Key Insights

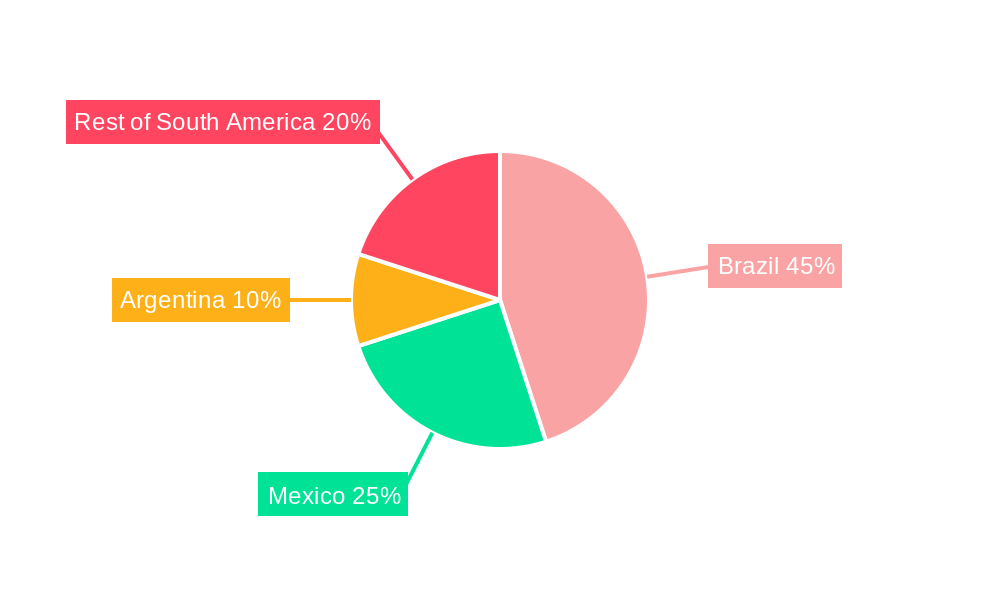

The Latin American jewelry market, valued at approximately $8.58 billion in the base year 2024, is projected to experience robust growth at a Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2033. This expansion is primarily attributed to rising disposable incomes, particularly within the expanding middle class of key economies such as Brazil and Mexico, leading to increased consumer expenditure on premium and aspirational items. The burgeoning e-commerce sector enhances market accessibility and convenience, extending reach beyond traditional retail. Favorable tourism trends and the influence of global fashion aesthetics further contribute to market vitality. Potential challenges include economic volatility and fluctuations in precious metal prices; however, the overall market trajectory remains positive. Key market segments include fine jewelry, driven by cultural significance and investment value, and fashion jewelry, appealing to a wider demographic seeking accessible adornments. Product categories such as necklaces, rings, and earrings are dominant, with bracelets and charms also showing significant contribution. Brazil is anticipated to lead the market, supported by strong domestic demand and a rich heritage in gold, followed by Mexico and Argentina.

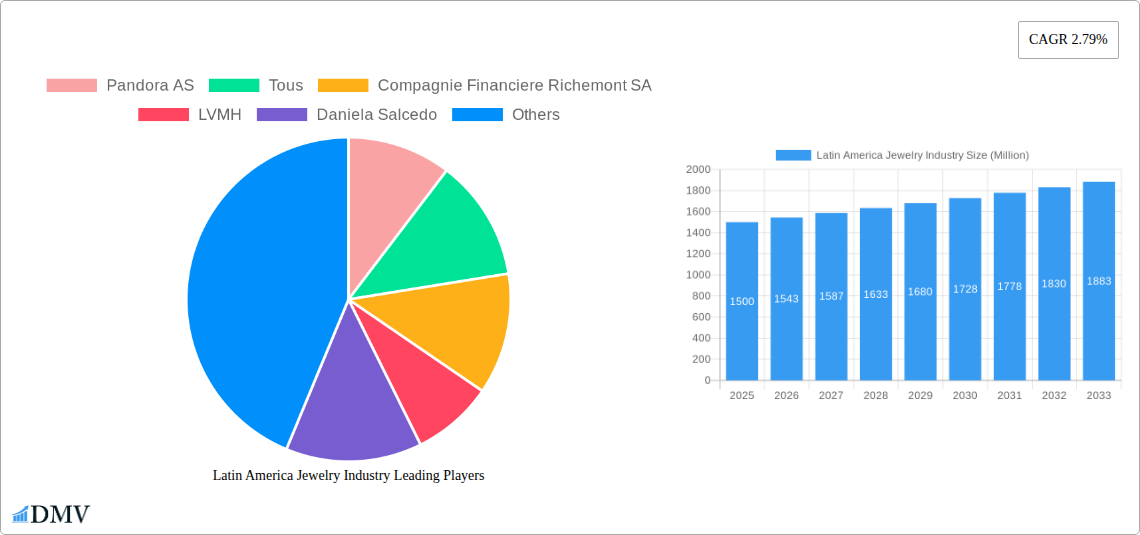

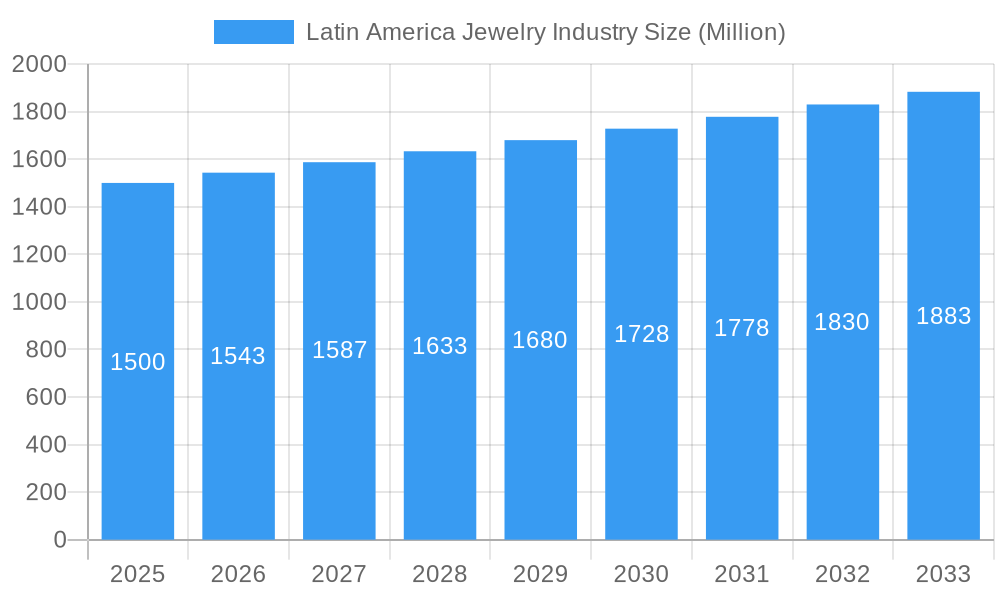

Latin America Jewelry Industry Market Size (In Billion)

The competitive arena features a blend of international luxury brands, including Pandora, Richemont, and LVMH, alongside significant regional players like Vivara and Daniel Espinosa. This diverse brand presence caters to varied consumer preferences across different styles and price segments. Market success hinges on a nuanced understanding of local cultural preferences, effective marketing initiatives, and efficient supply chain management for sourcing quality materials competitively. The ongoing growth of e-commerce platforms will intensify competition, presenting both opportunities and challenges for market participants. An increasing emphasis on sustainable and ethically sourced materials is also poised to influence consumer purchasing decisions.

Latin America Jewelry Industry Company Market Share

Latin America Jewelry Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America jewelry industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends through 2033, leveraging data from the historical period of 2019-2024. The report covers key segments, including real jewelry, costume jewelry, necklaces, rings, earrings, charms & bracelets, and others, across both offline and online distribution channels. Market value projections are provided in Millions.

Latin America Jewelry Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory factors, substitute product impacts, end-user preferences, and merger & acquisition (M&A) activities within the Latin American jewelry market. The report analyzes market share distribution among key players such as Pandora AS, Tous, Compagnie Financiere Richemont SA, LVMH, Daniela Salcedo, H Stern Jewelers Inc, Manoel Bernardes SA, Joias Vivara, Haramara Jewelry, and Daniel Espinosa Jewelry (list not exhaustive). We delve into the market concentration, identifying dominant players and their respective market shares (xx%). Innovation is assessed through the lens of new materials, designs, and technologies impacting the industry. Regulatory frameworks influencing production, sales, and ethical sourcing are explored. The analysis considers substitute products (e.g., imitation jewelry) and their market impact. End-user segmentation is detailed, focusing on demographics and purchasing behaviors. Finally, we examine recent M&A activities, including deal values (xx Million) and their consequences for market dynamics.

- Market Concentration: xx% of the market is controlled by the top 5 players.

- M&A Activity: Total M&A deal value in the last 5 years is estimated at xx Million.

- Key Innovations: Focus on sustainable materials and digitally-driven marketing.

- Regulatory Landscape: Varying regulations across Latin American countries impact import/export and ethical sourcing.

Latin America Jewelry Industry Evolution

This section details the evolutionary trajectory of the Latin American jewelry market from 2019 to 2033. We analyze market growth trajectories, pinpointing specific growth rates (xx% CAGR projected for 2025-2033) and influencing technological advancements, such as 3D printing and online design tools. We examine shifting consumer preferences, highlighting the growing demand for ethically sourced jewelry and personalized designs. Data on online adoption rates (xx% of sales expected to be online by 2033) are included, providing a comprehensive overview of the industry’s dynamic evolution. The impact of economic fluctuations on consumer spending is also considered.

Leading Regions, Countries, or Segments in Latin America Jewelry Industry

This section identifies the leading regions, countries, and segments within the Latin American jewelry market based on category (Real Jewelry vs. Costume Jewelry), type (Necklaces, Rings, Earrings, Charms & Bracelets, Others), and distribution channel (Offline vs. Online). We will provide in-depth analysis of the factors contributing to their dominance.

- Dominant Region: Brazil (due to xx factors).

- Dominant Country: Brazil (due to large population and high disposable income).

- Dominant Segment (Category): Real Jewelry (driven by xx).

- Dominant Segment (Type): Earrings (xx% market share due to xx).

- Dominant Segment (Distribution Channel): Offline Retail Stores (currently at xx% market share, declining due to xx factors).

Key Drivers: Strong domestic markets (Brazil, Mexico, Colombia), rising disposable incomes, increasing demand for luxury goods, and government initiatives supporting the industry.

Latin America Jewelry Industry Product Innovations

This section highlights recent product innovations within the Latin American jewelry industry. We describe the unique selling propositions (USPs) of new products, including sustainable and ethically sourced materials, personalized designs, and technologically advanced manufacturing techniques such as 3D printing. We also examine their impact on market performance metrics, such as sales growth and brand differentiation.

Propelling Factors for Latin America Jewelry Industry Growth

Key growth drivers for the Latin American jewelry industry are examined, focusing on technological advancements (e.g., e-commerce platforms, online design tools), economic factors (e.g., rising middle class, increased disposable income), and favorable regulatory environments (e.g., government support for the industry).

Obstacles in the Latin America Jewelry Industry Market

This section discusses barriers and restraints to growth within the Latin American jewelry market. These include regulatory challenges (e.g., import/export restrictions), supply chain disruptions (e.g., material shortages), intense competitive pressures (e.g., price wars, counterfeit products), and economic volatility. We quantify the impact of these obstacles on market performance (e.g., xx% decrease in growth due to supply chain issues in 2022).

Future Opportunities in Latin America Jewelry Industry

This section explores emerging opportunities in the Latin American jewelry market. These include expansion into new markets (e.g., online sales in under-penetrated regions), adoption of new technologies (e.g., AR/VR for online sales), and catering to evolving consumer trends (e.g., sustainable and personalized jewelry).

Major Players in the Latin America Jewelry Industry Ecosystem

- Pandora AS

- Tous

- Compagnie Financiere Richemont SA

- LVMH

- Daniela Salcedo

- H Stern Jewelers Inc

- Manoel Bernardes SA

- Joias Vivara

- Haramara Jewelry

- Daniel Espinosa Jewelry

Key Developments in Latin America Jewelry Industry Industry

- 2022 Q4: Launch of a new sustainable jewelry line by Joias Vivara.

- 2023 Q1: Acquisition of a smaller jewelry company by Pandora AS.

- 2023 Q2: Introduction of new online design tools by a major player.

- (Further developments will be added in the final report)

Strategic Latin America Jewelry Industry Market Forecast

This report projects sustained growth for the Latin American jewelry industry, driven by increasing consumer spending, technological innovation, and evolving consumer preferences. The market is expected to reach xx Million by 2033, presenting significant opportunities for existing and new players. The strategic forecast incorporates insights from the previous sections, providing a comprehensive outlook on the future of the Latin American jewelry industry.

Latin America Jewelry Industry Segmentation

-

1. Category

- 1.1. Real Jewelry

- 1.2. Costume Jewelry

-

2. Type

- 2.1. Necklaces

- 2.2. Rings

- 2.3. Earrings

- 2.4. Charms & Bracelets

- 2.5. Others

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

-

4. Geography

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

- 4.4. Rest of Latin America

Latin America Jewelry Industry Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Colombia

- 4. Rest of Latin America

Latin America Jewelry Industry Regional Market Share

Geographic Coverage of Latin America Jewelry Industry

Latin America Jewelry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market

- 3.3. Market Restrains

- 3.3.1. Possibility of Rashes and Allergic Reactions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Diamond in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Real Jewelry

- 5.1.2. Costume Jewelry

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Necklaces

- 5.2.2. Rings

- 5.2.3. Earrings

- 5.2.4. Charms & Bracelets

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Colombia

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Mexico

- 5.5.3. Colombia

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Real Jewelry

- 6.1.2. Costume Jewelry

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Necklaces

- 6.2.2. Rings

- 6.2.3. Earrings

- 6.2.4. Charms & Bracelets

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Retail Stores

- 6.3.2. Online Retail Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Mexico

- 6.4.3. Colombia

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Mexico Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Real Jewelry

- 7.1.2. Costume Jewelry

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Necklaces

- 7.2.2. Rings

- 7.2.3. Earrings

- 7.2.4. Charms & Bracelets

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Retail Stores

- 7.3.2. Online Retail Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Mexico

- 7.4.3. Colombia

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Colombia Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Real Jewelry

- 8.1.2. Costume Jewelry

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Necklaces

- 8.2.2. Rings

- 8.2.3. Earrings

- 8.2.4. Charms & Bracelets

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Retail Stores

- 8.3.2. Online Retail Stores

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Mexico

- 8.4.3. Colombia

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Rest of Latin America Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Real Jewelry

- 9.1.2. Costume Jewelry

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Necklaces

- 9.2.2. Rings

- 9.2.3. Earrings

- 9.2.4. Charms & Bracelets

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Retail Stores

- 9.3.2. Online Retail Stores

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.4.3. Colombia

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Pandora AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tous

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Compagnie Financiere Richemont SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LVMH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daniela Salcedo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 H Stern Jewelers Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Manoel Bernardes SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Joias Vivara

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Haramara Jewelry*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Daniel Espinosa Jewelry

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pandora AS

List of Figures

- Figure 1: Latin America Jewelry Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Jewelry Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Jewelry Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 12: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 17: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 22: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Jewelry Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Latin America Jewelry Industry?

Key companies in the market include Pandora AS, Tous, Compagnie Financiere Richemont SA, LVMH, Daniela Salcedo, H Stern Jewelers Inc, Manoel Bernardes SA, Joias Vivara, Haramara Jewelry*List Not Exhaustive, Daniel Espinosa Jewelry.

3. What are the main segments of the Latin America Jewelry Industry?

The market segments include Category, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market.

6. What are the notable trends driving market growth?

Growing Demand for Diamond in the Market.

7. Are there any restraints impacting market growth?

Possibility of Rashes and Allergic Reactions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Jewelry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Jewelry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Jewelry Industry?

To stay informed about further developments, trends, and reports in the Latin America Jewelry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence