Key Insights

The North American postal services market, including express and standard mail for domestic and international letters and parcels, is demonstrating consistent expansion. Driven by robust e-commerce growth, the market's Compound Annual Growth Rate (CAGR) is estimated at 1.14%. Key growth drivers include escalating online shopping adoption, which fuels demand for efficient parcel delivery, and the increasing number of businesses operating internationally, boosting cross-border mail services. While rising fuel costs and competition from private couriers present challenges, technological advancements in logistics and tracking are effectively mitigating these factors. Express postal services represent a high-growth segment, driven by the need for expedited delivery of time-sensitive shipments. The market features significant competition from major global providers such as UPS, FedEx, DHL, USPS, and Canada Post, alongside regional players like Estafeta and Paquetexpress, fostering continuous innovation in service offerings and operational efficiency.

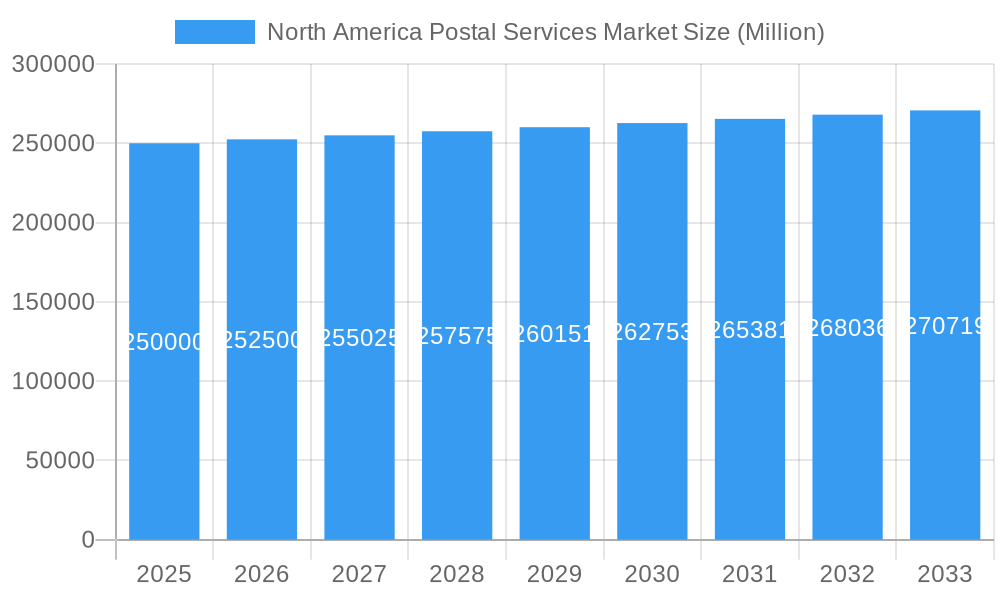

North America Postal Services Market Market Size (In Billion)

The market is projected to reach a substantial size of 87.88 billion in the base year 2025. The forecast period (2025-2033) anticipates continued growth, propelled by the ongoing expansion of e-commerce and evolving consumer expectations for speed and advanced tracking. The competitive landscape, characterized by both established global and agile regional players, spurs ongoing innovation in the North American postal services sector. Future expansion opportunities lie in specialized handling for valuable or fragile items and enhanced data analytics for optimizing delivery routes and improving customer experiences. Regulatory frameworks governing postal services and international shipments will also play a crucial role in shaping market dynamics throughout the forecast period.

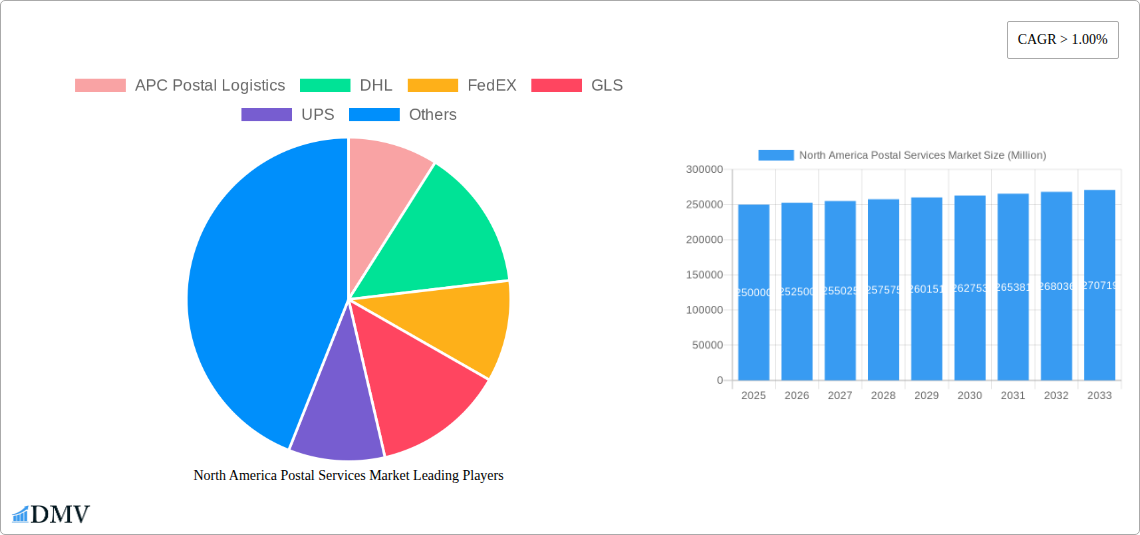

North America Postal Services Market Company Market Share

North America Postal Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America postal services market, encompassing its current state, future trajectory, and key players. With a comprehensive study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report offers invaluable insights for stakeholders seeking to navigate this dynamic sector. The market size is projected to reach xx Million by 2033, demonstrating significant growth potential.

North America Postal Services Market Composition & Trends

This section evaluates the competitive landscape, innovative drivers, regulatory environment, substitute products, and end-user profiles within the North American postal services market. The market exhibits a moderately concentrated structure, with key players such as USPS, Canada Post, FedEx, UPS, and DHL holding significant market share. However, smaller regional players and niche providers also contribute significantly.

Market Share Distribution (2024 Estimate): USPS (xx%), UPS (xx%), FedEx (xx%), Canada Post (xx%), DHL (xx%), Others (xx%). These figures are estimates based on available data.

Innovation Catalysts: The rising adoption of e-commerce, technological advancements in sorting and delivery systems (automation, AI), and the increasing demand for speed and efficiency are key drivers of innovation.

Regulatory Landscape: Government regulations, including pricing policies and service standards, significantly influence market dynamics. Ongoing legislative changes in various jurisdictions impact operational costs and service offerings.

Substitute Products: Private couriers and specialized delivery services represent alternative options, particularly for express and high-value shipments.

End-User Profiles: Businesses of all sizes and individual consumers comprise the primary end-users, with varying needs and preferences across different service types (express, standard) and shipment types (letters, parcels).

M&A Activities: While large-scale mergers and acquisitions are less frequent, smaller strategic acquisitions targeting specific technologies or regional expansion are observed. Total M&A deal value (2019-2024) is estimated at xx Million.

North America Postal Services Market Industry Evolution

The North American postal services market has undergone a significant transformation in recent years, driven by the exponential growth of e-commerce, technological advancements, and evolving consumer expectations. The market demonstrates a consistent growth trajectory, fueled primarily by the increase in online shopping. This has led to substantial growth in parcel volume, outpacing letter mail. Technological advancements, such as automated sorting systems and improved tracking technologies, have enhanced efficiency and service delivery. Furthermore, the shift in consumer demands towards faster and more reliable delivery options has prompted the development of innovative services like next-day delivery and specialized handling for various goods. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth reflects a continued increase in e-commerce transactions and ongoing investment in infrastructure and technology. Specific examples of technological advancements include the implementation of automated guided vehicles (AGVs) in sorting facilities, the use of AI-powered route optimization software, and the expansion of drone delivery services for specific use-cases.

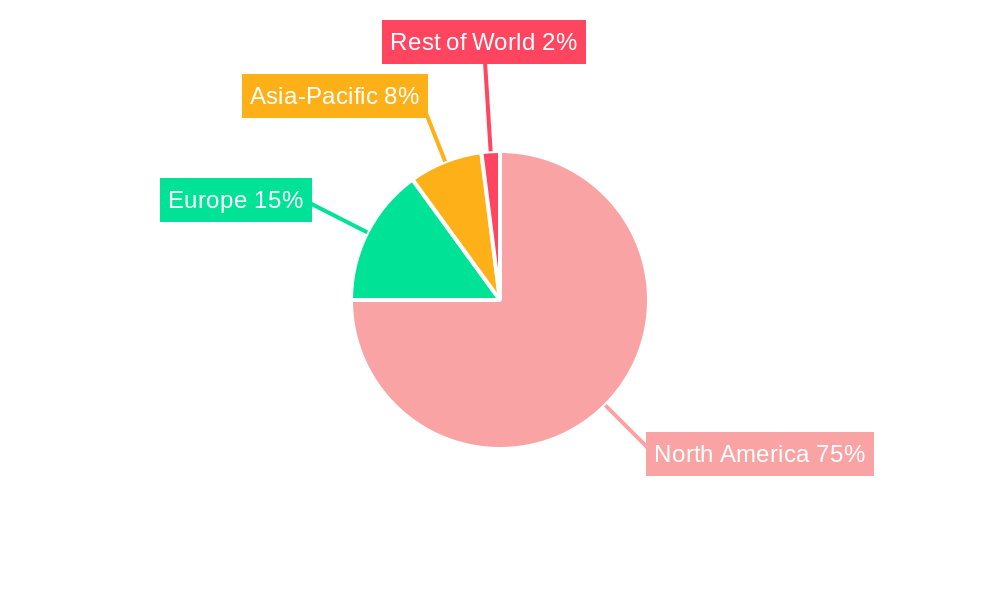

Leading Regions, Countries, or Segments in North America Postal Services Market

The United States holds the largest market share due to its massive e-commerce sector and extensive postal infrastructure. Canada also shows robust growth, driven by similar factors. The parcel segment is the fastest-growing, significantly exceeding the growth of letter mail. Domestic shipping remains the dominant segment, reflecting the prevalence of intra-regional trade and e-commerce transactions within each country.

Key Drivers:

- United States: High e-commerce penetration, extensive infrastructure, and strong regulatory support for USPS innovation.

- Canada: Growing e-commerce adoption, substantial investment in infrastructure upgrades (like Canada Post's new facility), and a supportive regulatory environment.

- Parcel Segment: Driven by the explosive growth of e-commerce and online retail.

- Domestic Segment: High levels of intra-regional trade and e-commerce within each country.

Dominance Factors: Strong domestic demand coupled with efficient logistics networks and government support contribute to the dominance of specific regions and segments.

North America Postal Services Market Product Innovations

Recent innovations encompass advanced tracking systems, improved last-mile delivery solutions (including drone technology and alternative delivery points), and specialized handling for temperature-sensitive goods and high-value items. These advancements offer enhanced visibility, efficiency, and reliability, addressing consumer demand for faster and more secure delivery. The introduction of services like USPS Connect Local demonstrates a focus on cost-effective next-day delivery for smaller packages.

Propelling Factors for North America Postal Services Market Growth

E-commerce expansion, technological advancements (automation, AI), and increasing demand for faster delivery are key drivers. Government initiatives promoting digitalization and infrastructure development also stimulate growth. Furthermore, expanding last-mile delivery options and a focus on sustainability are shaping market dynamics.

Obstacles in the North America Postal Services Market

Supply chain disruptions, labor shortages, and increasing fuel costs pose challenges. Maintaining competitive pricing while ensuring profitability is another key obstacle. Regulatory changes and evolving consumer expectations also require adaptability and innovation. For example, in 2022, fuel costs increased by xx%, directly impacting operational expenses.

Future Opportunities in North America Postal Services Market

Expanding into underserved rural areas, leveraging technological advancements (e.g., AI, automation, drone delivery), and catering to the growing demand for specialized logistics solutions present significant opportunities. Focus on sustainable practices and green logistics is also crucial. Growth in cross-border e-commerce also presents potential for expansion.

Key Developments in North America Postal Services Market Industry

February 2022: USPS launches 'USPS Connect Local,' 'USPS Connect Regional,' and 'USPS Connect National' for expedited delivery and 'USPS Connect Returns' for simplified package returns. This significantly impacts the competitive landscape by offering more affordable next-day delivery options.

May 2022: Canada Post unveils a new zero-carbon parcel sorting facility, significantly increasing parcel processing capacity and enhancing service capabilities. This investment boosts operational efficiency and strengthens Canada Post's position in the market.

Strategic North America Postal Services Market Forecast

The North American postal services market is poised for sustained growth, driven by e-commerce expansion and technological advancements. Strategic investments in infrastructure, technological innovations, and sustainable practices will shape the future. New service offerings and a focus on last-mile delivery solutions will be crucial for success in this evolving market. The market's robust growth trajectory, fueled by the continued rise of e-commerce, presents significant opportunities for both established players and new entrants. The strategic adoption of technologies such as AI and automation will further enhance efficiency and create new service offerings.

North America Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Geography

- 4.1. US

- 4.2. Canada

- 4.3. Mexico

North America Postal Services Market Segmentation By Geography

- 1. US

- 2. Canada

- 3. Mexico

North America Postal Services Market Regional Market Share

Geographic Coverage of North America Postal Services Market

North America Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Air cargo Transportation

- 3.3. Market Restrains

- 3.3.1. High Operation and Maintainance Cost

- 3.4. Market Trends

- 3.4.1. eCommerce Opens Opportunities for Postal Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. US

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. US

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. US North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Express Postal Services

- 6.1.2. Standard Postal Services

- 6.2. Market Analysis, Insights and Forecast - by Item

- 6.2.1. Letter

- 6.2.2. Parcel

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. US

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Express Postal Services

- 7.1.2. Standard Postal Services

- 7.2. Market Analysis, Insights and Forecast - by Item

- 7.2.1. Letter

- 7.2.2. Parcel

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. US

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Express Postal Services

- 8.1.2. Standard Postal Services

- 8.2. Market Analysis, Insights and Forecast - by Item

- 8.2.1. Letter

- 8.2.2. Parcel

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. US

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 APC Postal Logistics

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 DHL

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 FedEX

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GLS

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 UPS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Grenada Postal Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Santa Lucia Post

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Correos de Mexico

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 USPS

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Estafeta

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Paquetexpress**List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Canada Post Corporation

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Purolator

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 APC Postal Logistics

List of Figures

- Figure 1: North America Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 8: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 13: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 14: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 18: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 19: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Postal Services Market?

The projected CAGR is approximately 1.14%.

2. Which companies are prominent players in the North America Postal Services Market?

Key companies in the market include APC Postal Logistics, DHL, FedEX, GLS, UPS, Grenada Postal Corporation, Santa Lucia Post, Correos de Mexico, USPS, Estafeta, Paquetexpress**List Not Exhaustive, Canada Post Corporation, Purolator.

3. What are the main segments of the North America Postal Services Market?

The market segments include Type, Item, Destination, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Air cargo Transportation.

6. What are the notable trends driving market growth?

eCommerce Opens Opportunities for Postal Services.

7. Are there any restraints impacting market growth?

High Operation and Maintainance Cost.

8. Can you provide examples of recent developments in the market?

February 2022: In a bid to capture more packages for next-day delivery, the United States Postal Service has created a new, cheaper parcel service called 'USPS Connect Local.' The service will enable shippers to get next-day, first-class service on document packages of up to 13 ounces for USD 2.95, according to an order from the Postal Regulatory Commission. The USPS also will offer expedited service on shipments under new 'USPS Connect Regional' and 'USPS Connect National' programs. The agency also created a fourth program to help speed product return parcels. The program is called 'USPS Connect Returns' and promises free return package pickups by letter carriers or drop-offs at post offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Postal Services Market?

To stay informed about further developments, trends, and reports in the North America Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence