Key Insights

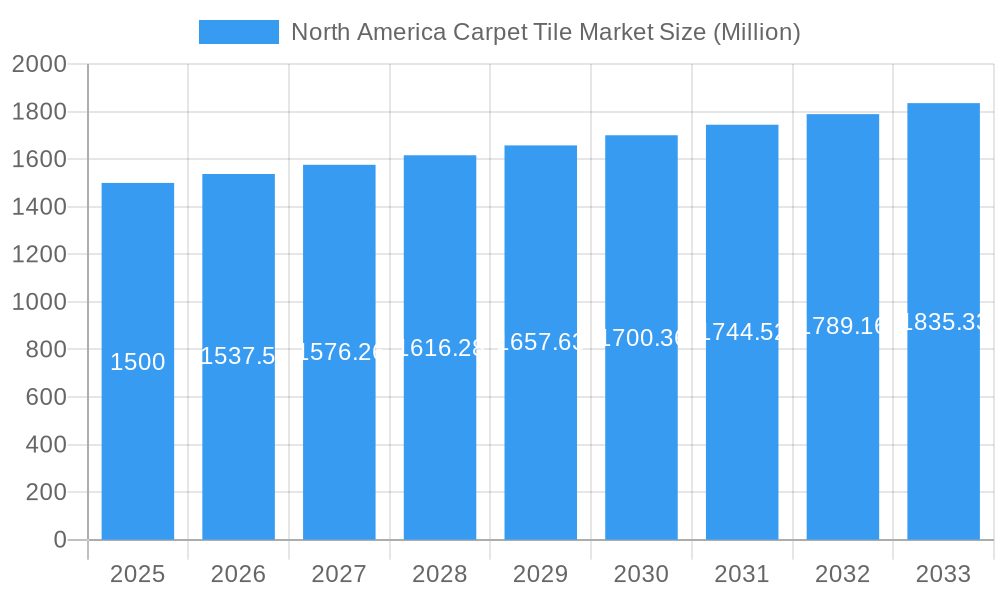

The North American carpet tile market, currently valued at an estimated $XX million in 2025, is projected to experience robust growth, exceeding a 2.50% CAGR through 2033. This expansion is driven by several key factors. The increasing popularity of carpet tiles in both residential and commercial settings is a significant contributor. Residential consumers are drawn to the ease of installation, repair, and replacement offered by carpet tiles, along with their design flexibility. Commercial spaces, especially offices and retail environments, favor carpet tiles due to their durability, cost-effectiveness in managing repairs (replacing individual tiles rather than whole sections), and ability to create customized floor designs. Furthermore, the growing preference for sustainable and eco-friendly flooring options is fueling demand for carpet tiles made from recycled materials or those with low VOC emissions. While supply chain disruptions and fluctuating raw material prices pose potential restraints, the overall market outlook remains positive, driven by ongoing innovation in carpet tile design, material technology, and installation methods. The market segmentation highlights strong growth in online sales channels, reflecting broader e-commerce trends in the flooring industry, and increased adoption in new construction projects.

North America Carpet Tile Market Market Size (In Billion)

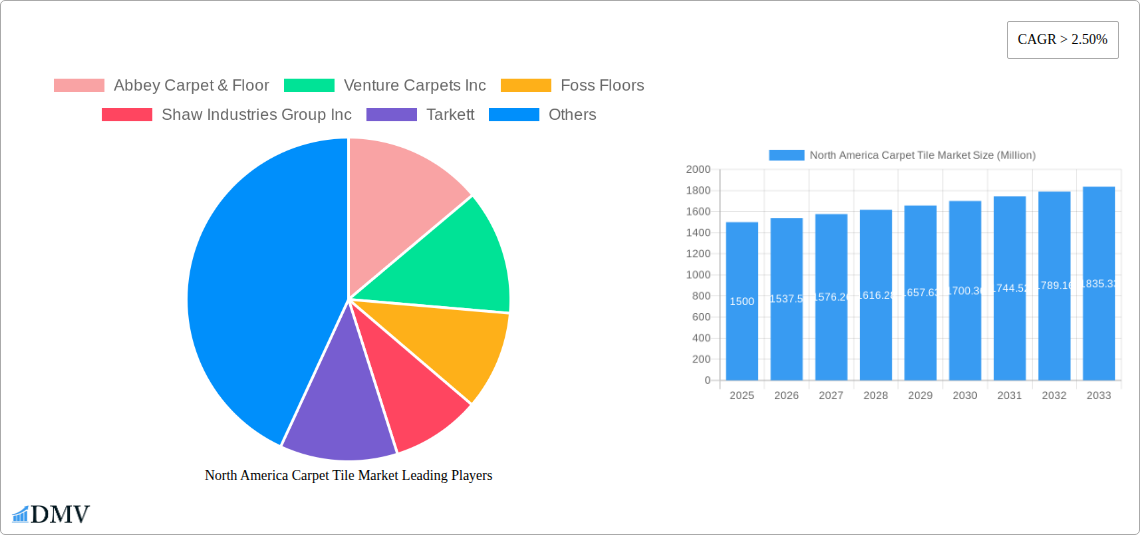

The leading players in the North American carpet tile market, including Mohawk Industries, Shaw Industries Group Inc., and Tarkett, are actively investing in research and development to introduce innovative products that meet evolving consumer preferences. This includes developing tiles with enhanced acoustic properties, improved stain resistance, and enhanced durability to cater to specific market needs. The market is witnessing a noticeable shift toward modular designs and customizable options, enabling greater design creativity and personalization for both residential and commercial projects. Competition among major players is intense, leading to ongoing efforts in product differentiation and strategic partnerships to expand distribution networks and market reach. The continued focus on sustainable practices within the industry, along with a diversified product range, promises to drive significant market expansion over the forecast period.

North America Carpet Tile Market Company Market Share

North America Carpet Tile Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America carpet tile market, offering a detailed examination of market dynamics, growth drivers, challenges, and future opportunities from 2019 to 2033. The study covers key segments including product type (square, rectangle), end-user (residential, commercial), and distribution channels (offline stores, online stores), providing stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis, covering a historical period of 2019-2024, a base year of 2025, and an estimated and forecast period of 2025-2033. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Carpet Tile Market Composition & Trends

This section delves into the competitive landscape of the North America carpet tile market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We assess the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their effect on market share distribution.

Market Concentration: The North America carpet tile market exhibits a moderately concentrated structure, with key players like Mohawk Industries, Shaw Industries Group Inc, and Interface holding significant market share. However, the presence of several smaller players and regional brands indicates a dynamic competitive environment. The market share distribution among the top five players is estimated at approximately xx% in 2025.

Innovation Catalysts: Technological advancements in fiber types, manufacturing processes, and design aesthetics drive innovation within the market. The increasing demand for sustainable and eco-friendly carpet tiles fuels the development of recycled content and low-VOC products.

Regulatory Landscape: Regulations concerning indoor air quality and VOC emissions significantly impact product development and market acceptance. Compliance with building codes and sustainability standards influence the choices of both manufacturers and end-users.

Substitute Products: Alternative flooring options like hardwood, laminate, and luxury vinyl tiles pose a competitive threat. The carpet tile industry needs to continually innovate to maintain its competitive advantage by offering superior features, such as durability and ease of installation.

End-User Profiles: The market caters to both residential and commercial sectors, with commercial applications driving significant demand. Large-scale projects in office spaces, hospitality venues, and healthcare facilities contribute to the high volume sales in the commercial segment.

M&A Activities: The past five years have witnessed a moderate level of M&A activity in the North America carpet tile market. Deal values have fluctuated, with significant transactions contributing to market consolidation and increased competition. The average M&A deal value during the period 2019-2024 was approximately xx Million.

North America Carpet Tile Market Industry Evolution

This section analyzes the evolution of the North America carpet tile market, tracing its growth trajectories, technological advancements, and evolving consumer preferences.

The North America carpet tile market has experienced steady growth over the past five years, primarily driven by the increasing demand for versatile and durable flooring solutions in both residential and commercial settings. The market is witnessing a shift towards sustainable and eco-friendly products, with consumers and businesses showing increasing preference for recycled materials and low-VOC options. The adoption of advanced manufacturing techniques has improved product quality and reduced production costs. Significant technological developments include advancements in fiber technology (e.g., improved stain resistance, enhanced durability), the use of recycled materials in manufacturing processes, and the development of modular and interlocking designs that simplify installation and maintenance. The market's growth rate from 2019 to 2024 averaged approximately xx%, reflecting the increasing acceptance of carpet tiles as a practical and aesthetically pleasing flooring choice. The adoption rate of eco-friendly carpet tiles is estimated to be xx% in 2025, indicating an upward trend. Consumer demand for improved acoustics and comfort also significantly impacts market growth, pushing innovation towards carpet tiles with superior sound absorption properties.

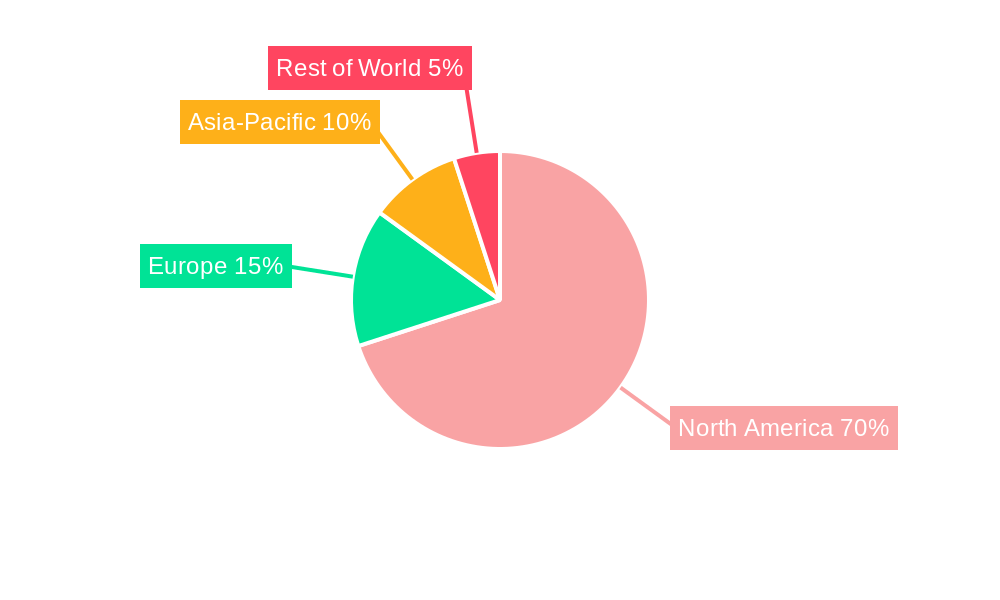

Leading Regions, Countries, or Segments in North America Carpet Tile Market

This section delves into the dominant regions, countries, and key segments shaping the North America carpet tile market, highlighting current trends and growth catalysts.

Dominant Segment: The commercial sector continues to lead the North America carpet tile market, projected to represent a significant share, estimated at approximately 65-70% of the overall market value in 2024. This dominance is fueled by robust demand from diverse commercial applications including dynamic office spaces, high-traffic retail environments, and the ever-evolving hospitality industry. While the commercial segment thrives, the residential sector is also poised for consistent expansion. This growth is underpinned by a surge in new housing construction, widespread renovation projects, and an increasing consumer preference for versatile and aesthetically pleasing flooring solutions within homes.

Key Drivers for Commercial Segment Dominance:

- Sustained demand stemming from large-scale corporate and institutional construction and renovation initiatives.

- Exceptional performance characteristics, including superior durability, resilience, and advanced stain and wear resistance, outperforming many traditional flooring alternatives.

- Logistical advantages in terms of simplified installation, maintenance, and cost-effective replacement of individual tiles, minimizing downtime and disruption.

- Significant and ongoing investments in commercial real estate development and modernization across key North American urban centers.

- Increasingly stringent regulatory frameworks and growing corporate sustainability mandates that favor the adoption of eco-friendly and low-VOC flooring solutions in commercial settings.

Key Drivers for Residential Segment Growth:

- The burgeoning popularity of do-it-yourself (DIY) home improvement trends, empowering homeowners to undertake flooring projects.

- Rising disposable incomes coupled with a growing desire for personalized and customizable interior design, leading to a greater demand for diverse carpet tile options.

- Continuous innovation in aesthetic design, offering a wider spectrum of colors, patterns, textures, and material finishes to complement various interior styles.

- Heightened consumer awareness and a proactive approach towards health and wellness, driving demand for hypoallergenic, antimicrobial, and low-VOC carpet tile products.

Regional Dynamics: The North American carpet tile market exhibits distinct regional variations in growth and adoption. The Eastern and Western United States are currently demonstrating higher growth trajectories, largely attributable to higher rates of urbanization, robust economic activity, and a concentration of commercial development. In contrast, the Central and Southern regions, while growing, are experiencing a more moderate pace. Canada, though representing a smaller market share, is witnessing a steady and encouraging increase in carpet tile penetration, driven by similar factors to its southern neighbor.

North America Carpet Tile Market Product Innovations

The carpet tile market is characterized by continuous product innovation, focusing on enhanced durability, improved aesthetics, and sustainability. Recent innovations include advanced fiber technologies resulting in improved stain and water resistance, increased sound absorption capabilities, and the integration of recycled materials in manufacturing. Unique selling propositions now include modular designs for easy installation and customizable patterns for personalized flooring solutions. Technological advancements in manufacturing processes have led to more precise cutting and enhanced dimensional stability, reducing waste and improving overall product quality. The use of antimicrobial treatments enhances hygiene and sanitation, particularly beneficial in commercial settings.

Propelling Factors for North America Carpet Tile Market Growth

Several factors fuel the growth of the North America carpet tile market. Technological advancements, including enhanced fiber technology and manufacturing processes, lead to improved product quality and durability. Economic growth, particularly in the construction and commercial sectors, creates significant demand for flooring solutions. Favorable government regulations and initiatives promoting sustainable construction practices also contribute to the market's expansion. For instance, the growing emphasis on LEED certification drives the adoption of eco-friendly carpet tiles.

Obstacles in the North America Carpet Tile Market

The North America carpet tile market faces several challenges. Fluctuations in raw material costs and supply chain disruptions due to geopolitical events can impact production and pricing. Intense competition from alternative flooring options such as hardwood, laminate, and luxury vinyl tiles exerts pressure on market share. Stringent environmental regulations, while promoting sustainable practices, can increase production costs. Furthermore, consumer preferences for specific aesthetics and features drive the continuous need for innovation and product diversification, which can add financial pressure to smaller players.

Future Opportunities in North America Carpet Tile Market

The North America carpet tile market is ripe with forward-looking opportunities, driven by evolving consumer preferences and technological advancements. A significant avenue lies in the burgeoning demand for sustainable and eco-friendly products. Manufacturers are presented with a clear opportunity to innovate and market carpet tiles with high recycled content, bio-based materials, and demonstrably low volatile organic compound (VOC) emissions. The integration of smart home technologies is another emerging frontier, potentially leading to the development of carpet tiles with embedded sensors for environmental monitoring, enhanced comfort control, or even interactive features. Further opportunities exist in targeting the renovation of aging building stock, offering modern and efficient flooring solutions. The expanding modular construction industry also presents a significant growth area, aligning perfectly with the inherent modularity of carpet tiles. Finally, the overarching trend towards personalization and customization is opening doors for manufacturers to provide bespoke solutions in terms of design, color palettes, and functional properties, catering to niche market demands.

Major Players in the North America Carpet Tile Market Ecosystem

- Abbey Carpet & Floor

- Venture Carpets Inc.

- Foss Floors

- Shaw Industries Group Inc.

- Tarkett

- Engineered Floors LLC

- Bentley Mills Inc.

- The Dixie Group Inc.

- Mohawk Industries

- Interface

Key Developments in North America Carpet Tile Market Industry

- January 2023: Mohawk Industries unveiled a new collection of carpet tiles specifically engineered for superior acoustic dampening, addressing the growing need for noise reduction in commercial and residential spaces.

- March 2022: Shaw Industries Group Inc. announced a strategic partnership with a leading recycled materials supplier, significantly bolstering its capacity to integrate post-consumer recycled content into its carpet tile manufacturing processes and enhance its sustainability credentials.

- June 2021: Tarkett strategically acquired a prominent smaller carpet tile manufacturer, thereby expanding its product portfolio, broadening its market reach, and strengthening its competitive position within the North American market. (Further granular details of this acquisition and its strategic implications would be presented in the comprehensive market report.)

- Ongoing: The industry continues to witness a surge in innovations focused on advanced material science for enhanced durability and stain resistance, as well as the development of more sustainable manufacturing techniques and products with reduced environmental footprints. (Additional significant developments, including specific dates and company actions, will be incorporated as they become available in the full market analysis.)

Strategic North America Carpet Tile Market Forecast

The North America carpet tile market is poised for sustained growth over the forecast period (2025-2033), driven by several factors. Technological innovation, increasing demand for sustainable products, and continued growth in the commercial construction sector will all contribute to the market's expansion. The ongoing trend towards personalization and customized flooring solutions will create new opportunities for manufacturers. The market is projected to reach xx Million by 2033, indicating significant market potential for investors and industry participants. This growth will likely be distributed across various segments, with the commercial sector maintaining a dominant position.

North America Carpet Tile Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Carpet Tile Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Carpet Tile Market Regional Market Share

Geographic Coverage of North America Carpet Tile Market

North America Carpet Tile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand in Residential Segment; Rising in Construction Activities is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Recession affects Customers' Purchasing Ability; Labor Shortages and Skill Gap Pose a Limit to the Market

- 3.4. Market Trends

- 3.4.1. The Residential Segment in North America is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Carpet Tile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abbey Carpet & Floor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Venture Carpets Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Foss Floors

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shaw Industries Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tarkett

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Engineered Floors LLC*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bentley Mills Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Dixie Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mohawk Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Interface

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Abbey Carpet & Floor

List of Figures

- Figure 1: North America Carpet Tile Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Carpet Tile Market Share (%) by Company 2025

List of Tables

- Table 1: North America Carpet Tile Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Carpet Tile Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Carpet Tile Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Carpet Tile Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Carpet Tile Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Carpet Tile Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: North America Carpet Tile Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Carpet Tile Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Carpet Tile Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Carpet Tile Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Carpet Tile Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Carpet Tile Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States North America Carpet Tile Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Carpet Tile Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Carpet Tile Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Carpet Tile Market?

The projected CAGR is approximately 10.14%.

2. Which companies are prominent players in the North America Carpet Tile Market?

Key companies in the market include Abbey Carpet & Floor, Venture Carpets Inc, Foss Floors, Shaw Industries Group Inc, Tarkett, Engineered Floors LLC*List Not Exhaustive, Bentley Mills Inc, The Dixie Group Inc, Mohawk Industries, Interface.

3. What are the main segments of the North America Carpet Tile Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand in Residential Segment; Rising in Construction Activities is Driving the Market.

6. What are the notable trends driving market growth?

The Residential Segment in North America is Driving the Market.

7. Are there any restraints impacting market growth?

Economic Recession affects Customers' Purchasing Ability; Labor Shortages and Skill Gap Pose a Limit to the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Carpet Tile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Carpet Tile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Carpet Tile Market?

To stay informed about further developments, trends, and reports in the North America Carpet Tile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence