Key Insights

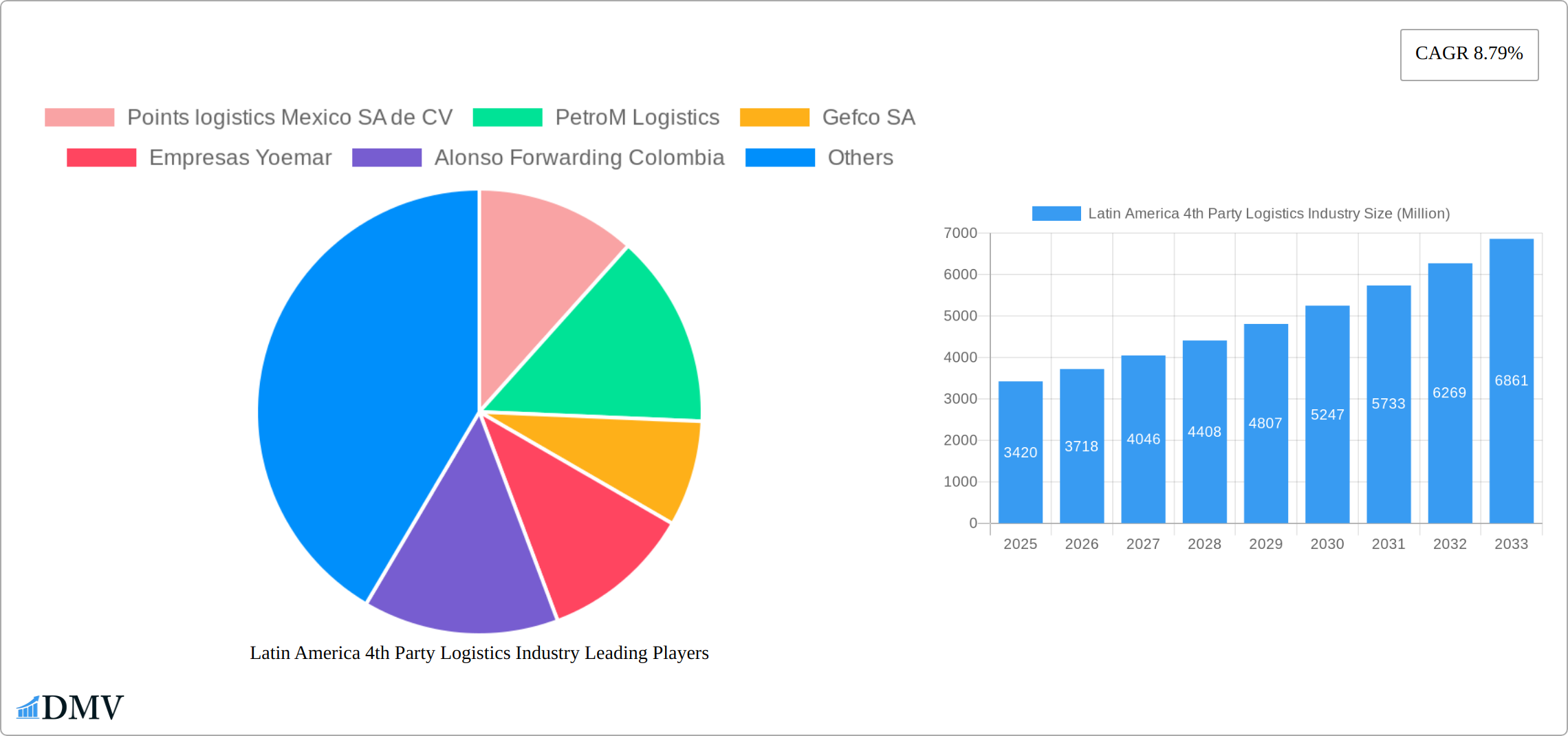

The Latin American 4PL market, valued at $3.42 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.79% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector in the region, particularly in countries like Brazil and Mexico, is driving demand for sophisticated logistics solutions. FMCG companies are increasingly outsourcing their logistics operations to 4PL providers to enhance efficiency and reduce costs, while the retail sector's embrace of omnichannel strategies necessitates flexible and scalable 4PL services. Furthermore, the growing need for supply chain visibility and optimization, coupled with increasing complexities in international trade, is propelling the adoption of 4PL solutions across various end-user industries, including technology, fashion, and reefer logistics. Technological advancements, such as AI and automation, are further optimizing operations and contributing to market growth.

Latin America 4th Party Logistics Industry Market Size (In Billion)

However, certain challenges persist. Infrastructure limitations in some parts of Latin America can hinder efficient logistics operations, while a shortage of skilled labor can impact the quality of service. Regulatory complexities and varying levels of digital infrastructure across different countries in the region also present hurdles. Despite these challenges, the long-term outlook for the Latin American 4PL market remains positive, driven by sustained e-commerce growth, rising consumer demand, and the increasing adoption of advanced logistics technologies. The market's segmentation across various operating models (Lead Logistics Provider, Solution Integrator, Digital Platform Solutions Provider) and end-user industries reflects the diverse needs of the region's businesses and offers opportunities for specialized 4PL providers. The presence of both global and regional players underscores the market's competitiveness and its potential for further consolidation.

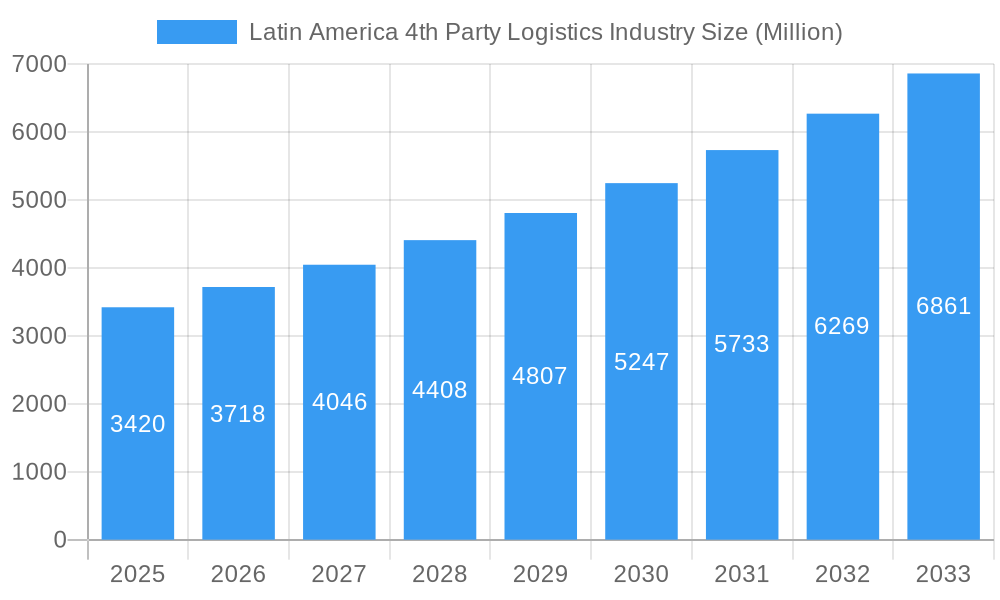

Latin America 4th Party Logistics Industry Company Market Share

Latin America 4th Party Logistics Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America 4th Party Logistics (4PL) industry, offering a comprehensive overview of market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, representing substantial growth from the xx Million recorded in 2024.

Latin America 4th Party Logistics Industry Market Composition & Trends

This section delves into the competitive landscape of the Latin American 4PL market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. The market is characterized by a moderate level of concentration, with a few major players holding significant market share, while numerous smaller companies compete in niche segments. The total market size in 2024 was estimated at xx Million.

Market Share Distribution: Kuehne + Nagel and DHL hold the largest shares, estimated at xx% and xx%, respectively. Other significant players include Points logistics Mexico SA de CV, PetroM Logistics, and Gefco SA, each holding around xx% collectively. The remaining market share is distributed among numerous smaller 4PL providers.

M&A Activity: The past five years have witnessed significant M&A activity, with deals totaling an estimated value of xx Million. These transactions reflect the consolidation trend within the industry and the strategic pursuit of enhanced capabilities and geographic expansion. For instance, DHL Supply Chain's acquisition of New Transport Applications in September 2022 illustrates this trend.

Innovation Catalysts: Technological advancements, such as AI-powered supply chain optimization tools and blockchain technology for enhanced transparency, are driving innovation within the 4PL sector.

Regulatory Landscape: Varying regulatory frameworks across Latin American countries present both opportunities and challenges for 4PL providers. Navigating diverse customs regulations and trade policies is crucial.

Substitute Products: The primary substitutes for 4PL services are traditional 3PL providers and in-house logistics operations. However, 4PL's strategic planning and end-to-end supply chain management capabilities are increasingly becoming more appealing.

End-User Profiles: Key end-users are diverse and include FMCG, retail, fashion and lifestyle, reefer, technology, and other sectors. FMCG and retail sectors represent significant portions of the overall market.

Latin America 4th Party Logistics Industry Industry Evolution

This section analyzes the historical and projected growth trajectory of the Latin American 4PL market, highlighting technological advancements and shifting consumer demands. The industry has experienced considerable growth in recent years, fueled by the expansion of e-commerce, the rise of global supply chains, and the increasing need for sophisticated logistics solutions. The compound annual growth rate (CAGR) during the historical period (2019-2024) was xx%, and it is expected to remain robust at approximately xx% during the forecast period (2025-2033). This growth is driven by the rising adoption of digital technologies and the increasing demand for integrated logistics solutions across multiple industry sectors.

The adoption of advanced technologies like AI, machine learning, and IoT (Internet of Things) is transforming the 4PL landscape, enabling enhanced visibility, optimized routing, predictive analytics, and improved efficiency. Demand for integrated, end-to-end solutions, rather than individual logistics services, has pushed the growth of the 4PL model. Furthermore, the rise of e-commerce and the associated demand for efficient last-mile delivery are further accelerating 4PL market expansion. The shift in consumer preferences towards faster delivery and greater transparency necessitates adoption of technologies that enable seamless tracking and delivery.

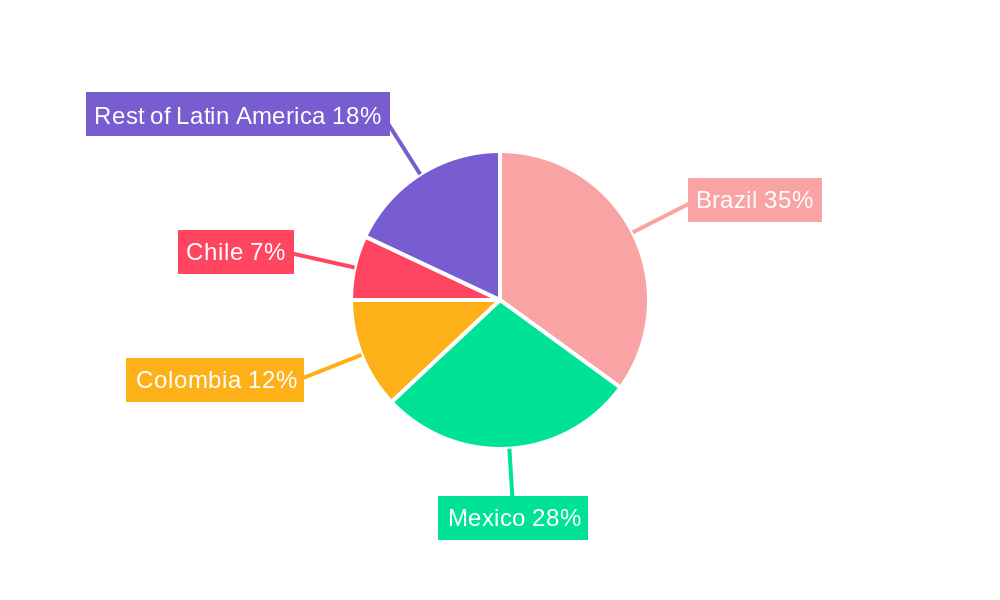

Leading Regions, Countries, or Segments in Latin America 4th Party Logistics Industry

The Latin American 4PL market is experiencing significant growth, driven by a confluence of factors including e-commerce expansion, increasing supply chain complexity, and the adoption of advanced technologies. This section analyzes the key regions, countries, and segments shaping this dynamic industry.

By Operating Model:

Lead Logistics Provider (LLP): LLPs maintain a substantial market share, offering comprehensive supply chain management services. This model is attractive due to its ability to centralize control and manage the complexities of global supply chains, particularly beneficial for multinational corporations operating in Latin America.

Solution Integrator Model: This model is gaining traction as businesses increasingly demand customized solutions tailored to their unique operational needs and industry specifics. The focus is on providing integrated, end-to-end solutions addressing specific pain points within the supply chain.

Digital Platform Solutions Provider (4PL): This rapidly evolving model leverages technology to provide enhanced visibility, efficiency, and scalability. The integration of advanced analytics, AI, and machine learning is key to optimizing supply chain performance and offering real-time data-driven insights.

By End-User Industry:

Fast-Moving Consumer Goods (FMCG): The high-volume, time-sensitive nature of FMCG supply chains fuels significant demand for 4PL services. The growth of e-commerce within this sector further intensifies the need for efficient and agile logistics solutions.

Retail: E-commerce expansion and the increasing importance of efficient last-mile delivery are key drivers of 4PL adoption in the retail sector. Retailers are seeking partners to optimize their fulfillment operations and enhance customer experience.

Manufacturing & Industrial Goods: This sector is increasingly relying on 4PL providers to manage complex global supply chains, ensuring timely delivery of components and finished goods. The need for sophisticated inventory management and supply chain risk mitigation is driving demand.

By Country:

Mexico: Mexico's robust economy, proximity to the US market, and significant manufacturing sector contribute to its leading position. Continued investment in infrastructure and a growing consumer base are further solidifying its dominance.

Brazil: Brazil's large and diverse economy, coupled with a rapidly expanding e-commerce sector, makes it a key market for 4PL services. Infrastructure development and growing domestic consumption are crucial growth factors.

Colombia and Chile: These countries represent significant growth opportunities, attracting investments in 4PL infrastructure and benefiting from economic diversification and expanding trade relationships.

Andean Region (Peru, Ecuador, Bolivia): This region offers significant, albeit less developed, potential for future growth. Increased regional trade and investment in logistics infrastructure will be key drivers.

Southern Cone (Argentina, Paraguay, Uruguay): The Southern Cone presents a unique market with considerable potential, though economic fluctuations might present challenges. Strategic partnerships and targeted investments are key to unlocking this market’s growth.

Latin America 4th Party Logistics Industry Product Innovations

Recent innovations focus on developing integrated platforms that leverage AI and machine learning for real-time visibility, predictive analytics, and optimized routing. These solutions offer enhanced supply chain visibility, proactive risk management, and data-driven decision-making capabilities. Blockchain technology is also being integrated to enhance transparency and security.

Propelling Factors for Latin America 4th Party Logistics Industry Growth

Growth is primarily driven by the expansion of e-commerce, increasing demand for efficient supply chain solutions, the rise of globalized business models, and investment in infrastructure, coupled with ongoing government support for logistics infrastructure development. Technological advancements, including AI and blockchain, further streamline operations and enhance efficiency.

Obstacles in the Latin America 4th Party Logistics Industry Market

Challenges include infrastructure limitations in certain regions, varying regulatory environments across countries, potential supply chain disruptions due to political or economic instability, and intense competition among 4PL providers. These factors can impact service reliability, cost-efficiency, and overall market growth.

Future Opportunities in Latin America 4th Party Logistics Industry

Opportunities exist in expanding into underserved markets, developing innovative solutions leveraging AI and blockchain, and catering to the rising demands of e-commerce and specialized sectors such as the reefer industry. Government initiatives promoting infrastructure development also present significant growth opportunities.

Major Players in the Latin America 4th Party Logistics Industry Ecosystem

- Points logistics Mexico SA de CV

- PetroM Logistics

- Gefco SA

- Empresas Yoemar

- Alonso Forwarding Colombia

- Logifashion

- Kuehne + Nagel

- Compass

- Belog Integrated Logistics Solutions

- Deutsche Post DHL

- XPLogistica

- 6 3 Other Companies

Key Developments in Latin America 4th Party Logistics Industry Industry

October 2022: EFL Global expands its Latin American presence with a new facility in San José, Costa Rica, offering warehousing, multimodal transportation, and customs processing services. This significantly increases their service capacity and market reach.

September 2022: DHL Supply Chain acquires New Transport Applications (NTA), a Mexican pharmaceutical logistics specialist, expanding its presence in the temperature-sensitive goods sector. This acquisition strengthens DHL's market share and expertise within a high-growth niche.

Strategic Latin America 4th Party Logistics Industry Market Forecast

The Latin American 4PL market is poised for substantial growth, driven by technological advancements, expanding e-commerce, and increasing demand for integrated supply chain solutions. Continued investment in infrastructure and favorable government policies will further fuel market expansion, creating significant opportunities for established and emerging players. The market is predicted to maintain a strong growth trajectory, with significant potential for increased market penetration and consolidation.

Latin America 4th Party Logistics Industry Segmentation

-

1. Operating Model

- 1.1. Lead Logistics Provider (LLP)

- 1.2. Solution Integrator Model

- 1.3. Digital Platform Solutions Provider (4PL)

-

2. End-User

- 2.1. FMCG (Fa

- 2.2. Retail (

- 2.3. Fashion and Lifestyle (Apparel, Footwear)

- 2.4. Reefer (

- 2.5. Technology (Consumer Electronics, Home Appliances)

- 2.6. Other End-Users

Latin America 4th Party Logistics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America 4th Party Logistics Industry Regional Market Share

Geographic Coverage of Latin America 4th Party Logistics Industry

Latin America 4th Party Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Growth in technology integration driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America 4th Party Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Model

- 5.1.1. Lead Logistics Provider (LLP)

- 5.1.2. Solution Integrator Model

- 5.1.3. Digital Platform Solutions Provider (4PL)

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. FMCG (Fa

- 5.2.2. Retail (

- 5.2.3. Fashion and Lifestyle (Apparel, Footwear)

- 5.2.4. Reefer (

- 5.2.5. Technology (Consumer Electronics, Home Appliances)

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Operating Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Points logistics Mexico SA de CV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PetroM Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gefco SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresas Yoemar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alonso Forwarding Colombia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Logifashion

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Compass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belog Integrated Logistics Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deutsche Post DHL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 XPLogistica**List Not Exhaustive 6 3 Other Companies (Overview/Key Information

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Points logistics Mexico SA de CV

List of Figures

- Figure 1: Latin America 4th Party Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America 4th Party Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Operating Model 2020 & 2033

- Table 2: Latin America 4th Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Operating Model 2020 & 2033

- Table 5: Latin America 4th Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Latin America 4th Party Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America 4th Party Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America 4th Party Logistics Industry?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Latin America 4th Party Logistics Industry?

Key companies in the market include Points logistics Mexico SA de CV, PetroM Logistics, Gefco SA, Empresas Yoemar, Alonso Forwarding Colombia, Logifashion, Kuehne + Nagel, Compass, Belog Integrated Logistics Solutions, Deutsche Post DHL, XPLogistica**List Not Exhaustive 6 3 Other Companies (Overview/Key Information.

3. What are the main segments of the Latin America 4th Party Logistics Industry?

The market segments include Operating Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products.

6. What are the notable trends driving market growth?

Growth in technology integration driving the market.

7. Are there any restraints impacting market growth?

4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

October 2022: EFL Global has increased its footprint in Latin America by opening a brand-new office and facility in Costa Rica's capital, San José. The facility will provide warehouse services, and multimodal transportation options, including ground, air, and ocean freight. Aside from warehouse alternatives with temperature-controlled, dangerous goods, and high-value cargo storage options, this new facility will also offer customs processing services, value-added services, and warehousing capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America 4th Party Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America 4th Party Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America 4th Party Logistics Industry?

To stay informed about further developments, trends, and reports in the Latin America 4th Party Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence