Key Insights

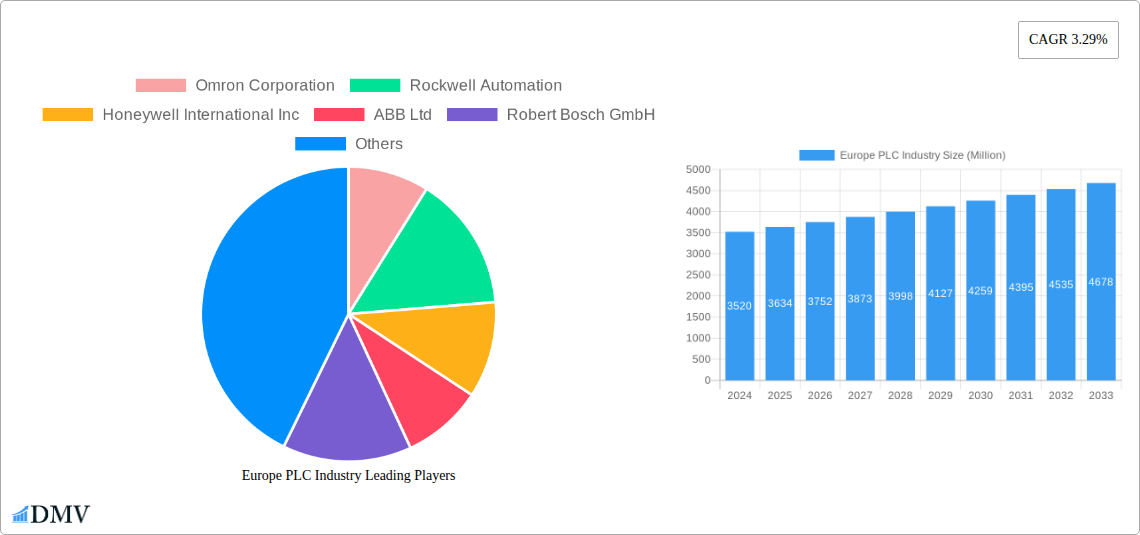

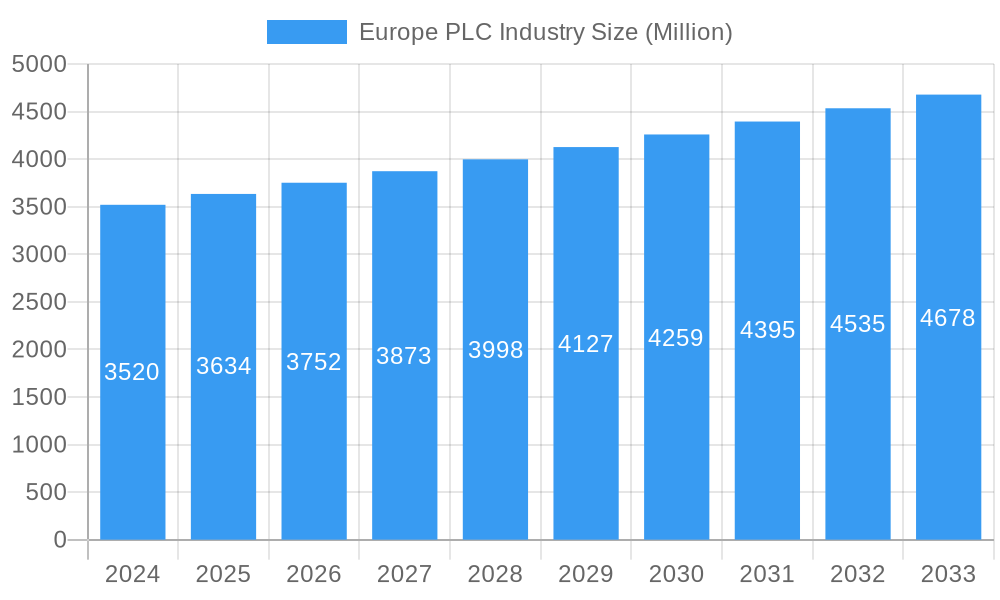

The European Programmable Logic Controller (PLC) market is poised for steady expansion, driven by increasing automation initiatives across diverse industrial sectors. With a current estimated market size of $3.52 billion, the industry is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 3.29% over the forecast period extending from 2025 to 2033. This growth is fundamentally propelled by the escalating adoption of Industry 4.0 technologies, the imperative for enhanced operational efficiency, and the continuous demand for sophisticated industrial automation solutions. Key market drivers include the robust manufacturing base within Europe, significant investments in smart factory concepts, and stringent regulatory requirements for process control and safety across industries like automotive, food & beverage, and pharmaceuticals. The hardware segment, encompassing various PLC types from large to nano, is expected to witness sustained demand, complemented by a growing need for advanced software solutions that enable sophisticated programming, monitoring, and data analytics.

Europe PLC Industry Market Size (In Billion)

The competitive landscape of the European PLC market is characterized by the presence of established global players and a growing number of specialized providers. Key trends shaping the market include the integration of AI and machine learning into PLC systems for predictive maintenance and enhanced decision-making, the rise of Industrial Internet of Things (IIoT) connectivity for seamless data exchange, and a shift towards more compact and modular PLC designs to accommodate space constraints in modern industrial settings. However, challenges such as the high initial investment costs for advanced automation systems and the need for skilled personnel to implement and manage these technologies may present some restraints. Despite these, the overall outlook remains positive, with significant opportunities in sectors like energy and utilities, and oil and gas, where automation is critical for optimizing complex operations and ensuring safety. The European market, with its strong industrial foundation and commitment to technological advancement, is expected to remain a significant contributor to the global PLC industry.

Europe PLC Industry Company Market Share

Europe PLC Industry Market Composition & Trends

This comprehensive report delves into the dynamic Europe PLC industry, analyzing market concentration, key innovation catalysts, evolving regulatory landscapes, the impact of substitute products, detailed end-user profiles, and strategic M&A activities. The market, currently experiencing a significant shift towards digitalization and smart manufacturing, exhibits a moderate level of concentration, with leading players like Siemens AG, ABB Ltd, and Schneider Electric SE holding substantial market share. Innovation is primarily driven by advancements in IoT integration, edge computing capabilities, and enhanced cybersecurity features within PLC hardware and software. Regulatory frameworks are increasingly focusing on industrial safety standards and data privacy, influencing product development and market entry strategies. While traditional PLCs remain dominant, advanced solutions incorporating AI and machine learning are emerging as key differentiators. End-users across sectors such as automotive, food & beverage, and pharmaceuticals are demanding more integrated and flexible automation solutions. M&A activities are on the rise as larger corporations seek to acquire niche technologies and expand their solution portfolios. Market Share Distribution: (Predictive: Siemens AG - 22%, ABB Ltd - 18%, Rockwell Automation - 15%, Schneider Electric SE - 13%, Omron Corporation - 10%, Honeywell International Inc - 8%, Robert Bosch GmbH - 6%, Other - 8%). M&A Deal Values: (Predictive: Estimated over 3,000 Million in the historical period, with projected growth of 15% annually). The study spans from 2019 to 2033, with a base year of 2025, providing an in-depth analysis of historical trends and future projections.

Europe PLC Industry Industry Evolution

The Europe PLC industry is undergoing a profound transformation, driven by the relentless march of Industry 4.0 and the increasing demand for smarter, more connected, and efficient industrial operations. Over the study period (2019–2033), the market has witnessed consistent growth, fueled by technological advancements and the widespread adoption of automation across diverse manufacturing sectors. The base year of 2025 marks a critical juncture, with a projected Compound Annual Growth Rate (CAGR) of 7.5% for the forecast period of 2025–2033. This robust growth is intrinsically linked to the evolution of PLC technology, moving beyond basic control functions to become intelligent hubs capable of data processing, predictive maintenance, and seamless integration with enterprise-level systems.

Key technological advancements propelling this evolution include the miniaturization of hardware, leading to the development of nano and small PLCs that offer greater flexibility and reduced footprint for specialized applications. Furthermore, the integration of advanced software functionalities, such as AI-powered analytics and machine learning algorithms, is enabling PLCs to perform more sophisticated tasks, optimizing production processes and reducing downtime. This shift is also reflected in the increasing demand for Industrial Internet of Things (IIoT) compatible PLCs, facilitating real-time data exchange and remote monitoring capabilities.

Shifting consumer demands for personalized products, faster delivery times, and higher quality standards are compelling manufacturers to invest in more agile and responsive automation solutions. PLCs are at the forefront of this shift, enabling flexible manufacturing lines that can quickly adapt to changing product requirements. The historical period (2019–2024) has seen a significant increase in investments in smart factory initiatives, with PLCs playing a pivotal role in building the backbone of these digitally integrated environments. Adoption metrics for IIoT-enabled PLCs have surged by an estimated 40% in the last two years alone. The forecast period is expected to witness further acceleration in the adoption of cloud-connected PLCs, advanced cybersecurity features, and sustainable automation solutions, solidifying the indispensable role of PLCs in the future of European manufacturing.

Leading Regions, Countries, or Segments in Europe PLC Industry

Within the dynamic Europe PLC industry, the Hardware and Software segment, particularly Large PLC and Medium PLC categories, currently exhibits the most significant dominance. This leadership is propelled by the ongoing digital transformation across major industrial sectors and the increasing complexity of automation requirements in factories and infrastructure projects across the continent. The Automotive industry and the Chemical and Petrochemical sectors, in particular, are major drivers of demand for these advanced PLC solutions.

Key Drivers for Dominance in Hardware and Software (Large & Medium PLC):

- High Investment Trends in Industry 4.0: European nations are heavily investing in smart factory initiatives, requiring robust and scalable PLC systems to manage complex production lines and integrate vast amounts of data. Estimated investment in this area exceeds 15,000 Million annually.

- Regulatory Support for Industrial Modernization: Government incentives and regulations promoting automation and digitalization across manufacturing sectors directly benefit the adoption of advanced PLC hardware and software.

- Demand for Increased Efficiency and Productivity: Industries like Automotive and Chemical require sophisticated control systems for precise operations, enabling higher throughput, reduced waste, and improved product quality.

- Growth of the IIoT Ecosystem: The proliferation of IIoT devices necessitates powerful PLCs capable of handling massive data streams, facilitating real-time monitoring, predictive maintenance, and remote control.

In-depth analysis reveals that countries such as Germany, France, and the United Kingdom are at the forefront of this dominance. Germany's strong manufacturing base, particularly in automotive and industrial machinery, consistently drives demand for high-performance PLCs. France's focus on modernizing its industrial infrastructure and the UK's emphasis on advanced manufacturing further contribute to the strong performance of this segment. The Automotive end-user industry, with its complex assembly lines and stringent quality control requirements, consistently accounts for the largest share of PLC deployments, estimated at 25% of the total market. The Chemical and Petrochemical sector follows closely, demanding robust, reliable, and safe PLC systems for process control.

While other segments like Nano PLC and services are experiencing significant growth, the foundational need for powerful, large-scale PLC hardware and integrated software solutions continues to solidify their leading position. The demand for integrated hardware and software platforms, offering seamless connectivity and advanced functionality, is a key factor in their sustained market leadership, with an estimated market share of 45% within the overall Europe PLC market.

Europe PLC Industry Product Innovations

The Europe PLC industry is characterized by continuous product innovation focused on enhancing intelligence, connectivity, and ease of use. Recent advancements include the development of PLCs with built-in edge computing capabilities, enabling faster data processing and decision-making directly at the machine level, reducing latency and reliance on cloud infrastructure. Integration of advanced cybersecurity features, such as secure boot and encrypted communication protocols, is becoming standard to protect against sophisticated cyber threats. Furthermore, the evolution of software platforms is enabling more intuitive programming environments, visual drag-and-drop interfaces, and seamless integration with cloud-based analytics tools. Performance metrics are improving with increased processing power, higher memory capacities, and faster scan times, allowing for more complex control algorithms and real-time optimization of industrial processes. The introduction of modular and scalable PLC architectures further enhances their adaptability to diverse application needs, from small-scale automation tasks to large enterprise-wide solutions.

Propelling Factors for Europe PLC Industry Growth

Several key factors are propelling the growth of the Europe PLC industry. Technological Advancements, particularly in areas like IIoT, AI, and edge computing, are creating demand for more intelligent and connected PLC solutions. The widespread adoption of Industry 4.0 principles across manufacturing sectors is a primary catalyst, as companies invest in smart factories to enhance efficiency, productivity, and flexibility. Government Initiatives and Funding aimed at modernizing industrial infrastructure and promoting digitalization further stimulate market growth. Growing Demand for Automation in sectors like automotive, food & beverage, and pharmaceuticals to meet stringent quality standards and reduce operational costs is also a significant driver. The increasing focus on Energy Efficiency and Sustainability in industrial operations is leading to the adoption of PLCs that can optimize energy consumption.

Obstacles in the Europe PLC Industry Market

Despite robust growth, the Europe PLC industry faces several obstacles. High Initial Investment Costs for advanced PLC systems and their integration can be a deterrent for small and medium-sized enterprises (SMEs). Shortage of Skilled Workforce with expertise in programming, implementing, and maintaining these complex automation systems poses a significant challenge. Cybersecurity Concerns remain a critical barrier, as the increasing connectivity of PLCs makes them vulnerable to cyberattacks, necessitating continuous investment in robust security measures, potentially adding up to 5% to total system costs. Supply Chain Disruptions, as witnessed in recent years, can impact the availability of critical components, leading to production delays and increased lead times. Interoperability Issues between different vendor systems can also hinder seamless integration, requiring custom solutions and increasing implementation complexity.

Future Opportunities in Europe PLC Industry

The Europe PLC industry is ripe with future opportunities. The accelerating adoption of IIoT and the Industrial Metaverse presents a significant avenue for growth, enabling more immersive monitoring, simulation, and control capabilities. The increasing demand for Sustainable Automation and energy-efficient solutions offers a substantial market for PLCs designed to optimize resource utilization. The expansion of Edge Computing within PLC architectures will unlock new possibilities for real-time data analytics and autonomous decision-making. Furthermore, the growing trend of Remote Operations and Maintenance necessitates advanced PLC functionalities for remote access, diagnostics, and troubleshooting. The development of more user-friendly, low-code/no-code PLC programming platforms will democratize automation, opening up opportunities in previously underserved sectors and SMEs.

Major Players in the Europe PLC Industry Ecosystem

- Siemens AG

- ABB Ltd

- Rockwell Automation

- Schneider Electric SE

- Omron Corporation

- Honeywell International Inc

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Emerson Electric Co

- Panasonic Corporation

- Beckhoff Automation

- General Electric Co

- Hitachi Ltd

Key Developments in Europe PLC Industry Industry

- February 2024: WEG introduced the PLC410 programmable logic controller, a versatile solution for industrial automation targeting equipment manufacturers (OEMs) in packaging, labeling, and filling machines, with applications in pulp and paper, metallurgy, pharmaceuticals, and sugar and alcohol industries.

- October 2023: Mouser Electronics, Inc. entered a distribution pact with Siemens, expanding its portfolio to include Siemens' industrial automation products, such as networking devices, power supplies, HMI solutions, and circuit protection offerings.

Strategic Europe PLC Industry Market Forecast

The strategic Europe PLC market forecast indicates continued robust growth, driven by the overarching trends of digital transformation and the imperative for enhanced industrial automation. The increasing integration of AI, machine learning, and IIoT capabilities within PLC systems will redefine operational efficiencies and unlock new avenues for predictive maintenance and data-driven decision-making. The ongoing shift towards smart manufacturing and the demand for agile, flexible production lines will further fuel the adoption of advanced PLC hardware and software solutions. Investments in cybersecurity will remain paramount, ensuring the resilience of critical infrastructure. Emerging opportunities lie in sustainable automation, edge computing advancements, and the development of more accessible programming interfaces, collectively poised to shape a dynamic and expanding market landscape. The projected CAGR of 7.5% for the forecast period (2025–2033) underscores the significant potential and strategic importance of the Europe PLC industry.

Europe PLC Industry Segmentation

-

1. Type

-

1.1. Hardware and Software

- 1.1.1. Large PLC

- 1.1.2. Nano PLC

- 1.1.3. Small PLC

- 1.1.4. Medium PLC

- 1.1.5. Other Hardware Types

- 1.2. Service

-

1.1. Hardware and Software

-

2. End-user Industry

- 2.1. Food, Tobacco, and Beverage

- 2.2. Automotive

- 2.3. Chemical and Petrochemical

- 2.4. Energy and Utilities

- 2.5. Pharmaceutical

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Europe PLC Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

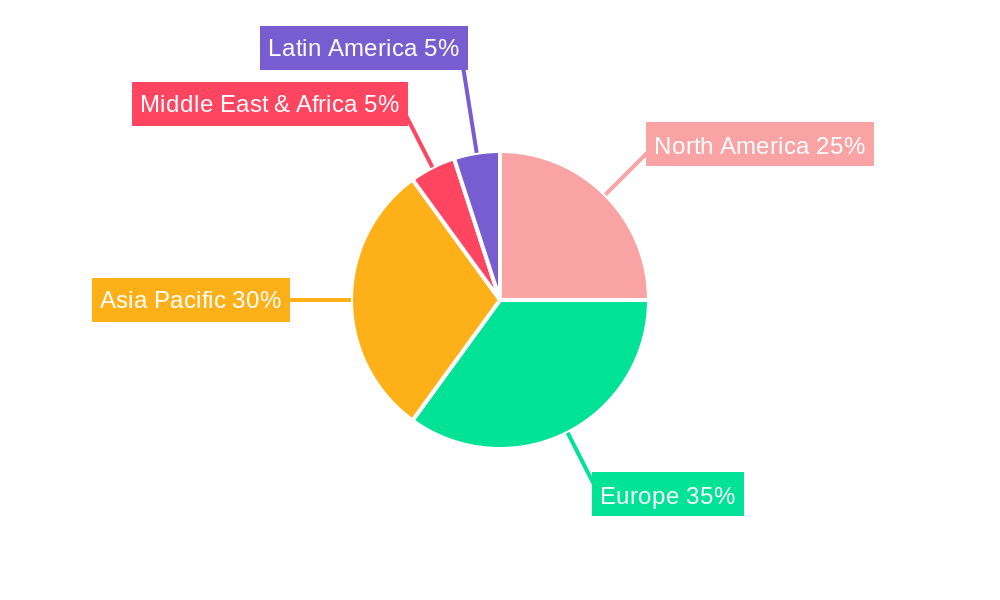

Europe PLC Industry Regional Market Share

Geographic Coverage of Europe PLC Industry

Europe PLC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption of Automation Systems; Ease of Use and Familiarity with PLC Programming to Sustain Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of AC Technology

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe PLC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware and Software

- 5.1.1.1. Large PLC

- 5.1.1.2. Nano PLC

- 5.1.1.3. Small PLC

- 5.1.1.4. Medium PLC

- 5.1.1.5. Other Hardware Types

- 5.1.2. Service

- 5.1.1. Hardware and Software

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food, Tobacco, and Beverage

- 5.2.2. Automotive

- 5.2.3. Chemical and Petrochemical

- 5.2.4. Energy and Utilities

- 5.2.5. Pharmaceutical

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Omron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rockwell Automation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ABB Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Robert Bosch GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emerson Electric Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Panasonic Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Electric Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siemens AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Beckhoff Automatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 General Electric Co

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Schneider Electric SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Omron Corporation

List of Figures

- Figure 1: Europe PLC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe PLC Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe PLC Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe PLC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe PLC Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe PLC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe PLC Industry?

The projected CAGR is approximately 3.29%.

2. Which companies are prominent players in the Europe PLC Industry?

Key companies in the market include Omron Corporation, Rockwell Automation, Honeywell International Inc, ABB Ltd, Robert Bosch GmbH, Hitachi Ltd, Emerson Electric Co, Panasonic Corporation, Mitsubishi Electric Corporation, Siemens AG, Beckhoff Automatio, General Electric Co, Schneider Electric SE.

3. What are the main segments of the Europe PLC Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of Automation Systems; Ease of Use and Familiarity with PLC Programming to Sustain Growth.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Adoption of AC Technology.

8. Can you provide examples of recent developments in the market?

February 2024 - WEG recently introduced the PLC410 programmable logic controller, a versatile solution for industrial automation. While it finds applications across diverse sectors like pulp and paper, metallurgy, pharmaceuticals, and sugar and alcohol, its primary focus targets equipment manufacturers (OEMs) in industries like packaging, labeling, and filling machines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe PLC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe PLC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe PLC Industry?

To stay informed about further developments, trends, and reports in the Europe PLC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence