Key Insights

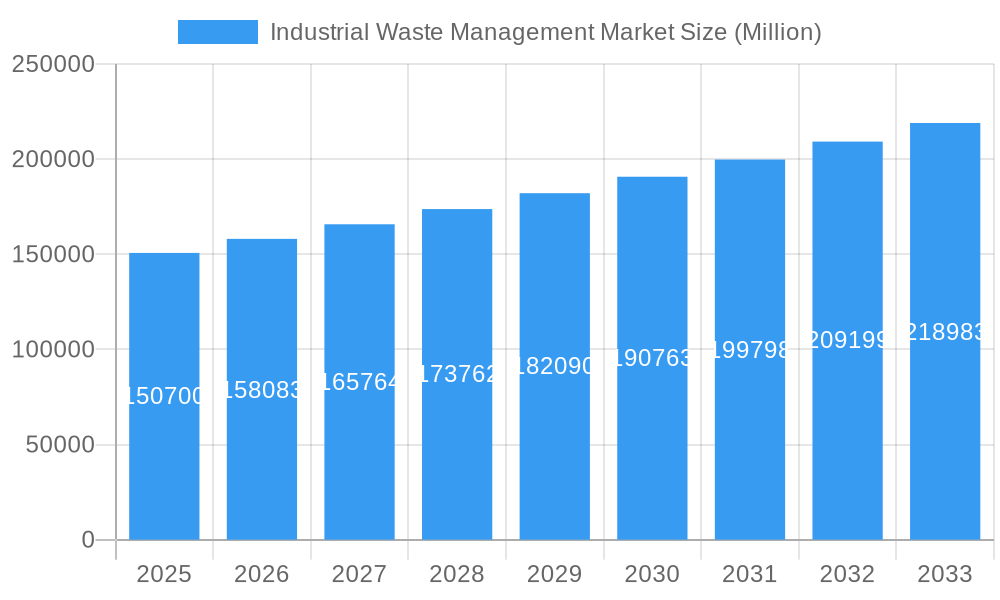

The global industrial waste management market, valued at $150.70 billion in 2025, is projected to experience robust growth, driven by stringent environmental regulations, increasing industrialization, and a rising focus on sustainable waste disposal practices. A compound annual growth rate (CAGR) of 4.79% is anticipated from 2025 to 2033, indicating a significant market expansion. Key growth drivers include the rising volume of hazardous and non-hazardous industrial waste generated globally, coupled with the increasing demand for efficient and environmentally sound waste management solutions. The shift towards circular economy principles, promoting waste reduction, reuse, and recycling, further fuels market expansion. Companies are investing heavily in advanced waste treatment technologies, including waste-to-energy conversion and advanced recycling processes, to enhance efficiency and reduce environmental impact. While challenges such as fluctuating raw material prices and stringent regulatory compliance requirements exist, the overall market outlook remains positive, driven by long-term growth in industrial production and increasing awareness of environmental sustainability.

Industrial Waste Management Market Market Size (In Billion)

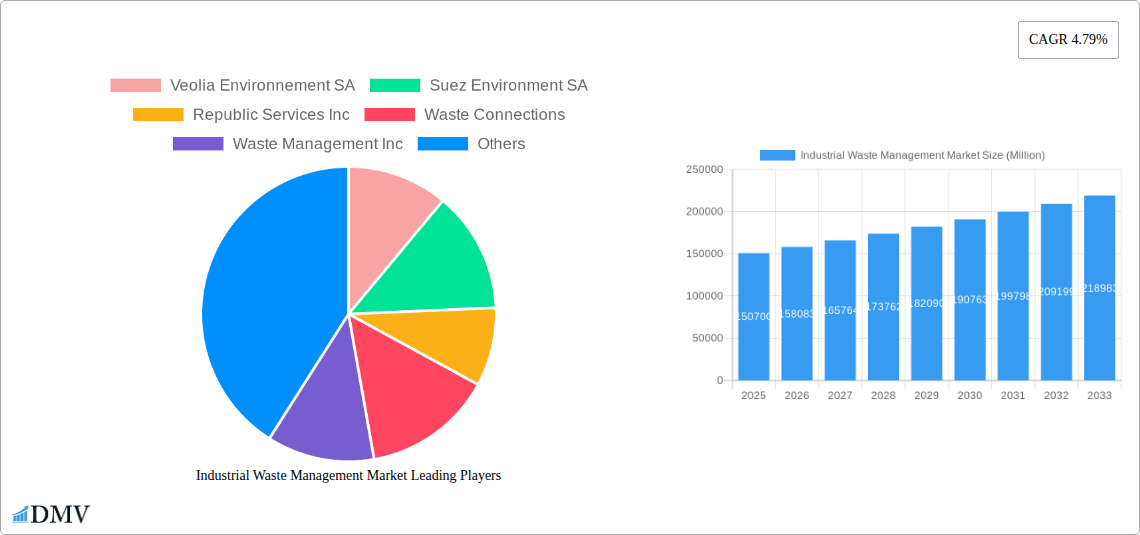

Major players like Veolia Environnement SA, Suez Environment SA, Waste Management Inc., and Republic Services Inc. are shaping the market through strategic acquisitions, technological advancements, and expansion into new geographical regions. Market segmentation likely includes hazardous waste management, non-hazardous waste management, and specialized services like recycling and remediation. Regional variations in market growth are expected, with developed economies exhibiting a steady growth trajectory due to established infrastructure and robust regulatory frameworks. Emerging economies, conversely, are poised for faster growth, driven by rapid industrialization and urbanization, leading to increased waste generation and the subsequent demand for efficient waste management services. This presents significant opportunities for both established players and new entrants. The market's future growth will be influenced by government policies promoting sustainable waste management, technological innovations improving efficiency and reducing costs, and evolving consumer preferences towards environmentally responsible practices.

Industrial Waste Management Market Company Market Share

Industrial Waste Management Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Industrial Waste Management Market, offering crucial insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report delivers a comprehensive overview of market trends, competitive dynamics, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Industrial Waste Management Market Composition & Trends

This section delves into the intricate landscape of the industrial waste management market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with key players like Veolia Environnement SA, Suez Environment SA, and Waste Management Inc. holding significant market share. However, the presence of numerous regional and specialized players contributes to a competitive dynamic.

- Market Share Distribution: Veolia Environnement SA holds an estimated xx% market share, followed by Suez Environment SA at xx% and Waste Management Inc. at xx%. The remaining share is distributed among numerous regional and specialized players.

- Innovation Catalysts: Stringent environmental regulations and increasing awareness of sustainable waste management practices are driving innovation in waste-to-energy technologies, advanced recycling methods, and digital waste tracking systems.

- Regulatory Landscape: Varying governmental regulations across different regions significantly influence market growth and operational strategies. Stringent regulations in developed nations push for higher recycling rates and stricter disposal methods, while emerging economies are gradually adopting similar measures.

- Substitute Products: The market faces competition from alternative waste management approaches, including incineration and landfilling, though these are increasingly scrutinized due to environmental concerns.

- End-User Profiles: The primary end-users include manufacturing industries (chemicals, food processing, etc.), construction and demolition sectors, and healthcare facilities.

- M&A Activities: The past five years have witnessed a significant number of M&A deals in the sector, with deal values averaging xx Million. These transactions reflect strategic consolidation within the industry and expansion into new geographical markets.

Industrial Waste Management Market Industry Evolution

The industrial waste management market has undergone a significant and dynamic evolution, transitioning from basic disposal methods to sophisticated, sustainable, and economically driven solutions. Over the past decade, this sector has experienced robust growth, fueled by a confluence of factors. Key among these are the relentless pace of industrialization globally, which inherently generates larger waste volumes, and the increasingly stringent environmental regulations enacted by governments worldwide. These mandates are not only pushing industries towards compliance but also fostering a greater awareness of the profound environmental and economic implications of effective waste management. Technological advancements are at the forefront of this transformation, with innovations such as Artificial Intelligence (AI)-powered waste sorting systems revolutionizing efficiency and accuracy in separating different waste streams. Coupled with advanced recycling technologies that enable higher recovery rates and the extraction of valuable resources, these innovations are reshaping market dynamics. Furthermore, a growing consumer and corporate demand for sustainable and ethically responsible waste management practices is creating new market niches and driving competitive differentiation. Looking ahead, the market is poised for an accelerated growth phase, largely driven by the widespread adoption of circular economy principles, which prioritize resource longevity and minimal waste, and a substantial increase in investments allocated towards building and enhancing sustainable waste management infrastructure. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be a significant xx%, underscoring a highly positive and dynamic growth outlook for the industrial waste management sector.

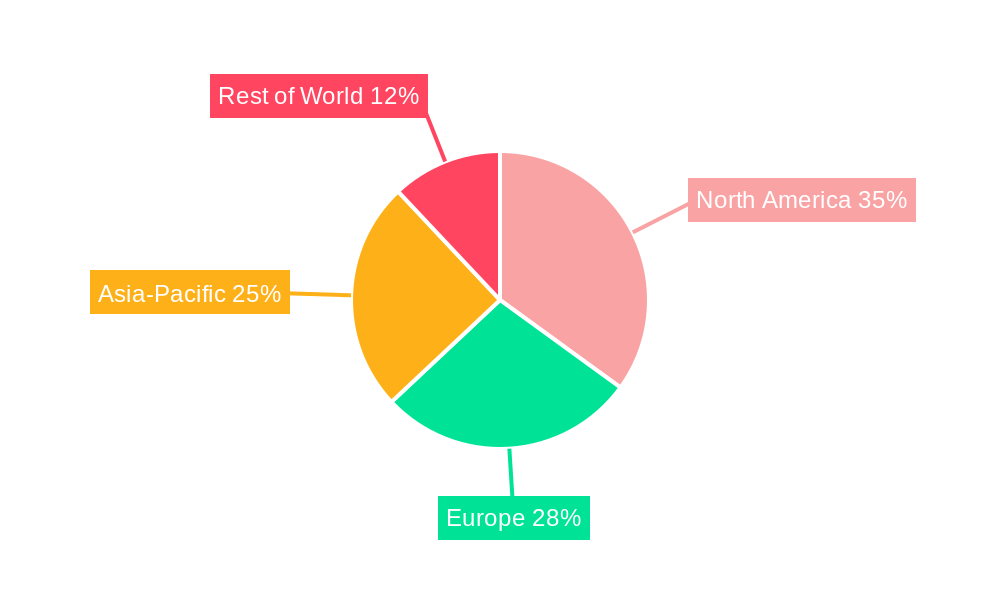

Leading Regions, Countries, or Segments in Industrial Waste Management Market

The North American and European regions currently dominate the industrial waste management market, driven by stringent environmental regulations, high levels of industrial activity, and well-established waste management infrastructure. However, Asia-Pacific is poised for significant growth due to rapid industrialization and increasing government initiatives.

- Key Drivers for North America: Strong regulatory frameworks, high investments in waste management infrastructure, and a mature market landscape are major contributors to this region's dominance.

- Key Drivers for Europe: Similar to North America, strict environmental regulations, coupled with a focus on the circular economy, fuel market growth.

- Key Drivers for Asia-Pacific: Rapid industrialization, rising disposable incomes, and increasing government investments in waste management infrastructure are driving substantial growth in this region.

- Key Drivers for other Regions: Although smaller in market size compared to the regions above, South America, the Middle East, and Africa are witnessing increasing demand for efficient waste management solutions fueled by factors such as population growth and urbanisation.

Industrial Waste Management Market Product Innovations

The landscape of industrial waste management is continuously being reshaped by groundbreaking product innovations. At the vanguard are advanced sorting technologies that leverage the power of Artificial Intelligence (AI) and machine learning to achieve unprecedented levels of precision and speed in waste stream separation. This leads to higher purity of recovered materials and greater efficiency in downstream processing. Concurrently, significant strides have been made in waste-to-energy systems, which now offer substantially higher energy conversion efficiencies and a marked reduction in emissions, transforming waste into a valuable energy resource. The development of novel biodegradable and compostable packaging materials is also a critical innovation, directly addressing the pervasive issue of single-use plastics and non-biodegradable waste. These collective advancements are strategically designed to tackle the core challenges of effective waste separation, maximizing energy recovery from waste streams, and minimizing the overall environmental footprint of industrial operations. The unique selling propositions of these innovations lie in their ability to deliver enhanced automation, optimize the recovery of valuable resources, and ultimately lead to a reduction in operational costs for businesses.

Propelling Factors for Industrial Waste Management Market Growth

The expansion of the industrial waste management market is being propelled by a robust set of interconnected factors. A primary driver is the escalating global concern over environmental degradation, which, in tandem with increasingly stringent government regulations and policies, is compelling industries to proactively adopt more sustainable and responsible waste management practices. This regulatory pressure is forcing a paradigm shift from traditional disposal methods to integrated waste management strategies. Secondly, the burgeoning emphasis on the principles of a circular economy is a significant catalyst. This economic model champions the continuous use and recovery of resources, thereby minimizing reliance on virgin materials and drastically reducing the volume of waste sent to landfills. Finally, rapid technological advancements are playing a pivotal role. Innovations such as AI-powered waste sorting systems, advanced chemical and mechanical recycling methods, and sophisticated data analytics for waste tracking are not only significantly improving operational efficiency but are also making waste management more cost-effective for industries.

Obstacles in the Industrial Waste Management Market

Despite its potential, the industrial waste management market faces challenges. High initial investment costs for advanced technologies may hinder adoption, particularly among smaller companies. Supply chain disruptions and fluctuating raw material prices can impact profitability. Moreover, varying regulatory landscapes across different regions add to the complexity of operations and create compliance burdens. These factors can collectively impact market growth.

Future Opportunities in Industrial Waste Management Market

The industrial waste management market is replete with promising future opportunities, particularly in the expansion of sustainable waste management solutions into emerging markets. Developing economies, characterized by rapid industrialization, represent a significant untapped potential for advanced waste management services and technologies. Furthermore, ongoing advancements in waste-to-energy technologies, including more efficient conversion processes and the utilization of diverse waste streams, alongside the development of innovative recycling methods for complex materials, present substantial avenues for market growth and investment. The global drive to reduce plastic waste and embrace the tenets of the circular economy will continue to be a major impetus, fostering increased demand for highly efficient, technologically advanced, and sustainable waste management systems that can effectively process and recover value from these materials.

Major Players in the Industrial Waste Management Market Ecosystem

- Veolia Environnement SA (Veolia)

- Suez Environment SA (Suez)

- Republic Services Inc (Republic Services)

- Waste Connections (Waste Connections)

- Waste Management Inc (Waste Management)

- Remondis AG & Co Kg

- Biffa Group (Biffa)

- Clean Harbors Inc (Clean Harbors)

- Covanta Holding Corporation (Covanta)

- Daiseki Co Ltd

Key Developments in Industrial Waste Management Market Industry

- November 2023: NEC Corporation Ltd. launched a real-time industrial waste monitoring system in Thailand, enhancing waste tracking and reducing illegal disposal.

- November 2023: P&G launched a digital watermarking test in France for improved recycling through the Holy Grail 2.0 program.

- May 2023: Waste Management Inc. announced plans to build a new construction and demolition recycling plant, significantly increasing recycling capacity.

Strategic Industrial Waste Management Market Forecast

The industrial waste management market is poised for significant growth, driven by factors such as stringent environmental regulations, technological advancements, and the increasing adoption of circular economy principles. The market's future potential is immense, with opportunities for innovation and expansion in emerging economies. Continued investment in sustainable infrastructure and technological advancements will further fuel market expansion in the coming years.

Industrial Waste Management Market Segmentation

-

1. Disposal Methods

- 1.1. Landfill

- 1.2. Incineration

- 1.3. Recycling

-

2. Type

- 2.1. Hazardous

- 2.2. Non-hazardous

Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Industrial Waste Management Market Regional Market Share

Geographic Coverage of Industrial Waste Management Market

Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Environmental Regulations; Growing Awareness of Sustainability

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Growing Awareness of Sustainability

- 3.4. Market Trends

- 3.4.1. A Growing Demand for Industrial Waste Management is Anticipated in Asia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.1.1. Landfill

- 5.1.2. Incineration

- 5.1.3. Recycling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hazardous

- 5.2.2. Non-hazardous

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 6. North America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 6.1.1. Landfill

- 6.1.2. Incineration

- 6.1.3. Recycling

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Hazardous

- 6.2.2. Non-hazardous

- 6.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 7. Europe Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 7.1.1. Landfill

- 7.1.2. Incineration

- 7.1.3. Recycling

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Hazardous

- 7.2.2. Non-hazardous

- 7.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 8. Asia Pacific Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 8.1.1. Landfill

- 8.1.2. Incineration

- 8.1.3. Recycling

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Hazardous

- 8.2.2. Non-hazardous

- 8.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 9. Middle East and Africa Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 9.1.1. Landfill

- 9.1.2. Incineration

- 9.1.3. Recycling

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Hazardous

- 9.2.2. Non-hazardous

- 9.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 10. Latin America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 10.1.1. Landfill

- 10.1.2. Incineration

- 10.1.3. Recycling

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Hazardous

- 10.2.2. Non-hazardous

- 10.1. Market Analysis, Insights and Forecast - by Disposal Methods

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Veolia Environnement SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Suez Environment SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Republic Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Waste Connections

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Management Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Remondis AG & Co Kg

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Biffa Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clean Harbors Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Covanta Holding Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Daiseki Co Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Veolia Environnement SA

List of Figures

- Figure 1: Global Industrial Waste Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Waste Management Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 4: North America Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 5: North America Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 6: North America Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 7: North America Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 9: North America Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 16: Europe Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 17: Europe Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 18: Europe Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 19: Europe Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 28: Asia Pacific Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 29: Asia Pacific Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 30: Asia Pacific Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 31: Asia Pacific Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 32: Asia Pacific Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 33: Asia Pacific Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 40: Middle East and Africa Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 41: Middle East and Africa Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 42: Middle East and Africa Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 43: Middle East and Africa Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Middle East and Africa Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Middle East and Africa Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East and Africa Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Industrial Waste Management Market Revenue (Million), by Disposal Methods 2025 & 2033

- Figure 52: Latin America Industrial Waste Management Market Volume (Billion), by Disposal Methods 2025 & 2033

- Figure 53: Latin America Industrial Waste Management Market Revenue Share (%), by Disposal Methods 2025 & 2033

- Figure 54: Latin America Industrial Waste Management Market Volume Share (%), by Disposal Methods 2025 & 2033

- Figure 55: Latin America Industrial Waste Management Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Latin America Industrial Waste Management Market Volume (Billion), by Type 2025 & 2033

- Figure 57: Latin America Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Latin America Industrial Waste Management Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Latin America Industrial Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Industrial Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Latin America Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Industrial Waste Management Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 2: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 3: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Global Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 8: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 9: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 18: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 19: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Germany Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 34: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 35: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 37: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Japan Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: India Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: South Korea Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 50: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 51: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Global Industrial Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 56: Global Industrial Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 57: Global Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Global Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 59: Global Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Waste Management Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Industrial Waste Management Market?

Key companies in the market include Veolia Environnement SA, Suez Environment SA, Republic Services Inc, Waste Connections, Waste Management Inc, Remondis AG & Co Kg, Biffa Group, Clean Harbors Inc, Covanta Holding Corporation, Daiseki Co Ltd**List Not Exhaustive.

3. What are the main segments of the Industrial Waste Management Market?

The market segments include Disposal Methods, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Environmental Regulations; Growing Awareness of Sustainability.

6. What are the notable trends driving market growth?

A Growing Demand for Industrial Waste Management is Anticipated in Asia.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Growing Awareness of Sustainability.

8. Can you provide examples of recent developments in the market?

November 2023: NEC Corporation Ltd announced the successful installation and delivery of a real-time industrial waste monitoring system to promote effective waste management in Thailand's industry estates. The system, designed in collaboration with the Industrial Estate Authority of Thailand, gives the ability to track, observe, and manage the movement of industrial waste from source to disposal. This system helps reduce the risk of illegal waste disposal and ensures the safety of the environment and the public.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence