Key Insights

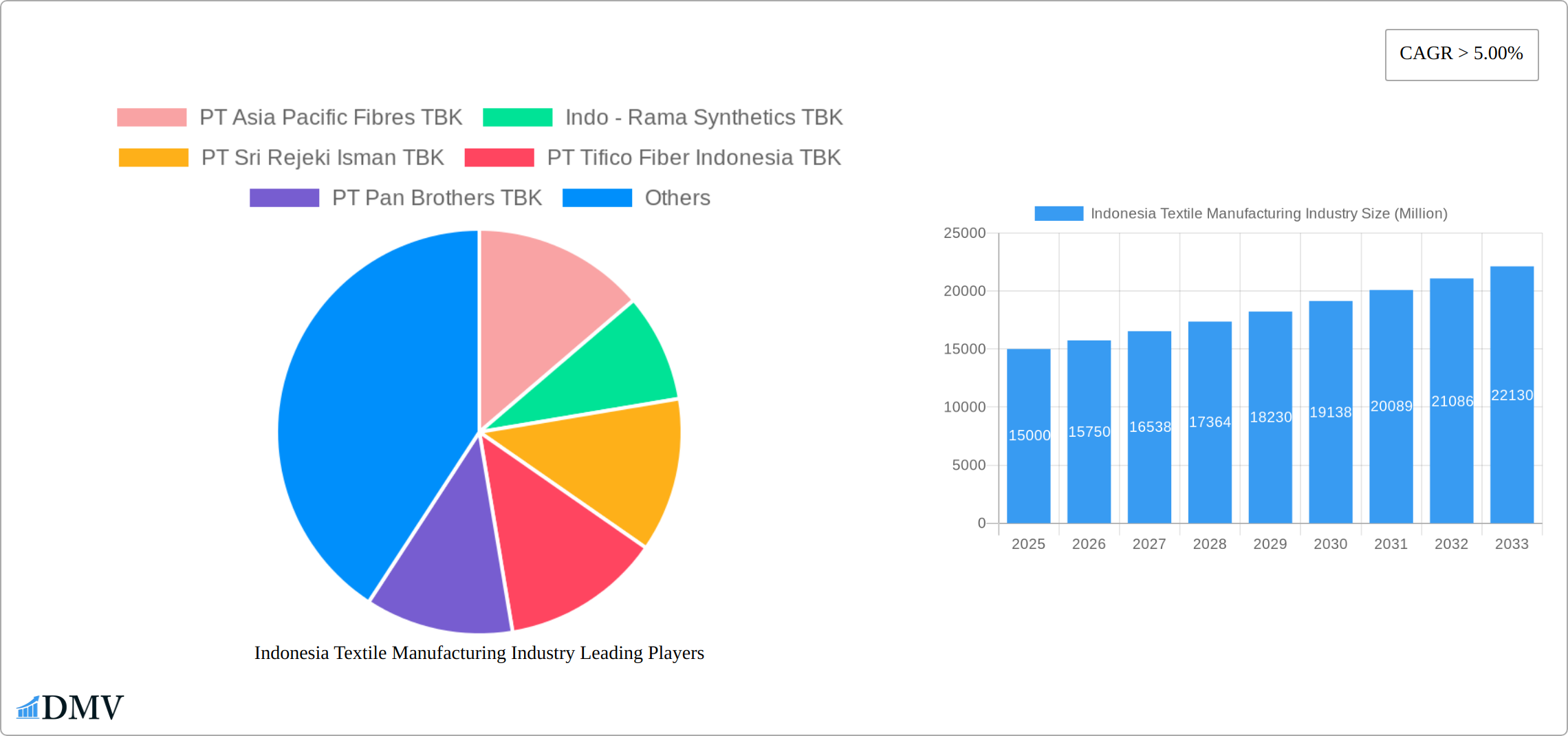

The Indonesian textile manufacturing industry is projected to reach $42 billion by 2025, with a compound annual growth rate (CAGR) of 4.84% anticipated between 2025 and 2033. This robust expansion is driven by a growing domestic consumer base, supportive government policies aimed at bolstering the manufacturing sector, and increasing foreign direct investment. Elevated demand for apparel and home textiles, both domestically and internationally, further fuels this growth trajectory. Nevertheless, the industry faces challenges including volatile raw material prices, particularly for cotton, intense regional competition, and rising labor costs. The market is segmented across apparel, home textiles, and industrial fabrics, each exhibiting distinct growth patterns. Leading companies are implementing strategic initiatives to overcome these obstacles and leverage emerging opportunities. Diversification into high-value products and the adoption of sustainable manufacturing practices are key strategies for enhancing competitiveness.

Indonesia Textile Manufacturing Industry Market Size (In Billion)

Looking forward, the Indonesian textile manufacturing industry is forecast to sustain a CAGR of over 5%. This sustained growth will be underpinned by persistent domestic demand, ongoing government support, and strategic operational optimizations by key industry players. Adapting to challenges and embracing innovation will be paramount. The integration of sustainable and technologically advanced manufacturing processes is critical for maintaining competitiveness and expanding market share. Consolidation through strategic alliances, mergers, and acquisitions is expected to reshape the competitive landscape. Long-term success will depend on effective cost management, responsiveness to evolving consumer preferences, and the strategic deployment of technological advancements to improve efficiency and productivity.

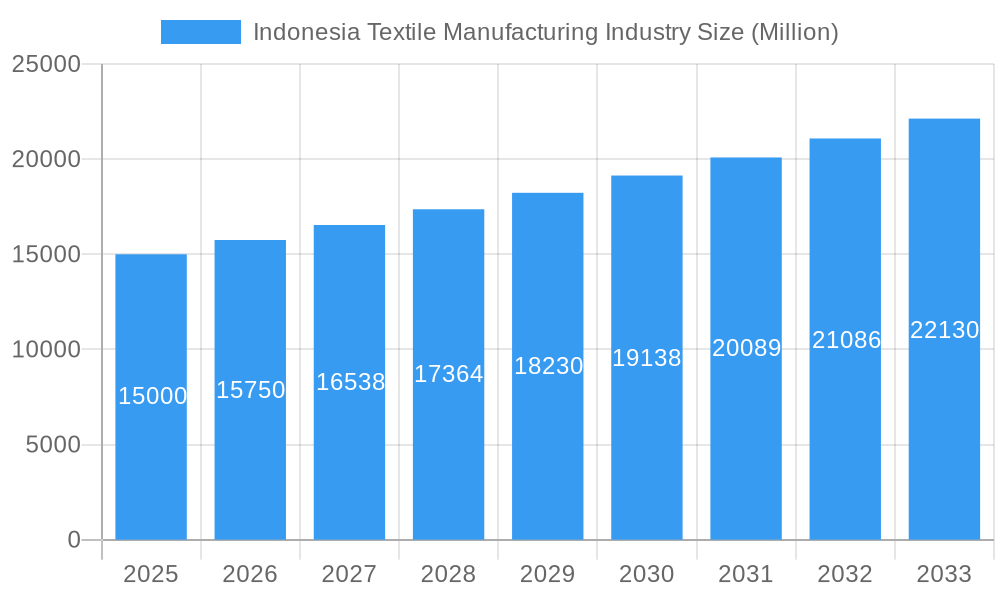

Indonesia Textile Manufacturing Industry Company Market Share

Indonesia Textile Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesian textile manufacturing industry, offering a comprehensive overview of its market composition, evolution, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The report projects a market value of xx Million by 2033, fueled by significant growth drivers and technological advancements.

Indonesia Textile Manufacturing Industry Market Composition & Trends

The Indonesian textile manufacturing industry is characterized by a moderately concentrated market with several dominant players alongside a significant number of smaller businesses. Market share distribution is currently skewed towards larger integrated mills, but the rise of specialized niche players is reshaping the landscape. Innovation is driven by the adoption of sustainable practices and technological advancements in production processes. The regulatory landscape, though evolving, presents both challenges and opportunities for businesses complying with labor and environmental standards. Substitute products from competing economies pose a significant challenge, necessitating continuous innovation. End-user profiles encompass both domestic and international markets, with the latter increasingly demanding higher quality and sustainable products. M&A activity within the sector has been relatively moderate in recent years, with deal values ranging from xx Million to xx Million, reflecting consolidation and strategic acquisitions.

- Market Concentration: Moderately concentrated, with a few dominant players holding significant market share.

- Innovation Catalysts: Sustainable practices, technological advancements in manufacturing processes.

- Regulatory Landscape: Evolving standards regarding labor and environmental compliance.

- Substitute Products: Competition from other textile-producing nations poses a significant challenge.

- End-User Profiles: Domestic and international markets, with increasing demand for sustainability.

- M&A Activities: Moderate activity, with deal values ranging from xx Million to xx Million.

Indonesia Textile Manufacturing Industry Industry Evolution

The Indonesian textile manufacturing industry has demonstrated robust and dynamic growth over the past decade. This expansion is underpinned by several key drivers, including a consistently increasing domestic consumption driven by a growing population and rising disposable incomes, alongside expanding export opportunities to both regional ASEAN markets and broader global arenas. Strategic government initiatives, designed to foster sector development and competitiveness, have also played a crucial role. Technological advancements, particularly in the realms of automation and digitalization, have been transformative, leading to significant improvements in production efficiency, product quality, and overall operational agility. However, the sector is not without its challenges. Increasing labor costs, a persistent concern, coupled with intense competition from countries with lower production costs, necessitate a continuous focus on value addition and efficiency gains. Furthermore, evolving consumer preferences, with a notable and growing emphasis on sustainable and ethically sourced products, are presenting both significant opportunities and demanding challenges for manufacturers to innovate and adapt their business models and production processes. Annual growth rates have exhibited fluctuations, ranging between **[Insert Specific Lower Percentage]%** and **[Insert Specific Higher Percentage]%** during the historical period (2019-2024). Looking ahead, the projected average annual growth rate for the forecast period (2025-2033) is estimated at **[Insert Projected Average Annual Growth Rate]%**. The adoption of new technologies, such as advanced automation systems and Industry 4.0 solutions, is currently estimated at approximately **[Insert Current Technology Adoption Percentage]%**, with a projected increase to **[Insert Projected Technology Adoption Percentage]%** by 2033, signaling a clear trend towards smart manufacturing and enhanced operational intelligence.

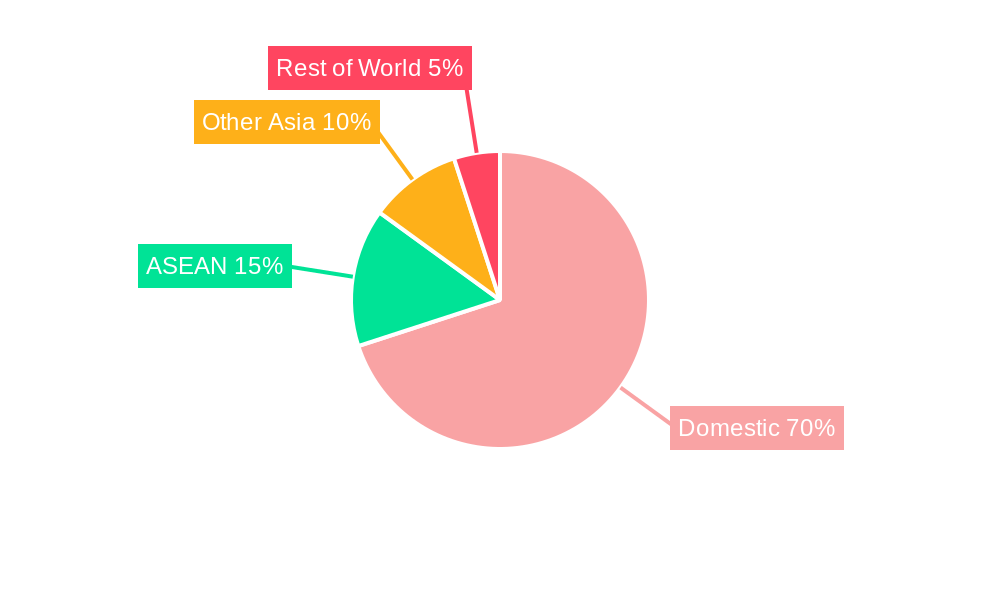

Leading Regions, Countries, or Segments in Indonesia Textile Manufacturing Industry

The dominance of specific regions and segments within the Indonesian textile industry is primarily influenced by factors such as infrastructure development, proximity to raw materials, and government support. While detailed regional data requires further investigation, initial analysis suggests that areas with established industrial zones and access to major ports enjoy a competitive advantage.

- Key Drivers of Dominance:

- Favorable Government Policies: Incentives and support for the industry drive growth in specific locations.

- Infrastructure Development: Efficient transportation networks and industrial zones are crucial for competitiveness.

- Access to Raw Materials: Proximity to cotton farms and other raw material sources reduces production costs.

- Skilled Labor Pool: Availability of skilled workers is essential for efficient and high-quality production.

The dominance of specific segments within the textile industry depends on consumer demand. Currently, garment manufacturing and woven fabrics segments seem to be strong performers. Continued growth will be shaped by shifts in consumer trends, particularly towards sustainable and ethically sourced materials.

Indonesia Textile Manufacturing Industry Product Innovations

Recent innovations in the Indonesian textile manufacturing industry are increasingly focused on a trifecta of critical areas: the integration of sustainable materials, the enhancement of production efficiency through advanced automation, and the development of products with demonstrably improved functionality and superior performance characteristics. This proactive approach includes the widespread adoption of recycled fabrics, a commitment to utilizing innovative dyeing techniques that significantly reduce water consumption and environmental impact, and the pioneering development of textiles with advanced properties such as enhanced breathability, exceptional durability, and built-in antimicrobial functionalities. These forward-thinking innovations are strategically designed to directly address and capitalize on the burgeoning global demand for textiles that are not only high-performing but also environmentally responsible and ethically produced.

Propelling Factors for Indonesia Textile Manufacturing Industry Growth

Growth in the Indonesian textile industry is propelled by a confluence of factors. Strong domestic consumption, fueled by a growing population and rising middle class, forms a solid base. Government support in the form of investment incentives and trade agreements facilitates export opportunities to regional and global markets. Technological advancements boost productivity and allow manufacturers to compete on quality and efficiency. Furthermore, a favorable investment climate attracts both domestic and foreign investment, contributing to sector expansion.

Obstacles in the Indonesia Textile Manufacturing Industry Market

The Indonesian textile industry grapples with a number of significant obstacles that can impede its progress and profitability. Chief among these are the persistent challenge of rising labor costs, intense and often price-driven competition from lower-cost global producers, and the inherent volatility of raw material prices, which can significantly impact production expenditures. Furthermore, susceptibility to supply chain disruptions, particularly exacerbated during periods of global economic or geopolitical uncertainty, can severely affect production schedules and the timely delivery of finished goods. Navigating and ensuring compliance with evolving regulatory frameworks, especially concerning stringent environmental and labor standards, presents another layer of complexity and potential cost. These multifaceted factors collectively exert considerable pressure on profit margins and can temper overall industry growth. The cumulative impact of these restraining forces could potentially lead to a reduction in annual growth rates by an estimated **[Insert Estimated Growth Reduction Percentage]%** during periods of peak disruption, underscoring the need for resilience and strategic mitigation planning.

Future Opportunities in Indonesia Textile Manufacturing Industry

The future outlook for the Indonesian textile industry is replete with significant and promising opportunities. A key avenue for growth lies in the strategic expansion into specialized niche markets, such as the high-potential sectors of technical textiles and advanced performance fabrics, which offer greater value addition and less susceptibility to price wars. Embracing and actively implementing circular economy principles, with a dedicated focus on textile recycling, upcycling, and the responsible sourcing of materials, is poised to create a distinct competitive advantage and resonate strongly with an increasingly environmentally conscious global consumer base. Leveraging cutting-edge technological advancements, with a particular emphasis on automation, artificial intelligence, and smart manufacturing (Industry 4.0) solutions, will be instrumental in further enhancing operational efficiency, boosting productivity, and solidifying the industry's competitive standing on the international stage. The escalating global demand for sustainable and ethically produced apparel and textiles presents a substantial and compelling market opportunity for manufacturers who are agile and proactive in adapting to these evolving consumer expectations and industry trends.

Major Players in the Indonesia Textile Manufacturing Industry Ecosystem

- PT Asia Pacific Fibres TBK

- Indo-Rama Synthetics TBK

- PT Sri Rejeki Isman TBK

- PT Tifico Fiber Indonesia TBK

- PT Pan Brothers TBK

- PT Ever Shine Tex TBK

- PT Trisula Textile Industries TBK

- PT Century Textile Industry TBK (Toray Industries)

- PT Polychem Indonesia TBK

- PT Argo Pantes TBK

- List Not Exhaustive

Key Developments in Indonesia Textile Manufacturing Industry Industry

- January 2022: Toray Industries of Indonesia forged a strategic partnership with Soramitsu (Japan) to pioneer the integration of blockchain technology. This collaboration aims to significantly enhance traceability throughout the supply chain and facilitate a robust closed-loop economy for textile recycling, thereby bolstering sustainability efforts and ensuring greater transparency in operations.

- March 2021: PT Pan Brothers took a significant step towards ethical sourcing by collaborating with the US Trust Cotton protocol. This partnership guarantees the use of sustainably sourced cotton, a move that not only enhances the brand's image but also appeals directly to environmentally aware and socially responsible consumers, demonstrating a strong commitment to ethical and sustainable practices within the industry.

Strategic Indonesia Textile Manufacturing Industry Market Forecast

The Indonesian textile manufacturing industry is poised for robust growth over the forecast period (2025-2033). This growth will be driven by a combination of increasing domestic demand, export opportunities, technological advancements, and a focus on sustainable practices. Addressing the challenges of rising labor costs and supply chain disruptions through automation and strategic partnerships will be crucial for sustained success. The continued focus on sustainability and innovation will attract foreign investment and position the Indonesian textile industry as a major player in the global market.

Indonesia Textile Manufacturing Industry Segmentation

-

1. Process Type

- 1.1. Spinning

- 1.2. Weaving

- 1.3. Knitting

- 1.4. Finishing

- 1.5. Other Process Types

-

2. Textile Type

- 2.1. Fiber

- 2.2. Yarn

- 2.3. Fabric

- 2.4. Garments

- 2.5. Other Textile Types

-

3. Equipment and Machinery

- 3.1. Simple Machines

- 3.2. Automated Machines

- 3.3. Console/Assembly Line Installations

Indonesia Textile Manufacturing Industry Segmentation By Geography

- 1. Indonesia

Indonesia Textile Manufacturing Industry Regional Market Share

Geographic Coverage of Indonesia Textile Manufacturing Industry

Indonesia Textile Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Exports driven by the Trade Agreements Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Textile Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Spinning

- 5.1.2. Weaving

- 5.1.3. Knitting

- 5.1.4. Finishing

- 5.1.5. Other Process Types

- 5.2. Market Analysis, Insights and Forecast - by Textile Type

- 5.2.1. Fiber

- 5.2.2. Yarn

- 5.2.3. Fabric

- 5.2.4. Garments

- 5.2.5. Other Textile Types

- 5.3. Market Analysis, Insights and Forecast - by Equipment and Machinery

- 5.3.1. Simple Machines

- 5.3.2. Automated Machines

- 5.3.3. Console/Assembly Line Installations

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Asia Pacific Fibres TBK

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Indo - Rama Synthetics TBK

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Sri Rejeki Isman TBK

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Tifico Fiber Indonesia TBK

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Pan Brothers TBK

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Ever Shine Tex TBK

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Trisula Textile Industries TBK

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Century Textile Industry TBK (Toray Industries)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Polychem Indonesia TBK

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Argo Pantes TBK**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Asia Pacific Fibres TBK

List of Figures

- Figure 1: Indonesia Textile Manufacturing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Textile Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Textile Type 2020 & 2033

- Table 3: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Equipment and Machinery 2020 & 2033

- Table 4: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 6: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Textile Type 2020 & 2033

- Table 7: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Equipment and Machinery 2020 & 2033

- Table 8: Indonesia Textile Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Textile Manufacturing Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Indonesia Textile Manufacturing Industry?

Key companies in the market include PT Asia Pacific Fibres TBK, Indo - Rama Synthetics TBK, PT Sri Rejeki Isman TBK, PT Tifico Fiber Indonesia TBK, PT Pan Brothers TBK, PT Ever Shine Tex TBK, PT Trisula Textile Industries TBK, PT Century Textile Industry TBK (Toray Industries), PT Polychem Indonesia TBK, PT Argo Pantes TBK**List Not Exhaustive.

3. What are the main segments of the Indonesia Textile Manufacturing Industry?

The market segments include Process Type, Textile Type, Equipment and Machinery.

4. Can you provide details about the market size?

The market size is estimated to be USD 42 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Exports driven by the Trade Agreements Boosting the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January, 2022: Toray Industries of Indonesia declared its collaboration with Soramitsu Company of Japan, which is a blockchain-based company. The main aim behind this collaboration is that Toray Industries want to focus on integrating proprietary recycling of fabrics, biomass, and other sustainable technologies that can contribute to a closed-loop economy means reusing fabrics. It also looks to integrate its product supply chain with Soramitsu's blockchain technologies to enhance traceability in product collection, reuse, and other processes. Such an approach would help engage all supply chain stakeholders in achieving a closed-loop economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Textile Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Textile Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Textile Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Indonesia Textile Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence