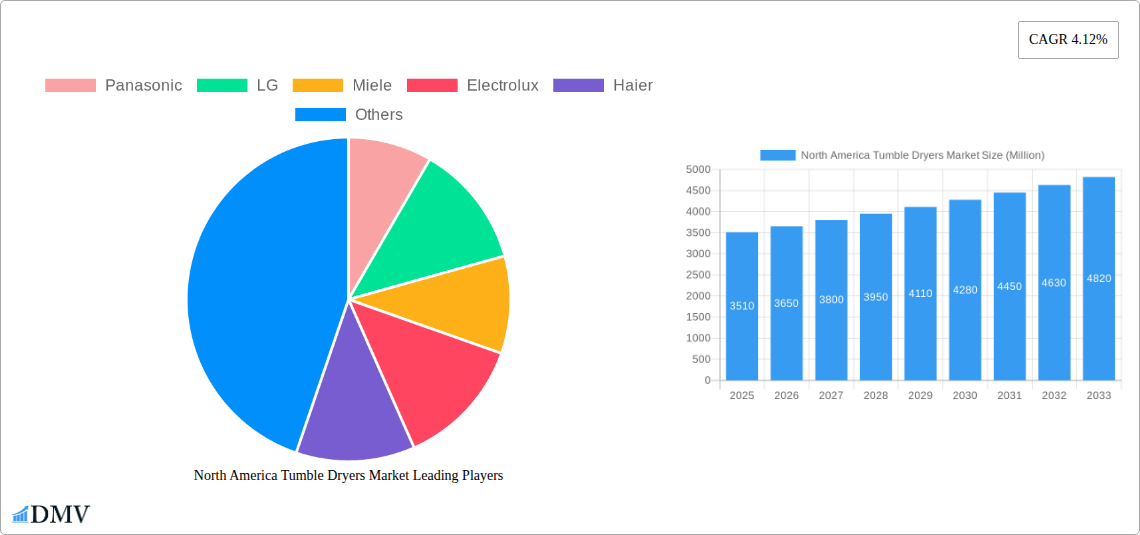

The competitive landscape is marked by both established global players and regional manufacturers. Panasonic, LG, Miele, Electrolux, and Samsung are major contenders, constantly vying for market share through technological advancements and marketing strategies. Successful strategies include focusing on features like smart home integration, advanced drying technology (e.g., sensor-drying), and eco-friendly designs. The distribution channels are diversifying, with a growing presence of online retailers alongside traditional brick-and-mortar stores. This trend is anticipated to further accelerate, particularly among younger demographics who prefer the convenience of online shopping and product comparison. Furthermore, the market's segmentation allows for tailored marketing strategies targeting specific needs in both residential and commercial settings. Understanding the nuances of regional differences within North America (e.g., the US vs. Canada) is also crucial for effective market penetration.

North America Tumble Dryers Market Company Market Share

North America Tumble Dryers Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America tumble dryers market, covering the period 2019-2033. With a base year of 2025 and an estimated year of 2025, this comprehensive study offers valuable forecasts from 2025 to 2033, along with a historical overview from 2019 to 2024. The report delves deep into market segmentation, competitive dynamics, technological advancements, and future growth prospects, making it an indispensable resource for stakeholders across the industry. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Tumble Dryers Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user dynamics, and merger & acquisition (M&A) activities within the North American tumble dryer market. We analyze market share distribution among key players such as Panasonic, LG, Miele, Electrolux, Haier, Whirlpool, Bosch, Asko Appliances, Pellerin Milnor, and Samsung. The report also quantifies the impact of M&A activities, providing insights into deal values and their implications for market consolidation.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2025.

- Innovation Catalysts: Technological advancements such as heat pump technology, smart features (Wi-Fi connectivity, AI integration), and energy-efficient designs are driving innovation.

- Regulatory Landscape: Stringent energy efficiency standards and environmental regulations are shaping product development and market dynamics.

- Substitute Products: Air drying and professional laundry services represent key substitute products, impacting market growth.

- End-User Profiles: Residential consumers constitute the largest segment, followed by commercial and industrial end-users.

- M&A Activities: The report analyzes completed and anticipated M&A activities, offering insights into deal values (estimated at xx Million in total for the period 2019-2024) and their impact on market structure.

North America Tumble Dryers Market Industry Evolution

This section delves into the dynamic evolution of the North American tumble dryer market, charting its growth trajectory, embracing technological innovation, and responding to evolving consumer demands. We dissect historical growth patterns, analyze the adoption rates across diverse dryer technologies including advanced heat pump, efficient condenser, traditional vented, and gas-heated models, and highlight the pronounced shift in consumer preference towards highly energy-efficient and intelligent connected appliances. Furthermore, this analysis explores the influential impact of escalating disposable incomes, the pervasive trend towards greater convenience in modern lifestyles, and the increasing demand for smart home integration, all of which are instrumental in shaping the market's forward momentum and expansion. From 2019 to 2024, the market has witnessed a notable compound annual growth rate (CAGR) of [Insert Specific CAGR Here, e.g., 5.8%], predominantly propelled by the escalating demand for both energy-efficient and feature-rich, technologically advanced dryers. The adoption of heat pump dryers, a testament to the growing environmental consciousness and desire for cost savings, is estimated to have surged by [Insert Specific Percentage Here, e.g., 25%] during this period, signifying a profound transformation in consumer choices and market priorities.

Leading Regions, Countries, or Segments in North America Tumble Dryers Market

This section identifies the dominant regions, countries, and segments within the North American tumble dryer market. The analysis covers product types (Heat Pump Tumble Dryer, Condenser Tumble Dryer, Vented Tumble Dryer, Gas Heated Tumble Dryer), distribution channels (Online, Offline), and end-users (Residential, Commercial).

Dominant Segment: The residential segment, particularly in the United States, constitutes the largest share of the market, driven by high household appliance ownership rates and rising disposable incomes.

Key Drivers (Residential Segment):

- Significant investments in new housing constructions.

- Government incentives for energy-efficient appliances.

- Growing preference for convenience and time-saving household appliances.

Dominant Product Type: Condenser tumble dryers hold the largest market share, followed by vented dryers. Heat pump dryers are witnessing significant growth due to energy efficiency advantages.

Key Drivers (Heat Pump Dryers):

- Government initiatives promoting energy efficiency.

- Growing consumer awareness regarding environmental sustainability.

- Technological advancements reducing the initial cost of heat pump dryers.

Dominant Distribution Channel: Offline channels (appliance retailers) continue to dominate, although online sales are steadily growing.

Key Drivers (Online Channel):

- Increased internet penetration and online shopping adoption.

- Competitive pricing and convenient home delivery options.

North America Tumble Dryers Market Product Innovations

Recent innovations include the integration of smart technologies like Wi-Fi connectivity, AI-powered features, and improved energy efficiency through heat pump technology. Manufacturers are focusing on developing compact designs and stackable units for space-saving solutions, catering to smaller living spaces. Unique selling propositions (USPs) include features like steam sanitization, remote control capabilities, and customized drying settings for various fabric types. Improved performance metrics focus on faster drying times, reduced energy consumption, and gentler fabric care.

Propelling Factors for North America Tumble Dryers Market Growth

The North American tumble dryer market is currently experiencing a period of robust and sustained growth, underpinned by a confluence of powerful driving forces. A primary catalyst is the consistent rise in disposable incomes across the region, empowering consumers to invest in and upgrade their home appliances, thereby stimulating demand for premium models equipped with advanced features and enhanced performance. Complementing this is the escalating consumer preference for convenience and time-saving solutions in their daily routines, which directly fuels the adoption of technologically sophisticated dryers designed for efficiency and ease of use. Moreover, stringent government regulations and environmental mandates focused on promoting energy efficiency are acting as significant incentives for the market. These regulations are not only encouraging but also actively driving innovation in the development of eco-friendly and energy-saving technologies, with heat pump dryers emerging as a prime example of this trend, offering substantial reductions in energy consumption and operational costs.

Obstacles in the North America Tumble Dryers Market

Despite the positive growth trajectory, the North American tumble dryer market encounters several significant challenges. Fluctuations in the prices of raw materials, such as metals and plastics, can directly impact manufacturing costs, leading to potential adjustments in product pricing and affecting profitability. Furthermore, persistent supply chain disruptions and shortages of critical components have, at various points, hampered production schedules and the timely delivery of goods. The market is also characterized by intense competition among established global manufacturers and emerging brands, which exerts considerable pressure on pricing strategies and profit margins. Additionally, the market faces ongoing pressure from alternative clothes drying methods, including traditional air drying, which remains a cost-effective option for some consumers, and the increasing availability and convenience of professional laundry services, which offer an alternative to in-home appliance ownership.

Future Opportunities in North America Tumble Dryers Market

Emerging opportunities lie in the expanding smart home market, with increased integration of dryers into connected home ecosystems. The growing demand for energy-efficient appliances presents opportunities for heat pump and other energy-saving technologies. Furthermore, the focus on customization and personalized drying settings offers potential for premium product differentiation.

Major Players in the North America Tumble Dryers Market Ecosystem

- Panasonic Canada

- LG Canada

- Miele Canada

- Electrolux Canada

- Haier Canada

- Whirlpool Canada

- Bosch Home Appliances Canada

- Asko Appliances

- Pellerin Milnor

- Samsung Canada

Key Developments in North America Tumble Dryers Market Industry

-

July 2022: Samsung revolutionized the market with the introduction of its innovative Bespoke laundry line. This collection prominently featured AI-enabled electric and smart steam-sanitized dryers, boasting advanced Wi-Fi connectivity and seamless remote control capabilities. This strategic launch significantly elevated the industry standard by integrating a new echelon of smart technology and offering unprecedented customization options to consumers.

-

June 2023: Equator Advanced Appliances strategically expanded its reach into the Canadian market by launching its highly anticipated Super Washer and Compact Vented Dryer Stackable Set. Available through major online retailers and prominent brick-and-mortar stores across Canada, this product introduction directly addresses the growing demand for space-saving solutions and underscores the brand's commitment to delivering unparalleled convenience to consumers with limited living spaces.

Strategic North America Tumble Dryers Market Forecast

The North America tumble dryers market is poised for continued growth, driven by technological advancements, increasing consumer preference for convenience, and government initiatives promoting energy efficiency. The market is expected to witness a robust expansion in the coming years, particularly in the segments of heat pump dryers and smart appliances. The continued adoption of online sales channels will further augment market growth.

North America Tumble Dryers Market Segmentation

-

1. Product

- 1.1. Heat Pump Tumble Dryer

- 1.2. Condenser Tumble Dryer

- 1.3. Vented Tumble Dryer

- 1.4. Gas Heated Tumble Dryer

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. End User

- 3.1. Residential

- 3.2. Commercial

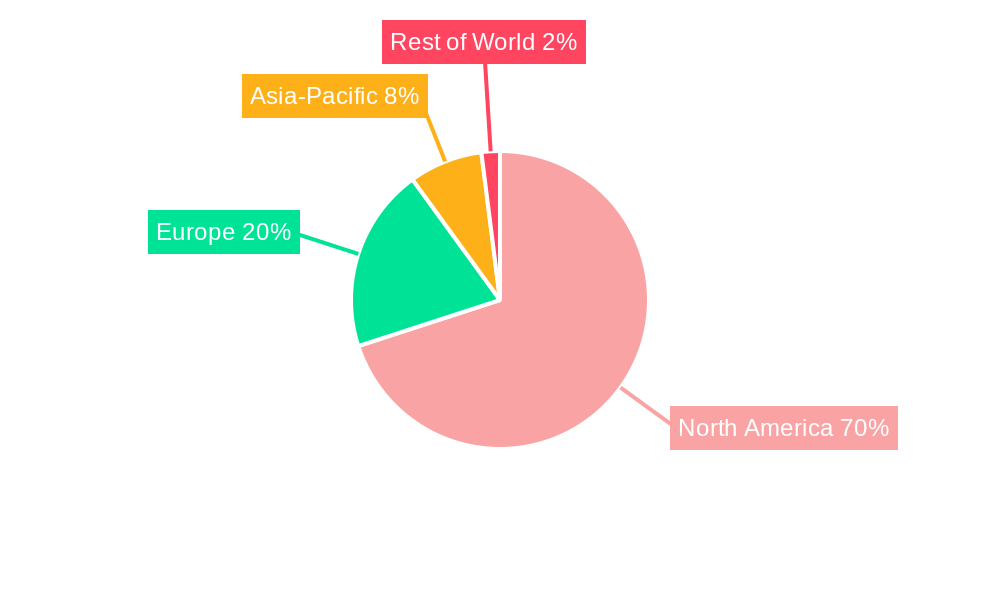

North America Tumble Dryers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Tumble Dryers Market Regional Market Share

Geographic Coverage of North America Tumble Dryers Market

North America Tumble Dryers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Major Household Appliances; Increasing Rate of Urbanization in North America

- 3.3. Market Restrains

- 3.3.1. Higher Price of Fully Automatic Tumble Dryers

- 3.4. Market Trends

- 3.4.1. Rising Online Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Tumble Dryers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Heat Pump Tumble Dryer

- 5.1.2. Condenser Tumble Dryer

- 5.1.3. Vented Tumble Dryer

- 5.1.4. Gas Heated Tumble Dryer

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Miele

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Haier

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Whirlpool

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Asko Appliances

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pellerin Milnor

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: North America Tumble Dryers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Tumble Dryers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Tumble Dryers Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Tumble Dryers Market Volume K Units Forecast, by Product 2020 & 2033

- Table 3: North America Tumble Dryers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Tumble Dryers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Tumble Dryers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: North America Tumble Dryers Market Volume K Units Forecast, by End User 2020 & 2033

- Table 7: North America Tumble Dryers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Tumble Dryers Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Tumble Dryers Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: North America Tumble Dryers Market Volume K Units Forecast, by Product 2020 & 2033

- Table 11: North America Tumble Dryers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Tumble Dryers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Tumble Dryers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: North America Tumble Dryers Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: North America Tumble Dryers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Tumble Dryers Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States North America Tumble Dryers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Tumble Dryers Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Tumble Dryers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Tumble Dryers Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Tumble Dryers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Tumble Dryers Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Tumble Dryers Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the North America Tumble Dryers Market?

Key companies in the market include Panasonic, LG, Miele, Electrolux, Haier, Whirlpool, Bosch, Asko Appliances, Pellerin Milnor, Samsung.

3. What are the main segments of the North America Tumble Dryers Market?

The market segments include Product, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Major Household Appliances; Increasing Rate of Urbanization in North America.

6. What are the notable trends driving market growth?

Rising Online Sales.

7. Are there any restraints impacting market growth?

Higher Price of Fully Automatic Tumble Dryers.

8. Can you provide examples of recent developments in the market?

July 2022: Samsung launched its Bespoke laundry line of washers and dryers. The product line consisted of the latest AI-enabled technology with Wi-Fi and sensors equipped in them. The dryer segment in the bespoke laundry line consists of electric dryers and smart steam-sanitized electric dryers that can be controlled remotely by the user.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Tumble Dryers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Tumble Dryers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Tumble Dryers Market?

To stay informed about further developments, trends, and reports in the North America Tumble Dryers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence