Key Insights

China's logistics sector is poised for significant expansion, driven by robust e-commerce activity, a thriving manufacturing base, and substantial infrastructure development. The market is currently valued at $200 billion as of 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.5%. Key growth catalysts include the "Belt and Road" initiative, which enhances global connectivity and trade, and escalating demand for efficient supply chain solutions across vital industries like oil & gas, manufacturing, and e-commerce. The industry is segmented by service (transportation, forwarding, warehousing, value-added services) and end-user (oil & gas, petrochemicals, mining, energy, construction, manufacturing, and others). Technological innovations such as automation, AI, and data analytics are further optimizing operations and reducing costs, fueling industry growth.

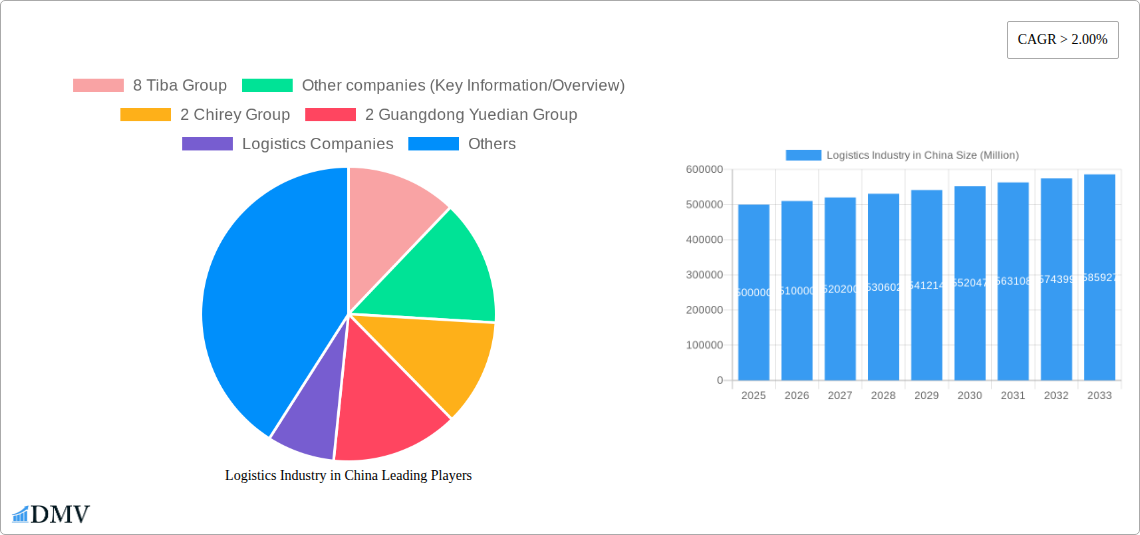

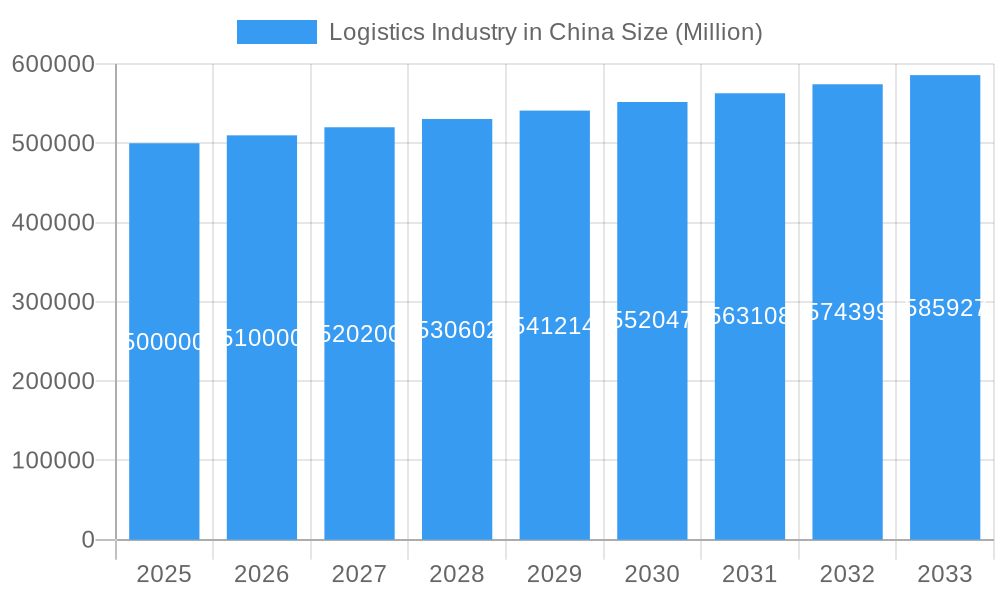

Logistics Industry in China Market Size (In Billion)

Despite regional infrastructure constraints, rising labor expenses, and intense competition, the long-term outlook for China's logistics industry remains highly favorable. Ongoing investments in infrastructure, coupled with the widespread adoption of cutting-edge technologies and a growing emphasis on sustainable logistics, will propel considerable market growth. The competitive arena features major international corporations alongside a multitude of domestic enterprises, presenting diverse opportunities for market participants. Strategic navigation of regional differences and regulatory frameworks will be paramount for businesses seeking to leverage the expanding potential within this critical market. Detailed analysis of segment-specific performance, such as growth variances between transportation and warehousing, will offer deeper market intelligence.

Logistics Industry in China Company Market Share

Logistics Industry in China: Market Composition, Trends & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of China's dynamic logistics industry, covering market size, key players, and future growth projections from 2019 to 2033. With a focus on market composition, technological advancements, and emerging opportunities, this report is an essential resource for stakeholders seeking to understand and capitalize on this significant market. The base year for this report is 2025, with the forecast period spanning 2025-2033 and the historical period encompassing 2019-2024. The report incorporates detailed analysis of key segments, including Transportation, Forwarding, Warehousing, and other value-added services, across diverse end-user sectors like Oil & Gas, Petrochemicals, and Manufacturing. The total market value is estimated at xx Million for 2025.

Logistics Industry in China Market Composition & Trends

China's logistics market is characterized by intense competition and rapid evolution. This report analyzes the market concentration, identifying key players and their market share distribution. We examine innovation catalysts, including technological advancements and government initiatives, alongside the regulatory landscape influencing market dynamics. The report also explores substitute products, end-user profiles and their changing demands, and a detailed overview of recent M&A activities, including deal values, to provide a comprehensive understanding of the market dynamics. The analysis includes evaluation of xx Million worth of M&A deals in the historical period (2019-2024) that significantly impacted the market concentration.

- Market Concentration: A highly fragmented market with a few dominant players controlling significant market share. The top 5 players hold an estimated xx% market share in 2025.

- Innovation Catalysts: Government initiatives promoting e-commerce and supply chain optimization are driving innovation. Technological advancements, such as AI and automation, are transforming logistics operations.

- Regulatory Landscape: Stringent regulations related to environmental protection and data privacy are shaping industry practices.

- Substitute Products: The emergence of innovative solutions like drone delivery and autonomous vehicles pose potential disruptions to existing modes.

- End-User Profiles: The manufacturing, energy, and e-commerce sectors are driving significant demand for logistics services.

- M&A Activities: Consolidation is evident through numerous mergers and acquisitions, with significant deals valued at xx Million in 2024, demonstrating strategic shifts in the market landscape.

Logistics Industry in China Industry Evolution

The Chinese logistics industry has experienced significant growth, driven by rapid urbanization, industrialization, and the rise of e-commerce. This report meticulously examines this growth trajectory, analyzing various aspects contributing to market expansion. Technological advancements, such as the adoption of digital platforms and autonomous vehicles, are reshaping the industry landscape. Furthermore, the changing consumer demands, particularly the preference for faster and more efficient delivery options, are influencing logistics providers to adapt and innovate. Detailed growth rates and technology adoption metrics are provided, illustrating the industry's evolution between 2019 and 2033. The market is expected to grow at a CAGR of xx% during the forecast period, reaching xx Million by 2033.

Leading Regions, Countries, or Segments in Logistics Industry in China

This section identifies the dominant regions and segments within China's logistics industry. Analysis focuses on key drivers for growth, including investment trends and regulatory support, within the major service and end-user categories. Dominance factors are analyzed in detail using data-driven insights from the period 2019-2024.

By Service: Transportation remains the largest segment, driven by robust manufacturing and e-commerce growth. Forwarding is also a significant segment. Warehousing and other value-added services are witnessing rapid growth.

By End-User: The manufacturing sector is the most significant end-user, followed by the e-commerce and energy sectors. The strong growth of e-commerce is significantly contributing to the expansion of the warehousing and last-mile delivery segments.

Key Drivers:

- Government Investment: Significant infrastructure investments in transportation networks.

- E-commerce Boom: The rapid expansion of online retail has significantly fueled demand for logistics services.

- Technological Advancements: Adoption of AI, blockchain, and IoT solutions are optimizing logistics operations.

- Regulatory Support: Policies promoting efficient and sustainable logistics practices.

Logistics Industry in China Product Innovations

The Chinese logistics industry is witnessing significant product innovations, encompassing intelligent warehousing systems, automated guided vehicles (AGVs), and advanced transportation management systems (TMS). These innovations enhance efficiency, optimize resource allocation, and improve overall supply chain visibility. The integration of artificial intelligence (AI) and big data analytics allows for predictive maintenance, demand forecasting, and real-time route optimization. The key selling propositions include improved cost efficiency, reduced lead times, and enhanced transparency in operations.

Propelling Factors for Logistics Industry in China Growth

Several factors are propelling the growth of China's logistics industry. These include:

- Technological advancements: Automation, AI, and IoT solutions are enhancing efficiency and reducing costs.

- Economic growth: China's sustained economic growth drives demand for logistics services across various sectors.

- Government support: Policies aimed at modernizing infrastructure and fostering technological innovation are driving market expansion. For example, the "Belt and Road Initiative" is expanding China's global logistics network.

Obstacles in the Logistics Industry in China Market

The Chinese logistics market faces several challenges, including:

- Regulatory hurdles: Navigating complex regulations can be time-consuming and costly for logistics providers.

- Supply chain disruptions: Geopolitical uncertainties and natural disasters can disrupt supply chains, impacting delivery timelines and costs.

- Intense competition: The highly competitive landscape puts pressure on profit margins and requires continuous innovation.

Future Opportunities in Logistics Industry in China

Future opportunities abound in China's logistics industry:

- Expansion into new markets: Growing demand in underserved rural areas and international markets presents significant opportunities.

- Technological innovation: Further adoption of AI, automation, and blockchain can significantly enhance efficiency and reduce costs.

- Sustainable logistics: Growing emphasis on environmental sustainability will drive demand for green logistics solutions.

Major Players in the Logistics Industry in China Ecosystem

- 8 Tiba Group

- 2 Chirey Group

- 2 Guangdong Yuedian Group

- 14 Kuehne + Nagel

- 12 Global Star Logistics (China) Co Ltd

- 1 China Gezhouba Group Corporation International Engineering Company

- 3 China National Chemical Engineering Group

- 7 CJ Smart Cargo

- 15 Agility Logistics Pvt Ltd

- 1 Broekman Logistics

- Rhenus Logistics

- Trans Global Projects Group (TGP)

- S F Systems(Group)Ltd

- Ziegler Group

- Dextrans Worldwide Group

- GEFCO S A

- Keyun Group

- Dolphin Logistcis Co Ltd

- TPL Project Stock Company

- Shanghai Beetle Supply Chain Management Company Limited

- 6 Sinotrans (HK) Logistics Ltd

- 4 Kerry Logistics Network Limited

- 13 Sunshine Int'l Logistics Co ltd

- 10 InterMax Logistics Solution Limited

- 5 Trans Global Projects Group (TGP)

- 5 China Civil Engineering Construction Corporation*

- 9 Mitsubishi Logistics Corporation

- 1 COSCO Shipping Logistics Co Ltd

- 4 China Railway Construction Corporation

- 3 Translink International Logistics Group

- 11 Wangfoong Transportation Ltd

- Other companies (Key Information/Overview)

Key Developments in Logistics Industry in China Industry

- January 2023: Maersk's $174 Million green and smart flagship logistics center in Shanghai's Lin-gang new area commences in Q3 2024. This reflects a significant investment in sustainable logistics infrastructure.

- January 2022: Launch of the Ocean Alliance Day 7 Product with 22.4 Million TEUs annual capacity and the deployment of 26 dual-fuel LNG-powered ships. This demonstrates a shift toward greener shipping practices.

Strategic Logistics Industry in China Market Forecast

The Chinese logistics industry is poised for sustained growth, driven by technological advancements, economic expansion, and government initiatives. The market is expected to experience significant expansion, creating numerous opportunities for logistics providers. The increasing adoption of advanced technologies, coupled with the growing e-commerce sector, will further accelerate market growth in the coming years. The estimated market value is expected to reach xx Million by 2033, exhibiting significant potential for investors and businesses operating in this sector.

Logistics Industry in China Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Warehousing

- 1.4. Other Value-added Services

-

2. End-user

- 2.1. Oil and Gas, Petrochemical

- 2.2. Mining and Quarrying

- 2.3. Energy and Power

- 2.4. Construction

- 2.5. Manufacturing

- 2.6. Other En

Logistics Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Industry in China Regional Market Share

Geographic Coverage of Logistics Industry in China

Logistics Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Cost - Intensive4.; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Wind power is expected to propel the demand for project logistics services through the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Oil and Gas, Petrochemical

- 5.2.2. Mining and Quarrying

- 5.2.3. Energy and Power

- 5.2.4. Construction

- 5.2.5. Manufacturing

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Oil and Gas, Petrochemical

- 6.2.2. Mining and Quarrying

- 6.2.3. Energy and Power

- 6.2.4. Construction

- 6.2.5. Manufacturing

- 6.2.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Oil and Gas, Petrochemical

- 7.2.2. Mining and Quarrying

- 7.2.3. Energy and Power

- 7.2.4. Construction

- 7.2.5. Manufacturing

- 7.2.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Oil and Gas, Petrochemical

- 8.2.2. Mining and Quarrying

- 8.2.3. Energy and Power

- 8.2.4. Construction

- 8.2.5. Manufacturing

- 8.2.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Oil and Gas, Petrochemical

- 9.2.2. Mining and Quarrying

- 9.2.3. Energy and Power

- 9.2.4. Construction

- 9.2.5. Manufacturing

- 9.2.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Forwarding

- 10.1.3. Warehousing

- 10.1.4. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Oil and Gas, Petrochemical

- 10.2.2. Mining and Quarrying

- 10.2.3. Energy and Power

- 10.2.4. Construction

- 10.2.5. Manufacturing

- 10.2.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 8 Tiba Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Other companies (Key Information/Overview)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 Chirey Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 2 Guangdong Yuedian Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Logistics Companies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 14 Kuehne + Nagel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 12 Global Star Logistics (China) Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 1 China Gezhouba Group Corporation International Engineering Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 China National Chemical Engineering Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 7 CJ Smart Cargo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 15 Agility Logistics Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Sinotrans (HK) Logistics Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Engineering/EPC Companies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 4 Kerry Logistics Network Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 13 Sunshine Int'l Logistics Co ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 10 InterMax Logistics Solution Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 5 Trans Global Projects Group (TGP)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 5 China Civil Engineering Construction Corporation*

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 9 Mitsubishi Logistics Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 1 COSCO Shipping Logistics Co Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 4 China Railway Construction Corporation

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 3 Translink International Logistics Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 11 Wangfoong Transportation Ltd

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 8 Tiba Group

List of Figures

- Figure 1: Global Logistics Industry in China Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 9: South America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 10: South America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 11: South America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 12: South America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 15: Europe Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 21: Middle East & Africa Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East & Africa Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 23: Middle East & Africa Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East & Africa Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 27: Asia Pacific Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 29: Asia Pacific Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Asia Pacific Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Logistics Industry in China Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 17: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 29: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 30: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 39: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Industry in China?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Logistics Industry in China?

Key companies in the market include 8 Tiba Group, Other companies (Key Information/Overview), 2 Chirey Group, 2 Guangdong Yuedian Group, Logistics Companies, 14 Kuehne + Nagel, 12 Global Star Logistics (China) Co Ltd, 1 China Gezhouba Group Corporation International Engineering Company, 3 China National Chemical Engineering Group, 7 CJ Smart Cargo, 15 Agility Logistics Pvt Ltd, 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited, 6 Sinotrans (HK) Logistics Ltd, Engineering/EPC Companies, 4 Kerry Logistics Network Limited, 13 Sunshine Int'l Logistics Co ltd, 10 InterMax Logistics Solution Limited, 5 Trans Global Projects Group (TGP), 5 China Civil Engineering Construction Corporation*, 9 Mitsubishi Logistics Corporation, 1 COSCO Shipping Logistics Co Ltd, 4 China Railway Construction Corporation, 3 Translink International Logistics Group, 11 Wangfoong Transportation Ltd.

3. What are the main segments of the Logistics Industry in China?

The market segments include Service, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 200 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce.

6. What are the notable trends driving market growth?

Wind power is expected to propel the demand for project logistics services through the forecast period.

7. Are there any restraints impacting market growth?

4.; Cost - Intensive4.; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

January 2023: Maersk and the administrative body of the Shanghai Free Trade Zone signed a land grant agreement late in December 2022 for the Lin-gang new area. This is the first green and smart flagship logistics center from Maersk to open in China. It has low or very low greenhouse gas emissions. The project will begin in the third quarter of 2024 and cost 174 million US dollars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Industry in China?

To stay informed about further developments, trends, and reports in the Logistics Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence