Key Insights

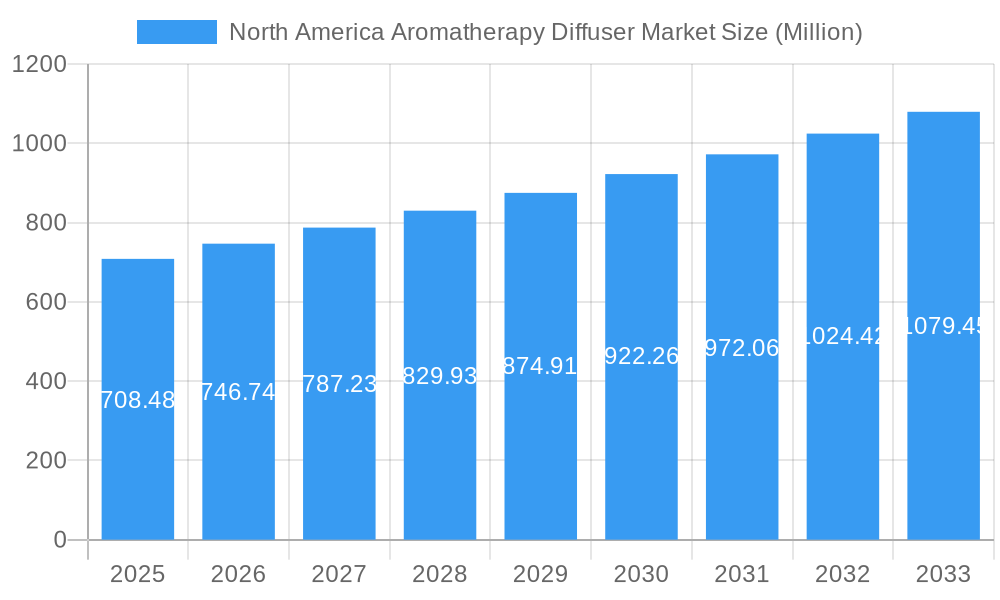

The North America aromatherapy diffuser market, valued at $708.48 million in 2025, is projected to experience robust growth, driven by rising consumer awareness of aromatherapy's health benefits and a growing preference for natural wellness solutions. The market's Compound Annual Growth Rate (CAGR) of 5.28% from 2019 to 2024 indicates a consistent upward trajectory. Key growth drivers include increased stress levels among consumers, leading to a surge in demand for relaxation and stress-relief products. The increasing popularity of holistic wellness practices and the rising adoption of aromatherapy in spas and wellness centers further fuel market expansion. Furthermore, the diverse product types available, including ultrasonic diffusers, nebulizers, and others, cater to varied consumer preferences and budgets, contributing to market breadth. The distribution channels, encompassing supermarkets, hypermarkets, specialist stores, and online retailers, ensure wide accessibility, facilitating market penetration. While precise data on individual segment shares isn't provided, it's reasonable to assume that online retailers and specialist stores are experiencing faster growth due to their targeted marketing and convenience. Companies like NOW Health Group, Young Living, and DoTERRA are major players, leveraging their brand recognition and established distribution networks to maintain market leadership. However, the market also features numerous smaller players, offering niche products and creating a competitive landscape.

North America Aromatherapy Diffuser Market Market Size (In Million)

Looking ahead to 2033, the continued emphasis on self-care and mental well-being, coupled with innovation in diffuser technology and design, will likely propel further market growth. However, potential restraints include price sensitivity among certain consumer segments and the emergence of substitute products. Nevertheless, the overall outlook remains positive, with the market poised for sustained expansion, driven by increasing consumer adoption and the growing integration of aromatherapy into daily life. Regional analysis suggests that the United States, as the largest market within North America, will continue to dominate, with Canada and Mexico exhibiting significant, albeit slower growth. The market's future growth will depend on successfully addressing evolving consumer demands and navigating the competitive landscape.

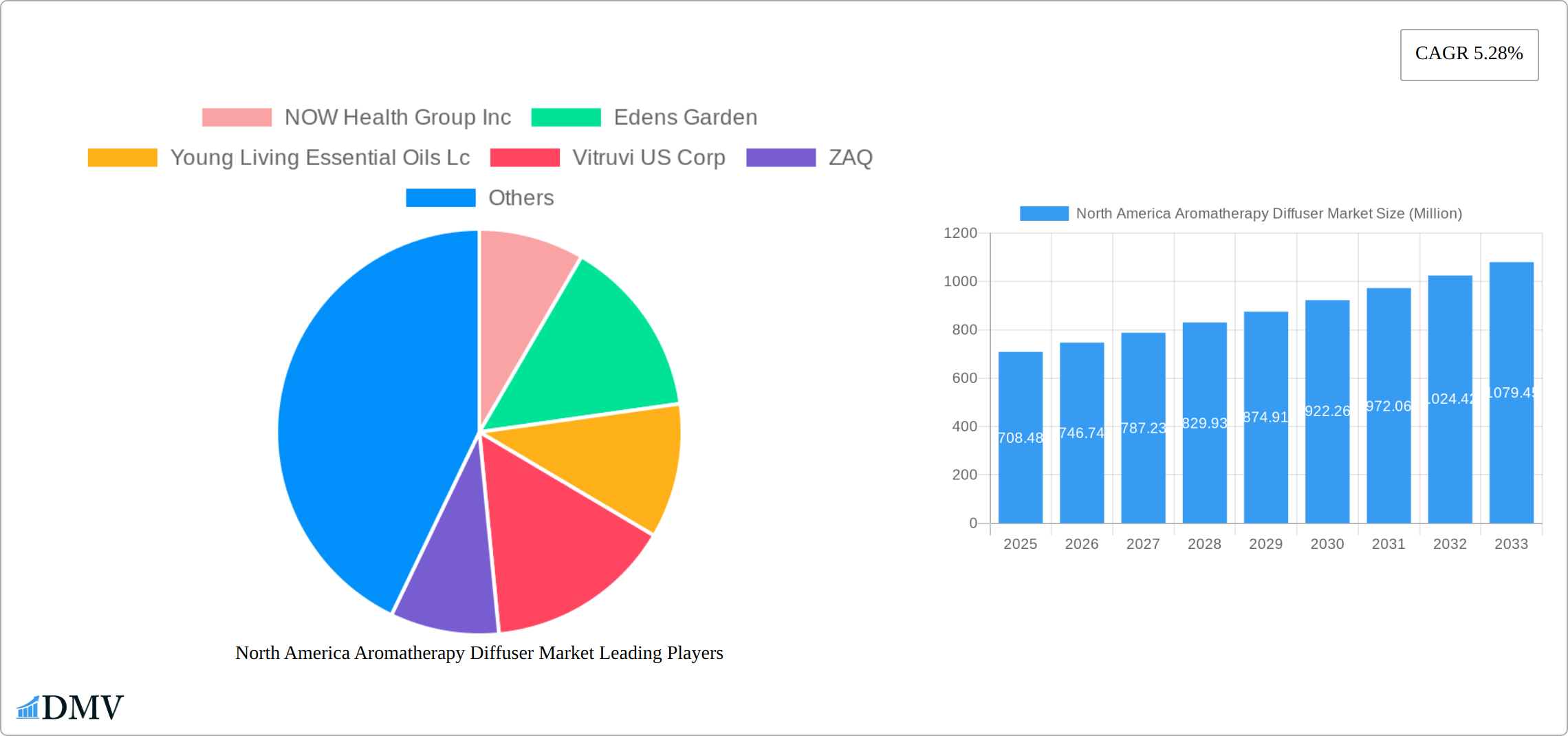

North America Aromatherapy Diffuser Market Company Market Share

North America Aromatherapy Diffuser Market Market Composition & Trends

The North America aromatherapy diffuser market is characterized by a moderate level of market concentration, with key players such as NOW Health Group Inc, Edens Garden, and Young Living Essential Oils LC holding significant shares. Innovation is a primary catalyst, driven by the integration of advanced technologies such as ultrasonic and nebulizing diffusers. The regulatory landscape is relatively favorable, with no stringent regulations hindering market growth. However, the presence of substitute products like candles and incense sticks poses a challenge. The end-user profile predominantly includes health-conscious consumers seeking wellness and relaxation solutions. M&A activities have been notable, with a cumulative deal value of approximately $200 Million in recent years, reflecting the market's dynamic nature.

- Market Share Distribution: NOW Health Group Inc holds around 15%, Edens Garden 12%, and Young Living Essential Oils LC 10%.

- Innovation Catalysts: Advances in ultrasonic and nebulizing technologies.

- Regulatory Landscape: No significant barriers, supportive of market growth.

- Substitute Products: Candles and incense sticks are primary substitutes.

- End-User Profiles: Health-conscious consumers focused on wellness.

- M&A Activities: Notable deals include acquisitions worth $200 Million.

North America Aromatherapy Diffuser Market Industry Evolution

The North America aromatherapy diffuser market has experienced significant growth over the study period of 2019-2033, with a projected Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025-2033. This growth is primarily driven by increasing awareness of aromatherapy benefits and the rising demand for natural wellness products. Technological advancements, such as the development of smart diffusers with Wi-Fi and Bluetooth connectivity, have further propelled market expansion. The adoption rate of aromatherapy diffusers has seen a steady increase, with approximately 30% of households in the United States using them by 2025.

Consumer demand has shifted towards more sophisticated products that offer customization and integration with smart home systems. The historical period of 2019-2024 witnessed a surge in product launches and innovations, with companies like Vitruvi US Corp and Aromatech Inc introducing high-end, design-focused diffusers. The market's evolution is also influenced by economic factors, such as disposable income levels and the willingness to invest in health and wellness. The base year of 2025 marks a pivotal point, with the market poised for further growth driven by technological integration and consumer education initiatives.

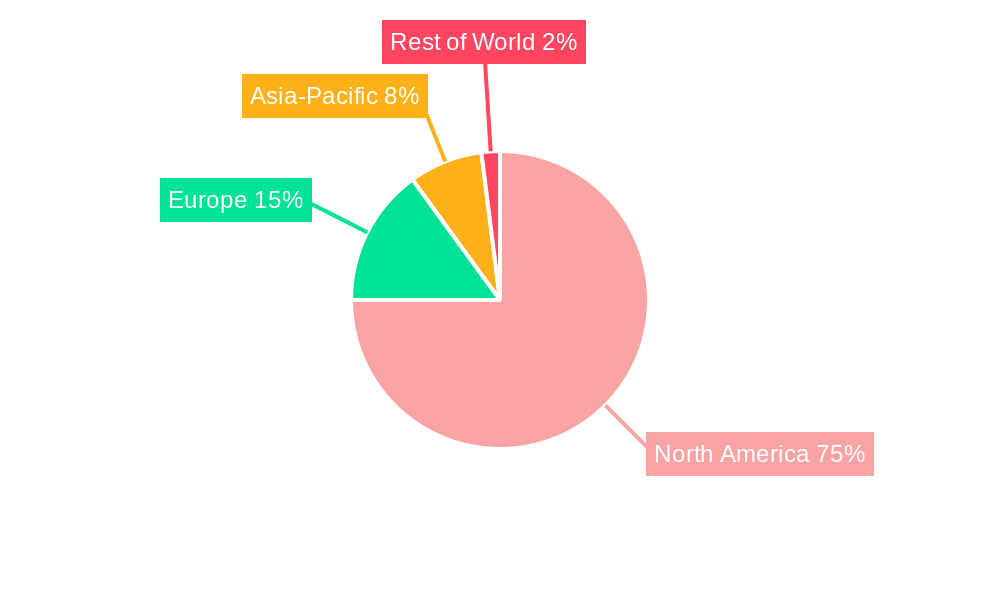

Leading Regions, Countries, or Segments in North America Aromatherapy Diffuser Market

The United States dominates the North American aromatherapy diffuser market, fueled by high consumer awareness of wellness and a robust culture prioritizing self-care. Within this thriving market, ultrasonic diffusers hold the leading position, commanding over 60% market share due to their efficient operation and user-friendly design. This dominance is further solidified by a strong regulatory environment encouraging innovation and prioritizing consumer safety.

Key Drivers in the United States:

Significant investment in health and wellness products reflecting a growing prioritization of self-care.

High disposable incomes enabling consumers to invest in premium aromatherapy products and experiences.

A robust online retail presence providing unparalleled accessibility and convenience for consumers.

Key Drivers for the Ultrasonic Segment:

Exceptional efficiency and ease of use, making them accessible to a broad range of consumers.

Wide availability across diverse distribution channels, ensuring accessibility and market penetration.

Ongoing technological advancements continuously enhancing features, performance, and user experience.

The ultrasonic segment's prevalence stems from its widespread adoption in both residential and commercial settings. Its ability to effectively disperse essential oils without heat preserves the oils' therapeutic properties, a key selling point for health-conscious consumers. Online retailers have experienced explosive growth, capturing almost 40% of the market share by 2025, a trend projected to continue as these platforms become increasingly integral to market dynamics. This growth is driven by the convenience and expansive product selection offered by e-commerce.

North America Aromatherapy Diffuser Market Product Innovations

Recent product innovations in the North America aromatherapy diffuser market include the introduction of smart diffusers with app-controlled features, allowing users to customize their aromatherapy experience. Companies like Vitruvi US Corp and Aromatech Inc have launched high-end, aesthetically pleasing diffusers that integrate seamlessly with modern home decor. These innovations not only enhance user experience but also improve performance metrics, such as diffusion efficiency and oil preservation. The unique selling propositions of these products include their ability to blend technology with wellness, catering to the tech-savvy and health-conscious consumer base.

Propelling Factors for North America Aromatherapy Diffuser Market Growth

The North America aromatherapy diffuser market is propelled by several key factors:

- Technological Advancements: Integration of smart technology in diffusers enhances user experience.

- Economic Factors: Rising disposable incomes enable consumers to invest in premium wellness products.

- Regulatory Support: Favorable regulations encourage product innovation and market entry.

These factors contribute to the market's robust growth, with companies like Newell Brands Inc and Saje Natural Wellness leveraging them to expand their product lines and market presence.

Obstacles in the North America Aromatherapy Diffuser Market Market

The North America aromatherapy diffuser market faces several obstacles:

- Regulatory Challenges: Compliance with varying state regulations can be cumbersome.

- Supply Chain Disruptions: Global supply chain issues impact product availability and costs.

- Competitive Pressures: Intense competition leads to price wars, affecting profit margins.

These barriers can hinder market growth, with companies needing to navigate them strategically to maintain market share and profitability.

Future Opportunities in North America Aromatherapy Diffuser Market

Emerging opportunities in the North America aromatherapy diffuser market include:

- New Markets: Expansion into untapped regions like Canada and Mexico.

- Technological Integration: Development of IoT-enabled diffusers for smart homes.

- Consumer Trends: Growing interest in personalized wellness solutions.

These opportunities present avenues for market growth and innovation, allowing companies to cater to evolving consumer needs and preferences.

Major Players in the North America Aromatherapy Diffuser Market Ecosystem

Key Developments in North America Aromatherapy Diffuser Market Industry

- April 2022: Nowell Brands Inc launched the WoodWick Radiance diffuser, impacting market dynamics with its innovative design and user-friendly features.

- March 2022: The Gift of Scent introduced Flash Scent USB aromatherapy diffusers, expanding the market's reach with portable, scent-specific options.

- June 2021: Saje Natural Wellness collaborated with The Little Market to launch the Aroma Mosaic diffuser, supporting fair trade and enhancing product appeal with a social mission.

Strategic North America Aromatherapy Diffuser Market Market Forecast

The North America aromatherapy diffuser market is poised for continued growth, driven by technological advancements and increasing consumer interest in wellness. The forecast period of 2025-2033 is expected to see a rise in smart diffuser adoption, further propelled by the integration of IoT and AI technologies. Opportunities in untapped markets and the demand for personalized wellness solutions will contribute to market expansion. The market's potential is significant, with companies likely to focus on innovation and strategic partnerships to capitalize on these trends and maintain competitive advantage.

North America Aromatherapy Diffuser Market Segmentation

-

1. Product Type

- 1.1. Ultrasonic

- 1.2. Nebulizer

- 1.3. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailers

- 2.5. Others

North America Aromatherapy Diffuser Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Aromatherapy Diffuser Market Regional Market Share

Geographic Coverage of North America Aromatherapy Diffuser Market

North America Aromatherapy Diffuser Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Increasing Demand From Spas and Wellness Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aromatherapy Diffuser Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ultrasonic

- 5.1.2. Nebulizer

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NOW Health Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Edens Garden

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Young Living Essential Oils Lc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vitruvi US Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZAQ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Newell Brands Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aromis Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Organic Aromas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Escents Aromatherapy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Scentsy Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DoTERRA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Aromatech Inc *List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saje Natural Wellness

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 NOW Health Group Inc

List of Figures

- Figure 1: North America Aromatherapy Diffuser Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Aromatherapy Diffuser Market Share (%) by Company 2025

List of Tables

- Table 1: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States North America Aromatherapy Diffuser Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Aromatherapy Diffuser Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Aromatherapy Diffuser Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Aromatherapy Diffuser Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Aromatherapy Diffuser Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Aromatherapy Diffuser Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aromatherapy Diffuser Market?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the North America Aromatherapy Diffuser Market?

Key companies in the market include NOW Health Group Inc, Edens Garden, Young Living Essential Oils Lc, Vitruvi US Corp, ZAQ, Newell Brands Inc, Aromis Ltd, Organic Aromas, Escents Aromatherapy, Scentsy Inc, DoTERRA, Aromatech Inc *List Not Exhaustive, Saje Natural Wellness.

3. What are the main segments of the North America Aromatherapy Diffuser Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 708.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Increasing Demand From Spas and Wellness Centers.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

April 2022: Nowell Brands Inc. launched the WoodWick Radiance diffuser - a battery-operated diffuser designed to reflect the brand's iconic hourglass silhouette and provide consumers with an easy-to-change refill process that doesn't require water.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aromatherapy Diffuser Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aromatherapy Diffuser Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aromatherapy Diffuser Market?

To stay informed about further developments, trends, and reports in the North America Aromatherapy Diffuser Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence