Key Insights

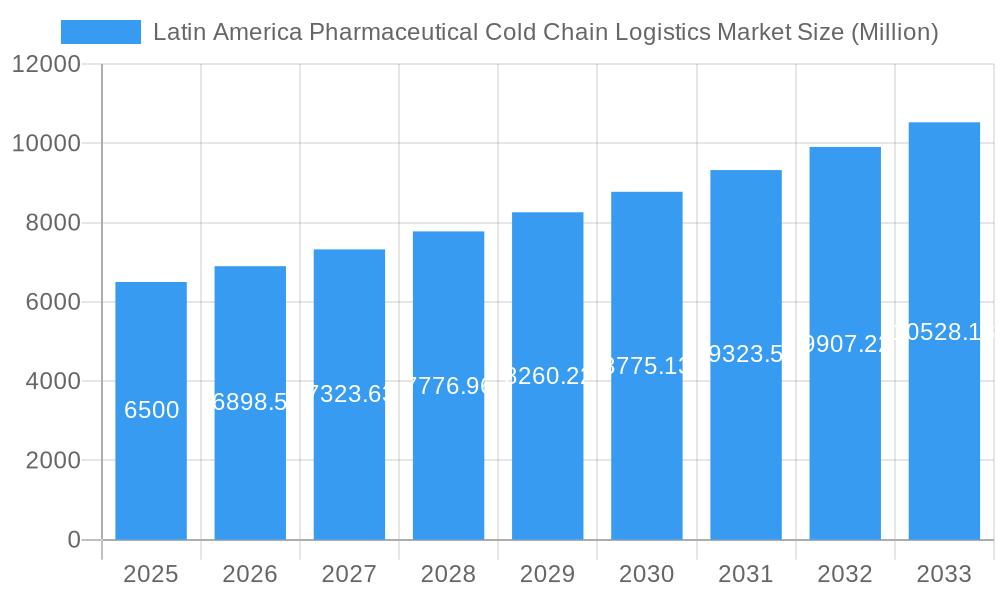

The Latin American pharmaceutical cold chain logistics market is experiencing robust growth, projected to reach $6.50 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand for temperature-sensitive pharmaceuticals, particularly vaccines and biologics, across the region fuels market growth. The expanding healthcare infrastructure in many Latin American countries, coupled with rising disposable incomes and improved healthcare access, further contributes to this demand. Government initiatives promoting pharmaceutical supply chain efficiency and improved cold chain infrastructure are also playing a significant role. The increasing prevalence of chronic diseases necessitates a reliable cold chain for delivering essential medications, bolstering market growth. Furthermore, technological advancements in cold chain monitoring and management, including real-time tracking and data analytics, enhance efficiency and reduce waste, positively impacting market expansion.

Latin America Pharmaceutical Cold Chain Logistics Market Market Size (In Billion)

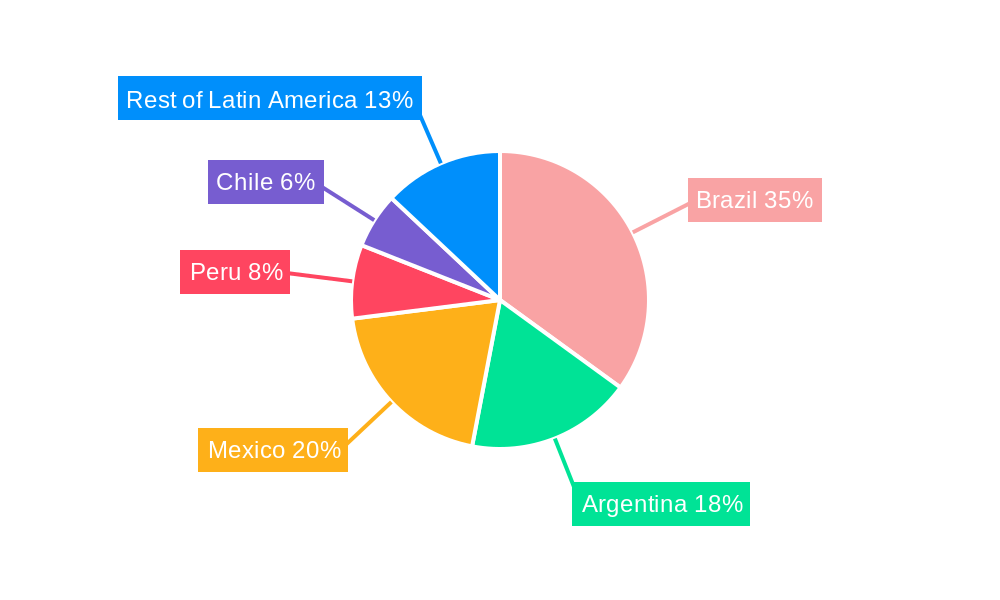

The market is segmented by service type (storage, transportation, value-added services) and destination (domestic, international). While storage and transportation currently hold significant market share, value-added services, such as packaging, labeling, and specialized handling, are expected to witness faster growth due to increasing regulatory compliance needs and the rising complexity of pharmaceutical products. Brazil, Argentina, and Mexico represent the largest markets within Latin America, driven by their relatively advanced healthcare infrastructure and significant pharmaceutical consumption. However, opportunities for growth exist in other countries like Peru and Chile as their economies develop and healthcare systems improve. Challenges remain, including infrastructure limitations in certain regions, fluctuating currency exchange rates, and the need for continuous investment in advanced cold chain technologies to ensure product integrity and reduce spoilage. Competitive dynamics are shaped by a mix of large multinational logistics providers and smaller, regional players. The market's future trajectory depends on continued investment in infrastructure, technological advancements, and regulatory improvements to support the safe and efficient delivery of life-saving medications across Latin America.

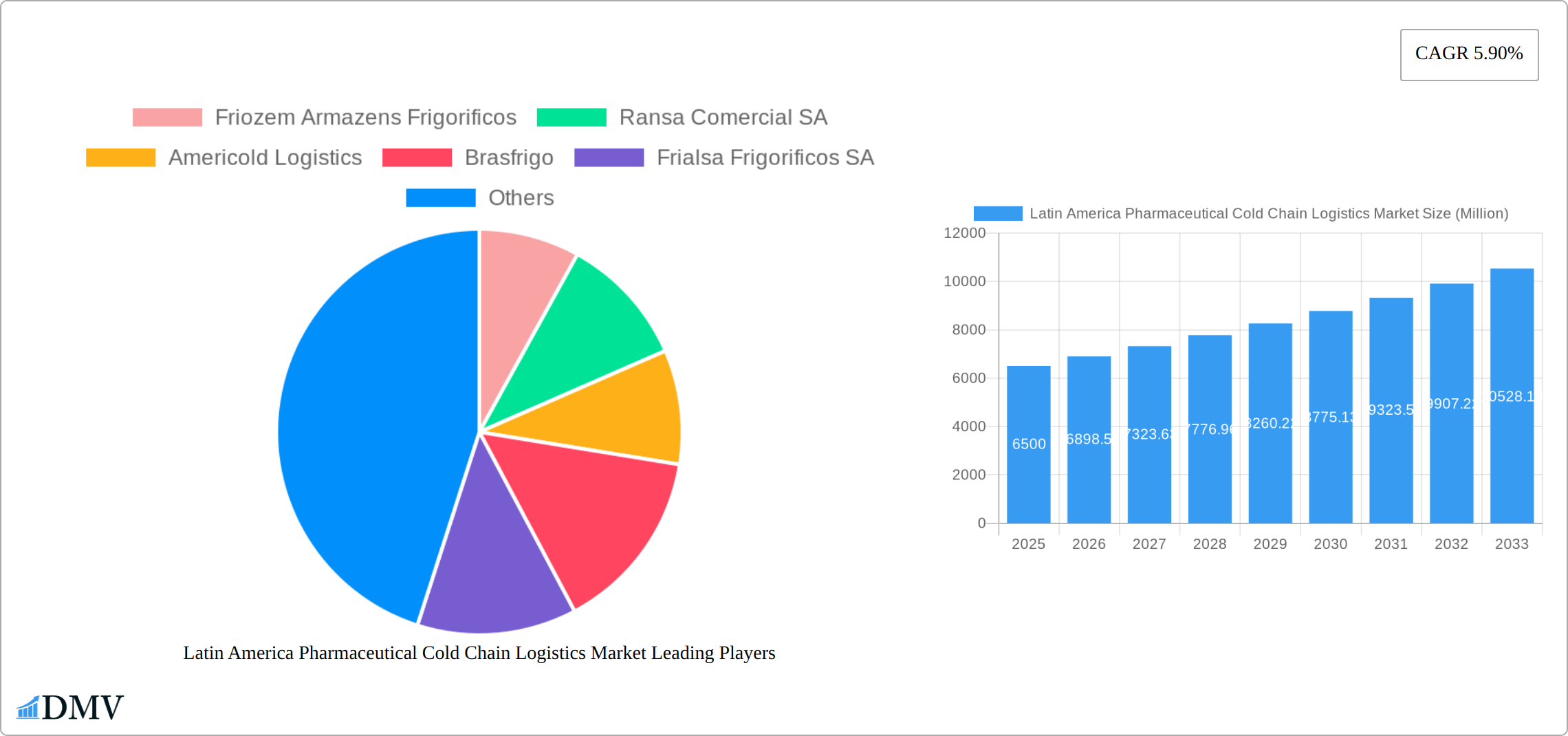

Latin America Pharmaceutical Cold Chain Logistics Market Company Market Share

Latin America Pharmaceutical Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America Pharmaceutical Cold Chain Logistics Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for stakeholders seeking to understand the market's complexities and capitalize on emerging opportunities. The market is projected to reach xx Million by 2033.

Latin America Pharmaceutical Cold Chain Logistics Market Market Composition & Trends

This section delves into the competitive landscape of the Latin American pharmaceutical cold chain logistics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with several large players holding significant market share. However, smaller, specialized firms are also thriving, particularly those focusing on niche services or geographic regions.

Market Share Distribution: While precise market share data for individual companies requires further investigation, Americold Logistics and Ransa Comercial SA are estimated to hold significant shares, followed by others like Brasfrigo and Localfrio. Smaller companies collectively contribute a substantial portion to the total market share. Further competitive analysis will provide more granular data.

Innovation Catalysts: Technological advancements in temperature-controlled transportation, real-time monitoring systems, and data analytics are driving innovation within the market. The growing demand for specialized services, such as cold chain packaging solutions and value-added services, presents further opportunities for innovation.

Regulatory Landscape: Varying regulatory standards across Latin American countries present both challenges and opportunities. Stringent regulations surrounding pharmaceutical storage and transportation necessitate compliance investments but also encourage standardization and enhance market quality.

Substitute Products: While direct substitutes are limited, alternative storage and transportation methods exist, impacting market share depending on factors like cost, temperature control reliability, and distance.

End-User Profiles: Key end-users include pharmaceutical manufacturers, distributors, hospitals, and pharmacies, each with unique requirements impacting the demand for specific services.

M&A Activities: Recent acquisitions, such as Emergent Cold's acquisition of Qualianz in February 2023, illustrate the industry's consolidation trend. These activities reshape the market landscape, driving efficiency and expanding service portfolios. Further analysis shows a total M&A deal value of xx Million for the period 2019-2024.

Latin America Pharmaceutical Cold Chain Logistics Market Industry Evolution

The Latin American pharmaceutical cold chain logistics market experienced substantial growth from 2019 to 2024, fueled by increased pharmaceutical consumption, healthcare infrastructure investment, and the rising use of temperature-sensitive pharmaceuticals. While continued growth is projected from 2025 to 2033, a potential moderation in the growth rate is anticipated. This moderation may be attributed to market saturation in certain segments and economic fluctuations across various nations. Technological advancements, including IoT-enabled monitoring and automated warehousing, are significantly enhancing efficiency and reliability. Simultaneously, evolving consumer demands for greater transparency and traceability are reshaping market strategies, pushing companies to adopt robust tracking and data management systems.

Leading Regions, Countries, or Segments in Latin America Pharmaceutical Cold Chain Logistics Market

Mexico and Brazil are the dominant forces in the Latin American pharmaceutical cold chain logistics market, driven by large populations, established pharmaceutical sectors, and robust healthcare infrastructure. However, Colombia, Argentina, and Chile exhibit considerable growth potential, presenting attractive opportunities for market expansion.

By Service: Storage services constitute the largest market segment, followed by transportation and value-added services (e.g., labeling, repackaging, and specialized handling). The expansion of storage capacity is a key driver of this sector's dominance.

By Destination: Domestic logistics currently holds the largest share, reflecting the extensive internal distribution networks within each country. Nevertheless, the increasing cross-border pharmaceutical trade is fostering growth within the international segment, presenting opportunities for companies specializing in international logistics and cross-border compliance.

Key Drivers:

Investment Trends: Substantial investments in modern cold chain infrastructure, encompassing advanced warehouses, refrigerated transportation fleets, and cutting-edge technology, are propelling market growth in key regions. This includes investment in specialized equipment for handling various temperature-sensitive pharmaceuticals.

Regulatory Support: Stringent government regulations aimed at enhancing cold chain infrastructure and ensuring product quality are vital in stimulating market development and driving the adoption of best practices within the industry.

Economic Growth: The robust economic growth witnessed in several Latin American nations is directly supporting the expansion of the pharmaceutical market and its associated logistics demands.

E-commerce Growth: The rise of e-commerce in pharmaceuticals is creating a need for efficient last-mile delivery solutions that maintain product integrity and temperature control, presenting a significant opportunity for specialized cold chain logistics providers.

Mexico and Brazil's leading positions are rooted in several factors: the presence of major pharmaceutical companies, robust regulatory frameworks ensuring cold chain compliance, high population densities driving demand, and significant investments in infrastructure modernization and technological advancements within the logistics industry. These factors create a favorable environment for growth and attract investment in the sector.

Latin America Pharmaceutical Cold Chain Logistics Market Product Innovations

Recent innovations include the wider adoption of cost-effective passive temperature-controlled containers, advancements in real-time tracking technologies leveraging IoT and GPS, and the development of specialized cold chain packaging that enhances product protection during transit. These innovations contribute to improved efficiency, risk mitigation, and guaranteed product integrity throughout the supply chain. A core focus is on enhancing temperature control precision, real-time monitoring, cost reduction through optimized routing, and improved traceability via comprehensive data logging and analysis. The integration of AI and machine learning is further enhancing predictive capabilities and optimizing resource allocation.

Propelling Factors for Latin America Pharmaceutical Cold Chain Logistics Market Growth

Several factors propel the market's growth. Increasing pharmaceutical consumption, driven by rising incomes and improved healthcare access, is a primary driver. Government initiatives supporting healthcare infrastructure development and stringent regulations ensuring pharmaceutical quality further stimulate market expansion. Technological advancements such as IoT-based monitoring and data analytics enhance efficiency and reduce spoilage, contributing significantly to growth. Furthermore, the expansion of e-commerce in pharmaceuticals and the rising demand for specialized cold chain services present substantial growth opportunities.

Obstacles in the Latin America Pharmaceutical Cold Chain Logistics Market Market

The market faces challenges, including inconsistent regulatory frameworks across different Latin American countries, creating compliance complexities. Infrastructure deficiencies, particularly in remote areas, hinder efficient distribution. Furthermore, the vulnerability of cold chains to natural disasters and supply chain disruptions, often amplified by climate change, poses a significant risk. Competition among established and emerging players, constantly vying for market share and customers, increases operational pressures. These obstacles can lead to increased costs and delays, hindering overall market growth.

Future Opportunities in Latin America Pharmaceutical Cold Chain Logistics Market

The market presents substantial growth opportunities. The expansion of the pharmaceutical industry into less-developed regions and the exploration of untapped segments within established markets offer considerable potential. The integration of advanced technologies like AI and blockchain will enhance supply chain transparency, traceability, and efficiency, generating lucrative opportunities for innovative logistics providers. The burgeoning demand for value-added services, such as last-mile delivery tailored to temperature-sensitive products and specialized handling for unique pharmaceutical needs, presents significant avenues for growth and differentiation.

Major Players in the Latin America Pharmaceutical Cold Chain Logistics Market Ecosystem

- Friozem Armazens Frigorificos

- Ransa Comercial SA

- Americold Logistics

- Brasfrigo

- Frialsa Frigorificos SA

- Arfrio Armazens Gerais Frigorificos

- Qualianz

- Superfrio Armazens Gerais

- Comfrio SoluCoes LogIsticas

- Localfrio

Key Developments in Latin America Pharmaceutical Cold Chain Logistics Market Industry

February 2023: Emergent Cold Latin America acquired Qualianz, expanding its footprint and enhancing its market position.

March 2023: DSV's planned acquisitions of S&M Moving Systems West and Global Diversity Logistics signal a significant expansion into the Latin American cross-border pharmaceutical cold chain logistics market. This will increase DSV's presence and capacity within this segment.

Strategic Latin America Pharmaceutical Cold Chain Logistics Market Market Forecast

The Latin American pharmaceutical cold chain logistics market is poised for sustained growth driven by a confluence of factors: expanding pharmaceutical markets, improving healthcare infrastructure, technological advancements, and increased regulatory focus on quality and safety. The market is expected to witness significant investment in modernizing cold chain infrastructure, accelerating the adoption of advanced technologies, and intensifying competition among players. This combination points towards a robust and dynamic market with considerable long-term growth potential.

Latin America Pharmaceutical Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-Added Services

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Geography

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Colombia

- 3.4. Rest Of Latin America

Latin America Pharmaceutical Cold Chain Logistics Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Rest Of Latin America

Latin America Pharmaceutical Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Latin America Pharmaceutical Cold Chain Logistics Market

Latin America Pharmaceutical Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for temperature - sensitive drugs; The growing pharmaceutical industry

- 3.3. Market Restrains

- 3.3.1. High cost of cold chain logistics; The limited availability of skilled personnel

- 3.4. Market Trends

- 3.4.1. Demand for pharmaceutical products in Latin America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-Added Services

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Rest Of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Colombia

- 5.4.4. Rest Of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Mexico Latin America Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-Added Services

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Mexico

- 6.3.2. Brazil

- 6.3.3. Colombia

- 6.3.4. Rest Of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Brazil Latin America Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-Added Services

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Mexico

- 7.3.2. Brazil

- 7.3.3. Colombia

- 7.3.4. Rest Of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Colombia Latin America Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-Added Services

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Mexico

- 8.3.2. Brazil

- 8.3.3. Colombia

- 8.3.4. Rest Of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest Of Latin America Latin America Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-Added Services

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Mexico

- 9.3.2. Brazil

- 9.3.3. Colombia

- 9.3.4. Rest Of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Friozem Armazens Frigorificos

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ransa Comercial SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Americold Logistics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Brasfrigo

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Frialsa Frigorificos SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Arfrio Armazens Gerais Frigorificos

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Qualianz**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Superfrio Armazens Gerais

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Comfrio SoluCoes LogIsticas

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Localfrio

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Friozem Armazens Frigorificos

List of Figures

- Figure 1: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Pharmaceutical Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 3: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 7: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 11: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 15: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 19: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Pharmaceutical Cold Chain Logistics Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Latin America Pharmaceutical Cold Chain Logistics Market?

Key companies in the market include Friozem Armazens Frigorificos, Ransa Comercial SA, Americold Logistics, Brasfrigo, Frialsa Frigorificos SA, Arfrio Armazens Gerais Frigorificos, Qualianz**List Not Exhaustive, Superfrio Armazens Gerais, Comfrio SoluCoes LogIsticas, Localfrio.

3. What are the main segments of the Latin America Pharmaceutical Cold Chain Logistics Market?

The market segments include Service, Destination, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for temperature - sensitive drugs; The growing pharmaceutical industry.

6. What are the notable trends driving market growth?

Demand for pharmaceutical products in Latin America.

7. Are there any restraints impacting market growth?

High cost of cold chain logistics; The limited availability of skilled personnel.

8. Can you provide examples of recent developments in the market?

March 2023: DSV has agreements in place to purchase S&M Moving Systems West and Global Diversity Logistics, two US-based transportation and logistics firms. These acquisitions will improve DSV's standing in the semiconductor sector, complement its newest activities at Phoenix-Mesa Gateway Airport, and assist the company in expanding cross-border services to Latin America. In April 2023, the deals are anticipated to close, barring any last-minute legal requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Pharmaceutical Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Pharmaceutical Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Pharmaceutical Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Latin America Pharmaceutical Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence