Key Insights

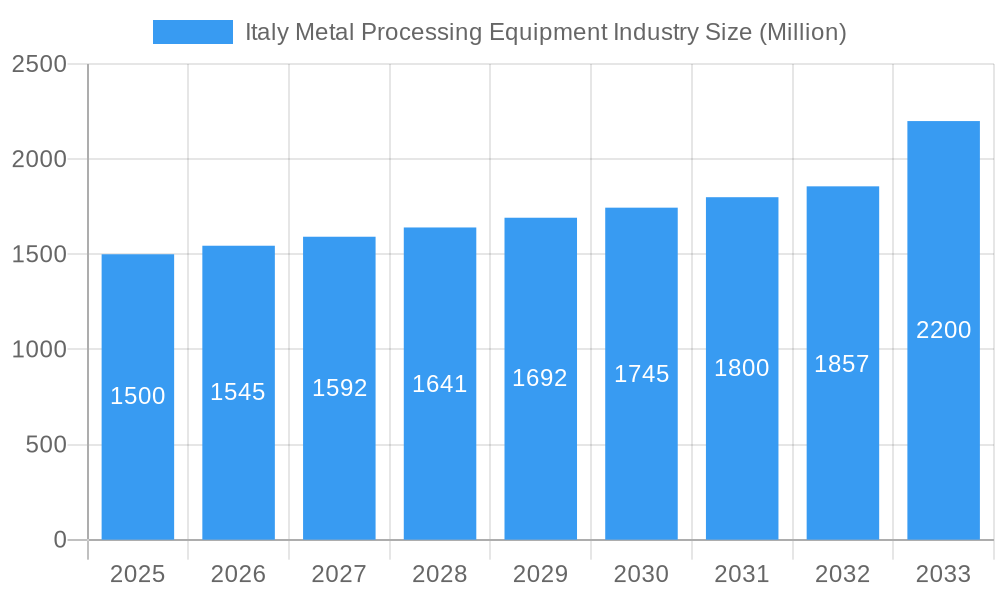

The Italian metal processing equipment market, valued at $1.8 billion in 2024, is poised for substantial growth with a projected Compound Annual Growth Rate (CAGR) of 1.941% from 2024 to 2033. This expansion is primarily driven by the robust performance of Italy's automotive and aerospace industries, which require continuous investment in precision metal processing machinery. The increasing demand for tailored products and expedited production cycles is also accelerating the adoption of automation and flexible manufacturing systems. Government-led industrial modernization programs further bolster market momentum. However, price volatility of raw materials and global competition present potential headwinds.

Italy Metal Processing Equipment Industry Market Size (In Billion)

The market is segmented by equipment type (e.g., laser cutting, bending, milling), application (automotive, aerospace, construction), and region (North, Central, South Italy). Leading companies like Kapco, DMG Mori, and TRUMPF are instrumental in shaping market dynamics through innovation and strategic collaborations.

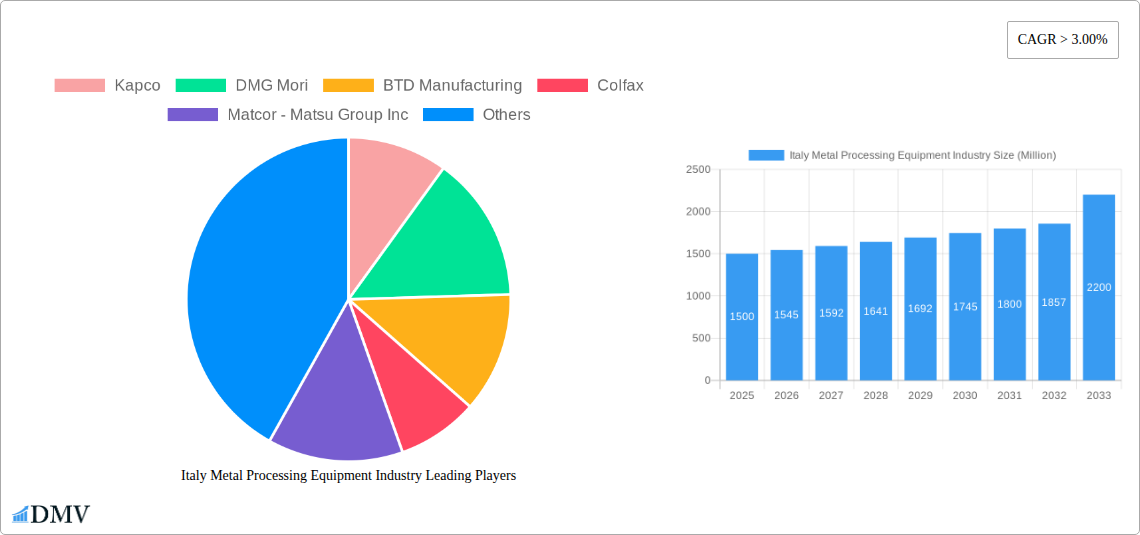

Italy Metal Processing Equipment Industry Company Market Share

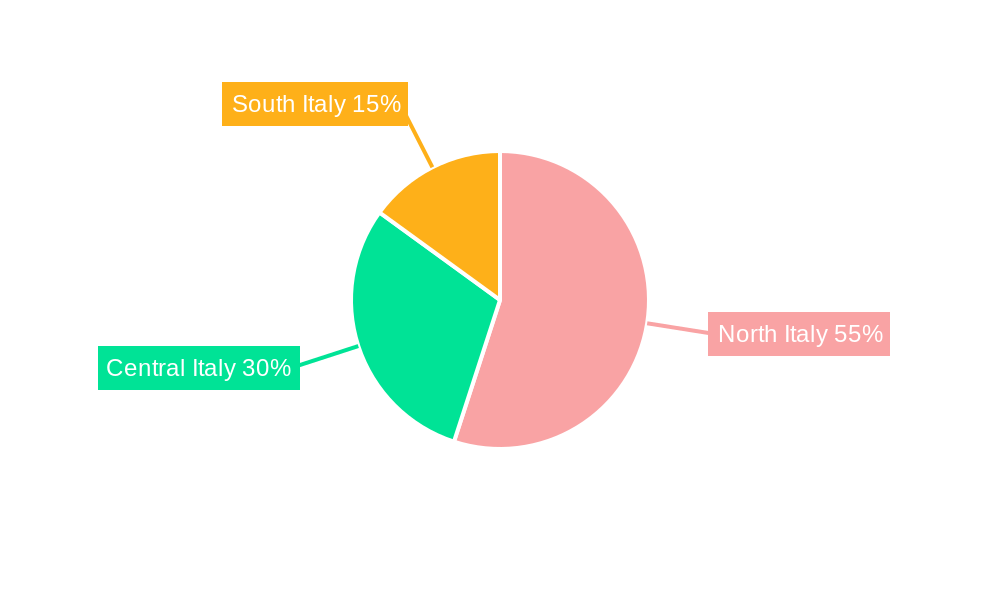

The forecast period (2024-2033) anticipates market expansion beyond $1.8 billion by 2033. This growth is underpinned by Italy's manufacturing sector expansion, the widespread integration of Industry 4.0 technologies, and the persistent need for efficient and accurate metal processing solutions. While economic fluctuations may influence investment, the market's fundamental growth drivers ensure a positive long-term outlook. Northern Italy is expected to retain its leading market share due to its high concentration of manufacturing activities. Competitive advantage will increasingly hinge on technological advancements, superior after-sales support, and the capacity to meet specialized customer requirements.

Italy Metal Processing Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Italy Metal Processing Equipment industry, offering valuable insights for stakeholders seeking to understand market dynamics, growth trajectories, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers crucial data-driven intelligence for informed decision-making. The total market value in 2025 is estimated at xx Million.

Italy Metal Processing Equipment Industry Market Composition & Trends

The Italian metal processing equipment market is characterized by a dynamic and evolving landscape. While a few dominant players hold substantial market share, a vibrant ecosystem of numerous specialized small and medium-sized enterprises (SMEs) fosters intense competition and innovation. This duality ensures both robust technological advancement and a highly responsive market.

Market Share Distribution (2025 Estimates):

- Top 5 Players: [Insert Percentage]%

- Remaining Players: [Insert Percentage]%

Innovation Catalysts: The relentless pursuit of efficiency, precision, and sustainability drives innovation. Key catalysts include the widespread adoption of automation, the integration of digital technologies aligned with Industry 4.0 principles, and the development of advanced sustainable manufacturing processes. These advancements not only improve operational performance but also address growing environmental concerns, thereby bolstering market demand.

Regulatory Landscape: Stringent European Union directives concerning environmental protection and worker safety exert a significant influence on the design and manufacturing of metal processing equipment. Compliance with these regulations necessitates continuous investment in cleaner, safer, and more energy-efficient technologies, acting as a powerful impetus for technological progress within the industry.

Substitute Products: While direct substitutes for core metal processing equipment are limited, alternative manufacturing methodologies, such as advanced additive manufacturing (3D printing) for specific, niche applications, present a developing, albeit currently minor, competitive pressure.

End-User Profiles: The Italian metal processing equipment industry serves a diverse and critical array of sectors. Prominent end-users include the automotive industry, aerospace manufacturers, the robust construction sector, and the dynamic consumer goods manufacturing segment. This broad application base underscores the foundational role of metal processing equipment in Italy's industrial economy.

M&A Activities: The market has recently witnessed strategic consolidations that are reshaping its structure. A notable example is the acquisition of the Italian Sovema Group by Schuler in August 2022, a transaction estimated at [Insert Estimated Value] Million. Such mergers and acquisitions are pivotal in consolidating technological capabilities, expanding market reach, and driving further innovation. The trend is expected to continue as larger entities seek to enhance their competitive edge and technological prowess.

Italy Metal Processing Equipment Industry Industry Evolution

This section traces the evolutionary path of the Italian metal processing equipment industry, analyzing market growth trajectories, technological advancements, and shifts in consumer demand. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by factors such as increased industrial activity and investments in modernizing production capabilities. The forecast period (2025-2033) anticipates a CAGR of xx%, fueled by continued technological advancements, government initiatives promoting industrial growth, and rising demand from key end-use sectors. This growth is further supported by increasing adoption rates of advanced technologies like laser cutting, robotic automation, and digital twinning. The shift towards sustainable manufacturing practices also represents a significant driver, pushing demand for environmentally friendly equipment.

Leading Regions, Countries, or Segments in Italy Metal Processing Equipment Industry

The Northern region of Italy dominates the metal processing equipment market, due to factors such as a high concentration of manufacturing industries, robust infrastructure, and a skilled workforce.

Key Drivers for Northern Italy's Dominance:

- High concentration of automotive, machinery, and aerospace industries.

- Significant government investments in infrastructure and technological innovation.

- Access to skilled labor and specialized technical expertise.

- Proximity to major European markets.

Italy Metal Processing Equipment Industry Product Innovations

Recent innovations include advancements in laser cutting technology offering improved precision and speed, robotic automation systems increasing efficiency and reducing labor costs, and the integration of digital twinning for predictive maintenance and optimized production processes. These advancements significantly enhance the performance and efficiency of metal processing equipment, providing unique selling propositions focused on improved precision, reduced production time, and enhanced sustainability.

Propelling Factors for Italy Metal Processing Equipment Industry Growth

The expansion of the Italian metal processing equipment market is propelled by a confluence of powerful drivers. Foremost among these are the continuous technological advancements, particularly in automation and digitalization, which are revolutionizing manufacturing processes. Significant investments in industrial modernization by the Italian government further bolster this growth. Additionally, escalating demand from crucial end-user sectors such as the automotive and aerospace industries provides a strong market pull. The increasing global emphasis on sustainable manufacturing practices is also a key factor, fostering demand for environmentally conscious and energy-efficient equipment solutions.

Obstacles in the Italy Metal Processing Equipment Industry Market

Challenges include potential supply chain disruptions impacting the availability of raw materials and components, increasing competition from foreign manufacturers, and the need for continuous investment in research and development to stay ahead of technological advancements. Furthermore, regulatory compliance can impose additional costs and complexity for manufacturers. These factors can potentially curb market growth, and require strategic mitigation.

Future Opportunities in Italy Metal Processing Equipment Industry

The Italian metal processing equipment sector is ripe with emerging opportunities. The growing demand for highly customized solutions tailored to specific client needs presents a significant avenue for growth. The integration of cutting-edge additive manufacturing technologies into traditional metal processing workflows offers novel production possibilities. Furthermore, expansion into new and specialized niche market segments, catering to evolving industrial requirements, holds substantial potential. The pervasive adoption of Industry 4.0 principles and the sustained focus on sustainable manufacturing practices will continue to create fertile ground for innovation and market expansion. Moreover, the global transition towards electric vehicles presents a particularly compelling and large-scale opportunity for manufacturers of specialized metal processing equipment.

Major Players in the Italy Metal Processing Equipment Industry Ecosystem

- Kapco

- DMG Mori (DMG Mori)

- BTD Manufacturing

- Colfax (Colfax)

- Matcor - Matsu Group Inc

- Standard Iron and Wire Works

- TRUMPF (TRUMPF)

- Bystronic Laser AG (Bystronic Laser AG)

- List Not Exhaustive

Key Developments in Italy Metal Processing Equipment Industry Industry

- August 2022: The acquisition of the Italian Sovema Group by Schuler (a member of ANDRITZ) marked a significant development, particularly in the domain of battery cell production equipment. This strategic move not only bolsters Italy's capacity in supplying critical technologies for the rapidly expanding electric vehicle industry but also highlights the consolidation and specialization trends within the market.

- June 2022: While not directly an Italian transaction, the acquisition of Chicago Elite Manufacturing Technologies by CGI Automated Manufacturing underscores a broader global trend of consolidation impacting the precision sheet metal components and assemblies market. This event serves as an indicator of potential similar strategic movements and opportunities for collaboration or acquisition within the Italian market landscape.

Strategic Italy Metal Processing Equipment Industry Market Forecast

The Italian metal processing equipment market is projected to experience sustained and robust growth throughout the forecast period (2025-2033). This optimistic outlook is underpinned by the continuous wave of technological advancements, substantial ongoing investments in industrial modernization, and the persistent high demand from key end-use sectors. The imperative for sustainability and the pervasive integration of Industry 4.0 principles are set to further accelerate market expansion. Consequently, the forecast indicates a highly favorable environment for market participants. To capitalize on these opportunities and ensure continued success, strategic investments in research and development, alongside a proactive and agile approach to adapting to evolving market demands and technological shifts, will be paramount.

Italy Metal Processing Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. Equipment Type

- 2.1. Cutting

- 2.2. Machining

- 2.3. Forming

- 2.4. Welding

- 2.5. Other Equipment Types

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Manufacturing

- 3.3. Power and Utilities

- 3.4. Construction

- 3.5. Other End-user Industries

Italy Metal Processing Equipment Industry Segmentation By Geography

- 1. Italy

Italy Metal Processing Equipment Industry Regional Market Share

Geographic Coverage of Italy Metal Processing Equipment Industry

Italy Metal Processing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.941% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is the Key Trend Driving Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Metal Processing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Cutting

- 5.2.2. Machining

- 5.2.3. Forming

- 5.2.4. Welding

- 5.2.5. Other Equipment Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Manufacturing

- 5.3.3. Power and Utilities

- 5.3.4. Construction

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DMG Mori

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BTD Manufacturing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colfax

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Matcor - Matsu Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Standard Iron and Wire Works

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bystronic Laser AG**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kapco

List of Figures

- Figure 1: Italy Metal Processing Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Metal Processing Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 3: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 7: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Metal Processing Equipment Industry?

The projected CAGR is approximately 1.941%.

2. Which companies are prominent players in the Italy Metal Processing Equipment Industry?

Key companies in the market include Kapco, DMG Mori, BTD Manufacturing, Colfax, Matcor - Matsu Group Inc, Standard Iron and Wire Works, TRUMPF, Bystronic Laser AG**List Not Exhaustive.

3. What are the main segments of the Italy Metal Processing Equipment Industry?

The market segments include Product Type, Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is the Key Trend Driving Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: The Italian Sovema Group was acquired by Schuler, a part of the global technology group ANDRITZ, enabling it to become a leading systems supplier of battery cell production solutions for the automobile industry and other markets. In collaboration with Sovema, Schuler will create the tools required to outfit gigafactories for the mass manufacture of lithium-ion batteries, whose widespread availability is crucial for the commercial viability of eco-friendly e-mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Metal Processing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Metal Processing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Metal Processing Equipment Industry?

To stay informed about further developments, trends, and reports in the Italy Metal Processing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence