Key Insights

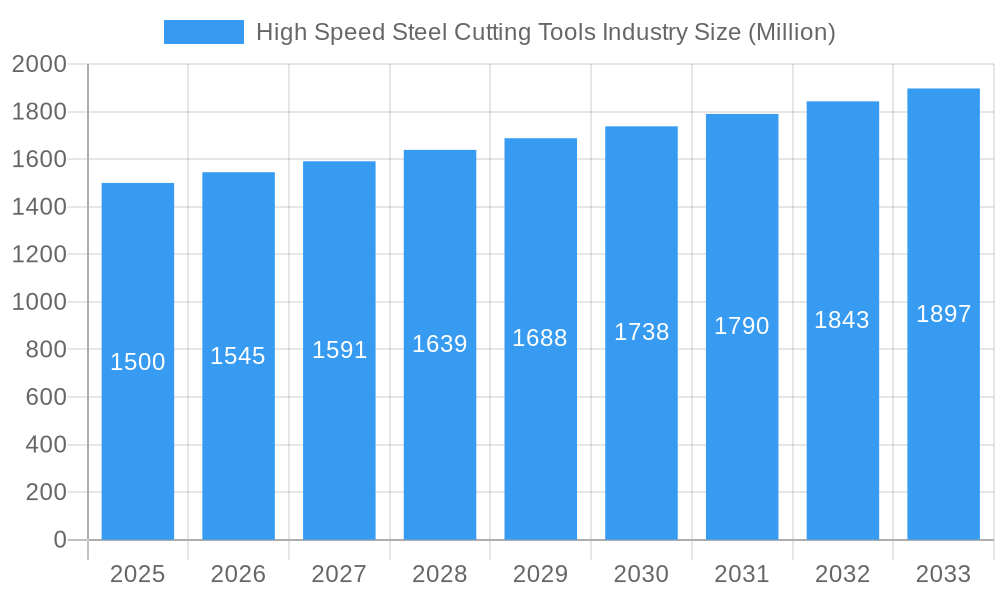

The global High-Speed Steel (HSS) cutting tools market is projected to reach $1.9 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4.2% from 2024 to 2033. This expansion is primarily fueled by the escalating demand for precision machining across critical industries such as automotive, aerospace, and general manufacturing. Technological advancements in HSS tool design, including material composition enhancements and advanced coating technologies, are significantly improving tool longevity and machining efficiency. The increasing adoption of automation in manufacturing processes further bolsters market growth, as automated systems necessitate durable and reliable cutting tools like those made from HSS. Challenges, however, include rising raw material costs and competition from alternative materials like carbide and ceramics. Nevertheless, the persistent need for high-quality, cost-effective machining solutions ensures sustained market growth. The market is segmented by tool type (e.g., drills, taps, end mills) and application, catering to specific industry requirements. Leading companies such as EraSteel, Kennametal, and Sandvik are instrumental in driving innovation and market competitiveness through strategic expansion initiatives.

High Speed Steel Cutting Tools Industry Market Size (In Billion)

Geographically, the market demonstrates varied growth dynamics, with developing economies anticipated to experience accelerated expansion due to their expanding manufacturing bases, potentially surpassing growth rates in established markets like North America and Europe. The competitive environment features a blend of established multinational corporations and regional entities, contributing to diverse pricing and product portfolios. Future market trends will likely be shaped by a growing focus on manufacturing sustainability, including eco-friendly cutting fluids and recycling programs. The forecast period is expected to witness continuous innovation aimed at extending tool life, enhancing surface finish quality, and reducing energy consumption in machining operations.

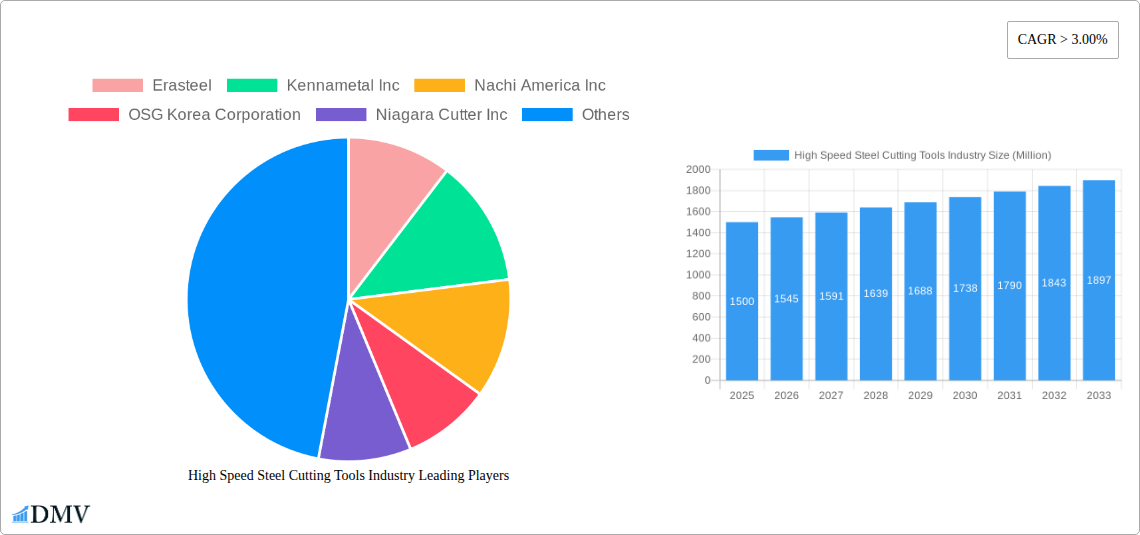

High Speed Steel Cutting Tools Industry Company Market Share

High Speed Steel Cutting Tools Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the High Speed Steel Cutting Tools industry, offering invaluable insights for stakeholders seeking to understand market dynamics, future trends, and investment opportunities. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, using 2025 as the base year. The market size is projected to reach xx Million by 2033.

High Speed Steel Cutting Tools Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory factors, and market evolution within the High Speed Steel Cutting Tools industry. We analyze market concentration, identifying key players and their respective market shares. The report examines the impact of mergers and acquisitions (M&A) activities, providing details on significant deals and their financial implications. Substitute product analysis, end-user segmentation, and regulatory landscapes are also thoroughly investigated.

- Market Concentration: The industry exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Erasteel, Kennametal Inc, and Sandvik Group are among the leading companies, although the exact distribution remains dynamic. The total market value in 2024 was estimated to be xx Million.

- Innovation Catalysts: Technological advancements in materials science and manufacturing processes are driving innovation. The adoption of advanced coatings and geometries significantly improves tool life and cutting performance.

- Regulatory Landscape: Regional and international regulations regarding safety and environmental standards significantly influence industry practices and product development. Compliance costs and evolving standards represent ongoing challenges.

- Substitute Products: The primary substitutes are ceramic and diamond cutting tools, posing a challenge in specific niche applications, but their overall market share remains limited.

- End-User Profiles: Key end-user industries include automotive, aerospace, energy, and construction, each with unique demands influencing tool specifications.

- M&A Activities: The industry witnesses periodic M&A activity, with recent examples including the January 2023 acquisition of Custom Carbide Cutter, Inc. by ARCH Cutting Tools Corp. The total value of M&A deals in the past five years is estimated at xx Million.

High Speed Steel Cutting Tools Industry Industry Evolution

This section delves into the historical and projected growth trajectories of the High Speed Steel Cutting Tools industry. We analyze technological advancements that have shaped market evolution, focusing on their impact on productivity, efficiency, and cost-effectiveness. Shifting consumer preferences, including demands for higher precision, longer tool life, and improved surface finishes, are also assessed. The report highlights the increasing adoption of automation and digital technologies in manufacturing, further driving industry growth.

The industry experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), driven by factors like increasing industrial automation, rising demand from emerging economies and advancements in materials science enabling superior performance cutting tools. The adoption of advanced cutting technologies, such as high-speed machining (HSM) and five-axis machining, is steadily growing, contributing to higher market demand. The adoption rate of automated tool changing systems increased by xx% from 2020 to 2024, leading to increased productivity and reduced downtime in many manufacturing processes.

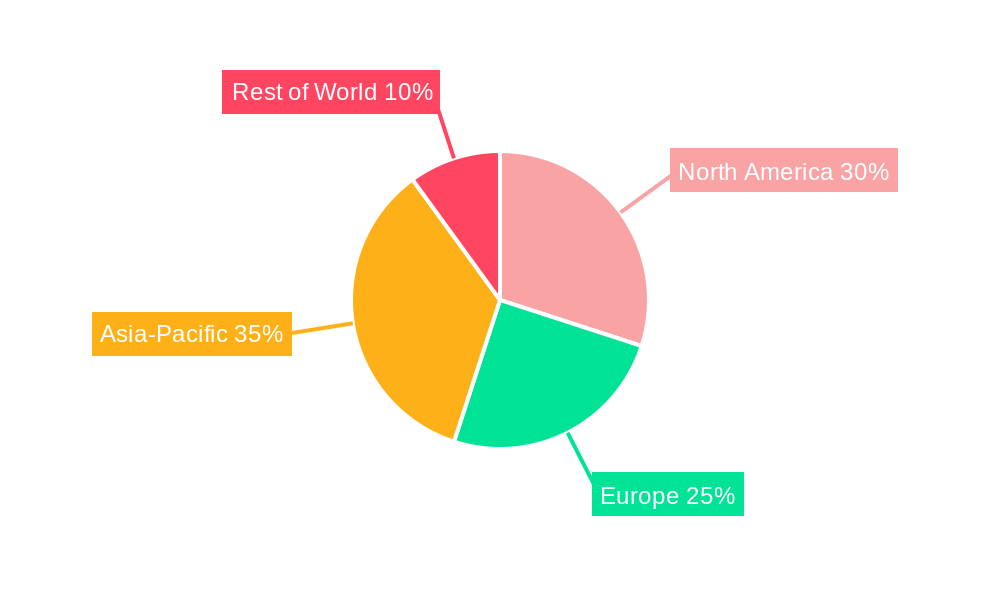

Leading Regions, Countries, or Segments in High Speed Steel Cutting Tools Industry

This section identifies the leading geographical regions and market segments within the High Speed Steel Cutting Tools industry. We explore the factors contributing to their dominance, such as robust industrial growth, favorable government policies, and significant investments in manufacturing infrastructure.

- Key Drivers:

- North America: Strong industrial base, high adoption of advanced manufacturing technologies, and considerable investments in research and development.

- Europe: Well-established manufacturing sector, focus on high-precision applications, and stringent environmental regulations.

- Asia Pacific: Rapid industrialization, rising manufacturing output, and cost-competitive labor.

- Dominance Factors: The Asia-Pacific region has emerged as a leading market, driven primarily by rapid industrialization in China, India, and other Southeast Asian countries. This region's robust growth in manufacturing, particularly in automotive and consumer goods sectors, fuels the demand for high-speed steel cutting tools. North America and Europe maintain significant market share due to their advanced manufacturing industries and strong focus on automation.

High Speed Steel Cutting Tools Industry Product Innovations

Recent innovations focus on improving tool life, cutting efficiency, and surface finish quality. Manufacturers are increasingly incorporating advanced coatings like PVD and CVD to enhance wear resistance and heat dissipation. The development of specialized geometries for specific machining operations and materials further optimizes cutting performance. Products like Walter's new MD340 and MD344 Supreme solid carbide milling cutters exemplify these advancements, offering superior performance in roughing and finishing operations. Unique selling propositions include increased tool life, enhanced cutting speeds, and reduced machining costs.

Propelling Factors for High Speed Steel Cutting Tools Industry Growth

Several factors contribute to the sustained growth of the High Speed Steel Cutting Tools industry. These include:

- Technological advancements: Improvements in materials science, coating technologies, and tool geometries continuously enhance cutting performance and tool life.

- Economic growth: Expansion in key end-user industries (automotive, aerospace, energy) directly correlates with increased demand for cutting tools.

- Government support: Policies promoting industrial automation and advanced manufacturing further stimulate market growth.

Obstacles in the High Speed Steel Cutting Tools Industry Market

The industry faces several challenges, including:

- Supply chain disruptions: Global supply chain instability can lead to material shortages and increased production costs.

- Competitive pressures: Intense competition among major players requires continuous innovation and cost optimization strategies.

- Regulatory compliance: Meeting stringent safety and environmental regulations can add to operational costs.

Future Opportunities in High Speed Steel Cutting Tools Industry

The future holds significant opportunities for the High Speed Steel Cutting Tools industry. These include:

- Expansion into new markets: Emerging economies present considerable growth potential.

- Development of sustainable cutting tools: Eco-friendly manufacturing practices are increasingly important.

- Adoption of digital technologies: Smart manufacturing and Industry 4.0 principles can optimize production processes.

Major Players in the High Speed Steel Cutting Tools Industry Ecosystem

- Erasteel

- Kennametal Inc

- Nachi America Inc

- OSG Korea Corporation

- Niagara Cutter Inc

- Addison & Co Ltd

- Sumitomo Electric Industries

- Tiangong International

- Walter AG

- NACHI-FUJIKOSHI CORP

- DeWALT

- Somta Tools (Pty) Ltd

- Morse Cutting Tools

- Sandvik Group

- Arch Cutting Tools (List Not Exhaustive)

Key Developments in High Speed Steel Cutting Tools Industry Industry

- January 2023: Walter AG launched its new MD340 & MD344 Supreme solid carbide milling cutters, enhancing roughing and finishing capabilities.

- January 2023: ARCH Cutting Tools Corp. acquired Custom Carbide Cutter, Inc., expanding its high-performance custom tooling portfolio.

Strategic High Speed Steel Cutting Tools Industry Market Forecast

The High Speed Steel Cutting Tools industry is poised for continued growth, driven by technological advancements, increasing automation in manufacturing, and the expansion of key end-user sectors. The market's potential is significant, particularly in emerging economies where industrialization is accelerating. Further innovation in materials science and cutting tool design will play a crucial role in driving future growth and shaping the competitive landscape.

High Speed Steel Cutting Tools Industry Segmentation

-

1. Type

- 1.1. Milling

- 1.2. Drilling

- 1.3. Tapping

- 1.4. Others

-

2. End-user

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas

- 2.3. Mining, and Quarrying

- 2.4. Agriculture, Fishing, and Forestry

- 2.5. Construction

- 2.6. Distributive Trade

- 2.7. Healthcare and Pharmaceutical

- 2.8. Other End Users

High Speed Steel Cutting Tools Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. Rest of APAC

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

High Speed Steel Cutting Tools Industry Regional Market Share

Geographic Coverage of High Speed Steel Cutting Tools Industry

High Speed Steel Cutting Tools Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Positive Outlook for the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milling

- 5.1.2. Drilling

- 5.1.3. Tapping

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas

- 5.2.3. Mining, and Quarrying

- 5.2.4. Agriculture, Fishing, and Forestry

- 5.2.5. Construction

- 5.2.6. Distributive Trade

- 5.2.7. Healthcare and Pharmaceutical

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Milling

- 6.1.2. Drilling

- 6.1.3. Tapping

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Oil and Gas

- 6.2.3. Mining, and Quarrying

- 6.2.4. Agriculture, Fishing, and Forestry

- 6.2.5. Construction

- 6.2.6. Distributive Trade

- 6.2.7. Healthcare and Pharmaceutical

- 6.2.8. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Milling

- 7.1.2. Drilling

- 7.1.3. Tapping

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Oil and Gas

- 7.2.3. Mining, and Quarrying

- 7.2.4. Agriculture, Fishing, and Forestry

- 7.2.5. Construction

- 7.2.6. Distributive Trade

- 7.2.7. Healthcare and Pharmaceutical

- 7.2.8. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Milling

- 8.1.2. Drilling

- 8.1.3. Tapping

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Oil and Gas

- 8.2.3. Mining, and Quarrying

- 8.2.4. Agriculture, Fishing, and Forestry

- 8.2.5. Construction

- 8.2.6. Distributive Trade

- 8.2.7. Healthcare and Pharmaceutical

- 8.2.8. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Milling

- 9.1.2. Drilling

- 9.1.3. Tapping

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Oil and Gas

- 9.2.3. Mining, and Quarrying

- 9.2.4. Agriculture, Fishing, and Forestry

- 9.2.5. Construction

- 9.2.6. Distributive Trade

- 9.2.7. Healthcare and Pharmaceutical

- 9.2.8. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Milling

- 10.1.2. Drilling

- 10.1.3. Tapping

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Oil and Gas

- 10.2.3. Mining, and Quarrying

- 10.2.4. Agriculture, Fishing, and Forestry

- 10.2.5. Construction

- 10.2.6. Distributive Trade

- 10.2.7. Healthcare and Pharmaceutical

- 10.2.8. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa High Speed Steel Cutting Tools Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Milling

- 11.1.2. Drilling

- 11.1.3. Tapping

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Manufacturing and Automotive

- 11.2.2. Oil and Gas

- 11.2.3. Mining, and Quarrying

- 11.2.4. Agriculture, Fishing, and Forestry

- 11.2.5. Construction

- 11.2.6. Distributive Trade

- 11.2.7. Healthcare and Pharmaceutical

- 11.2.8. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Erasteel

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kennametal Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nachi America Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 OSG Korea Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Niagara Cutter Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Addison & Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sumitomo Electric Industries

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tiangong International

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Walter AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 NACHI-FUJIKOSHI CORP

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 DeWALT

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Somta Tools (Pty) Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Morse Cutting Tools

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Sandvik Group

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Arch Cutting Tools**List Not Exhaustive

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Erasteel

List of Figures

- Figure 1: Global High Speed Steel Cutting Tools Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific High Speed Steel Cutting Tools Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific High Speed Steel Cutting Tools Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific High Speed Steel Cutting Tools Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: Asia Pacific High Speed Steel Cutting Tools Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: Asia Pacific High Speed Steel Cutting Tools Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific High Speed Steel Cutting Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America High Speed Steel Cutting Tools Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: North America High Speed Steel Cutting Tools Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America High Speed Steel Cutting Tools Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: North America High Speed Steel Cutting Tools Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: North America High Speed Steel Cutting Tools Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America High Speed Steel Cutting Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe High Speed Steel Cutting Tools Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe High Speed Steel Cutting Tools Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe High Speed Steel Cutting Tools Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe High Speed Steel Cutting Tools Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe High Speed Steel Cutting Tools Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe High Speed Steel Cutting Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America High Speed Steel Cutting Tools Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America High Speed Steel Cutting Tools Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America High Speed Steel Cutting Tools Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: South America High Speed Steel Cutting Tools Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: South America High Speed Steel Cutting Tools Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America High Speed Steel Cutting Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East High Speed Steel Cutting Tools Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East High Speed Steel Cutting Tools Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East High Speed Steel Cutting Tools Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Middle East High Speed Steel Cutting Tools Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East High Speed Steel Cutting Tools Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East High Speed Steel Cutting Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa High Speed Steel Cutting Tools Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: South Africa High Speed Steel Cutting Tools Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: South Africa High Speed Steel Cutting Tools Industry Revenue (billion), by End-user 2025 & 2033

- Figure 35: South Africa High Speed Steel Cutting Tools Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 36: South Africa High Speed Steel Cutting Tools Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: South Africa High Speed Steel Cutting Tools Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: India High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of APAC High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 14: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 20: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: United Kingdom High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Germany High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Spain High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 29: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 35: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 37: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 38: Global High Speed Steel Cutting Tools Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 39: Saudi Arabia High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East High Speed Steel Cutting Tools Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Speed Steel Cutting Tools Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the High Speed Steel Cutting Tools Industry?

Key companies in the market include Erasteel, Kennametal Inc, Nachi America Inc, OSG Korea Corporation, Niagara Cutter Inc, Addison & Co Ltd, Sumitomo Electric Industries, Tiangong International, Walter AG, NACHI-FUJIKOSHI CORP, DeWALT, Somta Tools (Pty) Ltd, Morse Cutting Tools, Sandvik Group, Arch Cutting Tools**List Not Exhaustive.

3. What are the main segments of the High Speed Steel Cutting Tools Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Positive Outlook for the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: One of the leading players, Walter, has launched new MD340 & and MD344 Supreme solid carbide milling cutters. The MD340 Supreme (dia. 2-25 mm or 1/16-") is specifically designed for roughing, full slotting, and dynamic milling of steel materials. The MD344 Supreme four-edge cutter with its special face geometry (dia. 6-20 mm) is designed for 90° plunging or ramping.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Speed Steel Cutting Tools Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Speed Steel Cutting Tools Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Speed Steel Cutting Tools Industry?

To stay informed about further developments, trends, and reports in the High Speed Steel Cutting Tools Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence