Key Insights

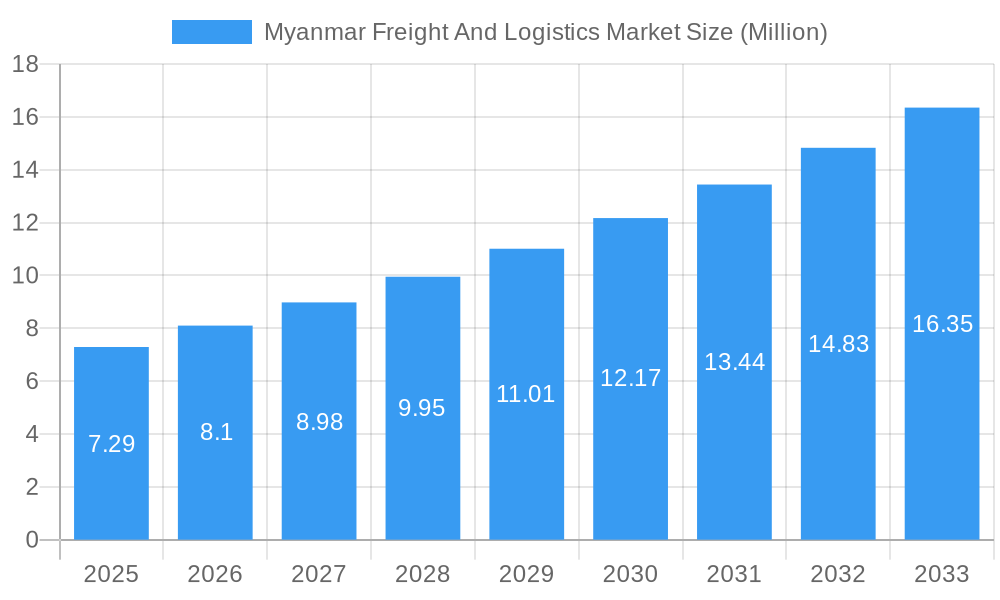

The Myanmar freight and logistics market, valued at $7.29 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.96% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing industrialization and manufacturing activities within the country fuel demand for efficient transportation and warehousing solutions. The burgeoning e-commerce sector further contributes to this growth, demanding faster and more reliable delivery services. Improvements in infrastructure, albeit gradual, also play a role, facilitating smoother logistics operations. Growth in sectors like construction, agriculture, and oil and gas adds to the market's dynamism. However, challenges remain, including underdeveloped infrastructure in certain regions, bureaucratic hurdles, and a sometimes unpredictable regulatory environment. These constraints, while not hindering overall growth, influence the speed of expansion and necessitate strategic planning for market entrants.

Myanmar Freight And Logistics Market Market Size (In Million)

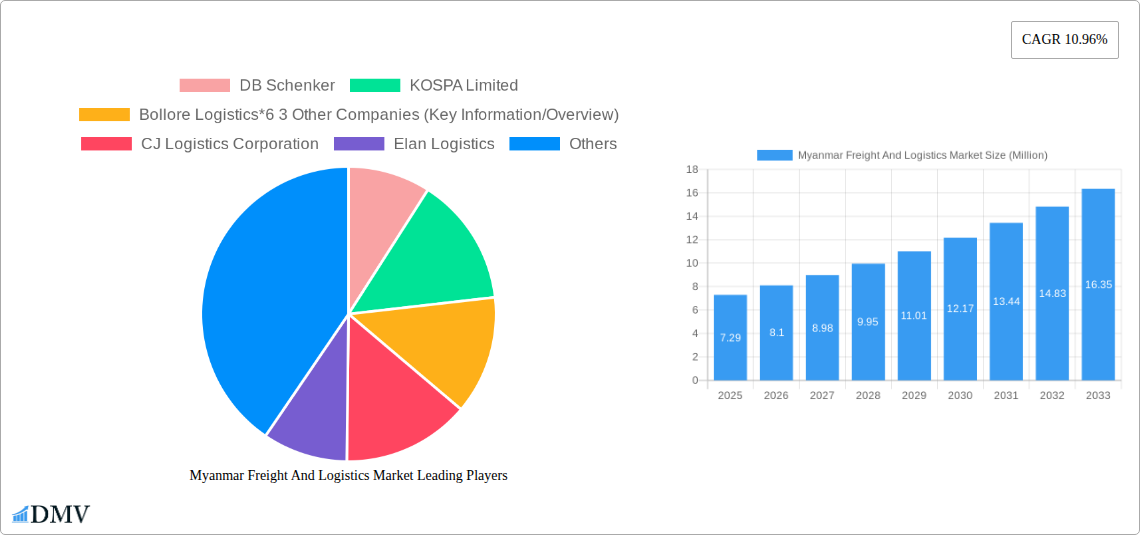

The market is segmented by function (freight transport, rail freight forwarding, warehousing, value-added services, and others) and end-users (manufacturing & automotive, oil & gas, mining & quarrying, agriculture, fishing & forestry, construction, distributive trade including FMCG, and other end-users like telecommunications, food & beverage, and pharmaceuticals). The dominance of specific segments will likely shift over the forecast period as Myanmar's economy diversifies. Companies operating in this market include both international giants like DB Schenker and DHL, and local players adapting to the evolving landscape. Competition is expected to intensify as both domestic and international firms vie for market share, driven by the market’s significant growth potential. The increasing adoption of technology and digitalization within the logistics sector is another major trend that will significantly shape the competitive landscape.

Myanmar Freight And Logistics Market Company Market Share

Myanmar Freight & Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Myanmar freight and logistics market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

Myanmar Freight And Logistics Market Market Composition & Trends

The Myanmar freight and logistics market exhibits a moderately concentrated structure, with a few major players commanding significant market share. However, the presence of numerous smaller, specialized companies indicates a competitive landscape. Innovation is driven by the need to improve efficiency and overcome infrastructure challenges, particularly within warehousing and value-added services. The regulatory environment, while evolving, presents both opportunities and challenges, requiring businesses to navigate complex rules and regulations. Substitute products are limited due to the specific needs of the diverse end-user segments. Mergers and acquisitions (M&A) activity remains moderate, with deal values averaging xx Million in recent years. The dominance of certain players and M&A activity indicates ongoing consolidation within this sector.

- Market Share Distribution (2024): DB Schenker (xx%), Bolloré Logistics (xx%), DHL (xx%), Other Players (xx%). (Note: Specific percentages are unavailable and estimated values would require deeper research)

- M&A Deal Value (2019-2024): Average of xx Million per deal. (Note: This is an estimate, precise figures require further investigation)

- Key End-User Segments: Manufacturing, Distributive Trade (FMCG), Oil & Gas.

Myanmar Freight And Logistics Market Industry Evolution

The Myanmar freight and logistics market has experienced significant growth over the past five years, fueled by increasing domestic consumption and foreign direct investment. However, this growth has been uneven, influenced by political and economic factors. Technological advancements, such as the adoption of warehouse management systems (WMS) and transportation management systems (TMS), are gradually improving efficiency and transparency. However, widespread adoption remains limited by infrastructure constraints and digital literacy. Consumer demand is shifting towards faster and more reliable delivery services, especially within the e-commerce sector. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Specific data on adoption rates of WMS/TMS requires further research. Key challenges like infrastructure limitations and political instability often hamper progress, resulting in fluctuations in market growth trajectories.

Leading Regions, Countries, or Segments in Myanmar Freight And Logistics Market

The Yangon region dominates the Myanmar freight and logistics market due to its concentration of ports, industries, and distribution centers. Within the functional segments, freight forwarding and warehousing are the most developed, reflecting the higher demand from the manufacturing and distributive trade sectors.

- By Function: Freight forwarding commands the largest segment share, followed closely by warehousing, indicating the significance of efficient movement and storage of goods within the country.

- By End-User: The manufacturing and automotive sector dominates end-user demand, followed by distributive trade (wholesale and retail, including FMCG). This is driven by Myanmar's growing manufacturing sector and expanding consumer base.

- Key Drivers: Growing FDI in manufacturing, increasing consumer spending, government initiatives aimed at improving infrastructure, and the rising adoption of technology in logistics are some of the key factors contributing to the prominence of these segments.

Myanmar Freight And Logistics Market Product Innovations

Recent innovations include the implementation of advanced warehouse management systems like DB Schenker's NextGen Warehouse Management System, improving operational efficiency and inventory control. Furthermore, the integration of GPS tracking and real-time data analytics provides better visibility into the supply chain, enhancing delivery accuracy and improving overall logistics operations. These advancements are driven by an increased focus on efficiency and improved customer service.

Propelling Factors for Myanmar Freight And Logistics Market Growth

Several factors propel the Myanmar freight and logistics market's growth. Rising foreign direct investment (FDI) into various sectors, coupled with increasing domestic consumption, fuels demand for efficient logistics solutions. Government initiatives focused on infrastructure development, such as improvements to roads and ports, are expected to positively impact the sector. Furthermore, technological advancements in transportation and warehousing are streamlining operations and improving productivity.

Obstacles in the Myanmar Freight And Logistics Market Market

The Myanmar freight and logistics market faces challenges including inadequate infrastructure (especially road and rail networks), leading to high transportation costs and delays. Political instability and regulatory uncertainties create an unpredictable business environment. Furthermore, competition from international players and limited access to finance are significant hurdles to market expansion. These factors contribute to the overall market complexity.

Future Opportunities in Myanmar Freight And Logistics Market

Future opportunities lie in the expansion of e-commerce, creating a higher demand for last-mile delivery solutions. The development of cold chain logistics infrastructure is necessary to support the growth of perishable goods. Investing in technology such as blockchain and AI-driven route optimization can significantly enhance efficiency and transparency throughout the supply chain.

Major Players in the Myanmar Freight And Logistics Market Ecosystem

- DB Schenker

- KOSPA Limited

- Bollore Logistics

- CJ Logistics Corporation

- Elan Logistics

- Yamato Holdings Co Ltd

- Advantis

- CEA Projects Co Ltd

- Sojitz Logistics Corporation/Premium Sojitz Logistics (PSL)

- Phee Group

- Deutsche Post DHL Group

- Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd )

- Damco

- Dextra Group

- Kargo

- DKSH

- Tigers Logistics

- Indo Trans Logistics Corporation

- Hellmann Worldwide Logistics

- Bee Logistics Corp

- SUZUE Corporation

- SECURE Shipping Services Co Ltd

- Rhenus Logistics

- Srithai Logistics

- Global Gifts Logistics Myanmar

- Hercules Logistics

- Daizen

- Magnate Group Logistics Company Limited

- EFR Group of Companies

Key Developments in Myanmar Freight And Logistics Market Industry

- August 2023: DB Schenker Myanmar implemented its NextGen Warehouse Management System (NGW) for a leading consumer goods company, demonstrating a shift towards advanced logistics technology.

- May 2023: The opening of a new port in Myanmar, developed with Indian assistance, signifies increasing regional economic integration and potential for expanded trade and logistics activity.

Strategic Myanmar Freight And Logistics Market Market Forecast

The Myanmar freight and logistics market is poised for continued growth, driven by infrastructure improvements, technological advancements, and the expansion of key industries. Opportunities abound in e-commerce, cold chain logistics, and the adoption of innovative technologies. The market's future trajectory depends on maintaining political stability and fostering a favorable regulatory environment. Despite challenges, the potential for significant growth remains substantial.

Myanmar Freight And Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End Users

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Myanmar Freight And Logistics Market Segmentation By Geography

- 1. Myanmar

Myanmar Freight And Logistics Market Regional Market Share

Geographic Coverage of Myanmar Freight And Logistics Market

Myanmar Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Road Transport Sector Remains the Dominant Mode of Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KOSPA Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bollore Logistics*6 3 Other Companies (Key Information/Overview)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CJ Logistics Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Elan Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yamato Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advantis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEA Projects Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sojitz Logistics Corporation/Premium Sojitz Logistics (PSL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phee Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deutsche Post DHL Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd )

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Damco

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Dextra Group Kargo DKSH Tigers Logistics Indo Trans Logistics Corporation Hellmann Worldwide Logistics Bee Logistics Corp SUZUE Corporation SECURE Shipping Services Co Ltd Rhenus Logistics Srithai Logistics Global Gifts Logistics Myanmar Hercules Logistics Daizen

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Magnate Group Logistics Company Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 EFR Group of Companies

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Myanmar Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Myanmar Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Freight And Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Myanmar Freight And Logistics Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 3: Myanmar Freight And Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Myanmar Freight And Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Myanmar Freight And Logistics Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 6: Myanmar Freight And Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Freight And Logistics Market?

The projected CAGR is approximately 10.96%.

2. Which companies are prominent players in the Myanmar Freight And Logistics Market?

Key companies in the market include DB Schenker, KOSPA Limited, Bollore Logistics*6 3 Other Companies (Key Information/Overview), CJ Logistics Corporation, Elan Logistics, Yamato Holdings Co Ltd, Advantis, CEA Projects Co Ltd, Sojitz Logistics Corporation/Premium Sojitz Logistics (PSL), Phee Group, Deutsche Post DHL Group, Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd ), Damco, Dextra Group Kargo DKSH Tigers Logistics Indo Trans Logistics Corporation Hellmann Worldwide Logistics Bee Logistics Corp SUZUE Corporation SECURE Shipping Services Co Ltd Rhenus Logistics Srithai Logistics Global Gifts Logistics Myanmar Hercules Logistics Daizen, Magnate Group Logistics Company Limited, EFR Group of Companies.

3. What are the main segments of the Myanmar Freight And Logistics Market?

The market segments include Function, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.29 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Road Transport Sector Remains the Dominant Mode of Transportation.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

August 2023: DB Schenker Myanmar migrated a leading consumer company to the NextGen Warehouse (NGW) Management System. This is DB Schenker’s advanced IT solution for Contract Logistics operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Myanmar Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence