Key Insights

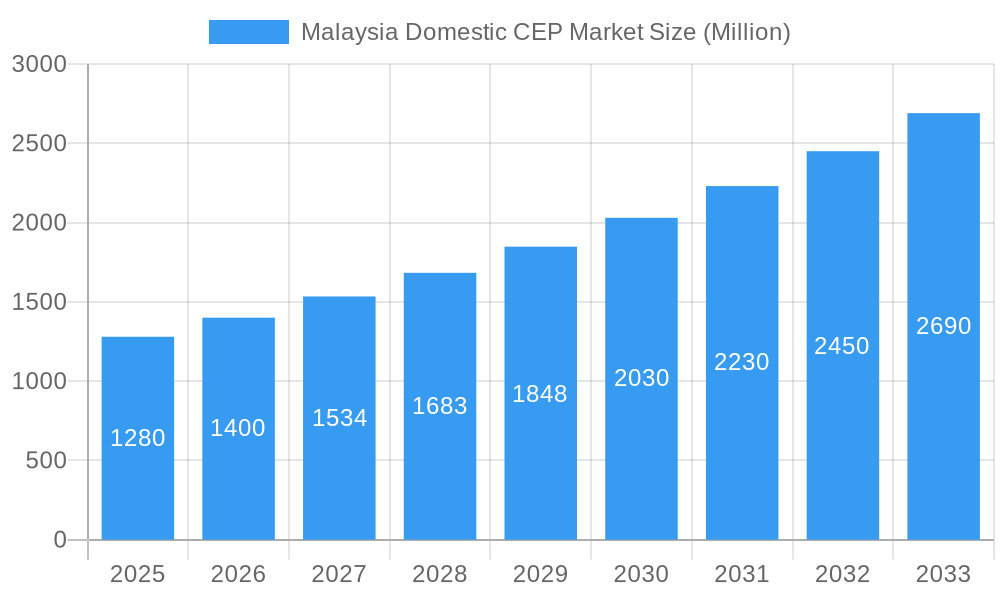

The Malaysia domestic courier, express, and parcel (CEP) market exhibits robust growth, projected to reach a market size of MYR 1.28 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 9.24% from 2025 to 2033. This surge is fueled by the burgeoning e-commerce sector, escalating consumer demand for faster delivery options, and increasing adoption of sophisticated logistics technologies. Key drivers include the rise of online shopping, particularly within the fast-moving consumer goods (FMCG) and fashion sectors. Growing urbanization and improved infrastructure further contribute to this expansion. However, challenges remain, including fluctuating fuel prices, intense competition among numerous players (including Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, and Ta-Q-Bin, amongst others), and the need for consistent service quality enhancements to meet rising customer expectations. The market is segmented by service type (express, same-day, etc.), delivery method, and geographic location, with significant regional variations in market penetration reflecting varying levels of e-commerce adoption and infrastructure development.

Malaysia Domestic CEP Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, driven by government initiatives promoting digitalization and logistics improvements. The competitive landscape is characterized by a mix of established national players and agile international entrants, leading to innovative solutions and price competitiveness. To maintain a strong market position, companies are focusing on technological upgrades to streamline operations, enhance tracking capabilities, and improve last-mile delivery efficiency. Expansion into underserved areas and strategic partnerships with e-commerce platforms will also be key success factors. The market's evolution hinges on navigating regulatory changes, managing operational costs, and consistently delivering exceptional customer experiences in a dynamic and increasingly competitive landscape.

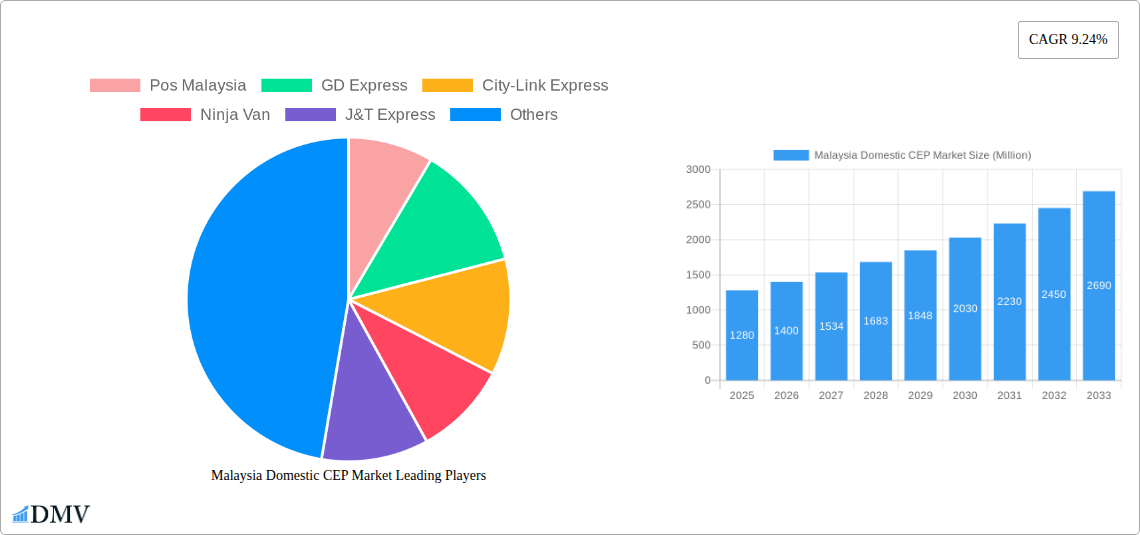

Malaysia Domestic CEP Market Company Market Share

Malaysia Domestic CEP Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Malaysian Domestic Courier, Express, and Parcel (CEP) market, offering crucial data and forecasts for stakeholders seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and the forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. This report is invaluable for investors, businesses, and policymakers seeking a deep understanding of market trends, competitive landscapes, and future growth opportunities within the Malaysian CEP industry. The market is expected to reach xx Million by 2033, showcasing significant growth potential.

Malaysia Domestic CEP Market Composition & Trends

This section dissects the Malaysian Domestic CEP market's structure, analyzing market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The market exhibits a moderately concentrated structure, with key players like Pos Malaysia, GD Express, and City-Link Express holding significant market share. However, the emergence of new players like Ninja Van and J&T Express is increasing competition.

- Market Share Distribution (2024): Pos Malaysia (30%), GD Express (15%), City-Link Express (12%), Ninja Van (10%), J&T Express (8%), Others (25%). (These are estimates; actual figures may vary).

- Innovation Catalysts: E-commerce growth, technological advancements (e.g., automated sorting systems, drone delivery), and increasing demand for faster delivery services are key drivers.

- Regulatory Landscape: The Malaysian Communications and Multimedia Commission (MCMC) plays a significant role in regulating the sector. Recent regulatory changes focusing on data privacy and consumer protection are shaping market dynamics.

- Substitute Products: Traditional postal services and alternative delivery networks offer some level of substitution.

- End-User Profiles: The market caters to a diverse range of end-users including businesses (B2B), consumers (B2C), and e-commerce platforms.

- M&A Activity (2019-2024): While precise deal values are confidential, several smaller acquisitions and strategic partnerships have occurred, enhancing market consolidation. Total M&A deal value is estimated at xx Million.

Malaysia Domestic CEP Market Industry Evolution

This section explores the historical and projected growth trajectories, technological advancements, and evolving consumer preferences within the Malaysian Domestic CEP market. The market has witnessed robust growth, fueled by the burgeoning e-commerce sector and rising consumer expectations for speed and convenience. Technological innovations, including the adoption of AI-powered route optimization, real-time tracking systems, and automated warehousing solutions, are enhancing operational efficiency and customer satisfaction. The shift towards online shopping continues to fuel the demand for reliable and efficient delivery services, driving significant market expansion. The compound annual growth rate (CAGR) during 2019-2024 was approximately xx%, projected to reach xx% during 2025-2033. Increased adoption of mobile apps for order tracking and delivery scheduling further emphasizes this technological integration. Consumer demand for same-day and next-day delivery is also influencing the sector's evolution, prompting companies to optimize their logistics networks.

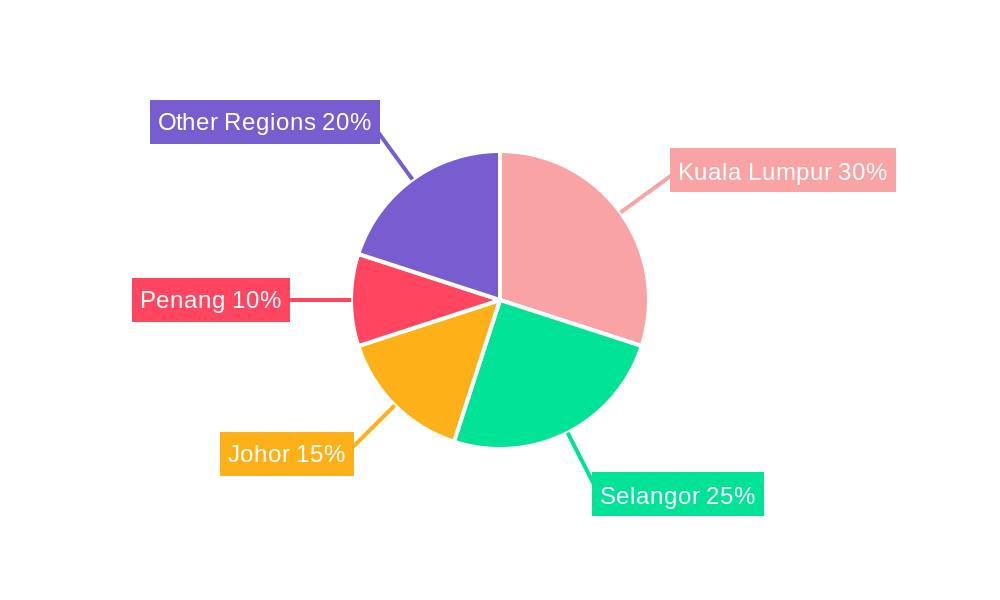

Leading Regions, Countries, or Segments in Malaysia Domestic CEP Market

The Klang Valley region, encompassing Kuala Lumpur and Selangor, dominates the Malaysian Domestic CEP market due to its high population density, robust e-commerce activity, and concentration of businesses.

- Key Drivers for Klang Valley Dominance:

- High concentration of e-commerce businesses and consumers.

- Well-developed infrastructure, including efficient road networks.

- Strong government support for logistics development.

- Significant investments in warehousing and distribution facilities.

This dominance is further amplified by the high concentration of e-commerce activities within the Klang Valley, coupled with the region’s well-established infrastructure, including efficient road and rail networks. Government initiatives aimed at fostering logistics development also contribute to this concentration. Significant investments in warehousing and distribution facilities further solidify the Klang Valley's leading position within the Malaysian Domestic CEP market.

Malaysia Domestic CEP Market Product Innovations

Recent innovations include the introduction of temperature-controlled delivery services for perishable goods by companies like Ninja Van, enhancing the scope of services offered. This signifies the market's adaptation to cater to a wider range of products. Further advancements in tracking technology, incorporating real-time location updates and delivery notifications, enhance customer experience and transparency. The integration of AI and machine learning for route optimization and predictive analytics contributes to improved efficiency and reduced delivery times.

Propelling Factors for Malaysia Domestic CEP Market Growth

The Malaysian Domestic Courier, Express, and Parcel (CEP) market is experiencing robust expansion, significantly propelled by several interconnected factors. The undeniable surge in e-commerce, fueled by widespread internet access and the pervasive use of smartphones, stands as a cornerstone of this growth. This digital shift has fundamentally altered consumer purchasing habits, leading to a higher volume of online transactions and, consequently, increased demand for reliable and swift delivery services. Complementing this, proactive government initiatives aimed at fostering digitalization and investing in crucial infrastructure development, such as enhanced logistics networks and digital payment systems, are creating a more conducive environment for CEP operations. Furthermore, the relentless pace of technological advancements, including the deployment of sophisticated automated sorting systems for faster processing and the implementation of advanced tracking technologies for greater transparency and customer assurance, are revolutionizing operational efficiency and elevating the overall customer experience. The upward trajectory of disposable incomes across Malaysia also plays a pivotal role, empowering consumers to engage more frequently in online shopping and underscoring the growing expectation for seamless and efficient parcel delivery solutions.

Obstacles in the Malaysia Domestic CEP Market

Despite its promising growth trajectory, the Malaysia Domestic CEP market navigates a landscape fraught with several persistent obstacles. Fluctuating fuel prices present a significant challenge, directly impacting operational costs and necessitating agile pricing strategies. The inherent vulnerability of supply chains to unforeseen disruptions, ranging from natural disasters to localized events, poses a constant risk of delivery delays and increased logistical complexity. The market is also characterized by intense competition, with a multitude of players vying for market share, which can exert downward pressure on pricing and profit margins. Navigating the intricacies of regulatory frameworks and ensuring continuous adaptation to the ever-evolving expectations of consumers, particularly regarding delivery speed, customization, and sustainability, require ongoing strategic adjustments. The combined effect of these factors can lead to significant price volatility and a squeeze on profitability for CEP providers.

Future Opportunities in Malaysia Domestic CEP Market

Emerging opportunities lie in expanding into underserved rural areas, leveraging advanced technologies such as drone delivery for remote regions, and catering to specialized delivery needs, including temperature-sensitive goods and high-value items. The growth of last-mile delivery solutions and the integration of sustainable practices within the delivery process will also shape future opportunities.

Major Players in the Malaysia Domestic CEP Market Ecosystem

- Pos Malaysia

- GD Express

- City-Link Express

- Ninja Van

- J&T Express

- DHL E-commerce

- Skynet

- ABX Express

- Nationwide Express

- Ta-Q-Bin

- 6-3 Other Companies

Key Developments in Malaysia Domestic CEP Market Industry

- April 2024: In a strategic move to cater to a growing niche, Ninja Van has significantly expanded its service offerings to include the specialized handling and delivery of perishable goods, addressing a key consumer need for fresh product delivery.

- January 2024: The Malaysian CEP landscape witnessed the entry of a new international player with DTDC establishing its presence by opening an office in Kuala Lumpur, signaling increased market competitiveness and potentially new service models.

These recent developments underscore the dynamic nature of the Malaysia Domestic CEP market, characterized by heightened competition, strategic expansions into new service verticals, and the continuous introduction of innovative solutions to meet the diverse and evolving demands of consumers and businesses alike.

Strategic Malaysia Domestic CEP Market Forecast

The Malaysian Domestic CEP market is poised for continued growth, driven by the sustained expansion of e-commerce, technological advancements, and supportive government policies. The focus on enhancing last-mile delivery capabilities, incorporating sustainable practices, and meeting the evolving needs of consumers will shape the future trajectory of the market. The market's potential for innovation and expansion offers significant opportunities for both established players and new entrants.

Malaysia Domestic CEP Market Segmentation

-

1. Business Model

- 1.1. Business-to-business (B2B)

- 1.2. Customer-to-customer (C2C)

- 1.3. Business-to-consumer(B2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non-e-commerce

-

3. End User

- 3.1. Service

- 3.2. Wholesale and Retail

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

Malaysia Domestic CEP Market Segmentation By Geography

- 1. Malaysia

Malaysia Domestic CEP Market Regional Market Share

Geographic Coverage of Malaysia Domestic CEP Market

Malaysia Domestic CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.4. Market Trends

- 3.4.1. Booming Smartphone Sales in E-Commerce Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Domestic CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Customer-to-customer (C2C)

- 5.1.3. Business-to-consumer(B2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non-e-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Service

- 5.3.2. Wholesale and Retail

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pos Malaysia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GD Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 City-Link Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ninja Van

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL E-commerce

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skynet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABX Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nationwide Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pos Malaysia

List of Figures

- Figure 1: Malaysia Domestic CEP Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Domestic CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 2: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 3: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Malaysia Domestic CEP Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia Domestic CEP Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 10: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 11: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Malaysia Domestic CEP Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia Domestic CEP Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Domestic CEP Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Malaysia Domestic CEP Market?

Key companies in the market include Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Malaysia Domestic CEP Market?

The market segments include Business Model, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

6. What are the notable trends driving market growth?

Booming Smartphone Sales in E-Commerce Segment.

7. Are there any restraints impacting market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

8. Can you provide examples of recent developments in the market?

April 2024: Ninja Van, a local express logistics company, broadened its services to transport perishable items, such as fresh fruit and sashimi, alongside its traditional parcel and online order deliveries.January 2024: DTDC, an express logistics company, announced its foray into the Malaysian market. This move was facilitated by its subsidiary, DTDC Global Express PTE Ltd, which inaugurated an office in Kuala Lumpur. The newly minted office, bolstering DTDC's presence in Southeast Asia, will primarily focus on providing advanced trans-shipment services to clients in Southeast Asia and the Australian peninsula, as per DTDC's official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Domestic CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Domestic CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Domestic CEP Market?

To stay informed about further developments, trends, and reports in the Malaysia Domestic CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence