Key Insights

The North American fashion accessories market, encompassing apparel, footwear, handbags, watches, and other items, is poised for significant expansion. Driven by rising disposable incomes, a demand for personalized style, and social media influence, the market is projected for sustained growth. Building on the current trajectory, the market is expected to achieve a CAGR of 8.6%. Key growth drivers include women's fashion accessories and online retail, supported by targeted marketing and e-commerce convenience. Major players and emerging brands contribute to a dynamic competitive landscape. While economic shifts and evolving consumer preferences pose challenges, the fundamental demand for fashion accessories remains strong.

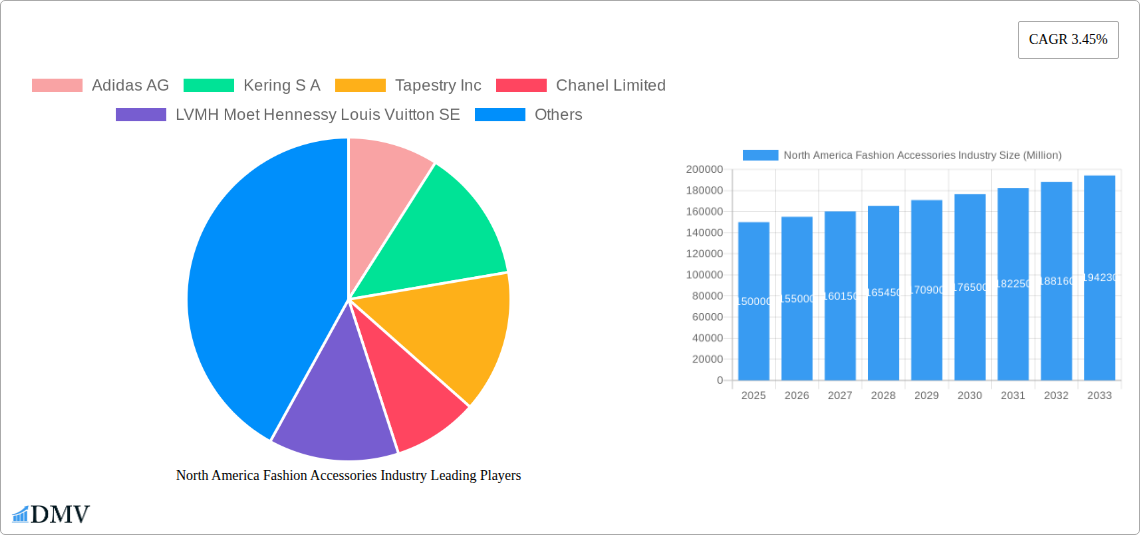

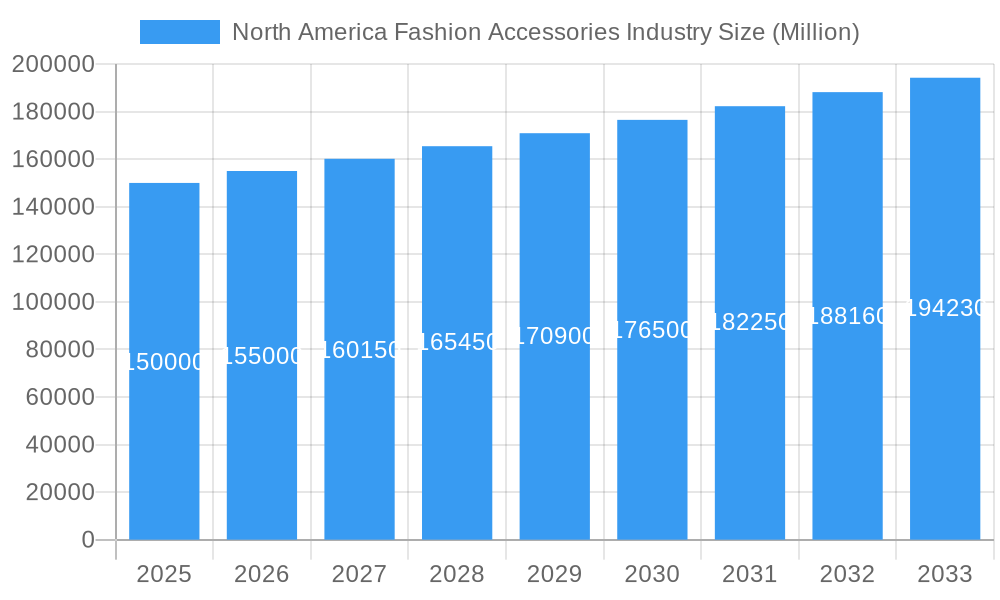

North America Fashion Accessories Industry Market Size (In Billion)

The competitive environment features both established luxury houses and agile, trend-focused companies. Diverse offerings cater to varied price points and consumer tastes. Higher consumption rates are anticipated in major metropolitan areas. A notable trend is the increasing consumer preference for sustainable and ethically sourced products, influencing brand strategies. Technological integration in retail, such as personalized experiences and augmented reality, will further shape the market. Niche market expansion and influencer collaborations are also expected to drive future growth.

North America Fashion Accessories Industry Company Market Share

North America Fashion Accessories Industry Market Report: 2025-2033

This comprehensive report delivers in-depth analysis of the North American fashion accessories market, providing critical insights for stakeholders. Covering the period from 2025 to 2033, with a base year of 2025, this study forecasts substantial growth and identifies key industry trends. The report examines market segmentation, leading players, product innovation, and emerging opportunities, offering a holistic view of the North American fashion accessories landscape. Focusing on essential segments such as apparel, footwear, handbags, and watches, this report is vital for strategic decision-making. The market size is projected to reach 41.71 billion by 2033.

North America Fashion Accessories Industry Market Composition & Trends

The North American fashion accessories market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. While precise figures for market share distribution are proprietary, Adidas AG, Nike Inc, and LVMH Moet Hennessy Louis Vuitton SE consistently rank among the top players. The market exhibits a high degree of innovation, driven by evolving consumer preferences, technological advancements (e.g., smartwatches), and the increasing importance of sustainability. Regulatory changes concerning product safety and labeling also influence market dynamics. Substitute products, such as affordable alternatives or handmade accessories, pose a competitive challenge. End-user profiles are diverse, encompassing men, women, and children, with significant variations in purchasing behavior and preferences across demographics. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years. Several significant acquisitions have consolidated market power and expanded product portfolios for major players.

- Market Concentration: Moderately concentrated, with top players holding significant share.

- Innovation Catalysts: Technological advancements, evolving consumer preferences, sustainability concerns.

- Regulatory Landscape: Influences product safety, labeling, and ethical sourcing.

- Substitute Products: Competition from affordable alternatives and handmade accessories.

- End-User Profiles: Diverse, with significant variations across demographics.

- M&A Activity: Moderate activity with deal values ranging from xx Million to xx Million.

North America Fashion Accessories Industry Industry Evolution

The North America fashion accessories market has witnessed consistent growth over the historical period (2019-2024), with an average annual growth rate (AAGR) of approximately xx%. Technological advancements, particularly in smartwatches and personalized accessories, have significantly influenced market evolution. The increasing adoption of e-commerce platforms has also driven market expansion. Shifting consumer demands towards sustainable and ethically sourced products are reshaping the industry. Growth in online retail channels is outpacing traditional offline channels. The market has demonstrated resilience during economic fluctuations, showing relatively consistent growth even during periods of economic uncertainty. The forecast period (2025-2033) predicts a continued expansion with a projected AAGR of xx%, fueled by factors including increasing disposable incomes, rising fashion consciousness, and the continued growth of online retail.

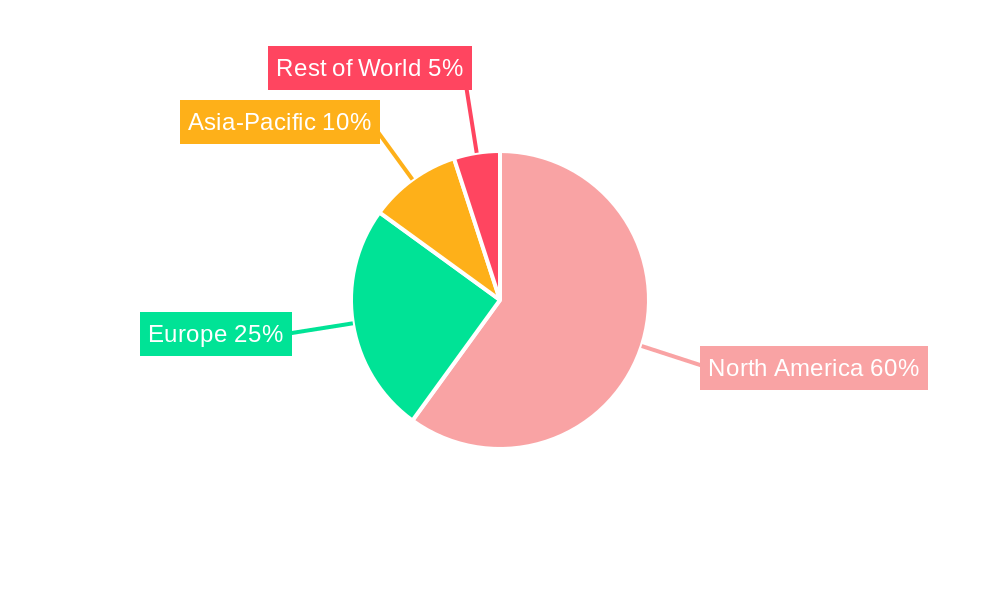

Leading Regions, Countries, or Segments in North America Fashion Accessories Industry

The United States dominates the North American fashion accessories market, accounting for the largest share of revenue. Within the U.S., major metropolitan areas with high population density and significant purchasing power contribute disproportionately to market volume.

- By Product Type: Handbags and footwear currently hold the largest market share, driven by high consumer demand and diverse product offerings. Watches are experiencing significant growth due to technological innovations.

- By End User: The women's segment dominates, followed by men's and unisex categories. The children's segment shows steady growth potential.

- By Distribution Channel: Online retail stores are experiencing rapid growth, fueled by convenience and broader reach, while offline retail stores remain a significant distribution channel.

Key Drivers:

- Investment Trends: Significant investment in e-commerce infrastructure and omnichannel strategies.

- Regulatory Support: Government initiatives promoting sustainable and ethical practices.

North America Fashion Accessories Industry Product Innovations

Recent years have seen significant product innovations, particularly in smartwatches and personalized accessories. Brands are leveraging technology to integrate features such as fitness tracking, contactless payments, and personalized notifications into their products. Unique selling propositions (USPs) often center on design aesthetics, material quality, and technological integration. The focus on sustainability is also driving innovation, with brands incorporating recycled materials and ethical manufacturing practices into their product lines.

Propelling Factors for North America Fashion Accessories Industry Growth

Several key factors are propelling growth in the North American fashion accessories market. Technological advancements, such as smartwatches and personalized accessories, are driving increased consumer demand. Economic factors, such as rising disposable incomes and increased consumer spending on discretionary items, also contribute to market growth. Government regulations promoting fair labor practices and sustainable sourcing positively impact the industry.

Obstacles in the North America Fashion Accessories Industry Market

The North American fashion accessories market faces challenges such as increasing competition from both established and emerging brands. Supply chain disruptions can significantly impact product availability and pricing. Fluctuations in raw material costs and currency exchange rates pose additional obstacles. Regulatory challenges and evolving consumer preferences necessitate continuous adaptation.

Future Opportunities in North America Fashion Accessories Industry

Emerging opportunities lie in the personalization of accessories, leveraging data analytics to cater to specific consumer preferences. Expansion into new markets, particularly in less-penetrated regions, holds substantial growth potential. The adoption of advanced technologies, such as augmented reality (AR) and virtual reality (VR), to enhance the shopping experience will likely drive market growth.

Major Players in the North America Fashion Accessories Industry Ecosystem

Key Developments in North America Fashion Accessories Industry Industry

- 2022 (Q3): Fossil Group launched its next-generation Gen 6 Hybrid smartwatch, enhancing its product portfolio.

- 2022 (Q4): Tapestry Inc.'s Coach brand introduced the new Coachies collection, expanding its handbag offerings.

- 2022 (Q4): La Marque-M launched a new gold and diamond jewelry collection through its online store.

Strategic North America Fashion Accessories Industry Market Forecast

The North America fashion accessories market is poised for continued growth, driven by ongoing technological advancements, evolving consumer preferences, and the expanding e-commerce sector. The market's future trajectory will be influenced by factors such as the adoption of sustainable practices, the rise of personalized accessories, and the integration of innovative technologies. The potential for market expansion remains significant, particularly in niche segments and emerging markets.

North America Fashion Accessories Industry Segmentation

-

1. Product Type

- 1.1. Apparel

- 1.2. Footwear

- 1.3. Handbags

- 1.4. Wallets

- 1.5. Watches

- 1.6. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Children

- 2.4. Unisex

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline Retail Stores

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Fashion Accessories Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Fashion Accessories Industry Regional Market Share

Geographic Coverage of North America Fashion Accessories Industry

North America Fashion Accessories Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Consumers Inclination Towards Luxury Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Apparel

- 5.1.2. Footwear

- 5.1.3. Handbags

- 5.1.4. Wallets

- 5.1.5. Watches

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.2.4. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Apparel

- 6.1.2. Footwear

- 6.1.3. Handbags

- 6.1.4. Wallets

- 6.1.5. Watches

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.2.4. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline Retail Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Apparel

- 7.1.2. Footwear

- 7.1.3. Handbags

- 7.1.4. Wallets

- 7.1.5. Watches

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.2.4. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline Retail Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Apparel

- 8.1.2. Footwear

- 8.1.3. Handbags

- 8.1.4. Wallets

- 8.1.5. Watches

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.2.4. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline Retail Stores

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Apparel

- 9.1.2. Footwear

- 9.1.3. Handbags

- 9.1.4. Wallets

- 9.1.5. Watches

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.2.4. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline Retail Stores

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kering S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tapestry Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Chanel Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LVMH Moet Hennessy Louis Vuitton SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tory Burch LL

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fossil Group Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nike Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Prada SPA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Guess Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: North America Fashion Accessories Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fashion Accessories Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Fashion Accessories Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: North America Fashion Accessories Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 5: North America Fashion Accessories Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Fashion Accessories Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Fashion Accessories Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: North America Fashion Accessories Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America Fashion Accessories Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 11: North America Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: North America Fashion Accessories Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: North America Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: North America Fashion Accessories Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 15: North America Fashion Accessories Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: North America Fashion Accessories Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: North America Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Fashion Accessories Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: North America Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America Fashion Accessories Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 21: North America Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: North America Fashion Accessories Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: North America Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 24: North America Fashion Accessories Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 25: North America Fashion Accessories Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 26: North America Fashion Accessories Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: North America Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Fashion Accessories Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: North America Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Fashion Accessories Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 31: North America Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: North America Fashion Accessories Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: North America Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 34: North America Fashion Accessories Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 35: North America Fashion Accessories Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Fashion Accessories Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Fashion Accessories Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Fashion Accessories Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: North America Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: North America Fashion Accessories Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: North America Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 44: North America Fashion Accessories Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 45: North America Fashion Accessories Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: North America Fashion Accessories Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: North America Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: North America Fashion Accessories Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: North America Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: North America Fashion Accessories Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fashion Accessories Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the North America Fashion Accessories Industry?

Key companies in the market include Adidas AG, Kering S A, Tapestry Inc, Chanel Limited, LVMH Moet Hennessy Louis Vuitton SE, Tory Burch LL, Fossil Group Inc, Nike Inc, Prada SPA, Guess Inc.

3. What are the main segments of the North America Fashion Accessories Industry?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.71 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Consumers Inclination Towards Luxury Products.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, Fossil Group launched its next-generation, Gen 6 Hybrid smartwatch for those who prefer a more classic look with some of the smart features of modern smartwatches. The Fossil Gen 6 Hybrid takes design elements from its other Gen 6 smartwatches and packs more tech into the hardware.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fashion Accessories Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fashion Accessories Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fashion Accessories Industry?

To stay informed about further developments, trends, and reports in the North America Fashion Accessories Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence