Key Insights

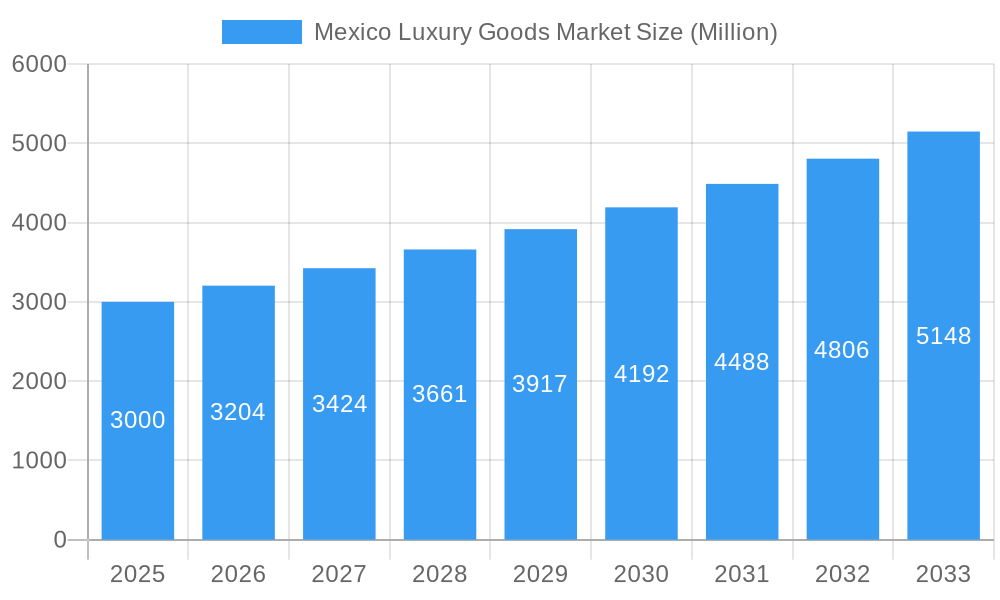

The Mexico luxury goods market is poised for significant growth, projected at a CAGR of 4.32%. The estimated market size for 2025 stands at $3.61 billion. Key growth drivers include increasing disposable incomes among high-net-worth individuals, the rise of an aspirational middle class, and robust tourism. The market is segmented by product type (apparel, footwear, accessories, watches, jewelry) and distribution channel (single-brand and multi-brand retail, online platforms). E-commerce adoption is a notable growth catalyst. Challenges include economic volatility and currency fluctuations. Major luxury players like LVMH and Richemont are active, employing multi-channel strategies to engage Mexican consumers.

Mexico Luxury Goods Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, fueled by Mexico's economic development and a growing, youthful population. Luxury brands can capitalize on this by implementing targeted marketing that highlights heritage and exclusivity, alongside strategic e-commerce utilization. While competition is expected to be intense, brands focusing on product diversification, robust customer experience, and brand loyalty will be well-positioned to thrive in this dynamic market.

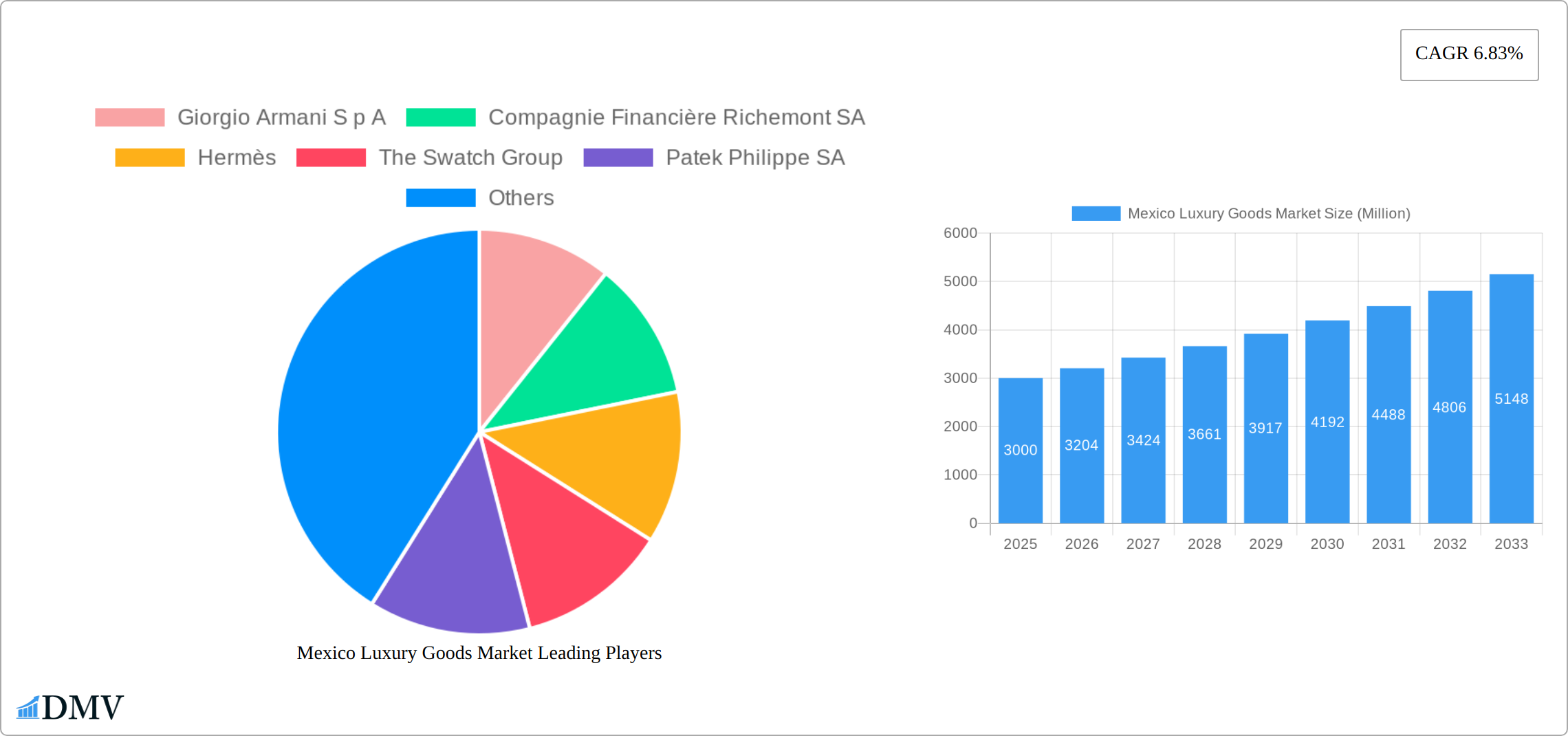

Mexico Luxury Goods Market Company Market Share

Mexico Luxury Goods Market Analysis and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the Mexico luxury goods market, detailing its current status and future outlook. Focusing on the period from 2025 to 2033, this study is essential for stakeholders aiming to leverage opportunities within this evolving sector. The market is valued at $3.61 billion in 2025 and is projected for substantial growth by 2033.

Mexico Luxury Goods Market Market Composition & Trends

The Mexican luxury goods market presents a dynamic landscape shaped by a complex interplay of factors. This section analyzes the market's competitive structure, revealing its moderate concentration and the opportunities it offers to both established luxury houses and emerging brands. We examine the market share distribution of key players such as LVMH Moët Hennessy Louis Vuitton, Kering, and Richemont, providing a granular understanding of the competitive dynamics. Beyond market share, we delve into the innovation drivers shaping the market. This includes a detailed look at how evolving consumer preferences, technological advancements in areas like personalization and e-commerce, and the growing focus on sustainability are impacting product development and marketing strategies. The regulatory environment, encompassing import/export regulations, taxation policies, and consumer protection laws, is also critically assessed for its influence on market access and operations. Furthermore, the analysis accounts for the presence of substitute products, including affordable luxury brands and counterfeit goods, which exert competitive pressure on the market. A comprehensive profile of the Mexican luxury consumer is presented, considering key demographic and psychographic factors such as age, income, lifestyle, and brand loyalty to understand purchasing behaviors and preferences. Finally, we provide an in-depth review of recent mergers and acquisitions (M&A) activities, analyzing deal values and their impact on market structure and consolidation. This data-driven analysis provides insights into the strategic shifts and competitive positioning within the Mexican luxury goods market.

- Market Concentration: A moderately concentrated market with leading players holding a significant, but not dominant, market share in 2024. Precise figures are available in the full report.

- Innovation Catalysts: Technological advancements, including personalized experiences, seamless e-commerce platforms, and the integration of sustainable and ethical sourcing practices, are driving innovation.

- Regulatory Landscape: A detailed analysis of import/export regulations, tax policies, and consumer protection laws affecting the luxury goods sector in Mexico.

- Substitute Products: The competitive pressure from accessible luxury brands and the pervasive challenge of counterfeit goods are examined.

- End-User Profiles: A comprehensive segmentation of Mexican luxury consumers based on demographics (age, income, location) and psychographics (lifestyle, values, brand preferences).

- M&A Activities: An overview of key M&A transactions between 2019 and 2024, including deal values and their impact on the competitive landscape. Specific deal values are provided in the full report.

Mexico Luxury Goods Market Industry Evolution

This section provides a comprehensive historical and projected analysis of the Mexican luxury goods market's evolution. We present data illustrating historical growth rates from 2019 to 2024, and project future growth from 2025 to 2033 using robust market modeling techniques. This analysis considers the interplay of various factors driving market evolution. Technological innovations are analyzed for their impact on product development, distribution channels (both online and offline), and marketing strategies. The shift in consumer preferences towards sustainability, ethical sourcing, and personalized experiences is explored in detail, highlighting the increasing importance of these factors in brand building and consumer engagement. Furthermore, the influence of macroeconomic factors such as economic growth, evolving consumer expectations, and brand image perception on the market's trajectory is critically examined. This detailed analysis provides a clear understanding of the past, present, and future dynamics of the Mexican luxury goods market.

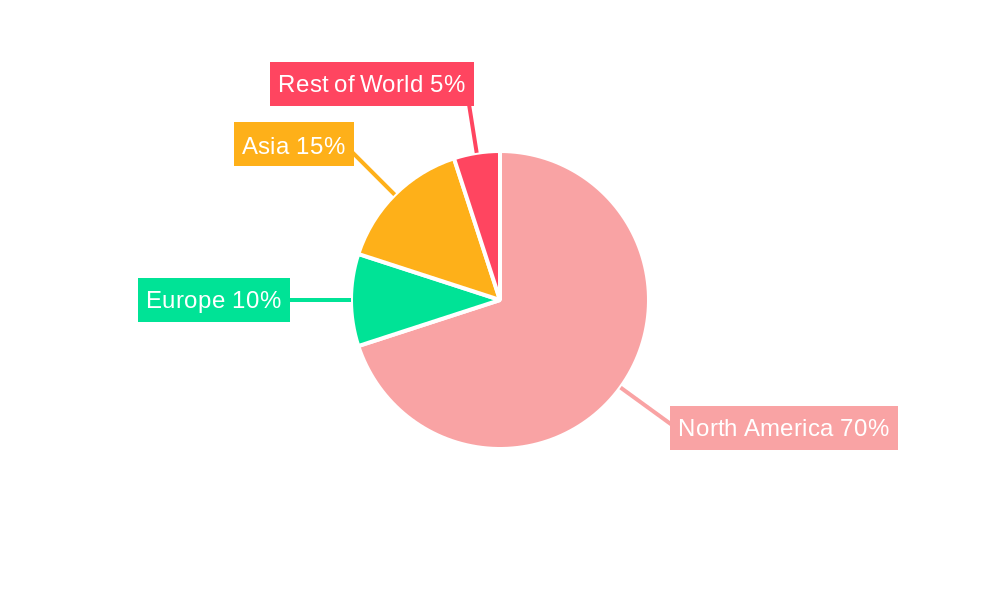

Leading Regions, Countries, or Segments in Mexico Luxury Goods Market

This section identifies the leading regions, countries, and segments within the Mexican luxury goods market based on sales data and market share analysis. The analysis encompasses both "By Type" (Clothing and Apparel, Footwear, Bags, Watches, Jewelry, Other Accessories) and "By Distribution Channel" (Single-Brand Stores, Multi-Brand Stores, Online Stores, Other Distribution Channels). It explores the key growth drivers for the dominant segment(s) and channels(s), examining investment trends, regulatory support, and market access.

- Dominant Segment (By Type): Watches and Jewelry, driven by high disposable incomes and demand for luxury timepieces.

- Dominant Channel (By Distribution): Single-Brand Stores, owing to their brand building and customer experience.

- Key Drivers:

- Growing affluence of the Mexican middle class.

- Increased tourism and foreign investment.

- Government initiatives promoting the luxury sector.

Mexico Luxury Goods Market Product Innovations

This section showcases the key product innovations driving the Mexican luxury goods market. We highlight unique selling propositions (USPs) and the strategic adoption of advanced technologies. This includes examples of sustainable material sourcing, personalized customization options that cater to individual consumer preferences, and innovative product designs reflecting current fashion trends and consumer demands. The incorporation of augmented reality (AR) and virtual reality (VR) technologies to enhance the customer experience is also examined. This section provides a glimpse into the cutting-edge innovations shaping the future of luxury goods in the Mexican market.

Propelling Factors for Mexico Luxury Goods Market Growth

The growth of the Mexico luxury goods market is propelled by several key factors. The expanding middle class with increasing disposable incomes is a major driver. Favorable economic conditions and government support for the luxury sector also contribute to growth. Additionally, technological advancements in e-commerce and marketing are increasing market access and boosting sales. Finally, the influence of global luxury brands establishing a presence in Mexico is significantly impacting the market's growth and expansion.

Obstacles in the Mexico Luxury Goods Market Market

Several challenges hinder the growth of the Mexican luxury goods market. Economic volatility and fluctuations in the Mexican peso can impact consumer spending. Supply chain disruptions, particularly those related to international shipping and logistics, can create delays and increase costs. Intense competition from both established luxury brands and emerging local players also poses a significant challenge. Furthermore, concerns surrounding counterfeiting and grey market goods continue to impact the market's profitability.

Future Opportunities in Mexico Luxury Goods Market

The Mexican luxury goods market presents several promising opportunities for growth and expansion. The burgeoning e-commerce sector and the increasing sophistication of digital marketing strategies are creating new avenues for customer acquisition and engagement. Moreover, the growing preference for sustainable luxury and ethical sourcing presents a significant opportunity for brands committed to responsible practices. Finally, targeting Mexico's expanding millennial and Gen Z populations with tailored products and branding strategies can unlock substantial market segments. This section outlines the key strategies and avenues for growth in the evolving Mexican luxury goods landscape.

Major Players in the Mexico Luxury Goods Market Ecosystem

Key Developments in Mexico Luxury Goods Market Industry

- October 2020: Hermès launched its first beauty line, Rouge Hermès.

- November 2021: Chanel opened a new store in Malaysia (indirect, but indicative of brand expansion strategy).

- February 2022: TOUS launched a new concept store in Kuala Lumpur, Malaysia (indirect, but indicative of brand expansion strategy).

Strategic Mexico Luxury Goods Market Market Forecast

The Mexican luxury goods market is poised for sustained growth, driven by a combination of economic expansion, rising consumer affluence, and technological advancements. The continued expansion of e-commerce, the increasing popularity of sustainable luxury, and the focus on delivering personalized experiences will shape the future of the market. Brands that successfully adapt to these evolving trends will capture a greater share of this lucrative and expanding market.

Mexico Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Mexico Luxury Goods Market Segmentation By Geography

- 1. Mexico

Mexico Luxury Goods Market Regional Market Share

Geographic Coverage of Mexico Luxury Goods Market

Mexico Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference for E-commerce Platform to Purchase Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermès

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Swatch Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Patek Philippe SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PRADA S P A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Estee Lauder Companies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Mexico Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Luxury Goods Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Mexico Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Compagnie Financière Richemont SA, Hermès, The Swatch Group, Patek Philippe SA, PRADA S P A, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Kering, Rolex SA, H & M Hennes & Mauritz AB (H&M), The Estee Lauder Companies.

3. What are the main segments of the Mexico Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Increasing Preference for E-commerce Platform to Purchase Luxury Goods.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2022, TOUS, the Spanish luxury brand launched a new concept store in Kuala Lumpur, Malaysia. The new boutique features a large assortment of key categories including bags, jewelry, gemstones, and perfumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Mexico Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence