Key Insights

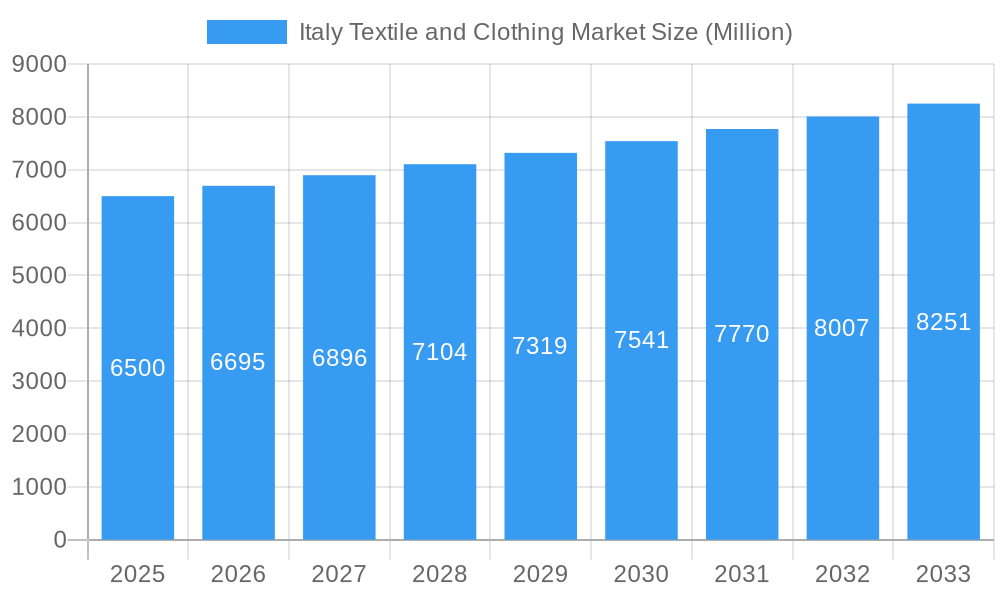

The Italian textile and clothing market, despite global competition and evolving consumer demands, offers significant growth potential. Influenced by economic fluctuations and the pandemic, the market is projected to recover, driven by rising demand for sustainable and ethically produced apparel, the resurgence of Italian luxury brands, and a renewed focus on domestic manufacturing. The industry's inherent strength in high-quality craftsmanship and design continues to attract discerning consumers globally. The forecast period (2025-2033) anticipates consistent expansion, supported by strategic investments in manufacturing automation and e-commerce expansion. Government initiatives promoting sustainability will further bolster industry growth and investment.

Italy Textile and Clothing Market Market Size (In Billion)

The estimated market size for 2025 is 26.9 billion. With a projected Compound Annual Growth Rate (CAGR) of 2.7 from the base year 2024, the market is set for steady growth throughout the forecast period. Luxury brands are expected to remain a significant contributor to market value. Successful market players will differentiate themselves through technological innovation and sustainable practices. The Italian textile and clothing sector demonstrates resilience and substantial growth prospects, leveraging its heritage and adaptability to meet future market needs.

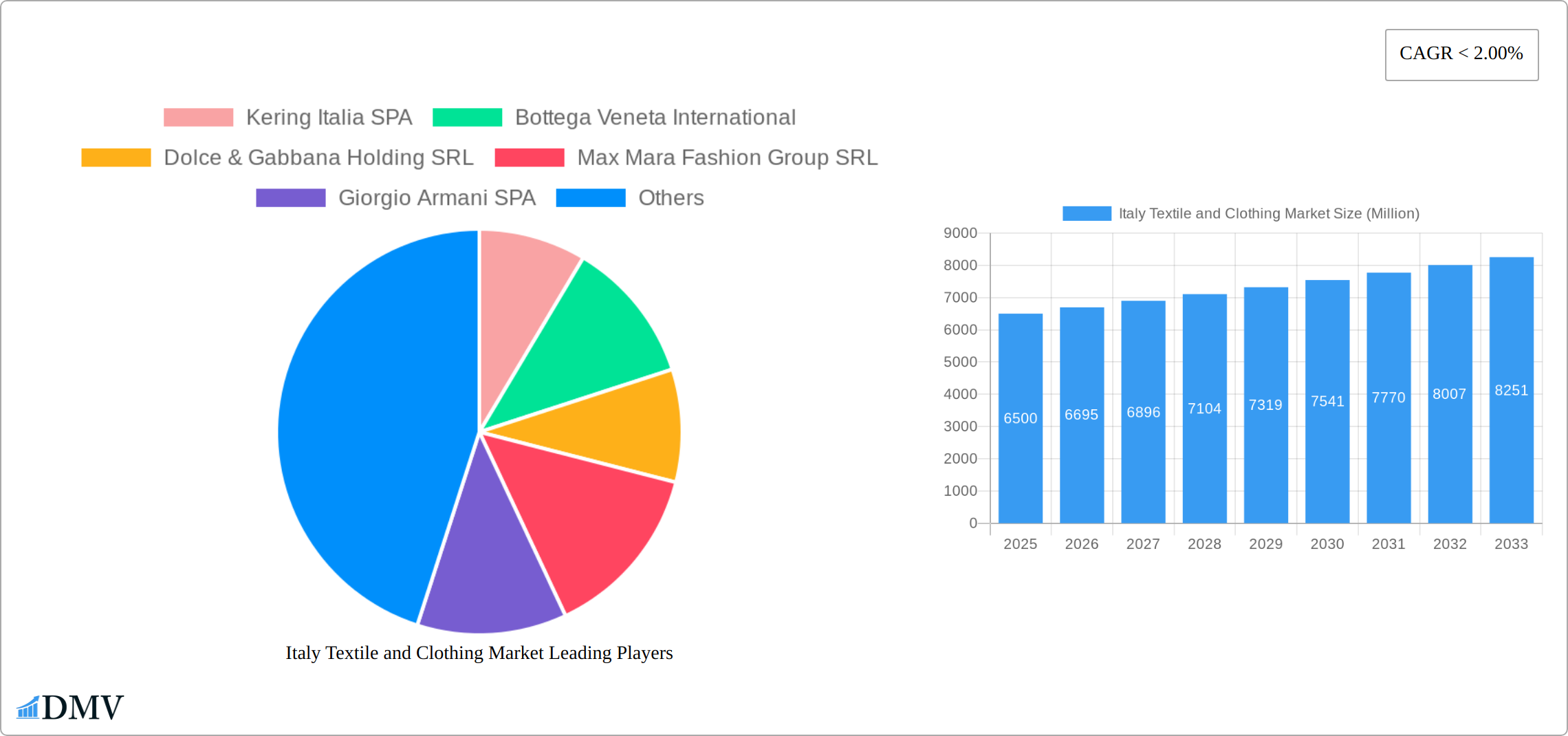

Italy Textile and Clothing Market Company Market Share

Italy Textile and Clothing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Italy Textile and Clothing Market, offering a comprehensive overview of its current state and future trajectory. From market size and segmentation to key players and emerging trends, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024.

Italy Textile and Clothing Market Market Composition & Trends

This section delves into the intricate structure of the Italian textile and clothing market, examining its concentration levels, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The Italian textile and clothing market is characterized by a dynamic interplay of established luxury houses and agile mass-market producers. Market share distribution reveals a notable concentration at the premium end, driven by a few globally recognized powerhouses, while a vibrant ecosystem of smaller firms meticulously caters to specialized niche segments. M&A activity within this sector remains robust, frequently witnessing deal values escalating into the hundreds of millions, underscoring strategic consolidation and investment.

- Market Concentration: High concentration is evident among renowned luxury brands, contrasted with a more fragmented competitive landscape within the mass-market segment. The top 5 players collectively commanded an estimated **xx%** of the market share in 2024, highlighting the influence of established names.

- Innovation Catalysts: A significant impetus for innovation stems from the growing emphasis on **sustainable practices**, the integration of cutting-edge **technological advancements in textile production** (such as advanced digital printing and novel fiber development), and the increasing demand for **personalized design solutions** that cater to individual consumer preferences.

- Regulatory Landscape: Operations are significantly shaped by overarching **EU regulations** concerning textile labeling, stringent worker safety protocols, and comprehensive environmental standards. Furthermore, **Italian-specific regulations** that champion artisanal production heritage and protect traditional craftsmanship play a crucial role in defining the market's operational framework.

- Substitute Products: The persistent rise of **fast fashion** and the proliferation of **synthetic materials** present a continuous challenge to traditional market players. Conversely, the escalating consumer demand for **high-quality, ethically sourced, and sustainable options** represents a significant and growing opportunity for differentiation and market expansion.

- End-User Profiles: The market adeptly serves a broad spectrum of consumers, ranging from discerning **luxury aficionados** with a penchant for exclusivity and craftsmanship, to the **mass market** seeking accessible and trend-driven apparel. This necessitates a diverse product offering across various quality tiers and price points.

- M&A Activities: The market experiences considerable M&A activity, involving both large-scale international corporations seeking strategic market entry or expansion, and smaller, highly specialized companies being acquired for their unique expertise or innovative capabilities. The **average deal value** for the period 2019-2024 stood at approximately **xx Million Euros**. A notable example includes the Ermenegildo Zegna Group's strategic acquisition of a majority stake in Tessitura Ubertino, reinforcing its vertical integration and commitment to premium textile production.

Italy Textile and Clothing Market Industry Evolution

This section analyzes the dynamic evolution of the Italian textile and clothing market, tracing market growth trajectories, technological progress, and shifting consumer preferences. The market has witnessed consistent growth, though the pace fluctuated due to global economic conditions and the COVID-19 pandemic. Technological innovations continue to reshape manufacturing processes and product offerings, while consumer demands for sustainability, ethical sourcing, and personalized experiences gain momentum. The market's value is expected to reach xx Million by 2025.

- Growth Trajectories: The market demonstrated an average annual growth rate (AAGR) of xx% during the historical period (2019-2024). The forecast period (2025-2033) projects an AAGR of xx%.

- Technological Advancements: Adoption of automation in manufacturing, integration of smart technologies in supply chains, and use of innovative materials are transforming the industry.

- Shifting Consumer Demands: Consumers increasingly prioritize sustainability, ethical sourcing, and transparency in the production process. Demand for luxury goods remains high, with a focus on craftsmanship and heritage.

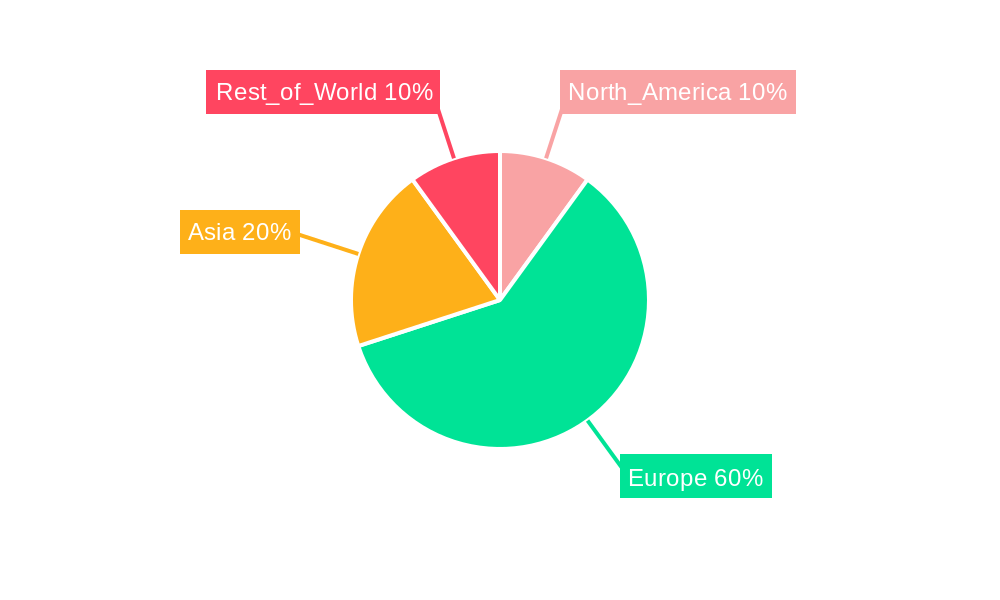

Leading Regions, Countries, or Segments in Italy Textile and Clothing Market

This section highlights the dominant geographical regions and key market segments within the Italian textile and clothing industry. While the industry's presence is distributed across the nation, certain regions and segments stand out for their significant contributions to growth, innovation, and export volume. The northern regions, particularly Lombardy and Veneto, are recognized as pivotal manufacturing and export powerhouses, benefiting from well-established industrial infrastructure, a highly skilled labor force, and excellent logistical connectivity.

- Key Drivers for Dominant Regions:

- Lombardy & Veneto: These regions boast robust **industrial clusters**, a deep pool of **skilled labor**, and advantageous **proximity to major European ports**, facilitating efficient export operations. They are home to a high concentration of luxury brands and sophisticated advanced manufacturing facilities.

- Tuscany: Renowned for its rich heritage in **leather goods and artisanal production**, Tuscany continues to attract prestigious high-end brands and a discerning clientele, solidifying its position in the premium segment.

- Dominance Factors: Access to a highly skilled and specialized workforce, sophisticated infrastructure networks, the established presence of globally recognized brands, supportive government incentives for regional development, and dedicated support for preserving and promoting artisan production are critical drivers of market dominance in these key regions. Furthermore, the significant contribution of **export opportunities** is instrumental in bolstering the economic performance of these areas.

Italy Textile and Clothing Market Product Innovations

The Italian textile and clothing market is characterized by an unwavering commitment to product innovation, driven by the synergistic forces of technological advancements and evolving consumer demands for exclusive, superior-quality, and environmentally responsible offerings. Recent breakthroughs include the development of advanced **innovative materials** with enhanced performance characteristics, such as high-performance bio-based fabrics and recycled material composites. The integration of **smart technologies**, including embedded wearable sensors for health monitoring and performance tracking, is also gaining traction. Furthermore, the application of **3D printing technology** in textile manufacturing is revolutionizing prototyping, customization, and the creation of intricate designs. These innovations not only elevate product functionality and aesthetic appeal but also strongly resonate with an increasingly environmentally conscious consumer base seeking sustainable and cutting-edge solutions.

Propelling Factors for Italy Textile and Clothing Market Growth

The growth trajectory of the Italian textile and clothing market is propelled by a multifaceted interplay of influential factors. **Technological advancements** in manufacturing processes and supply chain management are instrumental in driving increased operational efficiency and elevating product quality standards. Favorable **economic conditions**, such as rising disposable incomes and a robust consumer spending power, directly fuel demand for a wide array of textile and apparel products. **Regulatory support and incentives**, particularly those focused on promoting sustainability and innovation within the industry, provide a crucial impetus for growth. This is further amplified by an increasing consumer appetite for **personalized, high-quality, and uniquely designed products** that offer both style and substance.

Obstacles in the Italy Textile and Clothing Market Market

Despite its strengths, the Italian textile and clothing market faces several significant hurdles that can impede its growth and profitability. Stringent **regulatory complexities**, particularly those related to comprehensive environmental compliance and rigorous worker safety standards, can lead to increased operational costs and administrative burdens. Persistent **supply chain disruptions**, both on a global scale and within regional logistics networks, introduce uncertainty and pose the risk of production delays and increased lead times. The market is also subject to **intense competition** from both established domestic players and agile international brands, exerting continuous pressure on profit margins. Additionally, significant **fluctuations in the cost of raw materials** can substantially impact production expenses, requiring careful cost management and strategic sourcing.

Future Opportunities in Italy Textile and Clothing Market

The future holds significant opportunities for the Italian textile and clothing market. Expansion into new markets (e.g., emerging economies in Asia and Africa) offers growth potential. The adoption of sustainable practices and innovative technologies will attract environmentally conscious consumers and improve brand image. Focusing on personalized products, niche markets, and leveraging digital channels for enhanced customer engagement presents a promising avenue for future success.

Major Players in the Italy Textile and Clothing Market Ecosystem

- Kering Italia SPA

- Bottega Veneta International

- Dolce & Gabbana Holding SRL

- Max Mara Fashion Group SRL

- Giorgio Armani SPA

- Ferragamo Finanziaria SPA

- Vicuna Holding SPA

- Christian Dior Italia SRL

- Fedone SRL

- OTB SPA

- Di Vi Finanziaria Di Diego Della Valle & C SRL

- Lir SRL (List Not Exhaustive)

Key Developments in Italy Textile and Clothing Market Industry

- April 2021: Kering enhances its global logistics capabilities with a new hub in Northern Italy, increasing shipping capacity to 80 Million pieces per year and storage to 20 Million pieces, reducing lead times by 50%.

- June 2021: Ermenegildo Zegna Group acquires a 60% stake in Tessitura Ubertino, consolidating its position in the textile supply chain.

Strategic Italy Textile and Clothing Market Market Forecast

The Italian textile and clothing market is poised for continued growth driven by innovation, sustainability trends, and an increasing focus on luxury goods. The opportunities are significant, fueled by rising consumer spending, technological advancements, and the ongoing strength of Italian design and craftsmanship. The market's potential is substantial, with substantial growth anticipated in both domestic and international markets.

Italy Textile and Clothing Market Segmentation

-

1. Application

- 1.1. Clothing Application

- 1.2. Industrial Application

- 1.3. Household Application

-

2. Material

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Wool

- 2.5. Synthetic

- 2.6. Other

-

3. Process

- 3.1. Woven

- 3.2. Non-Woven

Italy Textile and Clothing Market Segmentation By Geography

- 1. Italy

Italy Textile and Clothing Market Regional Market Share

Geographic Coverage of Italy Textile and Clothing Market

Italy Textile and Clothing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Decreasing Consumption Expenditure on Textile

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Textile and Clothing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing Application

- 5.1.2. Industrial Application

- 5.1.3. Household Application

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Wool

- 5.2.5. Synthetic

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-Woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kering Italia SPA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bottega Veneta International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dolce & Gabbana Holding SRL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Max Mara Fashion Group SRL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Giorgio Armani SPA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ferragamo Finanziaria SPA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vicuna Holding SPA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Christian Dior Italia SRL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fedone SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OTB SPA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Di Vi Finanziaria Di Diego Della Valle & C SRL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lir SRL**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kering Italia SPA

List of Figures

- Figure 1: Italy Textile and Clothing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Textile and Clothing Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Textile and Clothing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Italy Textile and Clothing Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Italy Textile and Clothing Market Revenue billion Forecast, by Process 2020 & 2033

- Table 4: Italy Textile and Clothing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Textile and Clothing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Italy Textile and Clothing Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Italy Textile and Clothing Market Revenue billion Forecast, by Process 2020 & 2033

- Table 8: Italy Textile and Clothing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Textile and Clothing Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Italy Textile and Clothing Market?

Key companies in the market include Kering Italia SPA, Bottega Veneta International, Dolce & Gabbana Holding SRL, Max Mara Fashion Group SRL, Giorgio Armani SPA, Ferragamo Finanziaria SPA, Vicuna Holding SPA, Christian Dior Italia SRL, Fedone SRL, OTB SPA, Di Vi Finanziaria Di Diego Della Valle & C SRL, Lir SRL**List Not Exhaustive.

3. What are the main segments of the Italy Textile and Clothing Market?

The market segments include Application, Material, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Decreasing Consumption Expenditure on Textile.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2021- Kering enhances its global logistics capabilities with a new hub in Northern Italy.The hub will meet the demand from regional warehouses, retail stores, wholesalers and e-commerce worldwide, and will significantly increase the Group's capabilities in terms of shipping (up to 80 million pieces per year) and storage (up to 20 million pieces). It will also allow to reduce lead times by 50% by increasing the speed of deliveries and to enhance collaboration with the Group's brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Textile and Clothing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Textile and Clothing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Textile and Clothing Market?

To stay informed about further developments, trends, and reports in the Italy Textile and Clothing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence